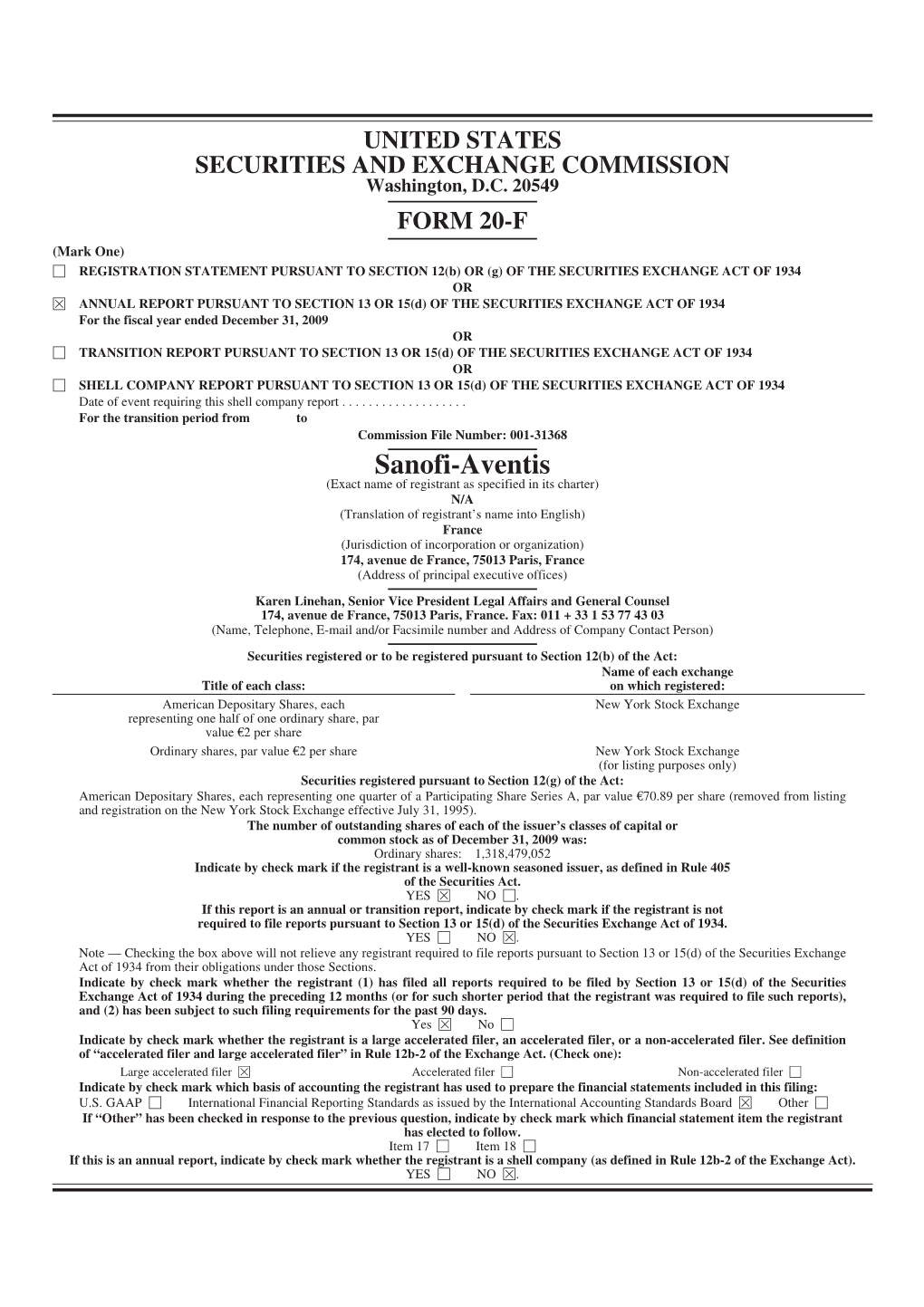

Annual Report on Form 20-F 2009

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nilotinib in Patients with Chronic Myeloid Leukemia: STAT2 Trial in Japan

