Whopper of an Opportunity

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

RODEO® STACKER KING™ Promotion Begins December 2 on Monday, Dec

Promotions Thursday, November 21, 2019 RODEO® STACKER KING™ Promotion Begins December 2 On Monday, Dec. 2, BURGER KING® restaurants will introduce the RODEO® STACKER KING™ sandwich for a limited time only. The sandwich will be added to the current KING™ line and requires no new items. As such, there are no auto shipments associated with the promotion. Restaurants can opt in and begin selling the RODEO® STACKER KING™ sandwich beginning Monday, Nov. 25 and will need to plan orders of Stacker Sauce accordingly. BKC Forecast: 8.8 servings per day Key Dates PROMOTION: RODEO® STACKER KING™ MONTH: NOVEMBER DECEMBER JANUARY Key Promotion Dates: 4 11 18 25 2 9 16 23 30 6 13 20 27 Auto-shipment "Opt-in" to DMB PROMOTION Product Build: RODEO® STACKER KING™ Single: Double: WHOPPER® Bun WHOPPER® Bun 0.75 oz. Stacker Sauce 0.75 oz. Stacker Sauce 0.5 oz. Bulk BBQ Sauce 0.5 oz. Bulk BBQ Sauce 4 Onion Rings 4 Onion Rings 3 Slices Bacon 6 Slices Bacon Salt & Pepper Blend Salt & Pepper Blend 2 Slices American cheese 4 Slices American cheese 1 WHOPPER® Beef Patty 2 WHOPPER® Beef Patties Wrap Bac King/Generic Wrap Bac King/Generic This RSI NewsBriefs is published for RSI’s Members in the United States including the U.S. BURGER KING® franchise community and Burger King Corporation by Restaurant Services, Inc. 5200 Blue Lagoon Drive, Suite 300, Miami, FL 33126 | Phone: 305.529.3400 | Fax: 305.529.3440 Web: www.rsilink.com | Email: [email protected] Average Restaurant Weekly Case Usage Restaurants with annual sales of $1.3 million can expect the -

The Impossible™ WHOPPER® Is Truly Impossible

Page 6 Thursday, Nov. 7, 2019 The Chronicle-News Trinidad, Colorado The Impossible™ WHOPPER® is truly impossible Kirk Loudon ever eaten something, then good option for vegetarians The Chronicle-News eat something hours later who just want a fast-food and all you can taste is the burger sometimes and even thing that you ate earlier? for meat lovers trying to re- I know, two fast food sto- That is this burger. It is actu- duce the amount of red meat ries in one month, but I felt ally a sin calling it a burger they eat on a regular basis. this one is a topic that I had at all. If a friend offers you a Here is a bit of science on to chat about. The Impos- Kale Burger, quickly reject the burger... Impossible™ sible™ WHOPPER®. All the the offer. I would also con- WHOPPER® was created things that they say about sider losing that person as by Impossible Foods, Inc., a this non-beef burger are ac- a friend. Let’s be honest, the Silicon Valley company that tually true. friend knew it was terrible, develops plant-based prod- We get coupons in the he just didn’t want to be the ucts to replicate the taste mail for the local Burger only person to have tried a and texture of real meat. King here in Trinidad and Kale Burger. They use a product called are always looking for a Okay...back to the Impos- “heme,” the iron-containing quick bite when we are on sible™ WHOPPER®. -

