Experian Market IQ Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

20Annual Report 2020 Equiniti Group

EQUINITI GROUP PLC 20ANNUAL REPORT 2020 PURPOSEFULLY DRIVEN | DIGITALLY FOCUSED | FINANCIAL FUTURES FOR ALL Equiniti (EQ) is an international provider of technology and solutions for complex and regulated data and payments, serving blue-chip enterprises and public sector organisations. Our purpose is to care for every customer and simplify each and every transaction. Skilled people and technology-enabled services provide continuity, growth and connectivity for businesses across the world. Designed for those who need them the most, our accessible services are for everyone. Our vision is to help businesses and individuals succeed, creating positive experiences for the millions of people who rely on us for a sustainable future. Our mission is for our people and platforms to connect businesses with markets, engage customers with their investments and allow organisations to grow and transform. 2 Contents Section 01 Strategic Report Headlines 6 COVID-19: Impact And Response 8 About Us 10 Our Business Model 12 Our Technology Platforms 14 Our Markets 16 Our Strategy 18 Our Key Performance Indicators 20 Chairman’s Statement 22 Chief Executive’s Statement 24 Operational Review 26 Financial Review 34 Alternative Performance Measures 40 Environmental, Social and Governance 42 Principal Risks and Uncertainties 51 Viability Statement 56 Section 02 Governance Report Corporate Governance Report 62 Board of Directors 64 Executive Committee 66 Board 68 Audit Committee Report 78 Risk Committee Report 88 Nomination Committee Report 95 Directors' Remuneration -

Reference Banks / Finance Address

Reference Banks / Finance Address B/F2 Abbey National Plc Abbey House Baker Street LONDON NW1 6XL B/F262 Abbey National Plc Abbey House Baker Street LONDON NW1 6XL B/F57 Abbey National Treasury Services Abbey House Baker Street LONDON NW1 6XL B/F168 ABN Amro Bank 199 Bishopsgate LONDON EC2M 3TY B/F331 ABSA Bank Ltd 52/54 Gracechurch Street LONDON EC3V 0EH B/F175 Adam & Company Plc 22 Charlotte Square EDINBURGH EH2 4DF B/F313 Adam & Company Plc 42 Pall Mall LONDON SW1Y 5JG B/F263 Afghan National Credit & Finance Ltd New Roman House 10 East Road LONDON N1 6AD B/F180 African Continental Bank Plc 24/28 Moorgate LONDON EC2R 6DJ B/F289 Agricultural Mortgage Corporation (AMC) AMC House Chantry Street ANDOVER Hampshire SP10 1DE B/F147 AIB Capital Markets Plc 12 Old Jewry LONDON EC2 B/F290 Alliance & Leicester Commercial Lending Girobank Bootle Centre Bridal Road BOOTLE Merseyside GIR 0AA B/F67 Alliance & Leicester Plc Carlton Park NARBOROUGH LE9 5XX B/F264 Alliance & Leicester plc 49 Park Lane LONDON W1Y 4EQ B/F110 Alliance Trust Savings Ltd PO Box 164 Meadow House 64 Reform Street DUNDEE DD1 9YP B/F32 Allied Bank of Pakistan Ltd 62-63 Mark Lane LONDON EC3R 7NE B/F134 Allied Bank Philippines (UK) plc 114 Rochester Row LONDON SW1P B/F291 Allied Irish Bank Plc Commercial Banking Bankcentre Belmont Road UXBRIDGE Middlesex UB8 1SA B/F8 Amber Homeloans Ltd 1 Providence Place SKIPTON North Yorks BD23 2HL B/F59 AMC Bank Ltd AMC House Chantry Street ANDOVER SP10 1DD B/F345 American Express Bank Ltd 60 Buckingham Palace Road LONDON SW1 W B/F84 Anglo Irish -

