Doing Business in India, Special Issue Fall 1999 1 Doing Business In

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Architect of New India Fortnightly Magazine Editor Prabhat Jha

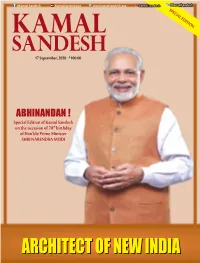

@Kamal.Sandesh KamalSandeshLive www.kamalsandesh.org kamal.sandesh @KamalSandesh SPECIAL EDITION 17 September, 2020 `100.00 ABHINANDAN ! Special Edition of Kamal Sandesh on the occasion of 70th birthday of Hon’ble Prime Minister SHRI NARENDRA MODI ARCHITECTARCHITECT OFOF NNEWEWArchitect ofII NewNDINDI India KAMAL SANDESHAA 1 Self-reliant India will stand on five Pillars. First Pillar is Economy, an economy that brings Quantum Jump rather than Incremental change. Second Pillar is Infrastructure, an infrastructure that became the identity of modern India. Third Pillar is Our System. A system that is driven by technology which can fulfill the dreams of the 21st century; a system not based on the policy of the past century. Fourth Pillar is Our Demography. Our Vibrant Demography is our strength in the world’s largest democracy, our source of energy for self-reliant India. The fifth pillar is Demand. The cycle of demand & supply chain in our economy is the strength that needs to be harnessed to its full potential. SHRI NARENDRA MODI Hon’ble Prime Minister of India 2 KAMAL SANDESH Architect of New India Fortnightly Magazine Editor Prabhat Jha Executive Editor Dr. Shiv Shakti Bakshi Associate Editors Ram Prasad Tripathy Vikash Anand Creative Editors Vikas Saini Bhola Roy Digital Media Rajeev Kumar Vipul Sharma Subscription & Circulation Satish Kumar E-mail [email protected] [email protected] Phone: 011-23381428, FAX: 011-23387887 Website: www.kamalsandesh.org 04 EDITORIAL 46 2016 - ‘IndIA IS NOT 70 YEARS OLD BUT THIS JOURNEY IS -

The Pioneer Prime Minister Atal

Year 2002 Vajpayee Doublespeak 'GUJARAT BOOSTED SECULARISM DEBATE' December 26 2002 Source: The Pioneer Prime Minister Atal Bihari Vajpayee feels that the energy that had erupted in Gujarat needs to be properly channelised. He also thinks that the Gujarat outcome will help the nation understand secularism in the proper perspective. "Ab Shabdon ke sahi aarth lagaye ja rahe hain," Mr Vajpayee said in an interview with Hindi daily Dainik Bhaskar, hinting that the true meaning of these words was being understood now. "Secularism had become a slogan. No attempt was being made to probe what the real form of secularism should be. It was not being debated. Little wonder, we remain fiercely secular for 364 days and launch an election campaign from temples on the 365th day," he remarked. "Unhe Deviji ke mandir mein puja karke abhiyan chalane mein koi aapatti nahin hoti," Mr Vajpayee quipped. He was probably taking a dig at Congress President Sonia Gandhi who had launched her election campaign in Gujarat after offering puja at Ambaji temple. He burst into laughter when asked if his Government, too, was surviving because of "Deviji", hinting that he faced no real threat from the Opposition as long as Mrs Sonia Gandhi remained the Congress president. Asked if the Gujarat episode would help him keep the country united, Mr Vajpayee said, "Ye jo urja nikali hai, use santulit rakhna hoga. Aur ise is yukti se nirman mein lagana hoga jisase hamare jeewan ke jo mulya hain, unki rakhsa ho sake (The energy that has been generated should be kept in balance. -

MPPSC PRELIMS the Only Comprehensive “CURRENT AFFAIRS” Magazine of “MADHYA PRADESH”In “ENGLISH MEDIUM”

