Grocery Outlet !

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Market Analysis for Grocery Retail Space in Forest Grove, Oregon

MARKET ANALYSIS FOR GROCERY RETAIL SPACE IN FOREST GROVE, OREGON PREPARED FOR THE CITY OF FOREST GROVE, FEBRUARY 2018 TABLE OF CONTENTS I. INTRODUCTION ............................................................................................................................................. 2 II. EXECUTIVE SUMMARY .................................................................................................................................. 2 III. TRADE AREA DEFINITION .............................................................................................................................. 4 IV. GROCERY MARKET OVERVIEW ...................................................................................................................... 5 THE PORTLAND METRO MARKET .............................................................................................................................. 5 METRO LOCATION PATTERNS ................................................................................................................................... 8 FOREST GROVE-CORNELIUS ................................................................................................................................... 15 V. SOCIO-ECONOMIC CONDITIONS .................................................................................................................. 19 POPULATION & HOUSEHOLDS ................................................................................................................................ 19 EMPLOYMENT & COMMUTING .............................................................................................................................. -

Alabama Vendor List.Xlsx

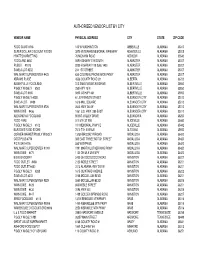

AUTHORIZED VENDOR LIST BY CITY VENDOR NAME PHYSICAL ADDRESS CITY STATE ZIP CODE FOOD GIANT #716 100 W WASHINGTON ABBEVILLE ALABAMA 36310 SUPER DOLLAR DISCOUNT FOODS 3970 VETERANS MEMORIAL PARKWAY ADAMSVILLE ALABAMA 35005 HYATT'S MARKET INC 70 MCHANN ROAD ADDISON ALABAMA 35540 FOODLAND #450 509 HIGHWAY 119 SOUTH ALABASTER ALABAMA 35007 PUBLIX #1073 9200 HIGHWAY 119 Suite 1400 ALABASTER ALABAMA 35007 SAVE-A-LOT #202 244 1ST STREET ALABASTER ALABAMA 35007 WAL MART SUPERCENTER #423 630 COLONIAL PROMENADE PKWY ALABASTER ALABAMA 35007 ABRAMS PLACE 4556 COUNTY ROAD 29 ALBERTA ALABAMA 36720 ALBERTVILLE FOODLAND 313 SAND MOUNTAIN DRIVE ALBERTVILLE ALABAMA 35950 PIGGLY WIGGLY #500 250 HWY 75 N ALBERTVILLE ALABAMA 35950 SAVE-A-LOT #165 5850 US HWY 431 ALBERTVILLE ALABAMA 35950 PIGGLY WIGGLY #238 61 JEFFERSON STREET ALEXANDER CITY ALABAMA 35010 SAVE-A-LOT #489 1616 MILL SQUARE ALEXANDER CITY ALABAMA 35010 WAL MART SUPERCENTER #726 2643 HWY 280 W ALEXANDER CITY ALABAMA 35010 WINN DIXIE #456 1061 U.S. HWY. 280 EAST ALEXANDER CITY ALABAMA 35010 ALEXANDRIA FOODLAND 85 BIG VALLEY DRIVE ALEXANDRIA ALABAMA 36250 FOOD FARE 517 5TH ST NW ALICEVILLE ALABAMA 35442 PIGGLY WIGGLY #102 101 MEMORIAL PKWY E ALICEVILLE ALABAMA 35442 BURTON'S FOOD STORE 7010 7TH AVENUE ALTOONA ALABAMA 35952 CORNER MARKET/PIGGLY WIGGLY 13759 BROOKLYN ROAD ANDALUSIA ALABAMA 36420 COST PLUS #774 305 EAST THREE NOTCH STREET ANDALUSIA ALABAMA 36420 PIC N SAV #776 550 W BYPASS ANDALUSIA ALABAMA 36420 WAL MART SUPERCENTER #1091 1991 MARTIN LUTHER KING PKWY ANDALUSIA ALABAMA 36420 WINN DIXIE -

