2019 Annual Round-Up

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Driving Directions from Bajaj Auto Limited to Bharat Forge

DRIVING DIRECTIONS FROM BAJAJ AUTO LIMITED TO BHARAT FORGE Start : Bajaj Auto Limited End : Bharat Forge Akurdi Mundhwa Pimpri-Chinchwad Pune - 411036 Maharashtra Maharashtra Estimated Time : 45 Minutes Driving Directions Distance (Km.) 1. Start point: Bajaj Auto at Akurdi, Pimpri Chinchwad. 0 2. From Bajaj Industries turn left on Mumbai Pune Rd. and drive till Akurdi Square. 0.95 3. Drive straight through Akurdi Square to Chinchwad Square. 0.25 4. Drive straight till Pimpri-Chinchwad Bus Depot Landmark: PCMC Office on left, Hindustan Antibiotics on left 4.21 5. Slight turn to right in South-East direction and drive straight till Bopodi Bridge. Here you will be passing through road confluence popularly known as Nashik Phata 4.67 Landmark: Hotel Kalasagar, Thermax facility on left. 6. Keep driving in South-East direction on Elphinstone Rd till Holkar Bridge 3.70 Landmark: Kirloskar Oil Engine on left 2.80 7. Drive straight through Holkar Bridge on Deccan College Rd till a Traffic Signal at Yerawada Bridge Landmark: Deccan College, Darga on right. 8. Turn right for Yerawada Bridge or Bund Garden Bridge till a next Traffic Signal 0.50 9. Drive on the road until next traffic signal and turn left Landmark: ICICI ATM centre on the right 0.25 10. Continue driving straight till a next Traffic Signal 0.30 11. Turn left on the signal towards east direction. Landmarks: two Petrol pump on either sides of the North Main Rd. 0.01 12. Continue driving on North Main Rd. for approximate 2.5 Kms. 2.5 Land mark: Hotel Westin on the Left side 13. -

7Rks Brochure Final01 CP

FORGET EVERYTHING YOU EVER IMAGINED ABOUT AFFORDABLE HOUSING! LAUNCHING DISCLAIMER: The information contained in this document (the“ Brochure”) or any document/s subsequently provided to Applicant(s), whether verbally or in documentary or any other form whatsoever, by the Promoter Company/ Owner Company or any of their employees or advisors or marketing agents is believed to be correct but is not guaranteed. The Master plan are only vision for the Sriram Grand city. Photographs of interiors, surroundings or location are digitally enhanced unless otherwise mentioned. The built-up areas and land areas of dierent zones as mentioned here are merely vision for the city. The amenities, specifications, facilities, surrounding infrastructure, stock images and features shown and/or mentioned and the images renders used herein are purely indicative and for representational purposes and may dier from the actuals. Prospective purchasers/ Applicant/s should make and must rely on their own enquiries. This Brochure is only a guide to the prospective purchasers/ Applicant/s and do not constitute an oer or contract. There is no commitment for the same and they may undergo changes due to evolving market demand. SAPNON KA SHAHAR. SAPNON KE DAAM. This Brochure is not an agreement and is neither an oer nor invitation to the prospective Buyer/ s/ Applicant/s or any other person. The purpose of this Brochure is to provide interested parties with information that may be useful to them in the formulation of their application for qualification pursuant to this Brochure. The assumptions, assessments, statements and information contained in this Brochure may not be complete, accurate, adequate or correct. -

428 Vol XVII MM 23 3 Colour.Pmd

Registered with the Reg. No. TN/PMG (CCR) /814/06-08 Registrar of Newspapers Licence to post without prepayment for India under R.N.I. 53640/91 Licence No. WPP 506/06-08 Rs. 5 per copy (Annual Subscription: Rs. 100/-) WE CARE FOR MADRAS THAT IS CHENNAI INSIDE Short N Snappy National Trusts team up MADRAS Dr. Kesaris reminiscences The weavers agony The Auroville dream Vol. XVII No. 23 MUSINGS March 16-31, 2008 WhenIs VPH will to IT getExpressway a new keep its promises? Would they fine us for not gener- ating waste, too? (By A Special Correspondent) The ides of April he Highways Secretary, A drive down the corridor News: Immediate fines for lit- TGovernment of Tamil shows that almost all is well on tering, garbage dumping (in- Nadu, has in a recent meeting the stretch from Madhya cluding unsystematic disposal) from April 1, 2008. announced that the work on Kailash to Tidel Park. But from You: Great. Watch out, all you the high profile IT Expressway Kandanchavadi and Perungudi paan-spitting, litter-bugging (now renamed Rajiv Gandhi onwards, it is clear that work Salai) will be completed by types, because ... (Continued on page 7) Voice-from-the-Crowd: Hoy! March 31st. He has also stated The Expressway to be completed by March 31, 2008! You (slightly taken aback): Yes? that the main carriageway of the VFTC: Are you being funny first phase from Madhya Kailash about something as serious as to Siruseri, spanning 20.1 km, garbage disposal? and the ECR Link Road, con- You: Er...no.. -

