MILITARY SIMULATOR CENSUS 2019 in Association with MILITARY SIMULATOR CENSUS 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1.1.3 Helicopters

Information on the Company’s Activities / 1.1 Presentation of the Company 1.1.3 Helicopters Airbus Helicopters is a global leader in the civil and military The HIL programme, for which the Airbus Helicopters’ H160 rotorcraft market, offering one of the most complete and modern was selected in 2017, was initially scheduled for launch range of helicopters and related services. This product range in 2022 by the current military budget law. Launching the currently includes light single-engine, light twin-engine, medium programme earlier will enable delivery of the fi rst H160Ms to and medium-heavy rotorcraft, which are adaptable to all kinds of the French Armed Forces to be advanced to 2026. The H160 mission types based on customer needs. See “— 1.1.1 Overview” was designed to be a modular helicopter, enabling its military for an introduction to Airbus Helicopters. version, with a single platform, to perform missions ranging from commando infi ltration to air intercept, fi re support, and anti-ship warfare in order to meet the needs of the army, the Strategy navy and the air force through the HIL programme. The new fi ve-bladed H145 is on track for EASA and FAA Business Ambition certifi cation in 2020. To ensure these certifi cations, two fi ve- bladed prototypes have clocked more than 400 fl ight hours Airbus Helicopters continues to execute its ambition to lead the in extensive fl ight test campaigns in Germany, France, Spain, helicopter market, build end-to-end solutions and grow new Finland, and in South America. First deliveries of the new H145 VTOL businesses, while being fi nancially sound. -

H1 2019 Results

AEROSTRUCTURES & INTERCONNECTION SYSTEMS H1 2019 RESULTS SEPTEMBER 4, 2019 DISCLAIMER Certain statements contained in this document are forward-looking statements. These statements includes, without limitation, statements that are predictions of or indicate future events, trends, plans, expectations or objectives. Examples of forward-looking statements include statements relating to business strategy, objectives, delivery schedules or future performance. Words such as “anticipates”, “believes”, “estimates”, “seeks”, “intends”, “may” and similar expressions are used to identify these forward-looking statements. Such statements are, by their nature, subject to known and unknown risks and uncertainties. These uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements as these are dependent on risk factors such as the variation of the exchange rates, program delays, industrial risks relating to safety, the evolution of regulations and the general economic and financial conditions and other matters of national, regional and global scale, including those of a political, economic, competitive and regulatory nature. Please refer to the section “Risks management” of the latest Latécoère’s Annual Report, for a description of certain important factors, risks and uncertainties that may affect Latécoère’s business. Latécoère makes no commitment to update or revise any of these forward-looking statements, whether to reflect new information, future events or circumstances or otherwise. This document is the property of Latécoère. It can not be disclosed or reproduced, even partially, without authorization. 2 H1 2019 HIGHLIGHTS 80% €372M 60/40% €28M TRANSFORMATION REVENUE AEROSTRUCTURES/ Rec. EBITDA 2020 TARGETED INTERCONNECTION SYSTEMS SAVINGS This document is the property of Latécoère. -

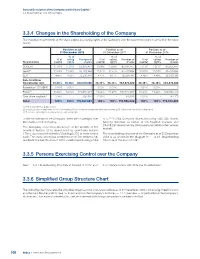

3.3.4 Changes in the Shareholding of the Company

General Description of the Company and its Share Capital / 3.3 Shareholdings and Voting Rights 3.3.4 Changes in the Shareholding of the Company The evolution in ownership of the share capital and voting rights of the Company over the past three years is set forth in the table below: Position as of Position as of Position as of 31 December 2018 31 December 2017 31 December 2016 % of % of % of % of voting Number of % of voting Number of % of voting Number of Shareholders capital rights shares capital rights shares capital rights shares SOGEPA 11.06% 11.06 % 85,835,477 11.08% 11.08% 85,835,477 11.11% 11.11% 85,835,477 GZBV(1) 11.04% 11.04 %85,709,82211.07% 11.07% 85,709,822 11.09% 11.09% 85,709,822 SEPI 4.16% 4.16 %32,330,381 4.17% 4.17% 32,330,381 4.18% 4.18% 32,330,381 Sub-total New Shareholder Agt. 26.26% 26.28% 203,875,680 26.32% 26.33% 203,875,680 26.38% 26.38% 203,875,680 Foundation “SOGEPA” 0.00% 0.00% 0 0.00% 0.00% - 0.00% 0.00% 0 Public(2) 73.66% 73.72% 571,855,277 73.66% 73.67% 570,550,857 73.60% 73.62% 568,853,019 Own share buyback(3) 0.08% - 636,924 0.02% - 129,525 0.02% - 184,170 Total 100% 100% 776,367,881 100% 100% 774,556,062 100% 100% 772,912,869 (1) KfW & other German public entities. -

