Private Equity

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Uila Supported Apps

Uila Supported Applications and Protocols updated Oct 2020 Application/Protocol Name Full Description 01net.com 01net website, a French high-tech news site. 050 plus is a Japanese embedded smartphone application dedicated to 050 plus audio-conferencing. 0zz0.com 0zz0 is an online solution to store, send and share files 10050.net China Railcom group web portal. This protocol plug-in classifies the http traffic to the host 10086.cn. It also 10086.cn classifies the ssl traffic to the Common Name 10086.cn. 104.com Web site dedicated to job research. 1111.com.tw Website dedicated to job research in Taiwan. 114la.com Chinese web portal operated by YLMF Computer Technology Co. Chinese cloud storing system of the 115 website. It is operated by YLMF 115.com Computer Technology Co. 118114.cn Chinese booking and reservation portal. 11st.co.kr Korean shopping website 11st. It is operated by SK Planet Co. 1337x.org Bittorrent tracker search engine 139mail 139mail is a chinese webmail powered by China Mobile. 15min.lt Lithuanian news portal Chinese web portal 163. It is operated by NetEase, a company which 163.com pioneered the development of Internet in China. 17173.com Website distributing Chinese games. 17u.com Chinese online travel booking website. 20 minutes is a free, daily newspaper available in France, Spain and 20minutes Switzerland. This plugin classifies websites. 24h.com.vn Vietnamese news portal 24ora.com Aruban news portal 24sata.hr Croatian news portal 24SevenOffice 24SevenOffice is a web-based Enterprise resource planning (ERP) systems. 24ur.com Slovenian news portal 2ch.net Japanese adult videos web site 2Shared 2shared is an online space for sharing and storage. -

Content Remains King, but Youtube Builds the Throne of the Future Content Creation May Have the Lowest of All Barriers to Entry

Sector Bulletin_ Digital Media and Internet Technology_ March 2014_ Content Remains King, but YouTube Builds the Throne of the Future Content creation may have the lowest of all barriers to entry. Anyone with access to a smartphone and wi-fi can create and distribute endless GBs of content. However, replicating this process at scale, demonstrating audience reach, authentication and measurement and then syndicating this content, that same list of creators contracts to a few. Fewer still are the options available to a producer to reach a mass audience in today’s increasingly fragmented, device agnostic world. Available platform alternatives include obtaining distribution with a major cable television or satellite operator, partnering with an over the top (OTT) provider such as Netflix, Hulu or Amazon, or joining one of thousands of multi-channel networks on YouTube . Distribution Alternatives National Cable Distribution Nirvana for any producer or content creator is signing a distribution agreement with a cable, telco or satellite provider. In October 2013, music mogul Sean Combs launched Revolt TV, filling the void of music television left by MTV. Revolt launched on both Comcast and Time Warner Cable to 25 million subscribers. It is rare for a new, non-repurposed cable channel to obtain national distribution. In addition to Combs’ celebrity (he produced a number of hit shows for MTV in the 2000s), the fledgling network looks to rely upon a strong online and social presence. The hope is the latter could help mitigate the cable TV boogieman of “cord cutting” or removal of cable service for other online or OTT alternatives. -

