Passenger Airlines and US Treasury Department Reach Agreement on CARES Act Payroll Support Program

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

United-2016-2021.Pdf

27010_Contract_JCBA-FA_v10-cover.pdf 1 4/5/17 7:41 AM 2016 – 2021 Flight Attendant Agreement Association of Flight Attendants – CWA 27010_Contract_JCBA-FA_v10-cover.indd170326_L01_CRV.indd 1 1 3/31/174/5/17 7:533:59 AMPM TABLE OF CONTENTS Section 1 Recognition, Successorship and Mergers . 1 Section 2 Definitions . 4 Section 3 General . 10 Section 4 Compensation . 28 Section 5 Expenses, Transportation and Lodging . 36 Section 6 Minimum Pay and Credit, Hours of Service, and Contractual Legalities . 42 Section 7 Scheduling . 56 Section 8 Reserve Scheduling Procedures . 88 Section 9 Special Qualification Flight Attendants . 107 Section 10 AMC Operation . .116 Section 11 Training & General Meetings . 120 Section 12 Vacations . 125 Section 13 Sick Leave . 136 Section 14 Seniority . 143 Section 15 Leaves of Absence . 146 Section 16 Job Share and Partnership Flying Programs . 158 Section 17 Filling of Vacancies . 164 Section 18 Reduction in Personnel . .171 Section 19 Safety, Health and Security . .176 Section 20 Medical Examinations . 180 Section 21 Alcohol and Drug Testing . 183 Section 22 Personnel Files . 190 Section 23 Investigations & Grievances . 193 Section 24 System Board of Adjustment . 206 Section 25 Uniforms . 211 Section 26 Moving Expenses . 215 Section 27 Missing, Interned, Hostage or Prisoner of War . 217 Section 28 Commuter Program . 219 Section 29 Benefits . 223 Section 30 Union Activities . 265 Section 31 Union Security and Check-Off . 273 Section 32 Duration . 278 i LETTERS OF AGREEMENT LOA 1 20 Year Passes . 280 LOA 2 767 Crew Rest . 283 LOA 3 787 – 777 Aircraft Exchange . 285 LOA 4 AFA PAC Letter . 287 LOA 5 AFA Staff Travel . -

Southwest Airlines 1996 Annual Report

1996 Annual Report TABLE OF CONTENTS Consolidated Highlights 2 Introduction 3 Letter to Shareholders 4 People and Planes 6 Southwest Spirit 8 THE Low Fare Airline 10 Productivity 12 Ontime Performance 14 Customer Satisfaction 16 Mintenance and Safety 18 What’s Next? 20 Financial Review 22 Management’s Discussion and Analysis 22 Consolidated Financial Statements 31 Report of Independent Auditors 49 Quarterly Financial Data 50 Common Stock Price Ranges and Dividends 50 Corporate Data 51 Directors and Officers 52 Ten Year Summary 55 CONSOLIDATED HIGHLIGHTS (DOLLARS IN THOUSANDS PERCENT EXCEPT PER SHARE AMOUNTS) 1996 1995 CHANGE Operating revenues $3,406,170 $2,872,751 18.6 Operating expenses $3,055,335 $2,559,220 19.4 Operating income $350,835 $313,531 11.9 Operating margin 10.3% 10.9% (0.6)pts. Net income $207,337 $182,626 13.5 Net margin 6.1% 6.4% (0.3)pts. Net income per common and common equivalent share $1.37 $1.23 11.4 Stockholders’ equity $1,648,312 $1,427,318 15.5 Return on average stockholders’ equity 13.5% 13.7% (0.2)pts. Debt as a percentage of invested capital 28.3% 31.7% (3.4)pts. Stockholders’ equity per common share outstanding $11.36 $9.91 14.6 Revenue passengers carried 49,621,504 44,785,573 10.8 Revenue passenger miles (RPMs)(000s) 27,083,483 23,327,804 16.1 Available seat miles (ASMs)(000s) 40,727,495 36,180,001 12.6 Passenger load factor 66.5% 64.5% 2.0 pts. Passenger revenue yield per RPM 12.07¢ 11.83¢ 2.0 Operating revenue yield per ASM 8.36¢ 7.94¢ 5.3 Operating expenses per ASM 7.50¢ 7.07¢ 6.1 Number of Employees at yearend 22,944 19,933 15.1 NET INCOME (in millions) $207 $179 $183 250 $154 200 $97 150 100 50 0 1992 1993 1994 1995 1996 2 NET INCOME PER SHARE $1.37 $1.22 $1.23 1.40 $1.05 1.20 1.00 $.68 0.80 0.60 0.40 0.20 0.00 1992 1993 1994 1995 1996 SOUTHWEST AIRLINES CO. -

