Aegon Annual Report 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pension Risk Strategy Summit Supplement

Advertising Supplement PENSION RISK MANAGEMENT STRATEGIES Understanding All the Derisking Possibilities PS001_PI_20170612.pdf RunDate: 06/12/17 pi Pension Risk Strategies supp 8 x 10.875 Color: 4?C Advertising Supplement SPONSORS Fidelity Institutional Asset Management 900 Salem Street Smitheld, RI 02917 Daniel Tremblay Senior Vice President and Director of Institutional Fixed Income Solutions 603.791.6599 [email protected] www.institutional.delity.com MetLife 200 Park Avenue New York, NY 10166 Asif Mohamed Director, U.S. Pensions 212.578.8624 [email protected] www.metlife.com/pensions NISA Investment Advisors, LLC 101 South Hanley Road, Suite 1700 St. Louis, MO 63105 Gregory J. Yess Managing Director, Client Services 314.721.1900 [email protected] www.nisa.com Prudential Retirement 280 Trumbull Street Hartford, CT 06103 Scott Gaul, FSA Senior Vice President and Head of Distribution, Pension Risk Transfer 860.534.4263 [email protected] www.pensionrisk.prudential.com Schroders 7 Bryant Park New York, NY 10018-3706 Jennifer Horne, CFA Head of U.S. Institutional Clients 212.641.3800 [email protected] www.schroders.com/us This special advertising supplement is not created, written or produced by the editors of Pensions & Investments and does not represent the views or opinions of the publication or its parent company, Crain Communications Inc. 2 Pension Risk Management Strategies PS002_PI_20170612.pdf RunDate: 06/12/17 pi Pension Risk Strategies supp 8 x 10.875 Color: 4?C Advertising Supplement CONTENTS 4 Taking a Journey Along the Derisking Spectrum Corporate plan sponsors wishing to mitigate pension risk have a myriad of possible strategies at their disposal 12 Underfunded? Taking the LDI Path to Full Funding Most plan sponsors looking to dial down funded status volatility turn to liability-driven investing. -

Top 10 Mutual Fund Rankings

Top 10 Mutual Fund Rankings June 2014 AF Advisors is part of the A Fortiori Group Content – Introducing AF Advisors – AF Advisors Top 10 rankings – Process – Asset classes • Global Large Cap Equity • Global Emerging Markets Large Cap Equity • US Large Cap Equity • European Large Cap Equity • European Small & Mid Cap Equity • Asia-Pacific ex Japan Large Cap Equity • European Government Bonds • European Corporate Bonds – Disclaimer AF Advisors is part of the A Fortiori Group 2 Introducing AF Advisors AF Advisors is an independent research and consultancy company servicing financial institutions active in asset management. In the evolving financial environment we offer our clients strategic advantages through the combination of our extended knowledge, experience and skills. AF Advisors not only offers advice, but is also capable to implement the advice. AF Advisors strives for a healthier, more transparent financial industry by providing value adding services. Clients value our: • in depth knowledge • thorough listening skills and no-nonsense, hands-on approach • candid advice AF Advisors is part of the A Fortiori Group 3 AF Advisors Top 10 Rankings – For all major asset classes AF Advisors delivers insight in the numerous mutual funds available to Dutch retail investors. – For each asset class the AF Advisors Ranking Model results in a useful apples to apples comparison list of 10 funds offering the best value for Dutch retail investors. – The model is based on several factors, qualitative as well as quantitative, such as cost, performance, risk, the importance of the investment strategy to the provider and the level of service provided to the Dutch market. -

