New Models for Universal Access to Telecommunications Services in Latin America

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Gsma Lança Iniciativas De Serviços Móveis Com O Governo E As Operadoras Brasileiras

GSMA LANÇA INICIATIVAS DE SERVIÇOS MÓVEIS COM O GOVERNO E AS OPERADORAS BRASILEIRAS 25 de fevereiro de 2014, Barcelona: A GSMA anunciou hoje várias iniciativas para melhorar o alcance e a escala dos serviços móveis no Brasil, em benefício de seus cidadãos e empresas. Paulo Bernardo, ministro das Comunicações do Brasil, e Anne Bouverot, diretora geral da GSMA, assinaram um acordo sob o qual a GSMA e o Governo brasileiro vão trabalhar juntos para acelerar a adoção da banda larga móvel e a entrega de novos serviços móveis no Brasil. Além disso, a GSMA e todas as operadoras de celular do Brasil – Algar Telecom, Claro, Nextel, Oi, Sercomtel, TIM Brasil e Vivo – anunciaram sua colaboração para proporcionar aos usuários experiências móveis mais convenientes e seguras, por meio de um conjunto de iniciativas que abordam questões como spam por SMS, roubo de aparelhos e proteção à criança. “Com aproximadamente 115 milhões de assinantes exclusivos e 277 milhões de conexões móveis, o Brasil é o maior mercado móvel na América Latina,” afirmou Anne Bouverot, diretora geral, GSMA. “Trabalhando em conjunto com o governo do Brasil e as operadoras móveis do país, continuaremos a expandir o alcance das redes e serviços móveis no Brasil, e a garantir que todos os clientes possam desfrutar dos benefícios de um ambiente mais confiável e protegido.” GSMA e Memorando de Entendimento com o Brasil A GSMA e o Ministério das Comunicações vão abordar uma série de áreas principais para acelerar a adoção de redes de banda larga móvel e serviços em todo o país. A GSMA vai oferecer sua experiência global e facilitar o diálogo em áreas como comunicações máquina a máquina (M2M), mHealth e mEducation, entre outras. -

New Models for Universal Access to Telecommunications Services in Latin America

40829 NEW MODELS FOR UNIVERSAL ACCESS TO TELECOMMUNICATIONS SERVICES Public Disclosure Authorized IN LATIN AMERICA PETER A. STERN, DAVID N. TOWNSEND FULL REPORT Public Disclosure Authorized Public Disclosure Authorized Public Disclosure Authorized THE WORLD BANK NEW MODELS FOR UNIVERSAL ACCESS TO TELECOMMUNICATIONS SERVICES IN LATIN AMERICA: LESSONS FROM THE PAST AND RECOMMENDATIONS FOR A NEW GENERATION OF UNIVERSAL ACCESS PROGRAMS FOR THE 21ST CENTURY FULL REPORT FORUM OF LATIN AMERICAN TELECOMMUNICATIONS REGULATORS Ceferino Alberto Namuncurá President, REGULATEL 2006-2007 Auditor, CNC Argentina ---------------------------------------- COMITE DE GESTION Ceferino Alberto Namuncurá Auditor, CNC Argentina Oscar Stuardo Chinchilla Superintendent, SIT Guatemala Héctor Guillermo Osuna Jaime President, COFETEL Mexico José Rafael Vargas President, INDOTEL, Secretary of State Dominican Republic Pedro Jaime Ziller Adviser, ANATEL Brazil Guillermo Thornberry Villarán President, OSIPTEL Peru -------------------------------- Gustavo Peña-Quiñones Secretary General All rights of publication of the report and related document in any language are reserved. No part of this report or related document can be reproduced, recorded or stored by any means or transmitted in any form or process, be it in electronic, mechanical, magnetic or any other form without the express, written permission obtained from the organizations who initiated and financed the study. The views and information presented in this report are the views of the authors and do not necessarily represent the views, opinions, conclusions of findings of the Forum of Latin American Telecommunications Regulators (Regulatel), the World Bank through its trust funds PPIAF and GPOBA, the European Commission and the Economic Commission for Latin America (ECLAC). Table of Contents Executive Summary I. INTRODUCTION, p. 1 I.1 Background and objectives, p. -