Turbulence in the Gulf

Come and see us at the Dubai Airshow on Stand 2018 AEROSPACE November 2017 FLYING FOR THE DARK SIDE IS MARS GETTING ANY CLOSER? HYBRID-ELECTRIC PROPULSION www.aerosociety.com November 2017 Volume 44 Number 11 Volume TURBULENCE IN THE GULF SUPERCONNECTOR AIRLINES BATTLE HEADWINDS Royal Aeronautical Society Royal Aeronautical N EC Volume 44 Number 11 November 2017 Turbulence in Is Mars getting any 14 the Gulf closer? How local politics Sarah Cruddas and longer-range assesses the latest aircraft may 18 push for a human impact Middle mission to the Red East carriers. Planet. Are we any Contents Clément Alloing Martin Lockheed nearer today? Correspondence on all aerospace matters is welcome at: The Editor, AEROSPACE, No.4 Hamilton Place, London W1J 7BQ, UK [email protected] Comment Regulars 4 Radome 12 Transmission The latest aviation and Your letters, emails, tweets aeronautical intelligence, and feedback. analysis and comment. 58 The Last Word Short-circuiting electric flight 10 Antenna Keith Hayward considers the Howard Wheeldon looks at the current export tariff spat over MoD’s planned Air Support to the Bombardier CSeries. Can a UK low-cost airline and a US start-up bring electric, green airline travel Defence Operational Training into service in the next decade? On 27 September easyJet revealed it had (ASDOT) programme. partnered with Wright Electric to help develop a short-haul all-electric airliner – with the goal of bringing it into service within ten years. If realised, this would represent a game-changing leap for aviation and a huge victory for aerospace Features Cobham in meeting or even exceeding its sustainable goals. -

Home at Airbus

Journal of Aircraft and Spacecraft Technology Original Research Paper Home at Airbus 1Relly Victoria Virgil Petrescu, 2Raffaella Aversa, 3Bilal Akash, 4Juan M. Corchado, 2Antonio Apicella and 1Florian Ion Tiberiu Petrescu 1ARoTMM-IFToMM, Bucharest Polytechnic University, Bucharest, (CE), Romania 2Advanced Material Lab, Department of Architecture and Industrial Design, Second University of Naples, 81031 Aversa (CE), Italy 3Dean of School of Graduate Studies and Research, American University of Ras Al Khaimah, UAE 4University of Salamanca, Spain Article history Abstract: Airbus Commerci al aircraft, known as Airbus, is a European Received: 16-04-2017 aeronautics manufacturer with headquarters in Blagnac, in the suburbs of Revised: 18-04-2017 Toulouse, France. The company, which is 100% -owned by the industrial Accepted: 04-07-2017 group of the same name, manufactures more than half of the airliners produced in the world and is Boeing's main competitor. Airbus was Corresponding Author: founded as a consortium by European manufacturers in the late 1960s. Florian Ion Tiberiu Petrescu Airbus Industry became a SAS (simplified joint-stock company) in 2001, a ARoTMM-IFToMM, Bucharest subsidiary of EADS renamed Airbus Group in 2014 and Airbus in 2017. Polytechnic University, Bucharest, (CE) Romania BAE Systems 20% of Airbus between 2001 and 2006. In 2010, 62,751 Email: [email protected] people are employed at 18 Airbus sites in France, Germany, the United Kingdom, Belgium (SABCA) and Spain. Even if parts of Airbus aircraft are essentially made in Europe some come from all over the world. But the final assembly lines are in Toulouse (France), Hamburg (Germany), Seville (Spain), Tianjin (China) and Mobile (United States). -