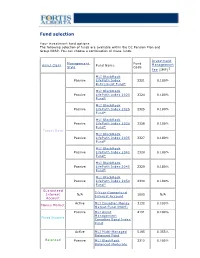

Fund Selection

Fund selection Y our investment fund options The following selection of funds are available within the DC Pension Plan and Group RRSP. You can choose a combination of these funds. Investment Management Fund Asset Class Fund Name Management Style Code Fee (IMF)1 MLI BlackRock Passive LifeP ath Index 2321 0.180% Retirement Fund* MLI BlackRock Passive LifeP ath Index 2020 2324 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2025 2325 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2030 2326 0.180% Fund* Target Date MLI BlackRock Passive LifeP ath Index 2035 2327 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2040 2328 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2045 2329 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2050 2330 0.180% Fund* Guaranteed 5-Y ear Guaranteed Interest N/A 1005 N/A Interest Account Account Active MLI Canadian Money 3132 0.100% Money Market Market Fund (MAM) Passive MLI Asset 4191 0.100% Management Fixed Income Canadian Bond Index Fund Active MLI Multi-Managed 5195 0.355% Balanced Fund Balanced Passive MLI BlackRock 2312 0.105% Balanced Moderate Index Fund Active MLI Canadian Equity 7011 0.210% Fund Canadian Passive MLI Asset 7132 0.100% Equity Management Canadian Equity Index Fund Active MLI U.S. Diversified 8196 0.375% Grow th Equity (Wellington) Fund U.S. Equity Passive MLI BlackRock U.S. 8322 0.090% Equity Index Fund* Active MLI MFS MB 8162 0.280% International Equity International Fund Equity Passive MLI BlackRock 8321 0.160% International Equity Index Fund* 1 IMFs shown do not include applicable taxes. -

NP Key Contacts.Pdf

IGP Network Partners: Key Contacts Region: Americas Country / Territory IGP Network Partner IGP Contact Email Type IGP Regional Coordinator Mr. Michael Spincemaille [email protected] Argentina SMG LIFE Mr. Nicolas Passet [email protected] Partner Brazil MAPFRE Vida S.A. Ms. Débora Nunes Santos [email protected] Partner Canada Manulife Financial Corporation Mr. Kajan Ramanathan [email protected] Partner Chile MAPFRE Chile Ms. Nathalie Gonzalez [email protected] Partner Colombia MAPFRE Colombia Ms. Ingrid Olarte Pérez [email protected] Partner Costa Rica MAPFRE Costa Rica Mr. Armando Sevilla [email protected] Partner Dominican Republic (Life) MAPFRE BHD Mrs. Alejandra Quirico [email protected] Partner Dominican Republic (Health) MAPFRE Salud ARS, S. A. Mr. Christian Wazar [email protected] Partner Ecuador MAPFRE Atlas * Mr. Carlos Zambrano [email protected] Correspondent El Salvador MAPFRE Seguros El Salvador S.A. Mr. Daniel Acosta González [email protected] Partner French Guiana Refer to France - - Partner Guadeloupe Refer to France - - Partner Guatemala MAPFRE Guatemala Mr. Luis Pedro Chavarría [email protected] Partner Honduras MAPFRE Honduras Mr. Carlos Ordoñez [email protected] Partner Martinique Refer to France - - Partner Mexico Seguros Monterrey New York Life Ms. Paola De Uriarte [email protected] Partner Nicaragua MAPFRE Nicaragua Mr. Dany Lanuza Flores [email protected] Partner Panama MAPFRE Panama Mr. Manuel Rodriguez [email protected] Partner Paraguay MAPFRE Paraguay Mr. Sergio Alvarenga [email protected] Partner Peru MAPFRE Peru Mr. Ramón Acuña Huerta [email protected] Partner Saint Martin Refer to France - - Partner Saint Barthélemy Refer to France - - Partner Saint Pierre & Miquelon Refer to France - - Partner United States Prudential Insurance Company of America Mr. -

Investor Presentation Transforming to a Specialist Wealth Manager

Investor Presentation Transforming to a specialist wealth manager March 2016 Van Lanschot at a glance Van Lanschot’s profile Solid performance on all key financials • One strategy: pure-play, independent wealth manager focusing on 2015 2014 preservation and creation of wealth for our clients • Net profit € 42.8m € 108.7m • Underlying result € 60.1m € 54.2m • Two leading brands: Van Lanschot and Kempen & Co • CET I ratio 16.3% 14.6% • CET I ratio, fully loaded 15.4% 13.4% • Total Capital ratio 17.0% 15.2% • Three core activities: Private Banking, Asset Management and • Leverage ratio, fully loaded 6.1% 5.3% Merchant Banking • Funding ratio 94.1% 95.3% • Client assets € 62.6bn € 58.5bn Good progress with strategy Financial targets 2017 • Private Banking: € 0.3 billion net inflow, € 1.5 billion entrusted to Evi Target van Lanschot, commission income +12% 2015 2017 • Asset Management: acquisition of fiduciary management KCM UK as • Common Equity Tier I ratio 16.3% >15% step stone for further international growth, new mandates won early 2016 adding approximately € 2 billion of AuM • Return on Common Equity Tier I 4.9% 10-12% • Merchant Banking: commission income +28%, solid market share in • Efficiency ratio 74.4% 60-65% selected niches, research coverage expanded • Corporate Banking: initial run-off target achieved, run-off continues Van Lanschot Investor Presentation - March 2016 1 1. Profile & Strategy of Van Lanschot 2. Financial Performance FY2015 Agenda Van Lanschot Investor Presentation - March 2016 2 Transforming from small “universal” -

