Gold Bullion Coins

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Britain's Cartwheel Coinage of 1797

Britain's Cartwheel Coinage of 1797 by George Manz You've probably heard these words and names before: Cartwheel, Soho, Matthew Boulton, and James Watt. But did you know how instrumental they were in accelerating the Industrial Revolution? Like the strands of a rope, the history of Britain's 1797 Cartwheel coinage is intertwined with the Industrial Revolution. And that change in the method of producing goods for market is intermeshed with the Soho Mint and its owners, Matthew Boulton and James Watt. We begin this story in Birmingham, England in 1759 when Matthew Boulton Jr., now in his early 30s, inherited his father's toy business which manufactured many items, including buttons. Later that year, or possibly the following year, young Matthew Boulton's first wife Mary died. "While personally devastating," Richard Doty writes in his marvelous book, The Soho Mint & the Industrialization of Money, "the deaths of his father and his first wife helped make Soho possible. His father had left the toy business to him, while the estate of his wife, who was a daughter and co-heiress of the wealthy Luke Robinson of Litchfield, added to his growing resources." Doty, the curator of numismatics for the Smithsonian Institution in Washington, D.C., notes that Boulton eventually went on to wed Mary's sister Anne; Luke Robinson's other daughter and now sole heir to the family fortune. Boulton built a mill which he called Soho Manufactory, named for a place already called Soho, near Birmingham. The mill was erected beside Hockley Brook, which provided the water- power to help power the new factory. -

Working Letter

Testimony of Patrick A. Heller of Liberty Coin Service, Lansing, Michigan IN SUPPORT OF HB 268: EXEMPT SALE OF INVESTMENT METAL BULLION AND COINS FROM SALES TAX AND SIMILAR LANGUAGE IN THE APPROPRIATIONS FOR FY 2022-2023 Submitted before the Ohio Senate Finance Committee May 18, 2021 Chair Dolan and members of the Committee, I write in support of HB 268 to re-establish a sales-and-use-tax exemption for investment metal bullion and coins and for similar language in the Appropriations for FY 2022- 2023 for Ohio. My name is Patrick A. Heller. After working as a CPA in Michigan, in 1981 I became the owner of Michigan’s largest coin dealer, Liberty Coin Service, in Lansing. When Michigan enacted a comparable exemption in 1999, the House and Senate fiscal agencies and the Michigan Treasury used my calculation of forsaken tax collections in their analyses. I also conservatively forecasted the likely increase in Michigan tax collections if the exemption was enacted, and later documented that the actual increase in tax collections was nearly double what I had projected. My analyses of both tax expenditures and documented increases in state Treasury tax collections were subsequently used to support a successful effort to previously adopt this exemption in Ohio. This research has also supported successful efforts to adopt sales and use tax exemptions for precious-metals bullion, coins, and currency in Alabama, Arkansas (signed into law by Governor Hutchinson on May 3, 2021 and taking effect October 1, 2021), Indiana, Iowa, Kansas, Minnesota, Nebraska, North Carolina, Oklahoma, Pennsylvania, South Carolina, Virginia, West Virginia, and Wyoming. -

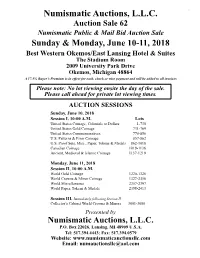

Numismatic Auctions, L.L.C. P.O

NumismaticNumismatic Auctions, LLC Auctions, Auction Sale 62 - June 10-11, 2018 L.L.C. Auction Sale 62 Numismatic Public & Mail Bid Auction Sale Sunday & Monday, June 10-11, 2018 Best Western Okemos/East Lansing Hotel & Suites The Stadium Room 2009 University Park Drive Okemos, Michigan 48864 A 17.5% Buyer’s Premium is in effect for cash, check or wire payment and will be added to all invoices Please note: No lot viewing onsite the day of the sale. Please call ahead for private lot viewing times. AUCTION SESSIONS Sunday, June 10, 2018 Session I, 10:00 A.M. Lots United States Coinage , Colonials to Dollars 1-730 United States Gold Coinage 731-769 United States Commemoratives 770-856 U.S. Patterns & Error Coinage 857-862 U.S. Proof Sets, Misc., Paper, Tokens & Medals 862-1018 Canadian Coinage 1019-1136 Ancient, Medieval & Islamic Coinage 1137-1219 Monday, June 11, 2018 Session II, 10:00 A.M. World Gold Coinage 1220-1326 World Crowns & Minor Coinage 1327-2356 World Miscellaneous 2357-2397 World Paper, Tokens & Medals 2398-2413 Session III, Immediately following Session II Collector’s Cabinet World Crowns & Minors 3001-3080 Presented by Numismatic Auctions, L.L.C. P.O. Box 22026, Lansing, MI 48909 U.S.A. Tel: 517.394.4443; Fax: 517.394.0579 Website: www.numismaticauctionsllc.com Email: [email protected] Numismatic Auctions, LLC Auction Sale 62 - June 10-11, 2018 Numismatic Auctions, L.L.C. Mailing Address: Tel: 517.394.4443; Fax: 517.394.0579 P.O. Box 22026 Email: [email protected] Lansing, MI 48909 U.S.A. -