Investor Guide FY 2019

Airbus - Investor Guide FY 2019 A Global Leader Key Financials Contact . A global leader in aeronautics, space and related services 2018 2019 Head of Investor Relations and Financial Communication: . 86% civil revenues, 14% defence . Three reportable segments: Airbus, Helicopters, Defence and Space Revenues (€ bn) 63.7 70.5 Thorsten Fischer [email protected] +33 5 67 19 02 64 . Robust and diverse backlog EBIT adjusted (€ bn) 5.8 6.9 Institutionals and Analysts: . Global footprint with European industrial roots RoSbased on EBIT adjusted 9.2% 9.9% 2019 Consolidated Airbus 2019 Consolidated Airbus EBIT reported (€ bn) 5.0 1.3 Mohamed Denden [email protected] +33 5 82 05 30 53 External Revenue by Division Order Book in value by Region Net Income/ loss (€ bn) 3.1 -1.4 Philippe Gossard [email protected] +33 5 31 08 59 43 EPS reported (€) 3.94 -1.75 Pierre Lu [email protected] +65 82 92 08 00 Dividend (€) 1.65 1.80* Net Cash Position (€bn) 13.3 12.5 Individual Investors : [email protected] +33 800 01 2001 FCF before M&A and Customer Financing (€bn) 2.9 3.5 € 70.5 bn € 471 bn t/o defence € 38 bn Further information on https://www.airbus.com/investors.html t/o defence € 10.1 bn Click here for guidance . * Board proposal to be submitted to the AGM 2020, subject to AGM approval. Airbus 2019 External Revenue Split 2019 Deliveries by Programme (units) 2019 Orders & Deliveries Airbus 77% Asia Pacific 31% Middle East 9% Key Financials Helicopters 8% Europe 28% Latin America 6% 2018 2019 Defence and Space 15% North America 18% Other 8% . -

Security & Defence European

a 7.90 D European & Security ES & Defence 4/2016 International Security and Defence Journal Protected Logistic Vehicles ISSN 1617-7983 • www.euro-sd.com • Naval Propulsion South Africa‘s Defence Exports Navies and shipbuilders are shifting to hybrid The South African defence industry has a remarkable breadth of capa- and integrated electric concepts. bilities and an even more remarkable depth in certain technologies. August 2016 Jamie Shea: NATO‘s Warsaw Summit Politics · Armed Forces · Procurement · Technology The backbone of every strong troop. Mercedes-Benz Defence Vehicles. When your mission is clear. When there’s no road for miles around. And when you need to give all you’ve got, your equipment needs to be the best. At times like these, we’re right by your side. Mercedes-Benz Defence Vehicles: armoured, highly capable off-road and logistics vehicles with payloads ranging from 0.5 to 110 t. Mobilising safety and efficiency: www.mercedes-benz.com/defence-vehicles Editorial EU Put to the Test What had long been regarded as inconceiv- The second main argument of the Brexit able became a reality on the morning of 23 campaigners was less about a “democratic June 2016. The British voted to leave the sense of citizenship” than of material self- European Union. The majority that voted for interest. Despite all the exception rulings "Brexit", at just over 52 percent, was slim, granted, the United Kingdom is among and a great deal smaller than the 67 percent the net contribution payers in the EU. This who voted to stay in the then EEC in 1975, money, it was suggested, could be put to but ignoring the majority vote is impossible. -

Global Military Helicopters 2015-16 Market Report Contents

GLOBAL MILITARY HELICOPTERS 2015-16 MARKET REPORT CONTENTS MARKET OVERVIEW 2 MILITARY HELICOPTER KEY REQUIREMENTS 4 EUROPE 5 NORTH AMERICA 10 LATIN AMERICA & THE CARIBBEAN 12 AFRICA 15 ASIA-PACIFIC 16 MIDDLE EAST 21 WORLD MILITARY HELICOPTER HOLDINGS 23 EUROPE 24 NORTH AMERICA 34 LATIN AMERICA & THE CARIBBEAN 36 AFRICA 43 ASIA-PACIFIC 49 MIDDLE EAST 59 EVENT INFORMATION 65 Please note that all information herein is subject to change. Defence IQ endeavours to ensure accuracy wherever possible, but errors are often unavoidable. We encourage readers to contact us if they note any need for amendments or updates. We accept no responsibility for the use or application of this information. We suggest that readers contact the specific government and military programme offices if seeking to confirm the reliability of any data. 1 MARKET OVERVIEW Broadly speaking, the global helicopter market is currently facing a two- pronged assault. The military helicopter segment has been impacted significantly by continued defense budgetary pressures across most traditional markets, and a recent slide in global crude oil prices has impacted the demand for new civil helicopters as well as the level of activity for existing fleets engaged in the offshore oil & gas exploration sector. This situation has impacted industry OEMs significantly, many of which had been working towards strengthening the civil helicopter segment to partially offset the impact of budgetary cuts on the military segment. However, the medium- to long-term view of the market is promising given the presence of strong fundamentals and persistent, sustainable growth drivers. The market for military helicopters in particular is set to cross a technological threshold in the form of next-generation compound helicopters and tilt rotorcraft. -