FSCS Information Sheet

FINANCIAL SERVICES COMPENSATION SCHEME INFORMATION SHEET Basic information about the protection of your eligible deposits Eligible deposits in Bank of Scotland plc are protected by: The Financial Services Compensation Scheme (“FSCS”)1 Limit of protection: £85,000 per depositor per bank2 The following trading names are part of your bank: Halifax, Intelligent Finance (IF), Birmingham Midshires (BM Savings), Bank of Scotland, Bank of Scotland Private Banking, Bank of Wales, and St. James’s Place Bank. Some savings accounts under the AA Savings and Saga brand names are also deposits with Bank of Scotland plc. If you have more eligible deposits at the same bank: All your eligible deposits at the same bank are “aggregated” and the total is subject to the limit of £85,0002 If you have a joint account with other person(s): The limit of £85,000 applies to each depositor separately3 Reimbursement period in case of bank’s failure: 20 working days4 Currency of reimbursement: Pound sterling (GBP, £) To contact Bank of Scotland plc for enquiries relating to You can visit one of our branches, call us, go online or your account: write to us at the address below: The Mound, Edinburgh, EH1 1YZ To contact the FSCS for further information Financial Services Compensation Scheme, on compensation: 10th Floor Beaufort House, 15 St Botolph Street, London, EC3A 7QU Tel: 0800 678 1100 or 020 7741 4100 Email: [email protected] More information: http://www.fscs.org.uk Additional Information 1 Scheme responsible for the protection of your eligible deposit Your eligible deposit is covered by a statutory Deposit Guarantee Scheme. -

A Study in Comparative Economic History

PRINCETON STUDIES IN INTERNATIONAL FINANCE NO. 36 The Formation of Financial Centers: A Study in Comparative Economic History Charles P. Kindlebergei INTERNATIONAL FINANCE SECTION DEPARTMENT OF ECONOMICS PRINCETON UNIVERSITY • 1974 PRINCETON STUDIES IN INTERNATIONAL FINANCE This is the thirty-sixth number in the series PRINCETON STUDIES IN INTERNATIONAL FINANCE, published from time to time by the Inter- national Finance Section of the Department of Economics at Princeton University. The author, Charles P. Kindleberger, is Ford Professor of Economics at the Massachusetts Institute of Technology. His work in economic history includes The World in Depression, 1929-1939 (1973) and Eco- nomic Growth in France and Britain, 1851-1950 (1964). He is the author of two Essays in International Finance, The Politics of Inter- national Money and World Language (No. 61, 1967) and Balance- of-Payments Deficits and the International Market for Liquidity (No. 46, 1965). This series is intended to be restricted to meritorious research stud- ies in the general field of international financial problems which are too technical, too specialized, or too long to qualify as ESSAYS. The Sec- tion welcomes the submission of manuscripts for this series. While the Section sponsors the studies, the writers are free to de- velop their topics as they will. Their ideas and treatment may.or may not be shared by the editorial committee of the Section or the mem- bers of the Department. PETER B. KENEN Director Princeton University PRINCETON STUDIES IN INTERNATIONAL FINANCE NO. 36 The Formation of Financial Centers: A Study in Comparative Economic History Charles P. Kindleberger INTERNATIONAL FINANCE SECTION DEPARTMENT OF ECONOMICS PRINCETON UNIVERSITY PRINCETON, NEW JERSEY November 1974 Copyright 0 1974, by International Finance Section Department of Economics, Princeton University Library of Congress Cataloging in Publication Data Kindleberger, Charles Poor, 1910- The formation of financial centers. -

2020-Bos-Annual-Report.Pdf

Bank of Scotland plc Report and Accounts 2020 Member of Lloyds Banking Group Bank of Scotland plc Contents Strategic report 2 Directors’ report 10 Directors 14 Forward looking statements 15 Independent auditors’ report 16 Consolidated income statement 25 Statements of comprehensive income 26 Balance sheets 28 Statements of changes in equity 30 Cash flow statements 32 Notes to the accounts 33 Subsidiaries and related undertakings 122 Registered office: The Mound, Edinburgh EH1 1YZ. Registered in Scotland No. 327000 Bank of Scotland plc Strategic report Principal activities Bank of Scotland plc (the Bank) and its subsidiaries (together, the Group) provide a wide range of banking and financial services. The Group’s revenue is earned through interest and fees on a broad range of financial services products including current and savings accounts, personal loans, credit cards and mortgages within the retail market; loans and other products to commercial, corporate and asset finance customers; and private banking. Business review In the year to 31 December 2020, the Group recorded a profit before tax of £883 million compared to £1,278 million in the year to 31 December 2019. Total income decreased by £886 million, or 15 per cent, to £5,147 million in the year ended 31 December 2020 compared to £6,033 million in 2019 with a £220 million decrease in net interest income combined with a reduction of £666 million in other income. Net interest income was £5,208 million in the year ended 31 December 2020, a decrease of £220 million, or 4 per cent compared to £5,428 million in 2019 reflecting the lower rate environment, actions taken during the year to support customers and reduced levels of customer activity and demand during the coronavirus pandemic. -