Haematologica HAEMATOL/2018/194894 Version 3 Haematologica HAEMATOL/2018/194894 Version 3 Treatment-free remission after two-year consolidation therapy with nilotinib in patients with chronic myeloid leukemia: STAT2 trial in Japan Naoto Takahashi, Kaichi Nishiwaki, Chiaki Nakaseko, Nobuyuki Aotsuka, Koji Sano, Chikako Ohwada, Jun Kuroki, Hideo Kimura, Michihide Tokuhira, Kinuko Mitani, Kazuhisa Fujikawa, Osamu Iwase, Kohshi Ohishi, Fumihiko Kimura, Tetsuya Fukuda, Sakae Tanosaki, Saori Takahashi, Yoshihiro Kameoka, Hiroyoshi Nishikawa, and Hisashi Wakita Disclosures: 1. This study was supported by research funding from Novartis Pharmaceuticals to N.T. 2. N.T reports grants from Novartis Pharmaceuticals, during the conduct of the study; grants and personal fees from Novartis Pharmaceuticals, grants and personal fees from Otsuka, grants and personal fees from Pfizer, personal fees from Bristol-Myers Squibb, outside the submitted work; K.N reports grants from Zenyaku Kogyo Company, Limited, grants from Chugai Pharmaceutical, grants from Novartis Pharma K.K., grants from Kyowa Hakko Kirin Co, Ltd, grants from Nippon Shinyaku Co, Ltd, outside the submitted work; C.N reports personal fees from Novartis, grants and personal fees from Bristol-Myers Squibb, grants and personal fees from Pfizer, grants and personal fees from Takeda pharmaceuticals, grants and personal fees from Kyowa Hakko Kirin, grants and personal fees from Otsuka Pharmaceutical, grants and personal fees from Ono Pharmaceutical, grants and personal fees from Chugai Pharmaceutical, grants and personal fees from Asahi Kasei Pharma, grants and personal fees from Shionogi, personal fees from Shire, personal fees from Jannsen, personal fees from Celgene, outside the submitted work; M.T. reports personal fees from Bristol-Myers Squib, personal fees from Pfizer, outside the submitted work; K.M reports grants from Kyowa Hakko Kirin Co. -

An N U Al R Ep O R T 2018 Annual Report

ANNUAL REPORT 2018 ANNUAL REPORT The Annual Report in English is a translation of the French Document de référence provided for information purposes. This translation is qualified in its entirety by reference to the Document de référence. The Annual Report is available on the Company’s website www.vivendi.com II –— VIVENDI –— ANNUAL REPORT 2018 –— –— VIVENDI –— ANNUAL REPORT 2018 –— 01 Content QUESTIONS FOR YANNICK BOLLORÉ AND ARNAUD DE PUYFONTAINE 02 PROFILE OF THE GROUP — STRATEGY AND VALUE CREATION — BUSINESSES, FINANCIAL COMMUNICATION, TAX POLICY AND REGULATORY ENVIRONMENT — NON-FINANCIAL PERFORMANCE 04 1. Profile of the Group 06 1 2. Strategy and Value Creation 12 3. Businesses – Financial Communication – Tax Policy and Regulatory Environment 24 4. Non-financial Performance 48 RISK FACTORS — INTERNAL CONTROL AND RISK MANAGEMENT — COMPLIANCE POLICY 96 1. Risk Factors 98 2. Internal Control and Risk Management 102 2 3. Compliance Policy 108 CORPORATE GOVERNANCE OF VIVENDI — COMPENSATION OF CORPORATE OFFICERS OF VIVENDI — GENERAL INFORMATION ABOUT THE COMPANY 112 1. Corporate Governance of Vivendi 114 2. Compensation of Corporate Officers of Vivendi 150 3 3. General Information about the Company 184 FINANCIAL REPORT — STATUTORY AUDITORS’ REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS — CONSOLIDATED FINANCIAL STATEMENTS — STATUTORY AUDITORS’ REPORT ON THE FINANCIAL STATEMENTS — STATUTORY FINANCIAL STATEMENTS 196 Key Consolidated Financial Data for the last five years 198 4 I – 2018 Financial Report 199 II – Appendix to the Financial Report 222 III – Audited Consolidated Financial Statements for the year ended December 31, 2018 223 IV – 2018 Statutory Financial Statements 319 RECENT EVENTS — OUTLOOK 358 1. Recent Events 360 5 2. Outlook 361 RESPONSIBILITY FOR AUDITING THE FINANCIAL STATEMENTS 362 1. -

