Introducing Norwegian the Modern Way to Fly

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Is the Low-Cost Long-Haul Business Model a Threat to European Major Airlines?

Pierre Rolland Is the low-cost long-haul business model a threat to European major airlines? Metropolia University of Applied Sciences Bachelor of Business Administration European Business Administration Bachelor’s Thesis 28/04/2021 Abstract Author Pierre Rolland Title Is the low-cost long-haul business model a threat to European major airlines? Number of Pages 40 pages + 5 appendices Date 28th April 2021 Degree Bachelor of Business Administration Degree Programme European Business Administration Instructor/Tutor Daryl Chapman, Senior Lecturer The objective of this thesis is to understand the low-cost air market in Europe and identify the differences to explain to what extent the low-cost long-haul business is a threat to the European major airlines. This thesis consists of an explanation of the different low-cost long-haul air-market strategies in Europe, observe their development, successes and failures, and analyse their impact on the major airlines. The result of this research shows us that the low-cost model has affected the traditional model, and that major airlines have to adapt their offers to retain their clients. We also find out that the low-cost strategy that applies to the long-haul is not and cannot be the same as the short and medium-haul strategy. Keywords Low-Cost Airlines, Norwegian Air Shuttle, Business Model, Europe, Long-haul, COVID-19 Contents Glossary 1 Introduction 1 2 Current state of the air transport market 3 2.1 Air transport in Europe 4 2.1.1 The medium-haul 6 2.1.2 The long-haul 7 2.2 Low-cost companies 8 -

World Air Transport Statistics, Media Kit Edition 2021

Since 1949 + WATSWorld Air Transport Statistics 2021 NOTICE DISCLAIMER. The information contained in this publication is subject to constant review in the light of changing government requirements and regulations. No subscriber or other reader should act on the basis of any such information without referring to applicable laws and regulations and/ or without taking appropriate professional advice. Although every effort has been made to ensure accuracy, the International Air Transport Associ- ation shall not be held responsible for any loss or damage caused by errors, omissions, misprints or misinterpretation of the contents hereof. Fur- thermore, the International Air Transport Asso- ciation expressly disclaims any and all liability to any person or entity, whether a purchaser of this publication or not, in respect of anything done or omitted, and the consequences of anything done or omitted, by any such person or entity in reliance on the contents of this publication. Opinions expressed in advertisements ap- pearing in this publication are the advertiser’s opinions and do not necessarily reflect those of IATA. The mention of specific companies or products in advertisement does not im- ply that they are endorsed or recommended by IATA in preference to others of a similar na- ture which are not mentioned or advertised. © International Air Transport Association. All Rights Reserved. No part of this publication may be reproduced, recast, reformatted or trans- mitted in any form by any means, electronic or mechanical, including photocopying, recording or any information storage and retrieval sys- tem, without the prior written permission from: Deputy Director General International Air Transport Association 33, Route de l’Aéroport 1215 Geneva 15 Airport Switzerland World Air Transport Statistics, Plus Edition 2021 ISBN 978-92-9264-350-8 © 2021 International Air Transport Association. -

The Hypocrisy Surrounding Transatlantic Commercial Aviation Regulation

Freedom to Fly THE HYPOCRISY SURROUNDING TRANSATLANTIC COMMERCIAL AVIATION REGULATION By Taylor Strosnider* n the cold morning of February 18, 2015, over 50 flight attendants and employees of the airline Norwegian Air Shuttle stood on the steps of the U.S. Department of Transportation’s (DOT) offices in Washington, D.C. in protest of the agency’s delay of Norwegian’s foreign air carrier operating permit.1 The sight was an unusual one: not only is it out of the ordinary to see airline personnel protesting outside of the DOT’s headquarters, but Norwegian was, and still is, a carrier with only a handful of flights to and from the U.S. The permit being sought from the Federal Aviation Ad- O ministration (FAA) had been pending for over a year, resulting in the entirety of Norwegian’s U.S. operations being caught in a seemingly endless period of limbo.2 FAA approval for the airline would allow it the long-sought opportunity to expand its transatlantic services to more cities throughout the country—each of them on state-of-the-art Boeing 787s, in contrast to the often decades-old aircraft used by existing carriers.3 However, despite the protest, petition, and lobbying taking place in Washington, Norwegian still sits in limbo today await- ing formal authorization of its foreign air carrier permit. Moreover, a total of 38 U.S. senators signed a letter to the DOT urging the rejection of the airline’s application.4 Journal of Consumer & Commercial Law 105 Despite the fact that increased competition on transat- While the impetus for Anderson’s remarks remains a lantic routes would be an unqualified win for consumers—many mystery, his remarks on whole clearly illustrate the problem pre- of whom pay a minimum of $1,000 to fly across the Atlantic dur- sented by the Gulf Three. -