Mac N' Cheetos

MAC N’ CHEETOS Contact: Kimberly Scott [email protected] About Mac N’ CHEETOS: Get ready for a very cheesy summer as CHEETOS and BURGER KING join forces to launch Mac N’ CHEETOS - creamy mac and cheese covered with crispy CHEETOS seasoning to make the perfect on-the-go handheld snack. Available only for a limited time at BURGER KING, get your hands on the snack that is double the cheese and double the fun. Sold exclusively at BURGER KING Price and participation may vary. About the BURGER KING Brand Founded in 1954, the BURGER KING brand is the second largest fast food hamburger chain in the world. The original HOME OF THE WHOPPER, the BURGER KING system operates more than 14,000 locations in approximately 100 countries and U.S. territories. Almost 100 percent of BURGER KING restaurants are owned and operated by independent franchisees, many of them family-owned operations that have been in business for decades. The BURGER KING brand is owned by Restaurant Brands International Inc. (TSX,NYSE:QSR), one of the world's largest quick service restaurant companies with more than $23 billion in system sales and over 19,000 restaurants. To learn more about the BURGER KING brand, please visit the BURGER KING brand website at www.bk.com or follow us on Facebook, Twitter and Instagram. About CHEETOS: CHEETOS snacks are the much-loved cheesy treats that are fun for everyone! You just can’t eat a CHEETOS snack without licking the signature “cheetle” off your fingertips. And wherever the CHEETOS brand and CHESTER CHEETAH go, cheesy smiles are sure to follow. -

Burger-King-Newport,PA.Pdf

Net Lease Investment Offering Burger King 313 Bretz Court Newport, PA Burger King | Newport, PA Table of Contents TABLE OF CONTENTS Offering Summary Executive Summary ................................................................... 1 Investment Highlights ............................................................. 2 Property Overview ...................................................................... 3 Location Overview Photographs ...................................................................................4 Location Aerial .............................................................................. 5 Site Plan .............................................................................................6 Location Map ................................................................................. 7 Market Overview Market Overview ..........................................................................8 Demographics ..............................................................................9 Tenant Summary Tenant Profile ...............................................................................10 | 2 | www.bouldergroup.com | Confidential Offering Memorandum Burger King | Newport, PA Executive Summary EXECUTIVE SUMMARY The Boulder Group is pleased to exclusively market for sale a single tenant net leased Burger King property located in Newport, Pennsylvania. The property was recently constructed in 2019 and has a twenty-year lease, which expires in December 2039. The lease is absolute triple net and features zero -

BURGER KING® USA Nutritionals: Core, Regional and Limited Time Offerings

BURGER KING® USA Nutritionals: Core, Regional and Limited Time Offerings July 2012 Allergens ▲ serving size (g) size serving Calories Calories from fat Total fat (g) Saturated Fat (g) Trans Fat (g) Chol (mg) Sodium (mg) Total Carb (g) FiberDietary (g) Protein (g) Nutrition facts (g) Sugar Total WHOPPER® Sandwiches WHOPPER® Sandwich 290 670 360 40 11 1 75 980 51 3 11 29 WES w/o Mayo 268 510 200 23 9 0.5 65 840 51 3 11 28 WS WHOPPER® Sandwich with Cheese 315 760 430 47 16 1 100 1410 53 3 11 33 MWES w/o Mayo 294 600 270 30 14 1 85 1270 53 3 11 32 MWS DOUBLE WHOPPER® Sandwich 373 900 510 57 19 1.5 140 1050 51 3 11 47 WES w/o Mayo 352 740 350 39 16 1 130 910 51 3 11 47 WS DOUBLE WHOPPER® Sandwich with Cheese 398 990 580 65 24 1.5 160 1480 53 3 11 52 MWES w/o Mayo 376 830 420 47 21 1.5 150 1340 53 3 11 52 MWS TRIPLE WHOPPER® Sandwich 455 1140 670 75 27 2 205 1110 51 3 11 67 WES w/o Mayo 434 980 510 57 24 1.5 190 970 51 3 11 66 WS TRIPLE WHOPPER® Sandwich With Cheese 480 1230 740 82 32 2 225 1550 53 3 11 71 MWES w/o Mayo 459 1070 580 64 29 2 215 1410 53 3 11 71 MWS Texas DOUBLE WHOPPER® Sandwich 410 1040 620 69 26 2 175 1770 50 3 8 56 MWES WHOPPER JR.® Sandwich 147 340 160 18 5 0 40 520 32 1 7 14 WES w/o Mayo 136 260 90 9 4 0 35 450 32 1 7 14 WS WHOPPER JR.® Sandwich with Cheese 159 380 190 21 8 0.5 50 710 33 1 7 16 MWES w/o Mayo 137 300 110 13 6 0 45 640 32 1 7 16 MWS Allergens ▲ serving size (g) size serving Calories Calories from fat Total fat (g) Saturated Fat (g) Trans Fat (g) Chol (mg) Sodium (mg) Total Carb (g) FiberDietary (g) Protein -

