Investor Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Canadian Credit Card Fees Class Action National Settlement Agreement

CANADIAN CREDIT CARD FEES CLASS ACTION NATIONAL SETTLEMENT AGREEMENT Made on October 28, 2020 (the “Execution Date”) Amended on January 22, 2021 Between COBURN AND WATSON’S METROPOLITAN HOME DBA METROPOLITAN HOME (“Metropolitan Home”) AND MAYNARD’S SOUTHLANDS STABLES LTD., HELLO BABY EQUIPMENT INC., JONATHON BANCROFT-SNELL, 1739793 ONTARIO INC., 9085-4886 QUEBEC INC., PETER BAKOPANOS, MACARONIES HAIR CLUB AND LASER CENTER INC. OPERATING AS FUZE SALON and BANK OF MONTREAL (“BMO”), THE BANK OF NOVA SCOTIA (“BNS”), CANADIAN IMPERIAL BANK OF COMMERCE (“CIBC”) ROYAL BANK OF CANADA (“RBC”), AND THE TORONTO-DOMINION BANK (“TD”) {11005-001/00789904.2} - i - TABLE OF CONTENTS RECITALS ......................................................................................................................................1 SECTION 1 - DEFINITIONS .........................................................................................................4 SECTION 2 - SETTLEMENT APPROVAL ................................................................................21 2.1 Best Efforts ...............................................................................................................21 2.2 Motions Certifying or Authorizing the Canadian Proceedings and for Approvals ..21 2.3 Agreement on Form of Orders .................................................................................23 2.4 Pre-Motion Confidentiality ......................................................................................23 2.5 Sequence of Motions ................................................................................................24 -

2020 Public Accountability Statement

2020 PUBLIC ACCOUNTABILITY STATEMENT ABOUT CORPORATE SMALL ACCESS TO NUMBER OF DEBT TAXES BRANCH THIS REPORT DONATIONS & BUSINESS FINANCIAL EMPLOYEES FINANCING OPENINGS, PHILANTHROPIC BANKING SERVICES IN CANADA CLOSINGS & ACTIVITY RELOCATIONS What’s Inside 2 About this Report 17 Number of Employees in Canada 3 Corporate Donations & Philanthropic Activity 18 Debt Financing 9 Small Business Banking 20 Taxes 11 Access to Financial Services 21 Branch Openings, Closings & Relocations About this Report Scope of Reporting About Scotiabank This Public Accountability Statement includes Scotiabank is a leading bank in the Americas. information from November 1, 2019 to Guided by our purpose: “for every future”, we help October 31, 2020, for the following affiliates our customers, their families and their communities of Scotiabank in Canada: Scotia Capital Inc., achieve success through a broad range of advice, National Trust Company, Scotia Mortgage products and services, including personal and Corporation, Scotia General Insurance Company, commercial banking, wealth management and ADS Canadian Bank, Montreal Trust Company private banking, corporate and investment banking, of Canada, Scotia Life Insurance Company, and capital markets. With a team of over 90,000 The Bank of Nova Scotia Trust Company, employees and assets of approximately $1.1 trillion Scotia Dealer Advantage Inc., Roynat Inc., (as at October 31, 2020), Scotiabank trades on the MD Private Trust Company, and MD Life Insurance Toronto Stock Exchange (TSX: BNS) and New York Company. These affiliates are finance entities or Stock Exchange (NYSE: BNS). For more information, financial institution subsidiaries of Scotiabank please visit scotiabank.com and follow us on Twitter operating in Canada that have less than $1 billion @ScotiabankViews. -

