Pinnacle Foods Inc. 2016 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Campbell Family of Brands

THE Corporate EXAMINER SPOTLIGHTS The Campbell Family of Brands In each issue of the Corporate Examiner, ICCR will feature a corporation and its work to advance ESG issues. Following is a conversation with Dave Stangis, Niki Kelley and Patricia Zecca of The Campbell Family of Brands. The Campbell’s Soup Company, founded in 1869, is an iconic American brand immortalized in pop art by Andy Warhol. Does this legacy influence you to show leadership within the food sector? Dave Stangis, Vice President DAVE: The Campbell Family of Brands has Patricia Zecca, Nutrition Niki Kelley, Manager - CSR Program Manager Program Office - Public Affairs and Corporate earned a place of trust in our consumers’ Responsibility hearts and minds. That trust is a paramount consumer promise that informs our where we live and work. The concept of NIKI: My participation in the Water behavior and practice every day. Quality a Human Right to Water Policy first arose Roundtable was a great example of how and safety will always be job one. The in our periodic conversations with ICCR we approach stakeholder engagement, and heritage of our brands is rooted in goodness members and shareholders. Reflecting on was an invaluable experience that allowed while nourishing the future and sets an the UN resolution recognizing water as an me to gain a better understanding of how expectation that Campbell will demonstrate undeniable human right as well as our own communities are impacted by water issues. leadership both in our sector as a food goal to be a role model in stewardship of Hearing from members of water-impacted company and in corporate citizenship the resources we touch in our business, it communities provided me with information as a leading global company. -

CAMPBELL SOUP CO Form DFAN14A Filed 2018-10-01

SECURITIES AND EXCHANGE COMMISSION FORM DFAN14A Definitive additional proxy soliciting materials filed by non-management including Rule 14(a)(12) material Filing Date: 2018-10-01 SEC Accession No. 0001193125-18-289694 (HTML Version on secdatabase.com) SUBJECT COMPANY CAMPBELL SOUP CO Mailing Address Business Address CAMPBELL PL CAMPBELL PL CIK:16732| IRS No.: 210419870 | State of Incorp.:NJ | Fiscal Year End: 0730 CAMDEN NJ 08103 CAMDEN NJ 08103 Type: DFAN14A | Act: 34 | File No.: 001-03822 | Film No.: 181098296 8563424800 SIC: 2000 Food and kindred products FILED BY Third Point LLC Mailing Address Business Address 390 PARK AVENUE 390 PARK AVENUE CIK:1040273| IRS No.: 133922602 | State of Incorp.:DE | Fiscal Year End: 1231 19TH FLOOR 19TH FLOOR Type: DFAN14A NEW YORK NY 10022 NEW YORK NY 10022 2122247400 Copyright © 2018 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 Filed by the Registrant ☐ Filed by a Party other than the Registrant ☒ Check the appropriate box: ☐ Preliminary Proxy Statement ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☐ Definitive Proxy Statement ☒ Definitive Additional Materials ☐ Soliciting Material Pursuant to §240.14a-12 CAMPBELL SOUP COMPANY (Name of the Registrant as Specified In Its Charter) THIRD POINT LLC DANIEL S. LOEB THIRD POINT PARTNERS QUALIFIED L.P. THIRD POINT PARTNERS L.P. THIRD POINT OFFSHORE MASTER FUND L.P. THIRD POINT ULTRA MASTER FUND L.P. -

Crown Holdings, Inc. 770 Township Line Road Yardley, Pennsylvania 19067 ______

Crown Holdings, Inc. 770 Township Line Road Yardley, Pennsylvania 19067 ________________________ NOTICE OF 2019 ANNUAL MEETING OF SHAREHOLDERS ________________________ NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of CROWN HOLDINGS, INC. (the “Company”) will be held at the Company’s Corporate Headquarters located at 770 Township Line Road, Yardley, Pennsylvania on the 25th day of April 2019 at 9:30 a.m. local time to elect Directors; to ratify the appointment of independent auditors for the fiscal year ending December 31, 2019; to vote on an advisory resolution to approve executive compensation for the Named Executive Officers as disclosed in this Proxy Statement (the “Say-on-Pay” vote); if properly presented, to consider and act upon a Shareholder proposal requesting the Board of Directors to adopt a policy for an independent Board Chairman; and to transact such other business as may properly come before the Annual Meeting. Only Shareholders of Common Stock of record as of the close of business on March 5, 2019 will be entitled to vote. By Order of the Board of Directors ADAM J. DICKSTEIN Corporate Secretary Yardley, Pennsylvania March 18, 2019 Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on April 25, 2019: The Proxy Statement and Proxy Card relating to the Annual Meeting of Shareholders and the Annual Report to Shareholders are available at https://www.crowncork.com/investors/proxy-online TABLE OF CONTENTS 2019 Proxy Statement Summary ........................... 1 Retirement Benefits ....................................... 43 Perquisites ..................................................... 44 Questions and Answers about the 2019 Annual Severance ...................................................... 45 Meeting ........................................................ 12 Tax Deductibility of Executive Proposal 1: Election of Directors ...................... -

