China - Peoples Republic Of

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Around Guangzhou

NOVEMBER 19, 20 CHINA DAILY PAGE 15 ASIAD AROUND GUANGZHOU ATTRACTIONS Ancestral Temple of the Chen Zhuhai and Zhaoqing. Th e exhibition Family (Chen Clan Academy) celebrates the 58th anniversary of the founding of the Guangzhou Daily and Phoenix Mountain and 陈家祠 Longyandong Forest Park also the Asian Games. Ancestral Temple of the Chen Family is Hours: 10 am-10 pm, until Nov 30 凤凰山、龙眼洞森林公园 also called Chen Clan Academy, which Address: Grandview Mall, 228 Tianhe Lu, Phoenix Mountain is one of the easi- is a place both for off ering sacrifi ces to Tianhe district Tel: (020) 38331818 est mountains to get to from the city ancestors and for studying. Now the Admission free center. A narrow winding road, fre- Chen Clan Ancestral Temple in Guang- quented by cars, cyclists and hikers, zhou, the Ancestoral Temple in Foshan, Harry Potter & Th e Deathly runs through part of the mountain and the former Residence of Sun Yat-sen in Hallows: Part 1 passes by a small lake before ascending. Zhongshan and the Opium War Memo- Most paths cutting through the forested rial Hall in Dongguan are regarded as Another edge-of-your-seat adventure mountain are small and infrequently the four major cultural tourist sites in awaits Harry Potter fans this month. used. Views towards Long Dong are not Guangdong province. Th e temple is a Voldemort’s death-eaters have taken spectacular, but to the east, hikers can compound consisting of nine halls, six over the Ministry of Magic and Hog- see rolling hills, ponds and lush green- courtyards and 19 buildings connected warts, but Voldemort won’t rest until ery. -

China - Peoples Republic Of

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Voluntary - Public Date: 1/26/2011 GAIN Report Number: CH0816 China - Peoples Republic of Post: Shanghai ATO China Retail Annual Report Report Categories: Retail Food Sector Approved By: Keith Schneller Prepared By: Leanne Wang, May Liu, Tong Wang and ATO-Chengdu Report Highlights: With increased disposal income, urbanization and food safety concerns, Chinese are consuming more U.S. food products; this is partly due to the excellent quality and safety reputation of American food products. While the Chinese economy has slowed this past year, it is still growing faster than any other major economy. This fact and Chinese customers‟ growing taste for imported products, makes the Chinese market very attractive to many U.S. food producers. Executive Summary In response to rising inflation and food safety concerns, more Chinese people are cutting back on eating out and are now cooking more and more at home. Consumers of imported food are generally expatriates and high and upper –middle income locals. They are least affected by inflation and pay great attention to food safety. Consumption of western style products continues to grow as they generally are regarded as good quality, nutritious and safe. Some products, such as fresh fruit, frozen vegetables and nuts, have much deeper penetration, and some supermarkets and convenience stores are becoming more interested in imported products. Rapid economic growth has caused the total U.S. dollar sales value of food and beverages to rise by 26.2% to USD132 billion in 2008. -

Annual Report 2007

Fully Global, Truly Local Annual Report 2007 Fiscal year ended February 20, 2007 A leading-edge, global-level operating and management infrastructure raises the quality and satisfaction of shopping with ÆON. 155 ÆON companies in Japan and overseas apply a “glocal (global + local) strategy”: global-class management systems tailored to local needs in a drive to be the best local retailer wherever we operate. Our business is based on large-scale shopping centers serving their respective communi- ties with tailored services comprising GMS (general merchandise store) retail, supermarkets, drugstores, home centers, convenience stores, specialty stores, shopping-mall development, financial services, entertainment, food services and more. ÆON is growing through internal expansion and strategic tie-ups that add new services, synergy and sales. Being the best local retailer means being the best at meeting local needs, with shuttle buses, environmental action and direct community involvement. Contents Highlights for the year 2 Financial section 29 The President’s message 4 Board of directors and executive officers 67 The Chairman’s message 6 Corporate responsibility 68 Review of operations 12 Corporate history 73 Environmental and social contribution activities 24 Major group companies 77 Shareholder information 77 ÆON ANNUAL REPORT 2007 1 Applying unique management know-how to develop and manage shopping malls centered on each community, ÆON is building a uniquely positioned retail network in Japan and overseas. In fact, ÆON shopping mall facilities -

