Case No COMP/M.6885 - SDNV/ GERMANISCHER LLOYD

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1972 Implementation, Testing, Inspection and Approval Note By

INTERNATIONAL MARITIME ORGANIZATION 4 ALBERT EMBANKMENT LONDON SE1 7SR E Telephone: 020-7735 7611 Fax: 020-7587 3210 Telex: 23588 IMOLDN G IMO Ref. T3/1.01 CSC/Circ.119 13 December 2000 Original: ENGLISH INTERNATIONAL CONVENTION FOR SAFE CONTAINERS (CSC), 1972 Implementation, testing, inspection and approval Note by the Secretariat 1 The Secretary-General has received, in accordance with article IV(2) of the International Convention for Safe Containers (CSC), 1972, the information set out in the attached annex*. 2 This circular replaces the information provided in CSC/Circ.115, which is hereby revoked. 3 CSC Contracting Parties, which have not yet done so, are invited to submit similar information. 4 To keep the list as up to date as possible, Contracting Parties, which have previously submitted relevant information, are invited to review the list and notify the Secretary-General of any changes required. *** *Annex English only. I:\CIRC\CSC\119.doc CSC/Circ.119 ANNEX ORGANIZATIONS ENTRUSTED TO TEST, INSPECT AND APPROVE CONTAINERS ARGENTINA Implementation Prefectura Naval Argentina Direccion de Policia de Seguridad de la Navigacion Av. E. Madero 235 1106 Buenos Aires República Argentina Telephone: + 54 1 34 1812 Telefax: + 54 1 331 2876 Telex: 18581 PREFEC AR AUSTRALIA Implementation Chief Executive Australian Maritime Safety Authority P.O. Box 1108 Belconnen ACT 2616 Australia Telephone + 61 6 279 5000 Telefax: + 61 6 279 5866 Testing, inspection and approval American Bureau of Shipping Bureau Veritas Det norske Veritas Germanischer Lloyd Lloyd's Register of Shipping Nippon Kaiji Kentei Kyokai and Nippon Kaiji Kyokai I:\CIRC\CSC\119.doc CSC/Circ.119 ANNEX Page 2 BAHAMAS Testing, inspection and approval American Bureau of Shipping Forty-five Broad Street New York, NY 10004 United States of America Germanischer Lloyd P.O. -

Safety Considerations and Approval Procedures for the Integration of Fuel Cells on Board of Ships

SAFETY CONSIDERATIONS AND APPROVAL PROCEDURES FOR THE INTEGRATION OF FUEL CELLS ON BOARD OF SHIPS Vogler, F.1 and Dr. Würsig, G.2 1 Risk Assessment & Mechanical Engineering, Germanischer Lloyd AG, Vorsetzen 35, Hamburg, 20459, Germany, [email protected] 2 Risk Assessment & Mechanical Engineering, Germanischer Lloyd AG, Vorsetzen 35, Hamburg, 20459, Germany, [email protected] ABSTRACT The shipping industry is becoming increasingly visible on the global environmental agenda. Shipping's share of emissions to air is regarded to be significant and public concern lead to ongoing political pressure to reduce shipping emissions. International legislation at the IMO governing the reduction of SOx and NOx emissions from shipping is being enforced, and both the European Union and the USA are planning to introduce additional regional laws to reduce emissions. Therefore new approaches for more environmental friendly and energy efficient energy converter are under discussion. One possible solution will be the use of fuel cell systems for auxiliary power or main propulsion. The presentation summarizes the legal background in international shipping related to the use for gas as ship fuel and fuel cells. The focus of the presentation will be on the safety principles for the use of gas as fuel and fuel cells on board of ships and boats. The examples given show the successful integration of such systems on board of ships. Furthermore a short outlook will be given to the ongoing and planed projects for the use of fuel cells on board of ships. 1.0 EMISSIONS IN SHIPPING 1.1 Emission in Shipping Global warming, acidification and degradation of air quality are environmental impact categories high on the international agenda. -

