Analysts' Meet, Mumbai June 20, 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2019-2020

Annual Report 2019 - 20 Annual Report 2019 - 20 National Institute of Rock Mechanics (Ministry of Mines, Government of India) Head Office: Outer Ring Road, Eshwar Nagar Banashankari 2nd Stage, Bengaluru – 560070, Karnataka, India Phone Nos.: +91-80-26934400/02 to 15; Fax: +91-80-26934401 Registered Office: P.O. Champion Reefs, Kolar Gold Fields – 563117 Karnataka, India Phone No.: +91- 8153-275001; Fax: +91-8153-275002 Web: www.nirm.in Email: [email protected] National Institute of Rock Mechanics 1 Annual Report 2019 - 20 NATIONAL INSTITUTE OF ROCK MECHANICS Department Contact Numbers Phone Name Designation Phone (off) (Mob.) Administrative Dr. H S Venkatesh Director +91-80-26934400 9845176287 ------- PA to the Director +91-80-26934402 ----- Mr. A Rajan Babu Officer-in-Charge, RO, KGF +91-8153-275001 9845188807 Dr. Sandeep Nelliat Controller of Administration +91-80-26934403 9481826252 Mr. S Ravi Purchase & Stores Officer +91-80-26934404 9448141794 Mrs. Uma H R Finance & Accounts Officer +91-80-26934405 8861460584 Mr. N Jothiappa Administrative Officer +91-80-26934406 9480496164 Dr. Sripad R Naik Officer-in-Charge, PMC +91-80-26934413 9449225973 Head of Scientific Departments Rock Blasting & Excavation Dr. H S Venkatesh +91-80-26934409 9845176287 Engineering Centre for Testing Services Mr. A Rajan Babu Geomechanics & Ground +91-8153-275001 9845188807 Control Dr. P C Jha Engineering Geophysics +91-80-26934407 9448044647 Dr. Sripad R Naik Numerical Modelling +91-80-26934408 9449225973 Dr. D S Subrahmanyam Geotechnical Engineering +91-80-26934415 9448402572 Dr. V R Balasubramaniam Engineering Seismology +91-80-26934410 9448713920 Dr. A K Naithani Engineering Geology +91-80-26934411 9412114842 Dr. -

Karnataka: State Geology and Mineral Maps – Geological Survey of India

GOVERNMENT OF INDIA GEOLOGICAL SURVEY OF INDIA MISCELLANEOUS PUBLICATION NO. 30 GEOLOGY AND MINERAL RESOURCES OF THE STATES OF INDIA PART VII – Karnataka & Goa Compiled By GeologicalOPERATION :Survey Karnataka & Goa of India Bangalore 2006 CONTENTS Page No. Section-1: Geology and Mineral Resources of Karnataka I. Introduction 1 II. Physiography 1 III. Geology 2 Sargur Group 5 Peninsular Gneissic Complex and Charnockite 5 Greenstone belts 7 Closepet Granite 10 Mafic-ultramafic complexes 11 Dyke Rocks 12 Proterozoic (Purana) Basins 12 Deccan Trap 13 Warkali Beds 13 Laterite 13 Quaternary Formations 14 Recent alluvial soil and rich alluvium 14 IV. Structure 14 Folds 15 Shear zones, Faults and Lineaments 15 V. Mineral Resources Antimony 16 Asbestos 17 Barytes 17 Basemetals (Cu, Pb, Zn) 18 Bauxite 18 Chromite 21 Clay 22 Corundum 23 Diamond 24 Dolomite 25 Feldspar 25 GeologicalFuller's Earth Survey of India25 Garnet 26 Gemstones 26 Gold 28 Graphite 33 Gypsum 33 Iron Ore 33 Kyanite and sillimanite 35 ii Limestone 35 Lithium 37 Magnesite 38 Manganese ores 38 Molybdenite 40 Nickel 40 Ochre 40 Ornamental stones and dimension stones 41 Felsite, fuchsite quartzite 43 Phosphorite 43 Platinoids 43 Quartz 44 Silica sand 44 Radioactive and Rare Earth Minerals 45 Steatite (Soap stone) 45 Tin 46 Titaniferous & vanadiferous magnetite 46 Tungsten 47 Vermiculite 47 Section 2 Geology and Mineral Resources of Goa I. Introduction 48 II. Physiography 48 III. Geology 49 IV. Mineral Resources 51 Bauxite 51 Chromite 52 Clay 52 Iron Ore 52 Limestone 53 Manganese -