MPPSC PRELIMS The Only Comprehensive “CURRENT AFFAIRS” Magazine of “MADHYA PRADESH”in “ENGLISH MEDIUM” National International MADHYA CURRENT Economy PRADESH MP Budget Current Affairs AFFAIRS MP Eco Survey MONTHLY Books-Authors Science Tech Personalities & Environment Sports OCTOBER 2020 Contact us: mppscadda.com [email protected] Call - 8368182233 WhatsApp - 7982862964 Telegram - t.me/mppscadda OCTOBER 2020 (CURRENT AFFAIRS) 1 MADHYA PRADESH NEWS Best wishes on International day of Older Persons Chief Minister Shri Shivraj Singh Chouhan has extended his best wishes on the International Day of Older Persons. He said that the elderly or senior persons have life experiences. They have the capacity to resolve many complicated problems. The biggest thing is that our elders have the qualities of patience, humility, ability, decision making and above all, the acquired knowledge that can give a direction to the society. Our youth must respect the elders. Their teachings must be imbibed in our lives. Chief Minister said that the elders are our heritage. Many legal provisions have been made for their honour and protection. Chief Minister has extended his best wishes to all senior citizens and elders on Senior Citizens day. Photos telling the story of Corona period Chief Minister Shri Shivraj Singh Chouhan today awarded the winners of the state level photo contest based on Covid-19 in a programme organized at Manas Bhawan and congratulated the photographers. Also inaugurated an exhibition of photographs clicked by press photographers of the state during the Corona period. Chief Minister Shri Chouhan said that the creativity of the photographers during Covid-19 crisis is apparent in this exhibition. -

Narendra Modi (Narendra Damodardas Modi)

Narendra Modi (Narendra Damodardas Modi) India, Primer ministro (2014-) Duración del mandato: 26 de Mayo de 2014 - En funciones Nacimiento: Vadnagar, distrito de Mehsana, estado de Gujarat, 17 de Septiembre de 1950 Partido político: Bharatiya Janata Party (BJP) Resumen Las elecciones generales celebradas en India entre abril y mayo de 2014 han supuesto el triunfo arrasador de una fuerza política derechista, el Bharatiya Janata Party (BJP), pero sobre todo de una persona revestida de un carisma nada común, Narendra Modi. El hasta ahora ministro principal del estado de Gujarat, un veterano militante del nacionalismo hindú que trenza en su discurso los guiños religiosos y el pragmatismo económico de signo liberal, ha devuelto a su formación al poder tras una década en la oposición al Gobierno del secularista Partido del Congreso (INC), hoy laminado en las urnas. El masivo corrimiento electoral, el mayor en 30 años, deja en manos del BJP una confortable mayoría absoluta en el Lok Sabha, mayoría que se acerca a los dos tercios con la suma de los socios de la Alianza Democrática Nacional (NDA). Durante la larga campaña electoral, librada con brillantez, Modi supo vender los logros de su gestión en Gujarat y fue indiferente a las viejas acusaciones de responsabilidad (ya descartada por los tribunales) en las masacres de cientos de gujaratíes musulmanes cuando las violencias intercomunales de 2002. Neutralizando las críticas por los aspectos más turbios de su reputación, que evocan a un hinduista sectario desdeñoso con las minorías y tendente al autoritarismo, Modi derrochó dinamismo, propuestas de avance nacional y una imagen de político inmune a la corrupción y administrador eficiente. -

