LANDSTAR SYSTEM, INC. (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Codes of Conduct L-R 2018.Pdf

Produced by the Center for Business Ethics, Bentley University www.bentley.edu/cbe Codes of Conduct: L-R L Brands L-3 Communications Holdings, Inc. L’Oreal Laboratory Corp. of America Holdings Lam Research Lamar Advertising Company Land O’ Lakes, Inc. Landstar System, Inc. Las Vegas Sands Corp. Lear Corporation Legg Mason, Inc. Leggett & Platt, Incorporated Leidos Holdings Lennar Corp. Lennox International, Inc. Leucadia National Level 3 Communications, Inc. Levi Strauss Lexmark International, Inc. Liberty Interactive Corporation Liberty Media Corporation Lifepoint Hospitals Lincoln Electric Holdings Lincoln National Corporation LinkedIn Linn Energy Lithia Motors, Inc. Live Nation Entertainment LKQ Lockheed Martin Loews Corporation Lorillard, Inc. Lowe's Companies, Inc. LPL Financial Holding Lubrizol M&T Bank Corporation Macy's Magellan Health Services, Inc. Magellan Midstream Partners Manitowoc Manpower Inc. Produced by the Center for Business Ethics, Bentley University www.bentley.edu/cbe ManTech International Marathon Oil Corporation Marathon Petroleum Corporation Markel Corporation MarkWest Energy Partners Marriott International, Inc. Marsh & McLennan Companies, Inc. Martin Marietta Materials, Inc. Masco Corporation Massachusetts Mutual Life Insurance Company MasTec, Inc. MasterCard Mattel Maxim Integrated Products, Inc. McCormick & Company, Incorporated McDermott McDonald's Corporation McGraw Hill Financial McKesson Corporation MDU Resources Group, Inc. Mead Johnson Nutrition Medical Mutual of Ohio Mednax Medtronic Men’s Wearhouse Merchants Bancshares, Inc. Merck Mercury General Corp Meredith Corporation Meritage Home Meritor, Inc. Metaldyne Performance Group MetLife MetroPCS Communications Mettler-Toledo International, Inc. MGM Resorts International Michaels Companies, Inc. Micron Technology, Inc. Microsoft Corporation Mitre Mohawk Industries, Inc. Molina Healthcare Produced by the Center for Business Ethics, Bentley University www.bentley.edu/cbe Molson Coors Brewing Company Momentive Specialty Chemicals Mondelez International, Inc. -

Trucking & Logistics Report

TRUCKING & LOGISTICS REPORT THIRD QUARTER 2019 Bridgepoint Investment Banking is a division of Bridgepoint Holdings, LLC. Securities offered through an unaffiliated entity, M&A Securities Group, Inc., member FINRA/SIPC. This entity is not affiliated or associated with, authorized or sponsored by Bridgepoint Advisers Limited TRUCKING & LOGISTICS INDUSTRY UPDATE Q3 2019 bridgepointib.com BRIDGEPOINT INSIGHTS Volatility in the Truckload Freight Market; Stability on the Horizon EXECUTIVE SUMMARY BIG PICTURE Trucking company median EBITDA Trucking company valuations and valuation multiples are currently at earnings are highly cyclical due to the 6.3x, near historical norms and well in nature of the industry and general excess of trough levels macroeconomic factors as well as Year-over-year truckload demand specific business characteristics has remained static, but carriers added too much capacity to capture the peak freight rates in 2018. Spot Cycle timing is critical to maximize market rates declined rapidly as a transaction value. Recent decline of 3.1x result while contract rates remained (32.6%) of public trucking companies’ flat – capacity utilization has receded, median TEV / EBTIDA multiple since and the driver shortage has increased September 2018 indicates that the slightly industry remains in the late stages of the Though there was solid growth with cycle private fleets, many for-hire trucking firms were down in the first-half of 2019, particularly small companies Bridgepoint Investment Banking advises trucking company owners seeking -