Retail Scene Report

GFSI CONFERENCE 2020 – DISCOVERY TOURS 25th February | Seattle, USA Retail Scene Report Seattle, Washington State & America’s Pacific Northwest 19 The Consumer Goods Forum GFSI CONFERENCE 2020 – DISCOVERY TOURS 25th February | Seattle, USA Retail Scene Report Seattle, Washington State & America’s Pacific Northwest FEBRUARY 2020 Kantar Consulting for The Consumer Goods Forum’s GFSI Conference 2020 20 The Consumer Goods Forum GFSI CONFERENCE 2020 – DISCOVERY TOURS 25th February | Seattle, USA Contents Seattle, Washington State & America’s Pacific Northwest .............. 22 Food Retail in the Pacific Northwest ........................................................ 24 Supercenters & Warehouse Clubs ........................................................ 27 Supermarkets & Convenience Stores .................................................. 29 Full-Service Supermarkets .................................................................. 29 Value/Private-Label Supermarkets ................................................ 32 Convenience Stores ................................................................................ 34 Food Safety in America & Washington State ......................................... 35 The US Federal Government & Agencies ........................................... 35 Washington State Food Safety ................................................................ 36 City, Town, & Local Food Safety ............................................................ 37 Conclusions ........................................................................................................ -

Oregon Redemption Centers Albany Beaverton

Oregon Redemption Centers and Associated Retailers (5,000 or more sq ft in size) ZONE 1 ZONE 2 EXEMPT** DEALER REDEMPTION CENTERS*** FULL SERVICE PARTICIPATING RETAILERS PARTICIPATING RETAILERS (accept 144 containers) (accept 24 containers) REDEMPTION CENTERS (accept 0 containers) (accept 24 containers) 0 - 2.0 miles radius Albany from redemption center No Zone 2 Zone 1 No Zone 2141 Santiam Hwy SE Albany Grocery Outlet Albany East Liquor Store 1103 ALOHA 1950 14th Ave SE 2530 Pacific Blvd SE Albertsons #3557 approved 6/18/2015 Big Lots #4660 Dollar Tree #1508 6055 SW 185th 2000 14th Ave SE, Ste 102 1307 Waverly Dr SE Bi-Mart #606 Lowe's #3057 BEAVERTON 2272 Santiam Hwy 1300 9th Ave SE Fred Meyer #482 Costco #0682 15995 SW Walker Rd 3130 Killdeer Ave SE Fred Meyer #005 CANBY 2500 Santiam Blvd Fred Meyer #651 North Albany Market 1401 SE 1st Ave 621 NE Hickory Rite Aid #5365 Safeway #2604 1235 Waverly Dr SE 1051 SW 1st Ave Safeway #1659 1990 14th Ave SE CLACKAMAS Target #T609 Fred Meyer #063 2255 14th Ave SE 16301 SE 82nd Dr Walgreens #6530 1700 Pacific Blvd SE DALLAS Walmart #5396 Safeway #4404 1330 Goldfish Farm SE 138 W Ellendale Ave Wheeler Dealer 1740 SE Geary St EUGENE Winco Foods Fred Meyer #325 (Santa Clara) 3100 Pacific Blvd SE 60 Division St 0 - 2.0 miles radius 2.01 - 2.8 miles radius Beaverton from redemption center from redemption center Either Zone FLORENCE 9307 SW Beaverton-Hillsdale Hwy Albertsons #505 99 Ranch Cost Plus World Market #6060 Fred Meyer #464 5415 SW Beaverton Hillsdale Hwy 8155 SW Hall Blvd 10108 SW Washington -