Indophil Resources Exploration Services (India) Pvt Ltd

Indophil Resources Exploration Services (India) Pvt Ltd. INDOPHIL RESOURCES EXPLORATION SERVICES (INDIA) PVT. LTD. CONSOLIDATED THREE YEAR REPORT ON MINERAL EXPLORATION CARRIED OUT IN THE 501.48 SQ KM, HUTTI NORTH RP BLOCK, RAICHUR DLSTIRCT, KARNATAKA 1 INTRODUCTION 1.1 LOCATION AND ACCESSIBILITY The Hutti North RP block granted to M/s Indophil Resources Exploration Services (India) Pvt. Ltd. (Indophil) is situated in the northern part of the Hutti greenstone belt of the Dharwar Craton, where the only working gold mine in the country-Hutti Gold Mines Limited is situated. The gold mine is located about 80 km west of Raichur, which is the headquarters of the District. The state highway SH-20 connecting Raichur to Lingsugur passes close to the southern boundary of the RP block. Nearest Railway Station is Raichur, which lies on the Guntakal-Sholapur section of South Central Railway (Fig.l). Hutti is an important mining town with all marketing and civil facilities. Indophil's technical personnel carried out a systematic study of the literature on the geology and mineral resources of the Hutti greenstone belt before selecting the area for filing the RP application. Literature research revealed many gaps and deficiencies in the exploration for gold carried out earlier and clearly indicated the possibility of discovering new gold bearing tracts and also finding extension of the known ones. The results of this research prompted M/s Indophil to prefer the northern part of the Hutti Belt for conducting exploration for gold under a Reconnaissance Permit. 2 DETAILS OF THE PERMIT RP application was submitted on 7.3.2001 at the office of the Director, Department of Mines and Geology, Bangalore, covering the northern part of the Hutti greenstone belt. -

A-Ailable At

Available Online at http://www.recentscientific.com International Journal of CODEN: IJRSFP (USA) Recent Scientific International Journal of Recent Scientific Research Research Vol. 8, Issue, 3, pp. 16266-16269, March, 2017 ISSN: 0976-3031 DOI: 10.24327/IJRSR Research Article EFFECTS OF GOLD MINING ON THE GENERAL POPULATION Amitha Hegde., Ankit Varun*., Momeka K and Vaisakh Vasudevan Department of Pedodontics,DOI: http://dx.doi.org/10.24327/ijrsr.2017.0803. A.B. Shetty Memorial Institute0115 of Dental Sciences, NITTE University, Mangalore ARTICLE INFO ABSTRACT Article History: Hutti, one of the three functioning gold mines in India, is located in Raichur District of Karnataka. Mercury and arsenic, being active constituents of the Gold mining industry are known toxicants that Received 17th December, 2016 st are hazardous to humans, wildlife and domestic animals and may accumulate in the environment Received in revised form 21 causing serious damage to ecosystems and human health. Hence a questionnaire based survey was January, 2017 conducted amongst the local population of the Hatti village. Most of the people who participated in Accepted 05th February, 2017 th the survey were aware of the ill effects of mining. In growing age these signs and symptoms are Published online 28 March, 2017 more pronounced than elders. Some of the most common health problems noticed were dark brown pigmentation of the skin (47%), loose stool, breathing difficulties and fatigue. Female population Key Words: reported 3% abortions and miscarriages. The poor accessibility and unavailability of health care Gold mining, Mercury, Arsenic, centers was the main reason for the increased incidence of health issues. -