Cynthia Kyriazis Is a Productivity Strategist, Organization Consultant, Time Management Coach, Speaker, and Author

Cynthia Kyriazis is a productivity strategist, organization consultant, time management coach, speaker, and author. She leads decision-makers, their teams, and staff in navigating the 24/7 demands on their time and energy by developing a clear line of sight on what’s important and a plan for how to get there. 80% of Cynthia’s clients report saving at least 45 minutes a day in real time and 91% have improved their overall productivity. Cynthia possesses a 20-year track record of success in serving Fortune 500 companies, entrepreneurial businesses, government, and non-profit agencies. Regardless of the organization size, Cynthia guides leaders and Cynthia star performers to make choices that create and sustain a productive kyriazis mindset, and positively impact both personal growth and organizational profitability. Cynthia is the Amazon best-selling author of Get Organized. Get Focused. Get Productivity Moving. How to Overcome Productivity Potholes. She has also been featured & Organization as an expert on Forbes.com, Wall Street Journal online, the Philadelphia Consultant Inquirer, Legal Intelligencer, and many regional publications, radio, and television shows – and was named one of the “28 Best Online Productivity Experts” by New York Times best-selling author Hank Reardon in his book Time Management 2.0. Organizations Qualifications & Education We Have Served • Past-Secretary to the National Association of Professional Organizers (NAPO) • American Diabetes Association • Past-President of the Kansas City chapter of the International Society for • Avery Dennison Performance Improvement (KC-ISPI) • Bayer HealthCare • Consultant to the American Coaching Association • Campbell Soup Company • Certified Professional Behavioral Analyst (CPBA) • Cerner • Certified Professional Values Analyst (CPVA) • Cisco • B.S., Communication, University of Kansas • Coca Cola Bottling • Eli Lily Endorsements • GlaxoSmithKline • G.E. -

U.S. Corporate Scores 2018

01 DISCLOSURE INSIGHT ACTION U.S. CORPORATE SCORES 2018 02 CORPORATE DISCLOSURE TO INVESTORS IN NORTH AMERICA 124 9 28 510 63 192 CONTENTS 03 04 CDP scoring methodology 2018 06 The A-List: North America 08 Corporate scores 34 Appendix I: CDP Activity classification system (cdp-acs) 40 Appendix II: Investor Members and Signatories 46 Appendix III: CDP Supply Chain Members Important Notice The contents of this report may be used by anyone providing acknowledgment is given to CDP. This does not represent a license to repackage or resell any of the data reported to CDP or the contributing authors and presented in this report. If you intend to repackage or resell any of the contents of this report, you need to obtain express permission from CDP before doing so. CDP has prepared the data and analysis in this report based on responses to the CDP 2018 information request. No representation or warranty (express or implied) is given by CDP as to the accuracy or completeness of the information and opinions contained in this report. You should not act upon the information contained in this publication without obtaining specific professional advice. To the extent permitted by law, CDP does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this report or for any decision based on it. All information and views expressed herein by CDP are based on their judgment at the time of this report and are subject to change without notice due to economic, political, industry and firm-specific factors. -

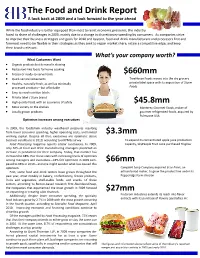

The Food and Drink Report a Look Back at 2009 and a Look Forward to the Year Ahead

