Country Report for Finland

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Country Report by Finland

COUNTRY REPORT BY FINLAND Implementation of the Beijing Platform for Action (1995) and the Outcome of the Twenty-Third Special Session of the General As- sembly (2000) June 2004 Table of Contents Part I: Overview of achievements and challenges in promoting gender equality and women’s empowerment __________________________________________________________4 Government Programmes since 1995________________________________________________5 Challenges ahead ________________________________________________________________6 Finland as an international actor ___________________________________________________7 Part II: Progress in implementation of the critical areas of concern of the Beijing Platform for Ac- tion and further initiatives and actions identified in the twenty-third special session of the General Assembly _________________________________________________________________________9 Elimination of multiple discrimination – safeguarding equality__________________________9 Challenges to eliminate multiple discrimination_______________________________________9 A. Women and poverty __________________________________________________________10 B. Education and training of women _______________________________________________10 Achievements_________________________________________________________________10 Challenges ahead ______________________________________________________________11 C. Women and health ___________________________________________________________12 Successful examples ___________________________________________________________12 -

Genetic Background of Extreme Violent Behavior

Molecular Psychiatry (2015) 20, 786–792 © 2015 Macmillan Publishers Limited All rights reserved 1359-4184/15 www.nature.com/mp ORIGINAL ARTICLE Genetic background of extreme violent behavior J Tiihonen1,2,3,19, M-R Rautiainen3,19, HM Ollila3,4, E Repo-Tiihonen2, M Virkkunen5,6, A Palotie7,8,9,10,11, O Pietiläinen3, K Kristiansson3, M Joukamaa12, H Lauerma3,13,14, J Saarela15, S Tyni16, H Vartiainen16, J Paananen17, D Goldman18 and T Paunio3,5,6 In developed countries, the majority of all violent crime is committed by a small group of antisocial recidivistic offenders, but no genes have been shown to contribute to recidivistic violent offending or severe violent behavior, such as homicide. Our results, from two independent cohorts of Finnish prisoners, revealed that a monoamine oxidase A (MAOA) low-activity genotype (contributing to low dopamine turnover rate) as well as the CDH13 gene (coding for neuronal membrane adhesion protein) are associated with extremely violent behavior (at least 10 committed homicides, attempted homicides or batteries). No substantial signal was observed for either MAOA or CDH13 among non-violent offenders, indicating that findings were specific for violent offending, and not largely attributable to substance abuse or antisocial personality disorder. These results indicate both low monoamine metabolism and neuronal membrane dysfunction as plausible factors in the etiology of extreme criminal violent behavior, and imply that at least about 5–10% of all severe violent crime in Finland is attributable to the aforementioned MAOA and CDH13 genotypes. Molecular Psychiatry (2015) 20, 786–792; doi:10.1038/mp.2014.130; published online 28 October 2014 INTRODUCTION Recently, it was reported that this finding has actually started to 9 Violent crime is a major issue that affects the quality of life even in influence the attitudes on court sentences in the US. -

![Dimensions of Work Ability. Results of the Health 2000 Survey]](https://docslib.b-cdn.net/cover/6478/dimensions-of-work-ability-results-of-the-health-2000-survey-426478.webp)

Dimensions of Work Ability. Results of the Health 2000 Survey]

Jorma Järvisalo and Seppo Koskinen, editors Jorma Järvisalo and Seppo Koskinen, Ilmarinen, Juhani Raija Gould, Dimensions of Helsinki 2008 Helsinki Work Ability Results of the Health 2000 Survey Raija Gould, Juhani Ilmarinen, Jorma Järvisalo and Seppo Koskinen, editors Work ability is an essential prerequisite for well-being Ability Dimensions of Work and employment. This book describes the work ability of working-aged Finns on the basis of material from the extensive Health 2000 Survey. It focuses on the multidimensionality of work ability. How are health, work, expertise, and attitudes related to perceived work ability? Are the unemployed able to work, and does the work ability of older workers suffice for lengthening their careers? Furthermore, has the work ability of the Finnish population changed over the last few decades? By shedding light on these questions, the book provides a comprehensive information basis for everyone who is interested in the contents and promotion of work ability. Dimensions of Work Ability Results of the Health 2000 Survey Raija Gould, Juhani Ilmarinen, Jorma Järvisalo and Seppo Koskinen, editors Helsinki 2008 Publishers Finnish Centre for Pensions (ETK) FI-00065 Eläketurvakeskus, Finland www.etk.fi The Social Insurance Institution (Kela) PL 450, FI-00101 Helsinki, Finland www.kela.fi National Public Health Institute (KTL) Mannerheimintie 166, FI-00300 Helsinki, Finland www.ktl.fi Finnish Institute of Occupational Health (FIOH) Topeliuksenkatu 41aA, FI-00250 Helsinki, Finland www.ttl.fi Graphic design Katri Saarteinen Layout Merja Raunis Figures Heidi Nyman ISBN 978-951-691-096-6 (printed book) ISBN 978-951-691-097-3 (PDF) Waasa Graphics Oy, Vaasa 2008 Dimensions_of_Work_Ability.indb 2 23.4.2008 13:18:49 Preface The focus on the population’s work ability has changed over the years due to changes in working life, public health, population structure, culture and societal norms. -