Deccan Gold Mines Limited

Draft Letter of Offer March 27, 2015 For Eligible Equity Shareholders only Deccan Gold Mines Limited (Our Company was originally incorporated as Wimper Trading Limited on November 29, 1984 under the Companies Act, 1956 with the Registrar of Companies, Mumbai, Maharashtra. The name of our Company was changed to Deccan Gold Mines Limited and fresh Certificate of Incorporation was issued by the Registrar of Companies, Mumbai on March 19, 2003. The Corporate Identification Number of our Company is L51900MH1984PLC034662) Registered Office: Parinee Crescenzo, C38-C39, G Block, Bandra Kurla Complex, Bandra (East), Mumbai - 400 051 Tel No: +91 22 3304 0797; Fax No: +91 22 3304 0779 Corporate Office: No. 5, 19th Main Road, 4th Sector, HSR Layout, Bengaluru - 560 102 Tel. No.: +91 80 6715 5700; Fax No.: +91 80 6715 5701 Compliance Officer: Mr. S. Subramaniam, Company Secretary E-mail: [email protected]; Website: www.deccangoldmines.com FOR PRIVATE CIRCULATION TO THE ELIGIBLE EQUITY SHAREHOLDERS OF DECCAN GOLD MINES LIMITED ONLY DRAFT LETTER OF OFFER ISSUE OF 29,609,125 EQUITY SHARES* OF FACE VALUE OF ` 1 EACH (“EQUITY SHARES”) OF DECCAN GOLD MINES LIMITED (“DECCAN” OR THE “COMPANY” OR THE “ISSUER”) FOR CASH AT A PRICE OF ` 15 (INCLUDING SHARE PREMIUM OF ` 14) PER EQUITY SHARE (“ISSUE PRICE”) FOR AN AGGREGATE AMOUNT OF ` 444.14 MILLIONS TO THE ELIGIBLE EQUITY SHAREHOLDERS ON RIGHTS BASIS IN THE RATIO OF 1 EQUITY SHARE FOR EVERY 2 EQUITY SHARES HELD BY THE ELIGIBLE EQUITY SHAREHOLDERS ON THE RECORD DATE, I.E. [●] (THE “ISSUE”). THE ISSUE PRICE IS 15 TIMES THE FACE VALUE OF THE EQUITY SHARES. -

Pre Feasibility Report of Copper Mining Project of Ingaldal Copper Mines Ltd

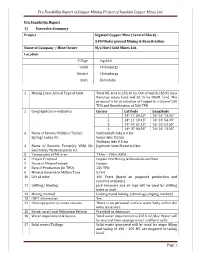

Pre Feasibility Report of Copper Mining Project of Ingaldal Copper Mines Ltd. Pre Feasibility Report 1) Executive Summary Project Ingaldal Copper Mine (Central Block) – 2490Underground Mining & Beneficiation Name of Company / Mine Owner M/s Hutti Gold Mines Ltd. Location Village Ingaldal Taluk Chitradurga District Chitradurga State Karnataka 1 Mining Lease Area & Type of land Total ML area is 259.10 ha. Out of which 238.95 ha is Revenue waste land and 20.15 ha HGML land. The proposal is for production of Copper to a tune of 250 TPD and Beneficiation of 500 TPD 2 Geographical co-ordinates Corner Latitude Longitude 1 140 11’ 09.59” 760 26’ 14.40” 2 140 11’ 10.13” 760 26’ 54.09” 3 140 10’ 01.15” 760 26’ 54.65” 4 140 10’ 00.88” 760 26’ 13.55” 3 Name of Rivers/ Nallahs/ Tanks/ Siddanahalli lake 6.0 km Spring/ Lakes etc Gonur lake 8.5 km Mallapur lake 8.5 km 4 Name of Reserve Forest(s), Wild life Jogimatti State Forest 6.0 km Sanctuary/ National parks etc. 5 Topography of ML area 744m – 790m AMSL 6 Project Proposal Copper Ore Mining & Beneficiation Plant 7 Name of Mineral mined Copper 8 Rate of Production (in TPD) 250 TPD 9 Mineral Reserve in Million Tons 9.164 10 Life of mine 100 Years (based on proposed production and reserves available) 11 Drilling/ Blasting Jack hammers and air legs will be used for drilling holes in shaft 12 Mining method Underground mining (shrinkage stoping method) 13 GWT intersection Yes. 14 Drainage pattern/ water courses There is no perennial surface water body within the mine lease area. -

