Sanofi-Aventis

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Overview of Ftc Antitrust Actions in Pharmaceutical Services and Products

OVERVIEW OF FTC ANTITRUST ACTIONS IN PHARMACEUTICAL SERVICES AND PRODUCTS Health Care Division Bureau of Competition Federal Trade Commission Washington D.C. 20580 Markus H. Meier Assistant Director Bradley S. Albert Deputy Assistant Director Saralisa C. Brau Deputy Assistant Director September 2009 TABLE OF CONTENTS Page I. INTRODUCTION. ........................................................... 1 II. CONDUCT INVOLVING PHARMACEUTICAL SERVICES AND PRODUCTS. 3 A. Monopolization. ...................................................... 3 B. Agreements Not to Compete. ............................................ 8 C. Agreements on Price or Price-Related Terms. 14 D. Agreements to Obstruct Innovative Forms of Health Care Delivery or Financing. 20 E. Illegal Tying and Other Arrangements. .................................... 20 III. PHARMACEUTICAL MERGERS. ........................................... 20 A. Horizontal Mergers Between Direct Competitors. 20 B. Potential Competition Mergers. ......................................... 44 C. Innovation Market Mergers. ............................................ 47 D. Vertical Mergers...................................................... 49 IV. INDUSTRY GUIDANCE STATEMENTS...................................... 50 A. Advisory Opinions. ................................................... 50 B. Citizen Petition to the Food and Drug Administration. 51 V. AMICUS BRIEFS. ......................................................... 51 VI. INDICES. ............................................................ -

Coordination Des Syndicats CGT

Coordination des syndicats CGT STRATEGIE DE LA DIRECTION DU GROUPE SANOFI CONSEQUENCES INDUSTRIELLES ET SOCIALES Document d’août 2014 1. Situation économique – Coût du capital p2 2. Evolution des effectifs – Bilan des restructurations majeures p3 3. Stratégie Sanofi 2009-2015 : Désengagement scientifique et industriel en Europe et plus particulièrement en France p4 4. Stratégie de structuration du groupe en entités qui peuvent être cédées, vendues, fermées, échangées. p6 5. Crédit d’impôt – Des aides publiques pour quel usage ? p7 6. Industrie pharmaceutique : des besoins fondamentaux p7 7. Interpellation des élus et du gouvernement p8 1. Situation économique – Coût du capital Première entreprise pharmaceutique française et européenne. Sanofi est issu de la fusion de nombreux laboratoires pharmaceutiques français dont les principaux étaient Roussel Uclaf, Rhône Poulenc, Synthelabo, Sanofi et de l’allemand Hoechst. Sanofi représente 30 à 40% du potentiel national (effectifs, sites, R&D,…) de l’industrie pharmaceutique française dans notre pays. L’avenir du groupe et de ses activités en France conditionne l’avenir de l’industrie pharmaceutique française et constitue un élément incontournable de l’indépendance thérapeutique du pays. Le C.A. de sanofi dans le monde sur 2013 a atteint 33 milliards € et devrait se situer à un niveau légèrement supérieur en 2014. Plusieurs médicaments de référence étant aujourd’hui tombés dans le domaine public, le chiffre d’affaires repart à la hausse. Le résultat net des activités a été de 6,8 milliards € en 2013 et les projections sur 2014 laissent envisager une progression de 5% de celui-ci. La rentabilité est estimée par les économistes parmi les meilleures de l’industrie pharmaceutique dans le monde. -

