Daiichi Sankyo Company, Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Daiichi Sankyo Company, Limited

[Translation] CONVOCATION NOTICE OF THE 14TH ORDINARY GENERAL MEETING OF SHAREHOLDERS For the Fiscal Year Ended March 31, 2019 Daiichi Sankyo Company, Limited *Note: This translation does not include pictures, charts etc. originally issued in the Japanese version. - 1 - [Translation] To Our Shareholders At the Daiichi Sankyo Group (“the Group”), we are proceeding with the initiatives of 4th mid- term business plan with the aim of becoming a “Global Pharma Innovator with Competitive Advantage in Oncology” as set forth in our 2025 Vision. In fiscal 2018, we made significant progress in developing new drugs in oncology area, including DS-8201, an antibody drug conjugates utilizing our proprietary technologies. In addition, we entered into a strategic collaboration agreement with AstraZeneca, which has strengths in the oncology business, for the global development and commercialization of DS-8201 in order to maximize its value. Furthermore, sales of mainstay products such as edoxaban, an anticoagulant which supports current earnings of the Group, were firm in Japan and overseas. The achievement of initial target of mid-term business plan for fiscal 2020 is expected to be delayed by two years due to failure of achievement of the plan for pain franchise business and additional investments in research and development. However, we are gaining confidence of achieving our 2025 Vision and accelerating growth in the future due to the significant improvement in the value of oncology area pipelines. We will continue to make every effort to achieve the goals of the Medium-Term Management Plan and 2025 Vision. I greatly appreciate your continued support in the future. -

Daiichi Sankyo Group Value Report 2019

External Evaluations (as of June 30,2019) ™ Daiichi Sankyo Group Value Report 2019 Value Daiichi Sankyo Group MSCI Japan Empowering Women Select Index THE INCLUSION OF DAIICHI SANKYO CO.,LTD. IN ANY MSCI INDEX, AND THE USE OF MSCI LOGOS, TRADEMARKS, SERVICE MARKS OR INDEX NAMES HEREIN, DO NOT CONSTITUTE A SPONSORSHIP, ENDORSEMENT OR PROMOTION OF DAIICHI SANKYO CO.,LTD. BY MSCI OR ANY OF ITS AFFILIATES. THE MSCI INDEXES ARE THE EXCLUSIVE PROPERTY OF MSCI. MSCI AND THE MSCI INDEX NAMES AND LOGOS ARE TRADE- MARKS OR SERVICE MARKS OF MSCI OR ITS AFFILIATES. “Eruboshi” Certification Mark “Kurumin” Certification Mark Logo given to Certified Health and Productivity Management Organization (White500) This report uses FSC® certified paper, which indicates that the paper used to print this Paper report was produced from properly managed forests. 3-5-1, Nihonbashi-honcho, Chuo-ku, Tokyo 103-8426, Japan This report was printed using 100% Inks biodegradable printing inks from vegetable Corporate Communications Department oil. Daiichi Sankyo Group Tel: +81-3-6225-1126 CSR Department The waterless printing method used for this Value Report 2019 Tel: +81-3-6225-1067 Printing report minimized the use and release of harmful liquid wastes. https://www.daiichisankyo.com/ Printed in Japan 005_7045687911909.indd 1 2019/09/27 18:22:19 Introduction Our Mission The Core Values and Commitments serve as the criteria for business activities and In addition, we have established the DAIICHI SANKYO Group Corporate Conduct Charter . decision-making used by executive officers and employees in working to fulfill Our Mission . This charter calls on us to fulfill our social responsibilities by acting with the highest ethical Our Corporate Slogan succinctly explains the spirit of Our Mission, Core Values and standards and a good social conscience appropriate for a company engaged in business Commitments. -