Amit Shah, MP CM Shri Shivraj Singh Chouhan and Other Senior Leaders Waving at the Gathering in Karyakarta Mahakumbh Held in Bhopal, Madhya Pradesh

https://www.facebook.com/Kamal.Sandesh/ www.kamalsandesh.org @kamalsandeshbjp ‘THE POOR OF MY COUNTRY MUST GET ALL FACILITIES THAt the rich enjoy’ Vol. 13, No. 20 16-31 October, 2018 (Fortnightly) `20 KARYAKARTA MAHAKUMBH, BHOPAL ‘THE MORE DIRT IS THROWN, THE MORE LOTUS WILL BLoom’ 16-31 OCTOBER,THE 2018 OIL PRICEI KAMALS AND SANDESH I 1 THE GREEN STATE OF MIND WHY SHASTRI MATTERS TODAY THE HYPOCRISY OF THE OPPOSITION PM Shri Narendra Modi flanked by BJP National President Shri Amit Shah, MP CM Shri Shivraj Singh Chouhan and other senior leaders waving at the gathering in Karyakarta Mahakumbh held in Bhopal, Madhya Pradesh BJP National President Shri Amit Shah paying floral tribute to BJP National President Shri Amit Shah receiving the greetings Pandit Deendayal Upadhyay after Inaugurating the Pt. Deendayal of BJP karyakartas at the Ex-Servicemen Sammelan in Sikar, Upadhyay Memorial in Dhanakya, Jaipur (Rajasthan) Rajasthan Rajasthan BJP welcomes BJP National President Shri Amit Shah BJP National President Shri Amit Shah and Chhattisgarh CM during a Shakti Kendra Sammelan in Bikaner, Rajasthan Dr. Raman Singh during Gujarati Samaj Sammelan in Bhilai, Chhattisgarh 2 I KAMAL SANDESH I 16-31 OCTOBER, 2018 Fortnightly Magazine Editor Prabhat Jha Executive Editor Dr. Shiv Shakti Bakshi Associate Editors Ram Prasad Tripathy Vikash Anand Creative Editors Vikas Saini Mukesh Kumar Phone +91(11) 23381428 FAX +91(11) 23387887 ‘FORTUNATE TO BE A KARYAKARTA OF BJP’ E-mail PM Shri Narendra Modi, along with BJP National President [email protected] [email protected] 06 Shri Amit Shah and Madhya Pradesh CM Shri Shivraj Singh Website: www.kamalsandesh.org Chouhan, addressed the ‘Karyakarta Mahakumbh’ in Bhopal,.. -

Indiagetsintolockdownmode

MONDAY, 23 MARCH 2020 16 pages in 1 section www.business-standard.com NEW DELHI (CITY) ~9.00 VOLUME XXVI NUMBER 241 Howmarkets performed last week % Chg over Dec 31, ‘19 Index on *One- --———————————————————————————————————————————————————————— Mar20, ‘20 week Local currencyin US $ Sensex 29,916 -12.3 -27.5 -31.2 Nifty 8,745 -12.2 -28.1 -31.8 COMPANIES P2 COMPANIES P3 DowJones 19,174 -17.3 -32.8 -32.8 Nasdaq 6,880 -12.6 -23.3 -23.3 Hang Seng 22,805 -5.1 -19.1 -18.7 EVENT FIRMS CANCEL SHOWS LOOKING TO INVEST IN MKTS Nikkei 16,553-5.0 -30.0 -31.4 FTSE 5,191 -3.3 -31.2 -39.6 WORTH OVER ~3,000 CRORE LIKE INDIA: SAUDI ARAMCO DAX 8,929 -3.3 -32.6 -35.7 *Change (%) over previous week Source: Bloomberg PUBLISHED SIMULTANEOUSLY FROM AHMEDABAD, BENGALURU, BHUBANESWAR, CHANDIGARH, CHENNAI, HYDERABAD, KOCHI, KOLKATA, LUCKNOW, MUMBAI (ALSO PRINTED IN BHOPAL), NEW DELHI AND PUNE TO OUR READERS In view of the need for widespread dissemination of news on the COVID-19 India gets into lockdown mode outbreak, Business Standard is making all such content free on its website for four months from the date of their publication. All our other routine content will also be freely accessible on 80districtsto be www.business-standard.com, as many readers may not be able to access our print edition owing to limited distribution or lockdown in some states. Stay safe, and isolatedascases enjoy reading Business Standard. spreadquickly MARKETS TO OPERATE NORMALLY TODAY Trains, Metros, interstate-buses won’t run SHINE JACOB The stock market will operate normally on New Delhi, 22 March Monday, regulatory and exchange officials said on Sunday. -

