Return of Organization Exempt from Income

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Department of Local Affairs Fy 2010-11 Joint Budget Committee Hearing Agenda

DEPARTMENT OF LOCAL AFFAIRS FY 2010-11 JOINT BUDGET COMMITTEE HEARING AGENDA Wednesday, January 6, 2010 9:00 am – 11:00 am 9:00-9:30 INTRODUCTIONS AND OPENING COMMENTS 9:30-10:15 CASH FUND TRANSFERS TO THE GENERAL FUND 1. The staff briefing indicated that upwards of $103 million would be transferred indefinitely from various cash funds administered by the Department. Is it assumed that these funds will never be repaid back to the originating cash fund? The department does not anticipate the transfers to be repaid. 2. Will the one-day transfers from the Local Government Severance Tax Fund and the Local Government Mineral Impact Fund that have been proposed by the Governor for FY 2009-10 have an operational impact on the program (i.e., grants distributed, loans issued)? Did the one-day transfers authorized by S.B. 09-279 have an operational impact? If yes, how did this impact manifest itself? None of the one day transfers had an impact on department operations. 3. Please provide a list all the grant awardees and amounts, by county, and by type of grant, made from the Local Government Limited Gaming Impact Fund in FY 2008-09. This is provided as Attachment 1. 4. Please provide the following related to the Colorado Waste Tire Program: (a) the total amount of stockpiled tires in the State; (b) the total number of waste tire processors and their relative size (i.e., consumption); (c) the energy produced from waste tires relative to coal and natural gas; (d) trends related to the amount of waste tires in the State; and (e) comparative analysis showing how waste tires are utilized in other states (i.e. -

Class Action Complaint Filed in Detroit, MI

UNITED STATES DISTRICT COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION PAT CASON-MERENDA and JEFFREY A. ) SUHRE on behalf of themselves and others ) similarly situated, ) Case No. 06-15601 ) Plaintiffs, ) Hon. Gerald E. Rosen ) v. ) Magistrate: Mona K. Majzoub ) DETROIT MEDICAL CENTER, HENRY ) FORD HEALTH SYSTEM, MOUNT ) CLEMENS GENERAL HOSPITAL, INC., ) ST. JOHN HEALTH, OAKWOOD ) HEALTHCARE INC., BON SECOURS ) COTTAGE HEALTH SERVICES, WILLIAM ) BEAUMONT HOSPITAL d.b.a BEAUMONT ) HOSPITALS, and TRINITY HEALTH CORP., ) ) Defendants. ) THIRD CORRECTED CLASS ACTION COMPLAINT JURY TRIAL REQUESTED Plaintiffs Pat Cason-Merenda and Jeffrey A. Suhre (“Plaintiffs”), by and through counsel, on behalf of themselves and all others similarly situated, bring this action against defendants for damages, and demand trial by jury, files this complaint. Nature of the Action 1. Defendants, which own and operate hospitals in the Detroit-Warren-Livonia Metropolitan Statistical Area (“Detroit MSA” or “Detroit area”), have for years conspired among themselves and with other hospitals in the Detroit MSA to depress the compensation levels of registered nurses (“RNs”) employed at the conspiring hospitals, in violation of Section 1 of the Sherman Act, 15 U.S.C. § 1. 2. In furtherance of their conspiracy, defendants and their co-conspirators also agreed to regularly exchange detailed and non-public information about the compensation each is paying or will pay to its RN employees. The agreement to exchange such information has facilitated the formation, implementation and enforcement of defendants’ wage-fixing conspiracy. Pursuant to this agreement defendants and their co-conspirators in fact have exchanged such information, through meetings, telephone conversations and written surveys. -