TENANT CREDIT RATINGS - 1St Quarter 2017

TENANT CREDIT RATINGS - 1st Quarter 2017 - PROVIDED TO YOU BY: TENANT CREDIT RATINGS MOODY’S AND STANDARD & POOR’S Hanley Investment Group is a boutique real estate brokerage and advisory services company that specializes in the sale of commercial retail properties nationwide. Our expertise, proven track record and unwavering dedication to put client needs first continues to set us apart in the industry. Hanley Investment Group creates value by delivering exceptional results through the use of property-specific marketing strategies, cutting-edge technology and local market knowledge. Our nationwide relationships with investors, developers, institutions, franchisees, brokers and 1031 exchange buyers are unparalleled in the industry, translating into maximum exposure and pricing for each property marketed and sold. With unmatched service, Hanley Investment Group has redefined the experience of selling retail investment properties. RETAIL TENANT LIST WITH TICKER SYMBOLS & CREDIT RATINGS - 1st Quarter 2017 - CREDIT TENANCY MOODY’S STANDARD & POOR’S Highest Quality Aaa AAA High Quality Aa AA Upper Medium Grade A A Medium Grade Baa BBB Lower Medium Grade * Ba BB Lower Grade * B B Poor Quality * Caa CCC Speculative * Ca CC No Interest Being Paid or BK Petition Filed * C C Note: The ratings from Aa to Ca by Moody’s may be modified by the addition of a 1, 2 or 3 to show the relative standing within the category. 1=High 3=Low * Below Investment Grade • Hanley Investment Group • 3500 East Coast Highway, Suite 100, Corona del Mar, CA 92625 • P: 949.585.7610 • www.HanleyInvestment.com • TENANT CREDIT RATINGS MOODY’S AND STANDARD & POOR’S TENANT TICKER MOODY'S S&P SUBSIDIARIES, AFFILIATES, AND BRAND NAMES AUTOMOTIVE Advance Auto Parts, Western Auto Supply, Discount Auto Parts, Advance Auto Parts, Inc. -

Covid19 Apr09 Info from Ala G

Company Work Phone Mailing Address City ST Zip County Curbside Home Delivery Third Party Service Food Giant #716 334-585-2789 100 W. Washington Street Abbeville AL 36310 Henry Publix Super Markets #1073 205-663-3443 9200 Hwy. 119, Ste. 1400 Alabaster AL 35007-5327 Shelby No Yes Instacart, Shipt Target 250 S Colonial Drive Alabaster AL Shelby Yes Yes Shipt 35007 Walmart Neighborhood Market 4756 9085 Highway 119 Alabaster AL 35007 Shelby Yes No Walmart Supercenter 0423 205-620-0360 630 Colonial Promenade Pkwy Alabaster AL 35007 Shelby Yes Yes DoorDash, PointPickup, Postmates, Roadie and Spark Albertville Foodland 256-891-0390 313 Sand Mountain Drive Albertville AL 35950 Marshall No No JMBL, Inc. 256-891-5410 P.O. Drawer 370 Albertville AL 35950-0006 Marshall No No Piggly Wiggly #500 256-878-2075 250 AL HWY 75 N Albertville AL 35951 Marshall Save-A-Lot #23562 256-891-1339 5850 US HWY 431 Albertville AL 35950-2049 Marshall Piggly Wiggly #238 256-234-3454 61 Jefferson Street Alexander City AL 35010 Tallapoosa Save-A-Lot #489 56) 215-4197 1612 Mill Square Street Alexander City AL 35010 Tallapoosa Walmart Supercenter 0726 205-324-0316 2643 Hwy 280 West Alexander City AL 35010-3675 Tallapoosa Yes No Winn-Dixie #456 256-234-5141 1061 US HWY 280 E Alexander City AL 35010-4622 Tallapoosa Alexandria Foodland 256-847-8466 P.O. Box 548 Alexandria AL 36250 Calhoun No No Food Outlet Jr. #465 334-820-4218 6346 Highway 431 Alexandria AL 36250-5005 Calhoun No No Food Fare 205-373-8734 517 5th St. -