Prospecto-Preliminar-Gvt.Pdf

Prospecto Preliminar de Oferta Pública de Distribuição Primária de Ações Ordinárias de Emissão da GVT (Holding) S.A. ospecto Preliminar está sujeito a a sujeito está Preliminar ospecto GVT (HOLDING) S.A. Companhia Aberta de Capital Autorizado - CVM nº 02011-7 CNPJ nº 03.420.904/0001-64 - NIRE nº 41300071331 Rua Lourenço Pinto, nº 299, 4º andar, Curitiba, PR Código ISIN BRGVTTACNOR8 52.000.000 Ações Valor da Distribuição: R$[●] odo de distribuição. No contexto desta Oferta (conforme definido abaixo), estima-se que o Preço por Ação (conforme definido abaixo) estará situado entre R$11,00 e R$16,00, ressalvado, no entanto, que o Preço por Ação poderá, eventualmente, ser fixado fora dessa faixa indicativa. nifestou a seu respeito. O presente Pr A GVT (Holding) S.A. (“Companhia”) está realizando uma oferta pública primária de 52.000.000 ações ordinárias (“Oferta”), todas nominativas, escriturais, sem valor nominal (“Ações”), a ser realizada na República Federativa do Brasil (“Brasil”), sob a coordenação do Banco de Investimentos Credit Suisse (Brasil) S.A. (“Coordenador Líder”) e do Banco UBS Pactual S.A. (“UBS Pactual” e, em conjunto com o Coordenador Líder “Coordenadores”), com esforços de colocação no exterior a serem realizados por Credit Suisse Securities (USA) LLC, UBS Securities LLC, ABN AMRO Inc. e J.P. Morgan Securities, Inc. A Oferta e o aumento de capital com a emissão das Ações foram aprovados por deliberação do Conselho de Administração da Companhia, em reunião realizada em 12 de janeiro de 2007, conforme ata a ser publicada no Diário Oficial do Estado do Paraná e nos jornais “Gazeta do Povo” de Curitiba e “Valor Econômico”, edição nacional. -

Digital and Social Media and Protests Against Large-Scale Mining Projects in Colombia Specht, D

WestminsterResearch http://www.westminster.ac.uk/westminsterresearch Gold, power, protest: Digital and social media and protests against large-scale mining projects in Colombia Specht, D. and Ros-Tonen, M.A.F. This is a copy of the accepted author manuscript of the following article: Specht, D. and Ros-Tonen, M.A.F. (2017) Gold, power, protest: Digital and social media and protests against large-scale mining projects in Colombia, New Media & Society, 19 (12), pp. 1907-1926. The final definitive version is available from the publisher, Sage at: https://dx.doi.org/10.1177/1461444816644567 © The Author(s) 2017 The WestminsterResearch online digital archive at the University of Westminster aims to make the research output of the University available to a wider audience. Copyright and Moral Rights remain with the authors and/or copyright owners. Whilst further distribution of specific materials from within this archive is forbidden, you may freely distribute the URL of WestminsterResearch: ((http://westminsterresearch.wmin.ac.uk/). In case of abuse or copyright appearing without permission e-mail [email protected] Gold, power, protest: Digital and social media and protests against large- scale mining projects in Colombia Doug Specht University of Westminster, UK Mirjam AF Ros-Tonen University of Amsterdam, The Netherlands Abstract Colombia’s Internet connectivity has increased immensely. Colombia has also ‘opened for business’, leading to an influx of extractive projects to which social movements object heavily. Studies on the role of digital media in political mobilisation in developing countries are still scarce. Using surveys, interviews, and reviews of literature, policy papers, website and social media content, this study examines the role of digital and social media in social movement organisations and asks how increased digital connectivity can help spread knowledge and mobilise mining protests. -