Form 20-F 2011 UNITED STATES SECURITIES and EXCHANGE COMMISSION WASHINGTON, D.C

Form 20-F 2011 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 Form 20-F/A (Amendment No. 1) (Mark One) ‘ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR Í ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2011 OR ‘ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to OR ‘ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report Commission file number: 1-10888 TOTAL S.A. (Exact Name of Registrant as Specified in Its Charter) Republic of France (Jurisdiction of Incorporation or Organization) 2, place Jean Millier La Défense 6 92400 Courbevoie France (Address of Principal Executive Offices) Patrick de La Chevardière Chief Financial Officer TOTAL S.A. 2, place Jean Millier La Défense 6 92400 Courbevoie France Tel: +33 (0)1 47 44 45 46 Fax: +33 (0)1 47 44 49 44 (Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act. Title of each class Name of each exchange on which registered Shares New York Stock Exchange* American Depositary Shares New York Stock Exchange * Not for trading, but only in connection with the registration of American Depositary Shares, pursuant to the requirements of the Securities and Exchange Commission. -

Cardiac Drug Therapy

Series Editor: Christopher P. Cannon ebook M. Gabriel Khan Cardiac Drug Therapy Contemporary Cardiology 8th Edition Disclaimer: This book is meant only for academic reference purpose only We acknowledge the Author and the Publisher www.pubrica.com +91-9884350006 [email protected] CONTEMPORARY CARDIOLOGY CHRISTOPHER P. C ANNON, MD SERIES EDITOR More information about this series at http://www.springer.com/series/7677 M. Gabriel Khan Cardiac Drug Therapy 8th Edition M. Gabriel Khan, MD, FRCPC, FRCP (London), FACC University of Ottawa The Ottawa Hospital Ottawa , ON , Canada ISSN 2196-8969 ISSN 2196-8977 (electronic) ISBN 978-1-61779-961-7 ISBN 978-1-61779-962-4 (eBook) DOI 10.1007/978-1-61779-962-4 Springer Totowa Heidelberg New York Dordrecht London Library of Congress Control Number: 2014952818 © Springer Science+Business Media New York 2015 This work is subject to copyright. All rights are reserved by the Publisher, whether the whole or part of the material is concerned, specifi cally the rights of translation, reprinting, reuse of illustrations, recitation, broadcasting, reproduction on microfi lms or in any other physical way, and transmission or information storage and retrieval, electronic adaptation, computer software, or by similar or dissimilar methodology now known or hereafter developed. Exempted from this legal reservation are brief excerpts in connection with reviews or scholarly analysis or material supplied specifi cally for the purpose of being entered and executed on a computer system, for exclusive use by the purchaser of the work. Duplication of this publication or parts thereof is permitted only under the provisions of the Copyright Law of the Publisher’s location, in its current version, and permission for use must always be obtained from Springer. -

Modifications to the Harmonized Tariff Schedule of the United States to Implement Changes to the Pharmaceutical Appendix

United States International Trade Commission Modifications to the Harmonized Tariff Schedule of the United States to Implement Changes to the Pharmaceutical Appendix USITC Publication 4208 December 2010 U.S. International Trade Commission COMMISSIONERS Deanna Tanner Okun, Chairman Irving A. Williamson, Vice Chairman Charlotte R. Lane Daniel R. Pearson Shara L. Aranoff Dean A. Pinkert Address all communications to Secretary to the Commission United States International Trade Commission Washington, DC 20436 U.S. International Trade Commission Washington, DC 20436 www.usitc.gov Modifications to the Harmonized Tariff Schedule of the United States to Implement Changes to the Pharmaceutical Appendix Publication 4208 December 2010 (This page is intentionally blank) Pursuant to the letter of request from the United States Trade Representative of December 15, 2010, set forth at the end of this publication, and pursuant to section 1207(a) of the Omnibus Trade and Competitiveness Act, the United States International Trade Commission is publishing the following modifications to the Harmonized Tariff Schedule of the United States (HTS) to implement changes to the Pharmaceutical Appendix, effective on January 1, 2011. Table 1 International Nonproprietary Name (INN) products proposed for addition to the Pharmaceutical Appendix to the Harmonized Tariff Schedule INN CAS Number Abagovomab 792921-10-9 Aclidinium Bromide 320345-99-1 Aderbasib 791828-58-5 Adipiplon 840486-93-3 Adoprazine 222551-17-9 Afimoxifene 68392-35-8 Aflibercept 862111-32-8 Agatolimod -