Alturas Planning Commission Regular Meeting City Hall Council Chambers March 14, 2018 5:30 P.M

Alturas Planning Commission Regular Meeting City Hall Council Chambers March 14, 2018 5:30 p.m. The meeting was called to order by Chairman Bill Hall at 5:30 p.m. Commissioners present: Tom Romero, Marlene Hamilton, Chris Lauppe. Commissioners absent: Robert Dolan. Staff present: Planner Jennifer Andersen Planning Director Joe Picotte, City Council Planning Dept. Liaison Mark Steffek, Secretary Bobbi Jean Melbourn, City Treasurer Sara Peet, Administrative Asst. Macey Binning. Public attending: 32 No one is present under the public forum. MOTION by Commissioner Romero, SECONDED by Commissioner Hamilton to approve the minutes of the December 13, 2017 meeting. ALL AYES. Commissioner Hall reviewed the guidelines of a Public Hearing and introduces Planner Jennifer Andersen to the public. PUBLIC HEARING ITEM A: Opened at 5:43 p.m. Clement Balser of Blackpoint Group, Inc. is requesting a Use Permit (UP2018-01) to develop a portion of vacant APN 001-090-014 into a retail shopping center anchored by a Grocery Outlet store. Planner Jennifer Andersen explains the location of the proposed project is north of the Department of Motor Vehicles with direct access from Highway 299 (W. 12th Street) and secondary access off of N. West 'C' Street. The Center is proposed as a phased development with Phase 1 to include a 16,000 SF Grocery Outlet and all the improvements illustrated in the Site Plan except the paving and landscaping surrounding the drive- through restaurant area and the curb and sidewalk improvements immediately surrounding the second retail pad. The proposed Use Permit is currently conditioned for any tenant. -

How Wages and Working Conditions for California's

HOW WAGES AND WORKING CONDITIONS FOR CALIFORNIA’S FOOD RETAIL WORKERS HAVE DECLINED AS THE INDUSTRY HAS THRIVED By Saru Jayaraman and the Food Labor Research Center, University of California, Berkeley Primary Research Support Provided by the Food Chain Workers Alliance and Professor Chris Benner, University of California, Davis June 2014 Commissioned by United Food and Commercial Workers, Western States Council EXECUTIVE SUMMARY – Shelved: How Wages and Working Conditions for California’s Food Retail Workers Have Declined as the Industry has Thrived Shelved: How Wages and Working Conditions for California’s Food Retail Workers Have Declined as the Industry has Thrived is based on worker surveys, in-depth interviews with workers and employers, analysis of industry and government data, and reviews of existing aca- demic literature. It represents the most comprehensive analysis ever conducted of California’s food retail industry. The report shows that while California’s food retail industry has enjoyed consistent growth over the past two decades, the expansion of a low-price, low-cost business model – and the choices that traditional, unionized grocers have made in the face of it – have produced a dramatic wage decline, with high rates of poverty and hunger among workers in a sector that once enjoyed relatively high wages and unionization rates. The report calls for a two- pronged strategy to arrest and reverse these trends: support for unionization, and public policies that support livable wages and benefits. This strategy would promote the creation of good jobs in the food retail sector and help build long-term prosperity for California’s families and communities. -