The Food and Drink Report A look back at 2009 and a look forward to the year ahead While the food industry is better equipped than most to resist economic pressures, the industry faced its share of challenges in 2009, mainly due to a change in discretionary spending by consumers. As companies strive to improve their business strategies and goals for 2010 and beyond, food and drink manufacturers and processors first and foremost need to be flexible in their strategies as they seek to regain market share, retain a competitive edge, and keep their brands relevant. What’s your company worth? What Customers Want • Organic products but demand is slowing • Restaurant‐like foods for home cooking • Frozen or ready‐to‐serve foods $660mm • Quick‐service restaurants TreeHouse Foods moves into the dry grocery • Healthy, naturally fresh, as well as minimally private label space with its acquisition of Sturm processed products—but affordable Foods • Easy‐to‐read nutrition labels • Private label / Store brand • High quality food, with an assurance of safety $45.8mm • More variety on the shelves Monterey Gourmet Foods, maker of • Locally grown products gourmet refrigerated foods, acquired by Pulmuone USA Optimism increases among executives In 2009, the food/drink industry weathered pressures resulting from lower consumer spending, higher operating costs, and limited $3.3mm working capital. Despite all that, executives are optimistic about business conditions in 2010, according to a KPMG survey. To expand its concentrated apple juice production Food Processing magazine reports similar conclusions. In 2009, capacity, SkyPeople Fruit Juice purchased Yingkou only 56% of food and drink manufacturing managers predicted an increase in production for their company. -

S P O T L I G H T Pa R T I C I Pa N

SPOTLIGHT PARTICIPANTS 12 Copyright © 2019 Mercer (US) Inc. All rights reserved. ORGANIZATION LISTING 3M (Minnesota Mining & Manufacturing) Atlas Energy Group LLC City of Overland Park, KS Cleveland Indians Baseball Co. A&E Television Networks Auburn University City of Winston-Salem, NC CliftonLarsonAllen, LLP A.O. Smith Corporation Automatic Data Processing California Health Care Foundation CMA CGM (America) LLC American Automobile Association, Inc., The Automobile Club of Southern California Cabot Oil & Gas Corporation CNH Industrial America LLC Accenture LLP AXA XL Cactus Feeders, Inc. CNO Financial Group Accudyne Industries, LLC Badger Meter, Inc. Cadmus Holding Company CNOOC Petroleum U.S.A. Inc. Advance Auto Parts Baltimore Orioles California Endowment, The CNX Resources ADVICS North America, Inc. Bank of the Ozarks, Inc. California ISO Colorado Rockies Baseball Club AECOM Building & Construction Bank of New York Mellon California Wellness Foundation Cobb Electric Membership Corporation AECOM Enterprise Baptist Health - FL Cambia Health Solutions (Regence Group) Coca-Cola Company, Inc., The AECOM Management Services Crestline Hotels & Resorts, LLC Canadian Imperial Bank of Commerce COG Operating, LLC Aera Energy Services Company Barnes & Noble, Inc. Canadian National Cognizant Technology Solutions Corporation Affinity Federal Credit Union BASF Corporation Canadian Pacific Railway CohnReznick LLP AgReserves Inc. Basin Electric Power Co-op Canadian Solar, Inc. Colby College Agri Beef Company Bates College Capital Group Companies, Inc., The Colonial Group, Inc. American International Group, Inc. (AIG) Battelle Memorial Institute Capital One Financial Corporation Columbia Sportswear Company Aimbridge Hospitality Baylor College of Medicine CarMax Auto Superstores, Inc. Columbia University American Institutes for Research BB&T Corporation Carilion Clinic Columbus McKinnon Corporation Air Liquide USA Blue Cross Blue Shield of Kansas Carrix, Inc. -

IN the SUPREME COURT of the STATE of DELAWARE the BANK of NEW YORK § MELLON TRUST COMPANY, § N.A., As Trustee, § No