Codebook Indiveu – Party Preferences

Codebook InDivEU – party preferences European University Institute, Robert Schuman Centre for Advanced Studies December 2020 Introduction The “InDivEU – party preferences” dataset provides data on the positions of more than 400 parties from 28 countries1 on questions of (differentiated) European integration. The dataset comprises a selection of party positions taken from two existing datasets: (1) The EU Profiler/euandi Trend File The EU Profiler/euandi Trend File contains party positions for three rounds of European Parliament elections (2009, 2014, and 2019). Party positions were determined in an iterative process of party self-placement and expert judgement. For more information: https://cadmus.eui.eu/handle/1814/65944 (2) The Chapel Hill Expert Survey The Chapel Hill Expert Survey contains party positions for the national elections most closely corresponding the European Parliament elections of 2009, 2014, 2019. Party positions were determined by expert judgement. For more information: https://www.chesdata.eu/ Three additional party positions, related to DI-specific questions, are included in the dataset. These positions were determined by experts involved in the 2019 edition of euandi after the elections took place. The inclusion of party positions in the “InDivEU – party preferences” is limited to the following issues: - General questions about the EU - Questions about EU policy - Questions about differentiated integration - Questions about party ideology 1 This includes all 27 member states of the European Union in 2020, plus the United Kingdom. How to Cite When using the ‘InDivEU – Party Preferences’ dataset, please cite all of the following three articles: 1. Reiljan, Andres, Frederico Ferreira da Silva, Lorenzo Cicchi, Diego Garzia, Alexander H. -

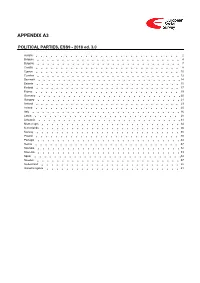

ESS9 Appendix A3 Political Parties Ed

APPENDIX A3 POLITICAL PARTIES, ESS9 - 2018 ed. 3.0 Austria 2 Belgium 4 Bulgaria 7 Croatia 8 Cyprus 10 Czechia 12 Denmark 14 Estonia 15 Finland 17 France 19 Germany 20 Hungary 21 Iceland 23 Ireland 25 Italy 26 Latvia 28 Lithuania 31 Montenegro 34 Netherlands 36 Norway 38 Poland 40 Portugal 44 Serbia 47 Slovakia 52 Slovenia 53 Spain 54 Sweden 57 Switzerland 58 United Kingdom 61 Version Notes, ESS9 Appendix A3 POLITICAL PARTIES ESS9 edition 3.0 (published 10.12.20): Changes from previous edition: Additional countries: Denmark, Iceland. ESS9 edition 2.0 (published 15.06.20): Changes from previous edition: Additional countries: Croatia, Latvia, Lithuania, Montenegro, Portugal, Slovakia, Spain, Sweden. Austria 1. Political parties Language used in data file: German Year of last election: 2017 Official party names, English 1. Sozialdemokratische Partei Österreichs (SPÖ) - Social Democratic Party of Austria - 26.9 % names/translation, and size in last 2. Österreichische Volkspartei (ÖVP) - Austrian People's Party - 31.5 % election: 3. Freiheitliche Partei Österreichs (FPÖ) - Freedom Party of Austria - 26.0 % 4. Liste Peter Pilz (PILZ) - PILZ - 4.4 % 5. Die Grünen – Die Grüne Alternative (Grüne) - The Greens – The Green Alternative - 3.8 % 6. Kommunistische Partei Österreichs (KPÖ) - Communist Party of Austria - 0.8 % 7. NEOS – Das Neue Österreich und Liberales Forum (NEOS) - NEOS – The New Austria and Liberal Forum - 5.3 % 8. G!LT - Verein zur Förderung der Offenen Demokratie (GILT) - My Vote Counts! - 1.0 % Description of political parties listed 1. The Social Democratic Party (Sozialdemokratische Partei Österreichs, or SPÖ) is a social above democratic/center-left political party that was founded in 1888 as the Social Democratic Worker's Party (Sozialdemokratische Arbeiterpartei, or SDAP), when Victor Adler managed to unite the various opposing factions. -