Annual Report 2020

NORWEGIAN AIR SHUTTLE ASA ANNUAL REPORT 2020 NORWEGIAN AIR SHUTTLE ASA NORWEGIAN AIR SHUTTLE – ANNUAL REPORT 2020 2 CONTENTS LETTER FROM THE CEO 3 BOARD OF DIRECTOR'S REPORT 5 FINANCIAL STATEMENTS 16 CONSOLIDATED 17 PARENT COMPANY 67 ANALYTICAL INFORMATION 89 CORPORATE RESPONSIBILITY 92 CORPORATE GOVERNANCE 98 DECLARATION FROM THE BOARD OF DIRECTORS AND CEO 103 AUDITOR'S REPORT 104 BOARD OF DIRECTORS 107 MANAGEMENT 111 DEFINITIONS AND ALTERNATIVE PERFORMANCE MEASURES 114 NORWEGIAN AIR SHUTTLE – ANNUAL REPORT 2020 3 LETTER FROM THE CEO The year began on a positive note as we The power and passion of the Norwegian were set to deliver a profitable 2020 thanks ‘voice’ has been heard over the last year to successful cost-saving initiatives and a and is a testament to the importance of our more efficient operation. 2020 also saw brand and the value that we bring to Nordic the highest summer bookings ever, but it economies through business and tourism. proved however to be a year like no other as travel effectively ground to a halt across I have had to make difficult decisions that all markets in which Norwegian operated have impacted dedicated colleagues across due to the pandemic and travel several business areas, however, on every restrictions. The impact has been occasion this has been a necessary step to profound, on both a financial and ensure the continued survival of the airline. operational front. Like all airlines we have By rightsizing the company at this crucial had to rapidly adapt in order to survive and time, we will be in a far better position to be in a position to capitalise on weather this storm that has still yet to pass. -

Industry Monitor the EUROCONTROL Bulletin on Air Transport Trends

Issue N°145. 31/10/12 Industry Monitor The EUROCONTROL bulletin on air transport trends European traffic down 3% in September. EUROCONTROL statistics and forecasts 1 Air France-KLM and Lufthansa posted higher Passenger airlines 2 3Q12 operating profit compared with the same period last year. Financial results of airlines 6 Qatar Airways is to join oneworld and is the first Environment 7 Gulf carrier to become a member of a global Aircraft Manufacturing 7 airline alliance. Airports 8 Oil prices reduced slightly to €86 per barrel in Regulation 8 October. International Energy Agency predicts Oil 9 oils prices to fall to €69 by 2017 due to global production capacity increasing and economic Fares 9 slowdown keeping demand growth sluggish. EUROCONTROL statistics and forecasts European flights decreased by 3% in September year-on-year, on the low side of the forecast range (see Figure 1). Low-cost and Charter were the only segments to show flight growth compared with September last year, with 3.2% and 2.5% respectively. Cargo decreased by 9.2%, business aviation by 6.2% and Traditional Scheduled by 5% versus 2011 levels (EUROCONTROL, October). Based on preliminary data from airlines for delay from all causes, 36% of flights were delayed on departure in September, a 3 percentage point decrease on September 2011. Analysis of the causes of delay shows a decrease of 0.8 minute per flight from reactionary delay and ATFCM en-route delays fell by 0.7 minutes to 0.4 minutes per flight. (see Figure 2) (EUROCONTROL, October). On 29 October, Hurricane Sandy is estimated to have cut 40% of west-bound and 9% of east- bound Atlantic flights compared with the same weekday in 2011 (EUROCONTROL, 31 October). -

