Form S-3 Registration Statement Under the Securities Act of 1933

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Accredited Gold Bar Manufacturers

ACCREDITED GOLD BAR MANUFACTURERS There are approximately 125 active gold refiners around the world whose relevant gold bars are accepted as “good delivery” by one or more of the associations and exchanges featured in this section. Section updated to November 2014, according to available information. ACCREDITATION A consolidated table in this section records – by region and country of location – the names of active refiners that are accredited to the following: • London Bullion Market Association (LBMA) • CME Group – Market Contract: COMEX • Tokyo Commodity Exchange (TOCOM) • Dubai Multi Commodities Centre (DMCC) The names of active refiners accredited to the 6 other exchanges are recorded separately as their lists rely partly on the LBMA list or focus on Manufacturing London Good domestic refiners: Delivery 400 oz bars at Johnson Matthey (USA). • BM&FBovespa, São Paulo (BM&F) • Istanbul Gold Exchange (IGE) • Multi Commodity Exchange of India Ltd (MCX) • Shanghai Gold Exchange (SGE) • The Chinese Gold & Silver Exchange Society, Hong Kong (CGSE) Importance of LBMA list As covered in the section on “Gold Associations & Exchanges”, the most important list of refiners for the international gold bar market is the one published by the LBMA. In summary, the LBMA list refers to more than 70 active refiners in 30 countries. Manufacturing kilobars at Tanaka (Japan). It can be noted that relevant bars of LBMA-accredited refiners are automatically accepted as good delivery by the Istanbul Gold Exchange, Multi Commodity Exchange of India Ltd, Shanghai Futures Exchange, Shanghai Gold Exchange and The Chinese Gold & Silver Exchange Society. In addition, the Dubai Multi Commodities Centre has a separate category for refiners accredited to the LBMA. -

A Guide to the London Bullion Market Association

A guide to The London Bullion Market Association 1-2 Royal Exchange Buildings, Royal Exchange, London, EC3V 3LF +44 (0)20 7796 3067 www.lbma.org.uk Introduction The London Bullion Market Association The LBMA is the pre-eminent body for the world’s largest and most important market for gold and silver bullion. The London Bullion Market is centred in London with a global Membership and client base, including the majority of the central banks that hold gold, private sector investors, mining companies and others. The LBMA’s Membership includes more than 145 companies, including traders, refiners, producers, fabricators, as well as those providing storage and secure carrier services. The LBMA was set up in 1987 by the Bank of England, which was Financial Market Regulation at the time the bullion market’s regulator. The London Bullion Since the passage of the Financial Markets Act 2012, responsibility Market is a truly international market, in that although dealers in for the regulation of the major participants in the London bullion other bullion trading centres may trade in their local markets and market lies with the Prudential Regulation Authority (“PRA”) at the commodity exchanges, they also deal extensively in “Loco London”. Bank of England. The PRA is now responsible for prudential banking This term means that the gold or silver will be settled in London by regulation of most of the firms active in the bullion market. The PRA the LBMA Member, either by way of book transfer or physically. Hence works closely with the Financial Conduct Authority (FCA) which is membership of the LBMA is vital to the London Bullion Market. -

Understanding Money Laundering Risks in the Conflict Gold Trade from East and Central Africa to Dubai and Onward

ADVISORY Understanding Money Laundering Risks in the Conflict Gold Trade From East and Central Africa to Dubai and Onward By Sasha Lezhnev and Megha Swamy November 2020 ADVISORY Executive Summary This advisory highlights the money laundering risks stemming from the flow of conflict gold from four sub-Sa- haran African countries affected by armed conflict and corruption—the Democratic Republic of Congo (DRC), South Sudan, Sudan, and Central African Republic (CAR)—with a focus on risks in Dubai, United Arab Emir- ates (UAE), the destination point for an estimated 95% of gold from East and Central Africa.1 Because gold is easily smuggled in high volumes, it is frequently used as a money laundering vehicle by armed groups, criminal networks, and corrupt actors, who can then mask its origins by melting it together with other gold.2 The record-breaking rise in world gold prices in recent years has driven a new artisanal gold mining and refining rush in conflict-affected and high-risk areas in East and Central Africa.3, 4, 5, 6 Annually, over $3 billion in gold mined in the affected regions, including conflict gold from which armed groups and army units profit, reaches international markets in the United States, Europe, Asia, and the Middle East,7 according to investi- gations by The Sentry and other organizations.8 Nearly all of this gold is first imported to Dubai, UAE, which has rapidly risen over the past 20 years to become one of the world’s largest gold trading centers, particularly for artisanal and small-scale gold from sub-Saharan Africa, Latin America, and South Asia.9 Artisanally mined gold from the DRC, South Sudan, and CAR is mainly smuggled or exported to one of six neighboring countries—Uganda, Rwanda, Cameroon, Kenya, Chad, or Burundi—before being exported to Dubai. -