Transportation & Logistics Industry Update

TRANSPORTATION & LOGISTICS INDUSTRY UPDATE │ FEBRUARY 2016 www.harriswilliams.com Investment banking services are provided by Harris Williams LLC, a registered broker-dealer and member of FINRA and SIPC, and Harris Williams & Co. Ltd, which is authorised and regulated by the Financial Conduct Authority. Harris Williams & Co. is a trade name under which Harris Williams LLC and Harris Williams & Co. Ltd conduct business. 0 TRANSPORTATION & LOGISTICS INDUSTRY UPDATE │ FEBRUARY 2016 WHAT WE’RE READING CONTENTS LOGISTICS | ADDRESSING FUTURE DEMAND LEVELS NOW . M&A TRANSACTIONS Increased variation in what buyers require at a given time means it is no longer . PUBLIC MARKETS OVERVIEW sufficient to rely on traditional baseline ordering patterns. Meeting demand on a . STOCK PRICE PERFORMANCE more consistent basis therefore requires complex stock management systems, building and maintaining key relationships throughout the supply chain and a . OUR GROUP review of the triggers that influence buying behavior. Recent years have seen a concerted focus on suppliers adopting more products lines – both in terms of volume and variation – in order to react quickly to the demands of buyers, which can often come at a moment’s notice. CONTACTS Supply Chain Digital UNITED STATES TRUCKING | LOGISTICS CHIEF EXPECTS TRUCKERS TO ADAPT TO NEW RULES Frank Mountcastle Logistics provider C.H. Robinson Worldwide Inc. says the trucking industry should Managing Director [email protected] absorb new federal safety regulations with relative ease despite sharp divisions +1 (804) 915-0124 among trucking companies over the rules. The requirement for electronic logging devices and restrictions on driving hours for truck drivers will raise costs for some Jason Bass smaller trucking companies, John Wiehoff, the company’s chief executive, said in Managing Director an earnings conference call with analysts on Wednesday. -

Annual Report 2019 Percent of Revenue by Industry

J.B. HUNT TRANSPORT SERVICES, INC. 2019 NOTICE OF ANNUAL MEETING, PROXY STATEMENT AND ANNUAL REPORT With more than 58 years of experience, J.B. Hunt continues to raise the expectations for companies in transportation and logistics. The company was founded by an entrepreneur which created a culture that places innovation at its core. Over the past few years, J.B. Hunt has taken unprecedented approaches to tackle some of the industry’s biggest challenges, such as uncovering new available capacity, improving the day-to-day experience for truck drivers, and enhancing its trucking fl eet to continue being one of the safest on the road. Table of Contents Letter to our Stockholders and Employees 3 Notice of Annual Meeting of Stockholders 8 Proxy Statement 9 Proxy Summary 9 Proposal Number One – Election of Directors 22 Information About the Board 22 Nominees for Director 23 Director Compensation 28 Executive Officers of the Company 30 Security Ownership of Management 31 Corporate Governance 33 Audit Committee 40 Executive Compensation Committee 41 Nominating and Corporate Governance Committee 42 Principal Stockholders of the Company 44 Executive Compensation 45 Compensation Discussion and Analysis 45 Process of Setting Compensation 48 2019 Compensation 54 Summary Compensation 61 Grants of Plan-Based Awards 62 Outstanding Equity Awards at Calendar Year-end 64 Restricted Share Units Vested 66 Nonqualified Deferred Compensation 67 Potential Post-Employment Benefits 68 CEO Pay Ratio 69 Report of the Executive Compensation Committee 71 Proposal Number Two – Advisory Vote on Executive Compensation 72 Report of the Audit Committee 74 Proposal Number Three – Ratification of Independent Registered Public Accounting Firm 75 Proposal Number Four – Stockholder Proposal Regarding Reporting Political Contributions 78 Proposal Number Five – Stockholder Proposal Seeking a Report on Climate Change Initiatives 81 Questions and Answers About the Proxy Materials and the Annual Meeting 86 J.B. -

