Guernsey Tourism Strategic Review

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Performance Report – 2009 Annual Performance Report 2009

Annual Performance Report – 2009 Annual Performance Report 2009 CONTENTS Page Introduction 2 Priority 1 Support the Island community through the economic downturn 3 See the full set of economic indicators set out under Priority 2 Priority 2 Maintain a strong, environmentally sustainable and diverse economy 4 2.1 Economic growth (Gross Value Added 2.2 GVA by sector 2.3 Inflation (RPIX) 2.4 Labour productivity (GVA/FTE) 2.5 Overall employment 2.6 Change in employment 2.7 Net change in business undertakings 2.8 Distribution of workforce by sector 2.9 Average earnings Priority 3 Reform the public service to improve efficiency 9 3.1 Increase/decrease in the value form of the Public Sector (see Annex) 3.2 Highly valued public services 3.3 Energy use in government buildings Priority 4 Ensure sustainable public finances 10 4.1 % Increase in tax revenue (including Impots) 4.2 States planned budget (deficit)/surplus in the Year 4.3 Capital expenditure as % of total States expenditure 4.4 Real increase/decrease in the cost of the Public Sector 4.5 Financial returns from States-owned Utilities 4.6 Tax as a % of GNI compared to other jurisdictions / GNI per capita Priority 5 Limit population growth 14 5.1 Changes in the overall population and inward migration 5.2 Employment / economic activity by age group / gender Page 1 Priority 6 Provide for the ageing population 15 6.1 Pension provisions: Proportion of households with various types of pension 6.2 Over 65s in households receiving Income Support 6.3 Economic activity of people above retirement age -

Heritage and Culture

Jersey’s Coastal Zone Management Strategy Heritage and Culture Jersey’s Coastal Zone Management Strategy aims to achieve integrated management of the whole of the Island’s inshore waters out to the Jersey maritime boundary for the first time. Seymour Tower © Jersey Tourism 1 Contents 1. HERITAGE & CULTURE IN JERSEY.............................................................................. 4 2. THE POLICY FRAMEWORK FOR HERITAGE AND CULTURE IN THE COASTAL ZONE......................................................................................................................................... 4 2.1. COUNCIL OF EUROPE CULTURAL CONVENTION FOR THE PROTECTION OF THE ARCHITECTURAL HERITAGE OF EUROPE GRANADA 1985, REVISED VALETTA, 1992 .................... 4 2.2. THE CROWN ESTATE .................................................................................................. 5 2.3. ISLAND PLANNING (JERSEY) LAW 1964, AS AMENDED................................................... 5 2.4. ISLAND PLAN 2002 ..................................................................................................... 5 2.5. SHIPPING (JERSEY) LAW 2002.................................................................................... 6 3. HISTORIC PORTS & COASTAL DEFENCE................................................................... 6 3.1. MILITARY DEFENCE FORTIFICATIONS ........................................................................... 6 3.2. HISTORIC PORTS ....................................................................................................... -