4 (1) (A) Kannada

ªÀiÁ»w ºÀPÀÄÌ C¢ü¤AiÀĪÀÄ,2005gÀ ¥ÀæPÀgÀt 4(1)(a) CrAiÀÄ°è PÀqÀvÀUÀ¼À ¥ÀjÀÌøvÀ ¥ÀnÖAiÀÄ£ÀÄß ¸ÁªÀðd¤PÀgÀ ªÀiÁ»wUÁV ¥ÀæPÀn¹zÉ. Date: 01.01.2018 PÀæªÀÄ PÀqÀvÀ ¥ÁægÀA¨sÀªÁzÀ PÀqÀvÀzÀ PÀqÀvÀzÀ ¸ÀASÉå PÀqÀvÀzÀ «ÀAiÀÄ PÀqÀvÀzÀ «ÀAiÀÄ PÀqÀvÀ «ÉAiÀiÁzÀ ¢£ÁAPÀ ÀgÁ ¸ÀASÉå ¢£ÁAPÀ ªÀVÃðPÀgÀt 1 1 DIPR Tender File 19/10/2016 20/11/2016 A Closed 2 2 DIPR Tender File 21/11/2016 05/12/2016 A Closed 3 3 DIPR Tender File 06/12/2016 15/01/2016 A Closed 4 4 DIPR Tender File 16/01/2016 31/01/2016 A Closed 5 5 DIPR Work Order File 01/02/2016 20/02/2016 A Closed 6 6 DIPR Tender File 21/02/2016 12/03/2016 A Closed 7 7 DIPR Tender File 12/03/2016 31/03/2016 A Closed 8 8 DIPR Tender File 01/04/2016 01/05/2016 A Current File 9 9 DIPR Tender File 02/05/2016 25/05/2016 A Current File 10 10 DIPR Tender File 26/05/2016 18/06/2016 A Current File 11 11 DIPR Tender File 01/06/2016 19/06/2016 A Current File 12 12 DIPR Tender File 19/06/2016 12/07/2016 A Current File 13 13 DIPR Tender File 14/07/2016 28/07/2016 A Current File 14 14 DIPR Tender File 20/08/2016 04/09/2016 A Current File 15 15 DIPR Tender File 05/09/2016 28/07/2016 A Current File 16 16 DIPR Tender File 29/07/2016 19/08/2016 A Current File 17 17 DIPR Tender File 20/08/2016 Till date A Current File 18 1 DIPR DIPR Payment file transferred from Geetha 2014 - 2016 A Current File 19 2 DIPR DIPR Payment file transferred from Punitha 2015 - 2016 A Current File 20 1 DIPR Bill Receipt File 01/10/2016 31/01/2016 A Closed 21 2 DIPR Bill Receipt File 01/02/2016 Till date A Current File 22 1 CTD Advertising File Apr-12 2014 -

Pre Feasibility Report of Copper Mining Project of Ingaldal Copper Mines Ltd

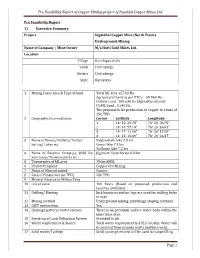

Pre Feasibility Report of Copper Mining project of Ingaldal Copper Mines Ltd. Pre Feasibility Report 1) Executive Summary Project Ingaldhal Copper Mine (North Block) Underground Mining Name of Company / Mine Owner M/s Hutti Gold Mines Ltd. Location Village Kunchiganahalu Taluk Chitradurga District Chitradurga State Karnataka 1 Mining Lease Area & Type of land Total ML area 157.83 Ha. Agricultural Land as per RTC’s : 59.960 Ha Private Land : 100.630 Ha (Agricultural land) HGML Land : 0.240 Ha The proposal is for production of Copper to a tune of 250 TPD. 2 Geographical co-ordinates Corner Latitude Longitude 1 140 12’ 20.78” 760 26’ 06.75” 2 140 11’ 57.14” 760 26’ 36.81” 3 140 11’ 12.06” 760 26’ 37.08” 4 140 11’ 10.69” 760 26’ 06.47” 3 Name of Rivers/ Nallahs/ Tanks/ Siddanahalli lake 7.0 km Spring/ Lakes etc Gonur lake 7.5 km Mallapur lake 7.5 km 4 Name of Reserve Forest(s), Wild life Jogimatti State Forest 6.0 km Sanctuary/ National parks etc. 5 Topography of ML area 750m AMSL 6 Project Proposal Copper Ore Mining 7 Name of Mineral mined Copper 8 Rate of Production (in TPD) 250 TPD 9 Mineral Reserve in Million Tons 10 Life of mine 100 Years (Based on proposed production and reserves available) 11 Drilling/ Blasting Jack hammers and air legs are used for drilling holes in shaft 12 Mining method Underground mining (shrinkage stoping method) 13 GWT intersection Yes. 14 Drainage pattern/ water courses There is no perennial surface water body within the mine lease area. -