Norwegian Air Shuttle ASA.Pdf

FACULTY F SOCIAL SCIENCES, UIS BUSINESS SCHOOL MASTER’S THESIS STUDY PROGRAM: THESIS IS WRITTEN IN THE FOLLOWING SPECIALIZATION/SUBJECT: Business and administration Applied Finance THE ASSIGNMENT IS NOT CONFIDENTIAL TITLE:Valuation of Norwegian Air Shuttle ASA AUTHOR(S) SUPERVISOR: Student number: Name: 230498 Christer B. Nordbø Marius Sikveland ………………… ……………………………………. 229868 Jabbar Raza ………………… ……………………………………. ACKNOWLEDGE RECEIPT OF 2 BOUND COPIES OF THESIS Stavanger, ……/…… 2016 Signature administration:………………………… Executive Summary The purpose of this thesis is to do a valuation on Norwegian Air Shuttle ASA, and based upon this objective we have formulated the following problem statement: “What is the fair value of Norwegian Air Shuttle ASA as per 31.03.2016?” The purpose of this valuation is to evaluate if the stock price is either over or under priced. Based on the findings in this thesis, we estimated the stock price of Norwegian Air Shuttle ASA to be NOK 283,1. On 31.03.2016 the stock price of Norwegian Air Shuttle ASA was NOK 311,5 and therefore our claim is that the stock is overvalued. Our recommendation is then to sell the stock. To answer the problem statement, we will do a fundamental valuation of Norwegian Air Shuttle ASA. First we did a strategic analysis, consisting one external analysis and one internal analysis. The external analysis consisted of a Pestle analysis and Porter Five Forces framework. This gave us the foundation for predicting future development and environment of the company. From the external analysis we found that the European market is driven by low margins and fierce competition. For the internal analysis we did a VRIO-analysis evaluating the internal resources. -

Atlas of Airports

COMPOSMENT TYPOLOGY CONFIGURATION AIRFIELDS NORWAY Norwegian airports with more than 100 000 passengers This airport research combines selected airports that with a certain annual passengers in Norway. The methodology of juxtaposition, the analysis of Terminals, Runway, Airport cities patterns as well as configuration, spatial, morphology, forms, which serve as a base-data for airport design. TYPOLOGY OF AIRPORTS - NORWAY SELECTED AIRPORT ANALYSIS & STUDY con- tent Oslo 3 Bergen 5 Stavanger 7 Trondheim 9 Tromsø 11 Sandefjord 13 Bodø 15 Kristiansand 17 Ålesund 19 Haugesund 21 Narvik and Harstad (Evenes Airport) 23 Alta 25 VMolde 27 Kristiansund 29 Kirkenes 31 Bardufoss 33 Hammerfest 35 Longyearbyen, Svalbard 37 Florø 39 Stokmarknes 41 Mo i Rana 43 Runway 45 Configuration 47 Airport cities 49 Terminals 51 OSL 60°12’10’’N 011°05’02’’E Airport type Public Operator Oslo Lufthavn AS Serves Oslo, Norway Location Gardermoen, Ullensaker, Akershus Runways 3,600/2,950 Passengers 25,788,610 International 14,567,406 Domestic 11,221,204 Aircraft movements 237,618 Cargo (tonnes) 130,301 3 OSL RUNWAY TERMINAL AIRPORT CITY STRUCTURE 1 AIRPORT CITY PATTERN TRANSFER AIRPORT CITY PATTERN The first airports to serve Oslo was Kjeller Airport that opened in 1912 and Gressholmen Airport that served seaplanes after its opening in 1926. The airport location was first used by the Norwegian Army from 1940, with the first military airport facilities being built during the 1940s. An expansion with a new terminal building and a third pier is scheduled to open in 2017.Oslo Airport is the largest and busiest of three major international airports located around Oslo. -

Press Briefing 11 July 2014, Brussels Social Partners Join Forces to Fight Against “Flags of Convenience” in Civil Aviation