Global Financial Services Regulatory Guide

Global Financial Services Regulatory Guide Baker McKenzie’s Global Financial Services Regulatory Guide Baker McKenzie’s Global Financial Services Regulatory Guide Table of Contents Introduction .......................................................................................... 1 Argentina .............................................................................................. 3 Australia ............................................................................................. 10 Austria ................................................................................................ 22 Azerbaijan .......................................................................................... 34 Belgium .............................................................................................. 40 Brazil .................................................................................................. 52 Canada ................................................................................................ 64 Chile ................................................................................................... 74 People’s Republic of China ................................................................ 78 Colombia ............................................................................................ 85 Czech Republic ................................................................................... 96 France ............................................................................................... 108 Germany -

The Precious Metals Trade - General Information Handbook

HANDBOOK H2/2009 THE PRECIOUS METALS TRADE - GENERAL INFORMATION HANDBOOK DIRECTORATE: MINERAL ECONOMICS HANDBOOK H2/2009 THE PRECIOUS METALS TRADE - GENERAL INFORMATION HANDBOOK DIRECTORATE: MINERAL ECONOMICS Compiled by: Alex Conradie ([email protected]) Picture on the front cover by courtesy of Precious-Metal.org This Directory is also available in electronic format. Please contact: [email protected] Issued (free of charge) by, and obtainable from: The Director, Mineral Economics, Mineralia Centre, 234 Visagie Street, Pretoria • Private Bag X59, Pretoria 0001 Telephone: +27 12 317 8538, Telefax: +27 12 320 4327 Website: http://www.dme.gov.za DEPARTMENT: MINERAL RESOURCES Director-General Adv. S Nogxina MINERAL POLICY AND PROMOTION BRANCH Acting Deputy Director-General Mr. M Mabuza MINERAL PROMOTION CHIEF DIRECTORATE Chief Director Dr. S Ndabezitha DIRECTORATE: MINERAL ECONOMICS Acting Director Ms. N Dlambulo Deputy Director: Precious Metals Mr. A S Conradie and Minerals and Ferrous Minerals FIRST PUBLISHED IN OCTOBER 2003 THIS, THE FIFTH REVISED EDITION, PUBLISHED IN OCTOBER 2009 ISBN: 978-1-920448-26-4 COPYRIGHT RESERVED WHEREAS THE GREATEST CARE HAS BEEN TAKEN IN THE COMPILATION OF THE CONTENTS OF THIS PUBLICATION, THE DEPARTMENT OF MINERAL RESOURCES CANNOT BE HELD RESPONSIBLE FOR ANY ERRORS OR OMISSIONS THIS HANDBOOK IS FOR GENERAL INFORMATION PURPOSES ONLY. IT DOES NOT PURPORT TO PROVIDE LEGAL ANALYSIS OF, OR ADVICE ON, THE PRECIOUS METALS ACT, 2005, NOR CAN IT SUBSTITUTE FOR THE CAREFUL READING OF THIS PIECE OF LEGISLATION TABLE OF CONTENTS Page TABLE OF CONTENTS ………………………………………………………..……..……… i LIST OF TABLES ……………………………………………………………….…………….. ii LIST OF ILLUSTRATIONS ……………………………………………………….…………. iii ABBREVIATIONS AND SYMBOLS …………………………………………..……………. iv 1. -

Switzerland - a Hub for Risky Gold? CASE STUDIES from the UNITED ARAB EMIRATES, SUDAN, the DEMOCRATIC REPUBLIC of CONGO, LIBERIA and PERU

