MM S&P 500® Index Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

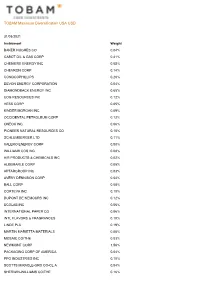

TOBAM Maximum Diversification USA USD

TOBAM Maximum Diversification USA USD 31/03/2021 Instrument Weight BAKER HUGHES CO 0.04% CABOT OIL & GAS CORP 0.41% CHENIERE ENERGY INC 0.05% CHEVRON CORP 0.14% CONOCOPHILLIPS 0.20% DEVON ENERGY CORPORATION 0.04% DIAMONDBACK ENERGY INC 0.65% EOG RESOURCES INC 0.12% HESS CORP 0.05% KINDER MORGAN INC 0.09% OCCIDENTAL PETROLEUM CORP 0.12% ONEOK INC 0.06% PIONEER NATURAL RESOURCES CO 0.10% SCHLUMBERGER LTD 0.11% VALERO ENERGY CORP 0.08% WILLIAMS COS INC 0.08% AIR PRODUCTS & CHEMICALS INC 0.02% ALBEMARLE CORP 0.05% APTARGROUP INC 0.03% AVERY DENNISON CORP 0.04% BALL CORP 0.08% CORTEVA INC 0.10% DUPONT DE NEMOURS INC 0.12% ECOLAB INC 0.06% INTERNATIONAL PAPER CO 0.06% INTL FLAVORS & FRAGRANCES 0.10% LINDE PLC 0.19% MARTIN MARIETTA MATERIALS 0.06% MOSAIC CO/THE 0.03% NEWMONT CORP 1.56% PACKAGING CORP OF AMERICA 0.04% PPG INDUSTRIES INC 0.10% SCOTTS MIRACLE-GRO CO-CL A 0.04% SHERWIN-WILLIAMS CO/THE 0.16% TOBAM Maximum Diversification USA USD 31/03/2021 Instrument Weight VULCAN MATERIALS CO 0.06% WESTROCK CO-WHEN ISSUED 0.03% 3M CO 0.31% ALLEGION PLC 0.03% AMERICAN AIRLINES GROUP INC 0.20% ARCONIC INC 0.04% AXON ENTERPRISE INC 0.03% C.H. ROBINSON WORLDWIDE INC 0.12% CARLISLE COS INC 0.02% CATERPILLAR INC 0.35% CLARIVATE ANALYTICS PLC 0.07% COPART INC 0.06% COSTAR GROUP INC 0.09% CUMMINS INC 0.11% DEERE & CO 0.11% DELTA AIR LINES INC 0.09% EMERSON ELECTRIC CO 0.15% EQUIFAX INC 0.06% EXPEDITORS INTL WASH INC 0.05% FASTENAL CO 0.08% FEDEX CORP 0.20% GENERAC HOLDINGS INC 0.06% GENERAL ELECTRIC CO 0.32% HEICO CORP-CLASS A 0.02% HUNT (JB) TRANSPRT SVCS -

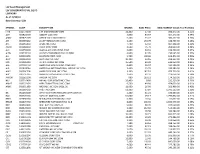

LSV Asset Management LSV CONSERVATIVE VAL EQ FD LSVFNDRV As Of: 9/30/19 Base Currency: USD

