Going to Extremes Politics After Financial Crises, 1870–2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Political Parties and Welfare Associations

Department of Sociology Umeå University Political parties and welfare associations by Ingrid Grosse Doctoral theses at the Department of Sociology Umeå University No 50 2007 Department of Sociology Umeå University Thesis 2007 Printed by Print & Media December 2007 Cover design: Gabriella Dekombis © Ingrid Grosse ISSN 1104-2508 ISBN 978-91-7264-478-6 Grosse, Ingrid. Political parties and welfare associations. Doctoral Dissertation in Sociology at the Faculty of Social Sciences, Umeå University, 2007. ISBN 978-91-7264-478-6 ISSN 1104-2508 ABSTRACT Scandinavian countries are usually assumed to be less disposed than other countries to involve associations as welfare producers. They are assumed to be so disinclined due to their strong statutory welfare involvement, which “crowds-out” associational welfare production; their ethnic, cultural and religious homogeneity, which leads to a lack of minority interests in associational welfare production; and to their strong working-class organisations, which are supposed to prefer statutory welfare solutions. These assumptions are questioned here, because they cannot account for salient associational welfare production in the welfare areas of housing and child-care in two Scandinavian countries, Sweden and Norway. In order to approach an explanation for the phenomena of associational welfare production in Sweden and Norway, some refinements of current theories are suggested. First, it is argued that welfare associations usually depend on statutory support in order to produce welfare on a salient level. Second, it is supposed that any form of particularistic interest in welfare production, not only ethnic, cultural or religious minority interests, can lead to associational welfare. With respect to these assumptions, this thesis supposes that political parties are organisations that, on one hand, influence statutory decisions regarding associational welfare production, and, on the other hand, pursue particularistic interests in associational welfare production. -

Europe on the Borderline © Photographer© Join Us for Progressive Thoughts on the 3Rd

N°02 /2011 | QUARTERLY MAGAZINE Europe on the borderline © Photographer© Join us for progressive thoughts on the 3rd EUSONET I ended up on a “death list” put The late Stieg Larsson’s column together by a Swedish Nazi group. I later from 2003 proves that we were warned got hold of a copy. It states that I’m an about the growth of rightwing extremism anti-racist (true); it has the address of (page 25). We are proud to have been my parents’ house (now sold), and our given permission to posthumously pub- landline phone number (still used by my lish a text that highlights the closeness mum). But the scary calls, made at night between Larsson’s work as a journalist, at the weekends when the Nazis had had and an underlying political message of one beer too many, stopped long ago. his Millennium trilogy. EDITORIAL “Uuuh, you must mean my son. I’m This magazine aims to become a ref- voting for the liberals.” That was my dad’s erence point for progressive politicians, answer to the accusation of being a red so it should not be a surprise that we bastard – which was a mixture of being asked Norway’s Prime Minister Jens sleepy and very probably feeling a little Stoltenberg to address our readers. His “We’re going to kill you, you red bastard.” scared. If so, the 22 July 2011 showed message reflects profoundly the impres- My dad was the first to get to the phone that my late father was scared of the vio- sive way in which he handled a national when it surprisingly rang in the small lent extreme right for a reason. -

