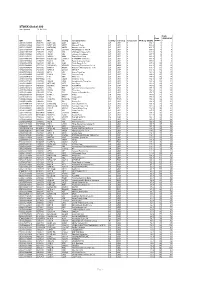

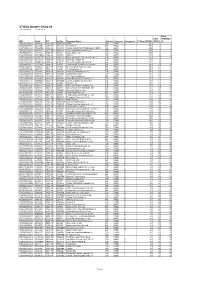

2011 PUF Detailed Schedule of Investments

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Cenovus Reports Second-Quarter 2020 Results Company Captures Value by Leveraging Flexibility of Its Operations Calgary, Alberta (July 23, 2020) – Cenovus Energy Inc

Cenovus reports second-quarter 2020 results Company captures value by leveraging flexibility of its operations Calgary, Alberta (July 23, 2020) – Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) remained focused on financial resilience in the second quarter of 2020 and used the flexibility of its assets and marketing strategy to adapt quickly to the changing external environment. This positioned the company to weather the sharp decline in benchmark crude oil prices in April by reducing volumes at its oil sands operations and storing the mobilized oil in its reservoirs for production in an improved price environment. While Cenovus’s financial results were impacted by the weak prices early in the quarter, the company captured value by quickly ramping up production when Western Canadian Select (WCS) prices increased almost tenfold from April to an average of C$46.03 per barrel (bbl) in June. As a result of this decision, Cenovus reached record volumes at its Christina Lake oil sands project in June and achieved free funds flow for the month of more than $290 million. “We view the second quarter as a period of transition, with April as the low point of the downturn and the first signs of recovery taking hold in May and June,” said Alex Pourbaix, Cenovus President & Chief Executive Officer. “That said, we expect the commodity price environment to remain volatile for some time. We believe the flexibility of our assets and our low cost structure position us to withstand a continued period of low prices if necessary. And we’re ready to play a significant -

DXE Liquidity Provider Registered Firms

DXE Liquidity Provider Program Registered Securities European Equities TheCboe following Europe Limited list of symbols specifies which firms are registered to supply liquidity for each symbol in 2021-09-28: 1COVd - Covestro AG Citadel Securities GCS (Ireland) Limited (Program Three) DRW Europe B.V. (Program Three) HRTEU Limited (Program Two) Jane Street Financial Limited (Program Three) Jump Trading Europe B.V. (Program Three) Qube Master Fund Limited (Program One) Societe Generale SA (Program Three) 1U1d - 1&1 AG Citadel Securities GCS (Ireland) Limited (Program Three) HRTEU Limited (Program Two) Jane Street Financial Limited (Program Three) 2GBd - 2G Energy AG Citadel Securities GCS (Ireland) Limited (Program Three) Jane Street Financial Limited (Program Three) 3BALm - WisdomTree EURO STOXX Banks 3x Daily Leveraged HRTEU Limited (Program One) 3DELm - WisdomTree DAX 30 3x Daily Leveraged HRTEU Limited (Program One) 3ITLm - WisdomTree FTSE MIB 3x Daily Leveraged HRTEU Limited (Program One) 3ITSm - WisdomTree FTSE MIB 3x Daily Short HRTEU Limited (Program One) 8TRAd - Traton SE Jane Street Financial Limited (Program Three) 8TRAs - Traton SE Jane Street Financial Limited (Program Three) Cboe Europe Limited is a Recognised Investment Exchange regulated by the Financial Conduct Authority. Cboe Europe Limited is an indirect wholly-owned subsidiary of Cboe Global Markets, Inc. and is a company registered in England and Wales with Company Number 6547680 and registered office at 11 Monument Street, London EC3R 8AF. This document has been established for information purposes only. The data contained herein is believed to be reliable but is not guaranteed. None of the information concerning the services or products described in this document constitutes advice or a recommendation of any product or service. -