20026 Alaska Native Medical Center

Preliminary Preliminary Medicare ID Hospital Street City State Zip County Penalty HAC Score 20026 Alaska Native Medical Center 4315 Diplomacy Dr Anchorage AK 99508 Anchorage Y 9 20017 Alaska Regional Hospital 2801 Debarr Road Anchorage AK 99508 Anchorage Y 8.95 20008 Bartlett Regional Hospital 3260 Hospital Dr Juneau AK 99801 Juneau N 3 20024 Central Peninsula General Hospital 250 Hospital Place Soldotna AK 99669 Kenai PeninsulaN 4 20012 Fairbanks Memorial Hospital 1650 Cowles Street Fairbanks AK 99701 Fairbanks NorthY Star 9 20006 Mat-Su Regional Medical Center 2500 South Woodworth LoopPalmer AK 99645 Matanuska NSusitna 6.75 20027 Mt Edgecumbe Hospital 222 Tongass Dr Sitka AK 99835 Sitka N 7 20001 Providence Alaska Medical Center Box 196604 Anchorage AK 99519 Anchorage Y 8.05 20018 Yukon Kuskokwim Delta Reg HospitalPo Box 287 Bethel AK 99559 Bethel N 6 10036 Andalusia Regional Hospital 849 South Three Notch StreetAndalusia AL 36420 Covington N 6 10079 Athens-Limestone Hospital 700 West Market Street Athens AL 35611 Limestone N 5.6 10169 Atmore Community Hospital 401 Medical Park Drive Atmore AL 36502 Escambia N 7 10149 Baptist Medical Center East 400 Taylor Road Montgomery AL 36117 MontgomeryN 3.6 10023 Baptist Medical Center South 2105 East South Boulevard Montgomery AL 36116 MontgomeryN 3.95 10103 Baptist Medical Center-Princeton 701 Princeton Avenue SouthwestBirmingham AL 35211 Jefferson N 5.45 10058 Bibb Medical Center 208 Pierson Ave Centreville AL 35042 Bibb N 7 10139 Brookwood Medical Center 2010 Brookwood Medical CenterBirmingham -

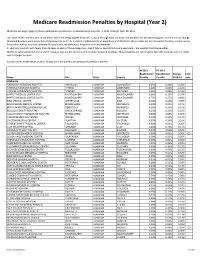

Readmissions Year 2 Data FORMATTED.Xlsx

Medicare Readmission Penalties by Hospital (Year 2) Medicare will begin applying these readmissions penalties to reimbursements from Oct. 1, 2013, through Sept. 30, 2014. This chart shows the first year of penalties, which are being applied from Oct. 1, 2012, through Sept. 30, 2013; the penalties for the upcoming year; and the annual change. Maryland hospitals were not penalized because the state has a unique reimbursement arrangement with Medicare. Also exempt are certain cancer hospitals, critical access hospitals as well as hospitals dedicated to psychiatry, rehabilitation, long‐term care and veterans. In addition, hospitals with fewer than 25 cases in each of three categories ‐‐ heart failure, heart attack and pneumonia ‐‐ are exempt from the penalties. Medicare calculated penalties for some hospitals that are not on its list of currently registered hospitals. Those hospitals are noted with a (1) in the footnote column. Some may no longer be open. Source: Kaiser Health News analysis of data from the Centers for Medicare & Medicaid Services FY2013 FY 2014 Readmission Readmission Change Foot Name City State County Penalty Penalty 2013‐14 note Alabama ANDALUSIA REGIONAL HOSPITAL ANDALUSIA ALABAMA COVINGTON 0.59% 0.33% ‐0.26% ATHENS‐LIMESTONE HOSPITAL ATHENS ALABAMA LIMESTONE 0.04% 0.00% ‐0.04% ATMORE COMMUNITY HOSPITAL ATMORE ALABAMA ESCAMBIA 0.95% 1.08% 0.13% BAPTIST MEDICAL CENTER EAST MONTGOMERY ALABAMA MONTGOMERY 0.36% 0.12% ‐0.24% BAPTIST MEDICAL CENTER SOUTH MONTGOMERY ALABAMA MONTGOMERY 0.75% 0.27% ‐0.48% BIBB MEDICAL CENTER CENTREVILLE -