Role of Classification Society in Arctic Shipping

ROLE OF CLASSIFICATION SOCIETY IN ARCTIC SHIPPING Seppo Liukkonen, Station Manager, DNVGL Station Helsinki Abstract The core mission of a classification society is “to protect human lives, property and the environment”. In first place the classification societies are fulfilling this function in marine environment, because the classification business in its current form started within sea transportation and shipping. Since then the function of the classification societies has widened to comprise shipbuilding, different kinds of off- shore activities and also some on-shore activities. When fulfilling their function the classification societies are using their own classification rules as their main, own tool. Additionally, the classification societies are often fulfilling their above-mentioned function by working together with and on behalf of the flag state administrations. Here the so-called IMO instruments such as the SOLAS and MARPOL conventions, for instance, are the main basis of the work. Also, international standards, such as the EN-ISO and IEC standards, for instance, and other national and international regulations, such as the Finnish-Swedish Ice Class Rules and Canadian Arctic Pollution Prevention Regulations, for instance, are used by the classification societies. Basically, the work of the classification societies is to ensure that the object in question, e.g., a ship, an off-shore structure, a quality management system, etc., is in compliance with the above-mentioned relevant rules and regulations. In practice this can be done, e.g., with plan approvals, supervision of manufacturing, surveys, inspections and audits. This presentation gives an overview about the role of the classification societies in ensuring and developing the safe Arctic shipping. -

International Association of Classification Societies

International Association of Classifi cation Societies Roy Nersesian and Subrina Mahmood I. Introduction Th e International Association of Classifi cation Societies (IACS), headquar- tered in London, is made up of ten classifi cation societies: Lloyds Register (LR), American Bureau of Shipping (ABS), Bureau Veritas (BV), China Clas- sifi cation Society (CCS), Det Norske Veritas (DNV), Germanischer Lloyd (GL), Korean Register (KR), Nippon Kaiji Kyokai (NK), Registro Italiano Navale (RINA), and the Russian Maritime Register of Shipping (RS), as well as the Indian Register of Shipping (IRS) as an associate member. According to the Maritime International Secretariet Services (www.marisec.org), there are 47,700 vessels in the world trading fl eet made up principally of general cargo vessels, bulk carriers, container ships, tankers, and passenger vessels. If vessels smaller than 100 gross tons are included (too small to venture on the high seas or participate in international trade), the world fl eet numbers close to 100,000. Most of the world’s trading vessels – nearly 41,000 in 2008 – are registered with classifi cation society members of the IACS. Th e remaining vessels are covered by non-IASC member classifi cation societies. Classifi cation societies develop and implement technical standards for ships and fl oating off shore oil production and storage facilities. Th ese societies set rules to ensure the structural strength and integrity of the ship’s hull and its internal structure, cargo holds, bridge superstructure as well as the functional aspects and reliability of propulsion, steering systems, power generation, cargo handling, ship control, communication, navigation, emer- gency and other auxiliary systems. -

Final Report European Maritime Safety Agency (EMSA) Study on Standards and Rules for Bunkering of Gas-Fuelled Ships

Final report European Maritime Safety Agency (EMSA) Study on Standards and Rules for Bunkering of Gas-Fuelled Ships Final report European Maritime Safety Agency (EMSA) - Study on Standards and Rules for bunkering of gas-fuelled Ships Report No. 2012.005 Version 1.1/2013-02-15 Disclaimer The content of the report represents the views of Germanischer Lloyd only and should not be taken as indicative of the official view of the European Maritime Safety Agency, or of any other EU institution or Member State. Report No. CL-T-SM 2012.005 Date 2013-02-15 Contents 1 Executive Summary 7 2 Introduction 9 2.1 Objective 9 2.2 Methodological Approach 9 2.3 Limitations to the Study 10 3 Classification of the Bunkering Process 11 3.1 Overview of possible LNG Bunkering Operations 11 3.2 Elements of the LNG Supply for the LNG bunker operations identified 14 3.3 Categorisation of the relevant rule framework of possible LNG supply chains 16 4 Relevant Standardisation Bodies 18 4.1 International Bodies 18 4.1.1 International Maritime Organisation (IMO) 18 4.1.2 International Organisation for Standardisation (ISO) 19 4.1.3 International Electrotechnical Commission (IEC) 21 4.1.4 Society of International Gas Tanker & Terminal Operators (SIGTTO) 21 4.1.5 Oil Companies International Marine Forum (OCIMF) 22 4.1.6 Intergovernmental Organisation for International Carriage by Rail (OTIF) 22 4.2 European bodies 23 4.2.1 European Commission (EC) 23 4.2.2 European Committee for Standardisation (CEN) 24 4.2.3 United Nations Economic Commission for Europe (UNECE) 26 4.2.4 -