2020 Governance, Compensation and Financial Report Ements

Governance, Compensation and Financial Report 2020 Governance, Compensation Governance report and Financial Report As part of our reporting suite, this stand-alone document contains the full details of our governance and compensation policies as well as the details of our financial performance. Compensation Compensation report An overview can be found in the Integrated Annual Report. Consolidated Consolidated report financial Statutory report financial Table of contents 3 Governance report 22 Compensation report 38 Consolidated financial report 102 Statutory financial report Appendix 114 Appendix Governance Report In this section 4 Group structure and shareholders 5 Capital structure 7 Board of Directors 16 Executive Committee 19 Compensation, shareholdings and loans 19 Shareholders’ participation 20 Change of control and defence measures 20 Auditors 21 Information policy Givaudan – 2020 Governance, Compensation and Financial Report 4 Corporate governance Governance report Ensuring proper checks and balances 1. Group structure and shareholders The Governance report is aligned with 1.1 Group structure 1.1.1 Description of the issuer’s operational Group structure international standards and has been prepared Givaudan SA, the parent company of the Givaudan Group, with its registered corporate headquarters at 5 Chemin de la Parfumerie, 1214 Vernier, Switzerland (‘the Company’), is a in accordance with the ‘Swiss Code of Obligations’, ‘société anonyme’, pursuant to art. 620 et seq. of the Swiss Code of Obligations. It is listed on Compensation Compensation report the ‘Directive on Information Relating to the SIX Swiss Exchange under security number 1064593, ISIN CH0010645932. Corporate Governance’ issued by the SIX Swiss The Company is a global leader in its industry. Givaudan operates around the world and has two principal businesses: Taste & Wellbeing and Fragrance & Beauty, providing customers Exchange and the ‘Swiss Code of Best Practice for with compounds, ingredients and integrated solutions. -

Cenovus Energy Inc. (CVE) – Quality and Growth for the Patient Investor

Portfolio Advisory Group Cenovus Energy Inc. (CVE) – Quality and Growth For The Patient Investor Cenovus was created through the split of Calgary-based Primer on the Oil Sands and energy company EnCana into two separate organizations in late 2009. As a result of this split, many Canadian Steam-Assisted-Gravity-Drainage investors found themselves holding two very different (SAGD) investments: a pure-play natural gas company (EnCana) Including the oil sands, Canada’s oil reserves are the and an integrated oil & gas company (Cenovus). This second largest in the world. Oil sands are composed document aims to provide some insight into the nature primarily of sand, clay, bitumen and water. Bitumen and long-term potential of Cenovus. is the product of oil sands production – a thick oil Cenovus owns oil sands projects that have a tremendous embedded in sand. growth profile over the next decade and are widely Recovery of bitumen is typically achieved by one of viewed as some of the highest-quality assets in the two methods: mining in open pits or drilling. Bitumen industry. However, since inception, the shares of extraction using drilling is referred to as in situ recovery, Cenovus have largely traded within a range. One reason and is generally used for reservoirs that are too deep for is that the company has made a trade-off between near- surface mining techniques to work economically. It is term and future production by drawing cash flows from estimated that approximately 80% of the total bitumen its natural gas business to fund growth in its oil sands recoverable in Alberta can only be produced with in business. -

Fidelity® Emerging Markets Index Fund

Quarterly Holdings Report for Fidelity® Emerging Markets Index Fund January 31, 2021 EMX-QTLY-0321 1.929351.109 Schedule of Investments January 31, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks – 92.5% Shares Value Shares Value Argentina – 0.0% Lojas Americanas SA rights 2/4/21 (b) 4,427 $ 3,722 Telecom Argentina SA Class B sponsored ADR (a) 48,935 $ 317,099 Lojas Renner SA 444,459 3,368,738 YPF SA Class D sponsored ADR (b) 99,119 361,784 Magazine Luiza SA 1,634,124 7,547,303 Multiplan Empreendimentos Imobiliarios SA 156,958 608,164 TOTAL ARGENTINA 678,883 Natura & Co. Holding SA 499,390 4,477,844 Notre Dame Intermedica Participacoes SA 289,718 5,003,902 Bailiwick of Jersey – 0.1% Petrobras Distribuidora SA 421,700 1,792,730 Polymetal International PLC 131,532 2,850,845 Petroleo Brasileiro SA ‑ Petrobras (ON) 2,103,697 10,508,104 Raia Drogasil SA 602,000 2,741,865 Bermuda – 0.7% Rumo SA (b) 724,700 2,688,783 Alibaba Health Information Technology Ltd. (b) 2,256,000 7,070,686 Sul America SA unit 165,877 1,209,956 Alibaba Pictures Group Ltd. (b) 6,760,000 854,455 Suzano Papel e Celulose SA (b) 418,317 4,744,045 Beijing Enterprises Water Group Ltd. 2,816,000 1,147,720 Telefonica Brasil SA 250,600 2,070,242 Brilliance China Automotive Holdings Ltd. 1,692,000 1,331,209 TIM SA 475,200 1,155,127 China Gas Holdings Ltd. 1,461,000 5,163,177 Totvs SA 274,600 1,425,346 China Resource Gas Group Ltd. -

The Annual Report on the Most Valuable and Strongest Real Estate Brands June 2020 Contents