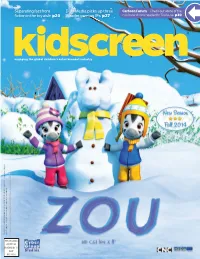

Separating Fact from Fiction in the Toy Aisle P20 Defy Media Picks up Three

Separating fact from Defy Media picks up three Cartoon Forum—Check out some of the fi ction in the toy aisle p20 Viacom gaming IPs p27 cool new shows headed to Toulouse p30 engaging the global children’s entertainment industry JULY/AUGUST 2014 US$7.95 in the U.S. CA$8.95 in Canada US$9.95 outside of & the U.S. in the U.S. US$7.95 CANADA POST AGREEMENT NUMBER 40050265 PRINTED IN CANADA USPS AFSM 100 Approved Polywrap CANADA POST AGREEMENT NUMBER 40050265 PRINTED IN USPS AFSM 100 Approved A publication of Brunico Communications Ltd. KS.24815.CyberGroup_soldCover.indd 1 2014-07-16 5:22 PM Everyday Moments Matter ™ & © 2014 Children’s Network, LLC. All rights reserved. FOR MORE INFORMATION, PLEASE CONTACT: Licensing: Cindy Chang 818-777-2067 or Tricia Chaves 818-777-2440 Digital Licensing: Bill Kispert 818-777-5446 Retail: Jamie Stevens 818-777-6716 BIG TENT ENTERTAINMENT: Scott Devine 940-594-3090 KS.24074.BigTent.indd 1 2014-07-16 4:28 PM engaging the global children’s entertainment industry JULY/AUGUST 2014 Ahoy! A boatload of promising projects lie straight ahead at Cartoon Forum 2014 003KS_July14Cover.indd 1 2014-07-17 2:58 PM EXPLORING NEW HORIZONS IN KIDS ENTERTAINMENT February 23-26, 2015 InterContinental Miami REGISTRATION IS NOW OPEN! The biggest event in kids entertainment is moving to Miami next year and will take place from February 23-26. We’re looking forward to this fresh start, and we hope you join us in our sunny new location for four days of can’t-miss networking, deal-making and market intelligence—it’s the best business investment you’ll make in 2015. -

Exhibit Redacted -For Public Inspection

EXHIBIT REDACTED -FOR PUBLIC INSPECTION Statement of Dr. Fiona Scott Morton re the Merger of Charter, TWC,and BHN November 2, 2015 REDACTED —FOR PUBLIC INSPECTION I. Qualifications, Assignment, and Summary of Opinion .........................................................................4 II. Comments and Responses ....................................................................................................................5 A. Comments with General Concerns not Related to the Merger ........................................................5 1. Substitutes for Cable Broadband ..................................................................................................5 2. Bundling Discount .........................................................................................................................5 3. Local Bargaining Power .................................................................................................................6 4. The Economics of Incentives to Support or Foreclose OVDs ........................................................6 B. Comments with Merger-Specific Concerns.......................................................................................7 1. Increased Concentration in a National Broadband Market ..........................................................7 2. Reduced Future Competition in N Anywhere .............................................................................8 3. Potential Foreclosure of Sling N ..................................................................................................9 -

Mládež a Fenomén Youtube

Mládež a fenomén YouTube Alena Lužová Bakalářská práce 2019 ABSTRAKT Tato bakalářská práce se zabývá problematikou mládeţe a platformou YouTube. Je členě- na na teoretickou a praktickou část. Teoretická část vysvětluje mládeţ z pohledu vývojové psychologie, také popisuje socializaci a její základní části a nakonec samotné YouTube, které se za poslední dobu stalo opravdu populární. Praktická část se věnuje výzkumnému šetření, které bylo provedeno metodou dotazníku. Šetření zjišťovalo frekvenci sledovanosti YouTube mládeţí, natáčení videí na YouTube mládeţí, také jakého YouTubera mládeţ povaţuje za svého oblíbence a v neposlední řadě v jakých konkrétních oblastech je YouTuber inspiruje. Klíčová slova: YouTube, YouTuber, mládeţ, socializace, fenomén ABSTRACT This bachelor thesis deals with the issue of youth and the YouTube platform. It is divided into a theoretical and a practical part. The theoretical part explains youth from the perspec- tive of developmental psychology, also describes socialization and its basic division. Final- ly, the theoretical part will define the phenomenon, which has recently become vastly pop- ular - YouTube itself. The practical part is based on a research, the data were acquired by a questionnaire designed by the author of this thesis. The survey explores the rate at which the youth watches YouTube, the frequency of posting YouTube video footages, and what YouTuber youth consider to be their favourite channel or influencer. Last but not least, this survey focused on the question concerning the areas in which today's Youtubers inspire young people the most. Keywords: YouTube, YouTuber, youths, socialization, trend OBSAH ÚVOD .............................................................................................................................. 9 I TEORETICKÁ ČÁST ............................................................................................... 10 1 MLÁDEŢ Z POHLEDU VÝVOJOVÉ PSYCHOLOGIE .................................. 11 2 SOCIALIZACE JAKO CELOŢIVOTNÍ PROCES .......................................... -

