Delta Air Lines Ecosystem Atlanta, GA 30320 Phone: (404) 715-2600 Delta.Com

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Aircraft Noise and Operations Report 2014 Bi-Annual Summary January – June

Aircraft Noise and Operations Report 2014 Bi-Annual Summary January – June Cincinnati/Northern Kentucky International Airport AIRCRAFT NOISE AND OPERATIONS REPORT 2014 BI-ANNUAL SUMMARY JANUARY - JUNE Table of Contents and Summary of Reports Aircraft Noise Report Page 1 This report details the locations of all complaints for the reporting period. Comparisons include state, county and areas within each county. Quarterly & Annual Comparison of Complaints Page 2 This report shows the trends of total complaints comparing the previous five years by quarter to the current year. Complaints by Category Page 3 Complaints received for the reporting period are further detailed by fourteen types of complaints, concerns or questions. A complainant may have more than one complaint, concern or question per occurrence. Complaint Locations and Frequent Complainants Page 4 This report shows the locations of the complainants on a map and the number of complaints made by the most frequent/repeat complainants for the reporting period. Total Runway Usage - All Aircraft Page 5 This report graphically shows the total number and percentage of departures and arrivals on each runway for the reporting period. Nighttime Usage by Large Jets Page 6 This report graphically shows the total number and percentage of large jet departures and arrivals on each runway during the nighttime hours of 10:00 p.m. to 7:00 a.m. for the reporting period. Nighttime Usage by Small Jets and Props Page 7 This report graphically shows the total number and percentage of small jet and prop departures and arrivals on each runway during the nighttime hours of 10:00 p.m. -

AF KL PPT Template Sales External

VISIT USA 2019 AIR FRANCE / KLM / DELTA 1 VISIT USA 2019 AIR FRANCE / KLM / DELTA 2 WE CONNECT SWITZERLAND TO THE WORLD UP TO 38 FLIGHTS AND 5,000 SEATS FROM SWITZERLAND – EVERY DAY Daily flights from Zurich: • 5x CDG, 6x AMS, 1x JFK (A330) 1x ATL (seasonally) Daily flights from Basel/Mulhouse: • 3x CDG, 3x ORY, 4x AMS Daily flights from Geneva: • 9x CDG, 6x AMS … and connect to destinations around the world: more than 200 destinations on Air France, 160 on KLM and 320 on Delta Air France & KLM & Delta Air Lines (& Virgin Atlantic, Alitalia) Biggest Airline Joint venture from/to North Atlantic All Carriers are combinable To all destinstions to North Atlantic AND world wide AMS NYC ZRH BSL PAR GVA VIRGIN ATLANTIC JOINS AF KL DL TRANSATLANTIC JOINT VENTURE • DL hält 49%, AF KL halten 31% Anteile an Virgin Atlantic (VS) • AF / KL / DL / VS ist der grösste Airline-Verbund zwischen Europa und Nordatlantik • 300 tägliche Flüge von/zu 60 Destinationen zwischen Europa und Nordatlantik 5 CDG HUB ZRH / GVA BSL AMS HUB At JFK airport – T4 • SkyPriority® Services : • Exclusive check-in areas • Priority boarding and baggage delivery • Priority service at ticket/transfer desks • Accelerated security and passport clearance • Delta Sky Club® lounge: • New Sky Deck terrace with unprecedented runway views • Free Wi-Fi • Personalized flight assistance • Refreshments and snacks • Magazines and newspapers NEW DESTINATIONS & ROUTES RAPIDLY EXPANDING GLOBAL NETWORK New KLM destinations (from AMS): • Boston (as of MAR19) • Las Vegas (as of JUN19) New Air France -

CFA Institute Research Challenge Atlanta Society of Finance And

CFA Institute Research Challenge Hosted by Atlanta Society of Finance and Investment Professionals Team J Team J Industrials Sector, Airlines Industry This report is published for educational purposes only by New York Stock Exchange students competing in the CFA Research Challenge. Delta Air Lines Date: 12 January 2017 Closing Price: $50.88 USD Recommendation: HOLD Ticker: DAL Headquarters: Atlanta, GA Target Price: $57.05 USD Investment Thesis Recommendation: Hold We issue a “hold” recommendation for Delta Air Lines (DAL) with a price target of $57 based on our intrinsic share analysis. This is a 11% potential premium to the closing price on January 12, 2017. Strong Operating Leverage Over the past ten years, Delta has grown its top-line by 8.8% annually, while, more importantly, generating positive operating leverage of 60% per annum over the same period. Its recent growth and operational performance has boosted Delta’s investment attractiveness. Management’s commitment to invest 50% of operating cash flows back into the company positions Delta to continue to sustain profitable growth. Growth in Foreign Markets Delta has made an initiative to partner with strong regional airlines across the world to leverage its world-class service into new branding opportunities with less capital investment. Expansion via strategic partnerships is expected to carry higher margin growth opportunities. Figure 1: Valuation Summary Valuation The Discounted Cash Flows (DCF) and P/E analysis suggest a large range of potential share value estimates. Taking a weighted average between the two valuations, our bullish case of $63 suggests an attractive opportunity. However, this outcome presumes strong U.S. -