Make in India: Journey So Far

Volume - 5, Issue- 10,October 2017 IC Value : 56.46 e-ISSN : 2347 - 9671| p- ISSN : 2349 - 0187 EPRA International Journal of Economic and Business Review SJIF Impact Factor(2016) : 6.484 ISI Impact Factor (2013): 1.259(Dubai) Research Paper MAKE IN INDIA: JOURNEY SO FAR www.eprawisdom.com 1 1 Asst.Professor,Department of Applied Sciences & Humanities, DewanV.S Mr. Aditya Sharma Group of Institutions, Meerut, U.P, India ABSTRACT “Make in India “ program has launched by Prime Minister Narendra Modi in Vigyan Bhawan where 3000 Business man ,CEO of leading companies from 30 Companies were present is an impressive effort to boost and encourage to boost investor confidence in the country as well as global recognition to the Indian economy. Manufacturing Sector provides share is very less in comparison to service sector. Government is focusing to increase this share. The major objective behind the initiative is to focus 25 Sectors (Annexure 1)of the economy for job creation and skills enhancement. Cheap labor, availability of raw material ,potential high profit making ,liberal industrial policy will help Indian government to make success this Programme while India ‘s rank is not up to mark in easy of doing business in India, land acquisitions bill, goods and service tax, labor laws, unsupported infrastructure and many other factors are biggest hurdle in the success of this programme.jobs in the economy are decreasing, high inflation and high interest rate and global slowdown are the major challenges in front of the it. The main objective behind this paper is to highlight that will make in India make jobs as well as how this Programme will face many challenges. -

Prisoner's Contact with Their Families

TABLE OF CONTENTS Topic Page No. List of Tables ii The Research Team iii Acknowledgments iv Glossary of Terms used in Prisons v Chapter I: Introduction 1 Chapter II: Review of Literature 5 Chapter III: Research Methodology 9 Chapter IV: Procedure and Practice for Prisoners’ Communication 14 with the Outside Chapter V: Communication Facilities: Processes, 35 Experiences and Perceptions Chapter VI: Good Practices and Recommendations 68 References 80 Appendix 81 End Notes 88 i List of Tables Title Page No. Table 3.1 Research Sites 10 Table 3.2. Number of Respondents (State-wise) 10 Table 4.1: Procedures for Prisoners’ Meetings with Visitors 14 Table 4.2. Facilities for Telephonic Communication 27 Table 4.3: Facilities for Communication through Inland-letters and Postcards 28 Table 4.4: Feedback and Concerns Shared about Practice and Procedure 29 ii The Research Team Researcher Ms. Subhadra Nair Data Collection Team Ms. Subhadra Nair Ms. Surekha Sale Ms. Pradnya Shinde Ms. Meenal Kolatkar Ms. Priyanka Kamble Ms. Karuna Sangare Ms. Komal Phadtare Report Writing Team Ms. Subhadra Nair Prof. Vijay Raghavan Dr. Sharon Menezes Ms. Devayani Tumma Ms. Krupa Shah Cover-page, Report Design and Layout Tabish Ahsan Administration Support Team Mr. Rajesh Gajbiye Ms. Shital Sakharkar Ms. Harshada Sawant Project Directors Prof. Vijay Raghavan Dr. Sharon Menezes iii Acknowledgements This study has reached its completion due to the support received from the Prison Departments of different states. We especially wish to thank the following persons for facilitating the study. 1. Shri S.N. Pandey, Director General (Prisons & Correctional Services), Mumbai, Maharashtra. 2. -

