A Study in Comparative Economic History

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

20Annual Report 2020 Equiniti Group

EQUINITI GROUP PLC 20ANNUAL REPORT 2020 PURPOSEFULLY DRIVEN | DIGITALLY FOCUSED | FINANCIAL FUTURES FOR ALL Equiniti (EQ) is an international provider of technology and solutions for complex and regulated data and payments, serving blue-chip enterprises and public sector organisations. Our purpose is to care for every customer and simplify each and every transaction. Skilled people and technology-enabled services provide continuity, growth and connectivity for businesses across the world. Designed for those who need them the most, our accessible services are for everyone. Our vision is to help businesses and individuals succeed, creating positive experiences for the millions of people who rely on us for a sustainable future. Our mission is for our people and platforms to connect businesses with markets, engage customers with their investments and allow organisations to grow and transform. 2 Contents Section 01 Strategic Report Headlines 6 COVID-19: Impact And Response 8 About Us 10 Our Business Model 12 Our Technology Platforms 14 Our Markets 16 Our Strategy 18 Our Key Performance Indicators 20 Chairman’s Statement 22 Chief Executive’s Statement 24 Operational Review 26 Financial Review 34 Alternative Performance Measures 40 Environmental, Social and Governance 42 Principal Risks and Uncertainties 51 Viability Statement 56 Section 02 Governance Report Corporate Governance Report 62 Board of Directors 64 Executive Committee 66 Board 68 Audit Committee Report 78 Risk Committee Report 88 Nomination Committee Report 95 Directors' Remuneration -

Annual Report 2018–2019 Artmuseum.Princeton.Edu

Image Credits Kristina Giasi 3, 13–15, 20, 23–26, 28, 31–38, 40, 45, 48–50, 77–81, 83–86, 88, 90–95, 97, 99 Emile Askey Cover, 1, 2, 5–8, 39, 41, 42, 44, 60, 62, 63, 65–67, 72 Lauren Larsen 11, 16, 22 Alan Huo 17 Ans Narwaz 18, 19, 89 Intersection 21 Greg Heins 29 Jeffrey Evans4, 10, 43, 47, 51 (detail), 53–57, 59, 61, 69, 73, 75 Ralph Koch 52 Christopher Gardner 58 James Prinz Photography 76 Cara Bramson 82, 87 Laura Pedrick 96, 98 Bruce M. White 74 Martin Senn 71 2 Keith Haring, American, 1958–1990. Dog, 1983. Enamel paint on incised wood. The Schorr Family Collection / © The Keith Haring Foundation 4 Frank Stella, American, born 1936. Had Gadya: Front Cover, 1984. Hand-coloring and hand-cut collage with lithograph, linocut, and screenprint. Collection of Preston H. Haskell, Class of 1960 / © 2017 Frank Stella / Artists Rights Society (ARS), New York 12 Paul Wyse, Canadian, born United States, born 1970, after a photograph by Timothy Greenfield-Sanders, American, born 1952. Toni Morrison (aka Chloe Anthony Wofford), 2017. Oil on canvas. Princeton University / © Paul Wyse 43 Sally Mann, American, born 1951. Under Blueberry Hill, 1991. Gelatin silver print. Museum purchase, Philip F. Maritz, Class of 1983, Photography Acquisitions Fund 2016-46 / © Sally Mann, Courtesy of Gagosian Gallery © Helen Frankenthaler Foundation 9, 46, 68, 70 © Taiye Idahor 47 © Titus Kaphar 58 © The Estate of Diane Arbus LLC 59 © Jeff Whetstone 61 © Vesna Pavlovic´ 62 © David Hockney 64 © The Henry Moore Foundation / Artists Rights Society (ARS), New York 65 © Mary Lee Bendolph / Artist Rights Society (ARS), New York 67 © Susan Point 69 © 1973 Charles White Archive 71 © Zilia Sánchez 73 The paper is Opus 100 lb. -

Cleveland Naturalists' Field Club and a Valued Contributor, After First Accepting the British

