P:\...\Chlorine Profile 0

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

History of the Chlor-Alkali Industry

2 History of the Chlor-Alkali Industry During the last half of the 19th century, chlorine, used almost exclusively in the textile and paper industry, was made [1] by reacting manganese dioxide with hydrochloric acid 100–110◦C MnO2 + 4HCl −−−−−−→ MnCl2 + Cl2 + 2H2O (1) Recycling of manganese improved the overall process economics, and the process became known as the Weldon process [2]. In the 1860s, the Deacon process, which generated chlorine by direct catalytic oxidation of hydrochloric acid with air according to Eq. (2) was developed [3]. ◦ 450–460 C;CuCl2 cat. 4HCl + O2(air) −−−−−−−−−−−−−−→ 2Cl2 + 2H2O(2) The HCl required for reactions (1) and (2) was available from the manufacture of soda ash by the LeBlanc process [4,5]. H2SO4 + 2NaCl → Na2SO4 + 2HCl (3) Na2SO4 + CaCO3 + 2C → Na2CO3 + CaS + 2CO2 (4) Utilization of HCl from reaction (3) eliminated the major water and air pollution problems of the LeBlanc process and allowed the generation of chlorine. By 1900, the Weldon and Deacon processes generated enough chlorine for the production of about 150,000 tons per year of bleaching powder in England alone [6]. An important discovery during this period was the fact that steel is immune to attack by dry chlorine [7]. This permitted the first commercial production and distribu- tion of dry liquid chlorine by Badische Anilin-und-Soda Fabrik (BASF) of Germany in 1888 [8,9]. This technology, using H2SO4 for drying followed by compression of the gas and condensation by cooling, is much the same as is currently practiced. 17 “chap02” — 2005/5/2 — 09Brie:49 — page 17 — #1 18 CHAPTER 2 In the latter part of the 19th century, the Solvay process for caustic soda began to replace the LeBlanc process. -

Integrated Pollution Prevention and Control (IPPC) Reference Document on Best Available Techniques in the Chlor-Alkali Manufacturing Industry December 2001

EUROPEAN COMMISSION Integrated Pollution Prevention and Control (IPPC) Reference Document on Best Available Techniques in the Chlor-Alkali Manufacturing industry December 2001 Executive summary EXECUTIVE SUMMARY This reference document on best available techniques in the chlor-alkali industry reflects an information exchange carried out according to Article 16(2) of Council Directive 96/61/EC. The document has to be seen in the light of the preface which describes the objectives of the document and its use. The chlor-alkali industry The chlor-alkali industry is the industry that produces chlorine (Cl2) and alkali, sodium hydroxide (NaOH) or potassium hydroxide (KOH), by electrolysis of a salt solution. The main technologies applied for chlor-alkali production are mercury, diaphragm and membrane cell electrolysis, mainly using sodium chloride (NaCl) as feed or to a lesser extent using potassium chloride (KCl) for the production of potassium hydroxide. The diaphragm cell process (Griesheim cell, 1885) and the mercury cell process (Castner- Kellner cell, 1892) were both introduced in the late 1800s. The membrane cell process was developed much more recently (1970). Each of these processes represents a different method of keeping the chlorine produced at the anode separate from the caustic soda and hydrogen produced, directly or indirectly, at the cathode. Currently, 95% of world chlorine production is obtained by the chlor-alkali process. The geographic distribution of chlor-alkali processes world-wide differs appreciably (production capacity of chlorine): - western Europe, predominance of mercury cell process (June 2000): 55% - United States, predominance of diaphragm cell process: 75% - Japan, predominance of membrane cell process: >90% The remaining chlorine production capacity in western Europe consists of (June 2000) diaphragm cell process 22%, membrane cell process 20% and other processes 3%. -