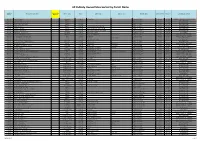

All Publicly Owned Sites Sorted by Parish Name

All Publicly Owned Sites Sorted by Parish Name Sorted by Proposed for Then Sorted by Site Name Site Use Class Tenure Address Line 2 Address Line 3 Vingtaine Name Address Parish Postcode Controlling Department Parish Disposal Grouville 2 La Croix Crescent Residential Freehold La Rue a Don Vingtaine des Marais Grouville JE3 9DA COMMUNITY & CONSTITUTIONAL AFFAIRS Grouville B22 Gorey Village Highway Freehold Vingtaine des Marais Grouville JE3 9EB INFRASTRUCTURE Grouville B37 La Hougue Bie - La Rocque Highway Freehold Vingtaine de la Rue Grouville JE3 9UR INFRASTRUCTURE Grouville B70 Rue a Don - Mont Gabard Highway Freehold Vingtaine des Marais Grouville JE3 6ET INFRASTRUCTURE Grouville B71 Rue des Pres Highway Freehold La Croix - Rue de la Ville es Renauds Vingtaine des Marais Grouville JE3 9DJ INFRASTRUCTURE Grouville C109 Rue de la Parade Highway Freehold La Croix Catelain - Princes Tower Road Vingtaine de Longueville Grouville JE3 9UP INFRASTRUCTURE Grouville C111 Rue du Puits Mahaut Highway Freehold Grande Route des Sablons - Rue du Pont Vingtaine de la Rocque Grouville JE3 9BU INFRASTRUCTURE Grouville Field G724 Le Pre de la Reine Agricultural Freehold La Route de Longueville Vingtaine de Longueville Grouville JE2 7SA ENVIRONMENT Grouville Fields G34 and G37 Queen`s Valley Agricultural Freehold La Route de la Hougue Bie Queen`s Valley Vingtaine des Marais Grouville JE3 9EW HEALTH & SOCIAL SERVICES Grouville Fort William Beach Kiosk Sites 1 & 2 Land Freehold La Rue a Don Vingtaine des Marais Grouville JE3 9DY JERSEY PROPERTY HOLDINGS -

The Ultimate Venue Hire Guide

THE ULTIMATE VENUE HIRE GUIDE Corporate and Private Hire | Weddings | Holiday Lets Whatever you’re celebrating, Jersey Heritage has the ideal venue. CONTENTS About Jersey and Jersey Heritage 1 & 2 PRIVATE HIRE Jersey Heritage private hire 3 & 4 La Hougue Bie 13 Mont Orgueil Castle 5 & 6 Maritime Museum 14 Elizabeth Castle 7 & 8 Jersey Archive 15 Hamptonne Country Life Museum 9 & 10 Living History 16 Jersey Museum 11 & 12 WEDDINGS Jersey Heritage weddings 17 & 18 Jersey Museum 25 & 26 Mont Orgueil Castle 19 & 20 La Hougue Bie 27 Elizabeth Castle 21 & 22 Victoria College 28 Hamptonne Country Life Museum 23 & 24 HOLIDAY LETS Jersey Heritage holiday lets 29 & 30 Seymour Tower 38 The Radio Tower 31 Archirondel Tower 39 Barge Aground 32 La Tour Cârrée 40 La Crête Fort 33 La Rocco Tower 41 Fort Leicester 34 Kempt Tower 42 Elizabeth Castle Apartment 35 Fisherman’s Cottage 43 L’Etacquerel Fort 36 Hamptonne Apartments 44 Lewis’s Tower 37 Advert Directory 45 to 52 Notes 55 & 56 Mont Orgueil Castle Heritage Site Locations 53 & 54 About Jersey • Page 1 About Jersey • Page 2 AbOut JERSEY JERSEY HERITAGE With its unspoilt landscape and unique blend At Jersey Heritage, we bring to life the rich history of British and French influences, Jersey really and culture of this beautiful Island. By hiring is a place where you can get away from it all. a Jersey Heritage venue for a private function, Relax and enjoy the famed hospitality of its people, wedding or holiday let, you can become a part of and lose yourself in the Island’s winding lanes the Island’s history, sharing in and enjoying the or on its breath-taking coast. -

Jersey's Military Landscape

Unlock the Island with Jersey Heritage audio tours that if the French fleet was to leave 1765 with a stone vaulted roof, to St Malo, the news could be flashed replace the original structure (which from lookout ships to Mont Orgueil (via was blown up). It is the oldest defensive Grosnez), to Sark and then Guernsey, fortification in St Ouen’s Bay and, as where the British fleet was stationed. with others, is painted white as a Tests showed that the news could navigation marker. arrive in Guernsey within 15 minutes of the French fleet’s departure! La Rocco Tower F 04 Standing half a mile offshore at St Ouen’s Bay F 02, 03, 04 and 05 the southern end of St Ouen’s Bay In 1779, the Prince of Nassau attempted is La Rocco Tower, the largest of to land with his troops in St Ouen’s Conway’s towers and the last to be Jersey’s spiritual Jersey’s maritime bay but found the Lieutenant built. Like the tower at Archirondel landscape Governor and the Militia waiting for it was built on a tidal islet and has a landscape Immerse Download the FREE audio tour Immerse Download the FREE audio tour him and was easily beaten back. surrounding battery, which helps yourself in from www.jerseyheritage.org yourself in from www.jerseyheritage.org the history the history However, the attack highlighted the give it a distinctive silhouette. and stories and stories need for more fortifications in the area of Jersey of Jersey and a chain of five towers was built in Portelet H 06 the bay in the 1780s as part of General The tower on the rock in the middle Supported by Supported by Henry Seymour Conway’s plan to of the bay is commonly known as Tourism Development Fund Tourism Development Fund fortify the entire coastline of Jersey. -

