Climate Change 2020 C0

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

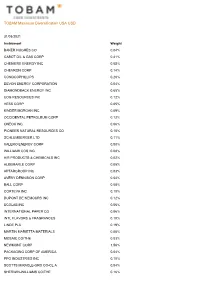

TOBAM Maximum Diversification USA USD

TOBAM Maximum Diversification USA USD 31/03/2021 Instrument Weight BAKER HUGHES CO 0.04% CABOT OIL & GAS CORP 0.41% CHENIERE ENERGY INC 0.05% CHEVRON CORP 0.14% CONOCOPHILLIPS 0.20% DEVON ENERGY CORPORATION 0.04% DIAMONDBACK ENERGY INC 0.65% EOG RESOURCES INC 0.12% HESS CORP 0.05% KINDER MORGAN INC 0.09% OCCIDENTAL PETROLEUM CORP 0.12% ONEOK INC 0.06% PIONEER NATURAL RESOURCES CO 0.10% SCHLUMBERGER LTD 0.11% VALERO ENERGY CORP 0.08% WILLIAMS COS INC 0.08% AIR PRODUCTS & CHEMICALS INC 0.02% ALBEMARLE CORP 0.05% APTARGROUP INC 0.03% AVERY DENNISON CORP 0.04% BALL CORP 0.08% CORTEVA INC 0.10% DUPONT DE NEMOURS INC 0.12% ECOLAB INC 0.06% INTERNATIONAL PAPER CO 0.06% INTL FLAVORS & FRAGRANCES 0.10% LINDE PLC 0.19% MARTIN MARIETTA MATERIALS 0.06% MOSAIC CO/THE 0.03% NEWMONT CORP 1.56% PACKAGING CORP OF AMERICA 0.04% PPG INDUSTRIES INC 0.10% SCOTTS MIRACLE-GRO CO-CL A 0.04% SHERWIN-WILLIAMS CO/THE 0.16% TOBAM Maximum Diversification USA USD 31/03/2021 Instrument Weight VULCAN MATERIALS CO 0.06% WESTROCK CO-WHEN ISSUED 0.03% 3M CO 0.31% ALLEGION PLC 0.03% AMERICAN AIRLINES GROUP INC 0.20% ARCONIC INC 0.04% AXON ENTERPRISE INC 0.03% C.H. ROBINSON WORLDWIDE INC 0.12% CARLISLE COS INC 0.02% CATERPILLAR INC 0.35% CLARIVATE ANALYTICS PLC 0.07% COPART INC 0.06% COSTAR GROUP INC 0.09% CUMMINS INC 0.11% DEERE & CO 0.11% DELTA AIR LINES INC 0.09% EMERSON ELECTRIC CO 0.15% EQUIFAX INC 0.06% EXPEDITORS INTL WASH INC 0.05% FASTENAL CO 0.08% FEDEX CORP 0.20% GENERAC HOLDINGS INC 0.06% GENERAL ELECTRIC CO 0.32% HEICO CORP-CLASS A 0.02% HUNT (JB) TRANSPRT SVCS -

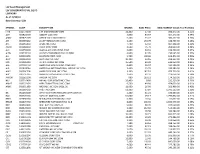

LSV Asset Management LSV CONSERVATIVE VAL EQ FD LSVFNDRV As Of: 9/30/19 Base Currency: USD