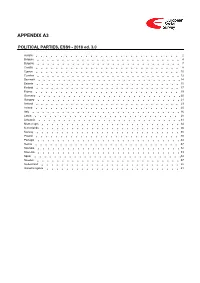

ESS9 Appendix A3 Political Parties Ed

APPENDIX A3 POLITICAL PARTIES, ESS9 - 2018 ed. 3.0 Austria 2 Belgium 4 Bulgaria 7 Croatia 8 Cyprus 10 Czechia 12 Denmark 14 Estonia 15 Finland 17 France 19 Germany 20 Hungary 21 Iceland 23 Ireland 25 Italy 26 Latvia 28 Lithuania 31 Montenegro 34 Netherlands 36 Norway 38 Poland 40 Portugal 44 Serbia 47 Slovakia 52 Slovenia 53 Spain 54 Sweden 57 Switzerland 58 United Kingdom 61 Version Notes, ESS9 Appendix A3 POLITICAL PARTIES ESS9 edition 3.0 (published 10.12.20): Changes from previous edition: Additional countries: Denmark, Iceland. ESS9 edition 2.0 (published 15.06.20): Changes from previous edition: Additional countries: Croatia, Latvia, Lithuania, Montenegro, Portugal, Slovakia, Spain, Sweden. Austria 1. Political parties Language used in data file: German Year of last election: 2017 Official party names, English 1. Sozialdemokratische Partei Österreichs (SPÖ) - Social Democratic Party of Austria - 26.9 % names/translation, and size in last 2. Österreichische Volkspartei (ÖVP) - Austrian People's Party - 31.5 % election: 3. Freiheitliche Partei Österreichs (FPÖ) - Freedom Party of Austria - 26.0 % 4. Liste Peter Pilz (PILZ) - PILZ - 4.4 % 5. Die Grünen – Die Grüne Alternative (Grüne) - The Greens – The Green Alternative - 3.8 % 6. Kommunistische Partei Österreichs (KPÖ) - Communist Party of Austria - 0.8 % 7. NEOS – Das Neue Österreich und Liberales Forum (NEOS) - NEOS – The New Austria and Liberal Forum - 5.3 % 8. G!LT - Verein zur Förderung der Offenen Demokratie (GILT) - My Vote Counts! - 1.0 % Description of political parties listed 1. The Social Democratic Party (Sozialdemokratische Partei Österreichs, or SPÖ) is a social above democratic/center-left political party that was founded in 1888 as the Social Democratic Worker's Party (Sozialdemokratische Arbeiterpartei, or SDAP), when Victor Adler managed to unite the various opposing factions. -

Alternatives in a World of Crisis

ALTERNATIVES IN A WORLD OF CRISIS GLOBAL WORKING GROUP BEYOND DEVELOPMENT MIRIAM LANG, CLAUS-DIETER KÖNIG EN AND ADA-CHARLOTTE REGELMANN (EDS) ALTERNATIVES IN A WORLD OF CRISIS INTRODUCTION 3 I NIGERIA NIGER DELTA: COMMUNITY AND RESISTANCE 16 II VENEZUELA THE BOLIVARIAN EXPERIENCE: A STRUGGLE TO TRANSCEND CAPITALISM 46 III ECUADOR NABÓN COUNTY: BUILDING LIVING WELL FROM THE BOTTOM UP 90 IV INDIA MENDHA-LEKHA: FOREST RIGHTS AND SELF-EMPOWERMENT 134 V SPAIN BARCELONA EN COMÚ: THE MUNICIPALIST MOVEMENT TO SEIZE THE INSTITUTIONS 180 VI GREECE ATHENS AND THESSALONIKI: BOTTOM-UP SOLIDARITY ALTERNATIVES IN TIMES OF CRISIS 222 CONCLUSIONS 256 GLOBAL WORKING GROUP BEYOND DEVELOPMENT Miriam Lang, Claus-Dieter König and Ada-Charlotte Regelmann (Eds) Brussels, April 2018 SEEKING ALTERNATIVES BEYOND DEVELOPMENT Miriam Lang and Raphael Hoetmer ~ 2 ~ INTRODUCTION INTRODUCTION ~ 3 ~ This book is the result of a collective effort. In fact, it has been written by many contribu- tors from all over the world – women, men, activists, and scholars from very different socio-cultural contexts and political horizons, who give testimony to an even greater scope of social change. Their common concern is to show not only that alternatives do exist, despite the neoliberal mantra of the “end of history”, but that many of these alternatives are currently unfolding – even if in many cases they remain invisible to us. This book brings together a selection of texts portraying transformative processes around the world that are emblematic in that they been able to change their situated social realities in multiple ways, addressing different axes of domination simultaneously, and anticipating forms of social organization that configure alternatives to the commodi- fying, patriarchal, colonial, and destructive logics of modern capitalism. -

