United States Mint

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

How to Collect Coins a Fun, Useful, and Educational Guide to the Hobby

$4.95 Valuable Tips & Information! LITTLETON’S HOW TO CCOLLECTOLLECT CCOINSOINS ✓ Find the answers to the top 8 questions about coins! ✓ Are there any U.S. coin types you’ve never heard of? ✓ Learn about grading coins! ✓ Expand your coin collecting knowledge! ✓ Keep your coins in the best condition! ✓ Learn all about the different U.S. Mints and mint marks! WELCOME… Dear Collector, Coins reflect the culture and the times in which they were produced, and U.S. coins tell the story of America in a way that no other artifact can. Why? Because they have been used since the nation’s beginnings. Pathfinders and trendsetters – Benjamin Franklin, Robert E. Lee, Teddy Roosevelt, Marilyn Monroe – you, your parents and grandparents have all used coins. When you hold one in your hand, you’re holding a tangible link to the past. David M. Sundman, You can travel back to colonial America LCC President with a large cent, the Civil War with a two-cent piece, or to the beginning of America’s involvement in WWI with a Mercury dime. Every U.S. coin is an enduring legacy from our nation’s past! Have a plan for your collection When many collectors begin, they may want to collect everything, because all different coin types fascinate them. But, after gaining more knowledge and experience, they usually find that it’s good to have a plan and a focus for what they want to collect. Although there are various ways (pages 8 & 9 list a few), building a complete date and mint mark collection (such as Lincoln cents) is considered by many to be the ultimate achievement. -

Buffalo Hunt: International Trade and the Virtual Extinction of the North American Bison

NBER WORKING PAPER SERIES BUFFALO HUNT: INTERNATIONAL TRADE AND THE VIRTUAL EXTINCTION OF THE NORTH AMERICAN BISON M. Scott Taylor Working Paper 12969 http://www.nber.org/papers/w12969 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 March 2007 I am grateful to seminar participants at the University of British Columbia, the University of Calgary, the Environmental Economics workshop at the NBER Summer Institute 2006, the fall 2006 meetings of the NBER ITI group, and participants at the SURED II conference in Ascona Switzerland. Thanks also to Chris Auld, Ed Barbier, John Boyce, Ann Carlos, Charlie Kolstad, Herb Emery, Mukesh Eswaran, Francisco Gonzalez, Keith Head, Frank Lewis, Mike McKee, and Sjak Smulders for comments; to Michael Ferrantino for access to the International Trade Commission's library; and to Margarita Gres, Amanda McKee, Jeffrey Swartz, Judy Hasse of Buffalo Horn Ranch and Andy Strangeman of Investra Ltd. for research assistance. Funding for this research was provided by the SSHRC. The views expressed herein are those of the author(s) and do not necessarily reflect the views of the National Bureau of Economic Research. © 2007 by M. Scott Taylor. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. Buffalo Hunt: International Trade and the Virtual Extinction of the North American Bison M. Scott Taylor NBER Working Paper No. 12969 March 2007 JEL No. F1,Q2,Q5,Q56 ABSTRACT In the 16th century, North America contained 25-30 million buffalo; by the late 19th century less than 100 remained. -

Initial Layout

he bison or buffalo is an enduring with the people who inhabited the Central typically located on built-in altars oppo- animal, having come from the Plains and its utility to them, it is not sur- site the east-facing entrances, so that the Tbrink of extinction in the latter part prising that the bison was an integral part morning light would fall upon them (see of the nineteenth century to a relatively of their lives. Buffalo were central char- earthlodge sketch at right). Such an altar substantial population today. The bison is acters in stories that were told of their can be seen at the Pawnee Indian Village also a living symbol, or icon, with mul- beginnings as tribal people living on Museum State Historic Site near Repub- tiple meanings to different people. earth, and bison figured prominently in lic, Kansas. Bison were also represented The association of bison with Ameri- ceremonies designed to insure the tribe’s in dances, such as the Buffalo Lodge can Indians is a firmly established and continued existence and good fortune. dance for Arapaho women; there were widely known image–and with good rea- Bison bone commonly is found as buffalo societies within tribal organiza- son. Archeological evidence and histori- food refuse in prehistoric archeological tions; and bison were represented in tribal cal accounts show that American Indians sites; but bison bones, in particular bison fetishes, such as the sacred Buffalo Hat or living in the Plains hunted bison for a skulls, also are revealed as icons. Per- Cap of the Southern Cheyenne. -