J-/S80C02S «^TU£V9—£2 STV K

J-/S80C02S «^TU£v9—£2 STUK-A62 June 1987 RADIOACTIVITY OF GAME MEAT IN FINLAND AFTER THE CHERNOBYL ACCIDENT IN 1986 Supplement 7 to Annua! Report STUK A55 Airo R.mMvii.ir;). T'mt! Nytjrr-r K.t.ulo r-jytJr»• r•; ,iin! T,ip,ifi' f-K v ••••<-!• STV K - A - - 6 2. STUK-A62 June 1987 RADIOACTIVITY OF GAME MEAT IN FINLAND AFTER THE CHERNOBYL ACCIDENT IN 1986 Supplement 7 to Annual Report STUK-A55 Aino Rantavaara, Tuire Nygr6n*, Kaarlo Nygren* and Tapani Hyvönen * Finnish Game and Fisheries Research Institute Ahvenjärvi Game Research Station SF - 82950 Kuikkalampi Finnish Centre for Radiation and Nuclear Safety P.O.Box 268, SF-00101 HELSINKI FINLAND ISBN 951-47-0493-2 ISSN 0781-1705 VAPK Kampin VALTIMO Helsinki 1988 3 ABSTRACT Radioactive substances in game meat were studied in summer and early autumn 1986 by the Finnish Centre for Radiation and Nuclear Safety in cooperation with the Finnish Game and Fisheries Research Institute. The concentrations of radioactive cesium and other gamma-emitting nuclides were determined on meat of moose8 and other cervids and also on small game in various parts of the country before or in the beginning of the hunting season. The most important radionuclides found in the samples were 134Cs and 137Cs. In addition to these, 131I was detected in the first moose meat samples in the spring, and 110"Ag in a part of the waterfowl samples. None of them was significant as far as the dietary intake of radionuclides is concerned. The transfer of fallout radiocesium to game meat was most efficient in the case of the arctic hare and inland waterfowl; terrestrial game birds and the brown hare belonged to the same category as moose. -

Exploring Police Relations with the Immigrant Minority in the Context of Racism and Discrimination: a View from Turku, Finland

ISSN 1554-3897 AFRICAN JOURNAL OF CRIMINOLOGY & JUSTICE STUDIES: AJCJS; Volume 1, No. 2, November 2005 EXPLORING POLICE RELATIONS WITH THE IMMIGRANT MINORITY IN THE CONTEXT OF RACISM AND DISCRIMINATION: A VIEW FROM TURKU, FINLAND Egharevba, Stephen Faculty of Law, University of Turku, Finland and Hannikainen, Lauri Faculty of Law, University of Turku, Finland Abstract Citizens and immigrant minorities come into contact with the police in various circumstances, either as witnesses, victims of crime, or even as suspects. The present study is an attempt to examine issues concerning racism and discrimination in police/immigrant relations in Finland under this circumstances, which to our knowledge has not received the academic scholastic investigation it deserves. Furthermore, this is also an attempt to look at police/immigrant everyday interactions to help in understanding this relationship. The research was carried out by means of a questionnaire (the sampled respondents consisting of forty-seven graduating police cadets a day before their graduation from the Police School and six serving police officers) and a semi- structured interview with thirteen police/cadets volunteers. These sources then served as the basis of this analysis Secondly, the participants’ experiences were examined in our attempt to determine whether the relationships were cordial or not. The authors are of the opinion that the experiences of these respondents could help to understand and shed some light on how Exploring Police Relations With The Immigrant Minority In The Context Of Racism And Discrimination: A View From Turku, Finland Egharevba, Stephen and Hannikainen, Lauri these two groups view their relations. The finding indicates some level of ignorance on the part of the police/cadets of the cultural differences between the immigrant minorities and the majority population. -

The Dangerous Offender As a Problem in Finnish Judicature and Society Bruun Kari* University of Tampere, Finland