Ramnath Kovind Th Becomes14 President of India

https://www.facebook.com/KamalSandeshBjp/ www.kamalsandesh.org @kamalsandeshbjp INDIA-ISRAEL INKS 7 IMPORTANT AGREEMENTS Vol. 12, No. 15 01-15 August, 2017 (Fortnightly) `20 RAMNATH KOVIND th BECOMES14 PRESIDENT OF INDIA NO PARTY WOULD BE ABLE TO COME REFLECTIONS AS IS MAMTa’s TMC FAST BECOMING 1 I KAMALCLOSE SANDESH TO THE I 01-15PERFORMA JULY, 2017NCE OF BJP... THE PRESIDENT RETIRES 01-15 AUGUST,JINN ah’s2017 IM KAMALUSLIM SANDESH LEAGUE? I 1 BJP National President Shri Amit Shah paying floral tribute to the martyrs of Kargil War on Kargil Vijay Diwas Delhi BJP President Shri Manoj Tiwari, Union Minister Dr. Harshvardhan and other senior leaders welcoming BJP National President Shri Amit Shah on his Vistrit Pravas in Dehli Gujarat CM Shri Vijay Rupani and other senior BJP leaders welcoming BJP National President Shri Amit 2 I KAMAL SANDESH I 01-15Shah AUGUST, to the 2017 Panna Pramukh Sammelan at Anawal Panchkakda, Gujarat Fortnightly Magazine Editor Prabhat Jha Executive Editor Dr. Shiv Shakti Bakshi Associate Editors Ram Prasad Tripathy Vikash Anand Creative Editors Vikas Saini Mukesh Kumar Phone +91(11) 23381428 FAX +91(11) 23387887 RAMNATH KOVIND BECOMES 14TH PRESIDENT OF INDIA E-mail NDA’s nominee Shri Ramnath Kovind won presidential election by more [email protected] than two-thirds of the total electoral college votes. Shri Ramnath Kovind [email protected] 06 secured over 65% of votes over rival Meira Kumar, who was backed by Website: www.kamalsandesh.org the Congress and other opposition parties. Shri Kovind received 2930... MODI GOVERNMENT VAICHARIKI 30 takes SEVERAL DHARMA IS NOT RELIGION 20 MEASURES TO ENHANCE INCOME OF Farmers SHRADHAnjALI In the last three years of its tenure Modi Government has Shat-Shat Naman!: Kushabhau Thakre 22 emerged as pro-farmer, pro- 14 No party wouLD BE village, pro-poor government. -

Introduction

Introduction On 4th April, 1980 the National Executive of the Janata Party adopted a resolution prohibiting members of RSS to continue in the Janata Party. This resolution was sequel to the fears entertained by Chandrashekhar’s Group and a few Socialists who had not left the Janata Party when the split caused by Ch. Charan Singh took place and others that the erstwhile Jana Sangh would capture the party on account its mass base and large army of dedicated workers. This development was anticipated by leaders and workers of the Jana Sangh and RSS background in Janata Party. So they had asked Jana Sangh workers from all over the country to assemble at Delhi before the meeting of the National Executive of Janata Party and to be prepared for all eventualities. The resolution adopted by the National Executive of Janata Party was not acceptable to erstwhile Jana Sangh constituent and to several other leaders and persons in Janata Party who had no RSS background. The Jana Sangh constituent had sincerely worked towards the strengthening and smooth working of the Janata Party. Even though it constituted the largest single constituent of the Janata Party and had a larger popular base in the country it did not ask for proportionate share either in Janata Government or in Janata Party and was content with whatever was given to it. The Jana Sangh constituent wanted Janata Party to succeed and emerge as an alternative to Congress which had ruled the country for three decades prior to 1977. In this background, there was a feeling of regret and unhappiness as well as of good riddance and relief in the Jana Sangh 2 • Party Document Vol-10 workers. -