Factset-Top Ten-0521.Xlsm

Pax International Sustainable Economy Fund USD 7/31/2021 Port. Ending Market Value Portfolio Weight ASML Holding NV 34,391,879.94 4.3 Roche Holding Ltd 28,162,840.25 3.5 Novo Nordisk A/S Class B 17,719,993.74 2.2 SAP SE 17,154,858.23 2.1 AstraZeneca PLC 15,759,939.73 2.0 Unilever PLC 13,234,315.16 1.7 Commonwealth Bank of Australia 13,046,820.57 1.6 L'Oreal SA 10,415,009.32 1.3 Schneider Electric SE 10,269,506.68 1.3 GlaxoSmithKline plc 9,942,271.59 1.2 Allianz SE 9,890,811.85 1.2 Hong Kong Exchanges & Clearing Ltd. 9,477,680.83 1.2 Lonza Group AG 9,369,993.95 1.2 RELX PLC 9,269,729.12 1.2 BNP Paribas SA Class A 8,824,299.39 1.1 Takeda Pharmaceutical Co. Ltd. 8,557,780.88 1.1 Air Liquide SA 8,445,618.28 1.1 KDDI Corporation 7,560,223.63 0.9 Recruit Holdings Co., Ltd. 7,424,282.72 0.9 HOYA CORPORATION 7,295,471.27 0.9 ABB Ltd. 7,293,350.84 0.9 BASF SE 7,257,816.71 0.9 Tokyo Electron Ltd. 7,049,583.59 0.9 Munich Reinsurance Company 7,019,776.96 0.9 ASSA ABLOY AB Class B 6,982,707.69 0.9 Vestas Wind Systems A/S 6,965,518.08 0.9 Merck KGaA 6,868,081.50 0.9 Iberdrola SA 6,581,084.07 0.8 Compagnie Generale des Etablissements Michelin SCA 6,555,056.14 0.8 Straumann Holding AG 6,480,282.66 0.8 Atlas Copco AB Class B 6,194,910.19 0.8 Deutsche Boerse AG 6,186,305.10 0.8 UPM-Kymmene Oyj 5,956,283.07 0.7 Deutsche Post AG 5,851,177.11 0.7 Enel SpA 5,808,234.13 0.7 AXA SA 5,790,969.55 0.7 Nintendo Co., Ltd. -

Efficacy of Amiodarone in the Treatment of Ventricular

EFFICACY OF AMIODARONE IN THE TREATMENT OF VENTRICULAR ARRHYTHMIAS IN PATIENTS WITH CORONARY ARTERY DISEASE IN BANGLADESH 1 2 3 1 4 5 ADHIKARY DK , SAHA SK , MAHMOOD M , SALIM A , JOARDER AI , SINGHA CK , RAHMAN 6 7 8 9 10 11 MW , AHASAN MH , KHALED MFI , BANERJEE SK , MAHBUBA F , AHMED A Abstract Background: Ventricular arrhythmias (VA) are among the most feared complications of coronary artery disease (CAD) and one of the major contributors of death in CAD patients. Antiarrhythmic drug (AAD) therapy is required for recurrent significant VA in the absence of need for further revascularization. But all AADs do not have the same efficacy against life threatening VA and supraventricular arrhythmias (SVAs). Methodology: All (50) patients admitted in the department of Cardiology, BSMMU with ventricular arrhythmias with CAD fulfilling the inclusion and exclusion criteria were included in the study. Informed written consent was taken from each patient before enrollment. Detailed history was taken and relevant physical examinations were done. Loading dose followed by maintenance dose of amiodarone was given and recorded. Relevant lab investigations were performed and recorded in predesigned semi-structured data collection sheet. Symptomatic improvement was assessed, relevant physical examination was done and lab investigations were performed at 1, 3 and 6 month follow up. After editing data analysis was carried out by using the Statistical Package for Social Science (SPSS) version 23.0 windows software. Results: The mean age was found 57.7±8.0 years with a range of 45 to 78 years. Almost two third (62.0%) patients were male and 19(38.0%) patients were female. -