ATO Guangzhou Supply Chain Workshop – Retail Cold

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Voluntary - Public Date: 10/26/2012 GAIN Report Number: CH11842 China - Peoples Republic of Post: Guangzhou ATO Guangzhou Supply Chain Workshop – Retail Cold Storage and Food Safety Seminar Report Categories: Market Development Reports Fresh Fruit Retail Foods Approved By: Jorge Sanchez Prepared By: May Liu Report Highlights: Summary: Throughout September 2012, ATO Guangzhou jointly coordinated a series of workshops and seminars targeting food retailers and in particular large national supermarket grocery chains. The seminars were entitled “Supply Chain Management – Retail Perishable Food Cold Storage and Food Safety Seminars” in South China, which received support from the U.S. Poultry and Egg Export Council (USAPEEC) and a locally hired representative of the U.S. logistics consultant company Food Tech. Six supermarkets chains in total were involved in this campaign. Pre-workshop visits and on-site best practices assessments were shared with the participating supermarket chain managers to help them understand existing weaknesses in their respective retail chain management in South China. Two half- day sit-down training seminars were held in Guangzhou (with 103 retail attendees in participation) and two in Shenzhen (with the participation of 96 retail managers). A follow-up on-site survey indicated that 97 percent of the participants widely agreed that the program helped them improve quality controls and cold chain management practices. General Information: Purpose for organizing a series of Retail Cold Storage and Food Safety Seminars: 1) To enhance awareness of cold management practices in retail supply chains and quantify these in terms of dollars lost as a result of inefficient logistics and cold storage practices 2) To identify the existing problems in most retail chains and provide immediate and practical solutions 3) To provide technical consultation on U.S. -

China: Retail Foods

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 12/28/2017 GAIN Report Number: GAIN0036 China - Peoples Republic of Retail Foods Increasing Change and Competition but Strong Growth Presents Plenty of Opportunities for U.S. Food Exports Approved By: Christopher Bielecki Prepared By: USDA China Staff Report Highlights: China remains one of the most dynamic retail markets in the world, and offers great opportunities for U.S. food exporters. Exporters should be aware of several new trends that are changing China’s retail landscape. Imported food consumption growth is shifting from China’s major coastal metropolitan areas (e.g., Shanghai; Beijing) to dozens of emerging market cities. China is also experimenting with new retail models, such as 24-hour unstaffed convenience stores and expanded mobile payment platforms. E-commerce sales continue to grow, but major e-commerce retailers are competing for shrinking numbers of new consumers. We caution U.S. exporters not to consider China as a single retail market. Over the past 10 years, the Chinese middle-class has grown larger and more diverse, and China has become a collection of 1 niche markets separated by geography, culture, cuisine, demographics, and commercial trends. Competition for these markets has become fierce. Shanghai and the surrounding region continues to lead national retail trends, however Beijing and Guangzhou are also important centers of retail innovation. Chengdu and Shenyang are two key cities leading China’s economic expansion into international trade and commerce. -