What's Left of the Left: Democrats and Social Democrats in Challenging

What’s Left of the Left What’s Left of the Left Democrats and Social Democrats in Challenging Times Edited by James Cronin, George Ross, and James Shoch Duke University Press Durham and London 2011 © 2011 Duke University Press All rights reserved. Printed in the United States of America on acid- free paper ♾ Typeset in Charis by Tseng Information Systems, Inc. Library of Congress Cataloging- in- Publication Data appear on the last printed page of this book. Contents Acknowledgments vii Introduction: The New World of the Center-Left 1 James Cronin, George Ross, and James Shoch Part I: Ideas, Projects, and Electoral Realities Social Democracy’s Past and Potential Future 29 Sheri Berman Historical Decline or Change of Scale? 50 The Electoral Dynamics of European Social Democratic Parties, 1950–2009 Gerassimos Moschonas Part II: Varieties of Social Democracy and Liberalism Once Again a Model: 89 Nordic Social Democracy in a Globalized World Jonas Pontusson Embracing Markets, Bonding with America, Trying to Do Good: 116 The Ironies of New Labour James Cronin Reluctantly Center- Left? 141 The French Case Arthur Goldhammer and George Ross The Evolving Democratic Coalition: 162 Prospects and Problems Ruy Teixeira Party Politics and the American Welfare State 188 Christopher Howard Grappling with Globalization: 210 The Democratic Party’s Struggles over International Market Integration James Shoch Part III: New Risks, New Challenges, New Possibilities European Center- Left Parties and New Social Risks: 241 Facing Up to New Policy Challenges Jane Jenson Immigration and the European Left 265 Sofía A. Pérez The Central and Eastern European Left: 290 A Political Family under Construction Jean- Michel De Waele and Sorina Soare European Center- Lefts and the Mazes of European Integration 319 George Ross Conclusion: Progressive Politics in Tough Times 343 James Cronin, George Ross, and James Shoch Bibliography 363 About the Contributors 395 Index 399 Acknowledgments The editors of this book have a long and interconnected history, and the book itself has been long in the making. -

List of Workshops: Workshop 1

List of workshops: Workshop 1 - Party system change in Scandinavia: From centrist to polarized? ......................................... 4 Workshop 2 - Improving on perfection? Democratic innovations in Nordic democracies........................... 4 Workshop 3 - Changes in democratic spaces – Institutional shifts in Nordic Higher Education in the 2000s ............................................................................................................................................................. 5 Workshop 4 - Political Backlash ................................................................................................................... 6 Workshop 5 - Taxation and state-society relations in a comparative perspective ........................................ 7 Workshop 6 - Administrative burdens in citizen-state interactions .............................................................. 8 Workshop 8 - Trust within Governance ........................................................................................................ 9 Workshop 9 - Teaching for citizenship and democracy ................................................................................ 9 Workshop 10 - Parliaments and Governments ........................................................................................... 10 Workshop 11 - Politics as a battlefield – understanding intraparty competition ........................................ 10 Workshop 12 - Political communication in a new media environment ..................................................... -

Radical Right Narratives and Norwegian

RADICAL RIGHT NARRATIVES AND NORWEGIAN COUNTER-NARRATIVES IN THE DECADE OF UTØYA AND BÆRUM SOLO-ACTOR ATTACKS The CARR-Hedayah Radical Right Counter Narratives Project is a year-long project between CARR and Hedayah that is funded by the EU STRIVE programme. It is designed to create one of the first comprehensive online toolkits for practitioners and civil society engaged in radical right extremist counter-narrative campaigns. It uses online research to map nar- ratives in nine countries and regions (Australia, Canada, Germany, Hungary, New Zealand, Norway, Ukraine, United Kingdom, and the United States), proposes counter-narratives for these countries and regions, and advises on how to conduct such campaigns in an effec- tive manner. This country report is one of such outputs. ABOUT THE AUTHOR Dr. Mette Wiggen is a lecturer in the School of Politics and International Studies (POLIS) at the University of Leeds. She teaches on the Extreme Right in Europe, and politics for the Introduction to Social Sciences foundation course aimed at Widening Participation- and international social science students at Leeds. Mette is the Widening Participation Officer for the University’s Social Science Cluster where she engages with non traditional students who are exploring and entering higher education. She has taught languages and politics, in Norway and the UK, with guest lectures and conference papers in Egypt, Spain, Portugal, The Netherlands, Norway, UK and USA. Mette has also given papers at teaching and learning conferences in the UK on intercultural communication, on student lead discussion groups and on how to engage with students and teach the undergraduate dissertation. -