Convocation Notice of the 16Th Ordinary General Meeting of Shareholders

[Translation] CONVOCATION NOTICE OF THE 16TH ORDINARY GENERAL MEETING OF SHAREHOLDERS For the Fiscal Year Ended March 31, 2021 Daiichi Sankyo Company, Limited *Note: This translation does not include pictures, charts etc. originally issued in the Japanese version. [Translation] To Our Shareholders We sincerely appreciate the continuous kindness of our shareholders. In addition, we would like to express our deepest sympathies to those who passed away due to COVID-19, and thank the medical personnel who are close to those who are fighting illness and are making efforts in treatment. We will continue to devote ourselves to the research and development of vaccines and therapeutic agents. Our “Purpose” is to “contribute to the enrichment of quality of life around the world.” As a pharmaceutical company with strengths in science and technology, we continuously create innovative pharmaceuticals and provide pharmaceuticals that meet diverse medical needs to provide sustainable value to society. We were able to launch the anti-cancer drug “Enhertu”, which is an antibody-drug conjugate (ADC) that utilizes our unique technology, in Japan and Europe in fiscal 2020, following the launch in the U.S. in fiscal 2019. Subsequent ADCs such as Dato-DXd and HER3-DXd are also steadily developing. Now, we have newly established our 2030 Vision of being an “Innovative Global Healthcare Company Contributing to the Sustainable Development of Society,” and have established 5-Year Business Plan (fiscal 2021 to fiscal 2025) as a plan to realize our 2025 Vision, “Global Pharma Innovator with Competitive Advantage in Oncology.” By working together as a Daiichi Sankyo Group on 5-Year Business Plan toward the 2030 Vision, we aim to solve the social issues expected of our company and increase shareholder value. -

CSR Report 2009

Locations Head Office 16-5, Konan 2-chome, Minato-ku, Tokyo Postal Code: 108-8215 Phone: 81-3-6716-3111 (main number) Fax: 81-3-6716-5800 Headquarters and Divisions General Machinery & Special Vehicle Headquarters 3000, Tana, Sagamihara, Kanagawa Postal Code: 229-1193 Phone: 81-42-761-1101 (General Affairs Dept.) Fax: 81-42-763-0800 Air-Conditioning & Refrigeration Systems Headquarters 3-1, Asahi, Nishi-biwajima-cho, Kiyosu, Aichi Postal Code: 452-8561 Phone: 81-52-503-9200 (General Affairs Dept.) Fax: 81-52-503-3533 Paper & Printing Machinery Division 1-1-1, Itozaki-Minami, Mihara, Hiroshima Postal Code: 729-0393 Phone: 81-848-67-2054 (General Affairs & Labor Section) Fax: 81-848-63-4463 Machine Tool Division 130, Roku-jizo, Ritto, Shiga Postal Code: 520-3080 Phone: 81-77-553-3300 (General Affairs Dept.) Fax: 81-77-552-3745 Works Nagasaki Shipyard & Machinery Works 1-1, Akunoura-machi, Nagasaki Postal Code: 850-8610 Phone: 81-95-828-4121 (General Affairs Dept.) Fax: 81-95-828-4034 Kobe Shipyard & Machinery Works 1-1-1, Wadasaki-cho, Hyogo-ku, Kobe Postal Code: 652-8585 Phone: 81-78-672-2220 (General Affairs Dept.) Fax: 81-78-672-2245 Address all inquiries about this report to: Shimonoseki Shipyard & Machinery Works 6-16-1, Hikoshima Enoura-cho, Shimonoseki Postal Code: 750-8505 Mitsubishi Heavy Industries, Ltd. Phone: 81-83-266-5978 (General Affairs & Labor Section) Corporate Social Responsibility Department Fax: 81-83-266-8274 CSR Report 16-5, Konan 2-chome, Minato-ku, Tokyo, Japan Yokohama Machinery Works 1-8-1, Sachiura, Kanazawa-ku, -

Whither the Keiretsu, Japan's Business Networks? How Were They Structured? What Did They Do? Why Are They Gone?

IRLE IRLE WORKING PAPER #188-09 September 2009 Whither the Keiretsu, Japan's Business Networks? How Were They Structured? What Did They Do? Why Are They Gone? James R. Lincoln, Masahiro Shimotani Cite as: James R. Lincoln, Masahiro Shimotani. (2009). “Whither the Keiretsu, Japan's Business Networks? How Were They Structured? What Did They Do? Why Are They Gone?” IRLE Working Paper No. 188-09. http://irle.berkeley.edu/workingpapers/188-09.pdf irle.berkeley.edu/workingpapers Institute for Research on Labor and Employment Institute for Research on Labor and Employment Working Paper Series (University of California, Berkeley) Year Paper iirwps-- Whither the Keiretsu, Japan’s Business Networks? How Were They Structured? What Did They Do? Why Are They Gone? James R. Lincoln Masahiro Shimotani University of California, Berkeley Fukui Prefectural University This paper is posted at the eScholarship Repository, University of California. http://repositories.cdlib.org/iir/iirwps/iirwps-188-09 Copyright c 2009 by the authors. WHITHER THE KEIRETSU, JAPAN’S BUSINESS NETWORKS? How were they structured? What did they do? Why are they gone? James R. Lincoln Walter A. Haas School of Business University of California, Berkeley Berkeley, CA 94720 USA ([email protected]) Masahiro Shimotani Faculty of Economics Fukui Prefectural University Fukui City, Japan ([email protected]) 1 INTRODUCTION The title of this volume and the papers that fill it concern business “groups,” a term suggesting an identifiable collection of actors (here, firms) within a clear-cut boundary. The Japanese keiretsu have been described in similar terms, yet compared to business groups in other countries the postwar keiretsu warrant the “group” label least. -