1 CLEVELAND NATURALISTS’ FIELD CLUB RECORD OF PROCEEDINGS 1920 - 1925 VOL.III. Part IV. Edited by Ernest W. Jackson F.I.C., F.G.S. PRICE THREE SHILLINGS (FREE TO MEMBERS) MIDDLESBROUGH; JORDISON AND CO., LTD, PRINTERS AND PUBLISHERS 1926 CONTENTS MEMOIR OF W.H. THOMAS - J.W.R. PUNCH 187 ROSEBERRY TOPPING IN FACT AND FICTION - J.J. BURTON, F.G.S. 190 WHITE FLINT NEAR LEALHOLME - EARNEST W. JACKSON, F.I.C. 206 THE MOUND BREAKERS OF CLEVELAND - WILLIAM HORNSBY, B.A 209 PEAT DEPOSITS AT HARTLEPOOL - J INGRAM, B. SC 217 COLEOPTERA OBSERVED IN CLEVELAND - M LAWSON THOMPSON, F.E.S. 222 ORIGIN OF THE FIELD CLUB - THE LATE J.S. CALVERT 226 MEMOIRS OF J.S. CALVERT - J.J. BURTON 229 MEMOIR OF BAKER HUDSON - F ELGEE 233 OFFICERS 1926 President Ernest W Jackson F.I.C., F.G.S Vice-Presidents F Elgee Miss Calvert J J Burton F.G.S. M.L.Thompson F.E.S. J W R Punch T A Lofthouse A.R.I.B.A., F.E.S H Frankland Committee Mrs Hood Miss Cotton C Postgate Miss Vero Dr Robinson P Hood Hon Treasurer H Frankland, Argyle Villa, Whitby Sectional Secretaries Archaeology – P Hood Geology – J J Burton, F.G.S. Botany – Miss Calvert Ornithology ) Conchology ) and ) - T A Lofthouse And )- T A Lofthouse Mammalogy ) F.E.S. Entomology ) F.E.S. Microscopy – Mrs Hood Hon. Secretaries G Knight, 16 Hawthorne Terrace, Eston M Odling, M.A., B.Sc.,”Cherwell,” the Grove, Marton-in-Cleveland Past Presidents 1881 - Dr W Y Veitch M.R.C.S. -

The Headquarters of National Provincial Bank of England

Symbolism in bank marketing and architecture: the headquarters of National Provincial Bank of England Article Published Version Creative Commons: Attribution 4.0 (CC-BY) Open Access Barnes, V. and Newton, L. (2019) Symbolism in bank marketing and architecture: the headquarters of National Provincial Bank of England. Management and Organizational History, 14 (3). pp. 213-244. ISSN 1744-9359 doi: https://doi.org/10.1080/17449359.2019.1683038 Available at http://centaur.reading.ac.uk/86938/ It is advisable to refer to the publisher’s version if you intend to cite from the work. See Guidance on citing . To link to this article DOI: http://dx.doi.org/10.1080/17449359.2019.1683038 Publisher: Taylor and Francis All outputs in CentAUR are protected by Intellectual Property Rights law, including copyright law. Copyright and IPR is retained by the creators or other copyright holders. Terms and conditions for use of this material are defined in the End User Agreement . www.reading.ac.uk/centaur CentAUR Central Archive at the University of Reading Reading’s research outputs online Management & Organizational History ISSN: 1744-9359 (Print) 1744-9367 (Online) Journal homepage: https://www.tandfonline.com/loi/rmor20 Symbolism in bank marketing and architecture: the headquarters of National Provincial Bank of England Victoria Barnes & Lucy Newton To cite this article: Victoria Barnes & Lucy Newton (2019) Symbolism in bank marketing and architecture: the headquarters of National Provincial Bank of England, Management & Organizational History, 14:3, 213-244, DOI: 10.1080/17449359.2019.1683038 To link to this article: https://doi.org/10.1080/17449359.2019.1683038 © 2019 The Author(s). -

