6-MONTH FINANCIAL REPORT for the PERIOD ENDED 30Th JUNE 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pre-Boarding Health Declaration Questionnaire OUTBOUND

OUTBOUND ATHENS-HYDRA Pre-boarding health declaration questionnaire (The questionnaire is to be completed by all adults before embarkation) Name of Vessel: Shipping Company: Date and time of itinerary: Port of disembarkation: FLYING CAT4 HELLENIC SEAWAYS 08:30 17/06/2021 PIREAS Contact telephone number for the next 14 days after disembarkation: First Name & Surname as shown Number of Aircraft in the identification Card/ Passport: Father’s name: Seat: Type Seat or Cabin Α B C D 1 Α) ECONOMY First Name & Surname of all children Β) AIRCRAFT TYPE travelling with you who are C) BUSINESS under 18 years old: D) CABIN Α B C D Α B C D Α B C D Α B C D Within the past 14 days have you or has any person listed above: YES NO 1. Presented sudden onset of symptoms of fever or cough or difficulty in breathing or sudden onset of anosmia, ageusia or dysgeusia? .................................................................................................. 2. Had close contact with anyone diagnosed as having coronavirus COVID-19 .......................................... 3. Provided care for someone with COVID-19 or worked with a health care worker infected with COVID-19?.......................................................................................................................... 4. Visited or stayed in close proximity to anyone with COVID-19? .............................................................. 5. Worked in close proximity to or shared the same classroom environment with someone with COVID-19?........................................................................................................................ 6. Travelled with a patient with COVID-19 in any kind of conveyance? ....................................................... 7. Lived in the same household as a patient with COVID-19? ..................................................................... TEST RESULTS AND VACCINATION 8. Have you been tested for COVID-19 with a molecular method (PCR) within the past 72 hours? NO PENDING RESULTS POSITIVE1 NEGATIVE 9. -

Agriculture, Fishery, Food and Sustainable Rural Development in Greece

Agricultural, fishery, food and sustainable rural development in Greece Kagkou E. in Allaya M. (ed.). Les agricultures méditerranéennes : analyses par pays Montpellier : CIHEAM Options Méditerranéennes : Série B. Etudes et Recherches; n. 61 2008 pages 207-240 Article available on line / Article disponible en ligne à l’adresse : -------------------------------------------------------------------------------------------------------------------------------------------------------------------------- http://om.ciheam.org/article.php?IDPDF=800138 -------------------------------------------------------------------------------------------------------------------------------------------------------------------------- To cite this article / Pour citer cet article -------------------------------------------------------------------------------------------------------------------------------------------------------------------------- Kagkou E. Agricultural, fishery, food and sustainable rural development in Greece. In : Allaya M. (ed.). Les agricultures méditerranéennes : analyses par pays . Montpellier : CIHEAM, 2008. p. 207- 240 (Options Méditerranéennes : Série B. Etudes et Recherches; n. 61) -------------------------------------------------------------------------------------------------------------------------------------------------------------------------- http://www.ciheam.org/ http://om.ciheam.org/ Agriculture, Fishery, Food and Sustainable Rural Development in Greece Elena Kagkou CIHEAM, Paris (France) • Economic developments in 2006 are -

THESSALONIKI GREECE Acomplia 210X290 ENGL.Pdf 9/5/08 4:57:23 PM

FINAL PROGRAMME & BOOK OF A BSTRACTS THESSALONIKI GREECE acomplia 210X290_ENGL.pdf 9/5/08 4:57:23 PM C M Y CM MY CY CMY K THESSALONIKI-GREECE CONTENTS Page Word of Welcome 5 About BalNeSO 6 About HMAO 7 Committees 8 HMAO Awards 9 Invited Speakers and Chairpersons 10 Programme at-a-glance 12 Scientific Programme 14 Registration 21 General Information 22 General Information about Greece 24 General Information about Thessaloniki 25 Abstract Book 29 Acknowledgements Exhibition Plan 3 THESSALONIKI-GREECE WORD OF WELCOME Dear colleagues, It is with great pleasure and honour that we welcome you to the 3rd Balkan Congress on Obesity which is taking place on October 17-19, 2008, at the Porto Palace Hotel, in Thessaloniki, Greece The congress is being organised by the Balkan Network for the Study of Obesity (BalNeSO) and the Hellenic Medical Association for Obesity (HMAO) Due to HMAO’s long history of well organised and successful scientific events, both locally and internationally, we believe that the 3rd BCO will be a unique experience The congress addresses all the important topics in the field of obesity, aiming to focus primarily on the region of the Balkan Peninsula We feel honoured that eminent scientists from all over Europe are going to contribute to a scientific programme of high level The 3rd BCO is being preceded by the 8th Macedonian Congress on Nutrition and Dietetics, which is being organised by the Technological Educational Institution of Thessaloniki and is taking place on October 16-17, 2008 Although its official language is Greek, -