Post Show Report

600+ participating companies from 30 countries 7973 Business Visitors 313 specialised business meetings through b2b Buyer Programme 23 – 25 September 2015 Country pavilions from Denmark, France, Korea ,Germany, Bombay Exhibition Centre, Mumbai, India www.inmex-smm-india.com Norway & Taiwan SOUTH ASIA’S LARGEST MARITIME EVENT Be part of the SUCCESS story POST SHOW REPORT SUPPORTED BY ORGANISED BY Exhibition | Conference | B2B Forum Full Steam Ahead The Maritime & Shipping industry was in full attendance at the 9th in series and first unified edition ofINMEX SMM India. Indian markets are showing signs of growth, with opportunities for maritime stakeholders. While the country still needs to tap the potential of its inland waterways, the Indian government has additionally targeted to increase the share of coastal shipping in carriage of cargo from 7 to 10 per cent by 2019-20. The Sagar Mala project is another step towards what can define India’s coastal potential. With an aim to tap this high-growth market, technology leaders from over 30 countries representing over 600 companies traversed the vast stretch of the Indian coastline to demonstrate their new technology developments from 23 – 25 September at INMEX SMM India 2015. Three days of pure b2b networking, numerous business deals and invaluable information exchange at the concurrent Conferences and Technical Seminars reinforced the leading position of this truly international platform for the Indian Maritime & Shipping industry. ”Danish Marine Group applaud the joining of INMEX and SMM as the right way to gather the maritime India. We believe that India plays a role in the global maritime industry on various levels and this is the place to reach out and gather the relevant actors for a dialogue on the present and future of Indian shipbuilding and global shipping.” “Good days are here for the shipping Mr. -

Guwahati Development

Editorial Board Advisers: Hrishikesh Goswami, Media Adviser to the Chief Minister, Assam V.K. Pipersenia, IAS, Chief Secretary, Assam Members: L.S. Changsan, IAS, Principal Secretary to the Government of Assam, Home & Political, I&PR, etc. Rajib Prakash Baruah, ACS, Additional Secretary to the Government of Assam, I&PR, etc. Ranjit Gogoi, Director, Information and Public Relations Pranjit Hazarika, Deputy Director, Information and Public Relations Manijyoti Baruah, Sr. Planning and Research Officer, Transformation & Development Department Z.A. Tapadar, Liaison Officer, Directorate of Information and Public Relations Neena Baruah, District Information and Public Relations Officer, Golaghat Antara P.P. Bhattacharjee, PRO, Industries & Commerce Syeda Hasnahana, Liaison Officer, Directorate of Information and Public Relations Photographs: DIPR Assam, UB Photos First Published in Assam, India in 2017 by Government of Assam © Department of Information and Public Relations and Department of Transformation & Development, Government of Assam. All Rights Reserved. Design: Exclusive Advertising Pvt. Ltd., Guwahati Printed at: Assam Government Press 4 First year in service to the people: Dedicated for a vibrant, progressive and resurgent Assam In a democracy, the people's mandate is supreme. A year ago when the people of Assam reposed their faith in us, we were fully conscious of the responsibility placed on us. We acknowledged that our actions must stand up to the people’s expectations and our promise to steer the state to greater heights. Since the formation of the new State Government, we have been striving to bring positive changes in the state's economy and social landscape. Now, on the completion of a year, it makes me feel satisfied that Assam is on a resurgent growth track on all fronts. -

Output Outcome Framework for Schemes 2018-2019 Demand No

PREFACE Major Expenditure Reforms have been undertaken by the Government over the last two-three years. This not only includes simplification of appraisal and approval processes, but also structural changes in the process of budget making itself like doing away with Plan Non-plan distinction. As a result,the cost-centres are being treated in an integrated manner, within only the statutory revenue capital framework. This enables another major structural reform, which is to bring the public schemes and projects under a monitorable Output-Outcome framework. Since 2017-18, in addition to the financial outlays of schemes of the Ministries being indicated in the Budget document, the expected outputs and outcomes of the schemes were also prepared and presented separately by each Ministry in the form of Outcome Budget. T h e s e Outlays, Outputs and Outcomes are being presented to the Parliament in measurable terms, bringing-in greater accountability for the agencies involved in the execution of government schemes and projects. utlay is the amount that is provided for a given scheme or project in the Budget; while Outpu refers to the direct and measurable product of program activities, often expressed in physical terms or units. utcome are the collective results or qualitative improvements brought about in the delivery of these services, often expressed in terms of improvements over ex-ante or earlier indicators and benchmarks. From the last year s budget, it was decided that the output and outcomes of the schemes of 68 Ministries and Departments would be available along with the financial outlays as a part of the Budget documents, so that clearly defined objectives and goals for each scheme can be seen by all. -