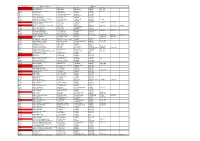

2021 Salary Projection Survey Summary

2021 Salary Projection Survey Insights on compensation trends expected in 2021 - Summary report 38th edition | September 2020 Table of contents 1 Introduction 2 Compensation consulting 3 Participant profile 6 Survey highlights 8 Historical base salary increase trend 9 Base salary 11 Salary structure 13 Survey participants 22 Notice 22 For more information Introduction The results presented in this report are an analysis of responses collected between July and August 2020 to the 38th edition of Morneau Shepell’s 2021 Salary Projection Survey. The data represents a broad cross-section of industries representing 889 organizations across Canada and provides data on actual salary budget increase percentages for the past and current years, along with projected increases for next year. • The report contains segmented data and a detailed analysis by Morneau Shepell’s compensation consultants. • Survey participation jumped over 75% on a year over year basis from 506 organizations participating in 2019, to 889 in 2020. Many of these organizations also participated in our 2020 Canadian Salary Surveys. • Survey data includes actual 2020 and projected 2021 base salary increases and salary structure adjustments. • Survey data is reported excluding zeros and including zeros (freezes) but does not include temporary rollbacks due to COVID-19. • Findings are summarized for non-unionized employees. • Statistical requirements applied to the data analysis include a minimum of three organizations for average/mean reported results, and a minimum of five organizations -

BANK MERGERS: IS BIGGER BETTER? Introduction

BANK MERGERS: IS BIGGER BETTER? Introduction In January 1998, the Bank of Montreal and the Royal Bank of Canada announced plans to merge and create one superbank. A few months later, in April, the Toronto Dominion Bank and the Canadian Imperial Bank of Commerce announced similar plans. The proposed bank mergers caught many people off guard, including Minister of Finance Paul Martin. In a Macleans interview, Martin said, "Just because they decided to get into bed together doesnt mean that I have to bless their union." Martins message seemed to be that Ottawa, not the banks, would decide the future of banking in Canada. "There will be no mergers in the banking sector until we are convinced that [it] is what is best for Canadians, and we will not be stampeded into making that decision." According to the banks, the proposed mergers were a natural response to a changing and highly competitive global marketplace. Mergers, they said, provide a way of maintaining a strong Canadian presence in the banking industry. Certainly, recent technological advances have dramatically changed the manner in which the financial services industry conduct their business, and the above- mentioned banks feel, therefore, that they need to be bigger to compete and to have a substantial presence in the global banking community. Martin himself acknowledged the changed nature of banking when he said, "If you look back at banking five years ago, you might as well look back two centuries." While the proposed bank mergers brought attention to the challenges facing Canadas banks, these challenges are not peculiar to the banks alone. -

Transalpine Pass Routes in the Swiss Central Alps and the Strategic Use of Topographic Resources

Preistoria Alpina, 42 (2007): 109-118 ISSN 09-0157 © Museo Tridentino di Scienze Naturali, Trento 2007 Transalpine pass routes in the Swiss Central Alps and the strategic use of topographic resources Philippe DELLA CASA Department of Pre-/Protohistory, University of Zurich, Karl-Schmid-Str. ���������������������������4, 8006 Zurich, Switzerland E-mail: [email protected] SUMMARY - Transalpine pass routes in the Swiss Central Alps and the strategic use of topographic resources - Using examples from the San Bernardino and the St. Gotthard passes in the Swiss Central Alps, this paper discusses how the existence of transalpine high altitude pass routes can be inferred, even though there is a lack physical evidence, from specific Bronze and Iron Age settlement patterns in access valleys. Particular attention is given to the effect of topography within the territorial and economic organizational area on transalpine tracks and traffic routes. A set of recurring patterns, such as strategic position, natural and/or artificial protection, presence of “foreign” materials, can help identifying (settlement) sites with particular functions as regards traffic and trade within the systems of territorial organization. Moreover, the paper also addresses socio-dynamic issues of the problem of transalpine pass routes. RIASSUNTO - Passi transalpini nelle Alpi Centrali Svizzere e uso strategico di risorse topografiche -Usando esempi dal Passo di San Bernardino e dal Passo del San Gottardo nelle Alpi Centrali Svizzere, il presente contributo discute come l’esistenza di vie di transito transalpine d’alta quota possa essere dedotta, anche mancando evidenze fisiche, da specifici modelli insediativi dell’età del Bronzo e del Ferro presenti nelle valli di accesso. -