Detentionlist 01 2016

SHORT GUIDANCE TO THE MONTHLY LIST OF DETENTIONS OF THE PARIS MOU • INFORMATION IN THE LIST The monthly list of detentions of the Paris MOU contains information about ships which were detained in the Paris MOU region during the month under review. An alphabetical index on ship’s name and an index on IMO number are provided with the list. The information listed for each ship is conform Annex 4 Publication of Information related to Detentions and Inspections. (As referred to in Section 5.2 of the Memorandum) http://www.parismou.org/Organization/2010.12.27/Memorandum_of_Understanding.htm Some of these items require an explanation: RO related deficiencies: a ‘Yes’ in this column indicates that one or more of the deficiencies mentioned under ‘Reasons for detention’ are the responsibility of the Recognized Organization which has issued the relevant certificate(s). This is not necessarily the Recognized Organization mentioned in the list (see below)! Port and date of release from detention: details of detentions are entered in the information system of the Paris MOU after the ship has been released. Therefore, the details on a detention of a ship detained in September but released in October are only available in October. Recognized Organization: the Recognized Organization mentioned is not necessarily the party issuing the certificates relevant for all deficiencies which were reasons for detention. ‘Ship allowed to sail to nearest repair yard for repairs’: in general, a ship is not released from detention before all necessary repairs have been made. However, sometimes it is not possible to repair all defects at the place of detention. -

Shipping Made in Hamburg

Shipping made in Hamburg The history of the Hapag-Lloyd AG THE HISTORY OF THE HAPAG-LLOYD AG Historical Context By the middle of the 19th Century the industrial revolution has caused the disap- pearance of many crafts in Europe, fewer and fewer workers are now required. In a first process of globalization transport links are developing at great speed. For the first time, railways are enabling even ordinary citizens to move their place of residen- ce, while the first steamships are being tested in overseas trades. A great wave of emigration to the United States is just starting. “Speak up! Why are you moving away?” asks the poet Ferdinand Freiligrath in the ballad “The emigrants” that became something of a hymn for a German national mo- vement. The answer is simple: Because they can no longer stand life at home. Until 1918, stress and political repression cause millions of Europeans, among them many Germans, especially, to make off for the New World to look for new opportunities, a new life. Germany is splintered into backward princedoms under absolute rule. Mass poverty prevails and the lower orders are emigrating in swarms. That suits the rulers only too well, since a ticket to America produces a solution to all social problems. Any troublemaker can be sent across the big pond. The residents of entire almshouses are collectively despatched on voyage. New York is soon complaining about hordes of German beggars. The dangers of emigration are just as unlimited as the hoped-for opportunities in the USA. Most of the emigrants are literally without any experience, have never left their place of birth, and before the paradise they dream of, comes a hell. -

Evolution of Class

Cover NOVEMBER MarPro:MTR May Cover V2.qxd 11/8/2011 11:16 AM Page 1 Maritime Professional 4Q 2011 www.MaritimeProfessional.com Evolution of Class AS CLASS DEVELOPS TO SERVICE AN EVER-CHANGING MARITIME INDUSTRY, EVEN DARWIN WOULD BE PROUD MP#1 C2 C3 & C4:MN#5 C2 C3 & C4.qxd 2/23/2011 4:51 PM Page 1 MP #4 (1-17):MP Layouts 11/9/2011 9:12 AM Page 1 MP #4 (1-17):MP Layouts 11/9/2011 9:17 AM Page 2 4th Quarter 2011 Maritime Volume 1 Number 4 Professional 4Q 2011 www.MaritimeProfessional.com 30 The Evolution of Class Modern class: Defined by change; Shaped by Competence. By Greg Trauthwein Plus “Class Insights” • DNV (p. 38) • Lloyd’s Register (p. 41) • ClassNK (p. 44) • RINA (p. 47) 14 Rising from the Ashes ... of Virtual Shipbuilding ... American Phoenix is not your father’s Jones Act product carrier. By Robert Kunkel 18 ABS Nautical Systems Karen Hughey, the President and COO of ABS Nautical Systems discusses “Class of the Future” via the NS5 Enterprise suite of software solutions. By Greg Trauthwein 26 Modern Ship Registry Bill Gallagher, President, International Registries, Inc. (IRI) helps to raises the bar on safety and compliance. By Joseph Keefe 50 Best Designs BWT Platform Presents Unique Challenges for Naval Architects. By Joseph Keefe ON THE COVER Charles Darwin probably had ocean commerce in mind when he thought up the concept of “survival of the fittest.” Even he probably couldn’t envision what today’s modern classification societies have evolved to become. -