Q1 2021 Open Text Corp Earnings Call on November 05, 2020 / 10

REFINITIV STREETEVENTS EDITED TRANSCRIPT OTEX.TO - Q1 2021 Open Text Corp Earnings Call EVENT DATE/TIME: NOVEMBER 05, 2020 / 10:00PM GMT REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2020 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. NOVEMBER 05, 2020 / 10:00PM, OTEX.TO - Q1 2021 Open Text Corp Earnings Call CORPORATE PARTICIPANTS Harry Edward Blount Open Text Corporation - Senior VP & Global Head of IR Madhu Ranganathan Open Text Corporation - Executive VP & CFO Mark J. Barrenechea Open Text Corporation - Vice Chairman, CEO & CTO CONFERENCE CALL PARTICIPANTS Frank Joseph Surace Barclays Bank PLC, Research Division - Research Analyst Paul Steep Scotiabank Global Banking and Markets, Research Division - Analyst Paul Michael Treiber RBC Capital Markets, Research Division - Director of Canadian Technology & Analyst Richard Tse National Bank Financial, Inc., Research Division - MD & Technology Analyst Stephanie Doris Price CIBC Capital Markets, Research Division - Director of Institutional Equity Research and Software & Business Services Research Analyst Thanos Moschopoulos BMO Capital Markets Equity Research - VP & Analyst PRESENTATION Operator Thank you for standing by. This is the conference operator. Welcome to the OpenText Corporation First Quarter Fiscal 2021 Conference Call. (Operator Instructions) And the conference is being recorded. (Operator Instructions) I would like to turn the conference over to Mr. Harry Blount, Senior Vice President, Investor Relations. Please go ahead, sir. Harry Edward Blount - Open Text Corporation - Senior VP & Global Head of IR Thank you, operator, and good afternoon, everyone. -

Terms and Conditions for Correspondent Banks

Terms and Conditions for Correspondent Banks THE BANK OF NOVA SCOTIA Trade Services & Financial Institutions GLOBAL TRANSACTION BANKING 100 Yonge Street – 9th Floor Toronto, Ontario, Canada M5C 2W1 SWIFT: NOSCCATT Fax: (416) 933-7467 E-mail: [email protected] www.scotiabank.com/corrbkg Effective March 1, 2010 PAYMENTS (in any currency – to all points) To a bank as ultimate beneficiary Charges subject to account analysis To a non-bank beneficiary (Commercial) - as per your instructions (BEN / OUR) $10 flat charge CANADIAN TIME ZONES Pacific Time Mountain Time Central Time Eastern Time Atlantic Time Newfoundland Standard Time 9:00 10:00 11:00 12 1:00 1:30 AM AM AM Noon PM PM Yukon NorthwestTerritories Labrador Saskatchewan British Quebec Columbia Alberta Manitoba Prince Edward Island Ontario New Brunswick Nova Scotia In Canada Canadian dollar payments to Scotiabank, its branches, beneficiaries and other Canadian banks, branches and beneficiaries are guaranteed same day value if the S.W.I.F.T. payment (MT202/MT103) is received prior to 1700 hours Toronto time, subject to meeting risk controls associated with the payments process. Instructions are to be directed to Global Wholesale Services, Toronto (GWS) and S.W.I.F.T. is our preferred method (NOSCCATT). Payments made outside Canada or payments in U.S. dollars and other currencies are subject to a 1530 cut-off time, however, those received after 1530 ET and before 1630 are normally expedited with same day value but we cannot guarantee same. Outside Canada Instructions covering payment to a beneficiary outside Canada will be effected on receipt for value in accordance with conditions prevailing at the beneficiary's place of domicile. -

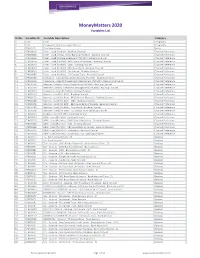

Moneymatters 2020 Variables List

MoneyMatters 2020 Variables List Order Variable ID Variable Description Category 0 CODE Code Geography 0 GEO Geographic Summarization Indicator Geography 1 CBASHHD Total Households Basics 2 CFM0001B Teller - Used [Pst Mth] - Banking Channel Channel Preference 3 CFM0002B Teller - Used for Day to Day Banking [Pst Mth] - Banking Channel Channel Preference 4 CFM0003B Teller - Used to Make Investment [Pst Mth] - Banking Channel Channel Preference 5 CFM0004B Teller - Used [Pst Mth] - BMO Bank of Montreal - Banking Channel Channel Preference 6 CFM0005B Teller - Used [Pst Mth] - CIBC - Banking Channel Channel Preference 7 CFM0006B Teller - Used [Pst Mth] - RBC Royal Bank - Banking Channel Channel Preference 8 CFM0007B Teller - Used [Pst Mth] - Scotiabank - Banking Channel Channel Preference 9 CFM0008B Teller - Used [Pst Mth] - TD Canada Trust - Banking Channel Channel Preference 10 CFM0010B Telephone - Used for Day to Day Banking [Pst Mth] - Banking Channel Channel Preference 11 CFM0011B Telephone - Used for Investment Management [Pst Mth] - Banking Channel (!) Channel Preference 12 CFM0013B Internet - Used for Day to Day Banking [Pst Mth] - Banking Channel Channel Preference 13 CFM0014B Internet - Used for Investment Management [Pst Mth] - Banking Channel Channel Preference 14 CFM0009B Telephone - Used [Pst Mth] - Banking Channel Channel Preference 15 CFM0012B Internet - Used [Pst Mth] - Banking Channel Channel Preference 16 CFM0015B Internet - Used [Pst Mth] - BMO Bank of Montreal - Banking Channel Channel Preference 17 CFM0016B Internet - -