'For Us Heritage Means Our Culture, Our Faith, Our

@KAMAL.SANDESH KAMALSANDESHLIVE WWW.KAMALSANDESH.ORG KAMAL.SANDESH @KAMALSANDESH 120-DAY NATIONWIDE PRAVAS FOR STRENGTHENING ORGANIZATION & EXPANSION OF PARTY Vol. 15, No. 24 16-31 December, 2020 (Fortnightly) `20 ‘for us heRITAGE MEANS OUR CULTURE, OUR FAITH, OUR 16-31Values!’ DECEMBER, 2020 I KAMAL SANDESH I 1 BJP National President Shri JP Nadda celebrates Samvidhan Diwas BJP National President Shri JP Nadda preforming “Ganga Aarti” Programme at BJP HQ, 6A DDU Marg, New Delhi at Har ki Pauri, Ganga Ghat, Haridwar BJP National President Shri JP Nadda visits Shantikunj, Haridwar BJP National President Shri JP Nadda offers prayers at Shri Bangla Sahib Gurudwara in New Delhi on the occasion of Prakash Parv of Shri Guru Nanak Dev ji 2 I KAMAL SANDESH I 16-31 DECEMBER, 2020 FORTNIGHTLY MAGAZINE EDITOR PRABHAT JHA EXECUTIVE EDITOR DR. SHIV SHAKTI BAKSHI ASSOCIATE EDITORS RAM PRASAD TRIPATHY VIKASH ANAND CREATIVE EDITORS VIKAS SAINI BHOLA ROY DIGITAL MEDIA RAJEEV KUMAR VIPUL SHARMA SUBSCRIPTION & CIRCULATION SATISH KUMAR GURU NANAK DEV JI HIMSELF IS THE BIGGEST SYMBOL OF REFORMS IN SOCIETY AND SYSTEM E-MAIL The Prime Minister, Shri Narendra Modi on November 30 [email protected] 06 [email protected] participated in Dev Deepawali Mahotsav in Varanasi... PHONE: 011-23381428, FAX: 011-23387887 WEBSITE: WWW.KAMALSANDESH.ORG 16 BJP RISES FROM FOUR VAICHARIKI TO 48 SEATS IN GHMC ELECTIONS Dharma is not Religion 21 Greater Hyderabad SHRADHANJALI Municipal Corporation Kushabhau Thakre 23 (GHMC) election results BJP leader Kiran Maheshwari is no more 23 10 BJP NATIONAL PRESIDENT declared on December 4... COMMENCES 120-DAY MANN KI BAAT NATIONWIDE PRAVAS.. -

'Hokl Surwhvwv Shdfhixo 2Ss Ohdghuv

, . RNI Regn. No. CHHENG/2012/42718, Postal Reg. No. - RYP DN/34/2013-2015 ")*+, /0)&1 02%*%0*3 40*'56 !+*,#&- . /0 2 . 3 1 6$7)+ ! "#$ %& $ ( ))*"$+*& ! -.- / 0& 12!12)34 )15 ! " # $%%"& ''"% #$%&&'( !(()(''*+&, %*%( R housands of students, Tactivists and others poured out into streets as the protest against the Citizenship Amendment Act (CAA) erupt- ed across the country on Thursday. Two protestors n were killed in the police firing in Mangaluru in Karnataka and one succumbed to bullet injury. Uttar Pradesh saw wide- spread violence, arson, and incidents of clashes between rotests against the police and protestors, but in PCitizenship Amendment other parts of the country the Act (CAA) have escalated protests were largely peaceful. across the country. Thursday In Mangaluru, police saw multiple protest rallies in clamped curfew until Friday the national Capital with night and aleged that the pro- senior Opposition leaders, a "" testors attempted to lay siege to large number of students and # $% & ' ! the Mangalore North police activists organising two mega station and tried to attack demonstrations. converged near the Jantar police personnel, following However, no reports of Mantar to voice their anger which force was used to dis- violence were reported in the against the contentious law perse them. national Capital on Thursday. after police forcefully evicted Two persons received bul- On Thursday morning, protesters from areas around let injuries in police firing and hundreds of protesters from Red Fort and Mandi House. they later succumbed at a hos- Jamia Millia Islamia, Jawaharlal “Police had requested the pital, police confirmed. The Nehru University (JNU) and protesters to apply for the des- deceased were identified as Delhi University, who have ignated place for the protest. -