Support for Learning

SUPPORT FOR LEARNING www.jerseyheritage.org SUPPORT FOR LEARNING JERSEY HERITAGE hold collections and manage a variety of historic sites which can provide an opportunity for a learning experience outside the classroom by providing pupils with unique experiences and insights, the opportunity to visit historic sites and to see and handle real objects and the opportunity to experience primary sources. Children’s attainment can be raised, self-esteem can be increased and different learning styles can be catered for. Jersey Heritage Jersey Heritage can help and support schools in a variety of ways • Help teachers to deliver the Jersey Curriculum The benefits for children targets by basing learning on objects, sites and activities include: • Help teachers to deliver across the Curriculum • Visiting local historic sites • Bring classroom teaching alive and access • Handling real and high quality replica culture and heritage artefacts • Help teachers to provide for cross-curricular • Developing thinking skills, including problem work solving, enquiry, observation, empathy, understanding • Offer enjoyable, positive experiences for children of all ages and abilities in an • Social benefits, e.g. team work, meeting new environment where all children feel they can adults contribute • The opportunity to participate actively as • Schools can visit Jersey Heritage sites for citizens and develop social skills with other teacher-guided tours people outside of the school environment. • Loan Boxes are available for reproduction and authentic artefact handling -

Le Gris Ventre Index Issues 1 to 82 Date Issue Page 'Big Spenders?’ - They’Re All Living in St Ouen

Le Gris Ventre Index Issues 1 to 82 Date Issue Page 'Big Spenders?’ - They’re all living in St Ouen .. September 2016 72 34 “Don’t pass me by” a letter from the Manse Bailey, Malcolm September 2007 36 19 “Our dear Channel Islands are also to be freed today” Vibert, Ken June 2005 27 1 “They left everything and followed him” : The Rector looks at trial and error … Pallent, Ian September 2014 64 14 #The Real Christmas Story Pallent, Ian December 2017 77 14 1565 and all that Guy, Jan December 2014 65 38 1565 and all that Guy, Jan March 2015 66 38 16 year old marksman wins President’s Cup Winter 2003 21 13 18th Jersey St Ouen Scout Group Clubs & Associations December 1998 1 12 1st Jersey (St Ouen’s) Beavers enjoy a night over the border December 2008 41 33 1st Jersey (St Ouen’s) Scout Group Autumn 2006 32 4 1st Jersey (St Ouen’s) Scout Group March 2007 34 31 2019 Centenary Calendar : Team names March 2019 82 42 A better bus service Ginns, Michael June 2007 35 23 A Botanist in our Midst Syvret, Ken March 2013 58 19 A brave Royal Air Force pilot to be commemorated : Henri Gonay June 2014 63 28 A busy time for Scouts in St Ouen Morel, Holly December 2016 73 10 A Childhood at St Ouen’s Manor A tour of our fascinating and dangerous coastlin Dagtolou, Genette September 2018 80 44 A Childhood at St Ouen’s Manor A tour of our fascinating coastline Dagtolou, Genette June 2018 79 40 A Childhood at St Ouen’s Manor Return to the Manor at the end of the Occupatio Dagtolou, Genette December 2017 77 19 A Childhood at St Ouen’s Manor The emergence of ‘Spider -