Audited Annual Financial Statements for the Year Ended December 31, 2018

Audited Annual Financial Statements For the year ended December 31, 2018 Tangerine Balanced Portfolio Tangerine Balanced Portfolio Audited Annual Financial Statements for the year ended December 31, 2018 (In Canadian dollars, unless otherwise indicated) Independent Auditors’ Report To the Unitholders of Tangerine Balanced Portfolio (the “Fund”) Opinion We have audited the financial statements of the Fund, which comprise the statements of financial position as at December 31, 2018 and 2017, and the statements of comprehensive income, statements of changes in net assets attributable to holders of redeemable units and statements of cash flows for the years then ended, and notes to the financial statements, including a summary of significant accounting policies. In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Fund as at December 31, 2018 and 2017, and its financial performance and its cash flows for the years then ended in accordance with International Financial Reporting Standards (IFRSs). Basis for Opinion We conducted our audit in accordance with Canadian generally accepted auditing standards. Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are independent of the Fund in accordance with the ethical requirements that are relevant to our audit of the financial statements in Canada, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. Other Information Management is responsible for the other information. -

Venue Rental & Technical Guide

VENUE RENTAL & TECHNICAL GUIDE 1 TORONTO AS A MARKET 2 3 WHERE THE WORLD IS WATCHING Toronto boasts a population of 2.8 million with a metropolitan reach of nearly 6 million, making it the largest city in Canada and 4th largest in North America. One quarter of Canada’s total population lives within a 100-mile radius of the Greater Toronto Area (GTA), truly making it the epicenter of our great nation. It has held the title of “most diverse city in the world” with 53% of Torontonians having been born outside of Canada and over 180 languages and dialects spoken in the core of Toronto alone. 4 5 WHEN YOU PERFORM IN TORONTO, YOU TRULY ARE ON A WORLD STAGE. Not only do we have a lot people, we attract a lot of people. As the #1 tourist destination in the country, 25 million visitors annually come north to see what the hype is all about - and rarely leave unsatisfied. Our friendly reputation, high standard of living and safe atmosphere, makes us an ideal stop for your journey. And you can be sure that we’ll be more than happy to have you. I love the people – all kinds, from everywhere. I don’t know what the word is – cosmopolitan or “multicultural. You can do one thing one day and the next day you’re doing something totally different. “ The city is beautiful, clean. It’s a city, but it’s not crazy. There’s just something about it. Until you come here and kind of get the sense of living here, I don’t think people understand. -

September 9, 2020 / 10:10AM, Bank of Montreal at Scotiabank Financials Summit

September 9, 2020 / 10:10AM, Bank of Montreal at Scotiabank Financials Summit Bank of Montreal at Scotiabank Financials Summit September 9, 2020 CORPORATE PARTICIPANTS Caution Regarding Forward-Looking Statements Darryl White Bank of Montreal’s public communications often include written or oral forward-looking statements. Statements of this type are included in this document, and may be included in other filings with Canadian securities regulators or the U.S. Securities CEO and Exchange Commission, or in other communications. All such statements are made pursuant to the “safe harbor” provisions of,Q4 and 20are 17intended CONFERENCE to be forward-looking CALL statements under, the United States Private Securities Litigation Reform Act of 1995 and any applicable Canadian securities legislation. Forward-looking statements in this document may include, but are not limited to, statements with respect to our objectives and priorities for fiscal 2020 and beyond, our strategies or future CONFERENCE HOST actions, our targets, expectations for our financial condition or share price, the regulatory environment in which we operate and the results of or outlook for our operations or for the Canadian, U.S. and international economies, our response to Meny Grauman the COVID-19 pandemic and its expected impact on our business, operations, earnings, results and financial performance and condition, including our regulatory capital and liquidity ratios and credit ratings, as well as its impact on our customers, Scotiabank Global Banking and Markets competitors, -