CAQ 409 33 CAQH 2008 Annual Report 6F.Indd

■■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■■■■■■■■ ■■ ■ ■■ ■ ■ ■■■■■■■ ■ ■■■■ ■■■ ■ ■ ■■ ■ ■ ■ ■ ■ ■■ ■ ■ ■ ■ ■ ■ 2008 HIGHLIGHTS: STEADY GROWTH, MEASURABLE RESULTS, LASTING CONTRIBUTIONS For nearly a decade CAQH® has consistently demonstrated that industry ingenuity can contribute meaningful solutions to improve the U.S. healthcare system. We started with highly regarded national education programs that communicated the appropriate use of antibiotics and the critical role that beta-blockers play in preventing future heart attacks. We developed and implemented a centralized approach to data collection that has now forever changed provider credentialing. We introduced an innovative e-prescribing initiative. Most recently, we launched a multi-stakeholder collaboration that is advancing system interoperability and driving consistent information exchange between health plans and providers. Through each, CAQH has created lasting impact. Our work in 2008 further positioned CAQH as a nonprofi t alliance that achieves what it sets out to accomplish. Both the Committee on Operating Rules for Information Exchange® (CORE) and the Universal Provider Datasource® (UPD) reached important milestones last year. CAQH solutions generated heightened interest and support from stakeholders throughout the industry. As a result, we were able to increase momentum toward realizing our vision of a healthcare system in which administrative processes are effi cient and easily understood by patients, caregivers and providers. CORE CORE effectively moved beyond the proof-of-concept stage when it fi nalized the Phase II rules in September. In addition to offering connectivity and other data-exchange infrastructure standards, the Phase II rules address information critical to the healthcare revenue cycle. These data elements include more robust patient eligibility and benefi ts information, and year-to-date patient fi nancial liability. -

Download WMTS User Guide

WMTS User Information Guide Powered by Table of Contents Introduction ....................................................................................... 3 Why use WMTS? .............................................................................. 4 Update on WMTS ............................................................................. 6 Register with ASHE .......................................................................... 7 WMTS Frequency Coordination Database ....................................... 9 Pricing Summary ............................................................................ 16 WMTS Deployment Form ............................................................... 17 Radio Astronomy ............................................................................ 21 Hospitals Affected by Carve-out Areas ........................................... 22 Contact Us ...................................................................................... 29 2 WMTS User Information Guide – V 10.1 December 2016 Powered by Introduction In response to growing concerns about interference resulting from new digital television transmitters, low power television transmitters, paging stations, and greater use of private land mobile radio equipment, the Federal Communications Commission (FCC) has done the following: Established the Wireless Medical Telemetry Service (WMTS), dedicating bands of frequencies to promote interference-free operation of medical telemetry systems, Appointed ASHE as the Frequency Coordinator for the -

Selected Papers of William L. White

Selected Papers of William L. White www.williamwhitepapers.com Collected papers, interviews, video presentations, photos, and archival documents on the history of addiction treatment and recovery in America. Citation: Baumohl, J. and White, W. (2003). Treatment Institutions. In Blocker, J. and Tyrell, I., Eds., Alcohol and Temperance in Modern History. Santa Barbara, CA: ABC-CLIO, pp. 619-624. Posted at www.williamwhitepapers.com Treatment Institutions Jim Baumohl and William L. White This article reviews the history of shortly before and after the Civil War. institutions established to “redeem,” Although the temperance movement would “reform,” “rehabilitate” or “treat” individuals become increasingly associated with the who experience problems in their goal of alcohol prohibition, groups like the relationship with alcohol and/or other drugs. Women’s Christian Temperance Union, Historically, the combined use of alcohol and founded in 1874, typically supported efforts other drugs has been very common, and to sober and rehabilitate obsessive drinkers. institutions established to treat obsessive Most temperance leaders believed that while drinkers rapidly found themselves dealing prohibition would prevent the creation of with habitués of opium, morphine, heroin, drunkards and make treatment measures cocaine, and in later years, a variety of more unnecessary at some point, in the meantime, exotic substances. treatment was an important element in the battle against Demon Rum. Therapeutic Temperance The temperance movement’s most important contribution to the history of Pleas from physicians and social treatment was a fellowship-based approach, reformers for the creation of specialized drawn from Protestant religious practices institutions for the care and control of (most notably early Methodism). -