List of Data Recipients Participating in the GDSN

List of Data Recipients Participating in the GDSN 1WorldSync Recipients in United States Subscribed to the GDSN Additional Recipients in United States http://www.1worldsync.com/customers/ Subscribed to the GDSN Global Data Recipients Subscribed to the GDSN 1 ABCO Corporation 1 Ahold USA, Inc. 1 Cooperative Obrera Argentina 2 Acme Paper & Supply Co. 2 AliMed, Inc. 2 Cordiez/Cyre Argentina 3 Acorn Distributors Inc. 3 Appert’s Foodservice 3 Coto Cisca Argentina 4 Acosta Sales 4 Aramark 4 Disco Argentina 5 Advantage Sales & Marketing, LLC 5 Aryzta, LLC 5 Disco Mendoza Argentina 6 Advantage Waypoint LLC 6 ATiP Foundation DBA Maryland Technology Development Corporation6 Jumbo Argentina 7 Alaska Housewares Inc 7 AutoZone 7 La Patagonia (La Anonima) Argentina 8 Albertsons Companies 8 Barnett Brass & Copper Inc. 8 Yaguar Argentina 9 Alder Foods, Inc. 9 Bartell Drugs 9 Coles Group Australia 10 Alliance for a Healthier Generation 10 Beaver Street Fisheries 10 Metcash Australia 11 Amazon Services LLC 11 Ben E. Keith Foods 11 Edeka Austria 12 American Paper & Supply Company 12 BiRite Foodservice Distributors 12 Metro Austria 13 American Paper & Twine Co. 13 Cheney Brothers, Inc. 13 Migros Austria 14 American Plastic Toys, Inc. 14 Costco Companies, Inc. 14 Cora Belgium (CDB) Belgium 15 AmerisourceBergen (Retail Insights) 15 Delhaize USA 15 Delhaize Belgium 16 Antonio Sofo & Son Importing Co., Inc. 16 DiCarlo Distributors, Inc. 16 Colruyt Belgium 17 Armada Supply Chain Solutions 17 Dining Alliance Inc. 17 Trustbox Belgium 19 Associated Food Stores, Inc. 18 Distribution Market Advantage 18 A dela Chevrotiere Ltee Brazil 20 Associated Grocers, Inc. 19 Doerle Food Services, LLC 19 Bridge Brand Food Services Ltd Canada 21 Associated Grocers of New England 20 Ellenbee Leggett 20 Bruce Edmeades Enterprises Ltd Canada 22 Associated Wholesale Grocers, Inc. -

A Case Study

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Research Papers in Economics Working Paper 97-05 Advancing Knowledge About Processing, Distribution, The Retail Food Industry Center Sales, and Food Service University of Minnesota Printed Copy $22.50 NEW COMPETITION FOR SUPERMARKETS: A CASE STUDY Oral Capps, Jr. Department of Agricultural Economics Texas A&M University College Station, Texas 77843-2124 (409)845-8491 fax: (409)862-3019 [email protected] July 1997 Oral Capps, Jr., is a professor and faculty member of the Department of Agricultural Economics, Texas A&M University. This paper is part of the Organized Symposium entitled, “Changes in the Food Retail Industry” for the 1997 AAEA meetings in Toronto, Canada. The Retail Food Industry Center is an Alfred P. Sloan Foundation Industry Study Center. NEW COMPETITION FOR SUPERMARKETS: A CASE STUDY Oral Capps, Jr. Abstract Non-traditional retailers such as warehouse club stores, discount drug stores, and discount mass merchandisers are new competitors for traditional food retailers. It is expected that non- traditional retailers will account for roughly 14 percent of total grocery sales by the turn of the century. The impact of a particular discount mass merchandiser (Wal-Mart) on the sales of a conventional retail grocery outlet (David’s Supermarket, Inc.) located in the rural areas surrounding the Dallas/Ft. Worth metroplex is analyzed in this case study. In this case study, Wal-Mart alone is responsible for about a 17 percent reduction in sales. Key words: Warehouse Club Stores, Discount Mass Merchandisers, Supermarkets, Competition. -