How to Collect Coins a Fun, Useful, and Educational Guide to the Hobby

$4.95 Valuable Tips & Information! LITTLETON’S HOW TO CCOLLECTOLLECT CCOINSOINS ✓ Find the answers to the top 8 questions about coins! ✓ Are there any U.S. coin types you’ve never heard of? ✓ Learn about grading coins! ✓ Expand your coin collecting knowledge! ✓ Keep your coins in the best condition! ✓ Learn all about the different U.S. Mints and mint marks! WELCOME… Dear Collector, Coins reflect the culture and the times in which they were produced, and U.S. coins tell the story of America in a way that no other artifact can. Why? Because they have been used since the nation’s beginnings. Pathfinders and trendsetters – Benjamin Franklin, Robert E. Lee, Teddy Roosevelt, Marilyn Monroe – you, your parents and grandparents have all used coins. When you hold one in your hand, you’re holding a tangible link to the past. David M. Sundman, You can travel back to colonial America LCC President with a large cent, the Civil War with a two-cent piece, or to the beginning of America’s involvement in WWI with a Mercury dime. Every U.S. coin is an enduring legacy from our nation’s past! Have a plan for your collection When many collectors begin, they may want to collect everything, because all different coin types fascinate them. But, after gaining more knowledge and experience, they usually find that it’s good to have a plan and a focus for what they want to collect. Although there are various ways (pages 8 & 9 list a few), building a complete date and mint mark collection (such as Lincoln cents) is considered by many to be the ultimate achievement. -

United States Mint

United States Mint Program Summary by Budget Activity Dollars in Thousands FY 2012 FY 2013 FY 2014 FY 2012 TO FY 2014 Budget Activity Actual Estimated Estimated $ Change % Change Manufacturing $3,106,304 $3,525,178 $2,937,540 ($168,764) -5.43% Total Cost of Operations $3,106,304 $3,525,178 $2,937,540 ($168,764) -5.43% FTE 1,788 1,844 1,874 86 4.81% Summary circulating coins in FY 2014 to meet the The United States Mint supports the needs of commerce. Department of the Treasury’s strategic goal to enhance U.S. competitiveness and promote Numismatic Program international financial stability and balanced Bullion – Mint and issue bullion coins global growth. while employing precious metal purchasing strategies that minimize or Since 1996, the United States Mint operations eliminate the financial risk that can arise have been funded through the Public from adverse market price fluctuations. Enterprise Fund (PEF), established by section 522 of Public Law 104–52 (codified at section Other Numismatic Products - Produce and 5136 of Title 31, United States Code). The distribute numismatic products in United States Mint generates revenue through sufficient quantities, through appropriate the sale of circulating coins to the Federal channels, and at the lowest prices Reserve Banks (FRB), numismatic products to practicable, to make them accessible, the public and bullion coins to authorized available, and affordable to people who purchasers. Both operating expenses and choose to purchase them. Design, strike capital investments are associated with the and prepare for presentation Congressional production of circulating and numismatic Gold Medals and commemorative coins, as coins and coin-related products. -

Accredited Gold Bar Manufacturers

ACCREDITED GOLD BAR MANUFACTURERS There are approximately 125 active gold refiners around the world whose relevant gold bars are accepted as “good delivery” by one or more of the associations and exchanges featured in this section. Section updated to November 2014, according to available information. ACCREDITATION A consolidated table in this section records – by region and country of location – the names of active refiners that are accredited to the following: • London Bullion Market Association (LBMA) • CME Group – Market Contract: COMEX • Tokyo Commodity Exchange (TOCOM) • Dubai Multi Commodities Centre (DMCC) The names of active refiners accredited to the 6 other exchanges are recorded separately as their lists rely partly on the LBMA list or focus on Manufacturing London Good domestic refiners: Delivery 400 oz bars at Johnson Matthey (USA). • BM&FBovespa, São Paulo (BM&F) • Istanbul Gold Exchange (IGE) • Multi Commodity Exchange of India Ltd (MCX) • Shanghai Gold Exchange (SGE) • The Chinese Gold & Silver Exchange Society, Hong Kong (CGSE) Importance of LBMA list As covered in the section on “Gold Associations & Exchanges”, the most important list of refiners for the international gold bar market is the one published by the LBMA. In summary, the LBMA list refers to more than 70 active refiners in 30 countries. Manufacturing kilobars at Tanaka (Japan). It can be noted that relevant bars of LBMA-accredited refiners are automatically accepted as good delivery by the Istanbul Gold Exchange, Multi Commodity Exchange of India Ltd, Shanghai Futures Exchange, Shanghai Gold Exchange and The Chinese Gold & Silver Exchange Society. In addition, the Dubai Multi Commodities Centre has a separate category for refiners accredited to the LBMA. -