INFORMATION BULLETIN #50 SALES TAX JULY 2017 (Replaces Information Bulletin #50 Dated July 2016) Effective Date: July 1, 2016 (Retroactive)

INFORMATION BULLETIN #50 SALES TAX JULY 2017 (Replaces Information Bulletin #50 dated July 2016) Effective Date: July 1, 2016 (Retroactive) SUBJECT: Sales of Coins, Bullion, or Legal Tender REFERENCE: IC 6-2.5-3-5; IC 6-2.5-4-1; 45 IAC 2.2-4-1; IC 6-2.5-5-47 DISCLAIMER: Information bulletins are intended to provide nontechnical assistance to the general public. Every attempt is made to provide information that is consistent with the appropriate statutes, rules, and court decisions. Any information that is inconsistent with the law, regulations, or court decisions is not binding on the department or the taxpayer. Therefore, the information provided herein should serve only as a foundation for further investigation and study of the current law and procedures related to the subject matter covered herein. SUMMARY OF CHANGES Other than nonsubstantive, technical changes, this bulletin is revised to clarify that sales tax exemption for certain coins, bullion, or legal tender applies to coins, bullion, or legal tender that would be allowable investments in individual retirement accounts or individually-directed accounts, even if such coins, bullion, or legal tender was not actually held in such accounts. INTRODUCTION In general, an excise tax known as the state gross retail (“sales”) tax is imposed on sales of tangible personal property made in Indiana. However, transactions involving the sale of or the lease or rental of storage for certain coins, bullion, or legal tender are exempt from sales tax. Transactions involving the sale of coins or bullion are exempt from sales tax if the coins or bullion are permitted investments by an individual retirement account (“IRA”) or by an individually-directed account (“IDA”) under 26 U.S.C. -

Frequently Asked Questions UPDATE: SPECIFIC to COVID-19

Perth Mint Protected Document Frequently asked questions UPDATE: SPECIFIC TO COVID-19 Current as of April 2020 Why can’t I get through to customer service? We are currently experiencing unprecedented demand for our services resulting in longer than expected wait times for our customers. We apologise for any inconvenience and appreciate your patience during this challenging time. Why does your website say you are out of stock of bullion? Due to overwhelming demand for our products we are out of stock of many items and some will be subject to considerable delays before they become available again. For further information please see perthmint.com/covid19.aspx. Products that are in stock will be listed as available on the individual product page on our bullion website at http://www.perthmintbullion.com/au/default.aspx. I need to change my address or otherwise update my bullion account details but I haven’t received a response from customer service. What can I do? Please note that there are currently some delays in processing changes to accounts due to the high volumes of enquiries. In the meantime, you may place orders to be sent to a different delivery address as long as you will be available to sign. This can be done in the delivery section of the checkout process by un-ticking ‘Use billing address’. Is your retail shop open? Due to the current COVID-19 outbreak, our Shop and Exhibition is closed to the public until further notice. Some limited services including gold buy back and bullion trading are still available. -

Selman Bayoglu (KTPB)