Flags of INconvenience Are they sinking the aviation industry? Press briefing 11 July 2014, Brussels Social Partners join forces to fight against “Flags of Convenience” in civil aviation Job losses, market distortion, declining labour standards, social dumping, unfair competition… All are just collateral damages from the of European jobs in the industry; the ability to emerging development in civil aviation to seek sidestep many areas of European regulation to fly under a “Flag of Convenience” (FoC). The and the ability to provide oversight of what same phenomenon that decimated the West’s is going on in these areas; and a race to the maritime industry decades ago has now arisen bottom in the industry as existing responsible in civil aviation. airlines are forced to follow suit in order to survive. What is a flag of convenience? This brings unfair competition and social ‘A flag of a different country under which a ship dumping. The EU legislator should not tolerate (or now - an aircraft) is registered in order to this. avoid financial charges, regulations or labour standards in the owner’s country.’ What is the Social Dialogue Committee for Civil Aviation? What effect does it have? A formal structure of the EU, the Committee It allows a business or owner to benefit from is composed of all the ‘Social Partner’ these advantages and have access to the organisations from every corner of the civil markets of the states in which they operate aviation sector. despite not having to comply with the laws, • It has a number of statutory rights, taxes, or labour standards in those states. -

Before the Us Department of Transportation

BEFORE THE U.S. DEPARTMENT OF TRANSPORTATION WASHINGTON, DC ) Application of ) ) Docket No. OST‐2013‐0204 NORWEGIAN AIR INTERNATIONAL ) LIMITED ) ) for an exemption under 49 U.S.C. § 40109 ) and a foreign air carrier permit pursuant to ) 49 U.S.C. § 41301 (US‐EU Open Skies) ) ) ANSWER OF AIR LINE PILOTS ASSOCIATION TO APPLICATION OF NORWEGIAN AIR INTERNATIONAL LIMITED FOR AN EXEMPTION AND FOREIGN AIR CARRIER PERMIT Jonathan A. Cohen Russell Bailey Air Line Pilots Association 1625 Massachusetts Avenue NW Washington, DC 20036 Phone: 202‐797‐4086 Fax: 202‐797‐4014 [email protected] [email protected] Attorneys for the Air Line Pilots Association Dated: December 17, 2013 BEFORE THE U.S. DEPARTMENT OF TRANSPORTATION WASHINGTON, DC ) Application of ) ) Docket No. OST‐2013‐0204 NORWEGIAN AIR INTERNATIONAL ) LIMITED ) ) for an exemption under 49 U.S.C. § 40109 ) and a foreign air carrier permit pursuant to ) 49 U.S.C. § 41301 (US‐EU Open Skies) ) ) ANSWER OF AIR LINE PILOTS ASSOCIATION TO APPLICATION OF NORWEGIAN AIR INTERNATIONAL LIMITED FOR AN EXEMPTION AND FOREIGN AIR CARRIER PERMIT Air Line Pilots Association (ALPA) opposes the application of Norwegian Air International Limited (NAI) for an exemption and a foreign air carrier permit. A self‐ described “foreign air carrier of Ireland,” NAI is an affiliate of Norwegian Air Shuttle (NAS) ‐‐ a foreign air carrier of Norway ‐‐ that has been established expressly to evade the social laws of Norway in order to lower the wages and working conditions of its air crew. As an entity under the control of Norwegian citizens, NAI could not expect to be granted a permit but for the opportunities made available by the U.S.‐ European/Norway/Iceland Air Transport Agreement (ATA).1 The ATA includes a provision that states that the opportunities created by the Agreement are not intended 1 The U.S.–European Union Air Transport Agreement was amended in June 2011 to apply to Norway and Iceland as if they were Member States of the European Union. -

Long-Haul Low Cost Airlines: a New Business Model Across the Transatlantic and Its Cost Characteristics∗