INFORMATION BULLETIN #50 SALES TAX JULY 2017 (Replaces Information Bulletin #50 Dated July 2016) Effective Date: July 1, 2016 (Retroactive)

INFORMATION BULLETIN #50 SALES TAX JULY 2017 (Replaces Information Bulletin #50 dated July 2016) Effective Date: July 1, 2016 (Retroactive) SUBJECT: Sales of Coins, Bullion, or Legal Tender REFERENCE: IC 6-2.5-3-5; IC 6-2.5-4-1; 45 IAC 2.2-4-1; IC 6-2.5-5-47 DISCLAIMER: Information bulletins are intended to provide nontechnical assistance to the general public. Every attempt is made to provide information that is consistent with the appropriate statutes, rules, and court decisions. Any information that is inconsistent with the law, regulations, or court decisions is not binding on the department or the taxpayer. Therefore, the information provided herein should serve only as a foundation for further investigation and study of the current law and procedures related to the subject matter covered herein. SUMMARY OF CHANGES Other than nonsubstantive, technical changes, this bulletin is revised to clarify that sales tax exemption for certain coins, bullion, or legal tender applies to coins, bullion, or legal tender that would be allowable investments in individual retirement accounts or individually-directed accounts, even if such coins, bullion, or legal tender was not actually held in such accounts. INTRODUCTION In general, an excise tax known as the state gross retail (“sales”) tax is imposed on sales of tangible personal property made in Indiana. However, transactions involving the sale of or the lease or rental of storage for certain coins, bullion, or legal tender are exempt from sales tax. Transactions involving the sale of coins or bullion are exempt from sales tax if the coins or bullion are permitted investments by an individual retirement account (“IRA”) or by an individually-directed account (“IDA”) under 26 U.S.C. -

Download This Lesson in Adobe Acrobat Format

REVOLUTIONARY MONEY Part One 3 Unlike the Spanish colonists to the south, the English settlers of our original thirteen colonies found no gold or silver among the riches of their new land. Neither did they receive great supplies of gold and silver coins from Britain—money was supposed to move the other way, to the mother country, in exchange for goods. The monetary system in the colonies was “notable because it was based on thin air,” says Smithsonian numismatics curator Richard Doty in his book America’s Money, America’s Story. To make up for the lack of curren- cy, the colonists would “replicate and create, try, reject, and redesign every monetary form ever invented anywhere else.” Examples of most of those forms are on display in the Hall of the History of Money and Medals at the Smithsonian’s National Museum of American History, Behring Center, an exhibit that draws on the 1.6 million coins and pieces of paper money in the National Numismatic Collection. Here in Smithsonian in Your Classroom, we present images of paper money from the American Revolution. Students examine the money in order to gather primary source information about the times— the Revolutionary period in general and the specific times when the bills were issued. The lessons address national standards for American history and for historical thinking. An issue of Smithsonian in Your Classroom titled “What Is Currency? Lessons from Historic Africa” introduces students to the meaning and uses of money, and might serve as a companion to this issue. It is on our Web site, educate.si.edu, under Lesson Plans. -

A Guide to the London Bullion Market Association

A guide to The London Bullion Market Association 1-2 Royal Exchange Buildings, Royal Exchange, London, EC3V 3LF +44 (0)20 7796 3067 www.lbma.org.uk Introduction The London Bullion Market Association The LBMA is the pre-eminent body for the world’s largest and most important market for gold and silver bullion. The London Bullion Market is centred in London with a global Membership and client base, including the majority of the central banks that hold gold, private sector investors, mining companies and others. The LBMA’s Membership includes more than 145 companies, including traders, refiners, producers, fabricators, as well as those providing storage and secure carrier services. The LBMA was set up in 1987 by the Bank of England, which was Financial Market Regulation at the time the bullion market’s regulator. The London Bullion Since the passage of the Financial Markets Act 2012, responsibility Market is a truly international market, in that although dealers in for the regulation of the major participants in the London bullion other bullion trading centres may trade in their local markets and market lies with the Prudential Regulation Authority (“PRA”) at the commodity exchanges, they also deal extensively in “Loco London”. Bank of England. The PRA is now responsible for prudential banking This term means that the gold or silver will be settled in London by regulation of most of the firms active in the bullion market. The PRA the LBMA Member, either by way of book transfer or physically. Hence works closely with the Financial Conduct Authority (FCA) which is membership of the LBMA is vital to the London Bullion Market. -