Gold Products&Services and Need for Standardization of Wholesale Market Selman BAYOĞLU Treasury Marketing Manager Seminar at Amwaj Islands, BAHRAIN / 04 December, 2017 KUVEYT TURK PARTICIPATION BANK CONTENT • GOLD ACCOUNTS • GOLD’EN CHEQUE • PRICING (5/24) • ELECTRONIC GOLD TRANSFER • SENDING GOLD VIA SMART APPLICATION • AUTOMATIC GOLD ACCUMULATION ORDER • COLLECTING CUSTOMERS’ SCRAP • GOLD FORWARD (WAAD) • GOLD SUPPORT • GOLD-INDEXED FUND SUPPORT • PHYSICAL GOLD BULLION TRADING • TRANSIT GOLD TRADING • LOCO-SWAPS FOR GOLD • GOLD FOR CENTRAL BANK REQUIRED RESERVE OPTION MECHANISM • SUKUK DENOMINATED IN GOLD • PHYSICAL OPERATIONS (INTERNATIONAL) • VAULTING Selman Bayoglu, Treasury Marketing Manager/KUVEYT TURK, Gold Products&Services and Need for Standardization of Wholesale Market, 04 Dec 2017, Bahrain 1 GOLD PRODUCTS & SERVICES Gold Accounts 995/1000 purity • Gold Deposit • Gold Participation 1, 3, 6, 12 months period Profits shares %85-%15 (customer-bank) Profit shares are in gold 916,6/1000 purity • Quarter Gold • Quarter Gold Participation • Gold Jewelry Participation 1, 3, 6, 12 months period Profits shares %95-%5 (customer-bank) Profit shares are in gold Selman Bayoglu, Treasury Marketing Manager/KUVEYT TURK, Gold Products&Services and Need for Standardization of Wholesale Market, 04 Dec 2017, Bahrain GOLD PRODUCTS & SERVICES Pricing (₺,$) Electronic Gold Automatic Gold •Interbank Transfers Accumulation •BIST • Domestic (in-KTPB, Order •Refineries interbank with •KTPB Clients Turkish Banks) (Branches and • International 5/24 -

State Attempts to Tax Sales of Gold Coin and Bullion in the United States: the Onsc Titutional Implications Neal S

Boston College International and Comparative Law Review Volume 5 | Issue 2 Article 2 8-1-1982 State Attempts to Tax Sales of Gold Coin and Bullion in the United States: The onsC titutional Implications Neal S. Solomon Linda D. Headley Follow this and additional works at: http://lawdigitalcommons.bc.edu/iclr Part of the Constitutional Law Commons, and the Tax Law Commons Recommended Citation Neal S. Solomon & Linda D. Headley, State Attempts to Tax Sales of Gold Coin and Bullion in the United States: The Constitutional Implications, 5 B.C. Int'l & Comp. L. Rev. 297 (1982), http://lawdigitalcommons.bc.edu/iclr/vol5/iss2/2 This Article is brought to you for free and open access by the Law Journals at Digital Commons @ Boston College Law School. It has been accepted for inclusion in Boston College International and Comparative Law Review by an authorized editor of Digital Commons @ Boston College Law School. For more information, please contact [email protected]. STATE ATTEMPTS TO TAX SALES OF GOLD COIN AND BULLION IN THE UNITED STATES: THE CONSTITUTIONAL IMPLICATIONS by Neal S. Solomon* and Linda D. Headley** I. INTRODUCTION When the U.S. Congress, in 1974, legalized private ownership of gold coin and bullion I after forty years of prohibition, Congress did not state whether it intended to permit the states to tax gold coin2 and bullion3 sales and purchases.4 Although at least one state has declined this new opportunity for tax revenue,5 Copyright 1982 by Neal S. Solomon and Linda D. Headley. • B.A., Yale University (1972); J.D., Stanford University (1975) . -