IN THE SUPREME COURT OF THE STATE OF DELAWARE THE BANK OF NEW YORK § MELLON TRUST COMPANY, § N.A., as Trustee, § No. 284, 2011 § Defendant Below, § Court Below – Court of Chancery Appellant, § of the State of Delaware § C.A. No. 5702 v. § § LIBERTY MEDIA CORPORATION § and LIBERTY MEDIA LLC, § § Plaintiffs Below, § Appellees. § Submitted: September 14, 2011 Decided: September 21, 2011 Before STEELE , Chief Justice, HOLLAND , BERGER , JACOBS and RIDGELY , Justices, constituting the Court en Banc . Upon appeal from the Court of Chancery. AFFIRMED . Joel Friedlander, Esquire, and Sean M. Brennecke, Esquire, Bouchard, Margules & Friedlander, P.A., Wilmington, Delaware, Steven D. Phol, Esquire (argued), Timothy J. Durken, Esquire, Brown, Rudnick, LLP, Boston, Massachusetts, Sigmund S. Wissner-Gross, Brown Rudnick LLP, New York, New York, Mark S. Baldwin, Esquire and Stephen R. Klaffky, Esquire, Brown, Rudnick LLP, Hartford, Connecticut, for Bank of New York Mellon Trust Company, N.A. Donald J. Wolfe, Jr., Esquire, Arthur L. Dent, Esquire, Michael A. Pittenger, Esquire (argued), Brian C. Ralston, Esquire, and Matthew F. Lintner, Esquire, Potter, Anderson & Corroon, LLP, Wilmington, Delaware, and Frederick H. McGrath, Esquire, Richard B. Harper, Esquire and Renee L. Wilm, Esquire, Baker Botts L.L.P., New York, New York, for Liberty Media Corporation and Liberty Media LLC. HOLLAND , Justice: 2 The plaintiffs-appellees, Liberty Media Corporation (“LMC”) and its wholly owned subsidiary Liberty Media LLC (“Liberty Sub,” together with LMC, “Liberty”) brought this action for declaratory and injunctive relief against the defendant-appellant, the Bank of New York Mellon Trust Company, N.A., in its capacity as trustee (the “Trustee”). -

Wilmington Trust Franklin Templeton Funds

WILMINGTON TRUST COLLECTIVE INVESTMENT TRUST FUNDS SUB-ADVISED BY FRANKLIN ADVISERS, INC. FINANCIAL STATEMENTS DECEMBER 31, 2019 WITH INDEPENDENT AUDITOR'S REPORT Wilmington Trust Collective Investment Trust Funds Sub-Advised by Franklin Advisers, Inc. CONTENTS Independent Auditor's Report ..................................................................................................................................................................... 1 Fund Index ................................................................................................................................................................................................. 3 Wilmington Trust Franklin DynaTech CIT ................................................................................................................................................... 4 Wilmington Trust Franklin Growth CIT ..................................................................................................................................................... 13 Wilmington Trust Franklin Real Estate Securities CIT .............................................................................................................................. 21 Wilmington Trust Franklin Templeton Global Bond Plus Trust ................................................................................................................. 27 Wilmington Trust Franklin U.S. Aggregate Bond CIT .............................................................................................................................. -

Fund Holdings

Wilmington International Fund as of 7/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS ISHARES MSCI CANADA ETF 3.48% TAIWAN SEMICONDUCTOR MANUFACTURING CO LTD 2.61% DREYFUS GOVT CASH MGMT-I 1.83% SAMSUNG ELECTRONICS CO LTD 1.79% SPDR S&P GLOBAL NATURAL RESOURCES ETF 1.67% MSCI INDIA FUTURE SEP21 1.58% TENCENT HOLDINGS LTD 1.39% ASML HOLDING NV 1.29% DSV PANALPINA A/S 0.99% HDFC BANK LTD 0.86% AIA GROUP LTD 0.86% ALIBABA GROUP HOLDING LTD 0.82% TECHTRONIC INDUSTRIES CO LTD 0.79% JAMES HARDIE INDUSTRIES PLC 0.78% DREYFUS GOVT CASH MGMT-I 0.75% INFINEON TECHNOLOGIES AG 0.74% SIKA AG 0.72% NOVO NORDISK A/S 0.71% BHP GROUP LTD 0.69% PARTNERS GROUP HOLDING AG 0.65% NAVER CORP 0.61% HUTCHMED CHINA LTD 0.59% LVMH MOET HENNESSY LOUIS VUITTON SE 0.59% TOYOTA MOTOR CORP 0.59% HEXAGON AB 0.57% SAP SE 0.57% SK MATERIALS CO LTD 0.55% MEDIATEK INC 0.55% ADIDAS AG 0.54% ZALANDO SE 0.54% RIO TINTO LTD 0.52% MERIDA INDUSTRY CO LTD 0.52% HITACHI LTD 0.51% CSL LTD 0.51% SONY GROUP CORP 0.50% ATLAS COPCO AB 0.49% DASSAULT SYSTEMES SE 0.49% OVERSEA-CHINESE BANKING CORP LTD 0.49% KINGSPAN GROUP PLC 0.48% L'OREAL SA 0.48% ASSA ABLOY AB 0.46% JD.COM INC 0.46% RESMED INC 0.44% COLOPLAST A/S 0.44% CRODA INTERNATIONAL PLC 0.41% AUSTRALIA & NEW ZEALAND BANKING GROUP LTD 0.41% STRAUMANN HOLDING AG 0.41% AMBU A/S 0.40% LG CHEM LTD 0.40% LVMH MOET HENNESSY LOUIS VUITTON SE 0.39% SOFTBANK GROUP CORP 0.39% NOVARTIS AG 0.38% HONDA MOTOR CO LTD 0.37% TOMRA SYSTEMS ASA 0.37% IMCD NV 0.37% HONG KONG EXCHANGES & CLEARING LTD 0.36% AGC INC 0.36% ADYEN -