Corporate Presentation

Corporate Presentation FY2013 results Contents Section 1: Group overview Section 2: Greek macroeconomic environment Section 3: FY2013 Financials Section 4: Convertible Bond Loan issue Section 5: MIG portfolio companies Vivartia Attica Group Hygeia Group SingularLogic FAI Aviation Group Sunce Bluesun Hilton Cyprus RKB MIG Real Estate Appendix: Management biographies Section 1 Group overview MIG at a snapshot 4 Portfolio of leading companies across key defensive sectors Food & Beverages Largest diversified food group in Greece No.1 milk producer in Greece (Delta) and Bulgaria (UMC) No.1 frozen vegetable and frozen pastry producer in Greece No.1 in Quick Service Restaurants (QSR), branded coffee shops and catering in Greece JV with Exeed Industries presents an attractive future growth pillar with a geographic scope encompassing over 330m consumers in the UAE, GCC and MENA region Strategic partnership with Granarolo to enhance exports growth Healthcare The largest hospital group in Greece with the leading general hospital facilities and maternity clinics 4 hospitals in full operation: 3 in Greece and 1 in Albania with a total licensed capacity of 1,261 beds The only JCI accredited hospital in Greece and the exclusive partner of Johns Hopkins in Greece High-calibre physicians using state of the art medical equipment IT & Telecoms Leader in the Greek IT market with the largest installed base: over 100 multinational, 700 large and 40,000 small & medium enterprise clients MIG at a snapshot (continued) 5 Portfolio of leading companies across key defensive sectors Transportation & Shipping Attica : leading passenger ferry operator in the Eastern Mediterranean with a modern fleet of 13 top class ferries. -

Investor Presentation June 2017 Table of Contents 2

Investor Presentation June 2017 Table of Contents 2 Page Section 1: Group overview 3 Section 2: Portfolio companies 18 Attica Group 26 Vivartia 36 Hygeia Group 48 SingularLogic 59 Hilton Cyprus 66 RKB 68 Section 3: Financial Statement information 71 Appendix: Management biographies 84 Section 1 Group Overview MIG at a snapshot 4 High-quality portfolio of leading companies across key defensive sectors Net Asset Value (NAV) (2016) €666m Group Assets (2016) €2,715m NAV per share (2016) €0.71 Group Net Fixed Assets (2016) €1,134m Group Revenues (2016) €1,104 EBITDA Business Operations (1) (2016) €172m Group Gross Debt (€m) (2016) €1,674m EBITDA Consolidated (2016) €134m Tourism & Transportation Food & Dairy Healthcare Real Estate IT (32% of GAV) (32% of GAV) (15% of GAV) (15% of GAV) Leisure (2% of GAV) (4% of GAV) March 2017: MIG announced the sale of its entire stake in Sunce Koncern d.d. (1) EBITDA Business Operations = Group EBITDA excl. holding companies, provisions beyond normal course of business (€15m impairment of trade receivables from Marinopoulos group), gains/losses from the sale of investment property, fixed & intangible assets & revaluation of investment property Highly diversified operations across attractive sectors 5 Revenue breakdown (2016 data) EBITDA breakdown (2016 data) Gross Asset Value breakdown (2016 data) 4% 11% 19% 3% 27% 21% 32% 2% 18% 51% 15% 24% 41% 32% Food & Dairy Transportation Healthcare IT Other (Real Estate, Leisure) 2014 2015 2016 (in €m) 2014 2015 2016 2014 2015 2016 Group Sales (€m) 1,117 1,143 1,104 EBITDA Business Ops 1 89 163 172 Gross Asset Value (€m) 1,534 1,480 1,381 % margin 8.0% 14.2% 15.6% y-o-y chg (%) +4% +2% -3% GroupGross Debt (€m) 1,752 1,693 1,674 EBITDA Consolidated 66 125 134 3 NAV (€m) 923 783 666 Greek GDP 2 0.4% -0.3% -0.1% y-o-y chg (%) % margin 5.9% 10.9% 12.1% NAV pershare (€) 0.98 0.83 0.71 (1) EBITDA Business Operations = Group EBITDA excl. -