Countryreport Colombia Wfpr

ABOUT The Swedish International Development Cooperation Agency, Sida, is a government agency working on behalf of the Swedish parliament and government, with the mission to reduce poverty in the world. Through our work and in cooperation with others, we contribute to implementing Sweden’s Policy for Global Development Established by the inventor of the Web, Sir Tim Berners-Lee, the World Wide Web Foundation seeks to establish the open Web as a global public good and a basic right, creating a world where everyone, everywhere can use the Web to communicate, collaborate and innovate freely. The World Wide Web Foundation operates at the confluence of technology and human rights, targeting three key areas: Access, Voice and Participation. Karisma Foundation is a woman-driven, digital rights NGO, hoping to continue its future work in the defense of freedom of expression, privacy, access to knowledge and due process through research and advocacy from gender perspective, filling a much-needed void in Colombia. Karisma focus has been politics at the intersection of human rights and digital technology. Karisma has worked with diverse communities, including: Librarians, journalists, persons with visual disability, women’s rights advocates to strengthen the defense of human rights in digital spaces. Karisma often works jointly with other NGOs and networks that support their actions and projects. EXECUTIVE SUMMARY INTRODUCTION Background to the study Population Poverty Millennium Development Goals (MDG) Context of internet and information society -

Global Information Society Watch 2009 Report

GLOBAL INFORMATION SOCIETY WATCH (GISWatch) 2009 is the third in a series of yearly reports critically covering the state of the information society 2009 2009 GLOBAL INFORMATION from the perspectives of civil society organisations across the world. GISWatch has three interrelated goals: SOCIETY WATCH 2009 • Surveying the state of the field of information and communications Y WATCH technology (ICT) policy at the local and global levels Y WATCH Focus on access to online information and knowledge ET ET – advancing human rights and democracy I • Encouraging critical debate I • Strengthening networking and advocacy for a just, inclusive information SOC society. SOC ON ON I I Each year the report focuses on a particular theme. GISWatch 2009 focuses on access to online information and knowledge – advancing human rights and democracy. It includes several thematic reports dealing with key issues in the field, as well as an institutional overview and a reflection on indicators that track access to information and knowledge. There is also an innovative section on visual mapping of global rights and political crises. In addition, 48 country reports analyse the status of access to online information and knowledge in countries as diverse as the Democratic Republic of Congo, GLOBAL INFORMAT Mexico, Switzerland and Kazakhstan, while six regional overviews offer a bird’s GLOBAL INFORMAT eye perspective on regional trends. GISWatch is a joint initiative of the Association for Progressive Communications (APC) and the Humanist Institute for Cooperation with -

Processo Nº 53500.010080/2019-55 Interessado: Algar Telecom S/A, ALGAR CELULAR S.A., Algar Multimídia S/A, Brasil Telecom Comunicação Multimídia Ltda

13/06/2019 2301 Página 1 de 1 Imprimir Boletim de Serviço Eletrônico em 13/06/2019 AGÊNCIA NACIONAL DE TELECOMUNICAÇÕES DESPACHO DECISÓRIO Nº 3/2019/RCTS/SRC Processo nº 53500.010080/2019-55 Interessado: Algar Telecom S/A, ALGAR CELULAR S.A., Algar Multimídia S/A, Brasil Telecom Comunicação Multimídia Ltda. (02.041.460/0001-93), OI S.A. - EM RECUPERAÇÃO JUDICIAL, OI MÓVEL S.A. - EM RECUPERAÇÃO JUDICIAL, Telemar Norte Leste S.A., Claro S.A., TELMEX DO BRASIL S/A, Embratel TVsat Telecomunicações S.A., Empresa Brasileira de Telecomunicações S.A. (Embratel), Nextel Telecomunicações Ltda., Sercomtel Participações S.A., Sercomtel S.A. - Telecomunicações, Telefônica Brasil S.A., TIM S.A., Sky Serviços de Banda Larga Ltda. A SUPERINTENDENTE DE RELAÇÕES COM CONSUMIDORES DA AGÊNCIA NACIONAL DE TELECOMUNICAÇÕES, no uso de suas atribuições legais e regulamentares, em especial a disposta no art. 160, I e IV, do Regimento Interno da ANATEL, aprovado pela Resolução nº 612, de 29 de abril de 2013, considerando: - as razões e justificativas constantes do Informe nº 49/2019/RCTS/SRC (4265244), e - a conveniência e oportunidade da proposta de implementação de mecanismo nacional e centralizado para o registro de intenções de bloqueio dos consumidores para que não recebam ligações de telemarketing, apresentada pelos Interessados em correspondências protocoladas nos autos dos processos nº 53500.012093/2019-69 (Grupo Oi), 53500.012094/2019-11 (Grupo Algar), 53500.012095/2019-58 (Grupo Claro), 53500.012098/2019-91 (Nextel), 53500.012100/2019-22 (Grupo Sercomtel), 53500.012102/2019-11 (Sky), 53500.012103/2019-66 (Grupo Tim), 53500.012104/2019-19 (Grupo Telefônica), DECIDE, com fundamento nos arts. -