Small Business Finance Markets 2018/19 2 British Business Bank

SMALL BUSINESS FINANCE MARKETS 2018/19 2 BRITISH BUSINESS BANK CONTENTS 3 FOREWORD 5 EXECUTIVE SUMMARY 8 INTRODUCTION 9 AGGREGATE FLOWS AND STOCK OF FINANCE TO SMALLER BUSINESSES 11 MACROECONOMIC DEVELOPMENTS 14 PART A: THEMES 15 1.1 ATTITUDES TO USING FINANCE 22 1.2 EQUITY FINANCE ENVIRONMENT FOR INNOVATIVE AND HIGH GROWTH FIRMS 38 1.3 SME FINANCE AT THE LOCAL LEVEL 48 PART B: MARKET DEVELOPMENTS SMALL BUSINESSES 49 2.1 SME BUSINESS POPULATION 54 2.2 USE OF EXTERNAL FINANCE FINANCE PRODUCTS 58 2.3 BANK LENDING AND CHALLENGER BANKS 68 2.4 EQUITY FINANCE 74 2.5 DEBT FUNDS 77 2.6 ASSET FINANCE AND INVOICE & ASSET-BASED LENDING 82 2.7 MARKETPLACE LENDING 86 GLOSSARY 90 ENDNOTES SMALL BUSINESS FINANCE MARKETS 2018/19 3 FOREWORD KEITH MORGAN, CEO, BRITISH BUSINESS BANK The British Business Bank, established in 2014, improves finance markets so they more effectively serve the needs of smaller UK businesses. Our fifth Small Business Finance Markets report The second theme is declining demand for finance. provides a timely, comprehensive and impartial As the latest data in this report shows, the stock of assessment of finance markets for smaller bank lending - which forms the largest part of the businesses at a moment of great significance for the market - has continued to decline in real terms UK and its economy. Combined with our experience although, encouragingly, alternatives to bank lending as an active market participant, the evidence, have continued to grow, albeit at a slower rate than research and insights in this and other reports previously. -

Who Wants to Be a Banker? PCF Bank Is Continuing to Innovate

VOL 11 I NO 122 I 2018 FOR THE UK EQUIPMENT LEASING AND ASSET FINANCE PROFESSIONAL Who wants to be a banker? PCF Bank is continuing to innovate www.leasingworld.co.uk n PROFILE PCF Bank continuing to innovate PAGE 10 n FEATURE The toughest job in asset finance? PAGE 14 n FEATURE Investec leading by example PAGE 20 n FEATURE 2017: a case of living in interesting times? PAGE 22 CONTENTS IN THIS ISSUE VOL 11 I NO 122 I 2018 FOR THE UK EQUIPMENT LEASING AND ASSET FINANCE PROFESSIONAL Who wants to be a banker? PCF Bank is continuing to innovate www.leasingworld.co.uk I PROFILE PCF Bank continuing to innovate PAGE 10 I FEATURE The toughest job in asset fi nance? PAGE 14 I FEATURE Investec leading by example PAGE 20 I FEATURE 2017: a case of living in interesting times? PAGE 22 20 Paul Cunningham, Investec PUBLISHER LeasingWorld Ltd Oakhill House Uphampton Droitwich Spa Worcs. WR9 OJR, UK T: +44 (0)1905 621444 E: [email protected] www.leasingworld.co.uk 16 Identity Fraud 06 Simply Asset Finance Published by LeasingWorld Ltd Company No: 5387699. ISSN 1749-3501 Printed in England by Pensord, Tram Road, Pontllanfraith, NEWS FEATURES Blackwood NP12 2YA UK NEWS 10 PROFILE: Who wants to be a banker No part of this publication may be 4 FLA completes 25th year How PCF Bank is continuing to innovate resold, reproduced or transmitted in in the leasing industry any form or by any means, electrical, 5 Investec beefs up block mechanical, photocopying, recording 6 Simply Asset Finance wins £60m 14 The toughest job in asset finance? or otherwise without the prior written 7 Apollo gets Haydock majority Credit underwriting: the hardest job in the asset finance permission of the publisher. -