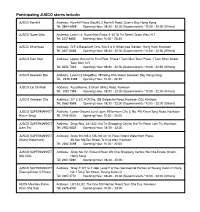

Participating JUSCO Stores Include

Participating JUSCO stores include: JUSCO Kornhill Address: Kornhill Plaza (South), 2 Kornhill Road, Quarry Bay, Hong Kong Tel: 2884 6888 Opening Hour: 08:30 - 23:00 (Supermarket) / 10:00 - 22:30 (Others) JUSCO Tsuen Wan Address: Level 1-4, Tsuen Wan Plaza, 4-30 Tai Pa Street, Tsuen Wan, N.T. Tel: 2412 8686 Opening Hour: 10:00 - 22:30 JUSCO Whampoa Address: G/F & Basement One, Site 5 & 6, Whampoa Garden, Hung Hom, Kowloon Tel: 2627 6688 Opening Hour: 08:30 - 22:30 (Supermarket) / 10:00 - 22:30 (Others) JUSCO Tuen Mun Address: Upper Ground to First Floor, Phase 1 Tuen Mun Town Plaza, 1 Tuen Shun Street, Tuen Mun, N.T. Tel: 2452 7333 Opening Hour: 08:30 - 22:30 (Supermarket) / 10:00 - 22:30 (Others) JUSCO Kowloon Bay Address: Level 1-2 MegaBox, 38 Wang Chiu Road, Kowloon Bay, Hong Kong Tel: 2339 3388 Opening Hour: 10:00 - 22:30 JUSCO Lai Chi Kok Address: AquaMarine, 8 Sham Shing Road, Kowloon Tel: 3120 7188 Opening Hour: 08:30 - 22:30 (Supermarket) / 10:00 - 22:30 (Others) JUSCO Kowloon City Address: 2/F & 3/F, KCP, No. 128 Carpenter Road, Kowloon City, Kowloon Tel: 2662 8888 Opening Hour: 08:30 - 22:30 (Supermarket) / 10:00 - 22:30 (Others) JUSCO SUPERMARKET Address: Lower Ground Level, apm, Millennium City 5, No. 418 Kwun Tong Road, Kowloon (Kwun Tong) Tel: 3148 9228 Opening Hour: 10:00 - 23:00 JUSCO SUPERMARKET Address: Shop Nos. 321-322, Kai Tin Shopping Centre, Kai Tin Road, Lam Tin, Kowloon. (Lam Tin) Tel: 2952 6822 Opening Hour: 08:30 - 22:30 JUSCO SUPERMARKET Address: Shop 101-105 & 125-130 on 1st Floor, Grand Waterfront Plaza, (Grand Waterfront) 38 San Ma Tau Street, To Kwa Wan, Kowloon. -

GAIN Report Global Agriculture Information Network

Foreign Agricultural Service GAIN Report Global Agriculture Information Network Required Report - public distribution Date: 8/8/2000 GAIN Report #JA0510 Japan Retail Food Sector 1999/2000 Interim Update Approved by: Terrence Barber, Executive Director U.S. Agricultural Trade Offices, Japan David Miller, ATO Tokyo Drafted and Prepared by: Terrence Barber, ATO Japan Karen Halliburton, Deputy ATO Tokyo Report Highlights: In 1999, total national supermarket food sales declined 3%. Results remain to be seen from the large-scale supermarket, convenience, and home meal replacement (HMR) subsectors in which U.S. Agriculture enjoys comparative advantages. These subsectors demonstrated substantial growth in 1998 despite stagnation of the overall supermarket sector and general recession. 1998 retail sales in Japan’s retail food sector reached nearly $380 billion. Large-scale supermarket food sales rose 5.4% nationwide in 1998, with key regions registering as high as 17% growth. HMR sales gained 3.5%, with some national retailers registering as high as 7% growth in HMR. ATO Tokyo expects an eventual slowdown in these subsectors, as new store openings taper due to the official one-year moratorium on new stores which commenced June 2000. Large-scale supermarket chains are streamlining distribution, while seeking direct overseas private label sources. Processors with entrenched domestic and third-country sources are tying in closely with top retailers, applying "efficient consumer response" systems, potentially locking U.S. suppliers out long-term, absent an aggressive and immediate marketing response. Includes PSD changes: No Includes Trade Matrix: No Annual Report Tokyo[JA1], JA GAIN Report # JA0510 Page 1 of 22 TABLE OF CONTENTS PREFACE: A CALL FOR ACTION ..................................................... -