Summary Report 2020-09-24 05:00

SUMMARY REPORT 2020-09-24 05:00 Average Max Geofence Geofence Ignition Ignition Device Distance Spent Engine Start End Sr Speed Speed Start Address End Address In Out On Off Name (Kms) Fuel hours Time Time (Km/h) (Km/h) (times) (times) (times) (times) 2020- 2020- 0 h 24 NH16, Sankrail, Howrah, West Bengal, 711322, Bombay Hotel,Bombay Road/NH 16 1 NL01AC4614 8.27 36.2 53.0 0 09-23 09-23 0 0 1 0 m India Ankurhati, West Bengal-711402 India 23:35:30 23:59:57 Bharat Petroleum Petrol Pump/Jay Nakoda Kpbdh Padalsingi, Padalsingi, Georai 2020- 2020- 1 h 39 Petroleum,Jaithaltech Ujjain Kota R Ghatiya 2 NL01AB5833 275.61 11.7 67.0 0 Subdistrict, Bid District, Maharashtra- 09-23 09-23 0 0 123 123 m Subdistrict, Ujjain District, Madhya Pradesh- 431143 India 05:01:35 23:59:57 456006 India NH163, Bapu Nagar, Ward 8 Habsiguda, Greater 2020- 2020- 1 h 48 Hyderabad Municipal Corporation East Zone, Tukkuguda, Maheswaram mandal, 3 HR38AA9865 53.18 32.5 58.0 0 09-23 09-23 0 0 9 9 m Hyderabad, Amberpet mandal, Hyderabad, Rangareddy, Telangana, India 00:01:02 21:36:12 Telangana, 500013, India Somanur Road, Madappur, Sulur, 2020- 2020- Somanur Road, Madappur, Sulur, 4 HR38W6371 0.00 0.0 0.0 0 0 h 6 m , Tamil Nadu, 641668, 09-23 09-23 0 0 2 2 , Tamil Nadu, 641668, India India 13:00:21 19:29:40 2020- 2020- 17 h 18 Warangal Khammam Road, Thorrur, NH547, Kelwad, Savner, Nagpur District, 5 HR38W0915 590.32 38.5 102.0 0 09-23 09-23 0 0 6 6 m Mahabubabad, Telangana-506163 India Maharashtra, 441112, India 00:00:03 23:59:03 2020- 2020- 1 h 11 Kalika Temple, Kalwa (Parsik -

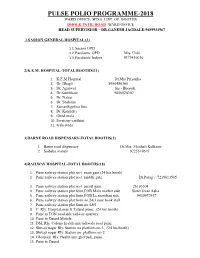

PPI-Booth List

PULSE POLIO PROGRAMME-201 8 WARD OFFICE WISE LIST OF BOOTHS DHOLE PATIL ROAD WARD OFFICE HEAD SUPERVISIOR – DR.GANESH JAGDALE-9689931967 1.SASSON GENERAL HOSPITAL (3) 1.1.Sasson OPD 1.2.Paediatric OPD Mrs. Urde 1.3.Paediatric Indoor 9373436036 2)K.E.M. HOSPITAL-TOTAL BOOTHS(11) 1. K.E.M.Hospital Dr.Mrs.Priyanka 2. Dr. Bhagli 8956486360 3. Dr. Agarwal Sis - Bhosale 4. Dr.Kumbhare 9850520307 5. Dr. Nahar 6. Dr. Shabana 7. Samarth police line 8. Dr. Kalshetty 9. Ghod mala 10. Swaroop vardhini 11. Kale wada 3)BARNE ROAD DISPENSARY-TOTAL BOOTHS(2) 1. Barne road dispensary Dr.Mrs. Maithali Kulkarni 2. Saibaba mandir 9225519619 4)RAILWAY HOSPITAL-TOTAL BOOTHS(18) 1. Pune railway station plat no-1 main gate.(24 hrs.booth) 2. Pune railway station plat no-1 middle gate. Dr.Parag / 7219613505 3. Pune railway station plat no-1 parcel gate 26105504 4. Pune railway station plat form,FOB Main market side Sister Jivan Asha 5. Pune railway station plat form,FOB Le meridian side. 9420972917 6. Pune railway station plat form no.2&3 near book stall. 7. Pune railway station plat form no.4&5. 8. C. Rly. Hospital,near S.T.stand pune. .(24 hrs.booth) 9. Pune to TGN road side railway quarters. 10. Pune to Daund Mobile 11. DSL Rly. Colony health unit tadiwala road pune. 12. Shivaji nagar Rly. Station on platform no-1, .(24 hrs.booth) 13. Shivaji nagar Rly. Station on platform no-2. 14. Ghorpadi Rly. Health unit ghorpadi, pune. 15. -