STP-Report>>> Switzerland - a Hub for Risky Gold? CASE STUDIES FROM THE UNITED ARAB EMIRATES, SUDAN, THE DEMOCRATIC REPUBLIC OF CONGO, LIBERIA AND PERU 1 NOTE The following text is the English version of the original STP report “Drehscheibe Schweiz für risikobehaftetes Gold? Fallstudien aus den Vereinigten Arabischen Emiraten, dem Sudan, der Demokratischen Republik Kongo, Liberia und Peru” (published in German).1 With regard to the methodology, the sources, the footnotes and detailed informa- tion about the research, STP refers to the original version in German. 1 German STP report “Drehscheibe Schweiz für risikobehaftetes Gold? Fallstudien aus den Vereinigten Arabischen Emiraten, dem Sudan, der Demokratischen Republik Kongo, Liberia und Peru”. Second, revised version The first version was revised after Peruvian authorities on 27 March 2018 confisca- ted almost 100 kg of gold shortly after the publication of the first version. They thus give more weight to the demands of the Society for Threatened Peoples. The reaction of two refineries have also been integrated into the report. IMPRINT This report has been researched with the support of Greenpeace Switzerland. Publisher: Society for Threatened Peoples Switzerland Schermenweg 154, 3072 Ostermundigen www.gfbv.ch ∕ [email protected] ∕ Phone: 0041 31 939 00 00 Donations: Berner Kantonalbank BEKB / IBAN CH05 0079 0016 2531 7232 1 Editing, illustrations and layout: Society for Threatened Peoples Switzerland Authors: Society for Threatened Peoples, Christoph Wiedmer, Oscar Castilla Contreras Cover Photo: La Rinconada: The road to the mine pits, Maria Eugenia Robles Mengoa, author of the study “Violencia de género y masculinidades en La Rinconada” Photography: Maria Eugenia Robles Mengoa, Daniel Schweizer, shutterstock.com Publication date: April 2018 TABLE OF CONTENTS Summary 5 1. -

INVESTING in GOLD by Tom Cloud Contributing: Dr

INVESTING IN GOLD By Tom Cloud Contributing: Dr. Katherine Cloud, Ph.D. (Economics) December 2010 The physical gold market provides investors several product options. The choice of tangible gold product is largely a matter of the investors’ goals and resources. Gold is primarily purchased as a store of wealth, as a “hedge” against inflation, and as insurance against the fluctuations and depreciation of paper money. Though less common, gold is also purchased for its bartering potential. If necessary, fractional gold products (those that contain less than one troy ounce of gold) could be used as a medium of exchange. However, because silver is available in smaller denominations and therefore more convenient, it is the preferred barter metal. Even a one tenth ounce gold coin would cost approximately $150.00. Varying “premiums” (which include dealer premiums and commissions, all shipping costs and insurance) and IRA regulations are also important to consider when deciding between the different vehicles. Currently, the U.S. Internal Revenue Service (IRS) allows gold to be included in a self-directed IRA if certain rules are followed. It is important to remember that this discussion focuses on one gold investment vehicle, the purchase of physical gold in the form of gold buillon, semi-numismatic and numismatic coins, and fungible gold certificates. GOLD WEIGHTS AND MEASURES When buying or selling gold, it is useful to better understand the relationships between weight (mass), fineness (or purity) and the gold content of these gold objects. The Troy Weight System The Troy Weight System is the universal system customarily used to weigh gold and other precious metals. -

A Guide to the London Bullion Market Association

A guide to The London Bullion Market Association 1-2 Royal Exchange Buildings, Royal Exchange, London, EC3V 3LF +44 (0)20 7796 3067 www.lbma.org.uk Introduction The London Bullion Market Association The LBMA is the pre-eminent body for the world’s largest and most important market for gold and silver bullion. The London Bullion Market is centred in London with a global Membership and client base, including the majority of the central banks that hold gold, private sector investors, mining companies and others. The LBMA’s Membership includes more than 145 companies, including traders, refiners, producers, fabricators, as well as those providing storage and secure carrier services. The LBMA was set up in 1987 by the Bank of England, which was at Financial Market Regulation the time the bullion market’s regulator. The London Bullion Market Since the passage of the Financial Markets Act 2012, responsibility is a truly international market, in that although dealers in other for the regulation of the major par ticipants in the London bullion bullion trading centres may trade in their local markets and market lies with the Prudential Regulation Authority (“PRA”) at the commodity exchanges, they also deal extensively in “Loco London”. Bank of England. The PRA is now responsible for prudential banking This term means that the gold or silver will be settled in London by regulation of most of the firms active in the bullion market. The PRA the LBMA Member, either by way of book transfer or physically. Hence works closely with the Financial Conduct Authority (FCA) which is membership of the LBMA is vital to the London Bullion Market. -

Switzerland - a Hub for Risky Gold? CASE STUDIES from the UNITED ARAB EMIRATES, SUDAN, the DEMOCRATIC REPUBLIC of CONGO, LIBERIA and PERU

