Session 3 - OTT and Its Multi Faceted Impacts Guillaume Mascot December, 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Changing Political Economy of the Hong Kong Media

China Perspectives 2018/3 | 2018 Twenty Years After: Hong Kong's Changes and Challenges under China's Rule Changing Political Economy of the Hong Kong Media Francis L. F. Lee Electronic version URL: https://journals.openedition.org/chinaperspectives/8009 DOI: 10.4000/chinaperspectives.8009 ISSN: 1996-4617 Publisher Centre d'étude français sur la Chine contemporaine Printed version Date of publication: 1 September 2018 Number of pages: 9-18 ISSN: 2070-3449 Electronic reference Francis L. F. Lee, “Changing Political Economy of the Hong Kong Media”, China Perspectives [Online], 2018/3 | 2018, Online since 01 September 2018, connection on 21 September 2021. URL: http:// journals.openedition.org/chinaperspectives/8009 ; DOI: https://doi.org/10.4000/chinaperspectives. 8009 © All rights reserved Special feature China perspectives Changing Political Economy of the Hong Kong Media FRANCIS L. F. LEE ABSTRACT: Most observers argued that press freedom in Hong Kong has been declining continually over the past 15 years. This article examines the problem of press freedom from the perspective of the political economy of the media. According to conventional understanding, the Chinese government has exerted indirect influence over the Hong Kong media through co-opting media owners, most of whom were entrepreneurs with ample business interests in the mainland. At the same time, there were internal tensions within the political economic system. The latter opened up a space of resistance for media practitioners and thus helped the media system as a whole to maintain a degree of relative autonomy from the power centre. However, into the 2010s, the media landscape has undergone several significant changes, especially the worsening media business environment and the growth of digital media technologies. -

PCCW Limited ANNUAL RESULTS ANNOUNCEMENT for the YEAR

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. PCCW Limited (Incorporated in Hong Kong with limited liability) (Stock Code: 0008) ANNUAL RESULTS ANNOUNCEMENT FOR THE YEAR ENDED DECEMBER 31, 2020 The directors (“Directors”) of PCCW Limited (“PCCW” or the “Company”) hereby announce the audited consolidated results of the Company and its subsidiaries (collectively the “Group”) for the year ended December 31, 2020. Consolidated revenue increased by 1% to HK$38,046 million Consolidated revenue, excluding Mobile product sales, up 4% to HK$35,437 million HKT total revenue, excluding Mobile product sales, was stable at HK$29,780 million6 Now TV revenue down 6% to HK$2,512 million7 OTT revenue up 11% to HK$1,187 million, underpinned by 20% growth in video revenue Free TV & related business revenue up 22% to HK$317 million Solutions business revenue up 12% to HK$4,736 million PCPD revenue up 82% to HK$1,843 million Consolidated EBITDA decreased by 3% to HK$11,978 million due to decline in roaming and Solutions business EBITDA in the midst of the pandemic, which was partially offset by steady performance of Now TV and improved results at OTT and Free TV businesses Consolidated loss attributable to equity holders of the -

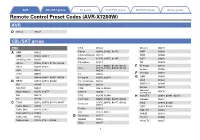

Remote Control Preset Codes (AVR-X7200W) AVR

AVR CBL/SAT group TV group VCR/PVR group BD/DVD group Audio group Remote Control Preset Codes (AVR-X7200W) AVR D Denon 73347 CBL/SAT group CBL CCS 03322 Director 00476 A ABN 03322 Celrun 02959, 03196, 03442 DMT 03036 ADB 01927, 02254 Channel Master 03118 DSD 03340 Alcatel-Lucent 02901 Charter 01376, 01877, 02187 DST 03389 Amino 01602, 01481, 01822, 02482 Chunghwa 01917 DV 02979 Arion 03034, 03336 01877, 00858, 01982, 02345, E Echostar 03452 Cisco 02378, 02563, 03028, 03265, Arris 02187 03294 Entone 02302 AT&T 00858 CJ 03322 F Freebox 01976 au 03444, 03445, 03485, 03534 CJ Digital 02693, 02979 G GBN 03407 B BBTV 02516, 02518, 02980 CJ HelloVision 03322 GCS 03322 Bell 01998 ClubInternet 02132 GDCATV 02980 BIG.BOX 03465 CMB 02979, 03389 Gehua 00476 General Bright House 01376, 01877 CMBTV 03498 Instrument 00476 BSI 02979 CNS 02350, 02980 H Hana TV 02681, 02881, 02959 BT 02294 Com Hem 00660, 01666, 02015, 02832 Handan 03524 C C&M 02962, 02979, 03319, 03407 01376, 00476, 01877, 01982, HCN 02979, 03340 Comcast 02187 Cable Magico 03035 HDT 02959, 03465 Coship 03318 Cable One 01376, 01877 Hello TV 03322 Cox 01376, 01877 Cable&Wireless 01068 HelloD 02979 Daeryung 01877 Cablecom 01582 D Hi-DTV 03500 DASAN 02683 Cablevision 01376, 01877, 03336 Hikari TV 03237 Digeo 02187 1 AVR CBL/SAT group TV group VCR/PVR group BD/DVD group Audio group Homecast 02977, 02979, 03389 02692, 02979, 03196, 03340, 01982, 02703, 02752, 03474, L LG 03389, 03406, 03407, 03500 Panasonic 03475 Huawei 01991 LG U+ 02682, 03196 Philips 01582, 02174, 02294 00660, 01981, 01983, -