The Chennai Comprehensive Transportation Study (CCTS)

ACKNOWLEDGEMENT The consultants are grateful to Tmt. Susan Mathew, I.A.S., Addl. Chief Secretary to Govt. & Vice-Chairperson, CMDA and Thiru Dayanand Kataria, I.A.S., Member - Secretary, CMDA for the valuable support and encouragement extended to the Study. Our thanks are also due to the former Vice-Chairman, Thiru T.R. Srinivasan, I.A.S., (Retd.) and former Member-Secretary Thiru Md. Nasimuddin, I.A.S. for having given an opportunity to undertake the Chennai Comprehensive Transportation Study. The consultants also thank Thiru.Vikram Kapur, I.A.S. for the guidance and encouragement given in taking the Study forward. We place our record of sincere gratitude to the Project Management Unit of TNUDP-III in CMDA, comprising Thiru K. Kumar, Chief Planner, Thiru M. Sivashanmugam, Senior Planner, & Tmt. R. Meena, Assistant Planner for their unstinted and valuable contribution throughout the assignment. We thank Thiru C. Palanivelu, Member-Chief Planner for the guidance and support extended. The comments and suggestions of the World Bank on the stage reports are duly acknowledged. The consultants are thankful to the Steering Committee comprising the Secretaries to Govt., and Heads of Departments concerned with urban transport, chaired by Vice- Chairperson, CMDA and the Technical Committee chaired by the Chief Planner, CMDA and represented by Department of Highways, Southern Railways, Metropolitan Transport Corporation, Chennai Municipal Corporation, Chennai Port Trust, Chennai Traffic Police, Chennai Sub-urban Police, Commissionerate of Municipal Administration, IIT-Madras and the representatives of NGOs. The consultants place on record the support and cooperation extended by the officers and staff of CMDA and various project implementing organizations and the residents of Chennai, without whom the study would not have been successful. -

Natural Economic Zone (Nez)

POLITY AND GOVERNANCE NATURAL ECONOMIC ZONE (NEZ) Entire Northeast region has a ―Natural Economic Zone (NEZ)‖ and said that it would be his priority to nourish the NEZ and tap its potential for the benefit of the region. Northeast region as India‘s ―capital of organic agriculture‖ HORNBILL FESTIVAL celebration held every year in the first week of December, in Nagaland held at Naga Heritage Village, Kisama which is about 12 km from Kohima All the tribes of Nagaland take part aim of the festival is to revive and protect the rich culture of Nagaland and display its extravaganza and traditions Festival is named after the hornbill, the globally respected bird and which is displayed in folklore in most of the state‘s tribes. INITIATIVES FOR NORTHEAST REGION modern apparel and garment manufacturing centre would be set up immediately in the State capitals of Assam, Nagaland and Sikkim Ishan Uday special scholarships for 10,000 students from the Northeast Ishan Vikas scheme for facilitating exposure visits of 2000 students and 500 teachers of colleges in the region NATIONAL LOK ADALAT organised by the National Legal Service Authority (NALSA) cases settled out of court include family disputes, matrimonial cases, motor accident claims, bank recoveries, petty criminal matters, revenue matters, disbursement of payment under the MGNREGA and other government welfare schemes. T.S.R SUBRAMANIAN COMMITTEE examine six laws administered by the Union Ministry of Environment, Forests & Climate Change six laws to be put under the scanner o Environment (Protection) Act, 1986 o Forest (Conservation) Act, 1980 o Wildlife (Protection) Act, 1972 o The Water (Prevention and Control of Pollution) Act, 1974 o The Air (Prevention and Control of Pollution) Act, 1981 o Indian Forest Act (IFA) of 1927.