Country State Business

Spotted Lanternfly Permit Participants These Participants have been trained on and found to be compliant with standards listed in the Order of Quarantine and Treatment regarding Spotted Lanternfly for operating in the quarantine area. The companies listed here have agreed to participate in and comply with the terms and conditions of the Order of Quarantine and Treatment which is designed to stop the movement of Spotted Lanternfly within or out of the current quarantine zone. Country State Business Canada AB 1763579 ON INC Canada AB 624889 BC LTD Canada AB 9958169 CANADA INC/LOHGARH TRANSPORT Canada AB ADMIRAL MERCHANTS MOTOR FREIGHT Canada AB BCD AB TRANSPORT LTD Canada AB CANEDA TRANSPORT LTD Canada AB CARAVAN AB INC Canada AB CBS TRUCKING INC Canada AB CERTARUS LTD Canada AB CODE LOGISTICS LTD Canada AB DAY AND ROSS INC Canada AB GILBERT TRUCKING LTD Canada AB JJ TRANSPORT INC Canada AB LANDSTAR Canada AB LOADSAFE CROSSBORDER FREIGHT INC Canada AB LOADSAFE/SL TRANSPORT LTD Canada AB MULLEN TRUCKING CORP Canada AB NORD-DECK TRANSPORT INC Canada AB SNOWY OWL TRANSPORTATION Canada BC 1063282 BC LTD Canada BC BERRY AND SMITH TRUCKING LTD Canada BC I-5 LOGISTICS SERVICES LTD Canada BC INTERNATIONAL MACHINE TRANSPORT INC Canada BC KDMS HOLDINGS INC Canada BC LODEXO LOGISTICS INC Canada BC MAVEN TRANSPORT LTD Canada BC PISTON TRANSPORT LTD Canada BC POWERLANE LOGISTICS INC Canada BC SKY BLUE TRANSPORT Canada BC SRT LOGISTICS Canada BC SYER TRANSPORTATION SERVICES LTD Canada BC TEN FOUR TRUCKING Canada BC THE DAY & ROSS TRANSPORTATION GROUP -

Werner 2020 Annual Report

2020 ANNUAL REPORT 2020 20 20 20 20 Operating revenues 22 20 2 2 200 * Net income 0 202 2 Diluted earnings per share* 2. 2. 2. 2.0 .0 Cash dividends declared per share** 0. 0. 0.2 0.2 Return on average stockholders equity* . .2 Operating ratio 0. 0. 0. .2 . Operating ratio Truckload Segent .0 . .2 . .0 Total assets 2 2 200 0 00 Total debt 200000 00000 2000 000 0000 Stockholders equity* 00 00 2 2 $994,787 Dollars in thousands except per share amounts * 20 includes the aorale ipact o the noncash reduction in deerred incoe tax expense o illion, or .2 per diluted share, in ourth uarter 20 due to the Tax uts and Jos Act o 20. ** 20 includes a . per share special diidend declared in ay 20. Total assets Operating revenues 2020 2,156,676 2020 22 2019 2,143,864 2019 20 2018 2,083,04 2018 2 2017 $1,807,991 2017 2 2016 $1,793,003 2016 200 Diluted earnings per share 2020 2.4 2019 2.3 2018 2.3 2017 $2.0 2016 $.09 Diersity, Euity and nclusion Drie Us ndustry Leader in Enironental Health and Saety pact At Werner, we support and encourage the diverse voices and perspectives of our associates, our customers and our suppliers. Diversity contributes Batteries to innovation and connects us to the many commu- tires nities we serve. We commit to embrace these values liquids as we move toward an increasingly inclusive culture where every associate feels empowered to bring their REDUCTION IN ACCIDENTS LIGHTING AT ALL FACILITIES whole self to Werner. -

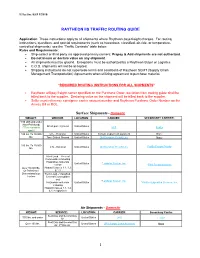

Effective: 6/20/05 NORTH TEXAS TRAFFIC ROUTING GUIDE

Effective 05/11/2016 RAYTHEON IIS TRAFFIC ROUTING GUIDE Application: These instructions apply to all shipments where Raytheon pays freight charges. For routing instructions, questions, and special requirements (such as hazardous, classified, air-ride, or temperature- controlled shipments), see the “Traffic Contacts” table below. Rules and Requirements: • Ship collect or third party via approved primary carriers; Prepay & Add shipments are not authorized. • Do not insure or declare value on any shipment. • All shipments must be ground. Exceptions must be authorized by a Raytheon Buyer or Logistics • C.O.D. shipments will not be accepted. • Shipping instructions do not supersede terms and conditions of Raytheon SCMT (Supply Chain Management Transportation) Agreements when utilizing agreement to purchase material. “REQUIRED ROUTING INSTRUCTIONS FOR ALL SHIPMENTS” • Raytheon will pay freight carrier specified on the Purchase Order, deviation from routing guide shall be billed back to the supplier. Declaring value on the shipment will be billed back to the supplier. • Seller must reference consignee carrier account number and Raytheon Purchase Order Number on the Airway Bill or BOL. Surface Shipments - Domestic WEIGHT: SERVICE: LOCATION: CARRIER: SECONDARY CARRIER: 1100 LBS and under (Non-Palletized) Small parcel ground United States (*Size restraints UPS FedEx apply) 100 lbs. To 10,000 LTL - Regional United States Contact Logistics Department None lbs. Time Critical Ground United States Old Dominion Freight Line None 100 lbs. To 10,000 LTL - National United States Old Dominion Freight Line FedEx Freight Priority lbs. Truck Load – General Commodities including Hazardous materials United States 2Landstar System, Inc. except 2Pilot Freight Services Over 10,000 lbs. Hazard Classes 1.1, 1.2 Or Palletized / & 1.3 Dimensional size Truck Load – Classified, Factors General Commodities and 2Landstar System, Inc. -