Corporate Ghg Inventorying and Target Setting Self-Assessment: V1.0

APPENDIX Corporate GHG Inventorying and Target Setting Self - Assessment : V1.0 Development and Methodology April 2020 APPENDIX: CORPORATE GHG INVENTORYING AND TARGET SETTING SELF-ASSESSMENT: V1.0 Purpose of this Self-Assessment and How it Can Lead to Action Companies are often in a stronger position to improve their greenhouse gas (GHG) management efforts once they understand their relative performance compared to their peers. In response to stakeholder interest, this self-assessment is designed to help companies estimate, at a high level, how their GHG inventorying and target-setting approaches compare to large peer companies representing different industry sectors. Once companies estimate how their key GHG measurement and target-setting efforts compare to their peers, they can evaluate, in greater detail, how other companies approach GHG inventorying and target setting. Helping companies locate their GHG management efforts within the broader market may spur competition, garner internal support for widening the scope of their GHG inventories or setting more aggressive GHG reduction targets, and prioritize resources to implement GHG reduction activities. • Entry-level: For companies beginning to address their GHG emissions, this resource aims to help them identify which inventorying and target-setting actions reflect common business practices today and provide them with a roadmap for developing their own inventories and setting targets. • Intermediate: For companies further along their sustainability journey, this self- assessment can validate more advanced inventorying and target-setting behaviors that position them to deepen GHG emission reductions. • Advanced: For leading companies, this resource can also validate their efforts and encourage them to explore implementing more cutting edge GHG management efforts, eventually pushing such innovations into the mainstream and sharing practices with others. -

United States District Court Northern District of Illinois Eastern Division

Case: 1:19-cv-02550 Document #: 1 Filed: 04/15/19 Page 1 of 28 PageID #:1 UNITED STATES DISTRICT COURT NORTHERN DISTRICT OF ILLINOIS EASTERN DIVISION HOUSTON MUNICIPAL EMPLOYEES Case No. ____ PENSION SYSTEM, Individually and On Behalf of All Others Similarly Situated, CLASS ACTION COMPLAINT FOR VIOLATION OF THE FEDERAL Plaintiff, SECURITIES LAWS v. JURY TRIAL DEMANDED CONAGRA BRANDS, INC., SEAN M. CONNOLLY, and DAVID S. MARBERGER Defendants. Plaintiff Houston Municipal Employees Pension System (“Plaintiff”) alleges upon personal knowledge as to allegations specifically pertaining to Plaintiff and, as to all other matters, upon the investigation of counsel, which included, without limitation: (a) review and analysis of public filings made by Conagra Brands, Inc. (“Conagra” or the “Company”) and other related parties and non-parties with the United States Securities and Exchange Commission (“SEC”); (b) review and analysis of press releases and other publications disseminated by certain of the Defendants and other related non-parties; (c) review of news articles, shareholder communications, conference calls and postings on Conagra’s website concerning the Company’s public statements; and (d) review of other publicly available information concerning Conagra and the Individual Defendants (as defined below). I. NATURE OF THE ACTION 1. This is a federal securities class action against Conagra and certain of its officers for violations of the federal securities laws. Plaintiff brings this action on behalf of all persons or entities that purchased or otherwise acquired Conagra common stock from June 27, 2018 through Case: 1:19-cv-02550 Document #: 1 Filed: 04/15/19 Page 2 of 28 PageID #:2 December 19, 2018, inclusive (the “Class Period”), including legacy Pinnacle Foods, Inc.