Long-haul low cost airlines: A new business model across the transatlantic and its cost characteristics∗ Christian Soyk, Jürgen Ringbeck and Stefan Spinler Chair in Logistics Management, WHU - Otto Beisheim School of Management May 4th, 2017 Abstract Existing academic literature is inconclusive about characteristics and viability of the long-haul low cost airline business model, whereas several airlines of this type are emerging. This article aims to uncover its defining characteristics by clustering a sample of 37 transatlantic airlines using principal component and hierarchical cluster analyses along a newly constructed long-haul airline business model framework. To contribute to the evaluation of business model viability, cost advantages between clusters are analyzed subsequently followed by a discussion of their sustainability. Key findings include the characterization of the emerging long-haul LCC business model and its significant differences from existing legacy hub and leisure carrier models. On a cluster average, 30-34% lower unit costs were identified. Keywords— Airlines, Business models, Long-haul, Low cost, Point-to-point ∗Draft manuscript. Please do not cite without the authors’ permission. 1 Transatlantic airline business models 1 Introduction Low cost carriers (LCCs) such as Ryanair and Southwest Airlines have revolutionized short- and medium-haul1 airline markets across the world since the 1990s. The validity of the business model is proven practically through higher profitabilities (cf. Corbo, 2016). Additionally, many academic studies of short-/medium-haul LCCs were conducted, which agree on common underlying principles of the business model (cf. Fu et al., 2011; de Wit and Zuidberg, 2012; Cho et al., 2015; Fageda et al., 2015; Fu et al., 2015). -

Pilot August 2014

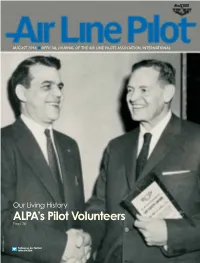

AUGUST 2014 n OFFICIAL JOURNAL OF THE AIR LINE PILOTS ASSOCIATION, INTERNATIONAL Our Living History ALPA’s Pi lot Volunteers Page 26 Follow us on Twitter PRINTED IN THE U.S.A. PRINTED IN @wearealpa 2 Air Line Pilot August 2014 ADP80654-01_G21413_1b.ai ADP80654-01-x1a-OP Revised.pdf 07.10.2014 Live: 7 x 9.958 Trim: 8.25 x 10.875 jn Bleed: 8.5 x 11.125 August 2014 • Volume 83, Number 8 7 FEATURES 37 About the 24 Exact Change CoVer Needed at the Ex-Im on march 6, 1957, Capt. ernie bank Cutrell (American) received ALPA’s first Air Safety Award from Clancy 26 ALPA’s 60th Air Sayen, ALPA’s president, at the Safety Forum: A Association’s Air Safety Forum for contributing to the advancement Celebration of Pilots of aviation through his work on Helping Get the Job centerline approach lightning. At Done Safely and the time of the award presentation, Cutrell’s Securely approach lighting system had become CommeNtAry the nation’s standard. Download a QR reader 4 taking off to your smartphone, Part of a Positive scan the code, and Solution read the magazine. Air Line Pilot (ISSN 0002-242X) is pub lished 5 Aviation matters monthly by the Air Line Pilots Association, Inter national, affiliated with AFl-CIo, ClC. In the Grey editorial offices: 535 herndon parkway, DepArtmeNts po box 1169, herndon, VA 20172-1169. 6 Weighing In telephone: 703-481-4460. Fax: 703-464- 7 Preflight 37 The Landing 2114. Copyright © 2014—Air line pilots Raising the Safety and Association, Inter national, all rights Safety—Front and reserved. -

Registration Document

Norwegian Air Shuttle ASA 13.03.2018 Registration Document Registration Document Norwegian Air Shuttle ASA Lysaker, 13.03.2018 Norwegian Air Shuttle ASA 13.03.2018 Registration Document Important notice This Registration Document is valid for a period of up to 12 months following its approval by the Financial Supervisory Authority of Norway (the “Norwegian FSA”) (Finanstilsynet). This Registration Document was approved by the Norwegian FSA on 13.03.2018. The prospectus for issuance of new bonds or other securities may for a period of up to 12 months from the date of the approval consist of this Registration Document and a securities note and summary applicable to each issue and subject to a separate approval. The Registration Document is based on sources such as annual reports and publicly available information and forwardlooking information based on current expectations, estimates and projections about global economic conditions, the economic conditions of the regions and industries that are major markets for the Company’s line of business. A prospective investor should consider carefully the factors set forth in chapter 1 Risk factors, and elsewhere in the Prospectus, and should consult his or her own expert advisers as to the suitability of an investment in bonds, including any legal requirements, exchange control regulations and tax consequences within the country of residence and domicile for the acquisition, holding and disposal of bonds relevant to such prospective investor. The manager and/or affiliated companies and/or officers, directors and employees may be a market maker or hold a position in any instrument or related instrument discussed in this Registration Document, and may perform or seek to perform financial advisory or banking services related to such instruments.