Equity Research

July 2, 2012 Equity Research CSA: Another Look With Similar Conclusions An Expanded Dataset And Another Look Highlights CSA Problems Sector Rating: Airfreight & Logistics, Market Weight Sector Rating: Trucking & Intermodal, Market Weight Price FY EPS FY P/E Company Name Rating 07/02/12 2012E 2013E 2012 2013 Airfreight & Logistics FedEx Corp. (FDX) 1 $91.54 $6.45 A $7.24 14.2x 12.6x United Parcel Service, Inc. (UPS) 2 78.69 4.88 5.39 16.1x 14.6x Trucking & Intermodal Arkansas Best Corp. (ABFS) 3 V 12.31 (0.08) 0.53 NM 23.2x C.H. Robinson Worldwide, Inc. 2 60.85 2.85 3.24 21.4x 18.8x (CHRW) Con-way Inc. (CNW) 2 V 35.62 2.35 2.73 15.2x 13.1x Heartland Express, Inc. (HTLD) 2 14.32 0.85 0.94 16.8x 15.2x Hub Group, Inc. (HUBG) 2 35.74 1.92 2.28 18.6x 15.7x J.B. Hunt Transport Services, Inc. 1 59.13 2.68 3.19 22.1x 18.5x (JBHT) Knight Transportation, Inc. (KNX) 1 15.99 0.95 1.14 16.8x 14.0x Landstar System, Inc. (LSTR) 2 51.85 2.78 3.10 18.7x 16.7x Old Dominion Freight Line, Inc. 1 44.42 2.82 3.20 15.8x 13.9x (ODFL) Ryder System, Inc. (R) 2 35.31 3.71 4.12 9.5x 8.6x Swift Transportation Co. (SWFT) 1 V 9.71 0.82 1.10 11.8x 8.8x Werner Enterprises, Inc. -

2020 Top 100 For-Hire Carriers Is an Annual Publication Produced by Transport Topics, with Assistance from SJ Consulting Group

COVID-19 Pandemic Muddles Outlook For Top 100 For-Hire Carriers he COVID-19 pandemic has transformed 2020 into a chal- Indianapolis, had ranked No. 38 a year ago. lenging and unprecedented year for the trucking industry. Meanwhile, familiar names continue to dominate the top of the T Freight networks faced major disruptions as businesses tem- 2020 list of North America’s largest for-hire carriers. Parcel giant porarily closed and people stayed home to help contain the spread of UPS Inc. remains firmly entrenched at No. 1, followed closely by the virus, bringing much of the economy to a standstill. rival FedEx Corp. Schneider, meanwhile, cracked the top 5 by edging past YRC Worldwide and Knight-Swift Transportation Holdings. Further down the list, several other carriers made notable jumps. Day & Ross Transportation Group, based in Hartland, New Bruns- Seth Clevenger wick, climbed to No. 37, from No. 46 a year ago. The Canadian car- rier ex panded its dedicated operations in the United States through Managing Editor, Features its April 2019 acquisition of A&S Kinard and Buckler Transport. Refrigerated carrier John Christner Trucking also continued its ascent. The Sapulpa, Okla.-based company’s ranking increased this year to No. 83, from No. 89 a year ago and No. 99 in 2018. Another big mover was Challenger Group, based in Cambridge, This public health crisis has forced North America’s largest for-hire Ontario. The company rose to No. 84, from No. 95 last year, as rev- carriers to adjust their operations while implementing safety mea- enue increased 17.5%. -

XPO Logistics, Inc. (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-Q (Mark One) ☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended March 31, 2014 ☐ TRANSITION REPORTS PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number: 001-32172 XPO Logistics, Inc. (Exact name of registrant as specified in its charter) Delaware 03-0450326 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) Five Greenwich Office Park Greenwich, CT 06831 (Address of principal executive offices) (Zip code) (855) 976-4636 (Registrant’s telephone number, including area code) (Former name, former address and former fiscal year, if changed since last report) Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐ Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. -