STP-Report>>> Switzerland - a Hub for Risky Gold? CASE STUDIES FROM THE UNITED ARAB EMIRATES, SUDAN, THE DEMOCRATIC REPUBLIC OF CONGO, LIBERIA AND PERU 1 Note The following text is the English version of the original STP report “Drehscheibe Schweiz für risikobehaftetes Gold? Fallstudien aus den Vereinigten Arabischen Emiraten, dem Sudan, der Demokratischen Republik Kongo, Liberia und Peru” (published in German).1 With regard to the methodology, the sources, the footnotes and detailed informa- tion about the research, STP refers to the original version in German. 1 German STP report “Drehscheibe Schweiz für risikobehaftetes Gold? Fallstudien aus den Vereinigten Arabischen Emiraten, dem Sudan, der Demokratischen Republik Kongo, Liberia und Peru”. Imprint This report has been researched with the support of Greenpeace Switzerland. Publisher: Society for Threatened Peoples Switzerland Schermenweg 154, 3072 Ostermundigen www.gfbv.ch ∕ [email protected] ∕ Phone: 0041 31 939 00 00 Donations: Berner Kantonalbank BEKB / IBAN CH05 0079 0016 2531 7232 1 Editing, illustrations and layout: Society for Threatened Peoples Switzerland Authors: Society for Threatened Peoples Oscar Castilla Contreras Cover Photo: La Rinconada: The road to the mine pits, Maria Eugenia Robles Mengoa, author of the study “Violencia de género y masculinidades en La Rinconada” Photography: Maria Eugenia Robles Mengoa, Daniel Schweizer, shutterstock.com Publication date: March 2018 Table OF Contents Summary 5 1. Introduction 10 1.1 Methodology: reference to the research and sources 11 2. Gold from Peru: Metalor Technologies and its supplier Minerales del Sur 12 2.1 Background 12 2.2 Where Metalor obtains its Peruvian gold 19 2.3 Gold from the biggest regions of illegal mining in South America: the concessions of Francisco Quintano Méndez 23 2.4 The owner of Metalor’s main supplier in Peru changes identity 26 3. -

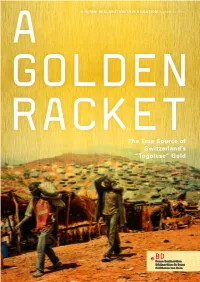

GOLDEN RACKET the True Source of Switzerland’S “Togolese” Gold CONTENTS

A A BERNE DECLARATION INVESTIGATION September 2015 GOLDEN RACKET The True Source of Switzerland’s “Togolese” Gold CONTENTS Executive Summary 3 Box 5: SOMIKA: Omnipresent in the Artisanal Gold Sector 23 1. INTRODUCTION 7 2.3.2 Valcambi: Silence is Golden 25 1.1 Tracing the True Source of “Togolese” Gold 8 Box 6: Valcambi SA 25 Box 1: From the UNGPs to the LBMA’s Responsible Box 7: The OECD and LBMA’s 5-Step Due Diligence Gold Guidance 8 Guidance 26 1.2 Gold Trade Data: Rare Reconciliation 9 Table 1: Reconciliation of Gold Trade Data for 3. CONCLUSION 27 Switzerland, Togo and Burkina Faso 9 4. FULL RECOMMENDATIONS 29 2. GOLDEN FOOTSTEPS: FROM THE SAHEL SCRUB 4.1 To the OECD and LBMA 29 TO THE PALM TREES OF TICINO 11 4.2 To the Swiss Authorities 29 2.1 “Everyone’s at It”, But at What Cost? 11 4.2.1 On Human Rights Supply Chain Due Diligence 29 Box 2: Abdoulaye and Issa’s Stories 11 4.2.2 On Anti-Money Laundering Due Diligence 29 2.1.1 Children at Work 14 4.2.3 On Gold Import and Customs Procedures 29 2.2 The Road to Lomé 14 Box 8: A Swiss Initiative for Responsible Business 30 Box 3: Albert Oussé: “The Goldfather” 17 4.3 To Valcambi 30 Box 4: Ammar Group: Of Tyres and Gold 20 4.4 To Ammar Group 30 2.2.1 “Un homme de confiance”: Impunity or Box 9: ROHMA 31 Complicity among Burkinabé Government Officials? 20 Table 2: Burkina Faso’s Tax Losses from Artisanal Annex 1: One Step Forward, Two Steps Back: Gold Smuggling 22 Shortfalls in the OECD and LBMA Guidance 33 2.3 On Swiss Soil: Ask No Questions and They’ll Annex 2: Glossary 34 Tell No Lies 23 Annex 3: Questions Addressed to Valcambi 35 2.3.1 Smooth Sailing through Swiss Customs 23 Notes 37 IMPRINT A Golden Racket: The True Source of Switzerland’s “Togolese” Gold. -