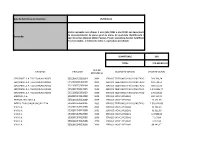

Data De Referência Do Relatório: 05/06/2012 Demanda

Data de Referência do Relatório: 05/06/2012 Multas aplicadas nos últimos 3 anos (abr/2009 a abr/2012) em decorrência de descumprimento de plano geral de metas de qualidade identificando o Demanda: tipo de serviço (Serviço Móvel Pessoal, TV por assinatura, Serviço Telefônico Fixo Comutado), o motivo da multa e a operadora penalizada. QUANTIDADE 190 TOTAL 275.429.825,32 ANO DE ENTIDADE PROCESSO DESCRIÇÃO SERVIÇO VALOR APLICADO REFERÊNCIA SERCOMTEL S.A. TELECOMUNICACOES 535160049302004 2009 SERVICO TELEFONICO FIXO COMUTADO 519.399,24 SERCOMTEL S.A. TELECOMUNICACOES 535000238592008 2009 SERVICO TELEFONICO FIXO COMUTADO 878.744,51 SERCOMTEL S.A. TELECOMUNICACOES 535160075292004 2009 SERVICO TELEFONICO FIXO COMUTADO 489.531,50 SERCOMTEL S.A. TELECOMUNICACOES 535000139942005 2009 SERVICO TELEFONICO FIXO COMUTADO 1.240.985,77 SERCOMTEL S.A. TELECOMUNICACOES 535160016202003 2009 SERVICO TELEFONICO FIXO COMUTADO 476.625,50 AMERICEL S.A. 535000134932008 2009 SERVIÇO MOVEL PESSOAL 485.313,33 TELEMIG CELULAR S.A 535000134912008 2009 SERVIÇO MOVEL PESSOAL 17.451,69 INTELIG TELECOMUNICACOES LTDA 535000152642005 2009 SERVICO TELEFONICO FIXO COMUTADO 1.820.426,88 VIVO S.A. 535000134912008 2009 SERVIÇO MOVEL PESSOAL 34.556,34 VIVO S.A. 535000134912008 2009 SERVIÇO MOVEL PESSOAL 35.315,00 VIVO S.A. 535000134912008 2009 SERVIÇO MOVEL PESSOAL 147.886,96 VIVO S.A. 535000134912008 2009 SERVIÇO MOVEL PESSOAL 7.117,84 VIVO S.A. 535000134912008 2009 SERVIÇO MOVEL PESSOAL 3.312,94 VIVO S.A. 535000134912008 2009 SERVIÇO MOVEL PESSOAL 88.443,17 VIVO S.A. 535000134912008 2009 SERVIÇO MOVEL PESSOAL 65.424,78 VIVO S.A. 535000134912008 2009 SERVIÇO MOVEL PESSOAL 51.447,53 VIVO S.A. -

OECD Telecommunication and Broadcasting Review of Brazil 2020 Brazil 2020 Brazil of Review Broadcasting and Telecommunication OECD