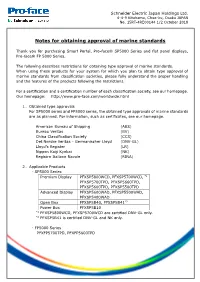

Standard Certification

Schneider Electric Japan Holdings Ltd. 4-4-9 Kitahama, Chuo-ku, Osaka JAPAN No. 15RT-4RE00144 1/2 October 2018 Notes for obtaining approval of marine standards Thank you for purchasing Smart Portal, Pro-face® SP5000 Series and flat panel displays, Pro-face® FP 5000 Series. The following describes restrictions for obtaining type approval of marine standards. When using these products for your system for which you plan to obtain type approval of marine standards from classification societies, please fully understand the proper handling and the features of the products following the restrictions. For a certification and a certification number of each classification society, see our homepage. Our homepage: http://www.pro-face.com/worldwide.html 1.Obtained type approvals For SP5000 series and FP5000 series, the obtained type approvals of marine standards are as planned. For information, such as certificates, see our homepage. American Bureau of Shipping (ABS) Bureau Veritas (BV) China Classification Society (CCS) Det Norske Veritas - Germanischer Lloyd (DNV-GL) Lloyd's Register (LR) Nippon Kaiji Kyokai (NK) Registro Italiano Navale (RINA) 2.Applicable Products ・SP5000 Series Premium Display PFXSP5800WCD, PFXSP5700WCD, *1 PFXSP5700TPD, PFXSP5660TPD, PFXSP5600TPD, PFXSP5500TPD Advanced Display PFXSP5600WAD, PFXSP5500WAD, PFXSP5400WAD Open Box PFXSP5B40, PFXSP5B41*2 Power Box PFXSP5B10 *1 PFXSP5800WCD, PFXSP5700WCD are certified DNV-GL only. *2 PFXSP5B41 is certified DNV-GL and NK only. ・FP5000 Series PFXFP5700TPD, PFXFP5600TPD Schneider Electric Japan Holdings Ltd. 4-4-9 Kitahama, Chuo-ku, Osaka JAPAN No. 15RT-4RE00144 2/2 October 2018 3.Restrictions The following describes restrictions for obtaining type approval concerning SP5000 series and FP5000 series. ・For installation, wiring and use of the products, be sure to read SP5000 series or FP5000 series instructions and SP5000 series or FP5000 series hardware manual. -

Western Canada Shipbuilding Summit Introduction

Western Canada Shipbuilding Summit The role of Classification Societies in Shipbuilding Marcel LaRoche, Marine Manager Western Canada Lloyd’s Register Canada Ltd. May 2nd, 2012 Introduction In the context of both international and Canadian shipping this presentation will examine the relationships between the key regulatory players related to shipbuilding and seek to clarify their roles. Ship Building Defining Design Criteria • Given the considerable cost of building a ship, three very important criteria must be established early in the design phase. 1. What is the need for the vessel thus establishing the design intent (ship type, area of operation…etc)? 2. To which Flag State will the ship be registered; hence establishing the regulatory framework to which the ship will be built and operated? 3. Will the ship be built to the Rules and Regulations of a Classification Society and if so, which one? Regulatory Regime Flag States (National Maritime Administrations) • That authority under which a country exercises regulatory control over the commercial vessel which is registered under its flag. • This involves the inspection, certification, and issuance of safety and pollution prevention documents. • Responsibilities include: • Development of national law and regulations • Implementation of international conventions and mandatory codes • Ensure compliance • Exercise control functions Regulatory Regime United Nations Convention on the Law of the Sea Article 94 of UNCLOS the Flag State has certain duties including: • “exercises its jurisdiction -