Gresham's Law - Wikipedia, the Free Encyclopedia

Gresham's law - Wikipedia, the free encyclopedia http://en.wikipedia.org/wiki/Gresham's_Law Help us provide free content to the world by donating today! Gresham's law From Wikipedia, the free encyclopedia (Redirected from Gresham's Law) Gresham's law is commonly stated: "Bad money drives out good." Gresham's law applies specifically when there are two forms of commodity money in circulation which are forced, by the application of legal-tender laws, to be respected as having the same face value in the marketplace. Gresham's law is named after Sir Thomas Gresham (1519 – 1579), an English financier in Tudor times. Contents 1 Definitions 1.1 "Good money" 1.2 "Bad money" 2 Theory 3 History of the concept 3.1 Origin of the name 4 The law in reverse 5 The law in other fields 6 See also 7 Notes 8 References 9 External links Definitions The terms "good" and "bad" money are used in a technical non-literal sense, and with regard to exchange values imposed by legal-tender legislation, as follows: "Good money" Good money is money that shows little difference between its exchange value and its commodity value. In the original discussions of Gresham's law, money was conceived of entirely as metallic coins, so the commodity value was the market value of the coined bullion of which the coins were made. An example is the US dollar, which was equal to 1/20.67 ounce (1.5048 g) of gold until 1934 — and carried an exchange value (at those fixed rates) roughly equal to its coined-gold market value. -

PJ01661 Bullion Britannia 2021 8PP Booklet D15 International PRINT.Indd

® Britannia 2021 BULLION COIN RANGE Redefining Bullion Security SURFACE ANIMATION MICRO-TEXT TINCTURE LINES LATENT FEATURE KEY FEATURES MICROTEXT LATENT FEATURE TINCTURE LINES SURFACE ANIMATION Th ese features are available on the one ounce, TIMELESS TRADITION, half-ounce, quarter-ounce and tenth-ounce fi ne gold MODERN INNOVATION editions of the coin and the one ounce fi ne silver edition. For centuries, Britannia has represented Britain. In 2021, this iconic symbol leads the way, redefi ning security in the bullion market with four groundbreaking features that combine to create the most visually secure coin in the world. Th e new Britannia design has micro-text featuring the INVEST IN A wording ‘DECUS ET TUTAMEN’, which translates as TIMELESS ICON ‘AN ORNAMENT AND A SAFEGUARD’, describing the features that both decorate and protect the coin. A new Th is award-winning Britannia design was created by latent feature switches between a trident and a padlock based Philip Nathan and was fi rst struck in 1987. In one hand, on the viewer’s perspective, emphasising Britannia’s maritime Britannia holds an olive branch which symbolises peace. strength and the coin’s secure nature. Details like the Union In the other, she holds a trident as a reminder of the nation’s fl ag on Britannia’s shield have been specially highlighted with power and a nod to Britannia’s naval connections. tincture lines, and the background has a surface animation With her Corinthian helmet and Union fl ag shield by her that refl ects the fl ow of waves as the coin is moved. -

PRECIOUS METALS LIST the Following Is a List of Precious Metals That Madison Trust Will Accept

PRECIOUS METALS LIST The following is a list of precious metals that Madison Trust will accept. TRUST COMPANY GOLD • American Eagle bullion and/or proof coins (except for “slabbed” coins) • American Buffalo bullion coins • Australian Kangaroo/Nugget bullion coins • Austrian Philharmonic bullion coins • British Britannia (.9999+ fineness) bullion coins • Canadian Maple Leaf bullion coins • Mexican Libertad bullion coins (.999+ fineness) • Bars, rounds and coins produced by a refiner/assayer/manufacturer accredited/certified by NYMEX/COMEX, NYSE/Liffe, LME, LBMA, LPPM, TOCOM, ISO 9000, or national government mint and meeting minimum fineness requirements(2)(3) SILVER • American Eagle bullion and/or proof coins (except for “slabbed” coins) • American America the Beautiful bullion coins • Australian Kookaburra and Koala bullion coins • Austrian Philharmonic bullion coins • British Britannia bullion coins • Canadian Maple Leaf bullion coins • Mexican Libertad bullion coins • Bars, rounds and coins produced by a refiner/assayer/manufacturer accredited/certified by NYMEX/COMEX, NYSE/Liffe, LME, LBMA, LPPM, TOCOM, ISO 9000, or national government mint and meeting minimum fineness requirements(2)(3) PLATINUM • American Eagle bullion and/or proof coins (except for “slabbed” coins) • Australian Koala bullion coins • Canadian Maple Leaf bullion coins • Bars, rounds and coins produced by a refiner/assayer/manufacturer accredited/certified by NYMEX/COMEX, NYSE/Liffe, LME, LBMA, LPPM, TOCOM, ISO 9000, or national government mint and meeting minimum