Primary & Secondary Sources

Primary & Secondary Sources Brands & Products Agencies & Clients Media & Content Influencers & Licensees Organizations & Associations Government & Education Research & Data Multicultural Media Forecast 2019: Primary & Secondary Sources COPYRIGHT U.S. Multicultural Media Forecast 2019 Exclusive market research & strategic intelligence from PQ Media – Intelligent data for smarter business decisions In partnership with the Alliance for Inclusive and Multicultural Marketing at the Association of National Advertisers Co-authored at PQM by: Patrick Quinn – President & CEO Leo Kivijarv, PhD – EVP & Research Director Editorial Support at AIMM by: Bill Duggan – Group Executive Vice President, ANA Claudine Waite – Director, Content Marketing, Committees & Conferences, ANA Carlos Santiago – President & Chief Strategist, Santiago Solutions Group Except by express prior written permission from PQ Media LLC or the Association of National Advertisers, no part of this work may be copied or publicly distributed, displayed or disseminated by any means of publication or communication now known or developed hereafter, including in or by any: (i) directory or compilation or other printed publication; (ii) information storage or retrieval system; (iii) electronic device, including any analog or digital visual or audiovisual device or product. PQ Media and the Alliance for Inclusive and Multicultural Marketing at the Association of National Advertisers will protect and defend their copyright and all their other rights in this publication, including under the laws of copyright, misappropriation, trade secrets and unfair competition. All information and data contained in this report is obtained by PQ Media from sources that PQ Media believes to be accurate and reliable. However, errors and omissions in this report may result from human error and malfunctions in electronic conversion and transmission of textual and numeric data. -

Rebooting Youtube | Fast Company | Business + Innovation 8/4/14, 6:01 PM

Rebooting YouTube | Fast Company | Business + Innovation 8/4/14, 6:01 PM Rebooting YouTube When Susan Wojcicki took over YouTube in February, she received almost as much unsolicited advice as there are YouTube videos. One open letter not-so-subtly pleaded with Wojcicki, "So please, I'm begging you, please, please, please, don't f*** it up." "There were lots of letters, public letters," says Wojcicki when we meet in her office in mid-June at YouTube's San Bruno, California, headquarters. "'Open Letter to Susan Wojcicki.' 'Do These Five Things.' There were videos from creators." Even her family got in on the act. "My mom is a high school teacher, so she would tell me, 'Oh, the students liked the video you posted today. Oh, the students didn't like the video that you posted today.' As though I, personally, posted a video!" she says, laughing. Her four kids gave her a YouTube crash course. "I was just starting to get to know a lot of these videos, and they'd be like, 'Oh, no, Mom. That video came out like six months ago.' And then they would go on about the whole backstory of this content and this creator. I didn't know how much time they were spending watching YouTube." The ambush of advice was, she admits in her amiable way, "a little overwhelming." Wojcicki, 46, is a consummate insider--she's Google employee No. 16--and a publicity deflector who isn't used to being in direct communication with a fan base as vocal and passionate as YouTube's. -

How Online Video Platforms Can Deliver Benefits for TV Producers and Broadcasters at Home and Abroad