Swiss Political System Introduction

SWIss POLITICAL SYSTEM INTRODUCTION Switzerland is a small country in Western roots date back to 1291, whereas the Europe with 7.8 million inhabitants. With modern nation state was founded in 1848. its 41,285 square kilometres, Switzerland Switzerland’s population is 1.5 % of Europe; accounts for only 0.15 % of the world’s total however, the country is economically com- surface area. It borders Germany in the paratively strong. north, Austria and Liechtenstein in the east, Italy in the south and France in the west. The population is diverse by language as well as by religious affiliation. Its historical FEDERAL SYSTEM Switzerland is a federation; the territory is divided into 26 cantons. The cantons themselves are the aggregate of 2,600 municipalities (cities and villages). ELECTIONS AND The political system is strongly influenced by DIRECT DEMOCRACY direct participation of the people. In addition to the participation in elections, referenda and ini- tiatives are the key elements of Switzerland’s well-established tradition of direct democracy. CONSENSUS The consensus type democracy is a third char- DEMOCRACY acteristic of Swiss political system. The institu- tions are designed to represent cultural diver- sity and to include all major political parties in a grand-coalition government. This leads to a non- concentration of power in any one hand but the diffusion of power among many actors. COMPARATIVE After the elaboration of these three important PERSPECTIVES elements of the Swiss political system, a com- parative perspective shall exemplify the main differences of the system vis-à-vis other western democracies CONTENTS PUBliCATION DaTA 2 FEDERAL SYSTEM Switzerland is a federal state with three ■■ The decentralised division of powers is political levels: the federal govern- also mirrored in the fiscal federal structure ment, the 26 cantons and around 2,600 giving the cantonal and municipal level own municipalities. -

Elderly/Disabled People Care Ecosystem and Welfare Technologies in Norway

Project Better social policy of town through „SeniorSiTy“ platform Elderly/Disabled people care ecosystem and welfare technologies in Norway 15.6.2020 This project is implemented with support from the European Social Fund under the Operational Program Effective Public Administration Elderly/Disabled people care ecosystem and welfare technologies in Norway Trondheim 15.06.2020 International Development Norway 1 Contents Part 1 – The Norwegian Health Care System with a focus on municipal health care for elderly sick . 3 Introduction ....................................................................................................................... 3 The Norwegian elderly care in a historical and international welfare context ......................... 3 Municipal elderly care organization in Norway .................................................................... 5 Who cares and where in the elderly care sector in Norway .................................................. 6 The new “elderly wave” as a welfare challenge ................................................................... 8 The changing welfare state and elderly care in Norway ....................................................... 8 Concluding thoughts ........................................................................................................ 12 References ...................................................................................................................... 13 Part 2 - Technologies in care for older people in Norway ...................................................... -