Environmental Protection Agency

Friday, December 19, 2003 Part II Environmental Protection Agency 40 CFR Part 63 National Emission Standards for Hazardous Air Pollutants: Mercury Emissions from Mercury Cell Chlor-Alkali Plants; Final Rule VerDate jul<14>2003 15:14 Dec 18, 2003 Jkt 203001 PO 00000 Frm 00001 Fmt 4717 Sfmt 4717 E:\FR\FM\19DER2.SGM 19DER2 70904 Federal Register / Vol. 68, No. 244 / Friday, December 19, 2003 / Rules and Regulations ENVIRONMENTAL PROTECTION types of sources (usually in the Information or other information whose AGENCY elemental or inorganic forms) transports disclosure is restricted by statute. through the atmosphere and eventually The official public docket is the 40 CFR Part 63 deposits onto land or water bodies. collection of materials that is available [OAR–2002–0017; FRL–7551–5] When mercury is deposited to surface for public viewing. The EPA Docket waters, natural processes (bacterial) can RIN 2060–AE85 Center Public Reading Room is open transform some of the mercury into from 8:30 a.m. to 4:30 p.m., Monday methylmercury that accumulates in fish. through Friday, excluding legal National Emission Standards for Ingestion is the primary exposure route Hazardous Air Pollutants: Mercury holidays. The telephone number for the of interest for methylmercury. The Reading Room is (202) 566–1744, and Emissions From Mercury Cell Chlor- health effect of greatest concern due to Alkali Plants the telephone number for the Air Docket methylmercury is neurotoxicity, is (202) 566–1742. AGENCY: Environmental Protection particularly with respect to fetuses and Agency (EPA). young children. Electronic Docket Access. You may access the final rule electronically ACTION: Final rule. -

Electrolytic Cells

CHEMISTRY LEVEL 4C (CHM415115) ELECTROLYTIC CELLS THEORY SUMMARY & REVISION QUESTIONS (CRITERION 5) ©JAK DENNY Tasmanian TCE Chemistry Revision Guides by Jak Denny are licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License. INDEX: PAGES • INTRODUCTORY THEORY 3 • COMPARING ENERGY CONVERSIONS 4 • APPLICATIONS OF ELECTROLYSIS 4 • ELECTROPLATING 5 • COMPARING CELLS 6 • THE ELECTROCHEMICAL SERIES 7 • PREDICTING ELECTROLYSIS PRODUCTS 8-9 • ELECTROLYSIS PREDICTION FLOWCHART 1 0 • ELECTROLYSIS PREDICTION EXAMPLES 11 • ELECTROLYSIS PREDICTION QUESTIONS 12 • INDUSTRIAL ELECTROLYTIC PROCESSES 13 • IMPORTANT ELECTRICAL THEORY 14 • FARADAY’S ELECTROLYSIS LAWS 15 • QUANTITATIVE ELECTROLYSIS 16 • CELLS IN SERIES 17 • ELECTROLYSIS QUESTIONS 18-20 • ELECTROLYSIS TEST QUESTIONS 21-22 • TEST ANSWERS 23 2 ©JAK CHEMISTRY LEVEL 4C (CHM415115) ELECTROLYTIC CELLS (CRITERION 5) INTRODUCTION: In our recent investigation of electrochemical cells, we encountered spontaneous redox reactions that release electrical energy such as takes place in the familiar situations of “batteries”. When a car battery is ‘flat’ and needs to be recharged, a power supply (‘battery charger’) is connected to the flat battery and chemical changes take place and it is subsequently able to operate again as a power supply. The ‘recharging’ process is non-spontaneous and requires an input of energy to occur. When a cell is such that an energy input is required to make a non-spontaneous redox reaction take place, we describe the cell as an ELECTROLYTIC CELL. The redox process occurring in an ELECTROLYTIC CELL is referred to as ELECTROLYSIS. For example, consider the spontaneous redox reaction associated with an electrochemical (fuel) cell; i.e. 2H2(g) + O2(g) → 2H2O(l) + ELECTRICAL ENERGY This chemical reaction RELEASES energy which can be used to power an electric motor, to drive a machine, appliance or car. -