FRIEND Platform for success: How online video platforms can deliver benefits ORfor TV producers and broadcasters FOE? at home and abroad INTRODUCTION AND SUMMARY HOW LARGE AN OPPORTUNITY OR THREAT ARE ONLINE 3RD PARTY OPEN PLATFORMS? QUESTIONS ADDRESSED IN HOW LARGE AN OPPORTUNITY OR THREAT ARE 3RD PARTY OPEN VIDEO ONLINE VIDEO HAS A LARGE A Growing: 1 PLATFORMS¹? It is well reported that, although small today, 3rd party open video is becoming a larger and THIS REPORT AND GROWING AUDIENCE larger share of overall consumption. In 2013, c.3-4% of all UK video hours were 3rd party HOW CAN PRODUCERS AND BROADCASTERS BENEFIT FROM THE 3RD PARTY open VoD (worth around 9 minutes per person per day – up from 5 minutes in 2010). 2 OPEN VIDEO OPPORTUNITY? Total UK Video Consumption UK Online Video on Demand Viewership YouTube Entertainment Data Minutes per Day per Person Minutes per Day per Person 2013 in this Report 3 WHAT MIGHT THE OUTLOOK BE FOR 3RD PARTY OPEN VIDEO PLATFORMS? Conceptual 255 255 Physical 19 3(1%) 2(1%) (eg DVD / Blu-Ray) Scope of YouTube Data Used in this 5(2%) 5 1 Online video viewership is increasing, diverse and international 9(4%) Online 3rd Party Open Report –c.3bn UK Hours, Plus SUMMARY OF FINDINGS 4(1%) International Online videos (long and shortform) are being watched by an audience that is: 10 (4%) Online Proprietary 18 10 A Growing – in some genres online audiences can now reach 20% of linear (7%) Other Genres B Diverse across demographic groups and genres – with growth supported by new 27 Recorded6 types of content for viewers (11%) 9 C International – the UK is a major exporter of content to both English and non- Top 19 225 Non-UK English speaking countries. -

Entertainment and the Rise of Digital Media in the LA Basin

ENTERTAINMENT AND THE RISE OF DIGITAL MEDIA IN THE LOS ANGELES BASIN An Industry Disrupted January 2018 CCW | 1 Contributions Authors Shannon M Sedgwick Lori Sanchez Senior Economist Director LAEDC Center of Excellence for Labor Market Research Tyler Laferriere Funded by the California Research Analyst Juan Madrigal Community Colleges, LAEDC Assistant Director Chancellor’s Office under Center of Excellence for the Strong Workforce Eric Hayes Labor Market Research Program (SWP) Los Angeles Research Analyst Regional Project under grant LAEDC agreement DO-17-2185-02 awarded to Citrus College, Additional Research Assistance: as the lead college for SWP Round 1. Wendy Disch & Sheri-Anne Vaughans LAEDC Interns Additional Contributions We thank the following for additional contributions made to this report: Wallace Walrod Ph.D. Alma Salazar, Ed.D. Adrian McDonald Chief Economic Advisor Senior Vice President Research Analyst Orange County Business Center for Education FilmLA Council Excellence & Talent Development Scott Porter Lauren McSherry Los Angeles Area Chamber and his team at Writing and Editing of Commerce Ernst & Young CCW | 2 CENTER FOR A COMPETITIVE WORKFORCE Center for a Competitive Workforce, a regional Strong Workforce project, is a partnership of 19 L.A. Region community colleges in the L.A.|O.C. Regional Consortium, LAEDC, Los Angeles Area Chamber of Commerce, and the Center of Excellence for Labor Market Research at Mt. San Antonio College. The Center’s mission is to better align supply and demand data with labor market information, support industry-driven career education and workforce development programs, and strengthen industry engagement across our region’s talent development systems with the goal to train, educate and upskill a more competitive workforce in the LA Basin for the knowledge- intensive industries that will come to dominate our economic future. -