Deccan Gold Mines Limited

Letter of Offer [●] For Eligible Equity Shareholders only Deccan Gold Mines Limited (Our Company was originally incorporated as Wimper Trading Limited on November 29, 1984 under the Companies Act, 1956 with the Registrar of Companies, Mumbai, Maharashtra. The name of our Company was changed to Deccan Gold Mines Limited and fresh Certificate of Incorporation was issued by the Registrar of Companies, Mumbai on March 19, 2003. The Corporate Identification Number of our Company is L51900MH1984PLC034662) Registered Office: Parinee Crescenzo, C38-C39, G Block, Bandra Kurla Complex, Bandra (East), Mumbai - 400 051 Tel No: +91 22 3304 0797; Fax No: +91 22 3304 0779 Corporate Office: No. 5, 19th Main Road, 4th Sector, HSR Layout, Bengaluru - 560 102 Tel. No.: +91 80 6715 5700; Fax No.: +91 80 6715 5701 Compliance Officer: Mr. S. Subramaniam, Company Secretary E-mail: [email protected]; Website: www.deccangoldmines.com FOR PRIVATE CIRCULATION TO THE ELIGIBLE EQUITY SHAREHOLDERS OF DECCAN GOLD MINES LIMITED ONLY LETTER OF OFFER ISSUE OF 29,609,125 EQUITY SHARES OF FACE VALUE OF ` 1 EACH (“EQUITY SHARES”) OF DECCAN GOLD MINES LIMITED (“DECCAN” OR THE “COMPANY” OR THE “ISSUER”) FOR CASH AT A PRICE OF ` 17 (INCLUDING SHARE PREMIUM OF ` 16) PER EQUITY SHARE (“ISSUE PRICE”) FOR AN AGGREGATE AMOUNT OF ` 503.36 MILLIONS TO THE ELIGIBLE EQUITY SHAREHOLDERS ON RIGHTS BASIS IN THE RATIO OF 1 EQUITY SHARE FOR EVERY 2 EQUITY SHARES HELD BY THE ELIGIBLE EQUITY SHAREHOLDERS ON THE RECORD DATE, I.E. SEPTEMBER 05, 2015 (THE “ISSUE”). THE ISSUE PRICE IS 17 TIMES THE FACE VALUE OF THE EQUITY SHARES. -

Answered On:12.05.2000 Gold Reserves Production Sadashivrao Dadoba Mandlik;Sultan Salahuddin Owaisi

GOVERNMENT OF INDIA MINES AND MINERALS LOK SABHA UNSTARRED QUESTION NO:7201 ANSWERED ON:12.05.2000 GOLD RESERVES PRODUCTION SADASHIVRAO DADOBA MANDLIK;SULTAN SALAHUDDIN OWAISI Will the Minister of MINES AND MINERALS be pleased to state: (a) the feasibility of gold available in these mines; the number of gold reserves discovered in the country during the (b) the location-wise details of mines where gold mining process is going on at present; (c) last three years, State-wise and location-wise; (d) the total production of gold during the same period; (e) whether India is self sufficient in meeting the gold demand of the country; (f) if so, the details thereof and if not, the steps being taken by the Government to extract more gold from the gold mines; (g) the number of gold mines closed down during the last three years and the reasons therefor; (h) whether the import of gold is cheaper than the gold produced in the country; and (i) if so, the details thereof and the comparative figure of per ten grams? Answer THE MINISTER OF STATE IN THE MINISTRY OF MINES AND MINERALS (SMT. RITA VERMA) (a) As on 31.3.2000, the gold mines in the country where mining had been carried out were as follows: State District Name of the mine(s) 1. Andhra Pradesh Chittoor Chigargunta Old Bisanatham 2. Karnataka Kolar Nundydroog Raichur Hutti and Uti (b) Feasibility of extracting gold from mines is governed by the techno-economic situation including the market price. (c) In the last three years, Geological Survey of India(GSI) has estimated nine gold reserves whose locations state wise are as follows: (i) Dona East block, Kurnool District, Andhra Pradesh. -