United Airlines Holdings Annual Report 2021

United Airlines Holdings Annual Report 2021 Form 10-K (NASDAQ:UAL) Published: March 1st, 2021 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission Exact Name of Registrant as Specified in its Charter, State of I.R.S. Employer File Number Principal Executive Office Address and Telephone Incorporation Identification No. Number 001-06033 United Airlines Holdings, Inc. Delaware 36-2675207 233 South Wacker Chicago, Illinois Drive, 60606 (872) 825-4000 001-10323 United Airlines, Inc. Delaware 74-2099724 233 South Wacker Chicago, Illinois Drive, 60606 (872) 825-4000 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Trading Symbol Name of Each Exchange on Which Registered United Airlines Holdings, Inc. Common Stock, $0.01 par value UAL The Nasdaq Stock Market LLC Preferred Stock Purchase Rights The Nasdaq Stock Market LLC United Airlines, Inc. None None None Securities registered pursuant to Section 12(g) of the Act: United Airlines Holdings, Inc. None United Airlines, Inc. None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act United Airlines Holdings, Inc. Yes ☒ No ☐ United Airlines, Inc. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. -

David Neeleman

David Neeleman David Neeleman is that rarest of entrepreneurs, a man who has created and launched four successful, independent airlines, including the USA’s JetBlue and Morris Air, Canada’s WestJet and Brazil’s Azul. Azul, just seven years old, has already boarded tens of millions of customers. Born in Brazil while his father was Reuter’s São Paulo Bureau Chief, David has always had a deep love for the country. After his family moved to Utah while he was still a child, David would return to Brazil many times throughout his life. A dual citizen, David today relishes the dream before him to make flying cheaper and easier for Brazilians, giving access to air travel for many who have never experienced the opportunity before. Azul serves more than 100 destinations with an operating fleet of more than 140 aircraft, including Brazilian-built Embraer E-190 and E-195 jets, and ATR-72s. Just as JetBlue in the US before it, Azul is the first airline in Latin America to offer LiveTV inflight TV programming via satellite. It has been named Best Low Cost Airline in South America for the last five years at the Skytrax World Airline Awards. In June 2015, it was announced that the Gateway consortium, led by David, had won the bidding to acquire a stake in Portugal’s national carrier TAP. Gateway’s investment represents 50% of the airline. With the new investment, TAP is taking delivery of A330s and inaugurated new daily service from both Boston’s Logan airport and New York’s John F Kennedy International in June and July, respectively. -

AF KL PPT Template Sales External

VISIT USA 2019 AIR FRANCE / KLM / DELTA 1 VISIT USA 2019 AIR FRANCE / KLM / DELTA 2 WE CONNECT SWITZERLAND TO THE WORLD UP TO 38 FLIGHTS AND 5,000 SEATS FROM SWITZERLAND – EVERY DAY Daily flights from Zurich: • 5x CDG, 6x AMS, 1x JFK (A330) 1x ATL (seasonally) Daily flights from Basel/Mulhouse: • 3x CDG, 3x ORY, 4x AMS Daily flights from Geneva: • 9x CDG, 6x AMS … and connect to destinations around the world: more than 200 destinations on Air France, 160 on KLM and 320 on Delta Air France & KLM & Delta Air Lines (& Virgin Atlantic, Alitalia) Biggest Airline Joint venture from/to North Atlantic All Carriers are combinable To all destinstions to North Atlantic AND world wide AMS NYC ZRH BSL PAR GVA VIRGIN ATLANTIC JOINS AF KL DL TRANSATLANTIC JOINT VENTURE • DL hält 49%, AF KL halten 31% Anteile an Virgin Atlantic (VS) • AF / KL / DL / VS ist der grösste Airline-Verbund zwischen Europa und Nordatlantik • 300 tägliche Flüge von/zu 60 Destinationen zwischen Europa und Nordatlantik 5 CDG HUB ZRH / GVA BSL AMS HUB At JFK airport – T4 • SkyPriority® Services : • Exclusive check-in areas • Priority boarding and baggage delivery • Priority service at ticket/transfer desks • Accelerated security and passport clearance • Delta Sky Club® lounge: • New Sky Deck terrace with unprecedented runway views • Free Wi-Fi • Personalized flight assistance • Refreshments and snacks • Magazines and newspapers NEW DESTINATIONS & ROUTES RAPIDLY EXPANDING GLOBAL NETWORK New KLM destinations (from AMS): • Boston (as of MAR19) • Las Vegas (as of JUN19) New Air France -