2020-Hbos-Annual-Report.Pdf

HBOS plc Report and Accounts 2020 Member of Lloyds Banking Group HBOS plc Contents Strategic report 2 Directors’ report 8 Directors 11 Forward looking statements 12 Independent auditors’ report 13 Consolidated income statement 23 Statements of comprehensive income 24 Consolidated balance sheet 25 Consolidated statement of changes in equity 27 Consolidated cash flow statement 28 Company balance sheet 29 Company statement of changes in equity 30 Company cash flow statement 31 Notes to the accounts 32 Subsidiaries and related undertakings 113 Registered office: The Mound, Edinburgh 1EH1 1YZ. Registered in Scotland no 218813 HBOS plc Strategic report Principal activities HBOS plc (the Company) and its subsidiaries (together, the Group) provide a wide range of banking and financial services. The Group’s revenue is earned through interest and fees on a broad range of financial services products including current and savings accounts, personal loans, credit cards and mortgages within the retail market; loans and other products to commercial, corporate and asset finance customers; and private banking. Business review In the year to 31 December 2020, the Group recorded a profit before tax of £1,214 million compared to £1,543 million in the year to 31 December 2019. Total income decreased by £787 million, or 13 per cent, to £5,508 million in the year ended 31 December 2020 compared to £6,295 million in 2019 with a £225 million decrease in net interest income combined with a reduction of £562 million in other income. Net interest income was £5,271 million in the year ended 31 December 2020, a decrease of £225 million, or 4 per cent compared to £5,496 million in 2019 reflecting the lower rate environment, actions taken during the year to support customers and reduced levels of customer activity and demand during the coronavirus pandemic. -

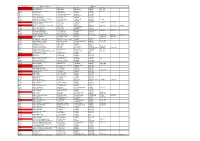

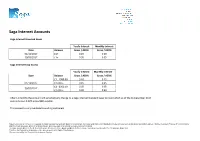

Saga Internet Accounts

Saga Internet Accounts Saga Internet Standard Saver Yearly Interest Monthly Interest Date Balance Gross / AER% Gross / AER% 01/12/2017 £1+ 0.20 0.20 30/03/2017 £1+ 0.05 0.05 Saga Internet Easy Access Yearly Interest Monthly Interest Date Balance Gross / AER% Gross / AER% £1 - £999.99 0.20 0.20 01/12/2017 £1,000 + 0.45 0.45 £1 - £999.99 0.05 0.05 30/03/2017 £1,000 + 0.30 0.30 After 12 months the account will automatically change to a Saga Internet Standard Saver Account which as of the 01 December 2017 currently pays 0.20% gross/AER variable. This account is only available to existing customers Rates correct as at 01.12.2017. Deposits in Saga Savings are held with Bank of Scotland plc. Accounts with Bank of Scotland plc include accounts with its divisions and trading names: Halifax, Intelligent Finance (IF), Birmingham Midshires (BM Savings), Bank of Scotland Private Banking, Bank of Scotland Germany, Bank of Scotland Treasury, Lloyds Bank (in the Netherlands only), St.James’s Place Bank and Bank of Wales. Some savings accounts under the AA Savings, Saga and Charities Aid Foundation brand names are also deposits with Bank of Scotland plc. We are covered by the Financial Ombudsman Service. Saga Internet Saver (Issue 21) Yearly Interest Monthly Interest After 12 First 12 months After 12 months First 12 months months Date Balance Gross / AER% Gross / AER% Gross / AER% Gross / AER% £1 - £999.99 0.20 0.20 0.20 0.20 01/12/2017 £1,000 + 0.95 0.20 0.95 0.20 £1 - £999.99 0.05 0.05 0.05 0.05 03/02/2017 £1,000 + 0.80 0.05 0.80 0.05 Minimum opening deposit must be for at least £1,000. -

Annual Report and Financial Statements 2018/19 Annual Report and Financial Statements 2018/19