Production/Consumption of Gold Development of Habib-Ganj Railway Station

57 Written Answers VAISAKHA 18, 1919 (Saka) To Questions 58 [English] of Prospecting Licence/Mining Lease for exploration/exploi tation of Gold in the Country. Further, Government have Production/Consumption of Gold issued guidelines for grant of Prospecting Licence for area 480. SHRI ANNASAHIB MX. PATIL: Will the Min larger than 25 square kilometer in cases involving aerial ister of MINES be pleased to state: survey. (a) the estimated production and consumption of (d) So far, the following two proposals have been gold in the country during the last three years in terms approved by the Foreign Investment Promotion Board of quantum and value and percentage increase/decrease; (FIPB): (b) the production targets for 1997-98 and addi (i) Hindustan Zinc Limited & BHP Minerals, Aus tional investment in ongoing/new projects— both in public tralia with 60% foreign equity for prospecting of Gold, sector and private sector; among other base metals. (c) whether the Government have proposed to (ii) Australian India Resources N.L., Australia for allow private/foreign participation in Gold Mines; 100% subsidiary unit for exploration/exploitation of Gold. No Prospecting Licence/Mining Lease has been granted to (d) if so, the details thereof along with proposals these Companies so far. received/cleared; and (e) Geological Survey of India (GSI) has located (e) the details of new Gold reserves located in the new deposits of gold in Andhra Pradesh, Bihar, Karnataka, country by GSI and steps taken/proposed to Mine these Kerala, Madhya Pradesh, Maharashtra, Rajasthan and reserves? Uttar Pradesh. The details are as follows:- THE MINISTER OF STEEL AND MINISTER OF Andhra Pradesh:-(i) Dona Temple Block, Kurnool MINES (SHRI BIRENDRA PRASAD BAISHYA): (a) The District, (ii) Kotnapalle Block, Anantpur District, (iii) Kudi- details of the estimated production of gold in the country thanpalle Block, Chittoor District. -

Lk Sabha Debates

Seventh Series ,Vol. XIV No.30 Friday, 27th March 1981 LK SABHA Chaitra 6, 1903 (Saka) DEBATES (SEVENTH SERIES) (Fifth Session) VOL. XIV I M a r c h 1 6 t o 2 7 , 1 9 8 1 jPhalguna 2 5 , 1 9 0 2 t o C h a i t r a 6 , 1 9 0 3 { S a k a )J rrt Fifth Session , 1 9 8 1 / 1 9 0 2 - 0 3 { S a k a ) {Vol. X IV contains N os. 2 0 — 3 0 ) LOK SABHA SECRETARIAT N E W D E L H I CONTENTS N o. 30, Frid ’.y, M irch 27, 1981 jC haiira 6, 1903 (Saka) C o lu m n s Oral Answers to Questions: * S farrr-d QuesTions Nos. 556 to 560, 563 to 565 and 568, 569 and 571 1— 33 Wruien Answers o Question', : ♦Starred Questions Nos. 561, 566, 567, 570 and 572 to 575 . 33—3 Unstarred Questions Nos. 5271105311,5313105417,5419 to 5424, 5426 to 5434 and 5436 to 5470 . 39—239 Rc. Questions of Privilege ........ 239—-4 Papers Laid on the Table ........ 248— 5 2 388— 9 0 Messages irom Rajya Sabha ........ 252— 5 Assent to Bills ........ 253 Public Accounts Committee— Sixteenth and Twenty-Second Reports ..... 254 Re. Adjournment Motions etc. 254—59 Calling Attention to Matter of Urgent Public Importance— Reported shortfall in interest account of Employees Providen': Fund Organisation. ........ 259— 75 Shri Rajesh Kumar Singh ....... 259— 60, 263— 65 Shrimati Ram Dulari Sinha ....... 260— 62 Shri Ram Vilas P;iswan .