Coins As Measure of Size Gerald Artner, Member, IEEE

PRELIMINARY VERSION, FINAL VERSION: IEEE INSTRUM. MEAS. MAG., VOL. 23, NO. 2, PP. 88-93, 2020, HTTPS://DOI.ORG/10.1109/MIM.2020.9062695 1 Coins as Measure of Size Gerald Artner, Member, IEEE Abstract—Coins are used as a measure of size in scientific and countries. Common practices for coin use are identified. publications. Over hundred examples are collected. Although Counterexamples to best practice are referenced if known standardized procedures for using coins as measure of size do to the author. The coin measurement technique is developed not exist, use among scientists is so widespread that some form of consensus has formed in the community. Contemporary usage further by giving counterexamples to those rules, where no patterns of coins as measure of size are analyzed qualitatively. counterexample was found in the literature. Several predictions Several rules and predictions are formulated based on this are formulated based on these qualitative investigations. analysis. Index Terms—coin, numismatics, dimension, measurement, II. COINS USED AS MEASURE OF SIZE IN SCIENTIFIC size. PUBLICATIONS Over hundred peer-reviewed scientific publications are in- I. INTRODUCTION vestigated for their use of coins as measure of size. It is not HOTOGRAPHS are widely used to depict prototypes in the goal of this article to provide a quantitative description or P scientific publications. To denote the size of an object investigate a historical origin. The large number of scientific in a photograph, a variety of methods are common among publications containing photographs, in which coins are used scientists. Well known objects have been used as comparison as a measure of size, shows that there is consensus among to give a rough size estimate in photographs, e.g. -

Glossary of Terms

GLOSSARY OF TERMS ACTUALS: Physical commodities as opposed BASIS: The variation between the spot price of to futures contracts or the commodity that a deliverable and the relative price of the underlies a futures contract. futures for the same actual that has the shortest duration until maturity. AG: The chemical symbol for silver. BEAR MARKET: Market characterized by a ALLOY: A substance composed of two or more declining trend in terms of price. metals. BID: The bid price is the price at which a ALLOCATED METAL: Assigning defined dealer is willing to buy a commodity; opposite quantities of physical metals to specific of “ask”. accounts. For example, if an investor buys shares in a gold exchange-traded fund, each BULLION: Precious metals, including gold, share is backed by a defined amount of silver, platinum and palladium, that are traded physical gold. based on their intrinsic metal value. ASK: The price which the seller is willing to BULLION COIN: A precious metal coin whose accept for a commodity; also known as the market value is determined by its inherent offer price; opposite of “bid”. precious metal content. They are bought and sold mainly for investment purposes. ASSAY: The act of testing the purity of precious metals. BULL MARKET: Market characterized by upwardly moving price trend. AU: The chemical symbol for gold. CARRY MARKET: A market situation in which BACKWARDATION: The theory that posits a futures contract for a commodity has a that as a futures contract approaches higher value in the nearest delivery month, expiration, its price tends to rise; also known relative to the expiration date. -

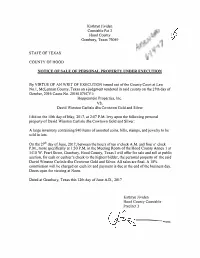

Notice of Sale of Personal Property Under Execution

Kathryn Jividen Constable Pct 3 Hood County Granbury, Texas 76049 STATE OF TEXAS COUNTY OF HOOD NOTICE OF SALE OF PERSONAL PROPERTY UNDER EXECUTION By VIRTUE OF AN WRIT OF EXECUTION issued out ofthe County Court at Law No. I, McLennan County, Texas on a judgmentrend ered in said county on the 27th day of October, 2016 Cause No. 20161075CVI: Hoppenstein Properties, Inc. vs. David Winston Carlisle dba Cowtown Gold and Silver I did on the 10th day of May, 2017, at 2:07 P.M. levy upon the following personal property of David Winston Carlisle dba Cowtown Gold and Silver: A large inventory containing 940 items of assortedcoins, bills, stamps, and jewelry to be sold in lots. On the 2th day of June, 2017, between the hours often o'clock A.M. and fouro' clock P.M., more specifically at I :30 P.M. in the Meeting Room of the Hood County Annex 1 at 1410 W. Pearl Street, Granbury, Hood County, Texas I will offer forsale and sell at public auction, for cash or cashier's check to the highest bidder, the personal propertyof the said David Winston Carlisle dba Cowtown Gold and Silver. All sales are final.A 10% commission will be charged on each lot and payment is due at the end of the business day. Doors open forviewing at Noon. Dated at Granbury, Texas this 12th day of June A.O., 2017 Kathryn Jividen Hood County Constable Precinct 3 --=-==--- Lot 1 Lot 4 #29, 43, 66, 69 Plastic Bin with Pennies The Complete Collection of uncirculated Sacagawea 293 .50cent rolls of pennies Golden Dollars PCS Stamps & Coins .41 cents loose pennies The Complete Collection -