Coaching Day-Hong Kong

Coaching Day-Hong Kong Food from Finland 4.5.2020 PROGRAM FOR THE DAY 9:00-9:10 AM Food from Finland 2020 plan for Hong Kong market 9:10-9:30 AM Hong Kong market overview 9:30-10:00 AM Profiling Future consumer in Hong Kong 10:00-10:15 AM Q&A 10:15-10:35 AM Finnish food and beverage export update 10:35-10:45 AM Coffee Break 10:45-11:45 AM Hong Kong import Food and beverage market analysis-PART 1 11:45-12:15 AM Lunch break 12:15-12:45 AM Hong Kong import Food and Beverage market analysis-PART 2 12:45-13:00 PM Q&A 13:00-13:20 PM Local support for Finnish food and beverage companies 13:20-14:00 PM Panel discussion with importers and speakers/ Q&A to all speakers Food from Finland Program . Food from Finland is team Finland’s Export Program for the Finland’s Food Sector since 2014. It’s funded by the Ministry of Economy and Employment and Ministry of Agriculture and Forestry. We have a close collaboration with the Foreign Ministry of Affairs . The program is managed by Business Finland in cooperation with Team Finland operators, Finnish Food Authority and The Finnish Food and Drink Industries’ Federation (ETL) . The program’s goal is to increase the Finnish F&B export, open new markets, and to create new jobs . Focus market for export activities: Germany, China and Hong Kong SAR, Japan, South Korea, Sweden, Denmark, France, and Russia Program Activity in Hong Kong 2020 Training Day 4.5.2020 (Webinar) Coaching day-Hong Kong Other events in planning for Hong Kong market Date until further Vegetarian food Asia Expo notice 10.6.2020 Export via -

Major Shopping Areas in Beijing

HANDBOOK FOR FOREIGNERS IN 留学惠园生活指南 Beverages 白开水 bái kāi shuǐ water (often served free) 茶水 chá shuǐ Tea (often served free) 菊花茶 jú huā chá Chrysanthemum tea Major Shopping Areas in Beijing 大麦茶 dà mài chá Barley tea Wangfujing Shopping Area(王府井) 啤酒 pí jǐu beer Wangfujing intersects with East Chang'an Avenue(东长安 大/小瓶可乐 dà/xiǎo píng kě lè large/small bottle of coke 街). It has a history of more than 100 years. The street, which is less than one kilometer long, is lined with all kinds of shops. Must-know words in the restaurant The best-known shop is the Oriental Plaza(东方新世界)and 服务员 fú wù yuán Waiter and Waitress the Beijing Department Store(北京百货大楼). To the north of the department Store is the One World Department Store, 英文菜单 yīng wén cài dān English Menu hosting a collection of Chinese and foreign brands and fine 点菜 diǎn cài May I order dishes now quality products. The nearby Sun Dong'an Market(新东安市 场) 我要一/两个… yào yì/liǎng gè… I would like one/two … is one of the largest supermarkets in Beijing. It covers a business floor space of 100,000 square meters and sells more 买单 mǎi dān Give me the bill than 200,000 kinds of goods. Pack the food and take 打包 dǎ bāo away Qianmen(前门) Qianmen street(前门大街)was a commercial center of Utensils Beijing more than 500 years ago. Its old shops and small stalls 筷子 kuài zi chopsticks are preferred by Beijingers. Not far from Tian'anmen Square (天安门广场) is Xidan(西单), which is regarded as the 勺子 sháo zi spoon second Wangfujing(王府井). -