Part VII Transfers Pursuant to the UK Financial Services and Markets Act 2000

PART VII TRANSFERS EFFECTED PURSUANT TO THE UK FINANCIAL SERVICES AND MARKETS ACT 2000 www.sidley.com/partvii Sidley Austin LLP, London is able to provide legal advice in relation to insurance business transfer schemes under Part VII of the UK Financial Services and Markets Act 2000 (“FSMA”). This service extends to advising upon the applicability of FSMA to particular transfers (including transfers involving insurance business domiciled outside the UK), advising parties to transfers as well as those affected by them including reinsurers, liaising with the FSA and policyholders, and obtaining sanction of the transfer in the English High Court. For more information on Part VII transfers, please contact: Martin Membery at [email protected] or telephone + 44 (0) 20 7360 3614. If you would like details of a Part VII transfer added to this website, please email Martin Membery at the address above. Disclaimer for Part VII Transfers Web Page The information contained in the following tables contained in this webpage (the “Information”) has been collated by Sidley Austin LLP, London (together with Sidley Austin LLP, the “Firm”) using publicly-available sources. The Information is not intended to be, and does not constitute, legal advice. The posting of the Information onto the Firm's website is not intended by the Firm as an offer to provide legal advice or any other services to any person accessing the Firm's website; nor does it constitute an offer by the Firm to enter into any contractual relationship. The accessing of the Information by any person will not give rise to any lawyer-client relationship, or any contractual relationship, between that person and the Firm. -

Manulife Global Fund Unaudited Semi-Annual Report

Unaudited Semi-Annual Report Manulife Global Fund Société d'Investissement à Capital Variable for the six month period ended 31 December 2020 No subscription can be received on the basis of nancial reports. Subscriptions are only valid if made on the bases of the current prospectus, accompanied by the latest annual report and semi-annual report if published thereaer. SICAV R.C.S Luxembourg B 26 141 Contents Directors ..................................................................................................................................................... 1 Management and Administration ............................................................................................................. 2 Directors’ Report ........................................................................................................................................ 4 Statement of Net Assets ........................................................................................................................... 10 Statement of Changes in Net Assets ........................................................................................................ 15 Statement of Operations ........................................................................................................................... 20 Statistical Information ............................................................................................................................... 25 Statement of Changes in Shares ............................................................................................................. -

Memorandum from the Division of Investment Management Regarding

MEMORANDUM TO: Proposed Rule: Updated Disclosure Requirements and Summary Prospectus for Variable Annuity and Variable Life Insurance Contracts (Release No. IC-33286; File No. S7-23-18) FROM: Dan Chang Senior Counsel, Division of Investment Management RE: Meeting with Representatives of the Committee of Annuity Insurers DATE: May 31, 2019 On May 29, 2019, Sarah G. ten Siethoff (Associate Director, Division of Investment Management (“IM”)), Brian M. Johnson (Assistant Director, IM); William J. Kotapish (Assistant Director, IM); Naseem Nixon (Senior Special Counsel, IM), Michael Kosoff (Senior Special Counsel, IM), Keith Carpenter (Senior Special Counsel, IM), Harry Eisenstein (Senior Special Counsel, IM), Michael Pawluk (Senior Special Counsel, IM), Sumeera Younis (Branch Chief, IM), Dan Chang (Senior Counsel, IM), Amy Miller (Senior Counsel, IM), Sonny Oh (Senior Counsel, IM), Alberto H. Zapata (Senior Counsel, IM), Patrick F. Scott (Senior Counsel, IM), DeCarlo McLaren (Special Counsel, IM), Daniel Deli (Financial Economist, Division of Economic and Risk Analysis (“DERA”)), Walter Hamscher (Senior IT Program Manager, DERA), and PJ Hamidi (Senior Counsel, DERA) met with the following representatives from the Committee of Annuity Insurers: Shane Daly, Vice President & Associate General Counsel, AXA Equitable Scott Durocher, Assistant Vice President & Senior Counsel, Lincoln Financial Jamie Castro, Managing Counsel, Nationwide Financial Bill Evers, Vice President & Chief Counsel, Prudential Financial Jordan Thomsen, Vice President & Corporate Counsel, Prudential Financial Steve Roth, Partner, Eversheds Sutherland Dodie Kent, Partner, Eversheds Sutherland Ron Coenen, Associate, Eversheds Sutherland Among other things, the participants discussed the SEC’s proposal relating to updated disclosure requirements and a summary prospectus for variable annuity and variable life insurance contracts. -