St Mary Matters

ST MARY-Q3-2020 R 2.qxp_Layout 1 14/09/2020 12:43 Page 1 EDITION 8 AUTUMNDBDB OUR COMMUNITY PAST PRESENT FUTURE Walking tall ST MARY-Q3-2020 R 2.qxp_Layout 1 14/09/2020 12:43 Page 2 IN THIS ISSUE Welcome IN , ‘’, , . , , , B Right: The festival provides Right: The festival provides the opportunity for car the opportunity for car and motorcycle and motorcycle enthusiasts to show off enthusiasts to show off their their AUTUMN 2020 CAPITAL p9 ST MARY-Q3-2020 R 2.qxp_Layout 1 14/09/2020 12:43 Page 3 ST MARY AUTUMN 2020 p3 Contents pF Bramble Farm IN THIS ISSUE pK Sark Swim This is my first chance to welcome readers from the Some of you will remember La Pepinière editor’s chair. Sit back Farm on La Rue de Crabbé. In its hey-day it pCB The St Mary’s was home to the largest herd of Jersey pub walk and enjoy the ride. cattle on the Island. However today it’s being transformed into what they call a ‘social’ or ‘care’ farm. The idea is to give a Some of you will be feeling cross-section of people with support needs a mild sense of déjà vu – or a sense of well-being through contact with more correctly déjà lu – at farm animals. We preview of a first for Jersey seeing my name because for Amongst our regulars Robin Pittman four years previously I gives us a tour of Jersey’s coastal fortifications but even those enduring p looked after the granite-clad towers and castles can be CD From the Constable predecessor to St Mary given a new lease of life as we discover at Matters called “The Grève de Lecq. -

Elizabeth Castle Conservation Report

A CONSERVATION PLAN for ELIZABETHCASTLE, JERSEY Prepared for the JERSEY HERITAGE TRUST MAY 2006 A CONSERVATION PLAN for ELIZABETH CASTLE, JERSEY CONTENTS EXECUTIVE SUMMARY ………………. ……. 1 INTRODUCTION ……………………… PART ONE : SIGNIFICANCE 1.0 UNDERSTANDING THE SITE 1.0.1 Historical Development Period 1 : 1594-1603 Period 2 : Seventeenth century Period 3 : Eighteenth century Period 4 : Nineteenth century Period 5 : Twentieth century 1.0.2 Description Upper Ward Lower Ward Charles Fort Outer Ward Hermitage Rock 1.1 HISTORICAL OVERVIEW 1.2 ASSESSMENT OF SIGNIFICANCE 1.2.1 STATEMENT OF SIGNIFICANCE 1.2.2 ASSESSMENT OF INDIVIDUAL ELEMENTS PART TWO : CONSERVATION POLICY 2.1 INTRODUCTION 2.2 VULNERABILITY 2.3 ISSUES 2.4 CONSERVATION PLAN POLICIES 2.5 IMPLEMENTATION AND REVIEW SUPPORTING INFORMATION References and bibliography Appendix 1 : Archival sources in the Jersey Archives Appendix 2 : Archival sources in the library of the Société Jersiaise Appendix 3 : Archival sources in The National Archives Appendix 4 : Archival sources in The British Library Figures 1-19 Prepared for the JERSEY HERITAGE TRUST MAY 2006 PART ONE : SIGNIFICANCE _____________________________________________________________________________________ 1.0 UNDERSTANDING THE SITE n order to obtain a clear understanding of the heritage significance of IElizabeth Castle, Hermitage Rock, and the breakwater linking the two it is proposed to first review their historical development (Section 1.0.1) and then provide a description of the surviving structures in some detail (Section 1.0.2).1 Whilst the primary purpose of the Conservation Plan is to inform and advise discussions and decisions concerning the preservation and use of the standing structures, it is recognised that some buildings have been demolished but their remains, or parts of them, may well survive under the surface. -