Prof. Paul Stephen Dempsey

AIRLINE ALLIANCES by Paul Stephen Dempsey Director, Institute of Air & Space Law McGill University Copyright © 2008 by Paul Stephen Dempsey Before Alliances, there was Pan American World Airways . and Trans World Airlines. Before the mega- Alliances, there was interlining, facilitated by IATA Like dogs marking territory, airlines around the world are sniffing each other's tail fins looking for partners." Daniel Riordan “The hardest thing in working on an alliance is to coordinate the activities of people who have different instincts and a different language, and maybe worship slightly different travel gods, to get them to work together in a culture that allows them to respect each other’s habits and convictions, and yet work productively together in an environment in which you can’t specify everything in advance.” Michael E. Levine “Beware a pact with the devil.” Martin Shugrue Airline Motivations For Alliances • the desire to achieve greater economies of scale, scope, and density; • the desire to reduce costs by consolidating redundant operations; • the need to improve revenue by reducing the level of competition wherever possible as markets are liberalized; and • the desire to skirt around the nationality rules which prohibit multinational ownership and cabotage. Intercarrier Agreements · Ticketing-and-Baggage Agreements · Joint-Fare Agreements · Reciprocal Airport Agreements · Blocked Space Relationships · Computer Reservations Systems Joint Ventures · Joint Sales Offices and Telephone Centers · E-Commerce Joint Ventures · Frequent Flyer Program Alliances · Pooling Traffic & Revenue · Code-Sharing Code Sharing The term "code" refers to the identifier used in flight schedule, generally the 2-character IATA carrier designator code and flight number. Thus, XX123, flight 123 operated by the airline XX, might also be sold by airline YY as YY456 and by ZZ as ZZ9876. -

Sky Pearl Club Membership Guide

SKY PEARL CLUB MEMBERSHIP GUIDE Welcome to China Southern Airlines’ Sky Pearl Club The Sky Pearl Club is the frequent flyer program of China Southern Airlines. From the moment you join The Sky Pearl Club, you will experience a whole new world of exciting new travel opportunities with China Southern! Whether you’re traveling for business or pleasure, you’ll be earning mileage toward your award goals every time you fly. Many Elite tier services have been prepared for you. We trust this Guide will soon help you reach your award flight to your dream destinations. China Southern Sky Pearl Club cares about you! 1 A B Earning CZ mileage Redeeming CZ mileage Airlines China Southern Airlines Award Ticket Hotels China Southern Airlines Award Upgrade Banks Partner Airlines Award Ticket Telecommunications, Car Rentals, Business Travel,Dining and others C D Enjoying Sky Pearl Elite Benefits Getting Acquainted with Sky Pearl Rules Definition Membership tiers Membership Qualification and Mileage Account Elite Qualification Mileage Accrual Elite Benefits Mileage Redemption Little Pearl Benefits Membership tier and Elite benefits 2 Others A Earning CZ mileage Whether it’s in the air or on the ground, The Sky Pearl Club gives you more opportunities than ever before to earn Award travel. When flying with China Southern or one of our many airline partners, you can earn FFP mileage. But, that’s not the only way! Hotels stays, car rentals, credit card services, telecommunication services or dining with our business-to-business partners can also help you earn mileage. 3 Airlines Upon making your reservation and ticket booking, please provide your Sky Pearl Club membership number and make sure that passenger’s name and ID is the same as that of your mileage account. -