Carrols Restaurant Group, Inc. Carrols Corporation

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, DC 20549 FORM 10-Q ☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended July 3, 2011 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission File Number: 001-33174 CARROLS RESTAURANT GROUP, INC. (Exact name of Registrant as specified in its charter) Delaware 16-1287774 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 968 James Street Syracuse, New York 13203 (Address of principal executive office) (Zip Code) Registrant’s telephone number, including area code: (315) 424-0513 Commission File Number: 001-06553 CARROLS CORPORATION (Exact name of registrant as specified in its charter) Delaware 16-0958146 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification Number) 968 James Street Syracuse, New York 13203 (Address of principal executive offices) (Zip Code) Registrant’s telephone number including area code: (315) 424-0513 Carrols Corporation meets the conditions set forth in General Instruction H(1) and is therefore filing this form with reduced disclosure format pursuant to General Instruction H(2). Indicate by check mark whether either of the registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. -

Brief of Amicus Curiae United States of America in Support of Neither Party

USCA11 Case: 20-13561 Date Filed: 12/07/2020 Page: 1 of 45 No. 20-13561 IN THE United States Court of Appeals for the Eleventh Circuit JARVIS ARRINGTON et al., Plaintiffs-Appellants, v. BURGER KING WORLDWIDE, INC. et al., Defendants-Appellees. On Appeal from the United States District Court for the Southern District of Florida No. 1:18-cv-24128 (Hon. Jose E. Martinez) BRIEF OF AMICUS CURIAE UNITED STATES OF AMERICA IN SUPPORT OF NEITHER PARTY MAKAN DELRAHIM Assistant Attorney General MICHAEL F. MURRAY Deputy Assistant Attorney General DANIEL E. HAAR MARY HELEN WIMBERLY Attorneys U.S. DEPARTMENT OF JUSTICE ANTITRUST DIVISION 950 Pennsylvania Ave., N.W. Room 3224 Washington, D.C. 20530-0001 (202) 514-4510 [email protected] Counsel for the United States USCA11 Case: 20-13561 Date Filed: 12/07/2020 Page: 2 of 45 Arrington v. Burger King Worldwide, Inc., 20-13561 CERTIFICATE OF INTERESTED PERSONS AND CORPORATE DISCLOSURE STATEMENT C-1 of 3 Pursuant to Eleventh Circuit Rules 26.1-1 to 26.1-3, 28-1(b), and 29-2, the undersigned certifies that, in addition to those persons and entities set forth in the Certificate of Interested Persons and Corporate Disclosure Statement in Appellants’ brief, the persons and entities listed below are known to her to have an interest in the outcome of this case or to have participated as attorneys or judges in the adjudication of this case. Counsel notes that the stock symbol for Restaurant Brands International Inc., a publicly traded entity listed in Appellants’ brief, is QSR. -