LSV Asset Management LSV CONSERVATIVE VAL EQ FD LSVFNDRV As of: 9/30/19 Base Currency: USD SYMBOL CUSIP DESCRIPTION SHARES BASE PRICE BASE MARKET VALUE% of Portfolio FITB 316773100 5TH 3RD BANCORP COM 14,400 27.38 394,272.00 0.51% ABT 002824100 ABBOTT LAB COM 3,600 83.67 301,212.00 0.39% ABBV 00287Y109 ABBVIE INC COM USD0.01 5,100 75.72 386,172.00 0.50% AYI 00508Y102 ACUITY BRANDS INC COM 1,400 134.79 188,706.00 0.24% AFL 001055102 AFLAC INC COM 7,400 52.32 387,168.00 0.50% AGCO 001084102 AGCO CORP COM 3,500 75.70 264,950.00 0.34% ALK 011659109 ALASKA AIR GROUP INC COM 3,000 64.91 194,730.00 0.25% ALSN 01973R101 ALLISON TRANSMISSION HOLDING 4,900 47.05 230,545.00 0.30% ALL 020002101 ALLSTATE CORP COM 5,700 108.68 619,476.00 0.80% ALLY 02005N100 ALLY FINL INC COM 10,200 33.16 338,232.00 0.44% MO 02209S103 ALTRIA GROUP INC COM 15,500 40.90 633,950.00 0.82% AAL 02376R102 AMERICAN AIRLINES INC COM USD1 6,800 26.97 183,396.00 0.24% AIG 026874784 AMERICAN INTERNATIONAL GROUP INC COM 3,400 55.70 189,380.00 0.24% AMP 03076C106 AMERIPRISE FINL INC COM 3,200 147.10 470,720.00 0.61% ABC 03073E105 AMERISOURCEBERGEN CORP COM 2,600 82.33 214,058.00 0.28% AMGN 031162100 AMGEN INC COM 900 193.51 174,159.00 0.22% NLY 035710409 ANNALY CAP MGMT INC COM 26,400 8.80 232,320.00 0.30% AMAT 038222105 APPLIED MATERIALS INC COM 9,500 49.90 474,050.00 0.61% ARNC 03965L100 ARCONIC INC COM USD1.00 11,900 26.00 309,400.00 0.40% T 00206R102 AT&T INC COM 51,300 37.84 1,941,192.00 2.50% BK 064058100 BANK NEW YORK MELLON CORP COM STK 4,300 45.21 194,403.00 0.25% BAC 060505104 -

Zebra Technologies Provides Durable UID Labeling Solution for J.C. Bamford Excavators Ltd

ZEBRA CASE STUDY Zebra Technologies Provides Durable UID Labeling Solution for J.C. Bamford Excavators Ltd. JCB's new military excavator can do 60 mph on highways, but it wasn't going anywhere without a UID labeling system from Zebra Technologies and A2B Tracking Solutions. Challenge Zebra 105SL Tabletop Printer J.C. Bamford Excavators Ltd. (JCB) is a Staffordshire, England-based manufacturer of heavy equipment, such as backhoe loaders, excavators and telescopic handlers, used for construction, agricultural, compaction and other industrial applications. It also makes diesel engines for industrial equipment and machinery. JCB's North American headquarters are based in Savannah, Ga., where it supports a sizeable contract for the U.S. Department of Defense (DoD). One of JCB's current military contracts is providing the U.S. Army with crew protection, 36,000-pound, high-mobility engineered excavators (HMEEs). “The Army didn't have anything like this in their inventory,” said Tom Cooper, Engineering Project Manager for JCB. “The idea was to have an excavator that could maintain convoy speeds on its own instead of having to be placed on a trailer pulled by a large truck. Basically, we designed a backhoe that can do 60 mph and rides like a Cadillac.” Because the HMEE and JCB's other high-performance products are used for military construction projects and mission critical applications for several military operations including Iraq and Afghanistan, the DoD included JCB in its Unique Identification (UID) program, which involves labeling and recording high value parts and complete products sold to the U.S. military. The DoD's UID MIL STD 130 mandate calls for suppliers to apply a permanent, machine readable 2-D Data Matrix bar code—on all parts and components valued at more than $5,000. -

United Airlines Holdings Annual Report 2021

United Airlines Holdings Annual Report 2021 Form 10-K (NASDAQ:UAL) Published: March 1st, 2021 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission Exact Name of Registrant as Specified in its Charter, State of I.R.S. Employer File Number Principal Executive Office Address and Telephone Incorporation Identification No. Number 001-06033 United Airlines Holdings, Inc. Delaware 36-2675207 233 South Wacker Chicago, Illinois Drive, 60606 (872) 825-4000 001-10323 United Airlines, Inc. Delaware 74-2099724 233 South Wacker Chicago, Illinois Drive, 60606 (872) 825-4000 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Trading Symbol Name of Each Exchange on Which Registered United Airlines Holdings, Inc. Common Stock, $0.01 par value UAL The Nasdaq Stock Market LLC Preferred Stock Purchase Rights The Nasdaq Stock Market LLC United Airlines, Inc. None None None Securities registered pursuant to Section 12(g) of the Act: United Airlines Holdings, Inc. None United Airlines, Inc. None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act United Airlines Holdings, Inc. Yes ☒ No ☐ United Airlines, Inc. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. -