Audit Opinion Robeco QI Global Factor Solution Fund

RobecoQIGlobalFactor Solution Fund Fund for joint account Annual Report 2019 Contents Report by the manager 4 General information 4 Key figures 5 General introduction 5 Investment policy 7 Investment result 8 Risk management 8 Movements in net assets 8 Remuneration policy 9 Sustainable investing 10 In Control Statement 13 Annual financial statements 14 Balance sheet 14 Profit and loss account 15 Cash flow statement 16 Notes 17 General 17 Accounting principles 17 Principles for determining the result 17 Principles for cash flow statement 18 Risk management 18 Risks relating to financial instruments 19 Notes to the balance sheet 23 Notes to the profit and loss account 25 Additional information on investments in Robeco Group funds 28 Robeco QI Global Conservative Equities Z EUR 28 Robeco QI Global Momentum Equities Z EUR 49 Robeco QI Global Value Equities Z EUR 63 Schedule of Investments 80 Other information 81 Provisions regarding appropriation of the result 81 Directors’ interests 81 Auditor’s report by the independent auditor 82 Robeco QI Global Factor Solution Fund 2 Robeco QI Global Factor Solution Fund (fund for joint account incorporated under Dutch law, subject to the definitions contained within the 1969 Dutch Corporation Tax Act, domiciled at the offices of the fund manager in Rotterdam, the Netherlands) Contact details Weena 850 PO Box 973 NL-3000 AZ Rotterdam Telephone +31 (0)10 - 224 12 24 Internet: www.robeco.com Manager Robeco Institutional Asset Management B.V. (‘RIAM’) Policymakers RIAM: Gilbert O.J.M. Van Hassel Karin van Baardwijk Monique D. Donga (until 30 June 2019) Peter J.J. -

SL Allianz Emerging Markets Equity Life Fund Invests Primarily in the Allianz Emerging Markets Equity Fund

Q2 SL Allianz Emerging Markets 2021 Equity Life Fund 30 June 2021 This document is intended for use by individuals who are familiar with investment terminology. Please contact your financial adviser if you need an explanation of the terms used. The SL Allianz Emerging Markets Equity Life Fund invests primarily in the Allianz Emerging Markets Equity Fund. Life Investment The aim of the Allianz Emerging Markets Equity Fund is summarised below. Fund The Fund aims to achieve capital growth in the long term by investing mainly in the equity markets of countries which are represented in the MSCI Emerging Markets Index (each an “Emerging Market Country” and together “Emerging Market Countries”). Up to 20% of the Fund’s assets may be invested outside Emerging Market Countries including developed economies and / or other emerging markets. Please see the Key Investor Information Document for objectives and investment policy. Equity Fund The value of any investment can fall as well as rise and is not guaranteed – you may get back less than you pay in. For further information on the Allianz Emerging Markets Equity Fund, please refer to the fund manager fact sheet, link provided below. Quarterly Standard Life does not control or take any responsibility for the content of this. Allianz Emerging Markets Equity - Fund Factsheet http://webfund6.financialexpress.net/clients/StandardLife/FS.aspx?Code=PZ93&Date=01/06/2021 Underlying Fund Launch Date February 2006 Standard Life Launch Date March 2006 Underlying Fund Size (30/06/2021) £170.7m Standard Life Fund Size (30/06/2021) £4.6m Underlying Fund Manager Kunal Ghosh, Lu Standard Life Fund Code 9S Yu Volatility Rating (0-7) 7 The investment performance you will experience from investing in the Standard Life version of the fund will vary from the investment performance you would experience from investing in the underlying fund directly. -