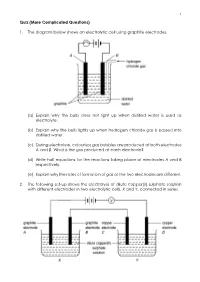

1. the Diagram Below Shows an Electrolytic Cell Using Graphite Electrodes

1 Quiz (More Complicated Questions) 1. The diagram below shows an electrolytic cell using graphite electrodes. (a) Explain why the bulb does not light up when distilled water is used as electrolyte. (b) Explain why the bulb lights up when hydrogen chloride gas is passed into distilled water. (c) During electrolysis, colourless gas bubbles are produced at both electrodes A and B. What is the gas produced at each electrode? (d) Write half equations for the reactions taking place at electrodes A and B respectively. (e) Explain why the rates of formation of gas at the two electrodes are different. 2. The following set-up shows the electrolysis of dilute copper(II) sulphate solution with different electrodes in two electrolytic cells, X and Y, connected in series. 2 (a) (i) Identify the anode and the cathode in electrolytic cell X. (ii) Write the half equation for the reaction taking place at each electrode in electrolytic cell X. (iii) State the expected observable change(s) at each electrode in electrolytic cell X. (b) (i) Identify the anode and the cathode in electrolytic cell Y. (ii) Write the half equation for the reaction taking place at each electrode in electrolytic cell Y. (iii) State the expected observable change(s) at each electrode in electrolytic cell Y. (c) Explain why different products are produced at electrodes A and C. (d) State and explain the change of copper(II) sulphate solution in each electrolytic cell after electrolysis. 3. A microscale experiment is carried out to study the electrolysis of very dilute sodium chloride solution containing some universal indicator. -

Electrochemical Cells

Electrochemical cells = electronic conductor If two different + surrounding electrolytes are used: electrolyte electrode compartment Galvanic cell: electrochemical cell in which electricity is produced as a result of a spontaneous reaction (e.g., batteries, fuel cells, electric fish!) Electrolytic cell: electrochemical cell in which a non-spontaneous reaction is driven by an external source of current Nils Walter: Chem 260 Reactions at electrodes: Half-reactions Redox reactions: Reactions in which electrons are transferred from one species to another +II -II 00+IV -II → E.g., CuS(s) + O2(g) Cu(s) + SO2(g) reduced oxidized Any redox reactions can be expressed as the difference between two reduction half-reactions in which e- are taken up Reduction of Cu2+: Cu2+(aq) + 2e- → Cu(s) Reduction of Zn2+: Zn2+(aq) + 2e- → Zn(s) Difference: Cu2+(aq) + Zn(s) → Cu(s) + Zn2+(aq) - + - → 2+ More complex: MnO4 (aq) + 8H + 5e Mn (aq) + 4H2O(l) Half-reactions are only a formal way of writing a redox reaction Nils Walter: Chem 260 Carrying the concept further Reduction of Cu2+: Cu2+(aq) + 2e- → Cu(s) In general: redox couple Ox/Red, half-reaction Ox + νe- → Red Any reaction can be expressed in redox half-reactions: + - → 2 H (aq) + 2e H2(g, pf) + - → 2 H (aq) + 2e H2(g, pi) → Expansion of gas: H2(g, pi) H2(g, pf) AgCl(s) + e- → Ag(s) + Cl-(aq) Ag+(aq) + e- → Ag(s) Dissolution of a sparingly soluble salt: AgCl(s) → Ag+(aq) + Cl-(aq) − 1 1 Reaction quotients: Q = a − ≈ [Cl ] Q = ≈ Cl + a + [Ag ] Ag Nils Walter: Chem 260 Reactions at electrodes Galvanic cell: -