Download All Holdings (PDF)

AMG GW&K High Income Fund - Portfolio Holdings as of February 28, 2021 Name Sector Asset Class Country Currency Par/Shares Price ($) Market Value ($) % of Fund Starwood Property Trust Inc Fixed 4.75% Mar 2025 Corporate Bond US USD 262,000 102.22 $267,810 2.52% HCA Inc Fixed 5.38% Feb 2025 Corporate Bond US USD 236,000 112.25 $264,910 2.49% Delta Air Lines Inc Fixed 7.38% Jan 2026 Corporate Bond US USD 225,000 116.57 $262,274 2.47% United Airlines Holdings Inc Fixed 5.00% Feb 2024 Corporate Bond US USD 254,000 102.63 $260,668 2.45% Apache Corp Fixed 4.63% Nov 2025 Corporate Bond US USD 251,000 103.63 $260,099 2.45% General Electric Co Floating Perpetual Corporate Bond US USD 271,000 94.56 $256,255 2.41% Howmet Aerospace Inc Fixed 6.88% May 2025 Corporate Bond US USD 220,000 115.75 $254,639 2.39% Hudbay Minerals Inc Fixed 4.50% Apr 2026 144A Corporate Bond CA USD 250,000 101.38 $253,445 2.38% Service Properties Trust Fixed 7.50% Sep 2025 Corporate Bond US USD 223,000 113.47 $253,033 2.38% American Axle & Manufacturing Inc Fixed 6.25% Apr 2025 Corporate Bond US USD 243,000 103.01 $250,314 2.35% JPMorgan Chase & Co Floating Perpetual Corporate Bond US USD 245,000 102.00 $249,900 2.35% Penske Automotive Group Inc Fixed 3.50% Sep 2025 Corporate Bond US USD 243,000 101.75 $247,253 2.32% Ford Motor Co Fixed 4.35% Dec 2026 Corporate Bond US USD 231,000 106.57 $246,186 2.31% Sprint Corp Fixed 7.13% Jun 2024 Corporate Bond US USD 211,000 115.14 $242,956 2.28% Ovintiv Exploration Inc Fixed 5.63% Jul 2024 Corporate Bond US USD 206,000 109.65 $225,881 -

Zebra Technologies Corporation | 2021 Proxy Statement 7 Proxy Summary

2021 Proxy Statement MAY 14, 2021 | 10:30 a.m. CT Dear Fellow Stockholder April 1, 2021 On behalf of the Board of Directors, I would like to thank you for your continued investment in Zebra Technologies and express our gratitude for the sacrifices of our employees and all front-line workers who have worked to keep us safe and healthy during the COVID-19 pandemic. It is my privilege to serve as Zebra Technologies’ Independent Chair. I am extremely proud of Zebra’s agility and resilience in responding to the rapidly evolving impacts of the virus. Our Board and management team have worked diligently to protect the health and wellbeing of all our employees and execute on our business continuity plans, allowing Zebra to continue to effectively serve our customers, drive value for stockholders, and support our local communities. We continue to put our employees first by implementing rigorous policies and procedures to ensure a safe work environment, equipping our worksites and individuals with protective health and safety equipment, expanding opportunities for remote work, broadening our internal well-being resources, and upholding our commitment to no pandemic-related layoffs. During the pandemic, many enterprise customers in a wide range of end markets have prioritized spend with Zebra to help digitize and automate their operations in an increasingly on-demand economy. At the same time, we have provided a number of solutions that specifically address COVID-19, including those that enable drive-thru testing and support the operations of temporary care facilities, as well as for proximity monitoring and contact tracing. -