Beneath the Shine a Tale of Two Gold Refiners

BENEATH THE SHINE A TALE OF TWO GOLD REFINERS July 2020 Stefan Wermuth/Bloomberg via Getty Images CONTENTS Kaloti ................................................................ 32 Executive Summary .............................................. 2 The Sudanese government ............................. 32 The DMCC ......................................................... 32 Kaloti’s links to Sudanese conflict gold ............ 2 The government of the UAE ............................ 33 Valcambi’s relationship with Kaloti .................. 3 Valcambi .......................................................... 33 Key recommendations ...................................... 4 Auditing companies......................................... 33 Methodology ......................................................... 4 The LBMA ......................................................... 33 Kaloti’s gold and the Sudanese armed conflict . 5 The government of Switzerland ...................... 33 The Abbala Armed Group .................................. 6 The European Commission ............................. 33 The Rapid Support Forces ................................. 7 The EU Member States .................................... 33 The Sudan Liberation Army .............................. 8 Endnotes ............................................................ 34 What risk is there that Kaloti acquired conflict gold from Sudan? .............................................. 8 Kaloti’s failure to comply with OECD Guidance with regard to its Sudanese gold ................... -

List of the Smelters Or Rifiners Identified in Seiko

List of the Smelters or Rifiners identified in Seiko Epson's supply chain which were known by RMI (As of Jun 30, 2020) セイコーエプソン サプライチェーン上のRMIによって認識されている製錬所/精製所(2020年6⽉30⽇時点) Metal Smelters or Rifiners Country/Region Status of RMAP * ⾦属 精錬所または精製所 国/地域 RMIの認証状況 Gold 8853 S.p.A. ITALY Conformant Gold Advanced Chemical Company UNITED STATES OF AMERICA Conformant Gold Abington Reldan Metals, LLC UNITED STATES OF AMERICA - Gold African Gold Refinery UGANDA - Gold Aida Chemical Industries Co., Ltd. JAPAN Conformant Gold Al Etihad Gold Refinery DMCC UNITED ARAB EMIRATES Conformant Gold Allgemeine Gold-und Silberscheideanstalt A.G. GERMANY Conformant Gold Almalyk Mining and Metallurgical Complex (AMMC) UZBEKISTAN Conformant Gold AngloGold Ashanti Corrego do Sitio Mineracao BRAZIL Conformant Gold Argor-Heraeus S.A. SWITZERLAND Conformant Gold Asahi Pretec Corp. JAPAN Conformant Gold Asahi Refining Canada Ltd. CANADA Conformant Gold Asahi Refining USA Inc. UNITED STATES OF AMERICA Conformant Gold Asaka Riken Co., Ltd. JAPAN Conformant Gold Atasay Kuyumculuk Sanayi Ve Ticaret A.S. TURKEY - Gold AU Traders and Refiners SOUTH AFRICA Conformant Gold Aurubis AG GERMANY Conformant Gold Bangalore Refinery INDIA Conformant Gold Bangko Sentral ng Pilipinas (Central Bank of the Philippines) PHILIPPINES Conformant Gold Boliden AB SWEDEN Conformant Gold C. Hafner GmbH + Co. KG GERMANY Conformant Gold Caridad MEXICO - Gold CCR Refinery - Glencore Canada Corporation CANADA Conformant Gold Cendres + Metaux S.A. SWITZERLAND Conformant Gold Chimet S.p.A. ITALY Conformant Gold Chugai Mining JAPAN Conformant Gold Daejin Indus Co., Ltd. KOREA, REPUBLIC OF - Gold Daye Non-Ferrous Metals Mining Ltd. CHINA - Gold Degussa Sonne / Mond Goldhandel GmbH GERMANY - Gold Dijllah Gold Refinery FZC UNITED ARAB EMIRATES - Gold DODUCO Contacts and Refining GmbH GERMANY Conformant Gold Dowa JAPAN Conformant Gold DS PRETECH Co., Ltd.