Facts & Figures & Figures

OCTOBER 2019 FACTS & FIGURES & FIGURES THE STAR ALLIANCE NETWORK RADAR The Star Alliance network was created in 1997 to better meet the needs of the frequent international traveller. MANAGEMENT INFORMATION Combined Total of the current Star Alliance member airlines: FOR ALLIANCE EXECUTIVES Total revenue: 179.04 BUSD Revenue Passenger 1,739,41 bn Km: Daily departures: More than Annual Passengers: 762,27 m 19,000 Countries served: 195 Number of employees: 431,500 Airports served: Over 1,300 Fleet: 5,013 Lounges: More than 1,000 MEMBER AIRLINES Aegean Airlines is Greece’s largest airline providing at its inception in 1999 until today, full service, premium quality short and medium haul services. In 2013, AEGEAN acquired Olympic Air and through the synergies obtained, network, fleet and passenger numbers expanded fast. The Group welcomed 14m passengers onboard its flights in 2018. The Company has been honored with the Skytrax World Airline award, as the best European regional airline in 2018. This was the 9th time AEGEAN received the relevant award. Among other distinctions, AEGEAN captured the 5th place, in the world's 20 best airlines list (outside the U.S.) in 2018 Readers' Choice Awards survey of Condé Nast Traveler. In June 2018 AEGEAN signed a Purchase Agreement with Airbus, for the order of up to 42 new generation aircraft of the 1 MAY 2019 FACTS & FIGURES A320neo family and plans to place additional orders with lessors for up to 20 new A/C of the A320neo family. For more information please visit www.aegeanair.com. Total revenue: USD 1.10 bn Revenue Passenger Km: 11.92 m Daily departures: 139 Annual Passengers: 7.19 m Countries served: 44 Number of employees: 2,498 Airports served: 134 Joined Star Alliance: June 2010 Fleet size: 49 Aircraft Types: A321 – 200, A320 – 200, A319 – 200 Hub Airport: Athens Airport bases: Thessaloniki, Heraklion, Rhodes, Kalamata, Chania, Larnaka Current as of: 14 MAY 19 Air Canada is Canada's largest domestic and international airline serving nearly 220 airports on six continents. -

News Release

Contacts: SJC - Rosemary Barnes 408-392-1199 / [email protected] Alaska Airlines – Media Relations 206-304-0008 / [email protected] April 4, 2018 NEWS RELEASE New Daytime, Nonstop Service to New York’s JFK on Alaska Airlines from Silicon Valley’s Airport -- No. 1 Requested Domestic Market by Silicon Valley Travelers; Daily, Daytime Nonstop Flight Begins July 6, 2018 -- San José, Calif. – Alaska Airlines today announced plans to begin daily, nonstop service to New York’s John F. Kennedy Airport (JFK) from Mineta San José International Airport (SJC) beginning July 6, 2018. The new service is significant as it marks the first daytime nonstop flight from SJC to JFK, the No. 1 requested domestic market by Silicon Valley travelers. Tickets are on sale now at www.alaskaair.com. Silicon Valley business and leisure travelers will love the addition of a direct, daytime flight to New York,” said San José Mayor Sam Liccardo. “I thank CEO Brad Tilden and his team at Alaska Airlines for launching this new nonstop service to New York-JFK, and for continuing to invest in destinations that are a high priority for our travelers.” Alaska will operate the daily service using modern Airbus A320 aircraft as follows: City Pair Departs Arrives San José – New York/JFK 7:05 a.m. 3:43 p.m. New York/JFK – San José 4:45 p.m. 8:23 p.m. Times are local. Average flight time is 6 hours. “We continue to add exciting new destinations from San Jose, providing our valued guests more nonstop options to meet their business and leisure needs,” said John Kirby, Alaska’s vice president of capacity planning. -