April 18, 2007 Press Release Ajinomoto Co., Inc. Eisai Co., Ltd

April 18, 2007 Press Release Ajinomoto Co., Inc. Eisai Co., Ltd. Takeda Pharmaceutical Company Limited A ONCE-WEEKLY FORMULATION OF RISEDRONATE SODIUM HYDRATE, AN ANTIOSTEOPOROTIC AGENT, WAS APPROVED. Ajinomoto Co., Inc. (“Ajinomoto”, President and CEO: Norio Yamaguchi, Headquarters: Tokyo) and Takeda Pharmaceutical Company Limited (“Takeda”, President: Yasuchika Hasegawa, Headquarters: Osaka) are pleased to announce that the Ministry of Health, Labour and Welfare approved today “ActonelⓇ 17.5 mg tablets” and “BenetⓇ 17.5 mg tablets”, a once-weekly formulation of risedronate sodium hydrate (generic name) for the treatment of osteoporosis. Both Ajinomoto and Takeda own the drug manufacturing approval of above products while Eisai Co., Ltd. (“Eisai”, President and CEO: Haruo Naito, Headquarters: Tokyo) will distribute “ActonelⓇ 17.5 mg tablets” supplied by Ajinomoto, and Takeda will distribute “BenetⓇ 17.5 mg tablets” respectively. Risedronate sodium hydrate is a bisphosphonate antiosteoporotic agent, which was originally synthesized by Norwich Eaton Pharmaceuticals, Inc. in the United States (then a subsidiary of The Procter & Gamble Company and now Procter & Gamble Pharmaceuticals, Inc.). This agent has two distinctive features from other antiosteoporotics: In the additional analysis of large clinical trials, vertebral and non-vertebral bone fractures suppressing effects of this agent showed statistically significant difference as compared to placebo as early as 6 months after starting administration. In large clinical trials with the primary endpoint of the reduction of frequency of hip fractures, this agent showed statistically significant difference as compared to placebo. The once-weekly formulation of risedronate sodium hydrate was approved in 2002 in the United States and now are being approved in more than 80 countries around the world. -

Press Release

Press Release Company name: DAIICHI SANKYO COMPANY, LIMITED Representative: Sunao Manabe, Representative Director, President and CEO (Code no.: 4568, First Section, Tokyo Stock Exchange) Please address inquiries to Junichi Onuma, Vice President, Corporate Communications Department Telephone: +81-3-6225-1126 https://www.daiichisankyo.com Daiichi Sankyo Announces Transfer from Astellas Pharma of Three Products in Asia Tokyo, Japan (October 15, 2019) – Daiichi Sankyo Company, Limited (hereafter, Daiichi Sankyo) today announced that it agreed with Astellas Pharma Inc. (hereafter, Astellas Pharma) that Astellas Pharma local subsidiaries companies in six Asian countries will transfer three products to Daiichi Sankyo. The products to be transferred and the countries where they are sold are as follows. Product Korea China Taiwan Thailand Philippines Indonesia [generic name (brand name)] Ramosetron Antiemetic ○ ○ ○ ○ (Nasea) Nicardipine Anti- ○ ○ ○ (Perdipine) hypertensive Barnidipine Anti- ○ (Oldeca) hypertensive ○ indicate the countries where the products are sold The antiemetics are expected to have synergistic effects with mirogabalin and the cancer drugs that Daiichi Sankyo is currently developing in Asia, and the two antihypertensives are expected to effectively utilize Daiichi Sankyo’s current infrastructures in combination with its cardiovascular products, such as olmesartan and edoxaban. The total net sales of Astellas Pharma's three products in fiscal year 2018 were approximately 5.0 billion yen. 1 Daiichi Sankyo will take over the rights -