Real Estate 25 2020The annual report on the most valuable and strongest real estate brands June 2020 Contents. About Brand Finance 4 Get in Touch 4 Brandirectory.com 6 Brand Finance Group 6 Foreword 8 Executive Summary 10 Brand Finance Real Estate 25 (USD m) 13 Sector Reputation Analysis 14 COVID-19 Global Impact Analysis 16 Definitions 20 Brand Valuation Methodology 22 Market Research Methodology 23 Stakeholder Equity Measures 23 Consulting Services 24 Brand Evaluation Services 25 Communications Services 26 Brand Finance Network 28 © 2020 All rights reserved. Brand Finance Plc, UK. Brand Finance Real Estate 25 June 2020 3 About Brand Finance. Brand Finance is the world's leading independent brand valuation consultancy. Request your own We bridge the gap between marketing and finance Brand Value Report Brand Finance was set up in 1996 with the aim of 'bridging the gap between marketing and finance'. For more than 20 A Brand Value Report provides a years, we have helped companies and organisations of all types to connect their brands to the bottom line. complete breakdown of the assumptions, data sources, and calculations used We quantify the financial value of brands We put 5,000 of the world’s biggest brands to the test to arrive at your brand’s value. every year. Ranking brands across all sectors and countries, we publish nearly 100 reports annually. Each report includes expert recommendations for growing brand We offer a unique combination of expertise Insight Our teams have experience across a wide range of value to drive business performance disciplines from marketing and market research, to and offers a cost-effective way to brand strategy and visual identity, to tax and accounting. -

Cenovus Completes Acquisition of Assets in Western Canada from Conocophillips

Cenovus completes acquisition of assets in Western Canada from ConocoPhillips Calgary, Alberta (May 17, 2017) – Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) has closed its previously announced purchase of assets in Western Canada from ConocoPhillips after receiving all necessary regulatory approvals for the transaction. The acquired assets include ConocoPhillips’ 50% interest in the FCCL Partnership, the oil sands venture which was jointly owned with and operated by Cenovus, as well as the majority of ConocoPhillips’ Deep Basin conventional assets in Alberta and British Columbia. “With the completion of this transformational deal, we now have full control of our best-in- class oil sands projects and an exciting new growth platform in the Deep Basin that provides us with significant short-cycle development opportunities to complement our long-term oil sands growth portfolio,” said Brian Ferguson, Cenovus President & Chief Executive Officer. “As a result of this transaction, we’ve now doubled our production and reserves base.” In the coming months, Cenovus will remain firmly focused on: • Continuing to safely and reliably operate all of its assets • Efficiently integrating the Deep Basin assets and staff into the company • Deleveraging its balance sheet, including using the proceeds of planned divestitures, such as the sale of the company’s Pelican Lake and Suffield assets, which are currently being marketed. Cenovus intends to provide an update on its investment plans for its consolidated oil sands business and newly acquired Deep Basin -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Hyundai Steel Announces Merger with Hyundai Hysco

Steel (Overweight/Maintain) Hyundai Steel announces merger with Hyundai Hysco Hyundai Steel to merge with Hyundai Hysco: Deal to be finalized on July 1 st , 2015 News Comment Merger likely to create only limited synergies April 9, 2015 Recommended strategy: Buy POSCO st Daewoo Securities CCo.,o., Ltd. Hyundai Steel to merge with Hyundai Hysco; Deal to be finalized on July 1 [Steel/Non-ferrous metal] On April 8th, Hyundai Steel announced it has decided to merge with Hyundai Hysco. Hyundai Hysco shareholders will receive 0.8577607 shares of Hyundai Steel for each existing Hyundai Seung-hun Jeon Hysco share they own. Dissenting shareholders will be able to exercise appraisal rights at +822-768-2713 W72,100 per share for Hyundai Steel and W63,552 per share for Hyundai Hysco, which are, [email protected] respectively, 9.2% and 6.4% lower than current share prices. The 2,667,762 shares Hyundai Hysco owns in Hyundai Steel will be allocated to Hyundai Hysco shareholders, which will have the same impact as cancelling 2% of treasury shares. As a result, the merged company will have 133,445,785 shares outstanding (rather than 136,113,547 shares). Merger likely to create only limited synergies In our view, the merger effects are more psychological than tangible. While the merger does have some benefits, we also see several negative effects that could partially offset the positives. We believe potential merger synergies between the two companies were mostly realized after Hyundai Hysco spun off its cold-rolled coil (CRC) division to Hyundai Steel in December 2013. -