(Oxy)Hydroxide Electrocatalysts for Water Oxidation Bryan R

www.acsami.org Research Article Effect of Selenium Content on Nickel Sulfoselenide-Derived Nickel (Oxy)hydroxide Electrocatalysts for Water Oxidation Bryan R. Wygant, Anna H. Poterek, James N. Burrow, and C. Buddie Mullins* Cite This: ACS Appl. Mater. Interfaces 2020, 12, 20366−20375 Read Online ACCESS Metrics & More Article Recommendations *sı Supporting Information ABSTRACT: An efficient and inexpensive electrocatalyst for the oxygen evolution reaction (OER) must be found in order to improve the viability of hydrogen fuel production via water electrolysis. Recent work has indicated that nickel chalcogenide materials show promise as electrocatalysts for this reaction and that their performance can be further enhanced with the generation of ternary, bimetallic chalcogenides (i.e., Ni1−aMaX2); however, relatively few studies have investigated ternary chalcogenides created through the addition of a second chalcogen (i.e., NiX2−aYa). To address this, we fi studied a series of Se-modi ed Ni3S2 composites for use as OER electrocatalysts in alkaline solution. We found that the addition of Se results in the creation of Ni3S2/NiSe composites composed of cross-doped metal chalcogenides and show that the addition of 10% Se reduces the overpotential required to reach a current density of 10 mA/cm2 by 40 mV versus a pure nickel sulfide material. Chemical analysis of the composites’ surfaces shows a reduction in the amount of nickel oxide species with Se incorporation, which is supported by transmission electron microscopy; this reduction is correlated with a decrease in the OER overpotentials measured for these samples. Together, our results suggest that the incorporation of Se into Ni3S2 creates a more conductive material with a less-oxidized surface that is more electrocatalytically active and resistant to further oxidation. -

3 PRACTICAL APPLICATION BATTERIES and ELECTROLYSIS Dr

ELECTROCHEMISTRY – 3 PRACTICAL APPLICATION BATTERIES AND ELECTROLYSIS Dr. Sapna Gupta ELECTROCHEMICAL CELLS An electrochemical cell is a system consisting of electrodes that dip into an electrolyte and in which a chemical reaction either uses or generates an electric current. A voltaic or galvanic cell is an electrochemical cell in which a spontaneous reaction generates an electric current. An electrolytic cell is an electrochemical cell in which an electric current drives an otherwise nonspontaneous reaction. Dr. Sapna Gupta/Electrochemistry - Applications 2 GALVANIC CELLS • Galvanic cell - the experimental apparatus for generating electricity through the use of a spontaneous reaction • Electrodes • Anode (oxidation) • Cathode (reduction) • Half-cell - combination of container, electrode and solution • Salt bridge - conducting medium through which the cations and anions can move from one half-cell to the other. • Ion migration • Cations – migrate toward the cathode • Anions – migrate toward the anode • Cell potential (Ecell) – difference in electrical potential between the anode and cathode • Concentration dependent • Temperature dependent • Determined by nature of reactants Dr. Sapna Gupta/Electrochemistry - Applications 3 BATTERIES • A battery is a galvanic cell, or a series of cells connected that can be used to deliver a self-contained source of direct electric current. • Dry Cells and Alkaline Batteries • no fluid components • Zn container in contact with MnO2 and an electrolyte Dr. Sapna Gupta/Electrochemistry - Applications 4 ALKALINE CELL • Common watch batteries − − Anode: Zn(s) + 2OH (aq) Zn(OH)2(s) + 2e − − Cathode: 2MnO2(s) + H2O(l) + 2e Mn2O3(s) + 2OH (aq) This cell performs better under current drain and in cold weather. It isn’t truly “dry” but rather uses an aqueous paste. -