Underwriting Issues and Innovations Seminar

Underwriting Issues and Innovations Seminar Attendee List by Last Name As of July 12, 2017 Stephen Abrokwah Merly Agellon Geoff Andrews Swiss Re Life & Health America Inc Sun Life Financial Carpe Data Fort Wayne, IN Toronto, ON Santa Barbara, CA David Aronson Thomas Ashley Denise Bates MIB Gen Re Penn Mutual Life Insurance Co Braintree, MA Stamford, CT Horsham, PA Natalie Bergstrom JP Bewley Phillip Beyer AIG Big Cloud Analytics USAA Life Insurance Company Milwaukee, WI Atlanta, GA San Antonio, TX Donnamarie Blake Paul Boudreau Laura Boylan Lexisnexis Risk Solution Munich Re Haven Life Alpharetta, GA Atlanta, GA New York, NY Greg Brandner Colin Bruesewitz Jessica Bublitz Munich Re American Family Insurance Milliman Intelliscript Nashwauk, MN Sun Prairie, WI Brookfield, WI Peggy Buck Marc Cagen Minyu Cao Milliman Intelliscript Fidelity Life Association RGA Brookfield, WI Chicago, IL Chesterfield, MO Eric Carlson Paul Carmody Audrey Chervansky Milliman Inc Pacific Guardian Life Insurance Swiss Re Life & Health America Brookfield, WI Honolulu, HI Armonk, NY Amanda Christensen Juliet Christenson Jennifer Ciollaro Riversource Insurance Royal Neighbors of America Swiss Re Minneapolis, MN Rock Island, IL Fort Wayne, IN Derek Coburn Brian Coens Joanne Collins Unum Clinical Reference Laboratory Stoneriver Worcester, MA Lenexa, KS Waxhaw, NC Chris Connor Sean Conrad Steve Cox Illinois Mutual Life Insurance Hannover Re Oneamerica Financial Partners Company Charlotte, NC Indianapolis, IN Peoria, IL Kathryn Cox Kim Curley Mike Curran RGA Great-West Financial Force Diagnostics, Inc. Chesterfield, MO Greenwood Village, CO Bannockburn, IL Bruce Dahlquist Donna Daniells Ben Davidson Clinical Reference Laboratory AXA US Sagicor Life Insurance Lenexa, KS Charlotte, NC Scottsdale, AZ Jim Davis Dee Davis Paul Dennee Synodex Swiss Re Trustmark Insurance Co Canton, CT Fort Wayne, IN Lake Forest, IL Tedd Determan Ammon Dixon Cris Downey Force Diagnostics, Inc. -

Demystifying Negative Screens: the Full Implications of ESG Exclusions

Marketing material for professional investors or advisers only Demystifying negative screens: The full implications of ESG exclusions December 2017 Contents Demystifying negative screens: Appendix: A close look at the full implications of ESG different screening options exclusions 14 Alcohol 3 Executive summary 15 Fossil fuels 3 Screening remains very popular 16 Fur in general 17 Gambling 4 But some individual screens are more 18 Nuclear popular than others 19 Pornography 4 Our Global Investor Survey highlights 20 Sin changing attitudes towards 21 Tobacco negative screens 22 Weapons 5 Interest in fossil fuel and tobacco divestment is rising 7 Focusing narrowly on returns can be deeply misleading 9 Screens can have a heavy impact on specific investment strategies 11 Details matter when implementing screens 11 Screen definition decisions can significantly alter exclusion lists and investment results 12 Different data providers can produce very different exclusion lists 12 Active management can add more value than passive when applying screens Demystifying negative screens: the full implications of ESG exclusions Screening out investments that Alexander Monk Sustainable do not meet environmental, social Investment Analyst or governance (ESG) criteria is and the Sustainable superficially simple but fraught with Investment Team practical challenges. Understanding the complexities and biases screens create before they are implemented and appropriately assessing performance afterward is crucial for investors. In this paper, we investigate the pitfalls when implementing different screens. Executive summary The chart in Figure 1 shows the extent to which typical Negative screens that sieve investments on environmental, negative exclusions constrain managers. Implementing social and governance grounds remain critical to many screens may be mechanical, but assessing their impact on investors.