Page11local.Qxd (Page 1)

DAILY EXCELSIOR, JAMMU SUNDAY, APRIL 17, 2016 (PAGE 11) RSS national leader Govt agrees for Challenging India's sovereignty breathing period Pendency of 3 cr cases in courts arrives on 2 day visit Excelsior Correspondent Excelsior Correspondent won't be tolerated: Rajnath JAMMU, Apr 16: The JAMMU, Apr 16: The RSS Seh Sarkarivah and number third in Government has agreed for a RAIPUR, Apr 16: where he was present as the chief worrisome backlog: Gowda guest. Sangh hierarchy, Datteraya Housebolay is on two days visit of breathing period of three months Asserting that India has been Prior to the programme, he Jammu. to grant the minor mineral conces- BHOPAL, Apr 16: “We have taken up the has increased manifold in the consistently trying to improve its chaired a meeting of senior police amendments to Arbitration last few years. Rs 3,691 crore The RSS leader reached here early this morning and he held sep- sion as per SRO 105 of 2016 in the Expressing concern over interest of general public and ties with Pakistan, Home Minister and paramilitary officials at the and Conciliation Act. We have has been released by Centre to arate meetings with Union Minister of State in PMO, Dr Jitendra the pendency of nearly three developmental works in the State. Rajnath Singh today said if any- new circuit house here. passed the legislation setting State Governments since Singh and Deputy Chief Minister Dr Nirmal Singh soon after his one raises questions over India's Chief Minister Raman Singh crore cases in the country, arrival in the City of Temples and discussed prevailing situation with This was stated in a handout up specialised Commercial 2011. -

Legend Magazine

LEGEND MAGAZINE (JULY - 2019) June Current Affairs and Quiz, English, Banking Awareness, Simplification Exclusively prepared for RACE students Issue: 20 | Page : 48 | Topic : Legend of July 2019 | Price: Not for Sale JULY CURRENT AFFAIRS Tamil Yeoman • Uttar Pradesh State government has Scientific name - Cirrochroa thais. It is known started DASTAK campaign against as Tamil Maravan means ‘warrior’ communicative diseases Acute Encephalitis NATIONAL NEWS Syndrome (AES) and Japanese Encephalitis • Ravi Shankar Prasad to launch Five-year vision plan EQUIP finalised and (JE) disease on 1 July in the State. commemoration of four years of Digital released by HRD Ministry • DASTAK campaign will run from 1st to 31st India initiative July. This campaign is part of the State’s • Electronics and Information Technology • Prime Minister of India finalized a five-year comprehensive Social and Behaviour Change Minister Ravi Shankar Prasad planned to launch vision plan for each Ministry. Communication (SBCC) strategy. the commemoration of four years of Digital • The Department of Higher Education of HRD • The campaign was started with an aim India initiative in New Delhi. Ministry finalized and released a five-year vision to create awareness about the communicable • The main aim of this initiative is to bridge the plan named Education Quality Upgradation diseases JE and AES. It will also ensure the digital divide and create awareness about and Inclusion Programme (EQUIP). availability of clean drinking water, initiate Information Technology. These digital services sanitation drive, and ensure vaccination and are offered by the government as well as the Lok Sabha passed the Central Educational early treatment so that disease should be nipped private sector.