Wildland Fire Incident Management Field Guide

A publication of the National Wildfire Coordinating Group Wildland Fire Incident Management Field Guide PMS 210 April 2013 Wildland Fire Incident Management Field Guide April 2013 PMS 210 Sponsored for NWCG publication by the NWCG Operations and Workforce Development Committee. Comments regarding the content of this product should be directed to the Operations and Workforce Development Committee, contact and other information about this committee is located on the NWCG Web site at http://www.nwcg.gov. Questions and comments may also be emailed to [email protected]. This product is available electronically from the NWCG Web site at http://www.nwcg.gov. Previous editions: this product replaces PMS 410-1, Fireline Handbook, NWCG Handbook 3, March 2004. The National Wildfire Coordinating Group (NWCG) has approved the contents of this product for the guidance of its member agencies and is not responsible for the interpretation or use of this information by anyone else. NWCG’s intent is to specifically identify all copyrighted content used in NWCG products. All other NWCG information is in the public domain. Use of public domain information, including copying, is permitted. Use of NWCG information within another document is permitted, if NWCG information is accurately credited to the NWCG. The NWCG logo may not be used except on NWCG-authorized information. “National Wildfire Coordinating Group,” “NWCG,” and the NWCG logo are trademarks of the National Wildfire Coordinating Group. The use of trade, firm, or corporation names or trademarks in this product is for the information and convenience of the reader and does not constitute an endorsement by the National Wildfire Coordinating Group or its member agencies of any product or service to the exclusion of others that may be suitable. -

Military Aircraft Markings Update Number 76, September 2011

Military Aircraft Markings Update Number 76, September 2011 Serial Type (other identity) [code] Owner/operator, location or fate N6466 DH82A Tiger Moth (G-ANKZ) Privately owned, Compton Abbas T7842 DH82A Tiger Moth II (G-AMTF) Privately owned, Westfield, Surrey DE623 DH82A Tiger Moth II (G-ANFI) Privately owned, Cardiff KK116 Douglas Dakota IV (G-AMPY) AIRBASE, Coventry TD248 VS361 Spitfire LF XVIE (7246M/G-OXVI) [CR-S] Spitfire Limited, Humberside TX310 DH89A Dragon Rapide 6 (G-AIDL) Classic Flight, Coventry VN799 EE Canberra T4 (WJ874/G-CDSX) AIRBASE, Coventry VP981 DH104 Devon C2 (G-DHDV) Classic Flight, Coventry WA591 Gloster Meteor T7 (7917M/G-BWMF) [FMK-Q] Classic Flight, Coventry WB188 Hawker Hunter GA11 (WV256/G-BZPB) AIRBASE, Coventry WD413 Avro 652A Anson T21 (7881M/G-VROE) Classic Flight, Coventry WK163 EE Canberra B2/6 (G-BVWC) AIRBASE, Coventry WK436 DH112 Venom FB50 (J-1614/G-VENM) Classic Flight, Coventry WM167 AW Meteor NF11 (G-LOSM) Classic Flight, Coventry WR470 DH112 Venom FB50 (J-1542/G-DHVM) Classic Flight, Coventry WT722 Hawker Hunter T8C (G-BWGN) [878/VL] AIRBASE, Coventry WV318 Hawker Hunter T7B (9236M/G-FFOX) WV318 Group, Cotswold Airport WZ798 Slingsby T38 Grasshopper TX1 Privately owned, stored Hullavington XA109 DH115 Sea Vampire T22 Montrose Air Station Heritage Centre XE665 Hawker Hunter T8C (G-BWGM) [876/VL] Classic Flight, Coventry XE689 Hawker Hunter GA11 (G-BWGK) [864/VL] AIRBASE, Coventry XE985 DH115 Vampire T11 (WZ476) Privately owned, New Inn, Torfaen XG592 WS55 Whirlwind HAS7 [54] Task Force Adventure -