LSV Asset Management LSV CONSERVATIVE VAL EQ FD LSVFNDRV As of: 9/30/19 Base Currency: USD SYMBOL CUSIP DESCRIPTION SHARES BASE PRICE BASE MARKET VALUE% of Portfolio FITB 316773100 5TH 3RD BANCORP COM 14,400 27.38 394,272.00 0.51% ABT 002824100 ABBOTT LAB COM 3,600 83.67 301,212.00 0.39% ABBV 00287Y109 ABBVIE INC COM USD0.01 5,100 75.72 386,172.00 0.50% AYI 00508Y102 ACUITY BRANDS INC COM 1,400 134.79 188,706.00 0.24% AFL 001055102 AFLAC INC COM 7,400 52.32 387,168.00 0.50% AGCO 001084102 AGCO CORP COM 3,500 75.70 264,950.00 0.34% ALK 011659109 ALASKA AIR GROUP INC COM 3,000 64.91 194,730.00 0.25% ALSN 01973R101 ALLISON TRANSMISSION HOLDING 4,900 47.05 230,545.00 0.30% ALL 020002101 ALLSTATE CORP COM 5,700 108.68 619,476.00 0.80% ALLY 02005N100 ALLY FINL INC COM 10,200 33.16 338,232.00 0.44% MO 02209S103 ALTRIA GROUP INC COM 15,500 40.90 633,950.00 0.82% AAL 02376R102 AMERICAN AIRLINES INC COM USD1 6,800 26.97 183,396.00 0.24% AIG 026874784 AMERICAN INTERNATIONAL GROUP INC COM 3,400 55.70 189,380.00 0.24% AMP 03076C106 AMERIPRISE FINL INC COM 3,200 147.10 470,720.00 0.61% ABC 03073E105 AMERISOURCEBERGEN CORP COM 2,600 82.33 214,058.00 0.28% AMGN 031162100 AMGEN INC COM 900 193.51 174,159.00 0.22% NLY 035710409 ANNALY CAP MGMT INC COM 26,400 8.80 232,320.00 0.30% AMAT 038222105 APPLIED MATERIALS INC COM 9,500 49.90 474,050.00 0.61% ARNC 03965L100 ARCONIC INC COM USD1.00 11,900 26.00 309,400.00 0.40% T 00206R102 AT&T INC COM 51,300 37.84 1,941,192.00 2.50% BK 064058100 BANK NEW YORK MELLON CORP COM STK 4,300 45.21 194,403.00 0.25% BAC 060505104 -

United Airlines Holdings Annual Report 2021

United Airlines Holdings Annual Report 2021 Form 10-K (NASDAQ:UAL) Published: March 1st, 2021 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission Exact Name of Registrant as Specified in its Charter, State of I.R.S. Employer File Number Principal Executive Office Address and Telephone Incorporation Identification No. Number 001-06033 United Airlines Holdings, Inc. Delaware 36-2675207 233 South Wacker Chicago, Illinois Drive, 60606 (872) 825-4000 001-10323 United Airlines, Inc. Delaware 74-2099724 233 South Wacker Chicago, Illinois Drive, 60606 (872) 825-4000 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Trading Symbol Name of Each Exchange on Which Registered United Airlines Holdings, Inc. Common Stock, $0.01 par value UAL The Nasdaq Stock Market LLC Preferred Stock Purchase Rights The Nasdaq Stock Market LLC United Airlines, Inc. None None None Securities registered pursuant to Section 12(g) of the Act: United Airlines Holdings, Inc. None United Airlines, Inc. None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act United Airlines Holdings, Inc. Yes ☒ No ☐ United Airlines, Inc. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. -

Download All Holdings (PDF)

AMG GW&K High Income Fund - Portfolio Holdings as of February 28, 2021 Name Sector Asset Class Country Currency Par/Shares Price ($) Market Value ($) % of Fund Starwood Property Trust Inc Fixed 4.75% Mar 2025 Corporate Bond US USD 262,000 102.22 $267,810 2.52% HCA Inc Fixed 5.38% Feb 2025 Corporate Bond US USD 236,000 112.25 $264,910 2.49% Delta Air Lines Inc Fixed 7.38% Jan 2026 Corporate Bond US USD 225,000 116.57 $262,274 2.47% United Airlines Holdings Inc Fixed 5.00% Feb 2024 Corporate Bond US USD 254,000 102.63 $260,668 2.45% Apache Corp Fixed 4.63% Nov 2025 Corporate Bond US USD 251,000 103.63 $260,099 2.45% General Electric Co Floating Perpetual Corporate Bond US USD 271,000 94.56 $256,255 2.41% Howmet Aerospace Inc Fixed 6.88% May 2025 Corporate Bond US USD 220,000 115.75 $254,639 2.39% Hudbay Minerals Inc Fixed 4.50% Apr 2026 144A Corporate Bond CA USD 250,000 101.38 $253,445 2.38% Service Properties Trust Fixed 7.50% Sep 2025 Corporate Bond US USD 223,000 113.47 $253,033 2.38% American Axle & Manufacturing Inc Fixed 6.25% Apr 2025 Corporate Bond US USD 243,000 103.01 $250,314 2.35% JPMorgan Chase & Co Floating Perpetual Corporate Bond US USD 245,000 102.00 $249,900 2.35% Penske Automotive Group Inc Fixed 3.50% Sep 2025 Corporate Bond US USD 243,000 101.75 $247,253 2.32% Ford Motor Co Fixed 4.35% Dec 2026 Corporate Bond US USD 231,000 106.57 $246,186 2.31% Sprint Corp Fixed 7.13% Jun 2024 Corporate Bond US USD 211,000 115.14 $242,956 2.28% Ovintiv Exploration Inc Fixed 5.63% Jul 2024 Corporate Bond US USD 206,000 109.65 $225,881 -