Coordination Des Syndicats CGT

Coordination des syndicats CGT STRATEGIE DE LA DIRECTION DU GROUPE SANOFI CONSEQUENCES INDUSTRIELLES ET SOCIALES Document d’août 2014 1. Situation économique – Coût du capital p2 2. Evolution des effectifs – Bilan des restructurations majeures p3 3. Stratégie Sanofi 2009-2015 : Désengagement scientifique et industriel en Europe et plus particulièrement en France p4 4. Stratégie de structuration du groupe en entités qui peuvent être cédées, vendues, fermées, échangées. p6 5. Crédit d’impôt – Des aides publiques pour quel usage ? p7 6. Industrie pharmaceutique : des besoins fondamentaux p7 7. Interpellation des élus et du gouvernement p8 1. Situation économique – Coût du capital Première entreprise pharmaceutique française et européenne. Sanofi est issu de la fusion de nombreux laboratoires pharmaceutiques français dont les principaux étaient Roussel Uclaf, Rhône Poulenc, Synthelabo, Sanofi et de l’allemand Hoechst. Sanofi représente 30 à 40% du potentiel national (effectifs, sites, R&D,…) de l’industrie pharmaceutique française dans notre pays. L’avenir du groupe et de ses activités en France conditionne l’avenir de l’industrie pharmaceutique française et constitue un élément incontournable de l’indépendance thérapeutique du pays. Le C.A. de sanofi dans le monde sur 2013 a atteint 33 milliards € et devrait se situer à un niveau légèrement supérieur en 2014. Plusieurs médicaments de référence étant aujourd’hui tombés dans le domaine public, le chiffre d’affaires repart à la hausse. Le résultat net des activités a été de 6,8 milliards € en 2013 et les projections sur 2014 laissent envisager une progression de 5% de celui-ci. La rentabilité est estimée par les économistes parmi les meilleures de l’industrie pharmaceutique dans le monde. -

The Impact of Secondary Innovation on Firm Market Value in the Pharmaceutical Industry

The Impact of Secondary Innovation on Firm Market Value in the Pharmaceutical Industry By: Maitri Punjabi Honors Thesis Economics Department The University of North Carolina at Chapel Hill March 2016 Approved: ______________________________ Dr. Jonathan Williams Punjabi 2 Abstract This paper analyzes the effect of the changing nature of innovation on pharmaceutical firm market value from the years 1987 to 2010 by using U.S. patent and claim data. Over the years, firms have started shifting focus from primary innovation to secondary innovation as new ideas and new compounds become more difficult to generate. In this study, we analyze the impact of this patent portfolio shift on the market capitalization of pharmaceutical firms. After using firm fixed effects and the instrumental variable approach, we find that there exists a strong positive relationship between secondary innovations and the market value of the firm– in fact, we find a stronger relationship than is observed between primary innovation and market value. When focusing on the different levels of innovation within the industry, we find that this relationship is stronger for less-innovative firms (those that have produced fewer patents) than it is for highly- innovative firms. We also find that this relationship is stronger for firms that spend less on research and development, complementing earlier findings that research productivity is declining over time. Punjabi 3 Acknowledgements I would primarily like to thank my adviser, Dr. Jonathan Williams, for his patience and constant support. Without his kind and helpful attitude, this project would have been a much more frustrating process. Through his knowledge of the industry, I have gained valuable insight and have learned a great deal about a unique and growing field. -