Ce Que Sanofi Dit De La Politique Industrielle Française

Ce que Sanofi dit de la politique industrielle française mediapart.fr/journal/economie/030221/ce-que-sanofi-dit-de-la-politique-industrielle-francaise Martine Orange, Mediapart, 3 février 2021 Les salariés de Sanofi ont beau essayer de chercher des explications, ils ne comprennent pas. Ou plutôt ils ne comprennent que trop bien la conduite du groupe pharmaceutique. Après le revers de sa stratégie dans l’élaboration d’un vaccin contre le Covid-19, repoussé désormais au mieux à la fin de l’année, tout aurait dû pousser la direction de Sanofi à s’interroger sur la pertinence de ses choix, sur la place laissée à la recherche jugée comme essentielle. Mais rien ne s’est passé. Le 28 janvier, la direction de Sanofi Recherche et Développement en France a confirmé à l’occasion d’un comité social d’entreprise (CSE) la suppression de 364 emplois en France, une mesure qui vise particulièrement l’unité de Strasbourg appelée à être transférée en région parisienne. Ce plan s’inscrit dans un programme plus large annoncé en juillet 2020. Le groupe entend supprimer 1 700 emplois en Europe dont un millier en France sur trois ans. « Mais ce n’est qu’une partie du projet Pluton, prévient Jean-Louis Perrin, délégué CGT à Montpellier. Sanofi est en train de se désindustrialiser. Toute la pharmacie de synthèse est appelée à disparaître dans le groupe. Les sites de Sisteron, Elbeuf, Vertolaye, Brindisi (Italie), Francfort (Allemagne), Haverhill (Royaume-Uni), Újpest (Hongrie) sont destinés à sortir du groupe. Au total, cela représente 3 500 emplois. » Centre de distribution de Sanofi à Val-de-Reuil. -

Fusiones 20De 20Labo

"Cuando los grandes se hacen gigantes" Fusiones de Laboratorios 1 INDICE PRÓLOGO……………………………………………………………………………...…….. 3 INTRODUCCIÓN: FUSIONES Y ADQUISICIONES…………………………………..….. 4 INVESTIGACIÓN Y DESARROLLO………………………………………………………. 5 LA INDUSTRIA FARMACEUTICA………………………………………………………. 16 FUSIÓN SANOFI – AVENTIS…………………………………………………………...… 20 FUSIÓN BAYER – SCHERING……………………………………………………………. 26 FUSIÓN PFIZER – WYETH……………………………………………………………….. 30 FUSIÓN MERCK & CO. – SCHERING PLOUGH…………………………………..……. 31 FUSIÓN ROCHE – GENENTECH………………………………………………………… 34 MERCADOS REGIONALES………………………………………………………….…… 40 LA INDUSTRIA FARMACÉUTICA EN LA ARGENTINA……………………...………. 42 CONCLUSIÓN……………………………………………………………………………… 49 2 PRÓLOGO Es un verdadero privilegio que hayan pensado en mí para prologar este interesante trabajo relacionado con la formación profesional de estos inquietos alumnos de la Carrera de Agentes de Propaganda Médica. Grato además, pues recrea mi participación activa en el mundo de la Industria Farmacéutica, en calidad de Asesor de la Fuerza de Ventas e Investigador Principal durante varias décadas, período que fue enriquecedor para mí y sumó un importante valor agregado a mi bagaje médico y personal. Entiendo que lo sucedido en los avances científicos y tecnológicos durante los últimos cuarenta años, ha constituido un quiebre en la Historia de la Medicina y, por lo tanto, de la Humanidad. Es por ello que veo con beneplácito que la formación de estos entusiastas jóvenes va de la mano con los cambios de planes y esquemas de estudios de los futuros médicos. -

The Life of the Abortion Pill in the United States

The Life of the Abortion Pill in the United States The Harvard community has made this article openly available. Please share how this access benefits you. Your story matters Citation The Life of the Abortion Pill in the United States (2000 Third Year Paper) Citable link http://nrs.harvard.edu/urn-3:HUL.InstRepos:8852153 Terms of Use This article was downloaded from Harvard University’s DASH repository, and is made available under the terms and conditions applicable to Other Posted Material, as set forth at http:// nrs.harvard.edu/urn-3:HUL.InstRepos:dash.current.terms-of- use#LAA 80 The Life of the Abortion Pill in the United States Julie A. Hogan Eleven years after mifepristone1, the drug that chemically induces abortion and hence coined the abortion pill, was approved for use in France, American women still do not have access to the drug, although women in at least ten other nations do.2 In 1988, Americans thought the Abortion Pill [was] on the Hori- zon.3 In 1993, almost five years later, American women still did not have access to the drug, although many women's hopes were raised by newspaper headlines claiming that the Door May Be Open for [the] Abortion Pill to Be Sold in [the] U.S.4 and newspaper accounts predicting that mifepristone would be available in the United States in 1996.5 In 1996, the headlines reported that the Approval of [the] Abortion Pill by the FDA [was] Likely Soon.6 Yet, mifepristone was still not available in 1999, and newspaper headlines were less optimistic about pre- 1Mifepristone is the generic name for RU-486, the designation given the drug by its French maker, Roussel-Uclaf. -