Hospital Address City State ZIP Code FY2013 Readmission Penalty

FY2013 FY2014 FY2015 FY2016 ZIP Hospital Address City State Readmission Readmission Readmission Readmission Code Penalty Penalty Penalty Penalty 4315 ALASKA NATIVE MEDICAL CENTER DIPLOMACY ANCHORAGE AK 99508 0.2300% 0.4500% 0.4900% 0.3400% DR 2801 ALASKA REGIONAL HOSPITAL DEBARR ANCHORAGE AK 99508 0% 0.0100% 0% 0.5700% ROAD 3260 BARTLETT REGIONAL HOSPITAL JUNEAU AK 99801 0% 0% 1.2700% 0.4500% HOSPITAL DR 250 CENTRAL PENINSULA GENERAL HOSPITAL HOSPITAL SOLDOTNA AK 99669 0.0700% 0.0900% 1.4100% 1.0200% PLACE PO BOX 160 - CORDOVA COMMUNITY MEDICAL CENTER 602 CHASE CORDOVA AK 99574 Not Assessed Not Assessed Not Assessed Not Assessed AVENUE 1650 FAIRBANKS MEMORIAL HOSPITAL COWLES FAIRBANKS AK 99701 0% 0% 0.0700% 0.1300% STREET KANAKANAK HOSPITAL P O BOX 130 DILLINGHAM AK 99576 Not Assessed Not Assessed Not Assessed Not Assessed 2500 SOUTH MAT-SU REGIONAL MEDICAL CENTER WOODWORT PALMER AK 99645 0.100% 0.0100% 0.9200% 0.4800% H LOOP 222 MT EDGECUMBE HOSPITAL SITKA AK 99835 0% 0% 0% 0% TONGASS DR 1000 GREG KRUSCHEK NORTON SOUND REGIONAL HOSPITAL NOME AK 99762 Not Assessed Not Assessed Not Assessed Not Assessed AVENUE (P O BOX 966) 3100 PEACEHEALTH KETCHIKAN MEDICAL CENTER TONGASS KETCHIKAN AK 99901 Not Assessed Not Assessed Not Assessed Not Assessed AVENUE PETERSBURG MEDICAL CENTER PO BOX 589 PETERSBURG AK 99833 Not Assessed Not Assessed Not Assessed Not Assessed PROVIDENCE ALASKA MEDICAL CENTER BOX 196604 ANCHORAGE AK 99508 0% 0% 0% 0.1200% 1915 EAST PROVIDENCE KODIAK ISLAND MEDICAL CTR REZANOF KODIAK AK 99615 Not Assessed Not Assessed Not Assessed -