REFERENCE DOCUMENT Including the Sustainable Development Report Contents

2015 REFERENCE DOCUMENT Including the Sustainable Development Report Contents Key Figures 2 1 Management Report 9 4 Financial statements 199 History of the Air Liquide Group 10 Consolidated fi nancial statements 201 Activities and risk factors 15 Statutory accounts of the parent company 275 2015 Performance 32 Investment cycle and fi nancing strategy 45 Innovation 53 Strategy and outlook 62 5 Annual General Meeting 2016 297 Board of Directors’ Report on the resolutions presented to the 2016 Combined Shareholders’ 2 2015 Corporate Social Responsibility Meeting 298 and Sustainable Development Report 65 Resolutions presented for the approval of the Combined Shareholders’ Meeting – Introduction 66 May 12, 2016 307 Our 2015 Social and Environmental Contribution 67 Statutory Auditors’ Reports 327 Environmental, social and governance (ESG) report 69 Reporting methodology 113 Independent verifi er’s report 115 Appendix 118 6 Additional information 339 Share capital 340 General information 346 3 Corporate governance 119 Trade payables 356 Factors that may have an impact in the event Management and control 120 of a takeover bid 357 Report from the Chairman of the Board of Directors 123 Person responsible for the Reference Document 359 Remuneration of the Executive Offi cers and Directors Cross-reference table for the Reference Document 360 of L’Air Liquide S.A. 147 Cross-reference table for the Annual Financial Report 364 Statutory Auditors’ Report 174 Cross-reference table for the Management Report 365 Transactions involving Company shares performed -

United States Securities and Exchange Commission Form 10-K Shire Pharmaceuticals Group

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K (Mark One) ፤ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 1999 អ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number 0-29630 SHIRE PHARMACEUTICALS GROUP PLC (Exact name of registrant as specified in its charter) England and Wales (State or other jurisdiction (I.R.S. Employer of incorporation or organization) Identification No.) N.A. East Anton, Andover, Hampshire SP10 5RG England (Address of principal executive offices) (Zip Code) 44 1264 333455 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of exchange on which registered American Depository Shares, each representing Nasdaq National Market 3 Ordinary Shares, 5 pence nominal value per share Securities registered pursuant to Section 12(g) of the Act: None (Title of class) Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ፤ No អ Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant's knowledge, in definitive proxy or information statements incorporated by reference to Part III of this Form 10-K or any amendment to this Form 10-K. -

Euronext Single Stock Dividend Futures: the Widest Choice of Contracts

DIVIDEND DERIVATIVES: PLAY THE DIVIDEND FIELD WITH EURONEXT EURONEXT SINGLE STOCK DIVIDEND FUTURES: THE WIDEST CHOICE OF CONTRACTS September 2019 EURONEXT SSDFS: THE WIDEST CHOICE OF CONTRACTS 1st Dividend Exchange by number of contracts Number of contracts per country of underlying Number Number of SSDFs Underlyings ▪ Euronext began developing the range in of SSDFs only on Euronext Italy 24 11 January 2015 and regularly issues contracts Germany 27 0 to satisfy the needs of end-users Netherlands 23 9 ▪ We have nearly 300 SSDF contracts tradable Belgium 15 14 with the most diversified underlyings from Portugal 3 3 France 47 7 across Europe and the USA. Ireland 1 0 ▪ Investors can access dividend contracts on UK 36 10 new underlyings, as a total of 117 SSDFs are Spain 22 10 only available at Euronext exclusively. USA 57 36 Finland 7 2 Sweden 13 12 Norway 2 2 Switzerland 18 0 Austria 1 1 │ 2 INTRODUCTION OF SEMI-ANNUAL MATURITIES Euronext introduced semi-annual maturities on a range of Single Stock Dividend Futures listed on the Paris Derivatives Market, which offer new trading opportunities to market participants by helping them target dividend distributions more accurately on most traded names (see below). For these underlyings, the maturities available are 6, 12, 18, 24, 30, 36, 42, 48, 54 and 60 months. UNDERLYING ISIN CODE TRADING SYMBOL 1 Sanofi FR0000120578 SA8 2 BNP Paribas FR0000131104 BN8 3 AXA FR0000120628 CS8 4 Air Liquide FR0000120073 AI8 5 Orange SA FR0000133308 FT8 6 Vinci SA FR0000133308 DG8 7 LVMH FR0000121014 MC8 8 ENGIE