The Story of RU-486 in the United States

The Story of RU-486 in the United States The Harvard community has made this article openly available. Please share how this access benefits you. Your story matters Citation The Story of RU-486 in the United States (2001 Third Year Paper) Citable link http://nrs.harvard.edu/urn-3:HUL.InstRepos:8889480 Terms of Use This article was downloaded from Harvard University’s DASH repository, and is made available under the terms and conditions applicable to Other Posted Material, as set forth at http:// nrs.harvard.edu/urn-3:HUL.InstRepos:dash.current.terms-of- use#LAA TABLE OF CONTENTS INTRODUCTION 1 I. THE BIRTH OF A CONTROVERSY 2 A. Background: What is RU-486 and How Does It Work? 2 B. The French Abortion Pill Fury 3 II. POLITICS AND CHEMISTRY MAKE A VOLATILE MIXTURE: \KEEPING THE ABORTION PILL BOTTLED UP IN FRANCE" 7 A. Moral Concerns 7 A. Moral Concerns 7 B. Corporate America's Lack of Interest 8 B. Corporate America's Lack of Interest 8 C. Supreme Court Jurisprudence's Impact on RU-486 10 D. Abortion Politics Goes Conservative 13 E. Regulatory Restrictions on Abortion 13 III. THE ABORTION TIDE BEGINS TO TURN 17 A. A New Administration 17 B. The Involvement of the Population Council 19 C. Concern From the Pro-Life Movement 22 1 IV. THE TIDE TURNS AGAIN { The Political Pendulum Swings to the Right 25 A. The Politics of Abortion Run Into The Contract With America 25 B. Conservative Congressional Legislation 27 V. THE FDA APPROVAL PROCESS GETS UNDERWAY 29 V. -

Opemmundi E Ljbope

OpemMundi E lJBOPE A WEEKLY REPORT ON THE ECONOMY OF THE COMMON MARKET ----- ------- -- �--- --· ------ -- - -----·-----·--·-------- of ooo oo oo 0000000000 ��-ONTENTt-4.oo o_Q';)o o oq ooo oo 0000001 g�!. ·----- ---·--····-············· ······-----· __ :__ --- ------ - - - . : g 0 I 0 o I : o / o I : o o I : o 0g I /ffJ ;1 r'i\J : og o INDEX f .i trr rtn "� o _ _, ;.;,·� Jt\J T 0 '-"' 1.•'- l",, 0 , ...4 �� ..1' ., . 0 ft iii 0 0 0 0 JO 0 I 0 0 0 0o To Euroflash 0o 0 0 0 0 0 0 ,0 0 , g from No 468 to No 492 inclusive g .,0 0 !o o 1 o o 0 0 0 0 0 o July 4, 1968 - December 19 , 1963 °o 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 · t;tlllOFLA.SH: llusiness 11enetration U('ross Europe o 01 0 0 :o g January 1969 Index No 11 · l g 0 :o 0 ,o 0 :o O :o 0 :o 0 :o 01 : 0 0 0 ooo -----------------------------------------------------o o oo o oo o oo oo oo o o_o oo o oo_o o o o o== oo--=:�� o o------o o o=:o -------------- oo o o oo oo �=� o-----o o o o Opera Mundi ElfR OPE A WEEKLY REPORT ON THE ECONOMY OF THE COMMON MARKET PUBLISHED ON BEHALF OF OPERA MUNDI BY EUROPEAN INTELLIGENCE LIMITED EUROPA HOUSE ROYAL TUNBRIDGE WELLS KENT TEL 25202/4 TELEX 95114 OPERA MUNDI EUROPE 100 Avenue Raymond Poincar� - PARIS 16e TEL: KLE 54-12 34-21 - CCP PARIS 3235-50 EDITOR & PUBLISHER . -