Mizuho Financial Group, Inc

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F (Mark One) ‘ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR È ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended March 31, 2016 OR ‘ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ‘ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report For the transition period from to Commission file number 001-33098 Kabushiki Kaisha Mizuho Financial Group (Exact name of Registrant as specified in its charter) Mizuho Financial Group, Inc. (Translation of Registrant’s name into English) Japan (Jurisdiction of incorporation or organization) 1-5-5 Otemachi Chiyoda-ku, Tokyo 100-8176 Japan (Address of principal executive offices) Masahiro Kosugi, +81-3-5224-1111, +81-3-5224-1059, address is same as above (Name, Telephone, Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act. Title of each class Name of each exchange on which registered Common Stock, without par value The New York Stock Exchange* American depositary shares, each of which represents two shares of The New York Stock Exchange common stock Securities registered or to be registered pursuant to Section 12(g) of the Act. None (Title of Class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None (Title of Class) Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. -

R&Co Risk-Based International Index – Weighting

Rothschild & Co Risk-Based International Index Indicative Index Weight Data as of June 30, 2021 on close Constituent Exchange Country Index Weight(%) Jardine Matheson Holdings Ltd Singapore 1.46 LEG Immobilien SE Germany 0.98 Ajinomoto Co Inc Japan 0.95 SoftBank Corp Japan 0.89 Shimano Inc Japan 0.85 FUJIFILM Holdings Corp Japan 0.73 Singapore Exchange Ltd Singapore 0.72 Japan Tobacco Inc Japan 0.72 Cellnex Telecom SA Spain 0.69 Nintendo Co Ltd Japan 0.69 Carrefour SA France 0.67 Nexon Co Ltd Japan 0.66 Deutsche Wohnen SE Germany 0.65 Bank of China Ltd Hong Kong 0.64 REN - Redes Energeticas Nacion Portugal 0.63 Pan Pacific International Hold Japan 0.63 Japan Post Holdings Co Ltd Japan 0.62 Nippon Telegraph & Telephone C Japan 0.61 Roche Holding AG Switzerland 0.61 Nestle SA Switzerland 0.61 Novo Nordisk A/S Denmark 0.59 ENEOS Holdings Inc Japan 0.59 Nomura Research Institute Ltd Japan 0.59 Koninklijke Ahold Delhaize NV Netherlands 0.59 Jeronimo Martins SGPS SA Portugal 0.58 HelloFresh SE Germany 0.58 Toshiba Corp Japan 0.58 Hoya Corp Japan 0.58 Siemens Healthineers AG Germany 0.58 MS&AD Insurance Group Holdings Japan 0.57 Coloplast A/S Denmark 0.57 Kerry Group PLC Ireland 0.57 Scout24 AG Germany 0.57 SG Holdings Co Ltd Japan 0.56 Symrise AG Germany 0.56 Nitori Holdings Co Ltd Japan 0.56 Beiersdorf AG Germany 0.55 Mitsubishi Corp Japan 0.55 KDDI Corp Japan 0.55 Sysmex Corp Japan 0.55 Chr Hansen Holding A/S Denmark 0.55 Ping An Insurance Group Co of Hong Kong 0.55 Eisai Co Ltd Japan 0.54 Chocoladefabriken Lindt & Spru Switzerland 0.54 Givaudan -

EA Pharma Filed Marketing Approval Application for AJM300 (Nonproprietary Name: Carotegrast Methyl) Indicated for Treatment of Ulcerative Colitis

May 28, 2021 EA Pharma Co., Ltd. Kissei Pharmaceutical Co., Ltd. (Code 4574, Tokyo Stock Exchange 1st Section) EA Pharma Filed Marketing Approval Application for AJM300 (Nonproprietary Name: Carotegrast Methyl) Indicated for Treatment of Ulcerative Colitis EA Pharma Co., Ltd. (President, Yuji Matsue; Headquarters, Chuo-ku, Tokyo, Japan; “EA Pharma”) and Kissei Pharmaceutical Co., Ltd. (Head Office: Matsumoto, Nagano; Chairman and CEO: Mutsuo Kanzawa; "Kissei") announced that EA Pharma has filed the marketing approval application in Japan for AJM300 (nonproprietary name: carotegrast methyl), which the two companies have developed for treatment of ulcerative colitis. The application was filed based on the results of Phase III clinical study (AJM300/CT3) and other studies conducted in Japan. Detailed data of AJM300/CT3 will be presented at an upcoming major medical conference this year. AJM300 is an orally available small molecule α4 integrin antagonist that was originated by EA Pharma (formerly known as Ajinomoto Pharmaceuticals Co., Ltd.). EA Pharma and Kissei have jointly developed AJM300 since 2015, aiming to launch the world-first orally available α4 integrin antagonist onto the market. In ulcerative colitis, lymphocytes and other inflammatory cells excessively aggregate and invade into the inflamed site in the colonic mucosa. AJM300 can antagonize both α4β1 and α4β7 integrins expressed on the surface of inflammatory cells and inhibit the cell adhesion mediated by binding to adhesion molecules excessively expressed on the vascular endotherial cells in the colonic mucosa, which suppresses invasion of lymphocytes into the inflamed site to exert anti-inflammation effects. EA Pharma and Kissei strive to quickly provide AJM300 for clinical use to increase treatment options for ulcerative colitis to contribute to QOL of patiens and their families. -