HITTING the MARK: Transportation Companies That Work for Women

Edition 3 | 2018 INSIDE... HITTING FOSTERING DIALOGUE THE MARK: About Gender Diversity Traits for SUCCESS 2018TOP 0 ANIES Driver Campaigns for MILLENNIALS Managing Holiday Stress SAME-GENDER TRAINING POLICY PHOTO CONTEST WINNERS At United Road, what makes us different makes us better. As the nation’s premier car-hauling expert, we transport over three million vehicles throughout North America each and every year. And what makes us the best, besides Carhaul Acquisition Expands Our Fleet Size Teamwork, New Investments In Equipment And Our North American Footprintour leading edge technology, industry-best capacity,Will andProduce Significant Positive Impacts Kathleen McCann, CEO Pat Riley, Senior Vice President diverse service offerings? Welcome to our newest team members! This edition of On the Road Our recent Over the coming months, you will see the was intentionally delayed because we wantedOUR to wait and PE shareO thisPLE. acquisition of transfer of truck equipment that is better suited to good news with you: United Road has completed its acquisition of the The Waggoners conduct the business that it was designed to do, carhaul divisionWe of Theinvite Waggoners you toTrucking learn Co. more We are soabout excited tothe women and men Trucking auto resulting in improved productivity and efficiency. welcome such a great group of professionals to our team! transport busi- Day cab quick loaders and high rail units will 2 3 Althoughthat this has make previously the been wheels communicated of United in various Roadways turn. ness expands work in rail ramp and regional locations where they over the last few weeks, it may be helpful to share the highlights of our United Road’s are best suited. -

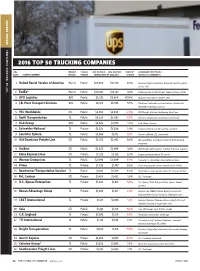

2016 Top 50 Trucking Companies 2016 Top 50 Trucking Companies

SPECIAL REPORT SPECIAL 2016 TOP 50 TRUCKING COMPANIES 2016 TOP 50 TRUCKING COMPANIES 2016 PRIMARY PUBLIC/ 2015 REVENUE 2016 REVENUE PERCENT SUBSIDIARY PORTFOLIO / RANK PARENT COMPANY SERVICE PRIVATE (IN MILLIONS OF DOLLARS) CHANGE SERVICES & COMMENTS 1 United Parcel Service of America Parcel Public $29,829 $31,770 6.5% Ground, freight, brokerage. Acquired Coyote Logistics in July 2015 TOP 50 TRUCKING COMPANIES TRUCKING 50 TOP 2 FedEx* Parcel Public $20,307 $22,127 9.0% FedEx Ground, FedEx Freight, FedEx Custom Critical 3 XPO Logistics IMC Public $3,273 $6,860 109.6% Acquired Con-way in October 2015 4 J.B. Hunt Transport Services IMC Public $6,188 $6,555 5.9% Truckload, dedicated contract service, intermodal, integrated capacity solutions 5 YRC Worldwide LTL Public $4,832 $4,698 -2.8% YRC Freight, Holland, Reddaway, New Penn 6 Swift Transportation TL Public $4,229 $4,032 -4.7% Dry-van, refrigerated, dedicated, nntermodal 7 Hub Group IMC Public $3,526 $3,573 1.3% Hub, Mode, Unyson 8 Schneider National TL Private $3,423 $3,506 2.4% Largest privately owned trucking company 9 Landstar System TL Public $3,364 $3,172 -5.7% Dry-van, flatbed, LTL, intermodal 10 Old Dominion Freight Line LTL Public $2,972 $2,992 0.6% Most profitable asset-based publicly held trucking company 11 ArcBest LTL Public $2,422 $2,496 3.0% ABF Freight, ABF Logistics, Panther Premium Logistics 12 Estes Express Lines LTL Private $2,135 $2,155 0.9% Largest privately owned LTL carrier 13 Werner Enterprises TL Public $2,094 $2,009 -4.0% One-way TL, dedicated, value-added services 14 Prime TL Private $1,736 $1,747 0.6% Prime Refrigerated, Prime Flatbed, Prime Tanker 15 Roadrunner Transportation Services TL Public $1,610 $1,709 6.2% Truckload revenue growth offset LTL revenue decline 16 R+L Carriers LTL Private $1,429 $1,452 1.6% LTL, Truckload 17 U.S.