Ssc-439 Comparative Structural Requirements

NTIS # SSC-439 COMPARATIVE STRUCTURAL REQUIREMENTS FOR HIGH SPEED CRAFTS This document has been approved For public release and sale; its Distribution is unlimited SHIP STRUCTURE COMMITTEE 2005 SHIP STRUCTURE COMMITTEE RADM Thomas H. Gilmour U. S. Coast Guard Assistant Commandant, Marine Safety and Environmental Protection Chairman, Ship Structure Committee Mr. W. Thomas Packard Dr. Jack Spencer Director, Senior Vice President Survivability and Structural Integrity Group American Bureau of Shipping Naval Sea Systems Command Mr. Joseph Byrne Mr.Gerard A. McDonald Director, Office of Ship Construction Director General, Marine Safety, Maritime Administration Safety & Security Transport Canada Mr. Thomas Connors Dr. Neil Pegg Director of Engineering Group Leader - Structural Mechanics Military Sealift Command Defence Research & Development Canada - Atlantic CONTRACTING OFFICER TECHNICAL REP. EXECUTIVE DIRECTOR Chao Lin / MARAD Lieutenant Eric M. Cooper Natale Nappi / NAVSEA U. S. Coast Guard Robert Sedat / USCG SHIP STRUCTURE SUB-COMMITTEE AMERICAN BUREAU OF SHIPPING DEFENCE RESEARCH & DEVELOPMENT ATLANTIC Mr. Glenn Ashe Dr David Stredulinsky Mr. Yung Shin Mr. John Porter Mr. Phil Rynn Mr. William Hanzalek MARITIME ADMINISTRATION MILITARY SEALIFT COMMAND Mr. Chao Lin Mr. Joseph Bohr Mr. Carlos Setterstrom Mr. Paul Handler Mr. Richard Sonnenschein Mr. Michael W. Touma NAVAL SEA SYSTEMS COMMAND TRANSPORT CANADA Mr. Jeffery E. Beach Mr. Jacek Dubiel Mr. Natale Nappi Jr. Mr. Allen H. Engle Mr. Charles L. Null UNITED STATES COAST GUARD Mr. Rubin Sheinberg Mr. Robert Sedat Captain Ray Petow Technical Report Documentation Page 1. Report No. 2. Government Accession No. 3. Recipient’s Catalog No. SSC-439 PB2005- 4. Title and Subtitle 5. Report Date Comparative Structural Requirements for High Speed Craft February 2005 6. -

CSC.1/Circ.150 5 November 2015 INTERNATIONAL CONVENTION

E 4 ALBERT EMBANKMENT LONDON SE1 7SR Telephone: +44 (0)20 7735 7611 Fax: +44 (0)20 7587 3210 CSC.1/Circ.150 5 November 2015 INTERNATIONAL CONVENTION FOR SAFE CONTAINERS (CSC), 1972 Implementation, testing, inspection and approval Note by the Secretariat 1 The Secretary-General has received, in accordance with article IV(2) of the International Convention for Safe Containers (CSC), 1972, information on organizations carrying out container testing, inspection and approval, as listed in the annex*. 2 CSC Contracting Parties, which have not yet done so, are invited to inform the Secretary-General of the names, addresses, telephone, telefax numbers and email addresses of the organizations entrusted by them to test, inspect and approve containers. 3 To keep the attached list as up to date as possible, CSC Contracting Parties, which have previously submitted relevant information are invited to review the information provided in the annex and notify the Secretary-General of any changes required. 4 This circular replaces the information provided in CSC.1/Circ.149, which is hereby revoked. *** * Annex in English only. https://edocs.imo.org/Final Documents/English/CSC.1-CIRC.150 (E).docx CSC.1/Circ.150 Annex, page 1 ANNEX ORGANIZATIONS ENTRUSTED TO TEST, INSPECT AND APPROVE CONTAINERS ARGENTINA Implementation Prefectura Naval Argentina Dirección de Policía de Seguridad de la Navegación Av. E. Madero 235 1106 Buenos Aires República Argentina Telephone: + 54 1 34 1812 Telefax: + 54 1 331 2876 Telex: 18581 PREFEC AR AUSTRALIA Implementation Manager – Ship Inspection Group Maritime Operations Australian Maritime Safety Authority GPO Box 2181 CANBERRA ACT 2601 Australia Telephone: + 61 2 6279 5048 Telefax: + 61 2 6279 5058 Testing, inspection and approval American Bureau of Shipping Bureau Veritas Det Norske Veritas Germanischer Lloyd Lloyd's Register of Shipping Nippon Kaiji Kyokai BAHAMAS Testing, inspection and approval American Bureau of Shipping Forty-five Broad Street New York, N.Y.