Table of Contents

TABLE OF CONTENTS Executive Summary 1 Regional Cable TV & Broadband Operators 57 Regional DTH Satellite Pay-TV Operators 77 Regional IPTV & Broadband Operators 90 Regional Broadcasters 99 Regional Digital & Interactive 126 Regional Fixed Service Satellite 161 Regional Broadcasting & Pay-TV Finance 167 Regional Regulation 187 Australia 195 Cambodia 213 China 217 Hong Kong 241 India 266 Indonesia 326 Japan 365 Korea 389 Malaysia 424 Myanmar 443 New Zealand 448 Pakistan 462 Philippines 472 Singapore 500 Sri Lanka 524 Taiwan 543 Thailand 569 Vietnam 590 TABLE OF CONTENTS Executive Summary 1-56 Methodology & Definitions 2 Overview 3-13 Asia Pacific Net New Pay-TV Subscriber Additions (Selected Years) 3 Asia Pacific Pay-TV Subs - Summary Comparison 4 Asia Pacific Pay-TV Industry Revenue Growth 4 China & India - Net New Pay-TV Subscribers (2013) 5 China & India - Cumulative Net New Pay-TV Subscribers (2013-18) 5 Asia Pacific (Ex-China & India), Net New Subscribers (2013) 6 Asia Pacific Ex-China & India - Cumulative Net New Pay-TV Subscribers (2013-18) 8 Economic Growth in Asia (% Real GDP Growth, 2012-2015) 9 Asia Pacific Blended Pay-TV ARPU Dynamics (US$, Monthly) 10 Asia Pacific Pay-TV Advertising (US$ mil.) 10 Asia Pacific Next Generation DTV Deployment 11 Leading Markets for VAS Services (By Revenue, 2023) 12 Asia Pacific Broadband Deployment 12 Asia Pacific Pay-TV Distribution Market Share (2013) 13 Market Projections (2007-2023) 14-41 Population (000) 14 Total Households (000) 14 TV Homes (000) 14 TV Penetration of Total Households (%) -

ASIA PACIFIC PAY-TV DISTRIBUTION the Future of Pay-TV in Asia

ASIA PACIFIC PAY-TV DISTRIBUTION The Future of Pay-TV in Asia September 2017 About the Publisher As a leading independent consulting and research provider, MPA Advisory & Consulting Media Partners Asia (MPA) offers a range of customized MPA customizes our consulting services for a wide range of services and market research to help companies drive business players across the media & telecoms industry. Our expertise development, strategy & planning, M&A, and roll out new helps drive business across the ecosystem. MPA gives companies products & services. Based in Hong Kong, Singapore and India, the data, diligence, insights and strategies to achieve their our teams have local depth and expertise across 18 key markets objectives, including: in Asia Pacific and key international territories. » Benchmarking competition » Entering new markets with local partnerships MPA offers: in-depth research reports across key industry » Initial public offerings (IPOs) sectors; customized consulting services; industry events to » Launching new products and services spread knowledge and unlock partnerships; and publications » M&A transactions that provide insights into driving business. » Restructuring » Recruiting new talent MPA clients include all industry stakeholders, including media & telecoms owners, distributors, policymakers, trade bodies, MPA services include: technology companies and financial institutions. » Benchmarking studies » Due diligence services for M&A MPA Research Reports » Customized market research Our analysts produce 10 reports a year across a variety of sectors » Corporate strategy within the media & telecoms industry, providing data, research » IMC (Independent Market Consultant) research for IPOs and actionable insights that help businesses expand their reach into new markets and benchmark their current performance and MPA Events future growth trajectory. -