Daiichi Sankyo Group Value Report 2016

Daiichi Sankyo Group Value Report 2016 Daiichi Sankyo Group Value Daiichi Sankyo Group Value Report 2016 Our Mission Core Values and Commitments(Criteria of the Value Judgment to Fulfill Our Mission) Core Values Notes To contribute to the enrichment of quality of life around the world Innovation : the introduction of new ideas, methods, or invention through the creation of innovative pharmaceuticals, and through the Integrity : the quality of being honest and of always having high moral principles provision of pharmaceuticals addressing diverse medical needs. Accountability : being responsible for the effects of your actions, and being willing to explain or be criticized for them Commitments We have established Core Values and Commitments as the criteria for our business activities 1. To create innovative medicines changing SOC * and decision making. Our global brand is a pledge to our stakeholders of what the * SOC (Standard of Care): Universally applied best treatment practice in today’s medical science Company is capable of delivering, now and in the future. Our corporate slogan succinctly 2. To take a global perspective, and respect regional values states how we make efforts for what and for whom. 3. To foster intellectual curiosity and strategic insight In addition, we have established the DAIICHI SANKYO Group Corporate Conduct Charter * to act with the highest ethical standards and a good social conscience appropriate 4. To provide the highest quality medical information for a company engaged in a business that affects human lives. 5. To provide a stable supply of top-quality pharmaceutical products * The full text of the DAIICHI SANKYO Group Corporate Conduct Charter can be found on page 28. -

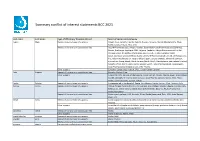

Summary Conflict of Interest Statements BCC 2021

Summary conflict of interest statements BCC 2021 Last name First name Type of affiliation/ financial interest Name of commercial company Aapro Matti Receipt of grants/research supports: Amgen, Eisai, Genomic Health, Helsinn, Hospira, Novartis, Merck, Mundipharma, Pfizer, Rache, Sandoz, Tesaro, Teva, Vifor Receipt of honoraria or consultation fees: Accord Pharmaceuticals, Amgen, Astellas, Bayer HealthCare Pharmaceuticals (Schering), Biocon, Boehringer Ingelheim, BMS, Celgene, Cephalon, Chugai Pharmaceutical Co. Ltd., Clinigen Group, Dr.Reddy's Laboratories, Eisai Co. Ltd., Eli Lilly, Genomic Health (Exact Sciences), GlaxoSmithKline (GSK), Glenmark Pharmaceuticals Limited, Gl Therapeutics, lnc., Helsinn Healthcare SA, Hospira (Pfizer), lpsen, Janssen Biotech, Johnson & Johnson, Kyowa Kirin Group, Merck, Merck Serono (Merck KGaA), Mundipharma International Limited, Novartis, Pfizer, Pierre Fabre, Rache, Sandoz, Sanofi, Taiho Pharmaceutical, Tesaro (GSK), Teva Pharmaceutical lndustries Ltd., Vifor Pharma Other support: European Cancer Organisation, SPCC, Cancer Center Genolier Aebi Stephan Receipt of honoraria or consultation fees: Novartis, Roche, Pfizer Other support: Support for CME lectures of the Lucerne Cancer Center: Amgen, Astellas, Bayer, Bristol-Myers Squibb, Debiopharm International SA, Eisai, Ipsen Pharma, Janssen, Merck, MSD, Pfizer, Roche, Sanofi Genzyme, Servier, Takeda André Fabrice Receipt of grants/research supports: Comepensated to the hospital: Roche, AstraZeneca, Daiichi Sankyo, Pfizer, Novartis, Lilly Barrios Carlos