Medicare Readmission Chart with September 2012 Update

Medicare Readmission Penalties by Hospital (September Update) Medicare will apply the readmissions penalty to reimbursements beginning on Oct. 1. This chart shows both the original penalties released by Medicare in August and the corrected numbers Medicare released on Sept. 28. Maryland hospitals were not penalized because the state has a unique reimbursement arrangement with Medicare. In addition, hospitals with fewer than 25 cases in each of three categories-- heart failure, heart attack and pneumonia--are exempt from the penalties. These hospitals are noted in the "Penalty Eligibility Status." Source: Kaiser Health News analysis of data from the Centers for Medicare & Medicaid Services Initial Corrected Readmission Readmission Penalty Penalty Change in Penalty Eligibility Hospital Name City State Hospital Referral Region (August) (September) Penalty Status Alabama ANDALUSIA REGIONAL HOSPITAL ANDALUSIA AL Pensacola, FL 0.62% 0.67% 0.05% Enough Cases ATHENS-LIMESTONE HOSPITAL ATHENS AL Huntsville, AL 0.05% 0.06% 0.01% Enough Cases ATMORE COMMUNITY HOSPITAL ATMORE AL Pensacola, FL 0.94% 1.00% 0.06% Enough Cases BAPTIST MEDICAL CENTER EAST MONTGOMERY AL Montgomery, AL 0.37% 0.40% 0.03% Enough Cases BAPTIST MEDICAL CENTER SOUTH MONTGOMERY AL Montgomery, AL 0.71% 0.74% 0.03% Enough Cases BAPTIST MEDICAL CENTER-PRINCETON BIRMINGHAM AL Birmingham, AL 0.00% 0.00% 0.00% Enough Cases BIBB MEDICAL CENTER CENTREVILLE AL Tuscaloosa, AL 0.00% 0.00% 0.00% Enough Cases BROOKWOOD MEDICAL CENTER BIRMINGHAM AL Birmingham, AL 0.00% 0.00% 0.00% Enough Cases -

R O O T E D I N F a I T H , G R O W I N G T O G E T H E R

3005&%*/'"*5) (308*/(50(&5)&3 $SFBUJOHUIF"TDFOTJPO)FBMUI&YQFSJFODF "TDFOTJPO)FBMUI"OOVBM3FQPSU -ISSION 2OOTEDINTHELOVINGMINISTRYOF*ESUSASHEALER WE COMMITOURSELVESTOSERVINGALLPERSONSWITHSPECIAL ATTENTIONTOTHOSEWHOAREPOORANDVULNERABLE/UR #ATHOLICHEALTHMINISTRYISDEDICATEDTOSPIRITUALLY CENTERED HOLISTICCARE WHICHSUSTAINSANDIMPROVES THEHEALTHOFINDIVIDUALSANDCOMMUNITIES7EARE ADVOCATESFORACOMPASSIONATEANDJUSTSOCIETY THROUGHOURACTIONSANDOURWORDS 6ISION 7EENVISIONASTRONG VIBRANT#ATHOLICHEALTH MINISTRYINTHE5NITED3TATESWHICHWILLLEADTOTHE TRANSFORMATIONOFHEALTHCARE7EWILLENSURESERVICE THATISCOMMITTEDTOHEALTHANDWELL BEINGFOROUR COMMUNITIESANDTHATRESPONDSTOTHENEEDSOF INDIVIDUALSTHROUGHOUTTHELIFECYCLE7EWILLEXPAND THEROLEOFLAITY INBOTHLEADERSHIPANDSPONSORSHIP TOENSUREA#ATHOLICHEALTHMINISTRYOFTHEFUTURE 6ALUES 3ERVICEOFTHE0OOR'ENEROSITYOFSPIRIT ESPECIALLYFORPERSONSMOSTINNEED 2EVERENCE2ESPECTANDCOMPASSIONFORTHEDIGNITY ANDDIVERSITYOFLIFE )NTEGRITY)NSPIRINGTRUSTTHROUGHPERSONALLEADERSHIP 7ISDOM)NTEGRATINGEXCELLENCEANDSTEWARDSHIP #REATIVITY#OURAGEOUSINNOVATION $EDICATION!FlRMINGTHEHOPEANDJOYOF OURMINISTRY Letter to Associates, Colleagues and Friends “Be transformed by the renewal of your mind, that you may discern what is the will of God, what is good and pleasing and perfect.” Romans 12:2 For people of faith, the concept of transformation is not new. Believers in every generation have strived to be faithful “transformers.” History is filled with stories of powerful leaders and humble servants who, thanks to their sense of mission and purpose, changed their -