Adaptive Connected.Xlsx

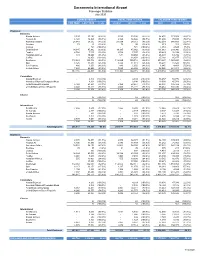

Sacramento International Airport Passenger Statistics July 2020 CURRENT MONTH FISCAL YEAR TO DATE CALENDAR YEAR TO DATE THIS YEAR LAST YEAR % +/(-) 2020/21 2019/20 % +/(-) 2020 2019 % +/(-) Enplaned Domestic Alaska Airlines 3,593 33,186 (89.2%) 3,593 33,186 (89.2%) 54,432 173,858 (68.7%) Horizon Air 6,120 14,826 (58.7%) 6,120 14,826 (58.7%) 31,298 75,723 (58.7%) American Airlines 28,089 54,512 (48.5%) 28,089 54,512 (48.5%) 162,319 348,689 (53.4%) Boutique 79 95 (16.8%) 79 95 (16.8%) 613 201 205.0% Contour - 721 (100.0%) - 721 (100.0%) 4,461 2,528 76.5% Delta Airlines 14,185 45,962 (69.1%) 14,185 45,962 (69.1%) 111,063 233,946 (52.5%) Frontier 4,768 7,107 (32.9%) 4,768 7,107 (32.9%) 25,423 38,194 (33.4%) Hawaiian Airlines 531 10,660 (95.0%) 531 10,660 (95.0%) 26,393 64,786 (59.3%) Jet Blue - 16,858 (100.0%) - 16,858 (100.0%) 25,168 85,877 (70.7%) Southwest 112,869 300,716 (62.5%) 112,869 300,716 (62.5%) 899,647 1,963,253 (54.2%) Spirit 8,425 11,318 (25.6%) 8,425 11,318 (25.6%) 38,294 15,526 146.6% Sun Country 886 1,650 (46.3%) 886 1,650 (46.3%) 1,945 4,401 (55.8%) United Airlines 7,620 46,405 (83.6%) 7,620 46,405 (83.6%) 98,028 281,911 (65.2%) 187,165 544,016 (65.6%) 187,165 544,016 (65.6%) 1,479,084 3,288,893 (55.0%) Commuters Alaska/Skywest - 4,304 (100.0%) - 4,304 (100.0%) 36,457 50,776 (28.2%) American/Skywest/Compass/Mesa - 8,198 (100.0%) - 8,198 (100.0%) 18,030 45,781 (60.6%) Delta/Skywest/Compass 5,168 23,651 (78.1%) 5,168 23,651 (78.1%) 62,894 146,422 (57.0%) United/Skywest/GoJet/Republic 4,040 16,221 (75.1%) 4,040 16,221 (75.1%) -

Monthly Statistics Report

Monthly Statistics Report To: Tom Jones, Aviation Director; Tim O’Krongley, Deputy Director From: Brian Pratte, Air Service Administrator Copies: San Antonio Regional Stakeholders Subject: July 2016 Monthly Statistics Date: August 26, 2016 SUMMARY Calendar year-to-date (CYTD) traffic continued its growth, up 0.56%, representing a total of 5,003,408 total passengers. This represents the largest CYTD traffic on record through July, the first time the total passenger count has exceeded 5 million in the first seven months of the year. The San Antonio International Airport served 802,345 total passengers in July 2016, a slight decrease of (0.9%) when compared to July 2015. The decrease must be viewed in context. In July 2015, the General Conference of Seventh-day Adventist Church was held in San Antonio. This convention, one of the largest conventions to be held in San Antonio, brought an estimated 65,000 attendees. Approximately 60% (~78,000) of those conventioneers arrived and departed via air travel. If last year’s convention were excluded from the year over year comparison, total passengers would have increased approximately 8.7%. Domestic traffic for the month was up 0.5%, while international traffic experienced a decline of (17.5%). Again, context is important. The rate of decline in international passengers has decreased and is in line with the year-over-year reduction in capacity. In October 2015, Southwest Airlines opened their new international terminal at Houston Hobby Airport. In order to expand international service at Hobby, and to maximize the available slots into Mexico City (MEX), the SAT-MEX flight was negatively impacted and eliminated. -