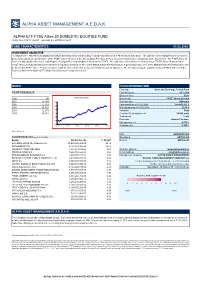

Alpha Asset Management Α.Ε.D.Α.Κ

ALPHA ASSET MANAGEMENT Α.Ε.D.Α.Κ. ALPHA ETF FTSE Athex 20 DOMESTIC EQUITIES FUND HCMC Rule 789/13.12.2007 Gov.Gaz. s.n. 2474/B/31.12.07 FUND CHARACTERISTICS 01.02.2008 INVESTMENT OBJECTIVE The Alpha ETF FTSE Athex 20 DOMESTIC EQUITIES FUND is the first Exchange Traded Fund listed on the Athens Stock Exchange. The objective of the Mutual Fund’s investment policy is to replicate the performance of the FTSE® Athex 20 Index of the Athens Stock Exchange in Euro, by mirror matching the composition of the Benchmark. The FTSE® Athex 20 Index is a big capitalization Index, capturing the 20 largest blue chip companies listed on the ATHEX. The total value of investments in shares of the FTSE® Athex 20 Index and in FTSE® Athex 20 Index derivatives accounts for a regulatory minimum of 95% of the Mutual Fund’s Net Asset Value. A percentage up to 35% of the Mutual Fund’s Net Asset Value may be invested in FTSE® Athex 20 Index derivatives with the aim of achieving the Mutual Fund’s investment objectives. The derivatives may be tradable (such as FTSE® Athex 20 Index futures) and/or non-tradable (OTC Swap Transactions) in a regulated market. INDEX FUND INFORMATION Fund type Domestic Exchange Traded Fund PERFORMANCE First listing date 24.1.2008 Base currency Euro Year (%) FTSE Athex 20 Index Benchmark FTSE® Athex 20 Index 2007 15,79% 3300 Currency risk Minimum 2006 17,73% Fund assets as of 01.02.2008 141.403.221 € 2800 2005 30,47% Net unit price as of 01.02.2008 23,40 € 2004 32,27% 2300 Valuation Daily 2003 35,43% 1800 Creation / Redemption unit 50.000 units 1300 Trading unit 1 unit Dividends Annual - 30 June 800 Management fee 0,275% 300 31/12/02 31/12/03 31/12/04 31/12/05 31/12/06 31/12/07 Custodian fee 0,100% Source: Bloomberg ISIN GRF000013000 COMPOSITION (as of 01.02.2008) Bloomberg AETF20 GA Equity Market Cap (€) % Weight Reuters AETF20.AT NATIONAL BANK OF GREECE S.A. -