10-03-2020 UAE Orders Lockheed Martin Sniper Targeting Pods for Its

10-03-2020 UAE orders Lockheed Martin Sniper Targeting Pods for its Mirage 2000s 2020 - 03 - 06 - www.airrecognition.com Lockheed Martin received a direct Squadron (Mirage 2000-9EAD/DAD from commercial sale contract from the United Al Safran Air Base). Deliveries of Sniper Arab Emirates Air Force and Air Defense ATPs and spares will support the UAE (AFAD) for expedited delivery of Sniper AFAD’s requirement to provide precision Advanced Targeting Pods (ATP), spares, targeting capability for their existing and upgrades. The company says that Mirage 2000 fleet. UAE AFAD currently this contract marks the first integration of employs Sniper ATP on its F-16 Block 60 Sniper ATP on the Mirage 2000 aircraft. aircraft. UAE’s fleet includes 43 multirole Mirage 2000-9/EAD/RAD and 14 conversion “The additional Sniper ATPs and trainer Mirage 2000-9D/DAD. upgrades will enhance the UAE AFAD’s precision targeting capability,” said The air force units operating the Mirage Kenen Nelson, Fixed Wing Programs 2000s are the 71st Fighter Squadron director at Lockheed Martin Missiles and (Mirage 2000-9EAD/DAD), the 76th Fire Control. Chosen by over 27 Fighter Squadron (Mirage international customers and the U.S. Air 2000-9EAD/DAD) and the 86th Fighter Force, Sniper ATP is a global leader... Lire la suite APPELS D’OFFRES Spares for the Scheduled Maintenance of MD-520MG helicopter 2020 - 03 - 10 - www.philgeps.gov.ph Ref: PB-PAFBAC-057-20 Organisme: Air Force Date limite: 30.03.2020 Montant HT: 12 997 000 PHP Tel: 63-966-3479652 E-mail: [email protected] Lire la -

English BAE Systems and Nally, It Develops Arms Systems for War- the Second World Military Aerospace Ships Through the FABA Programme, Company After Boeing

THE MILITARY INDUSTRIAL COMPLEX A PARASITE ON SPANISH ECONOMY REPORT no. 12 REPORT no. 12 THE MILITARY INDUSTRIAL COMPLEX A parasite on Spanish economy Pere Ortega Camino Simarro Centre d’Estudis per la Pau J.M. Delàs · Justícia i Pau Barcelona, April 2012 Centre d’Estudis per la Pau JM Delàs Justícia i Pau · Rivadeneyra 6, 10è 08002 Barcelona T. 93 317 61 77 F. 93 412 53 84 www.centredelas.org [email protected] [email protected] Barcelona, April 2012 Graphic design: Fundació Tam-Tam D.L.: B-19745-2010 ISSN: 2013-8032 REPORT no. 12 The military industrial complex. A parasite on Spanish economy 4 THE MILITARY REPORT INDUSTRIAL COMPLEX A PARASITE ON SPANISH ECONOMY no. 12 Index EXECUTIVE SUMMARY 1. INTRODUCTION......................7 The military-industrial complex in Spain is based on an oligopoly made up of four big companies that provide all the weapons that the Ministry of Defence 2. MILITARY PRODUCTION IN SPAIN . .8 uses for its armies. EADS-Casa manufactures aeronautics for the air force; Na- vantia produces warships for the navy; Santa Bárbara/General Dynamics sells 3. A SHORT HISTORY OF THE MILITARY heavy and small arms to the army and, last but not least, Indra provides all the INDUSTRY IN SPAIN . 9 aforementioned armed forces and their weapons with most of the electronics and new technologies. 4. SOME SIGNIFICANT CHANGES IN THE SECTOR . .11 These four companies make up between 75 and 80% of the total turnover of military production which amounted to approximately E 6.6 billion in 2009. 5. DEFENCE INDUSTRIAL That represented 1.24% of the national industrial production and 1.1% of the SUBSECTORS .