Little Island. Big Story. #Theislandbreak

Occupation and Liberation Trail Guide Download FREE Audio Trail Little island. Big story. #theislandbreak www.jersey.com Occupation and Liberation Trail Guide Occupation & Liberation Discovery Audio Trail Download the FREE Geotourist App on Apple iPhone or Android. Search Jersey to Occupation sites. listen to the Occupation & Liberation Discovery Audio Trail. Take a little glimpse at our big past by selecting your preferred trail. Simply press ‘START’ on the preferred trail summary to reveal the map of the location of the points. You can also use the ‘Route Little discoveries. Big legacy. me to starting point’ on the summary page to be navigated to the beginning of the trail. It’s a little journey, that will give you a big experience. The Channel Islands were the only part of the British Isles to be occupied by German forces in World War Two. The Occupation has left an extraordinary legacy on Jersey, with hundreds of concrete bunkers, walls and tunnels ringing the coast and scattering the island’s interior. The order for such an immense construction effort came directly from Hitler, who demanded his much-prized Channel Islands be turned into impregnable fortresses. He insisted that Jersey become a centrepiece in the Atlantic Wall, Germany’s steel and concrete belt of fortifications protecting Western Europe from Allied invasion. Hitler’s blind obsession and ruthless Nazi efficiency drove the fortress building programme at a furious pace. Though never completed, fortification building in the Channel Islands drew in around one tenth of enemy wartime construction effort – leaving the amazing results seen today. Exploring, you will find most of these remarkable structures still in place, some preserved, most derelict. -

Character Type B: Coastal Plain

CHARACTER TYPE B: COASTAL PLAIN LOCATION CHARACTER AREAS • BI. Grouville • B2. St. Clement St. Saviour • B3. South Coast - Urban • B4. Quennevais Dunes • BS. St. Ouen's Bay NATURAL INFLUENCES The coastal plain character type comprises the flat apron of land which fringes the coastline in the south-east, south and west of the Island. The underlying geology is very variable including both igneous rock and Jersey Shales. It is uniformly overlain by thick drift deposits of loess, blown sand, alluvium and peats. The alluvium and peats characterise the areas where the interior valleys wash out onto the plain, while the blown sand, generally lies adjacent to the coastal edge. The area contains some of the most important habitats on the Island including freshwater marsh and salt marsh and sand dunes. The sand dunes are recognised as being of outstanding International importance, while the wetlands are of Jersey importance. CULTURAL INFLUENCES The coastal plains have been used and modified by man from Neolithic times although the threat of sand blow and flooding has meant that they have always been marginal. The Grouville area for example was heavily used in Neolithic times but was abandoned during the Bronze Age as a result of a sea level rise. The plains have many place names signifying common land or marsh and in Medieval times dunes and salt marsh would have been grazed by stock and cut for hay. Human influence would also have impacted on the plains through the arrival in the Island, with the Normans, of the rabbit. The flat open plain lies open to the sea and has been successfully defended over the centuries with numerous fortifications dating from the seventeenth century to World War II. -

2017 Red-Billed Chough Reports

RED-BILLED CHOUGH Pyrrhocorax pyrrhocorax January 2017 Report Elizabeth Corry, Bird Department Further photos (with captions) and videos can be seen at www.birdsontheedge.org New Year, new adventures. That appears to be the motto of the juveniles, in particular the foster chicks who have taken a liking to the bay at Le Pulec, known to locals as "Stinky Bay". This area is just below Battery Moltke, Les Landes, were we reported the choughs were last month. So not a surprise, but certainly an interesting addition to their home range. The bay has plenty of rotting seaweed, hence the name, harbouring insects attractive to many shorebirds. Are the choughs also exploiting this food resource as Scottish choughs do? Early morning at Stinky Bay where the juveniles have been hanging out. Photo by Liz Corry Dozens of rock pipits were down at Stinky Bay to raid the strandline for tasty morsels. Photo by Liz Corry So far our observations suggest not. Trying my best to avoid analogies to a certain president and his wall, there is a current divide between the shore birds foraging below the sea wall defence and the choughs probing the loose soil on the other side. That may change as January’s freezing temperatures restrict the amount of food available in the coastal grassland forcing the choughs to look for alternative sources. The choughs were definitely more hungry this month than last. Wing-begging at staff is just one way to determine how hungry each individual is. Having the entire group of 35 stalk staff from the public car park along the cliff path to the aviary shows just how little wild food is available.