Canadian Patriotism and the Timbit: a Rhetorical Analysis of Tim Horton's

Canadian Patriotism and the Timbit: A Rhetorical Analysis of Tim Horton’s Inc.’s Canadian Connection through the Application of Semiotics _________________________________________ Presented to the Faculty of Liberty University School of Communication & Creative Arts In Partial Fulfillment of the Requirements for the Master of Arts in Communication Studies ________________________________________ By Shelanne Jennings May 2014 RUNNING HEAD: CANADIAN PATRIOTISM & THE TIMBIT 2 Thesis Committee Carey Martin, Ph.D., Chair Date Stewart Schwartz, Ph.D. Date William Mullen, Ph.D. Date RUNNING HEAD: CANADIAN PATRIOTISM & THE TIMBIT 3 Copyright © 2014 Shelanne Nicole Jennings All Rights Reserved RUNNING HEAD: CANADIAN PATRIOTISM & THE TIMBIT 4 Dedication To my amazing family, who are my legs when I cannot stand, & my awesome Lord and Savior, who is my life’s hope and purpose. RUNNING HEAD: CANADIAN PATRIOTISM & THE TIMBIT 5 Acknowledgements I cannot fully express my appreciation to my thesis committee: Dr. Martin, Dr. Mullen and Dr. Schwartz. Dr. Martin, thank you for all of the care, support and dedication throughout the research process. Your encouragement gave me the confidence I needed to pursue a topic that was true to my interests and identity. Dr. Mullen, thank you for your care and detailed critiques of my thesis work, as well as your encouragement in prior classes. Your dedication has made me a better student and a clearer academic writer. Dr. Schwartz, thank you for your practicality and your honesty – your advice has given me the confidence I needed to step out into the business world. To my supervisor, mentor and friend, Mrs. Deborah Huff, thank you for giving me the opportunity to serve in your office while I pursued my Master’s degree. -

Press Release

Press Release FINANCIÈRE QUICK PROVIDES A STRATEGIC UPDATE AND ANNOUNCES CERTAIN PRELIMINARY RESULTS FOR THE YEAR 2016 Saint-Denis, France — April 10, 2017, 8:00 am. Financière Quick (the “Company”), a subsidiary of Burger King France S.A.S., provides today updated information regarding its strategy following its acquisition by Burger King France in December 2015. References to “Quick” refer to restaurants bearing the Quick brand and references to “Burger King” refer to restaurants in France bearing the Burger King brand. This press release constitutes a public disclosure of inside information by Financière Quick under Regulation (EU) 596/2014 (16 April 2014) and Implementing Regulation (EU) No 2016/1055 (10 June 2016). Strategic Update In December 2015, we were acquired by Burger King France, who seized the opportunity to secure its growth trajectory of the Burger King brand throughout mainland France. Following the acquisition, we have started to implement an ambitious plan to accelerate our development through the selective and controlled conversion of Quick restaurants to Burger King brand restaurants, while continuing to support and improve the Quick brand and network. Since the beginning of the implementation of this plan, we have demonstrated a successful track-record of converting Quick restaurants to the Burger King brand and have increased comparable restaurant sales as well as increased restaurant-level profitability, in particular through improved operating metrics at the converted restaurants. For the year ended December 31, 2016, the annualized ARS (as defined below) for our Burger King brand restaurants was approximately €4.0 million as compared to the annualized ARS for our Quick restaurants of approximately €1.9 million. -

Amrest Holdings SE 28 FEBRUARY 2020

(all figures in EUR millions unless stated otherwise) Consolidated Directors’ Report for the year ended 31 December 2019 AmRest Holdings SE 28 FEBRUARY 2020 Net 1 AmRest Group Consolidated Directors’ Report for the year ended 31 December 201 9 (all figures in EUR millions unless stated otherwise) 2 AmRest Group Consolidated Directors’ Report for the year ended 31 December 201 9 (all figures in EUR millions unless stated otherwise) Contents LETTER TO THE SHAREHOLDERS ........................................................................................................................................ 4 FINANCIAL HIGHLIGHTS (CONSOLIDATED DATA) ........................................................................................................... 6 GROUP BUSINESS OVERVIEW .............................................................................................................................................. 7 FINANCIAL AND ASSET POSITION OF THE GROUP ...................................................................................................... 12 BRANDS OPERATED BY THE GROUP............................................................................................................................... 21 KEY INVESTMENTS .............................................................................................................................................................. 25 PLANNED INVESTMENT ACTIVITIES ................................................................................................................................ -