Pension Reform Task Force July 21, 2011 Supplemental Packet - Item 4

Pension Reform Task Force July 21, 2011 - Supplemental Packet - Item 4 Description of City of Phoenix Labor Units and Associated Groups Police Supervisory & Supervisory & Middle Field Unit 1 Field Unit 2 Office & Clerical Police Officers Fire Professional Professional Managers Executives Unit Representative: LIUNA, Local 777 AFSCME, Local 2384 AFSCME, Local 2960 PLEA IAFF, Local 493 ASPTEA PPSLA City Manager City Manager Number of regular, full-time employees 1098 1763 2331 2593 1493 2726 453 293 82 This group is Field employees in the Field Employees in the Office employees in Police Officers Firefighter, Fire Supervisory & Police composed of: City Clerk, Human Aviation, Convention Center, clerical and Engineer, and Professional classes Sergeants and Services, Parks & Finance, Fire, Housing, paraprofessional Fire Captain Citywide Lieutenants Recreation, and Street Information Technology, classes Citywide. Transportation Library, Neighborhood Departments, and the Services, Police, Street Solid Waste Division in Transportation, and Water the Public Works Services Departments. Field Department employees in the Equipment Management, Facilities, and Downtown Facilities Management divisions in the Public Works Department Most Common Solid Waste Equipment Operations & Maintenance Police Secretary III, Classifications found Operator, Technician, Electrician, Utility Communications Administrative Assistant I, in this group: Groundskeeper, Technician, Building Operator, Secretary II, Senior User Technology Gardner, Street Maintenance Worker *U2, -

2020 Definitive Proxy

April 7, 2020 Cerner shareholders: I am pleased to invite you to attend the 2020 Annual Shareholders' Meeting of Cerner Corporation to be held on May 22, 2020 at 10:00 a.m. (CDT). The situation with COVID-19 is continuing to rapidly evolve, as is Cerner's response to help protect the health of our associates, clients and their patients, shareholders, and our communities. Based on the unfolding information, we have elected to hold our first virtual meeting of stockholders. You will be able to attend the 2020 Annual Meeting online, vote your shares, and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/CERN2020. Three directors will stand for re-election at this year's Annual Shareholders' Meeting. We also will vote to ratify the appointment of KMPG LLP as our independent accounting firm and approve the compensation of our Named Executive Officers. Additionally, after carefully considering the advantages and disadvantages of the classification of our Board, the current views of our shareholders, and a growing sentiment among institutional investors and their advisory services in favor of annual elections, Cerner's Board recommends that you approve the proposed amendments to our charter that would declassify our Board of Directors and more clearly align the advance notice provisions for director nominations with those in our bylaws. Health information technology remains a dynamic industry that is an integral component in the delivery of global health care. For more than 40 years, Cerner has been at the forefront of digitizing health care - an important step toward improving the standard of living of the world's population. -

CERNER CORPORATION (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended: December 31, 2005 OR o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number: 0-15386 CERNER CORPORATION (Exact name of registrant as specified in its charter) Delaware 43-1196944 (State or other jurisdiction of (I.R.S. Employer Incorporation or organization) Identification No.) 2800 Rockcreek Parkway North Kansas City, MO 64117 (Address of principal executive offices) (Zip Code) (816) 221-1024 (Registrant’s telephone number, including area code) None (Former name, former address and former fiscal year, if changed since last report) Securities registered pursuant to Section 12(b) of the Act: None Securities registered pursuant to Section 12(g) of the Act: Common Stock, $.01 par value per share Preferred Stock Voting Rights (Title of Class) Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No o Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes No o Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Bar Codes in the Manufacturing Process