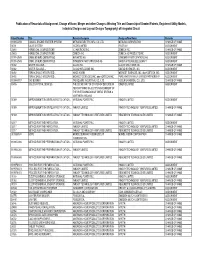

Publication of Recordals of Assignment, Change of Name

Publication of Recordals of Assignment, Change of Name, Merger and other Changes Affecting Title and Ownership of Granted Patents, Registered Utility Models, Industrial Designs and Lay-out Designs Topography) of Integrated Circuit Patent Number Title Patentee/Assignor Assignee/New Name Remarks 1199654059 COAXIAL ENGINE STARTER SYSTEM MITSUBA ELECTRIC MFG. CO. LTD. MITSUBA CORPORATION CHANGE OF NAME 31731 VALVE SYSTEM ISCOR LIMITED IPCOR NV ASSIGNMENT 25483 HERBICIDAL COMPOSITIONS ICI AMERICAS INC. ZENECA INC. CHANGE OF NAME 25483 HERBICIDAL COMPOSITIONS ZENECA INC. ZENECA AG PRODUCTS INC. ASSIGNMENT 1199142549 OXIME ETHERS DERIVATIVES NOVARTIS AG SYNGENTA PARTICIPATIONS AG ASSIGNMENT 1199142549 OXIME ETHERS DERIVATIVES SYNGENTA PARTICIPATIONS AG BAYER AKTIENGESELLSCHAFT ASSIGNMENT 31882 WATER SOLUBLE… GLAXO INC. GLAXO WELLCOME INC. CHANGE OF NAME 31882 WATER SOLUBLE… GLAXO WELLCOME INC. GILEAD SCIENCES, INC. ASSIGNMENT 31492 REPLACEABLE INTEGRATED… AMOS KORIN MIDWEST SCIENCES, INC. dba KORTECH, INC. ASSIGNMENT 31492 REPLACEABLE INTEGRATED… MIDWEST SCIENCES, INC. dba KORTECH, INC. PURE WATER FAMILY LIMITED PARTNERSHIP ASSIGNMENT 1199447817 GAS BURNER TRI-SQUARE INDUSTRIAL CO., LTD. HOSUN UNIVERSAL CO., LTD. CHANGE OF NAME 18495 LIQUID CRYSTAL DEVICES THE SECRETARY OF STATE FOR DEFENSE IN QINETIQ LIMITED ASSIGNMENT HER BRITTANIC MAJESTY'S GOVERNMENT OF THE UNITED KINGDOM OF GREAT BRITAIN & NORTHERN IRELAND 31389 IMPROVEMENTS IN OR RELATING TO CATION… NATIONAL POWER PLC INNOGY LIMITED ASSIGNMENT 31389 IMPROVEMENTS IN OR RELATING TO CATION… -

Marginable OTC and Foreign Margin Stocks

LIST OF MARGINABLE OTC STOCKS 1 AND LIST OF FOREIGN MARGIN STOCKS 2 AS OF May 12, 1997 The List of Marginable OTC Stocks and the List of Foreign Margin Stocks are published quarterly by the Board of Governors of the Federal Reserve System (the Board). The List of Marginable OTC Stocks is composed of stocks traded in the United States over-the-counter (OTC) that have been determined by the Board to be subject to margin requirements as of May 12, 1997, pursuant to Section 207.6 of Federal Reserve Regulation G, ‘‘Securities Credit by Persons Other Than Banks, Brokers, or Dealers,’’ Section 220.17 of Regulation T, ‘‘Credit by Brokers and Dealers,’’ and Section 221.7 of Regulation U, ‘‘Credit by Banks for the Purpose of Purchasing or Carrying Margin Stocks.’’ It also includes all OTC stocks designated as National Market System (NMS) securities. Additional NMS securities may be added in the interim between Board quarterly publications; these securities are immediately marginable upon designation as NMS securities. The names of these securities are available at the National Association of Securities Dealers, Inc. and at the Securities and Exchange Commission. This List supersedes the previous List of Marginable OTC Stocks published effective February 10, 1997. The List of Foreign Margin Stocks is composed of foreign equity securities that have met the Board’s eligibility criteria, pursuant to Regulation T, Section 220.17. These foreign equity securities are eligible for margin treatment at broker–dealers on the same basis as domestic margin securities. This list supersedes the previous List of Foreign Margin Stocks published effective February 10, 1997. -