GOLD 587 Bullion Brochure-Goldzmag2

THE BENCHMARK THE RIGHT PLACE TO MORE FOR THE INVESTOR IN GOLD BULLION COINS BUY BULLION DIRECT! No investment has a stronger pedigree than gold. For 7,000 Recognised as an essential element of a diversified investment With a reputation that spans more than a century, The Perth Mint's THE AUSTRALIAN PRECIOUS years, it has been highly prized as a symbol of splendour, portfolio, precious metal helps investors protect their wealth against expertise in producing bullion coins and bars is impeccable. wealth and power. Today, there is a dramatic resurgence in fluctuations in the value of other asset classes. The Perth Mint offers an unrivalled combination of choice, METALS COIN PROGRAM investor interest in gold as a safe store of value. convenience and quality. The Perth Mint's Australian Kangaroo and Australian Lunar bullion coin series are ideal choices for investors seeking to add pure gold BUY BULLION ONLINE AT: www.perthmintbullion.com to their portfolios. ! Live prices ! Choice of sizes to suit every budget ! 99.99% pure gold coins and bars ! Secure insured shipping ! 99.9% pure silver coins ! Guaranteed buybacks ! Convenience UNIQUE PERTH MINT QUALITY QUALITY Australian bullion coins minted from 'four nines' gold The Perth Mint's unbeatable minting experience and its use of were introduced by the historic Perth Mint in 1987. advanced manufacturing technology contribute to the coins' Today, The Perth Mint produces an internationally reputation of being the highest quality in the world. sought-after range of bullion coins. AUSTRALIAN GOVERNMENT GUARANTEE Struck from 99.99% pure gold, each coin in the program is issued as official legal tender under the Australian Currency Act 1965, Struck by the historic Perth Mint from 99.99% pure gold, each coin's its Government guarantee of quality. -

2020 American Eagle Silver Bullion Coins Produced in Philadelphia

April 27, 2020 2020 American Eagle Silver Bullion Coins Produced in Philadelphia In light of the ongoing coronavirus pandemic, the United States Mint has temporarily reduced production in its facilities in order to reduce the risk of employee exposure to COVID-19. The health and safety of the Mint workforce remains our highest priority. Typically, American Eagle Silver Bullion Coins are minted at the Mint’s West Point facility. However, due to the reduced production at the West Point facility amid the coronavirus pandemic, from April 8 until April 20, 2020, the United States Mint at Philadelphia produced 240,000 American Eagle Silver Bullion Coins. These 2020 American Eagle Silver Bullion Coins minted in Philadelphia were all packaged manually. The coins were shipped in so-called “monster boxes,” each of which contains 25 tubes of 20 coins, for a total of 500 coins in each box. Monster boxes of 2020 American Eagle Silver Bullion Coins minted in Philadelphia were affixed with a typed label containing the box tracking number; additionally, box tracking numbers were hand written directly on the boxes. Box tracking numbers 400,000 through and including 400,479 were used on boxes of coins minted in Philadelphia. The United States Mint does not sell its bullion coins directly to the public. Instead, we distribute our coins through a network of official distributors called “Authorized Purchasers” to provide investors the opportunity to acquire precious metal coins at a slight premium to spot market prices. As such, all American Eagle Silver Bullion Coins are, by their very nature, homogeneous. None of these coins bears a mint mark designating the facility where it was produced.