Reference Banks / Finance Address

Reference Banks / Finance Address B/F2 Abbey National Plc Abbey House Baker Street LONDON NW1 6XL B/F262 Abbey National Plc Abbey House Baker Street LONDON NW1 6XL B/F57 Abbey National Treasury Services Abbey House Baker Street LONDON NW1 6XL B/F168 ABN Amro Bank 199 Bishopsgate LONDON EC2M 3TY B/F331 ABSA Bank Ltd 52/54 Gracechurch Street LONDON EC3V 0EH B/F175 Adam & Company Plc 22 Charlotte Square EDINBURGH EH2 4DF B/F313 Adam & Company Plc 42 Pall Mall LONDON SW1Y 5JG B/F263 Afghan National Credit & Finance Ltd New Roman House 10 East Road LONDON N1 6AD B/F180 African Continental Bank Plc 24/28 Moorgate LONDON EC2R 6DJ B/F289 Agricultural Mortgage Corporation (AMC) AMC House Chantry Street ANDOVER Hampshire SP10 1DE B/F147 AIB Capital Markets Plc 12 Old Jewry LONDON EC2 B/F290 Alliance & Leicester Commercial Lending Girobank Bootle Centre Bridal Road BOOTLE Merseyside GIR 0AA B/F67 Alliance & Leicester Plc Carlton Park NARBOROUGH LE9 5XX B/F264 Alliance & Leicester plc 49 Park Lane LONDON W1Y 4EQ B/F110 Alliance Trust Savings Ltd PO Box 164 Meadow House 64 Reform Street DUNDEE DD1 9YP B/F32 Allied Bank of Pakistan Ltd 62-63 Mark Lane LONDON EC3R 7NE B/F134 Allied Bank Philippines (UK) plc 114 Rochester Row LONDON SW1P B/F291 Allied Irish Bank Plc Commercial Banking Bankcentre Belmont Road UXBRIDGE Middlesex UB8 1SA B/F8 Amber Homeloans Ltd 1 Providence Place SKIPTON North Yorks BD23 2HL B/F59 AMC Bank Ltd AMC House Chantry Street ANDOVER SP10 1DD B/F345 American Express Bank Ltd 60 Buckingham Palace Road LONDON SW1 W B/F84 Anglo Irish -

FSCS Information Sheet

FINANCIAL SERVICES COMPENSATION SCHEME INFORMATION SHEET Basic information about the protection of your eligible deposits Eligible deposits in Bank of Scotland plc are protected by: The Financial Services Compensation Scheme (“FSCS”)1 Limit of protection: £85,000 per depositor per bank2 The following trading names are part of your bank: Halifax, Intelligent Finance (IF), Birmingham Midshires (BM Savings), Bank of Scotland, Bank of Scotland Private Banking, Bank of Wales, and St. James’s Place Bank. Some savings accounts under the AA Savings and Saga brand names are also deposits with Bank of Scotland plc. If you have more eligible deposits at the same bank: All your eligible deposits at the same bank are “aggregated” and the total is subject to the limit of £85,0002 If you have a joint account with other person(s): The limit of £85,000 applies to each depositor separately3 Reimbursement period in case of bank’s failure: 20 working days4 Currency of reimbursement: Pound sterling (GBP, £) To contact Bank of Scotland plc for enquiries relating to You can visit one of our branches, call us, go online or your account: write to us at the address below: The Mound, Edinburgh, EH1 1YZ To contact the FSCS for further information Financial Services Compensation Scheme, on compensation: 10th Floor Beaufort House, 15 St Botolph Street, London, EC3A 7QU Tel: 0800 678 1100 or 020 7741 4100 Email: [email protected] More information: http://www.fscs.org.uk Additional Information 1 Scheme responsible for the protection of your eligible deposit Your eligible deposit is covered by a statutory Deposit Guarantee Scheme. -

France À Fric: the CFA Zone in Africa and Neocolonialism

France à fric: the CFA zone in Africa and neocolonialism Ian Taylor Date of deposit 18 04 2019 Document version Author’s accepted manuscript Access rights Copyright © Global South Ltd. This work is made available online in accordance with the publisher’s policies. This is the author created, accepted version manuscript following peer review and may differ slightly from the final published version. Citation for Taylor, I. C. (2019). France à fric: the CFA Zone in Africa and published version neocolonialism. Third World Quarterly, Latest Articles. Link to published https://doi.org/10.1080/01436597.2019.1585183 version Full metadata for this item is available in St Andrews Research Repository at: https://research-repository.st-andrews.ac.uk/ FRANCE À FRIC: THE CFA ZONE IN AFRICA AND NEOCOLONIALISM Over fifty years after 1960’s “Year of Africa,” most of Francophone Africa continues to be embedded in a set of associations that fit very well with Kwame Nkrumah’s description of neocolonialism, where postcolonial states are de jure independent but in reality constrained through their economic systems so that policy is directed from outside. This article scrutinizes the functioning of the CFA, considering the role the currency has in persistent underdevelopment in most of Francophone Africa. In doing so, the article identifies the CFA as the most blatant example of functioning neocolonialism in Africa today and a critical device that promotes dependency in large parts of the continent. Mainstream analyses of the technical aspects of the CFA have generally focused on the exchange rate and other related matters. However, while important, the real importance of the CFA franc should not be seen as purely economic, but also political. -