International Directory of Hospitals

healthcare international directory of hospitals membership information what you need to know your international directory of hospitals Welcome Welcome to your international directory of hospitals listing those hospitals worldwide with which we have a direct settlement agreement for in-patient care. This directory forms part of the terms of your policy. Wherever you are in the world, your directory will help you and your medical practitioner to select a hospital should you need in-patient treatment. Please keep it in a convenient place in case you need it. contents section page number this section explains: 1 introduction 3 • what your directory tells you • how to use your directory • how to arrange direct settlement 5 • what happens with out-patient-treatment • third party local knowledge 2 international directory • where you can receive treatment in the of hospitals following parts of world 7 • Caribbean 8 • Central America 9 • South America 10 • India 11 • Canada 12 • Africa 13 • Asia 50 • Australasia 66 • North America 459 • Europe 524 • Middle East Information is correct as at October 2014 2 1 introduction What your directory tells you Your international directory of hospitals lists all the hospitals worldwide with which AXA has what is known as a direct settlement agreement for in-patient care. This means that, if you receive in-patient treatment at any of the named hospitals, we will pay your eligible bills direct to them, providing that we have agreed your treatment in advance. It means you won’t have the worry of having to pay in advance for your in-patient care and then claiming reimbursement from us. -

Hospital-Acquired Condition Penalties, Year 3

Hospital-Acquired Condition Penalties, Year 3 Medicare is reducing payments to 769 hospitals with high rates of potentially avoidable infections and complications such as blood clots, bed sores and falls. This is the third year of the Hospital-Acquired Conditions Reduction Program, which was mandated by the federal health law to reduce patient injuries. Hospitals will lose 1 percent of each Medicare payment during the 12 months that began last October. This chart indicates which years hospitals were penalized under the program. Source: Centers for Medicare & Medicaid Services Hospital Name City State 2015 2016 2017 ALASKA NATIVE MEDICAL CENTER ANCHORAGE AK Yes ALASKA REGIONAL HOSPITAL ANCHORAGE AK Yes Yes BARTLETT REGIONAL HOSPITAL JUNEAU AK CENTRAL PENINSULA GENERAL HOSPITAL SOLDOTNA AK Yes CORDOVA COMMUNITY MEDICAL CENTER CORDOVA AK FAIRBANKS MEMORIAL HOSPITAL FAIRBANKS AK KANAKANAK HOSPITAL DILLINGHAM AK MANIILAQ HEALTH CENTER KOTZEBUE AK MAT-SU REGIONAL MEDICAL CENTER PALMER AK MT EDGECUMBE HOSPITAL SITKA AK NORTON SOUND REGIONAL HOSPITAL NOME AK PEACEHEALTH KETCHIKAN MEDICAL CENTER KETCHIKAN AK PETERSBURG MEDICAL CENTER PETERSBURG AK PROVIDENCE ALASKA MEDICAL CENTER ANCHORAGE AK Yes Yes PROVIDENCE KODIAK ISLAND MEDICAL CTR KODIAK AK PROVIDENCE SEWARD HOSPITAL SEWARD AK PROVIDENCE VALDEZ MEDICAL CENTER VALDEZ AK SAMUEL SIMMONDS MEMORIAL HOSPITAL BARROW AK SITKA COMMUNITY HOSPITAL SITKA AK SOUTH PENINSULA HOSPITAL HOMER AK WRANGELL MEDICAL CENTER WRANGELL AK YUKON KUSKOKWIM DELTA REG HOSPITAL BETHEL AK ANDALUSIA REGIONAL HOSPITAL ANDALUSIA AL ATHENS LIMESTONE HOSPITAL ATHENS AL ATMORE COMMUNITY HOSPITAL ATMORE AL Hospital-Acquired Condition Penalties, Year 3 Kaiser Health News Hospital Name City State 2015 2016 2017 BAPTIST MEDICAL CENTER EAST MONTGOMERY AL BAPTIST MEDICAL CENTER SOUTH MONTGOMERY AL BIBB MEDICAL CENTER CENTREVILLE AL BROOKWOOD MEDICAL CENTER BIRMINGHAM AL Yes Yes BRYAN W.