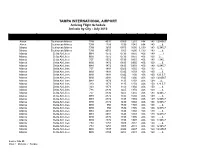

Flight-Schedule-Template

TAMPA INTERNATIONAL AIRPORT Arriving Flight Schedule Arrivals by City - July 2015 Departure Arrival Cities Served Airline Aircraft Flight No. Miles Seats Days Time Time Akron Southwest Airlines 73W 4531 0950 1210 894 143 1234567 Akron Southwest Airlines 73W 1108 1330 1545 894 143 .....6. Albany Southwest Airlines 73W 3650 0705 1005 1,130 143 12345.7 Albany Southwest Airlines 73W 4553 1305 1605 1,130 143 .....6. Atlanta Delta Air Lines M88 1572 0730 0850 406 149 ......7 Atlanta Delta Air Lines M90 1572 0730 0850 406 160 .2..... Atlanta Delta Air Lines 757 1572 0730 0850 406 183 1.345.. Atlanta Delta Air Lines M90 1472 0835 0956 406 160 .....6. Atlanta Delta Air Lines M88 1472 0835 0958 406 149 12345.7 Atlanta Delta Air Lines 757 1891 0925 1050 406 183 ...4... Atlanta Delta Air Lines M90 1891 0935 1059 406 160 .....6. Atlanta Delta Air Lines M90 1891 0935 1100 406 160 123.5.7 Atlanta Delta Air Lines M90 2091 1035 1200 406 160 1234567 Atlanta Delta Air Lines M88 1373 1135 1258 406 149 ...4... Atlanta Delta Air Lines 320 1373 1135 1258 406 150 123.5.7 Atlanta Delta Air Lines 320 1373 1140 1302 406 150 .....6. Atlanta Delta Air Lines 738 2330 1225 1350 406 160 .....6. Atlanta Delta Air Lines 757 2330 1225 1350 406 183 12345.7 Atlanta Delta Air Lines M88 2372 1335 1502 406 149 .....6. Atlanta Delta Air Lines M88 2372 1335 1504 406 149 12345.7 Atlanta Delta Air Lines M90 2172 1430 1602 406 160 12345.7 Atlanta Delta Air Lines M90 950 1530 1703 406 160 .....6. -

(VWP) Carriers

Visa Waiver Program (VWP) Signatory Carriers February 1, 2020 In order to facilitate the arrival of Visa Waiver Program (VWP) passengers, carriers need to be signatory to a current agreement with U.S. Customs and Border Protection (CBP). A carrier is required to be signatory to an agreement in order to transport aliens seeking admission as nonimmigrant visitors under the VWP (Title 8, U.S.C. § 1187(a)(5). The carriers listed below are currently signatory to the VWP and can transport passengers under the program. The date indicates the expiration of the current signed agreement. Agreements are valid for 7 years. If you transport VWP passengers and are not a signatory carrier, fines will be levied. Use the following link to apply to CBP to become a Signatory Carrier: https://www.cbp.gov/travel/international-visitors/business-pleasure/vwp/signatory-status # 21st Century Fox America, Inc. (04/07/2022) 245 Pilot Services Company, Inc. (01/14/2022) 258131 Aviation LLC (09/18/2020) 4770RR, LLC (12/06/2023) 51 CL Corp. (06/23/2024) 51 LJ Corporation (02/01/2023) 650534 Alberta, Inc. d/b/a Latitude Air Ambulance (01/09/2024) 711 CODY, Inc. (02/09/2025) A A&M Global Solutions, Inc. (09/03/2021) A.J. Walter Aviation, Inc. (01/17/2021) A.R. Aviation, Corp. (12/30/2022) Abbott Laboratories Inc. (08/26/2026) AbbVie US LLC (10/15/2026) Abelag Aviation NV d/b/a Luxaviation Belgium (02/27/2026) ABS Jets A.S. (05/07/2025) ACASS Canada Ltd. (02/27/2026) Accent Airways LLC (01/12/2022) Ace Flight Center Inc. -