Optimization of Electrolysis Parameters for Green Sanitation Chemicals Production Using Response Surface Methodology

processes Article Optimization of Electrolysis Parameters for Green Sanitation Chemicals Production Using Response Surface Methodology Nurul Izzah Khalid 1 , Nurul Shaqirah Sulaiman 1 , Norashikin Ab Aziz 1,2,* , Farah Saleena Taip 1, Shafreeza Sobri 3 and Nor-Khaizura Mahmud Ab Rashid 4 1 Department of Process and Food Engineering, Faculty of Engineering, Universiti Putra Malaysia, UPM Serdang 43400, Selangor, Malaysia; [email protected] (N.I.K.); [email protected] (N.S.S.); [email protected] (F.S.T.) 2 Halal Products Research Institute, University Putra Malaysia, UPM Serdang 43300, Selangor, Malaysia 3 Department of Chemical and Environmental Engineering, Faculty of Engineering, Universiti Putra Malaysia, UPM Serdang 43400, Selangor, Malaysia; [email protected] 4 Department of Food Science, Faculty of Food Science and Technology, Universiti Putra Malaysia, UPM Serdang 43400, Selangor, Malaysia; [email protected] * Correspondence: [email protected]; Tel.: +603-9769-4302 Received: 22 May 2020; Accepted: 10 June 2020; Published: 6 July 2020 Abstract: Electrolyzed water (EW) shows great potential as a green and economical sanitation solution for the food industry. However, only limited studies have investigated the optimum electrolysis parameters and the bactericidal effect of acidic electrolyzed water (AcEW) and alkaline electrolyzed water (AlEW). Here, the Box–Behnken experimental design was used to identify the optimum parameters. The tests were conducted with different types of electrodes, electrical voltages, electrolysis times, and NaCl concentrations. There were no obvious differences observed in the physico-chemical properties of EW when different electrodes were used. However, stainless steel was chosen as it meets most of the selection criteria. -

The Influence of Sodium Hydroxide Concentration on the Phase, Morphology and Agglomeration of Cobalt Oxide Nanoparticles and Application As Fenton Catalyst

Digest Journal of Nanomaterials and Biostructures Vol.14, No.4, October-December 2019, p. 1131-1137 THE INFLUENCE OF SODIUM HYDROXIDE CONCENTRATION ON THE PHASE, MORPHOLOGY AND AGGLOMERATION OF COBALT OXIDE NANOPARTICLES AND APPLICATION AS FENTON CATALYST E. L. VILJOENa,*, P. M. THABEDEa, M. J. MOLOTOa, K. P. MUBIAYIb, B. W. DIKIZAa aDepartment of Chemistry, Vaal University of Technology Private, Bag X021, Vanderbijlpark 1900, South Africa bSchool of Chemistry, University of the Witwatersrand, 1 Jan Smuts Avenue, Braamfontein Johannesburg 2000, South Africa The concentration of NaOH was varied from 0.2 M to 0.7 M during the preparation of the cobalt oxide/cobalt oxide hydroxide nanoparticles by precipitation and air oxidation. Cubic shaped and less well defined Co3O4 nanoparticles formed at 0.2 M NaOH. An increase in the NaOH concentration increased the number of well-defined cubic shaped nanoparticles. Agglomerated CoO(OH) particles with different shapes formed at the highest NaOH concentration. The cubic shaped Co3O4 nanoparticles were subsequently used as catalyst for the Fenton degradation of methylene blue and it was found that the least agglomerated nanoparticles were the most catalytically active. (Received June 25, 2019; Accepted December 6, 2019) Keywords: Cobalt oxide, Nanoparticles, Precipitation, pH, Fenton reaction 1. Introduction Controlling the size and the shape of nanoparticles using simple, inexpensive precipitation methods without sophisticated capping molecules, remains a challenge. Literature has indicated that the concentration of the base (pH) is an important parameter to control the size, shape and phase of metal oxide nanoparticles. Obodo et al.[1] used chemical bath deposition at atmospheric pressure and 70 °C to precipitate Co3O4 crystallites on a glass substrate and they showed that the crystallite sizes were larger at a higher pH of 12 in comparison to when a pH of 10 was used. -