STOXX Global 200 Last Updated: 01.02.2018

STOXX Global 200 Last Updated: 01.02.2018 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) US0378331005 2046251 AAPL.OQ AAPL Apple Inc. US USD Y 694.2 1 1 US5949181045 2588173 MSFT.OQ MSFT Microsoft Corp. US USD Y 588.4 2 2 US0231351067 2000019 AMZN.OQ AMZN Amazon.com Inc. US USD Y 466.7 3 3 US30303M1027 B7TL820 FB.OQ US20PD FACEBOOK CLASS A US USD Y 355.6 4 4 US46625H1005 2190385 JPM.N CHL JPMorgan Chase & Co. US USD Y 329.9 5 5 US4781601046 2475833 JNJ.N JNJ Johnson & Johnson US USD Y 297.7 6 6 US30231G1022 2326618 XOM.N XON Exxon Mobil Corp. US USD Y 296.9 7 7 US02079K1079 BYY88Y7 GOOG.OQ US40C2 ALPHABET CLASS C US USD Y 289.1 8 8 US0605051046 2295677 BAC.N NB Bank of America Corp. US USD Y 250.0 9 9 US9497461015 2649100 WFC.N NOB Wells Fargo & Co. US USD Y 237.5 10 11 KR7005930003 6771720 005930.KS KR002D Samsung Electronics Co Ltd KR KRW Y 223.3 11 10 US0846707026 2073390 BRKb.N BRKB Berkshire Hathaway Inc. Cl B US USD Y 218.2 12 13 CH0038863350 7123870 NESN.S 461669 NESTLE CH CHF Y 216.1 13 12 US4370761029 2434209 HD.N HD Home Depot Inc. US USD Y 192.8 14 17 US1667641005 2838555 CVX.N CHV Chevron Corp. US USD Y 190.6 15 15 US00206R1023 2831811 T.N SBC AT&T Inc. US USD Y 184.6 16 14 US92826C8394 B2PZN04 V.N U0401 VISA Inc. -

STOXX Greater China 80 Last Updated: 01.08.2017

STOXX Greater China 80 Last Updated: 01.08.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Y 113.9 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 80.6 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.5 3 3 TW0002317005 6438564 2317.TW TW002R Hon Hai Precision Industry Co TW TWD Y 51.5 4 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 50.8 5 5 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 41.3 6 6 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 32.0 7 9 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 31.8 8 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 31.1 9 8 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.0 10 10 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 20.6 11 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 20.0 12 11 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.0 13 13 TW0003008009 6451668 3008.TW TW05PJ LARGAN Precision TW TWD Y 19.7 14 15 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 18.3 15 14 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.4 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 15.4 17 19 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. -

Euro Stoxx® Multi Premia Index

EURO STOXX® MULTI PREMIA INDEX Components1 Company Supersector Country Weight (%) SARTORIUS STEDIM BIOTECH Health Care France 1.59 IMCD Chemicals Netherlands 1.25 VOPAK Industrial Goods & Services Netherlands 1.15 BIOMERIEUX Health Care France 1.04 REMY COINTREAU Food, Beverage & Tobacco France 1.03 EURONEXT Financial Services France 1.00 HERMES INTERNATIONAL Consumer Products & Services France 0.94 SUEZ ENVIRONNEMENT Utilities France 0.94 BRENNTAG Chemicals Germany 0.93 ENAGAS Energy Spain 0.90 ILIAD Telecommunications France 0.89 DEUTSCHE POST Industrial Goods & Services Germany 0.88 FUCHS PETROLUB PREF Chemicals Germany 0.88 SEB Consumer Products & Services France 0.87 SIGNIFY Construction & Materials Netherlands 0.86 CARL ZEISS MEDITEC Health Care Germany 0.80 SOFINA Financial Services Belgium 0.80 EUROFINS SCIENTIFIC Health Care France 0.80 RATIONAL Industrial Goods & Services Germany 0.80 AALBERTS Industrial Goods & Services Netherlands 0.74 KINGSPAN GRP Construction & Materials Ireland 0.73 GERRESHEIMER Health Care Germany 0.72 GLANBIA Food, Beverage & Tobacco Ireland 0.71 PUBLICIS GRP Media France 0.70 UNITED INTERNET Technology Germany 0.70 L'OREAL Consumer Products & Services France 0.70 KPN Telecommunications Netherlands 0.68 SARTORIUS PREF. Health Care Germany 0.68 BMW Automobiles & Parts Germany 0.68 VISCOFAN Food, Beverage & Tobacco Spain 0.67 SAINT GOBAIN Construction & Materials France 0.67 CORBION Food, Beverage & Tobacco Netherlands 0.66 DAIMLER Automobiles & Parts Germany 0.66 PROSIEBENSAT.1 MEDIA Media Germany 0.65