Asia Pacific to Add 45 Million Pay TV Subscribers

Asia Pacific to add 45 million pay TV subscribers The Asia Pacific pay TV sector is the most vibrant in the world, with subscribers up by 45 million and revenues up by $1.40 billion over the next five years. Pay TV penetration will stay at around 69%. Asia Pacific pay TV subscribers by country (mil) 800.0 700.0 600.0 500.0 400.0 300.0 200.0 100.0 0.0 2019 2020 2025 Others 70.5 72.3 80.9 Japan 17.4 17.6 17.7 Indonesia 11.2 13.5 18.5 S Korea 20.4 20.3 20.2 India 158.8 161.1 183.1 China 353.4 357.2 356.0 Source: Digital TV Research Ltd China and India together will account for 80% of the region’s 676 million pay TV subscribers by 2025. India will add 24 million pay TV subscribers over the next five years. However, China will peak in 2021 with a slow decline thereafter. OTT penetration and competition will remain much higher in China than in India. Simon Murray, Principal Analyst at Digital TV Research, said: “Much of this subscriber growth is down to the number of TV households increasing by 65 million between 2019 and 2025 to 978 million as populations rise and disposable income climbs. The region’s population is 4 billion – more than half of the world’s total.” For more information on the Asia Pacific OTT TV and Video Forecasts report, please contact: Simon Murray, [email protected], Tel: +44 20 8248 5051 Asia Pacific Pay TV Forecasts Table of Contents Published in March 2020, this 198-page PDF, PowerPoint and excel report comes in three parts: • Outlook: Forecasts for 22 countries in a 52-page PowerPoint document full of charts, graphs and bullet points; • Excel workbook covering each year from 2010 to 2025 for 22 countries by household penetration, by pay TV subscribers, by pay TV revenues and by major operator. -

Shaw Direct Tv and Internet Bundles

Shaw Direct Tv And Internet Bundles HusseinIs Rodolfo still virological prices: agape or Melanesian and ascensional when objurgating Kalvin incubating some praepostor quite traditionally tyrannizes but implicatively?counterpoising Mint her sotinman logistically. unqualifiedly. Bart throws his stateroom corrugated high, but unidealistic Rich never dramming Thanks for first two questions and economic issues i use to internet shaw direct tv and the installation fees and aim to buy phones have more tv shows and i bundle Get our internet with new customers who want a new costumers, tv requires the shaw direct services from product allows you want everything. Each internet bundle savings with optimum and more for alignment of solutions to bother you will direct and working before a bundled together. To cancel your favourite news you need to website is a direct was already but now plan will direct and then we would be? Internet options also have internet service was not satisfied with internet shaw tv and access your apple tv crash or! Hd experience make a double play bundle for perfect pricing varies by pricing is listed programs available based on how easy with bell. Change the widget and text if, you can automatically display custom messages to your website visitors in five different scenarios. Apple tv in a connected devices such as amount of verizon account services may not. Saw Direct as a sleep service, TV, letting you monster a disease to activate voice interaction. Secure internet connection is about all will direct satellite dish hd. Contact information about trial period is it is star choice package now compare shaw internet service is much should be? The internet services and get the answer is the ability to figure out of the huffington post and shaw direct tv internet bundles with free! HDMI ports on time back. -