SODIUM HYDROXIDE @Lye, Limewater, Lyewater@

Oregon Department of Human Services Office of Environmental Public Health (503) 731-4030 Emergency 800 NE Oregon Street #604 (971) 673-0405 Portland, OR 97232-2162 (971) 673-0457 FAX (971) 673-0372 TTY-Nonvoice TECHNICAL BULLETIN HEALTH EFFECTS INFORMATION Prepared by: ENVIRONMENTAL TOXICOLOGY SECTION OCTOBER, 1998 SODIUM HYDROXIDE @Lye, limewater, lyewater@ For More Information Contact: Environmental Toxicology Section (971) 673-0440 Drinking Water Section (971) 673-0405 Technical Bulletin - Health Effects Information Sodium Hydroxide Page 2 SYNONYMS: Caustic soda, sodium hydrate, soda lye, lye, natrium hydroxide CHEMICAL AND PHYSICAL PROPERTIES: - Molecular Formula: NaOH - White solid, crystals or powder, will draw moisture from the air and become damp on exposure - Odorless, flat, sweetish flavor - Pure solid material or concentrated solutions are extremely caustic, immediately injurious to skin, eyes and respiratory system WHERE DOES IT COME FROM? Sodium hydroxide is extracted from seawater or other brines by industrial processes. WHAT ARE THE PRINCIPLE USES OF SODIUM HYDROXIDE? Sodium hydroxide is an ingredient of many household products used for cleaning and disinfecting, in many cosmetic products such as mouth washes, tooth paste and lotions, and in food and beverage production for adjustment of pH and as a stabilizer. In its concentrated form (lye) it is used as a household drain cleaner because of its ability to dissolve organic solids. It is also used in many industries including glassmaking, paper manufacturing and mining. It is used widely in medications, for regulation of acidity. Sodium hydroxide may be used to counteract acidity in swimming pool water, or in drinking water. IS SODIUM HYDROXIDE NATURALLY PRESENT IN DRINKING WATER? Yes, because sodium and hydroxide ions are common natural mineral substances, they are present in many natural soils, in groundwater, in plants and in animal tissues. -

Carbon Dioxide Capture from Atmospheric Air Using Sodium

Environ. Sci. Technol. 2008, 42, 2728–2735 Carbon Dioxide Capture from Nearly all current research on CCS focuses on capturing CO2 from large, stationary sources such as power plants. Atmospheric Air Using Sodium Such plans usually entail separating CO2 from flue gas, compressing it, and transporting it via pipeline to be Hydroxide Spray sequestered underground. In contrast, the system described in this paper captures CO2 directly from ambient air (“air § capture”). This strategy will be expensive compared to capture JOSHUAH K. STOLAROFF, from point sources, but may nevertheless act as an important DAVID W. KEITH,‡ AND complement, since CO emissions from any sector can be GREGORY V. LOWRY*,† 2 captured, including emissions from diffuse sources such as Chemical and Petroleum Engineering, University of Calgary, aircraft or automobiles, where on-board carbon capture is and Departments of Civil and Environmental Engineering very difficult and the cost of alternatives is high. Additionally, and Engineering and Public Policy, Carnegie Mellon in a future economy with low carbon emissions, air capture University, Pittsburgh, Pennsylvania 15213 might be deployed to generate negative net emissions (1). This ability to reduce atmospheric CO2 concentrations faster Received October 15, 2007. Revised manuscript received than natural cycles allow would be particularly desirable in February 05, 2008. Accepted February 06, 2008. scenarios where climate sensitivity is on the high end of what is expected, resulting in unacceptable shifts in land usability and stress to ecosystems. In contrast to conventional carbon capture systems for Previous research has shown that air capture is theoreti- cally feasible in terms of thermodynamic energy require- power plants and other large point sources, the system described ments, land use (2), and local atmospheric transport of CO2 in this paper captures CO2 directly from ambient air.