Case Study Dates Effort Ran: December 4, 2018 – December 12, 2018 2020 EFFIE AWARDS UNITED STATES Category Situation: GOLD WINNER Growing

Competition: Effie United States Ran in: United States Category: Marketing Innovation Solutions Brand/Client: Burger King Lead Agency: FCB New York Contributing Companies: O Positive Mackcut Alison Brod Marketing + Communications Product/Service: Food Classification: National Case Study Dates Effort Ran: December 4, 2018 – December 12, 2018 2020 EFFIE AWARDS UNITED STATES Category Situation: GOLD WINNER Growing Credits: “THE WHOPPER DETOUR” Nick Divers Ari Halper BK needed to generate excitement for its revamped Adam Isidore mobile app with order-ahead functionality. Rather than Henna Kathiya using a typical coupon, we leveraged a powerful insight: Janice Katz With the new BK App, anywhere can be a place to order a Jonathan Klein Whopper – even a McDonald’s, turning their much larger Ralph Laucella footprint into ours. Rewarding customers with a $0.01 Fred Levron Whopper (when ordered from McD’s), we invited Htat Lin Htut consumers to engage in the trolling fun, hitting #1 on both Jesse Morris app stores, generating 1.5 million downloads in just 9 Gina Pagano days, and an ROI of 37:1. Jason Reda Brooke Scher Mogan Gabriel Schmitt Alex Sprouse Laszlo Szloboda Sarah Tarner Version: Original Effie Awards Category Context At a structural disadvantage against McDonald’s and with a miniscule budget, BK needed to get an indifferent world excited about its revamped mobile app. Ditching timeworn incentives such as discounts, we leveraged a powerful insight: with the new BK app, anywhere becomes a place to order BK - even a McDonald’s. Leveraging the much larger real estate footprint of our main competitor we amplified our reach dramatically. -

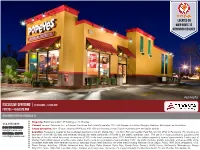

Located on Main Route to Renowned Beaches

Located on main route to renowned Beaches FILE PHOTO EXCLUSIVE OFFERING | $2,343,000 – 5.50% CAP Popeyes– absolute nnn 4511 saufley field rd, pensacola, fl Property. Brand new 2,265+ SF building on +0.77 acres. 214.915.8890 Tenant. Lessee: Sailormen Inc., a Popeyes franchisee that currently operates 130+ unit Popeyes in Florida, Georgia. Alabama, Mississippi, and Louisiana. BOB MOORHEAD Lease structure. New 15-year, absolute NNN lease with 10% rent increases every 5 years in primary term and option periods. [email protected] Location. Popeyes is located at the southwest quadrant of US-90 “Mobile Hwy.” (33,000 VPD) and Saufley Field Rd. (29,000 VPD) in Pensacola, FL. US-90 is an RUSSELL SMITH east-west 1,633-mile US Hwy. that traverses through the entire panhandle of Florida to the state’s northeast coast.. The site is in close proximity to popular tourist [email protected] beaches of the city, which has cause an increase of 30% in the local economy since 2015. Additionally, the subject property is located approximately 2-miles east of Saufley Field military airport, an active naval station that is home to a population of approximately 1,000. The traffic volumes, growth, popularity, and accessibility of the immediate trade area have attracted numerous nationally known retail brands to the trade area including Walmart, Home Depot, Publix, Winn Dixie, Walgreens, CVS, Planet Fintess, AutoZone, O’Reilly, Advanced Auto, Pep Boys, Dollar General, Dollar Tree, Family Dollar, Denny’s, Waffle House, McDonald’s, Whataburger, Burger King, KFC, Sonic, Pizza Hut, Taco Bell, Arby’s, Subway, and many more.