Open Access Journal of Forensic and Crime Studies RESEARCH ARTICLE ISSN: 2638-3578 The Dangerous Offender as a Problem in Finnish Judicature and Society Bruun Kari* University of Tampere, Finland *Corresponding author: Bruun Kari, University of Tampere, Finland, Tel: + 358415451454, E-mail: [email protected] Citation: Bruun Kari (2019) The Dangerous Offender as a Problem in Finnish Judicature and Society. J Forensic Crime Stu 3: 102 Abstract In Finnish judicature, as elsewhere, the dangerousness of offenders has gained increasing attention during the past few decades. The question asked in this study is this: what were the knowledge and belief systems, conditions and struggles, in the judicial and societal spheres in particular, through which dangerousness reached its current status in the context of actor-centric prevention of crime? The research data consisted of government proposals, various documents, literature, and newspaper articles on law drafting as well as assessment, prediction, and conceptions of dangerousness. The analysis was done by examining the data discursively, reaching beyond the textual structure towards language-mediated social construction of reality. The analysis lends support to the notion that presumed dangerousness is a condition that is attached to the offender on the basis of certain indications but that it is not always an omen of severe violence in the future. Although the methods of assessing and predicting dangerousness have shown great progress lately, they still prove controversial in regard to an individual person. Also, the notion of decreasing the risk of offender violence by means of treatment is discernibly less emphasized in Finnish judicature than in most other Western countries. -

What's Left of the Left: Democrats and Social Democrats in Challenging

What’s Left of the Left What’s Left of the Left Democrats and Social Democrats in Challenging Times Edited by James Cronin, George Ross, and James Shoch Duke University Press Durham and London 2011 © 2011 Duke University Press All rights reserved. Printed in the United States of America on acid- free paper ♾ Typeset in Charis by Tseng Information Systems, Inc. Library of Congress Cataloging- in- Publication Data appear on the last printed page of this book. Contents Acknowledgments vii Introduction: The New World of the Center-Left 1 James Cronin, George Ross, and James Shoch Part I: Ideas, Projects, and Electoral Realities Social Democracy’s Past and Potential Future 29 Sheri Berman Historical Decline or Change of Scale? 50 The Electoral Dynamics of European Social Democratic Parties, 1950–2009 Gerassimos Moschonas Part II: Varieties of Social Democracy and Liberalism Once Again a Model: 89 Nordic Social Democracy in a Globalized World Jonas Pontusson Embracing Markets, Bonding with America, Trying to Do Good: 116 The Ironies of New Labour James Cronin Reluctantly Center- Left? 141 The French Case Arthur Goldhammer and George Ross The Evolving Democratic Coalition: 162 Prospects and Problems Ruy Teixeira Party Politics and the American Welfare State 188 Christopher Howard Grappling with Globalization: 210 The Democratic Party’s Struggles over International Market Integration James Shoch Part III: New Risks, New Challenges, New Possibilities European Center- Left Parties and New Social Risks: 241 Facing Up to New Policy Challenges Jane Jenson Immigration and the European Left 265 Sofía A. Pérez The Central and Eastern European Left: 290 A Political Family under Construction Jean- Michel De Waele and Sorina Soare European Center- Lefts and the Mazes of European Integration 319 George Ross Conclusion: Progressive Politics in Tough Times 343 James Cronin, George Ross, and James Shoch Bibliography 363 About the Contributors 395 Index 399 Acknowledgments The editors of this book have a long and interconnected history, and the book itself has been long in the making. -

Seeing Behind Stray Finds : Understanding the Late Iron Age Settlement of Northern Ostrobothnia and Kainuu, Finland

B 168 OULU 2018 B 168 UNIVERSITY OF OULU P.O. Box 8000 FI-90014 UNIVERSITY OF OULU FINLAND ACTA UNIVERSITATIS OULUENSIS ACTA UNIVERSITATIS OULUENSIS ACTA HUMANIORAB Ville Hakamäki Ville Hakamäki University Lecturer Tuomo Glumoff SEEING BEHIND STRAY FINDS University Lecturer Santeri Palviainen UNDERSTANDING THE LATE IRON AGE SETTLEMENT OF NORTHERN OSTROBOTHNIA Postdoctoral research fellow Sanna Taskila AND KAINUU, FINLAND Professor Olli Vuolteenaho University Lecturer Veli-Matti Ulvinen Planning Director Pertti Tikkanen Professor Jari Juga University Lecturer Anu Soikkeli Professor Olli Vuolteenaho UNIVERSITY OF OULU GRADUATE SCHOOL; UNIVERSITY OF OULU, FACULTY OF HUMANITIES, Publications Editor Kirsti Nurkkala ARCHAEOLOGY ISBN 978-952-62-2093-2 (Paperback) ISBN 978-952-62-2094-9 (PDF) ISSN 0355-3205 (Print) ISSN 1796-2218 (Online) ACTA UNIVERSITATIS OULUENSIS B Humaniora 168 VILLE HAKAMÄKI SEEING BEHIND STRAY FINDS Understanding the Late Iron Age settlement of Northern Ostrobothnia and Kainuu, Finland Academic dissertation to be presented with the assent of the Doctoral Training Committee of Human Sciences of the University of Oulu for public defence in the Wetteri auditorium (IT115), Linnanmaa, on 30 November 2018, at 10 a.m. UNIVERSITY OF OULU, OULU 2018 Copyright © 2018 Acta Univ. Oul. B 168, 2018 Supervised by Docent Jari Okkonen Professor Per H. Ramqvist Reviewed by Docent Anna Wessman Professor Nils Anfinset Opponent Professor Janne Vilkuna ISBN 978-952-62-2093-2 (Paperback) ISBN 978-952-62-2094-9 (PDF) ISSN 0355-3205 (Printed) ISSN 1796-2218 (Online) Cover Design Raimo Ahonen JUVENES PRINT TAMPERE 2018 Hakamäki, Ville, Seeing behind stray finds. Understanding the Late Iron Age settlement of Northern Ostrobothnia and Kainuu, Finland University of Oulu Graduate School; University of Oulu, Faculty of Humanities, Archaeology Acta Univ. -