Download This PDF File

Media and Communication (ISSN: 2183-2439) 2016, Volume 4, Issue 3, Pages 131-141 Doi: 10.17645/mac.v4i3.548 Article Not Yet the Post-TV Era: Network and MVPD Adaptation to Emergent Distribution Technologies Mike Van Esler Department of Film and Media Studies, University of Kansas, KS 66044, Lawrence, USA; E-Mail: [email protected] Submitted: 4 January 2016 | Accepted: 29 February 2016 | Published: 14 July 2016 Abstract Television as a medium is in transition. From DVRs, to Netflix, to HBO Now, consumers have never before had such con- trol over how they consume televisual content. The rapid changes to the medium have led to rhetoric heralding the im- pending “post-TV era.” Looking at the ways that legacy television companies have adapted to new technologies and cultural practices suggests that rather than traditional television going the way of radio, television as a medium is actu- ally not terribly different, at least not enough to conclude that we have entered a new era. Press releases, discursive practices by the news media, corporate structures and investments, and audience research all point to the rhetoric of post-TV as being overblown. By thinking about contemporary television as being in transition, greater emphasis and atten- tion can be placed on the role that major media conglomerates play in developing, funding, and legitimizing new forms of television distribution, in addition to co-opting disruptive technologies and business models while hindering others. Keywords convergence; hulu; Netflix; networks; over-the-top; streaming; television Issue This article is part of the issue “(Not Yet) the End of Television”, edited by Milly Buonanno (University of Roma “La Sapienza”, Italy). -

Exploring the Language and Grammar of Video Games

Authored Agency: Exploring the Language and Grammar of Video Games by Allen Kwan A Thesis presented to The University of Guelph In partial fulfilment of requirements for the degree of Doctor of Philosophy in School of English and Theatre Studies Guelph, Ontario, Canada © Allen Kwan, January, 2016 ABSTRACT AUTHORED AGENCY: EXPLORING THE LANGUAGE AND GRAMMAR OF VIDEO GAMES Allen Kwan Advisor: University of Guelph, 2016 Professor Alan Filewod This thesis is an examination of narrative structure of single-player story-driven video games, shifting the focus toward the exploration of their design and methods by which game designers and authors are able to use the language of interactivity in order to convey meaning to a video game player. Although the role of the player is important in examining video game narratives, it is only recently that scholars and critics have begun to examine the role that the game designer has in creating the conditions that allow for meaning to be created in the first place. This thesis examines the narrative structure of video games by exploring the major attempts to define a language of video games and using this criticism to suggest a greater shift toward considering how many moments of interactivity are purposefully designed in order to encourage a specific interpretation of the game’s narrative. The thesis surveys a significant number of video games to help illustrate how player interactivity is specifically authored and uses this survey to provide context for a more in depth discussion of major single-player story-driven video games released in the last few years. -

25JUL201322550356 to Our Shareholders

25JUL201322550356 To Our Shareholders: Fiscal 2016 was a year in which we achieved tremendous operating and strategic momentum as we continued to build one of the largest content platforms in the world and positioned ourselves closer to our consumers. It was a year of organic growth in which our television business significantly increased its scale, diversified its programming and achieved record-breaking results for the third year in a row. We also continued to roll out a suite of over-the-top (“OTT”) platforms for targeted audiences, expanded our nascent location-based entertainment, gaming and virtual reality businesses and deepened a portfolio of brands and franchises that we expect to drive the profitable growth of our film business for years to come. We complemented this internal growth with a number of strategic initiatives culminating in our announcement on June 30th that we entered into an agreement to acquire Starz for $4.4 billion in cash and stock, the largest and potentially most transformative transaction in our Company’s history. We expect the transaction to close by the end of 2016. Combination of Lionsgate & Starz Creates a Global Content Powerhouse Starz President and CEO Chris Albrecht and his team have built a powerful brand and a robust platform. The combination of Lionsgate, a premier next generation content leader, and Starz, a leading integrated media and entertainment company, will create a global powerhouse. The combined entity will generate a tremendous amount of content across all platforms, giving us the scale to compete successfully in today’s fast-changing global marketplace. Our company will encompass approximately 40 films annually, including 14-18 wide releases, and nearly 90 television series on more than 40 networks, enhancing what is already one of the industry’s elite television businesses, all driven by world-class brands and backed by a 16,000- title library.