Tap Air Portugal Founded 74 Years Ago, Brings Europe, the Americas and Africa Closer, Flying to More Than 90 Destinations with a Fleet in Excess of 100 Aircraft

TAP AIR PORTUGAL FOUNDED 74 YEARS AGO, BRINGS EUROPE, THE AMERICAS AND AFRICA CLOSER, FLYING TO MORE THAN 90 DESTINATIONS WITH A FLEET IN EXCESS OF 100 AIRCRAFT. LED MOOD LIGHTING TO REDUCE JET LAG 20-inch monitor State-of-the-art in-flight entertainment system Wi-Fi with free text messaging Innovative noise reduction technology New Airbus A330neo TAP was the first airline in the world to operate this leading-edge aircraft type, offering additional space and passenger comfort, as well as, a modern environment, larger overhead baggage compartments and a state-of-the-art in-flight entertainment system. With noise reduction technology and more efficient Rolls-Royce Trent engines and advanced design, it is more fuel-efficient and less polluting than other aircraft. 4 TAP offers 8 destinations within North America (and more than 30+ destinations code-shared with JetBlue and United Airlines), 11 destinations to South America (and more than 40 code-shared with Azul), 50 in Europe and 17 in Africa, with excellent connections. Alicante Budapest Geneva Malaga Nice Toulouse NEW Amesterdam Cologne Gran Canaria Manchester Oslo Valencia ROUTES Barcelona Copenhagen Hamburg Marseille Paris Warsaw 2019 Berlin Dublin Helsinki Milan Prague Venice Bilbao Dusseldorf London Moscow Rome Wien Bologne Stockholm Luxembourg Munich Seville Zurich Bordeaux Florence Lyon Nantes Stuttgart Choose TAP Brussels Frankfurt Madrid Naples Tenerife North America South America Leading airline from Boston San Francisco Belém Fortaleza Rio de Janeiro Europe to Brazil, Chicago Toronto Belo Horizonte Natal Salvador Miami Washington Brasília Porto Alegre São Paulo offering more than 80 New York Caracas Recife weekly flights to ten (JFK e Newark) Brazilian cities (Belém, Belo Horizonte, Brasilia, Fortaleza, Natal, Middle Africa Abidjan Casablanca Maputo São Vicente Porto Alegre, Recife, East Accra Conakry Marrakesh Tangier Tel Avive Rio de Janeiro, São Banjul Dakkar Praia Paulo and Salvador). -

Amadeus Yearbook of Ancillary Revenue by Ideaworks

Issued 29 August 2012 The Amadeus Yearbook of Ancillary Revenue by IdeaWorks Table of Contents 2012 Amadeus Yearbook of Ancillary Revenue ................................................................................... 4 Europe and Russia ............................................................................................................................... 17 The Americas........................................................................................................................................ 28 Asia and the South Pacific ................................................................................................................. 52 Middle East and Africa ........................................................................................................................ 63 Currency Exchange Rates Used for the Worldwide Statistics .................................................. 67 Disclosure to Readers of this Report IdeaWorks makes every effort to ensure the quality of the information in this report. Before relying on the information, you should obtain any appropriate professional advice relevant to your particular circumstances. IdeaWorks cannot guarantee, and assumes no legal liability or responsibility for, the accuracy, currency or completeness of the information. The views expressed in the report are the views of the author, and do not represent the official view of Amadeus. Issued by IdeaWorksCompany.com LLC Shorewood, Wisconsin, USA www.IdeaWorksCompany.com The free distribution of this report -