Charter Report - 2019 Prospectuses

CHARTER REPORT - 2019 PROSPECTUSES Beginning Number of Type of Aircraft Charter Operator Carrier Origin Destination Date Ending Date Remarks/Indirect Carrier Flights & No. of Seats Embraer 135 19-001 Resort Air Services RVR Aviation (air taxi) DAL-89TE LAJ-DAL-89TE 2/22/2019 12/15/2019 94 w/30 sts New England Air Transport Inc. PILATUS PC-12 19-002 JetSmarter Inc. (air taxi) FLL MYN 2/8/2019 2/8/2019 1 w/6 guests Hawker 800 w/8 19-003 JetSmarter Inc. Jet-Air, LLC (air taxi) FLL HPN 3/3/2019 3/3/2019 1 guests Gulfstream G200 w/10 19-004 JetSmarter Inc. Chartright Air Inc. (air taxi) FLL YYZ 3/7/2019 3/7/2019 1 guests Domier 328 Jet Ultimate Jetcharters, LLC dba w/30sts/ Ultimate Jet Shuttle Public Ultimate JETCHARTERS, LLC Embraer 135 Jet 19-005 Charters Inc.(co-charterer) dba Ultimate Air Shuttle CLT PDK 2/25/2019 2/24/2020 401 w/30 sts Citation C J2 19-006 JetSmarter Inc. Flyexclusive, Inc. (air taxi) ORL TEB 3/30/2019 3/30/2019 1 w/6 guests Phenom 300 19-007 JetSmarter Inc. GrandView Aviation (air taxi) JAX MTN 3/24/2019 3/24/2019 1 w/7 guests Aviation Advantage/E-Vacations Corp Boeing 737-400 19-008 (co-charterer) Swift Air SJU-PUJ-POP-etc PUJ-SJU-CUN-etc 6/3/2019 8/3/2019 50 w/150 sts Boeing 737-400 19-009 PrimeSport Southwest Airlines BOS ATL 2/1/2019 2/4/2019 50 w/150 sts CHARTER REPORT - 2019 PROSPECTUSES Delux Public Charter, LLC EMB-135 w/30 19-010 JetBlue Airways Corporation dba JetSuite X (commuter) KBUR-KLAS-KCCR-etc KLAS-KBUR-KCCR-etc 4/1/2019 7/1/2019 34,220 sts Glulfstream IV- 19-011 MemberJets, LLC Prine Jet, LLC (air taxi) OPF-TEB-MDW--etc TEB-OPF-PBI-etc 2/14/2019 12/7/2019 62.5 SP w/10 sts Phenom 300 19-012 JetSmarter Inc. -

Delta Air Lines Inc. Fundamental Company Report Including

+44 20 8123 2220 [email protected] Delta Air Lines Inc. Fundamental Company Report Including Financial, SWOT, Competitors and Industry Analysis https://marketpublishers.com/r/DEEF4523D88BEN.html Date: September 2021 Pages: 50 Price: US$ 499.00 (Single User License) ID: DEEF4523D88BEN Abstracts Delta Air Lines Inc. Fundamental Company Report provides a complete overview of the company’s affairs. All available data is presented in a comprehensive and easily accessed format. The report includes financial and SWOT information, industry analysis, opinions, estimates, plus annual and quarterly forecasts made by stock market experts. The report also enables direct comparison to be made between Delta Air Lines Inc. and its competitors. This provides our Clients with a clear understanding of Delta Air Lines Inc. position in the Airline Industry. The report contains detailed information about Delta Air Lines Inc. that gives an unrivalled in-depth knowledge about internal business-environment of the company: data about the owners, senior executives, locations, subsidiaries, markets, products, and company history. Another part of the report is a SWOT-analysis carried out for Delta Air Lines Inc.. It involves specifying the objective of the company's business and identifies the different factors that are favorable and unfavorable to achieving that objective. SWOT-analysis helps to understand company’s strengths, weaknesses, opportunities, and possible threats against it. The Delta Air Lines Inc. financial analysis covers the income statement and ratio trend-charts with balance sheets and cash flows presented on an annual and quarterly basis. The report outlines the main financial ratios pertaining to profitability, margin analysis, asset turnover, credit ratios, and company’s long- Delta Air Lines Inc. -

(VWP) Carriers

Visa Waiver Program (VWP) Signatory Carriers March 1, 2020 In order to facilitate the arrival of Visa Waiver Program (VWP) passengers, carriers need to be signatory to a current agreement with U.S. Customs and Border Protection (CBP). A carrier is required to be signatory to an agreement in order to transport aliens seeking admission as nonimmigrant visitors under the VWP (Title 8, U.S.C. § 1187(a)(5). The carriers listed below are currently signatory to the VWP and can transport passengers under the program. The date indicates the expiration of the current signed agreement. Agreements are valid for 7 years. If you transport VWP passengers and are not a signatory carrier, fines will be levied. Use the following link to apply to CBP to become a Signatory Carrier: https://www.cbp.gov/travel/international-visitors/business-pleasure/vwp/signatory-status # 21st Century Fox America, Inc. (04/07/2022) 245 Pilot Services Company, Inc. (01/14/2022) 258131 Aviation LLC (09/18/2020) 4770RR, LLC (12/06/2023) 51 CL Corp. (06/23/2024) 51 LJ Corporation (02/01/2023) 650534 Alberta, Inc. d/b/a Latitude Air Ambulance (01/09/2024) 711 CODY, Inc. (02/09/2025) A A&M Global Solutions, Inc. (09/03/2021) A.J. Walter Aviation, Inc. (01/17/2021) A.R. Aviation, Corp. (12/30/2022) Abbott Laboratories Inc. (08/26/2026) AbbVie US LLC (10/15/2026) Abelag Aviation NV d/b/a Luxaviation Belgium (02/27/2026) ABS Jets A.S. (05/07/2025) ACASS Canada Ltd. (02/27/2026) Accent Airways LLC (01/12/2022) Ace Flight Center Inc. -