Pandemic Populism”: the COVID-19 Crisis and Anti-Hygienic Mobilisation of the Far-Right

social sciences $€ £ ¥ Article The “New Normal” and “Pandemic Populism”: The COVID-19 Crisis and Anti-Hygienic Mobilisation of the Far-Right Ulrike M. Vieten School of Social Sciences, Education and Social Work, Queen’s University Belfast, Belfast BT7 1NN, UK; [email protected] Received: 30 June 2020; Accepted: 15 September 2020; Published: 22 September 2020 Abstract: The paper is meant as a timely intervention into current debates on the impact of the global pandemic on the rise of global far-right populism and contributes to scholarly thinking about the normalisation of the global far-right. While approaching the tension between national political elites and (far-right) populist narratives of representing “the people”, the paper focuses on the populist effects of the “new normal” in spatial national governance. Though some aspects of public normality of our 21st century urban, cosmopolitan and consumer lifestyle have been disrupted with the pandemic curfew, the underlying gendered, racialised and classed structural inequalities and violence have been kept in place: they are not contested by the so-called “hygienic demonstrations”. A digital pandemic populism during lockdown might have pushed further the mobilisation of the far right, also on the streets. Keywords: far-right populism; structural violence; national elites; normalisation; COVID-19; “anti-hygienic” demonstrations in Germany 1. Introduction1 In 1953, Hannah Arendt argued that the subject of a totalitarian state is the individual, who cannot distinguish between fact and fiction and, in consequence, the totalitarian threat could be witnessed to the degree to which the individuals’ capacity of differentiating true from false information is undermined (Arendt 1953). -

5 Populist Parties in Poland

A University of Sussex DPhil thesis Available online via Sussex Research Online: http://sro.sussex.ac.uk/ This thesis is protected by copyright which belongs to the author. This thesis cannot be reproduced or quoted extensively from without first obtaining permission in writing from the Author The content must not be changed in any way or sold commercially in any format or medium without the formal permission of the Author When referring to this work, full bibliographic details including the author, title, awarding institution and date of the thesis must be given Please visit Sussex Research Online for more information and further details Supply and Demand Identifying Populist Parties in Europe and Explaining their Electoral Performance Stijn Theodoor van Kessel University of Sussex Thesis submitted for the degree of Doctor of Philosophy July, 2011 ii I hereby declare that this thesis has not been and will not be, submitted in whole or in part to another University for the award of any other degree. Signature: iii Contents List of Tables and Figures v List of Abbreviations viii Acknowledgements x Summary xii 1 Introduction 1 1.1 Setting the Scene 1 1.2 State of the Art: The Problems of Populism 4 1.3 Defining and Identifying Populist Parties 12 1.4 Explaining the Electoral Performance of Populist Parties 19 1.5 Research Design and Methodology 31 2 Populist Parties and their Credibility in 31 European Countries 38 2.1 Introduction 38 2.2 The Populist Parties and their Credibility 41 2.3 Conclusion 80 3 Paths to Populist Electoral Success -

Parental Leave, Childcare and Gender Equality in the Nordic Countries Equality in the Nordic Countries

TemaNord 2011:562 TemaNord Ved Stranden 18 DK-1061 Copenhagen K www.norden.org Parental leave, childcare and gender Parental leave, childcare and gender equality in the Nordic countries equality in the Nordic countries The Nordic countries are often seen as pioneers in the area of gender equality. It is true that the position of women in Nordic societies is generally stronger than in the rest of the world. There is an explicit drive in most – or perhaps all – areas of society to promote and strengthen equality between women and men. In recent years, some significant changes have occurred on the family front, where men now assume a greater share of childcare, household work and other tasks that used to be primarily women’s domain. Occasionally, we hear questions in the context of public debate as to whether the investments we have made to ensure equal opportunities, rights and obligations for women and men have in fact occurred at the expense of children. This concerns particularly the expansion of child- care and the system of shared parental leave. This book addresses some of these questions through an overview of political and policy developments in Nordic parental leave and childcare. In addition, the book descri- bes research on the situation of Nordic children and their wellbeing as viewed through international comparisons. This book is the outcome of a joint-Nordic project coor- dinated by editors Guðný Björk Eydal and Ingólfur V. Gíslason. Its other contributors are Berit Brandth, Ann-Zofie Duvander, Johanna Lammi-Taskula and Tine Rostgaard. TemaNord 2011:562 ISBN 978-92-893-2278-2 TN2011562 omslag.indd 1 24-10-2011 08:38:39 Parental leave, childcare and gender equality in the Nordic countries Ingólfur V.