MEDIA KIT 2019 Spice SPICEJET’S EXCLUSIVE INFLIGHT MAGAZINE Spice

MEDIA KIT 2019 spice SPICEJET’S EXCLUSIVE INFLIGHT MAGAZINE spice THE INFLIGHT MAGAZINE MEDIA KIT 2019 MEDIA KIT 2019 spice SPICEJET’S EXCLUSIVE INFLIGHT MAGAZINE | | | SPICEJET’S SOARING SUCCESS | | | “FOR THE 50TH MONTH IN A ROW SPICEJET HAS FLOWN WITH THE HIGHEST LOADS IN SPICEJET MARKET INDIA. IN MAY, OUR PLF STOOD AT 93.9%. THIS IS A FEAT UNPARALLELED IN GLOBAL AVIATION SHARE AS PER DGCA INDUSTRY AND A HUGE MILESTONE FOR SPICEJET. THIS RECORD FIRMLY ESTABLISHES SPICEJET SIGNS CODESHARE SPICEJET’S STANDING AS THE COUNTRY’S MOST AGREEMENT WITH EMIRATES MARKET SHARE TO PREFERRED AIRLINE.” TO GAIN LARGER GLOBAL INCREASE BY 5% FOOTPRINT FROM JUNE 2019 INTRODUCTING SPICEBIZ: 15% ONWARDS THE SALIENT FEATURES • SPICEJET HAS A DEDICATED CABIN CREW FOR BUSINESS CLASS PASSENGERS. • THEY WILL ALSO HAVE A WIDE VARIETY OF GOURMET MEALS TO CHOOSE FROM. • THERE WILL BE DEDICATED AIRPORT COACHES FOR 575 PASSENGERS USING THE SPICEBIZ FACILITY. 94% DAILY FLIGHTS TO 62 • SPICEJET WILL SOON OFFER SPICEBIZ ON SELECT PASSENGER LOAD FACTOR FOR 50 DESTINATIONS WHICH INTERNATIONAL ROUTES. SUCCESSIVE MONTHS, A FIRST IN INCLUDE 53 DOMESTIC AND INDIAN AVIATION HISTORY. 9 INTERNATIONAL. SPICEJET WON THE MOST OUTSTANDING GLOBAL THE EDITOR’S AVIATION TURNAROUND AWARD CHOICE AWARD AT THE IIIRD TRAVEL & HOSPITALITY FOR BEST DOMESTIC LOW AWARDS COST AIRLINE AT THE TIMES TRAVEL AWARDS * As per DGCA website MEDIA KIT 2019 spice SPICEJET’S EXCLUSIVE INFLIGHT MAGAZINE | | | ADVANTAGE SPICE ROUTE | | | More than 1.8 million passengers 67% board SpiceJet MALE flights every PASSENGERS month 205 Boeing 737 SpiceJet has 50 Bombardier+ a fleet of planes to be added within 2 Years 100 aircraft Your space in the sky. -

AMERICAN CENTURY INVESTMENT TRUST Form NPORT-P Filed 2021

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2021-08-24 | Period of Report: 2021-06-30 SEC Accession No. 0001145549-21-048495 (HTML Version on secdatabase.com) FILER AMERICAN CENTURY INVESTMENT TRUST Mailing Address Business Address 4500 MAIN STREET 4500 MAIN STREET CIK:908406| IRS No.: 000000000 | State of Incorp.:MA | Fiscal Year End: 0331 KANSAS CITY MO 64111 KANSAS CITY MO 64111 Type: NPORT-P | Act: 40 | File No.: 811-07822 | Film No.: 211201694 816-531-5575 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document American Century Investments® Quarterly Portfolio Holdings High-Yield Fund June 30, 2021 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document High-Yield - Schedule of Investments JUNE 30, 2021 (UNAUDITED) Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Shares/ Principal Amount ($) Value ($) CORPORATE BONDS — 86.4% Aerospace and Defense — 2.0% Bombardier, Inc., 6.00%, 10/15/22(1) 96,000 96,316 Bombardier, Inc., 7.50%, 3/15/25(1)(2) 305,000 314,341 Howmet Aerospace, Inc., 5.125%, 10/1/24 175,000 193,590 Rolls-Royce plc, 5.75%, 10/15/27(1) 250,000 275,695 TransDigm, Inc., 6.25%, 3/15/26(1) 1,000,000 1,056,250 TransDigm, Inc., 6.375%, 6/15/26 520,000 539,354 TransDigm, Inc., 4.625%, 1/15/29(1) 500,000 501,645 2,977,191 Airlines — 1.2% American Airlines, Inc. / AAdvantage Loyalty IP Ltd., 5.50%, 4/20/26(1) 504,000 534,240 United Airlines Holdings, Inc., 5.00%, 2/1/24(2) 555,000 577,930 United Airlines Pass Through Trust, 4.875%, 7/15/27 235,832 250,458 United Airlines, Inc., 4.625%, 4/15/29(1) 373,000 386,521 1,749,149 Auto Components — 0.7% Goodyear Tire & Rubber Co. -