Marfin Investment Group Financial Results: First Half 2013

Investor Relations +30 210 3504046 www.marfininvestmentgroup.com Investor Release 2 September 2013 MARFIN INVESTMENT GROUP FINANCIAL RESULTS: FIRST HALF 2013 MIG achieves operating EBITDA profitability from recurring business operations (€11.1m vs. €1.6m losses in H1 2012) Consolidated H1 2013 revenues of €581.3m, 3.6% annual reduction, amid ongoing adverse economic and market conditions. Consolidated Q2 2013 revenues of €313.2m, vs. €323.3m in Q2 2012, implying a deceleration to the annual rate of revenue decline on a quarterly basis. H1 2013 EBITDA from recurring business operations 1 of €11.1m, a significant improvement vs. €1.6m loss in H1 2012, attributed to market share gains, expanding gross profit margins, cost containment effectiveness and improved efficiency. Reported group EBITDA of €4.0m, vs. €7.6m loss in H1 2012. Consolidated net loss, after tax and minorities, of €139.7m, adversely impacted by one-off deferred taxes (€35m) and discontinued operations’ losses (€22.8m), vs. €960.5m losses in H1 2012. H1 2013 Net Asset Value (NAV) of €1.23bn (vs. €1.30bn in FY2012), translating to a NAV per share of €1.59 (vs. €1.68 in FY2012). Cash balances, including restricted cash, of €177m at group and €100m at parent company level. Group receivables from the Greek state at €130m in H1 2013 vs. €146m in FY2012. Continuous dynamic asset rebalancing, aimed at deleveraging, yields the desired results, as consolidated gross debt declined by €61m vs. FY2012. Convertible Bond Loan (CBL) issue (29.07.2013) was covered by a total amount of €215m, of which €211.9m originated from the tender for exchange of bonds issued by the Company on 19.03.2010 and €3.1m represents new capital from the exercise of pre-emption rights. -

6-MONTH FINANCIAL REPORT for the PERIOD ENDED 30Th JUNE 2017

6-MONTH FINANCIAL REPORT FOR THE PERIOD ENDED 30th JUNE 2017 According to article 5 of L. 3556/2007 and relevant executive decisions of Hellenic Market Commission Board of Directors (amounts in € thousand unless otherwise mentioned) MARFIN INVESTMENT GROUP HOLDINGS S.A. 67, Thiseos Avenue, 146 71 Kifissia, Greece Tel. +30 210 6893450 General Commercial Reg. Nr. 3467301000 (Societe Anonyme Reg. Nr. 16836/06/Β/88/06) INTERIM FINANCIAL REPORT FOR THE th PERIOD ENDED JUNE 30 , 2017 [THIS PAGE HAS DELIBERATELY BEEN LEFT BLANK] MARFIN INVESTMENT GROUP HOLDING S.A., 67 Thiseos Ave, 146 71 Kifissia, Greece Page 2 INTERIM FINANCIAL REPORT FOR THE th PERIOD ENDED JUNE 30 , 2017 Table of Contents A. REPRESENTATIONS OF THE MEMBERS OF THE BOARD OF DIRECTORS ................................................ 6 B. INDEPENDENT AUDITOR’S REVIEW REPORT ............................................................................................... 7 C. MANAGEMENT REPORT OF THE BOARD OF DIRECTORS OF “MARFIN INVESTMENT GROUP S.A.” ON THE CONSOLIDATED AND CORPORATE FINANCIAL STATEMENTS FOR THE SIX-MONTH PERIOD ENDED AS AT 30/06/2017 .......................................................................................................................................... 9 D. INTERIM CONDENSED SEPARATE AND CONSOLIDATED FINANCIAL STATEMENTS FOR THE PERIOD ENDED JUNE 30th 2017 ............................................................................................................................ 25 Ι. INTERIM SIX MONTH FINANCIAL STATEMENTS FOR THE SIX-MONTH -

Market Dynamics in Food Supply Chains: the Impact of Globalisation and Consolidation on Firms’ Mark-Ups

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Kaditi, Eleni A. Working Paper Market Dynamics in Sypply Chains: The Impact of Globalization and Consolidation on food companies' mark-ups LICOS Discussion Paper, No. 273 Provided in Cooperation with: LICOS Centre for Institutions and Economic Performance, KU Leuven Suggested Citation: Kaditi, Eleni A. (2011) : Market Dynamics in Sypply Chains: The Impact of Globalization and Consolidation on food companies' mark-ups, LICOS Discussion Paper, No. 273, Katholieke Universiteit Leuven, LICOS Centre for Institutions and Economic Performance, Leuven This Version is available at: http://hdl.handle.net/10419/74915 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available -