Azusa Shopping Cart Retrievals August 2020

CITY OF AZUSA August- Cart Retrieval Report Date Location Store Carts 8/1/2020 Arrow & Cerritos CVS 2 469 Arrow Lowes 1 8/3/2020 565 Mason El Super 1 339 Pasadena Grocery Outlet 1 340 Motor Costco 1 735 Pasadena Smart & Final 1 721 Pasadena Lowes 1 401 Foothill CVS 1 341 Rockvale Grocery Outlet 1 345 Haltern Stater Bros. 1 345 Haltern CVS 1 333 Rockvale Total Wine 1 355 Alosta Grocery Outlet 1 1130 Alosta Stater Bros. 1 8/4/2020 Arrow & Azusa El Super 1 8/5/2020 17 East Arrow Highway Superior 1 915 East Arrow Highway Aldi 1 415 South Pasadena Avenue Smart & Final 1 200 West 5th Street Grocery Outlet 1 735 Georgia Avenue Valley Thrift Store 1 735 Georgia Avenue Valley Thrift Store 1 720 Georgia Avenue Grocery Outlet 1 934 West Industrial Street CVS 1 905 North Pasadena Avenue Home Depot 1 553 East 8th Street Smart & Final 1 304 East Foothill Boulevard CVS 1 360 North Cerritos Avenue CVS 1 390 North Cerritos Avenue Sprouts 1 390 North Cerritos Avenue Grocery Outlet 3 360 North Cerritos Avenue Stater Bros 1 835 East Haltern Street Grocery Outlet 1 203 North Fenimore Avenue Grocery Outlet 1 671 East Bagnall Street Grocery Outlet 1 690 East Sixth Street CVS 1 1007 East Hollyvale Street Big Lots 1 887 Azusa Home Depot 1 8/7/2020 321 Mason El Super 1 349 Pasadena El Super 1 409 Pasadena El Super 1 1 195 Gladstone El Super 1 737 Pasadena Smart & Final 1 304 East Foothill Boulevard Smart & Final 1 304 East Foothill Boulevard Stater Bros 1 363 Calera Stater Bros 1 1130 Alosta Stater Bros 2 469 Arrow El Super 1 8/8/2020 Arrow & Azusa Family Store -

Participating Film and Bag Recycling Partners

PARTICIPATING FILM AND BAG RECYCLING PARTNERS ALABAMA GEORGIA MARYLAND NEW OREGON UTAH Mitchell’s Grocery Food Lion Food Lion HAMPSHIRE Albertsons Albertsons Piggly Wiggly Ingles Giant Demoulas Market Basket Fred Meyer Sprouts Farmers Market Sav-A-Lot Piggly Wiggly Giant Eagle Hannaford Haggen Target Target Sprouts Farmers Market Redner’s Markets Price Chopper QFC Winn Dixie Target Safeway Shaw’s Safeway VERMONT Winn Dixie Target Stop and Shop Target Hannaford ARIZONA Target Winco Price Chopper Albertsons IDAHO MASSACHUSETTS To p s Shaw’s Bashas Albertsons Big Y Whole Foods PENNSYLVANIA Target Goodwill Industries Fred Meyer Demoula’s Market Basket ACME Whole Foods Safeway Safeway Hannaford NEW JERSEY Food Lion Sprouts Farmers Market Target Price Chopper ACME Giant VIRGINIA Winco Shaw’s McCaffrey’s Food Giant Eagle Farm Fresh ARKANSAS Stop and Shop Markets Price Chopper Food City Harps ILLINOIS Target Stop and Shop Redner’s Market Food Lion Target Hyvee Whole Foods Target Safeway Giant Jewel-Osco Whole Foods Sharp Shopper Harris Teeter CALIFORNIA Mariano’s Fresh Market MICHIGAN SuperValu Martins Albertsons Meijer Meijer NEW MEXICO Target Safeway Chula Vista Grocery Schnucks Target Affiliated Foods To p s Target Outlet SuperValu Albertsons Weis Escondido Grocery Target MINNESOTA Safeway WASHINGTON Outlet Coborn’s Sprouts Farmers Market RHODE ISLAND Albertsons Grocery Outlet INDIANA Cub Foods Target RI Resource Recovery Fred Meyer National City Econofoods Econofoods Shaw’s Haggen Safeway Family Thrift Center Family Thrift Center NEW YORK