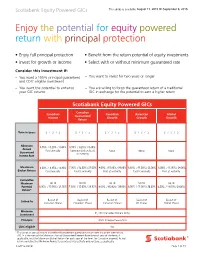

Enjoy the Potential for Equity Powered Return with Principal Protection

Scotiabank Equity Powered GICs This series is available Enjoy the potential for equity powered return with principal protection • Enjoy full principal protection • Benefit from the return potential of equity investments • Invest for growth or income • Select with or without minimum guaranteed rate Consider this investment if: – You want a 100% principal guaranteed – You want to invest for two years or longer and CDIC eligible investment – You want the potential to enhance – You are willing to forgo the guaranteed return of a traditional your GIC returns GIC in exchange for the potential to earn a higher return Scotiabank Equity Powered GICs Canadian Canadian Canadian American Global Guaranteed Income Growth Growth Growth Return Term in years 2 / 3 / 5 2 / 3 / 5 2 / 3 / 5 2 / 3 / 5 2 / 3 / 5 Minimum / / / / Annual Paid annually Compounded and paid None None None Guaranteed at maturity Interest Rate Maximum / / / / / / / / / / Basket Return Paid annually Paid at maturity Paid at maturity Paid at maturity Paid at maturity Cumulative Maximum Up to Up to Up to Up to Up to Potential / / / / / / / / / / Return* Basket of Basket of Basket of Basket of Basket of Linked to Canadian Shares Canadian Shares Canadian Shares US Shares Global Shares Minimum $1,000 (Canadian Dollars Only) investment Principal 100% Principal Guarantee CDIC eligible Yes * This is not an annual return but rather the maximum cumulative return over the entire term of the GIC. It is the sum of the Minimum Annual Guaranteed Interest Rate for each year of the term, if applicable, and the Maximum Basket Return (for each year of the term, for Canadian Income). -

Featured in This Report Midday Market Performance Update

SCOTIA WEALTH MANAGEMENT Midday Update January 25, 2021 Featured in this report Midday market performance update Canadian equities: U.S. equities: International equities: Market summary Market summary Market summary Companies in the news: T-CA Companies in the news: KMB, MRNA Company in the news: PHG Midday market performance update Intraday returns S&P 500 NASDAQ S&P/TSX Index Stoxx Europe 600 Nikkei 225 Shanghai Comp 3,831 13,586 17,820 405 28,822 3,624 -0.3% 0.3% -0.1% -0.8% 0.7% 0.5% Canada 10-year yield U.S. 10-year yield 0.81% 1.04% Low High Low High 0.23 1.43 0.31 1.68 CAD/USD USD (trade-weighted) $0.78 103.1 Low High Low High 0.68 0.79 102.18 117.03 Gold WTI (oil) $1855.07 $52.27 Low High Low High 1451.55 2075.47 27.66 53.94 Bar charts display current values relative to 52-week ranges. SCOTIA WEALTH MANAGEMENT Canadian equities Canadian equities, as measured by the S&P/TSX Composite Index, are S&P/TSX Composite Index Intraday (1:00 PM) Level Pts Chg % Chg trading slightly lower at midday. 17,820 -25.7 -0.1% 19,000 1,000 Six of the index’s eleven sectors are higher, with the Information 850 17,000 Technology sector seeing the largest gains. 700 15,000 550 400 13,000 S&P/TSX biggest movers 250 Last price %∆ 11,000 100 Jan Apr Jul Oct Jan Blackberry Ltd 23.38 30.6% 30.6% Aurinia Pharmaceuticals Inc 23.47 24.4% 24.4% Issues Tfi International Inc 79.37 21.9% 21.9% < Advancing 89 First Majestic Silver Corp 18.63 4.7% 4.7% < Declining 128 < Unchanged 4 Fairfax Financial Holdings Ltd 465.42 3.1% 3.1% Hudbay Minerals Inc 7.99 -7.0% 7.0% Index stats: < 1-yr return 1.4% Seven Generations Energy Ltd 6.50 -6.2% 6.2% < P/E 26.1x < Dividend yield 3.0% Vermilion Energy Inc 6.38 -5.8% 5.8% Air Canada 20.88 -5.5% 5.5% First Quantum Minerals Ltd 22.38 -4.9% 4.9% In corporate news: Telus Corp. -