As China Goes, So Goes the World

University of Nebraska - Lincoln DigitalCommons@University of Nebraska - Lincoln The hinC a Beat Blog Archive 2008-2012 China Beat Archive 2010 As China Goes, So Goes the World Follow this and additional works at: https://digitalcommons.unl.edu/chinabeatarchive Part of the Asian History Commons, Asian Studies Commons, Chinese Studies Commons, and the International Relations Commons "As China Goes, So Goes the World" (2010). The China Beat Blog Archive 2008-2012. 791. https://digitalcommons.unl.edu/chinabeatarchive/791 This Article is brought to you for free and open access by the China Beat Archive at DigitalCommons@University of Nebraska - Lincoln. It has been accepted for inclusion in The hinC a Beat Blog Archive 2008-2012 by an authorized administrator of DigitalCommons@University of Nebraska - Lincoln. As China Goes, So Goes the World November 17, 2010 in Excerpt by The China Beat | Permalink Karl Gerth is a tutor and fellow at Merton College and a historian of modern China at Oxford University. His new book is As China Goes, So Goes the World: How Chinese Consumers are Transforming Everything (Hill & Wang, 2010). (See this review by Christina Larson at the Washington Monthly and this oneat Kirkus Reviews for more on Gerth’s book.) Below, an excerpt from chapter 1 of As China Goes, which takes a look at one of the most notable phenomena of 21st- century Chinese life: the sudden boom in car ownership and its far-reaching consequences. No Going Back? China Creates a Car Culture and Economy Today’s China sounds different. Back when I arrived in Nanjing for my junior year in college in 1986, one of the first things that struck me was the absence of car noise, signaling, of course, the absence of cars. -

The Ivory Markets of East Asia

The Ivory Markets of East Asia Esmond Martin and Daniel Stiles Published by Save the Elephants PO Box 54667 7 New Square Nairobi Lincoln’s Inn Kenya London WC2A 3RA March 2003 © Esmond Martin and Daniel Stiles, March 2003 All rights reserved ISBN No. 9966-9683-3-4 Front cover photograph: Japanese craftsmen still carve the finest ivory items for the local market, such as this recently made 30 cm figurine. Photo credit: Esmond Martin Published by Save the Elephants, PO Box 54667, Nairobi, Kenya and 7 New Square, Lincoln’s Inn, London WC2A 3RA, United Kingdom. Printed by Majestic Printing Works Ltd., PO Box 42466, Nairobi, Kenya. The Ivory Markets of East Asia Esmond Martin and Daniel Stiles Drawings by Andrew Kamiti Published by Save the Elephants PO Box 54667 c/o Ambrose Appelbe Nairobi 7 New Square, Lincoln’s Inn Kenya London WC2A 3RA 2002 ISBN 9966-9683-3-4 1 Contents List of tables...................................................................................................................................... 3 Executive summary ......................................................................................................................... 5 Introduction ...................................................................................................................................... 7 Methodology .................................................................................................................................... 9 Results............................................................................................................................................... -

2.0 Hong Kong – Avocado Market

1 Author AdrianoBrescia,TradeandInvestmentOfficer,FoodandAgribusiness,TradeandInvestmentQueensland, QueenslandTreasuryandTrade Projectleader JodieCampbell,PostharvestHorticulturist,HorticultureandForestryScience,AgriͲScienceQueensland, DepartmentofAgriculture,FisheriesandForestry(DAFF) Disclaimer ThispublicationhasbeenpreparedbytheStateofQueenslandasaninformationonlysource. TheStateofQueenslandmakesnostatements,representationsorwarrantiesabouttheaccuracyor completenessof,andyouandallotherpersonsshouldnotrelyon,anyinformationcontainedinthis publication.Anyreferencetoanyspecificorganisation,productorservicedoesnotconstituteorimplyits endorsementorrecommendationbytheStateofQueensland. TheStateofQueenslanddisclaimsallresponsibilityandallliability(includingwithoutlimitation,liabilityin negligence)forallexpenses,losses,damagesandcostsyoumightincurasaresultoftheinformationbeing inaccurateorincompleteinanyway,andforanyreason. ©TheStateofQueensland,QueenslandTreasuryandTrade,2012. Copyrightprotectsthismaterial.Enquiriesshouldbeaddressedtotradeinfo@qld.gov.au(telephone +61732244035) 2 Contents Tablesandfigures 5 Tables 5 Figures 5 Acknowledgements 6 QueenslandGovernment 6 Industrypartners 6 Executivesummary 7 1.0Introduction 8 1.1Projectbackground8 1.2Marketresearchobjectives 8 1.3Methodology 8 1.3.1Secondarysources 8 1.3.2Primarysources 8 1.4Limitations 9 2.0 HongKong–Avocadomarket 10 2.1 Avocadoimports 10 2.2 MarketshareofcountriessupplyingavocadostoHongKong