Annual report and financial statements 2018/19 Annual report and financial statements 2018/19 Officers and professional advisers Directors Carol Bell Non-Executive Director Gareth Bullock Chair Roger Jeynes Non-Executive Director Giles Thorley Chief Executive Margaret Llewellyn OBE Non-Executive Director Huw Morgan Non-Executive David Staziker Senior Independent Director Chief Financial Officer (appointed 1 April 2018) Iraj Amiri Non-Executive Director Company Secretary Judi Oates Registered office Bankers Auditors Unit J Barclays Bank Plc Deloitte LLP Yale Business Village PO Box 69 5 Callaghan Square Ellice Way Queen Street Cardiff Wrexham Cardiff CF10 5BT LL13 7YL 2 ANNUAL REPORT AND FINANCIAL STATEMENTS 2018/19 Contents Introduction 3 Risk management framework 82 Mission, Vision, Values, Goals 5 Risk culture 83 Five year target 6 Risk tolerance 84 Chair's statement 7 Principal risks 85 Chief Executive's report 9 Lines of defence model 93 Performance highlights 11 Responsible business 95 Our year 13 Business model 15 Governance 102 Investment Director's report 17 Governance section 103 Directors' report 104 Investments and other services 19 Directors' biographies 105 Starting a business 21 Corporate Governance statement 112 Growing a business 25 Audit and Risk Committee report 114 Fast-track loans 37 Remuneration Committee Report 119 Developing a tech venture 39 Nomination Committee Report 121 Buying a business 47 Other committees 122 Financing a property development 51 Angels Invest Wales 53 Financial statements 123 Economic Intelligence -

Bank Credit Conditions and Their Influence on Productivity Growth: Company-Level Evidence

Bank Credit Conditions and their Influence on Productivity Growth: Company-level Evidence Rebecca Riley*, Chiara Rosazza Bondibene* and Garry Young** *National Institute of Economic and Social Research & Centre For Macroeconomics **Bank of England & Centre For Macroeconomics Productivity and Firm Growth Workshop NIESR 11 November 2014 Disclaimers: Any views expressed cannot be taken to represent those of the Bank of England or to state Bank of England policy. Acknowledgements: The financial support of the Economic and Social Research Council grant reference ES/K00378X/1 is gratefully acknowledged. Disclaimer Any views expressed cannot be taken to represent those of the Bank of England or to state Bank of England policy. Motivation • The productivity puzzle – it remains unclear how and to what extent the lack of credit has affected productivity • Difficult to disentangle what is a change in credit supply and what is a change in credit demand • A credit supply shock may reduce labour productivity: – Bank forbearance (prevalence of zombie companies) – Resource reallocation across companies hampered – Reduction in investment due to difficulty in accessing finance A Quasi-Experiment • Exploit exogenous variation induced by the financial crisis in credit availability to companies to investigate impacts of credit supply shocks • Compare outcomes for companies who were subjected to tougher credit constraints to outcomes for companies that were less likely to be constrained – Quasi-experimental approach – Divide firm observations into ‘treatment’ -

The London Gazette, Srd April 1980 5175

THE LONDON GAZETTE, SRD APRIL 1980 5175 3 Applications under consideration received from institu- Castle Philips Finance Co. Ltd. tions which were conducting a deposit-taking business Catties Holdings Finance Ltd. on 1st October 1979 Cayzer Ltd. CDB Investments Ltd. Al (Investment) Ltd. Cedar Holdings Ltd. Abbey Finance Co. Ltd. Central Banking & Finance Corporation Ltd. Advie Property Co. Ltd. The Central Investment Corporation Ltd. The Afghan National Bank Ltd. Central Trust Ltd. African Continental Bank Ltd. Central Trustee Savings Bank Ltd. Allied Irish Finance Co. Ltd. Century Factors Ltd. American Express International Banking Corporation Century Industrial Services Ltd. American National Bank and Trust Company of Chicago Chancellor Finance Ltd. Andola Finance Co. Ltd. Chancery Securities Ltd. Anglo-Romanian Bank Ltd. Charter Consolidated Finance Ltd. Armada Investments Ltd. The Chartered Bank Assemblies of God Property Trust Chartered Trust Ltd. Associated Credits Ltd. Chase Bank (Ireland) Ltd. Associated Japanese Bank (International) Ltd. Chemical Bank International Ltd. Associates Capital Corporation Ltd. Chesterfield Street Trust Ltd. Aston Rothbury & Co. Ltd. The Cho-Heung Bank, Ltd. Atlantic International Bank Ltd. CP Choularton, Sons & Partners Ltd. Auban Finance Ltd. Citibank Trust Ltd. Cleveland Guaranty Ltd. Banco do Brasil S.A. Close Bros. Ltd. Banco do Estado do Sao Paulo S.A. Clydesdale Bank Finance Corporation Ltd. Banco Espanol en Londres S.A. CE Coates & Co. Ltd. Banco de Jerez S.A. Cobnar Finance Co. Ltd. Banco Mercantil de Sao Paulo S.A. Commercial Bank of Malawi Ltd. Banco National de Mexico S.A. The Commercial Bank of the Near East Ltd. Banco Real S.A. Commercial Bank of Wales Ltd.