Before the Department of Transportation Washington, D.C

BEFORE THE DEPARTMENT OF TRANSPORTATION WASHINGTON, D.C. Joint Application of ) ) DELTA AIR LINES, INC. ) and ) CHINA EASTERN AIRLINES CORPORATION LTD. ) Docket DOT-OST-2011-0065 ) for Statements of Authorization and Blanket ) Exemptions ) ) (U.S.-China Codesharing) ) Joint Application of ) ) DELTA AIR LINES, INC. ) AEROLINEAS ARGENTINAS S.A. ) and ) Docket DOT-OST-2011-0153 AUSTRAL LINEAS AEREAS-CIELOS DEL SUR S.A. ) ) for statements of authorization pursuant to 14 C.F.R. ) Part 212 and related exemptions pursuant to 49 U.S.C. § ) 40109 (reciprocal codesharing) ) Joint Application of ) ) DELTA AIR LINES, INC. ) and ) WESTJET ) Docket DOT-OST-2011·0199 ) for statements of authorization ) pursuant to 14 C.F.R. Part 212 ) NOTICE OF ADDITIONAL DELTA CONNECTION OPERATOR February 28, 2012 Communications with respect to this document should be addressed to: Alexander Van der Bellen Managing Director – Government Affairs & Associate General Counsel Jeff Morgan Regional Director-Government Affairs DELTA AIR LINES, INC. 1212 New York Avenue, N.W. Washington, D.C. 20005 (202) 842-4184 [email protected] . BEFORE THE DEPARTMENT OF TRANSPORTATION WASHINGTON, D.C. Joint Application of ) ) DELTA AIR LINES, INC., ) and ) CHINA EASTERN AIRLINES CORPORATION LTD. ) Docket DOT-OST-2011-0065 ) for Statements of Authorization and Blanket ) Exemptions ) ) (U.S.-China Codesharing) ) Joint Application of ) ) DELTA AIR LINES, INC. ) AEROLINEAS ARGENTINAS S.A. ) and ) Docket DOT-OST-2011-0153 AUSTRAL LINEAS AEREAS-CIELOS DEL SUR S.A. ) ) for statements of authorization pursuant to 14 C.F.R. ) Part 212 and related exemptions pursuant to 49 U.S.C. § ) 40109 (reciprocal codesharing) ) Joint Application of ) ) DELTA AIR LINES, INC., ) and ) WESTJET ) Docket DOT-OST-2011·0199 ) for statements of authorization ) pursuant to 14 C.F.R. -

Skyteam Timetable Covers Period: 01 Sep 2017 Through 30 Nov 2017

SkyTeam Timetable Covers period: 01 Sep 2017 through 30 Nov 2017 Regions :North America - Asia Pacific Contact Disclaimer To book, contact any SkyTeam member airline. The content of this PDF timetable is for information purposes only, subject to change at any time. Neither Aeroflot www.aeroflot.com SkyTeam, nor SkyTeam Members (including without Aerolneas Argentinas www.aerolineas.com limitation their respective suppliers) make representation Aeromexico www.aeromexico.com or give warranty as to the completeness or accuracy of Air Europa www.aireuropa.com such content as well as to its suitability for any purpose. Air France www.airfrance.com In particular, you should be aware that this content may be incomplete, may contain errors or may have become Alitalia www.alitalia.com out of date. It is provided as is without any warranty or China Airlines www.china-airlines.com condition of any kind, either express or implied, including China Eastern www.ceair.com but not limited to all implied warranties and conditions of China Southern www.csair.com merchantability, fitness for a particular purpose, title and Czech Airlines www.czechairlines.com non-infringement. Given the flexible nature of flight Delta Air Lines www.delta.com schedules, our PDF timetable may not reflect the latest information. Garuda Indonesia www.garuda-indonesia.com Kenya Airways www.kenya-airways.com By accessing the PDF timetable, the user acknowledges that the SkyTeam Alliance and any SkyTeam member KLM www.klm.com airline will not be responsible or liable to the user,