The History of Banks in France

The history of banks in France Alain Plessis Some forms of progress long hindered In the Middle Ages and at the beginning of modern times, banking activities in France experienced a belated and more difficult development than in neighbouring countries such as Italy, the Netherlands or the United Provinces. The overwhelmingly precarious agriculture and a very limited participation on the international exchange scene, the dominant influence of the catholic church as well as the priests' sermons, long denouncing the practice of loaning at interest, and a very hostile mentality towards anything that resembled usury rendered all big merchants suspect and hindered the free development of their activities. Nevertheless the expansion of trade - which first began in the twelfth and thirteenth centuries through the activities of the fairs in Champagne and then through the dynamism of the commercial markets such as the large royal ports or the city of Lyons - as well as the financial needs of the royal government, all made the use of banking practices more and more indispensable. Banking methods, generally invented in Italy, arrived in France: manual exchange transactions and the use of bills of exchange for transferring funds, as well as the credit operations which developed in connection with those operations, deposits, credit transfers and various investment. The bankers in these professions, who sometimes grew quite rich, were primarily foreigners who lived cut off from the national community, especially Italians and Jews. These Italians were called Lombards; in Paris, already a banking city, the moneychangers from Piedmont set themselves up in a street which has since then been called rue des Lombards. -

Gotthard Bergstrecke’

University of Lugano, Switzerland Faculty of Economics The touristic future on and along the ‘Gotthard Bergstrecke’ Exploring the associations people have with the region, the motivations of prospective visitors, their requirements to a ‘Gottardo Express’ train offer and the potential of regional attractions. Master’s dissertation Author: Fabio Flepp Supervisor: Prof. Rico Maggi Second Reader: Stefano Scagnolari Academic year: 2014/2015 Submission date: December 2014 ! Contact Author: Fabio Flepp - Linkedin: https://ch.linkedin.com/in/fabio-flepp-a2567043 - Email: [email protected] Table of Contents LIST OF FIGURES IV LIST OF TABLES V LIST OF ABBREVIATIONS VI 1. INTRODUCTION 1 1.1 CHOICE OF TOPIC 1 1.1.1 ALPTRANSIT AND “BERGSTRECKE” 2 1.1.2 CONSEQUENCES, FEARS AND SIMILAR PLACES 3 1.1.3 DISCUSSIONS ABOUT THE FUTURE TOURISM DEVELOPMENT 4 1.2 RESEARCH AIM 5 1.3 OUTLINE 7 2. TRANSPORT AND TOURISM 8 2.1 GENERAL 8 2.2 TRANSPORTATION FOR TOURISM 9 2.3 (TOURISM-) IMPACTS OF NEW TRAFFIC INFRASTRUCTURE 9 2.4 TRANSPORT AS TOURISM & SLOW TRAVEL 10 2.5 RAIL TOURISM 12 2.5.1 MOTIVATION FOR TRAIN TRAVEL 12 2.5.2 HERITAGE RAILWAYS 13 3. GOTTHARD 14 3.1 HISTORY OF THE TRANSPORTATION LANDSCAPE 14 3.2 TOURISM HISTORY IN THE GOTTHARD REGION 15 3.3 TOURISM TODAY 17 3.3.1 TOURISM NUMBERS OF THE GOTTHARD REGION 18 3.3.2 TOURISM MONITOR 2013 18 3.3.3 PRESENT TOURISM PRODUCTS AND TOURISM CARD OFFERS 19 4. TOURISM PRODUCTS (+ DESTINATIONS) 23 4.1 GENERAL 23 4.2 CO-CREATION OF THE TOURISM EXPERIENCE 24 4.3 TOURISM PRODUCT DEVELOPMENT 25 I 5.