Robert J. Desalvo Papers Business Combinations in the Cosmetic and Pharmaceutical Industries 1944

Robert J. DeSalvo Papers Business Combinations in the Cosmetic and Pharmaceutical Industries 1944 - 1990 Collection #107 Abstract Robert J. DeSalvo’s research focused on business combinations (acquisitions, mergers, and joint ventures in the cosmetic and pharmaceutical industries. This topic was the basis for his master’s thesis in pharmacy administration at the University of Pittsburgh and continued as a life-long interest. This collection consists of two series of notebooks that Dr. DeSalvo developed to record relevant business combinations. The first series records acquisitions, proposed acquisitions, mergers, and joint ventures for the period of 1944 –1990 in an alphabetical arrangement. The information on these entries is cumulative so that the history of an organization is collected in one place. The second series of notebooks is arranged in chronological blocks. The information is arranged alphabetically by the name of the acquirer. The name of the acquired (merged), type of combination (acquisition, proposed acquisition, joint venture) and the date is also provided. The information is cross-referenced between the two series so that the researcher can approach the information by the name of the parent company or chronologically. Dr. DeSalvo used this resource for many of his publications as well as his master’s thesis. A copy of these publications and his thesis make up the remainder of the collection. Donor Gift of Barbara DeSalvo, 2000 Biography Robert James DeSalvo was born on July 20, 1933 in Toledo, OH. He died on January 23, 1993 in Cincinnati, OH. DeSalvo graduated from high school in Toledo and attended pharmacy school at the University of Toledo where he received his B.S. -

Envisioning a Transformed Clinical Trials Enterprise for 2030

Envisioning a Transformed Clinical Trials Enterprise for 2030 A Four-Part Virtual Workshop Part 3: March 24, 2021 Table of Contents Envisioning a Transformed Clinical Trials Enterprise: Establishing an Agenda for 2030 Workshop Background ........................................................................................................................................................... Workshop Two-Pager ........................................................................................................................................ p. 2 Workshop Agenda .................................................................................................................................................... p. 4 Workshop Planning Committee ...................................................................................................................................... Planning Committee Bios ......................................................................................................................................... p. 8 Speaker Bios ........................................................................................................................................................... p. 14 Forum Information ............................................................................................................................................................ Forum on Drug Discovery, Development, and Translation .................................................................................... p. 18 Background -

Margin Stocks, Notice 97-22

F e d e r a l R e s e r v e B a n k OF DALLAS ROBERT D. MCTEER, JR. _____ p r e s i d e n t DALLAS, TEXAS AND CHIEF EXECUTIVE OFFICER 75265-5906 March 10, 1997 Notice 97-22 TO: The Chief Executive Officer of each member bank and others concerned in the Eleventh Federal Reserve District SUBJECT Over-the-Counter (OTC) Margin Stocks DETAILS The Board of Governors of the Federal Reserve System has revised the list of over- the-counter (OTC) stocks that are subject to its margin regulations, effective February 10, 1997. Included with the list is a listing of foreign margin stocks that are subject to Regulation T. The foreign margin stocks listed are foreign equity securities eligible for margin treatment at broker- dealers. The Board publishes complete lists four times a year, and the Federal Register announces additions to and deletions from the lists. ATTACHMENTS Attached are the complete lists of OTC stocks and foreign margin stocks as of February 10, 1997. Please retain these lists, which supersede the complete lists published as of February 12, 1996. Announcements containing additions to and deletions from the lists will be provided quarterly. MORE INFORMATION For more information regarding marginable OTC stock requirements, please contact Eugene Coy at (214) 922-6201. For additional copies of this Bank's notice and the complete lists, please contact the Public Affairs Department at (214) 922-5254. Sincerely yours, yf f a * / ' . For additional copies, bankers and others are encouraged to use one of the following toll-free numbers in contacting the Federal Reserve Bank of Dallas: Dallas Office (800) 333 -4460; El Paso Branch Intrastate (800) 592-1631, Interstate (800) 351-1012; Houston Branch Intrastate (800) 392-4162, Interstate (800) 221-0363; San Antonio Branch Intrastate (800) 292-5810.