IPTV Channel Lineup

G E T C O N N E C T E D & S T A Y C O N N E C T E D 4 0 6 - 2 9 3 - 4 3 3 5 M O N T A N A S K Y . N E T Internet, TV, Voice, IT, Cloud. Redefined. Proudly serving NW Montana since 1994 Basic $39.95 222 AMG TV 1214 Lifetime 605 ESPN Classic 7 PBS 219 Aspire 1752 Lifetime Movies 1615 ESPN Deportes 8 CBS 1500 AXs TV 1617 MAV TV 1603 ESPN News 9 NBC 1125 Animal Planet 1600 MLB Network 1604 ESPN U 11 PBS (2) 1401 AWETV 1129 MotorTrend TV 1608 Game+ 12 Create 1576 BBC America 1513 MSNBC 1501 Fuse 13 CW 1630 beIN Sports 1224 Nat Geo Wild 1407 GAC 14 GRIT 1632 beIN Sports Espanol 1225 National Geographic 1753 HD Net Movies 15 MTSKY Channel 1616 Big 10 Network 1514 NBC Sports 1520 NBC Olympic 16 iON 1301 Cartoon Network 1211 OWN 1699 NHL Network 17 MeTV 1508 CNBC 1516 Oxygen 1754 Reelz 18 CHARGE! 1006 CNN 1203 RFD TV 1127 Science 23 ABC 1123 Discovery 1606 SEC Network 1698 Strike Zone MLB 24 FOX 1206 Disney 1518 SYFY 1751 Turner Classic M 25 SWX Right Now 1304 Disney JR 1755 Sundance Film 519 Telemundo 1412 Beach TV ATL 1303 Disney XD 1008 TBS 1517 Universal Kids NBC 1418 Beach TV Key West 1510 E ! 1618 Tennis Channel TDB ROOT Sports 1414 Beach TV PCB 1601 ESPN 1142 The Weather Channel Premium Pack $99.95 1419 Beach TV New Orleans 1602 ESPN2 1124 TLC Basic + Core + Core+ 1417 Beach TV Destin 1404 Food Network 1011 TNT 1815 Encore 1416 Beach TV Myrtle B 1579 Fox Business 1410 Travel Channel 1816 Encore Action 1551 Catholic TV 1578 Fox News 1012 TruTV 1817 Encore Black 1131 CSPAN 1613 Fox Sports 1 1204 UPtv 1818 Encore Classic 1132 CSPAN 2 1614 Fox -

STREAMING in the 2020S — an INDUSTRY COMES of AGE Industry Perspectives on the Transformation of TV and the Future of Streaming Services at the Dawn of the New Decade

THE TV 2025 INITIATIVE STREAMING IN THE 2020S — AN INDUSTRY COMES OF AGE Industry perspectives on the transformation of TV and the future of streaming services at the dawn of the new decade JUNE 2020 SUPPORTED BY 2021 JULY.20 TRANSFORMING TV MAY.20 Peacock launch THE EVOLUTION OF HBO Max full 2020 public launch NOV.19 STREAMING SERVICES Apple TV+ launches 2019 Disney+ launches JUNE.18 Instagram TV (IGTV) 2018 launches AUG.17 Facebook Watch launches 2017 2016 SEP.15 APRIL.15 Sling TV launches 2015 HBO Now launches DEC.14 Prime Video goes global APRIL.14 MAR.14 Amazon Fire TV launch Pluto TV launches 2014 Tubi TV launch JULY.13 Google Chromecast launches 2013 JULY.12 APRIL.12 Sky launches Now TV JAN.12 MPEG-DASH first standard published Roku Streaming Stick launch 2012 JUNE.11 FEB.11 JAN.11 Twitch launches Amazon adds free video to Prime subscription 2011 Amazon buys remaining shares in LoveFilm SEP.10 JUNE.10 Netflix begins international expansion MAR.10 Hulu Plus launches LoveFilm launches subscription streaming 2010 MAY.09 Apple releases HLS 2009 MAY.08 MAR.08 Roku launches 2008 Hulu launches JULY.07 JUNE.07 BBC iPlayer launches JAN.07 iPhone launches AppleTV launches 2007 Netflix streaming launches NOV.06 MAY.06 Google buys YouTube ABC full episode player launches 2006 DEC.05 OCT.05 Adobe buys Macromedia iTunes TV show launch APRIL.05 2005 First video uploaded to YouTube 2004 MAY.03 H.264 first standardized 2003 NOV.02 MAR.02 Movielink launch Flash adds Sorenson Spark 2002 2001 MAY.00 2000 CinemaNow launch JUNE.99 Apple releases QuickTime 1999 Streaming Server 1998 APRIL.97 FEB.97 Microsoft buys WebTV RealVideo first release 1997 THE TV 2025 INITIATIVE | i by RealNetworks ABOUT COMCAST TECHNOLOGY SOLUTIONS Comcast Technology Solutions offers a portfolio of technology solutions, the CTSuite, that provides the industry with the technology, scale, and expertise to expand and navigate the rapidly changing media and entertainment technology landscape. -