Annual Report 2000

Northwest Northwest Annual Report Airlines Corporation Corporation Annual Report 2000 Northwest Airlines Corporation 5101 Northwest Drive St. Paul, MN 55000-3034 www.nwa.com ©2000 Northwest Airlines Corporation 2000 Northwest Airlines Annual Report 2000 CONDENSED FINANCIAL HIGHLIGHTS Northwest Airlines Corporation Year Ended December 31 Percent (Dollars in millions, except per share data) 2000 1999 Change FINANCIALS Operating Revenues $ 11,415 $ 10,276 11.1 Operating Expenses 10,846 9,562 13.4 Operating Income $ 569 $ 714 Operating Margin 5.0% 6.9% (1.9)pts. Net Income $ 256 $ 300 Our cover depicts the new Detroit terminal, Earnings Per Common Share: due to open in 2001. Basic $ 3.09 $ 3.69 Diluted $ 2.77 $ 3.26 Number of Common Shares Outstanding (millions) 85.1 84.6 NORTHWEST AIRLINES is the world’s fourth largest airline with domestic hubs in OPERATING STATISTICS Detroit, Minneapolis/St. Paul and Memphis, Asian hubs in Tokyo and Osaka, and a Scheduled Service: European hub in Amsterdam. Northwest Airlines and its alliance partners, including Available Seat Miles (ASM) (millions) 103,356 99,446 3.9 Continental Airlines and KLM Royal Dutch Airlines, offer customers a global airline Revenue Passenger Miles (RPM) (millions) 79,128 74,168 6.7 network serving more than 785 cities in 120 countries on six continents. Passenger Load Factor 76.6% 74.6% 2.0 pts. Revenue Passengers (millions) 58.7 56.1 4.6 Table of Contents Revenue Yield Per Passenger Mile 12.04¢ 11.58¢ 4.0 Passenger Revenue Per Scheduled ASM 9.21¢ 8.64¢ 6.6 To Our Shareholders . -

List of CA100+ Non-Disclosers 142 of 167 CA100+ Target Companies (85%) Have Not Published a Review of Their Alignment with Industry Associations on Climate Change

List of CA100+ Non-Disclosers 142 of 167 CA100+ target companies (85%) have not published a review of their alignment with industry associations on climate change. A full list is below: • A.P. Moller - Maersk • CEZ, A.S. • Adbri Ltd • China National Offshore Oil Corporation (CNOOC) Limited • AES Corporation • China Petroleum & Chemical • Air France KLM S.A. Corporation (Sinopec) • Air Liquide • China Shenhua Energy • Airbus Group • China Steel Corporation • American Airlines Group Inc. • Coal India • American Electric Power Company, Inc. • Coca-Cola Company • Anhui Conch Cement • Colgate-Palmolive Company • ANTAM (Aneka Tambang) • CRH • Bayer AG • Cummins Inc. • Berkshire Hathaway • Daikin Industries, Ltd. • Bluescope Steel Limited • Daimler AG • BMW • Dangote Cement Plc • Boeing Company • Danone S.A. • Boral Limited • Delta Air Lines, Inc. • Bumi Resources • Devon Energy Corporation • Bunge Limited • Dominion Energy, Inc • Canadian Natural Resources Limited • Dow Inc • Caterpillar Inc. • E.ON SE • CEMEX S.A.B. De C.V. • Ecopetrol Sa • Centrica • EDF List of CA100+ Non-Disclosers 1 • Enbridge Inc. • LafargeHolcim Ltd • ENEL SpA • Lockheed Martin Corporation • ENEOS Holdings • Lukoil OAO • ENGIE • LyondellBasell Industries Cl A • Eni SpA • Marathon Petroleum • Eskom Holdings Soc Limited • Martin Marietta Materials, Inc. • Exelon Corporation • National Grid Plc • Fiat Chrysler Automobiles NV • Naturgy • FirstEnergy Corp. • Nestlé • Formosa Petrochemical • NextEra Energy, Inc. • Fortum Oyj • Nippon Steel Corporation • Gazprom • Nissan Motor Co., Ltd. • General Electric Company • Nornickel (MMC Norilsk Nickel OSJC) • General Motors Company • NRG Energy, Inc. • Grupo Argos • NTPC Ltd • Grupo Mexico • Occidental Petroleum Corporation • Hitachi, Ltd. • Oil & Natural Gas Corporation • Hon Hai Precision Industry • Oil Search • Honda Motor Company • Orica • Iberdrola, S.A. -