Air Travel Consumer Report

Air Travel Consumer Report A Product Of THE OFFICE OF AVIATION CONSUMER PROTECTION Issued: August 2021 Flight Delays1 June 2021 January - June 2021 Mishandled Baggage, Wheelchairs, and Scooters 1 June 2021 January -June 2021 Oversales1 2nd Quarter 2021 Consumer Complaints2 June 2021 (Includes Disability and January - June 2021 Discrimination Complaints) Airline Animal Incident Reports4 June 2021 Customer Service Reports to 3 the Dept. of Homeland Security June 2021 1 Data collected by the Bureau of Transportation Statistics. Website: http://www.bts.gov 2 Data compiled by the Office of Aviation Consumer Protection. Website: http://www.transportation.gov/airconsumer 3 Data provided by the Department of Homeland Security, Transportation Security Administration 4 Data collected by the Office of Aviation Consumer Protection. TABLE OF CONTENTS Section Page Section Page Flight Delays Flight Delays (continued) Introduction 3 Table 8 35 Explanation 4 List of Regularly Scheduled Domestic Flights with Tarmac Delays Over 3 Hours, By Marketing/Operating Carrier Branded Codeshare Partners 5 Table 8A Table 1 6 List of Regularly Scheduled International Flights with 36 Overall Percentage of Reported Flight Tarmac Delays Over 4 Hours, By Marketing/Operating Carrier Operations Arriving On-Time, by Reporting Marketing Carrier Appendix 37 Table 1A 7 Mishandled Baggage Overall Percentage of Reported Flight Ranking- by Marketing Carrier (Monthly) 39 Operations Arriving On-Time, by Reporting Operating Carrier Ranking- by Marketing Carrier (YTD) 40 Table 1B 8 -

Special Rates for Your Group

Special rates for your group. Group travel discounts include: 5% off the lowest applicable fare For reservations, call 1-800-433-1790, and refer to the authorization number below: AN# A8799AQ Now Book your Discount Fares Directly Online To take advantage of a 5% discount on AA, American Eagle and AmericanConnections. It's simple! After you have selected your flight(s) under the "Enter Passenger Details" tab, go to the "AA.com Promotion Code" field and enter in your Authorization Code without the leading “A”. Go directly to www.aa.com to book your flights. Discount Fares are valid for travel on American Airlines, American Eagle®, AmericanConnection®, oneworld Alliance, and codeshare partners from anywhere to your meeting destination. Reservations and Ticketing For reservations and ticketing information, call AmericanAirlines Meeting Services Desk, or have your travel professional call 1-800-433-1790 from anywhere in the United States or Canada, seven days a week, from 6:00 a.m. to 12:00 midnight (Central Time), and reference the authorization number shown above. Reservations for the hearing and speech impaired are also available at 1-800-543-1586. There is a $20.00USD reservations service fee for tickets issued through AA reservations, and a $30.00USD ticketing fee for tickets issued at the airport. Frequent Flyer Miles Earn AAdvantage® miles for your trip. The AAdvantage program was the first airline frequent traveler program, and for more than 20 years has offered members the most innovative ways to earn travel awards. Enroll online at www.aa.com. *Seats are limited. American Airlines, American Eagle, AmericanConnection, American Airlines Group & Meeting Travel and AAdvantage are marks of American Airlines, Inc. -

Prof. Paul Stephen Dempsey

AIRLINE ALLIANCES by Paul Stephen Dempsey Director, Institute of Air & Space Law McGill University Copyright © 2008 by Paul Stephen Dempsey Before Alliances, there was Pan American World Airways . and Trans World Airlines. Before the mega- Alliances, there was interlining, facilitated by IATA Like dogs marking territory, airlines around the world are sniffing each other's tail fins looking for partners." Daniel Riordan “The hardest thing in working on an alliance is to coordinate the activities of people who have different instincts and a different language, and maybe worship slightly different travel gods, to get them to work together in a culture that allows them to respect each other’s habits and convictions, and yet work productively together in an environment in which you can’t specify everything in advance.” Michael E. Levine “Beware a pact with the devil.” Martin Shugrue Airline Motivations For Alliances • the desire to achieve greater economies of scale, scope, and density; • the desire to reduce costs by consolidating redundant operations; • the need to improve revenue by reducing the level of competition wherever possible as markets are liberalized; and • the desire to skirt around the nationality rules which prohibit multinational ownership and cabotage. Intercarrier Agreements · Ticketing-and-Baggage Agreements · Joint-Fare Agreements · Reciprocal Airport Agreements · Blocked Space Relationships · Computer Reservations Systems Joint Ventures · Joint Sales Offices and Telephone Centers · E-Commerce Joint Ventures · Frequent Flyer Program Alliances · Pooling Traffic & Revenue · Code-Sharing Code Sharing The term "code" refers to the identifier used in flight schedule, generally the 2-character IATA carrier designator code and flight number. Thus, XX123, flight 123 operated by the airline XX, might also be sold by airline YY as YY456 and by ZZ as ZZ9876.