Bar Codes in the Manufacturing Process A ZEBRA BLACK&WHITE PAPER Copyrights ©2006 ZIH Corp. All product names and numbers are Zebra trademarks, and Zebra and the Zebra head graphic are registered trademarks of ZIH Corp. All rights reserved. All other trademarks are the property of their respective owners. Unauthorized reproduction of this document or the software in the label printer may result in imprisonment of up to one year and fines of up to $10,000 (17 U.S.C.506). Copyright violators may be subject to civil liability. Manufacturers depend on a well-coordinated chain of events to make their operations work effectively. Today’s business software packages, such as enterprise resource planning (ERP), materials management, production control and supply chain execution applications depend on real-time data collection systems to provide information crucial to the entire manufacturing operation. As more companies turn to enterprise-wide software for process improvement and cost reduction, there is a significant opportunity to enhance these systems by adding bar coding and radio frequency identification (RFID) applications throughout manufacturing facilities. This document takes you further into a production facility and provides an overview of the many, growing applications for bar coding and RFID in manufacturing. Compliance Labeling Ever since the Wrigley Company put a Universal Product Code (UPC) label on a pack of gum, bar codes have been a key component of the industry. Manufacturers’ shipping labels are often designed to meet the needs of their customers. Many organizations in all business sectors, including Wal-Mart, General Motors, Boeing, the U.S. Department of Defense and various regulatory and safety bodies require compliance labels on all incoming packaging. -

Rock Solid Performance WHY Caterpillar?

2012 YEAR IN REVIEW ROCK SOLID Potential | Position | Plan | People | Performance In a global marketplace filled with shifting dynamics, our customers count on Caterpillar as a dependable source of products, services and solutions to meet their needs. This strategy is the stabilizing force behind our business. Today, we’re as confident of our rock solid strength as at any time in our history. ROCK SOLID 2012 Year in Review Forward-Looking Statements Certain statements in this 2012 Year in Review relate to future events and expectations and are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “believe,” “estimate,” “will be,” “will,” “would,” “expect,” “anticipate,” “plan,” “project,” “intend,” “could,” “should” or other similar words or expressions often identify forward-looking statements. All statements other than statements of historical fact are forward-looking statements, including, without limitation, statements regarding our outlook, projections, forecasts or trend descriptions. These statements do not guarantee future performance, and we do not undertake to update our forward-looking statements. Caterpillar’s actual results may differ materially from those described or implied in our forward-looking statements based on a number of factors, including, but not limited to: (i) global economic conditions and economic conditions in the industries and markets we serve; (ii) government monetary or fiscal policies and infrastructure spending; (iii) commodity or component -

Boeing Reports Second-Quarter Results

Boeing Reports Second-Quarter Results ▪ Continued progress on global safe return to service of 737 MAX ▪ Revenue of $17.0 billion, GAAP earnings per share of $1.00 and core (non-GAAP)* earnings per share of $0.40 ▪ Operating cash flow of ($0.5) billion; cash and marketable securities of $21.3 billion ▪ Commercial Airplanes backlog grew to $285 billion and added 180 net orders Table 1. Summary Financial Results Second Quarter First Half (Dollars in Millions, except per share data) 2021 2020 Change 2021 2020 Change Revenues $16,998 $11,807 44% $32,215 $28,715 12% GAAP Earnings/(Loss) From Operations $1,023 ($2,964) NM $940 ($4,317) NM Operating Margin 6.0 % (25.1) % NM 2.9 % (15.0) % NM Net Earnings/(Loss) $567 ($2,395) NM $6 ($3,036) NM Earnings/(Loss) Per Share $1.00 ($4.20) NM $0.09 ($5.31) NM Operating Cash Flow ($483) ($5,280) NM ($3,870) ($9,582) NM Non-GAAP* Core Operating Earnings/(Loss) $755 ($3,319) NM $402 ($5,019) NM Core Operating Margin 4.4 % (28.1) % NM 1.2 % (17.5) % NM Core Earnings/(Loss) Per Share $0.40 ($4.79) NM ($1.12) ($6.49) NM *Non-GAAP measure; complete definitions of Boeing’s non-GAAP measures are on page 6, “Non-GAAP Measures Disclosures." CHICAGO, July 28, 2021 – The Boeing Company [NYSE: BA] reported second-quarter revenue of $17.0 billion, driven by higher commercial airplanes and services volume. GAAP earnings per share of $1.00 and core earnings per share (non-GAAP)* of $0.40 primarily reflects higher commercial volume and lower period costs (Table 1).