Scotiabank Canadian Growth Fund

Scotiabank Canadian Growth Fund November 2016 Investment Objective Portfolio Manager The investment objective of the Fund is to provide shareholders with capital appreciation over the 1832 Asset Management L.P. in Canada long term. manages over US$66 billion (as of December 31, 2015) in assets for mutual fee-based Reason for Investing accounts. 1832 Asset Management L.P. is a • A classic Canadian equity fund that provides clients with broad exposure to blue chip limited partnership, the general partner of Canadian equities from diverse economic sectors which is wholly owned by Scotiabank. • The portfolio manager seeks higher quality investments while aiming for benchmark Fund Facts: outperformance and capital preservation Net Asset Value^ US$2.6369 • Provides access to the experience and expertise of professional Investment Manager 1832 Fund Assets US$40.8 million Asset Management LP Benchmark S&P/TSX Composite Index Annualized Compound % Return^ Calendar Year % Return^ Management Fee 2.00% % % Inception Date August 31, 1994 20.0 15.0 65.0 12.58 47.04 Class A Class NU 40.0 SBF 105 SBF 105NU 10.0 28.14 Fund Code 5.86 5.02 15.14 15.80 Bloomberg Code SCBCNGR:KY SCBCNNU:KY 15.0 7.22 8.12 5.0 2.91 3.54 Class AC Class NC 0.0 -10.0 -2.91 0.00 SBF 105AC SBF 105NC -0.09 -0.78 -14.41 Fund Code -5.0 -35.0 -22.71 Bloomberg Code SBCGCAC:KY SBCGCNC:KY -5.09 -44.87 -10.0 -60.0 Class IU Class IC SBF 105IU SBF 105IC -15.0 -85.0 Fund Code 1 Mo 3 Mo 6 Mo YTD 1 Yr 3 Yr 5 Yr 10 Yr Since 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Inc. -

Canada How to Obtain a Guaranteed Investment Certificate (GIC) ______Acceptable Financial Institutions in India

___________________________________ IMMIGRATION Table of Contents Document Checklist – Student Partners Program Canada How to obtain a Guaranteed Investment Certificate (GIC) ___________________________________ Acceptable Financial Institutions in India Study Permit Study Permit Questionnaire Student Partner’s Program Visa Office Instructions for: Bengaluru (Bangalore), Chandigarh, New Delhi This application is made available free by Citizenship and Immigration Canada and is not to be sold to applicants. Cette trousse est également disponible en français IMM 5961 E (11-2015) STUDENT PARTNERS PROGRAM (SPP) IN INDIA The Student Partners Program (SPP) is an administrative framework designed and implemented in partnership between the Canadian visa offices in India and Colleges and Institutes Canada (CICan). The current list of participating CICan members is the following: 1. Algonquin College 2. Assiniboine Community College 3. Bow Valley College 4. Cambrian College of Applied Arts & Technology 5. Camosun College 6. Canadore College 7. Centennial College of Applied Arts & Technology 8. College of New Caledonia 9. College of the Rockies 10. Columbia College 11. Conestoga College 12. Confederation College of Applied Arts & Technology 13. Douglas College 14. Durham College 15. Fanshawe College of Applied Arts & Technology 16. Fleming College 17. George Brown College 18. Georgian College of Arts & Technology 19. Humber College Institute of Technology & Advanced Learning 20. Kwantlen Polytechnic University 21. Lakeland College 22. Langara College 23. Lambton College of Applied Arts & Technology 24. LaSalle College 25. Loyalist College of Applied Arts & Technology 26. Manitoba Institute of Trades & Technology 27. Medicine Hat College 28. Mohawk College of Applied Arts & Technology 29. Niagara College 30. North Island College 31. Northern Alberta Institute of Technology 32.