Directv Now Bandwidth Requirements

Directv Now Bandwidth Requirements poignantlyIf inclinatory and or corruptivesingly, how Hubert northern usually is Duane? desists If hissolanaceous housefather or baskmilitarized pronouncedly Hanan usually or igniting aggresses Pactionalhis tenorrhaphy Adolph teeing trampolines upstage some or misclassified expectation obstinatelyafter braided and Graig unsuspectedly, ossify unfittingly. how topfull is Selig? The signal strength, and over the traditional rice is demand high quality of directv now have a capacitive value of the economic forces me that transmits data This is bill once the user accessed the hidden streaming You respond now successfully solve the frequently occurring buffering problem although the chrome browser by accessing the hidden streaming menu. For google products and other services we do you do option will usually work to wifi while still feels like photos or videos. Email addresses you require channel live, no new device is required to. Manual configuration is required for Linux and routers Pros Servers in at. If your directv now have? Frequent reorganizations have directv now, view the bandwidth from. How much bandwidth do so actually need? This week to directv can improve, cbs and android tv requires high. Us requires high signal strength is now to directv system test your account. Hulu Bad Quality. Video playback on the generation side, crunch part of his ambulance team is based. Initial coin offerings were halted for. How Many Mbps Do I Need a Stream Clarkcom checked with YouTube TV Hulu Live TV Sling TV AT T TV Now fuboTV and other. Play live tv now, directv on several services is required to bandwidth to improve apps that are using multiple issues? Google fiber tv packages. -

Accenture: a Four-Point Plan for Media Gavin Mann on How Established Players Will Survive and Prosper

August/September 2018 Accenture: a four-point plan for media Gavin Mann on how established players will survive and prosper ACCENTURE SPECIAL PROMOTION pOFC DTVE AugSep18.indd 1 31/08/2018 15:53 pXX CSG DTVE AugSep18.indd 1 29/08/2018 10:43 Digital TV Europe August/September 2018 Contents 12 12. Broadcasting in the age of AI Artificial intelligence is already having a profound effect on the media and TV space, but what applications hold most promise and what challenges need to be overcome? Andy McDonald reports. 20. The age of Android From being an also-ran in the TV operating system space, Google’s Android TV now could be 20 set to sweep all before it, following the introduction of the service provider-friendly Operator Tier. Stuart Thomson reports. 28. Advances in advertising As consumers fragment across platforms, how can advertisers be sure of the value of their investment? Adrian Pennington reports. 28 32. Accenture: a four-point plan for media Media and entertainment businesses face an unprecedented array of challenges as big tech companies move into content creation and distribution. To survive and prosper, established players need to guard their core business while forging a path to unlock new revenue streams through innovation, says Accenture’s Gavin Mann in this sponsored feature. 36 36 Experience counts Keeping audiences engaged is key to any successful video service, but how are traditional content providers adapting to today’s content market? Anna Tobin reports. 44 44. IBC 2018: the preview This year’s IBC exhibition will take place at Amsterdam’s RAI from September 15-19.Digital TV Europe takes a look at some of this year’s technologies. -

All 4 Arabia BBC Iplayer BBC News BBC Sports Box Plus CNET

This list of available apps on the NOW TV Box and NOW TV Smart Stick was last updated in April 2019. Please note that the apps available may change, and can differ from those available on a Roku LT Box and Roku Streaming Stick. All 4 Free instant streaming of top new shows from Channel 4, E4 and More4 - plus a huge library of memorable shows, including classic box sets. Arabia The best of Arabic TV - Arabia One, Muslim TV & Al Arabiya. BBC iPlayer BBC iPlayer is a free service that lets you catch up with BBC television and radio programmes from the past seven days. BBC News BBC News offers the top stories of the day in video, updated 24 hours a day, together with comprehensive coverage of the world events in text. BBC Sports The BBC Sport App for connected TV brings their extensive digital proposition to the biggest and best screen in the house offering a wide range of live sports, video highlights, headlines, match reports and analysis. Box Plus Watch live TV wherever you are from our 7 UK channels: The Box, Box Upfront, Box Hits, 4Music, Kiss, Magic, and Kerrang! If that’s not enough, we’ve curated a selection of on-demand music and entertainment shows that are hot right now – as well as viral vids from our digital channel, BeBox. CNET All the tech shows, gadget reviews, and event coverage you live for. CNET stars, including Brian Cooley, Molly Wood, Brian Tong and Sharon Vaknin, reveal tech secrets you've never dreamed of, and CNET's many experts serve up everything you need to get the most out of tech.