Speakers' Bios

Sandra Ghandi Al Azzeh, Education for Employment alumnus Sandra Ghandi Al Azzeh is an alumnus of Education for Employment (EFE). She graduated from Bethlehem University in 2012 with a degree in Hotel Management. Despite the challenging job market in Palestine she was able to find a receptionist position in the hostel of a local Lutheran Church. After three years there, she realized that there was no opportunity for advancement and felt that she was being exploited as a young worker. Looking to advance her career, in 2013 she applied for the hospitality training program at Palestine Education for Employment (PEFE). PEFE had partnered with Ararat Hotel, a luxury hotel and the second largest in Bethlehem, to help the hotel source entry-level employees with strong time management, customer service and communications skills needed for positions in the hospitality agency. After the month- long training course, Sandra was placed into a job at Ararat and has quickly moved up in the ranks, becoming a front office supervisor. She aims to become the general manager of a hotel, and wants to focus specifically on recruiting young, entry-level employees. Orestis Andreadakis, Artistic Director, Athens International Film Festival Orestis Andreadakis was born in Herakleion in Crete, studied cinema in Athens and Paris, lived and worked in Geneva and southern France. He has provided articles and reviews on film to the newspapers Eleftheros Typos, Avgi and Ethnos, and to various monthly and weekly magazines. These last few years, he has been the director of CINEMA magazine, the Artistic Director of the Athens International Film Festival and the Athens Open Air Film Festival, and film journalist for MEGA TV. -

AXIA Research

AXIA Research Bloomberg <AXVA> Greece-Daily Note April 13, 2018 Headlines Athens General Index Macroeconomic News According to press, EuroWorking Group (EWG) officials told the Greek government that the draft growth strategy it presented for the day after Greece’s exit from the adjustment program, needs to be more precise in specific areas and to clearly account for the associated costs on the budget. According to Kathimerini, in parallel to the EWG meeting yesterday, there was also a Washington Group meeting yesterday. Debt relief and reforms will be the focus in today’s meeting between the Greek Finance Minister Euclid Tsakalotos and his German counterpart Olaf Scholz in Berlin. ELSTAT announced that the seasonally adjusted unemployment rate for January 2018 came to 20.6% compared to the upward revised 23.2% in January 2017 and 20.8% in December 2017. According to ELSTAT, total building activity in Jan’18 on the basis of issued permits increased close daily % Ytd % by 18.0% y-o-y, by 45.8% in volume terms while increased by 45.2% in surface terms. For the Athens General 806.08 0.85% 0.46% Market Turnover (EURm) 60.847 21.35% rolling 12-month period, building permits are up 9.2% (+20.7% surface, +23.5% volume). Market Cap (EURbn) 55.507 Market Cap / GDP* 29.67% Additional Headlines *2016 th ECB’s Governing Council on April 11 lowered the ELA ceiling for Greek banks by EUR 1.9bn to FTSE ASE movers (last trading day) EUR 14.7bn TOP Aegean Airlines announced that traffic volumes in 1Q18 increased by 12%. -

PRESS RELEASE Q1 2016 Results

27 May 2016 PRESS RELEASE Q1 2016 Results Consolidated EBITDA from business operations 1 increased 60.2% to €26.5m vs. €16.5m in Q1 2015 Consolidated Q1 2016 revenues amounted to €245m, recording a marginal decline of €1.2m, or -0.5% vs. Q1 2015. The marginal reduction is attributed to the prolonged economic recession in Greece, as the GDP in Q1 2016 declined by -1.3% vs. Q1 2015, as well as to the ongoing challenging economic and market conditions in the majority of the business sectors. Consolidated EBITDA from business operations increased 60.2% to €26.5m vs €16.5m in Q1 2015. The increase is primarily attributed to the marked profitability improvement of subsidiaries ATTICA, VIVARTIA and HYGEIA. Group consolidated EBITDA (including holding companies) increased 75.6% to €23.4m vs. €13.3m in Q1 2015. Group consolidated EBITDA margin almost doubled to 9.6% vs. 5.4% in Q1 2015. The widening margin is attributed to efficiency improvements as well as cost containment effectiveness. In May 2016, the Company issued a new common bond loan amounting to €150m, which EUROBANK ERGASIAS undertook to cover, to refinance an equivalent amount of an existing debt facility. The refinancing agreement provides for the long-term restructuring of the said debt, by extending the maturity by 3 years (October 2019). With this agreement, the Company completed the long-term restructuring of the entirety of its outstanding common bond loans, achieving the extension of the maturity horizon. 1 Consolidated EBITDA from business operations is defined as Group EBITDA excluding holding companies and non-recurring items.