WEDNESDAY 8Th 2010

10th Annual Conference of the European Society of Criminology CRIME AND CRIMINOLOGY: FROM INDIVIDUALS TO ORGANIZATIONS BOOK OF ABSTRACTS Table of Contents Table of Contents Organizing Comittee ............................................................................................................................................................. 9 List of Participants ................................................................................................................................................................. 13 Panel Session 1 ........................................................................................................................................................................ 79 1. Different perspectives on social perception in the fear of crime : relational concerns and social anxieties .......................................................................................................................... 79 2. The science of Art Crime ................................................................................................................................................ 81 3. Judicial Rehabilitation in Europe – Working Group Community Sanctions ............................................................ 82 4. Youth Violence ................................................................................................................................................................. 83 5. Mafia ................................................................................................................................................................................. -

Acta Universitatis Carolinae Studia Territorialia Xxi 2021 1

ACTA UNIVERSITATIS CAROLINAE STUDIA TERRITORIALIA XXI 2021 1 ACTA UNIVERSITATIS CAROLINAE STUDIA TERRITORIALIA XXI 2021 1 CHARLES UNIVERSITY KAROLINUM PRESS 2021 Editor-in-Chief: PhDr. Jan Šír, Ph.D. (Charles University) Executive Editor: PhDr. Lucie Filipová, Ph.D. (Charles University) Editorial Board: Maria Alina Asavei, Ph.D. (Charles University), Ing. Mgr. Magdalena Fiřtová, Ph.D. (Charles University), doc. RNDr. Vincenc Kopeček, Ph.D. (University of Ostrava), PhDr. Ondřej Matějka, Ph.D. (Charles University), doc. PhDr. Tomáš Nigrin, Ph.D. (Charles University), prof. PhDr. Jiří Kocian, CSc. (Institute of Contemporary His- tory of the Czech Academy of Sciences), doc. PhDr. Luboš Švec, CSc. (Charles Universi- ty), doc. PhDr. Jiří Vykoukal, CSc. (Charles University) International Advisory Board: Prof. dr hab. Marek Bankowicz (Uniwersytet Jagielloński w Krakowie), Prof. Dr. Chris- toph Boyer (Universität Salzburg), Prof. Alan Butt Philip (University of Bath), Prof. Iain McLean (Nuffield College, University of Oxford), Soňa Mikulová, Ph.D. (Max-Planck-In- stitut für Bildungsforschung, Berlin), Prof. Dr. Marek Nekula (Universität Regensburg), Prof. Dr. Dietmar Neutatz (Albert-Ludwigs-Universität Freiburg), Prof. James F. Pontuso (Hampden-Sydney College), Prof. Jacques Rupnik (Sciences Po, Paris), Prof. Dr. Wolf- gang Wessels (Universität zu Köln) Website: https://stuter.fsv.cuni.cz © Charles University – Karolinum Press, 2021 ISSN 1213-4449 (Print) ISSN 2336-3231 (Online) CONTENTS Editorial . 7 Articles ................................................................. 9 Memories of the Maya: National Histories, Cultural Identities, and Academic Orthodoxy ................................................. 11 KATHRYN M. HUDSON, JOHN S. HENDERSON Undemocratic History Politics in a Democratic State: Celebrations of Finland’s 100 Years of Independence ..................................... 45 JUHO KORHONEN The Politics of Memory and the Refashioning of Communism for Young People: The Illustrated Guide to Romanian Communism ............