Fiscal Year 2017-2018

CITY & COUNTY OF SAN FRANCISCO AIRPORT COMMISSION ANNUAL GIFT REPORT FISCAL YEAR 2017-2018 SPONSOR NAME ITEM GIVEN DONATION DATE CASH IN-KIND TOTAL NATURE OF DONOR RELATIONSHIP TO CITY David A. Abercrombie Delta: ticket jacket (1); Eastern: ticket (1). 7/3/2017 $ - $ 30.00 $ 30.00 None Ululani Jung Pan Am: vaccination log (1), credit union card (1); United: benefits handbook (1). 7/3/2017 $ - $ 50.00 $ 50.00 None Barbara Koppel AA: stewardess recruitment brochure. 7/3/2017 $ - $ 3.00 $ 3.00 None William True FAA: Commercial pilot manuals (2). 7/3/2017 $ - $ 10.00 $ 10.00 None Flying Tigers: stewardess jacket (1), wings (1), hat wing (1), luggage tag (1), lighter (1), charm (1), souvenir hat (1), digital Joanna Henrichs 7/6/2017 $ - $ 100.00 $ 100.00 None scans of photographs (9), scan of autographed place mat (1). Boeing: brochures (2); aviation periodicals: Aero modeller (66 issues), Aviation (3 issues), Aerial age weekly (1 bound volume), Model airplane news (52 issues), Jane’s all the world’s aircraft (5 issues) Rudolf H. Stahl aviation books (3): 7/6/2017 $ - $ 393.00 $ 393.00 None The Spokane aviation story The saga of Iron Annie The challenge of the Atlantic. Nancy Miller Digital scans of photographs from career of Pan Am stewardess Nancy Miller (6). 7/6/2017 $ - $ 6.00 $ 6.00 None PAA: digital scan of airmail flight cover (1), scan of Transpacific folio, archive resolution (1), scan of Transpacific folio, Michael Exstein 7/10/2017 $ - $ 1,200.00 $ 1,200.00 None working resolution (1). Hiller Aviation Museum PAA: amenity kits (2). -

American Airlines Inflight Magazine November 2018

American airlines inflight magazine november 2018 Continue This article needs additional quotes to verify. Please help improve this article by adding quotes to reliable sources. Non-sources of materials can be challenged and removed. Find sources: Airborne Magazine - News Newspaper Book Scientist JSTOR (February 2012) (Learn how and when to delete this template message) Issue of Navi, Air Canada's onboard business class magazine. An on-board magazine (or flight log) is a free magazine distributed through the airline's seats or in the airport lounge. Review Many airlines or several key content establishment companies produce on-board logs to provide detailed information about their fleet, as well as articles about destinations or other interesting travel information and destinations. Publishing and media are a niche in the world of magazines. Airline names control distribution costs, and readership figures come from existing and ever-increasing passenger traffic. Most airlines use outside publishers to produce their magazines, and ink is now the world's leading company in the sector. In a recent Harris Poll, 94% of business passengers read airline magazines seat in front of them, and readers average about 30 minutes of flying with magazines, according to a 2009 Arbitron study. Despite the challenges facing the publishing industry, it is a healthy sector, and on a large scale, onboard magazines have suffered less than magazines in general. While the quality of magazines on board varies from carrier to carrier, their upscale, valuable and captivating readers appeal to advertisers, in all sectors including luxury manufacturers, car manufacturers, beauty and fashion brands, as well as global destinations.