OECD Telecommunication and Broadcasting Review of azil 2020 Br OECD Telecommunication and Broadcasting Review of Brazil 2020 OECD Telecommunication and Broadcasting Review of Brazil 2020 This work is published under the responsibility of the Secretary-General of the OECD. The opinions expressed and arguments employed herein do not necessarily reflect the official views of OECD member countries. This document, as well as any data and map included herein, are without prejudice to the status of or sovereignty over any territory, to the delimitation of international frontiers and boundaries and to the name of any territory, city or area. The statistical data for Israel are supplied by and under the responsibility of the relevant Israeli authorities. The use of such data by the OECD is without prejudice to the status of the Golan Heights, East Jerusalem and Israeli settlements in the West Bank under the terms of international law. Please cite this publication as: OECD (2020), OECD Telecommunication and Broadcasting Review of Brazil 2020, OECD Publishing, Paris, https://doi.org/10.1787/30ab8568-en. ISBN 978-92-64-31744-4 (print) ISBN 978-92-64-93255-5 (pdf) Photo credits: Cover © Sarunyu_foto/Shutterstock; © ElenVD/Shutterstock. Corrigenda to publications may be found on line at: www.oecd.org/about/publishing/corrigenda.htm. © OECD 2020 The use of this work, whether digital or print, is governed by the Terms and Conditions to be found at http://www.oecd.org/termsandconditions. FOREWORD 3 Foreword The OECD Directorate for Science, Technology and Innovation (DSTI) carried out this study under the auspices of the Committee on Digital Economy Policy (CDEP) and the Working Party of Communication Infrastructures and Services Policy (WPCISP). -

Istanbul Aydin University Institute of Social Sciences

ISTANBUL AYDIN UNIVERSITY INSTITUTE OF SOCIAL SCIENCES THE IMPACT OF SOCIAL MEDIA ON THE PURCHASING BEHAVIOR OF UNIVERSITY STUDENTS WHO COLLECT ITEMS AS A HOBBY IN COLOMBIA THESIS Juan Sebastian VIUCHE NIETO Department of Business Business Management Program Thesis Advisor: Assist. Prof. Dr. Farid HUSEYNOV JANUARY 2019 ISTANBUL AYDIN UNIVERSITY INSTITUTE OF SOCIAL SCIENCES THE IMPACT OF SOCIAL MEDIA ON THE PURCHASING BEHAVIOR OF UNIVERSITY STUDENTS WHO COLLECT ITEMS AS A HOBBY IN COLOMBIA THESIS Juan Sebastian VIUCHE NIETO (Y1612.130132) Department of Business Business Management Program Thesis Advisor: Assist. Prof. Dr. Farid HUSEYNOV JANUARY 2019 ii To my Mother Carmenza and my Father Jose, the beacon of this adventure. Thank you, for everything. iii DECLARATION I declare that this thesis titled as “How social media makes an impact on the purchase behavior of university students collects items as a hobby in Colombia” has been written by myself in accordance with the academic rules. I also declare that all the materials benefited in this thesis consist of the mentioned resources in the reference list. I verify all these with my honor. Juan Sebastian VIUCHE NIETO iv FOREWORD This thesis is the effort of my parents, the reason of why I am here, in the other side of the world, fulfilling my goals. I want to give special thanks to my supervisor professor Farid Huseynov, his support was vital and exceptional in every aspect of this research work. Collectibles are my passion and the reason I chose this specific topic, I cannot be more grateful on how many happy moments being part of this world it gave me. -

View Annual Report

ˆ200F4SiTSmCf0j!ZMŠ 200F4SiTSmCf0j!ZM NY8690AM021467 OI S.A. RR Donnelley ProFile11.9.13 NCR keebj0nm19-May-2016 17:10 EST 171431 FS 1 8* FORM 20-F NYC HTM ESS 0C Page 1 of 2 As filed with the Securities and Exchange Commission on May 20, 2016 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ⌧ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2015 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number: 001-15256 OI S.A. (Exact Name of Registrant as Specified in Its Charter) N/A The Federative Republic of Brazil (Translation of Registrant’s Name into English) (Jurisdiction of Incorporation or Organization) Rua Humberto de Campos, 425 Leblon, Rio de Janeiro, RJ, Brazil 22430-190 (Address of Principal Executive Offices) Flavio Nicolay Guimarães Investor Relations Officer Rua Humberto de Campos, 425 8º andar Leblon, Rio de Janeiro, RJ, Brazil 22430-190 Tel: +55 21 3131-2918 [email protected] ˆ200F4SiTSmCf0j!ZMŠ 200F4SiTSmCf0j!ZM NY8690AM021467 OI S.A. RR Donnelley ProFile11.9.13 NCR keebj0nm19-May-2016 17:10 EST 171431 FS 1 8* FORM 20-F NYC HTM ESS 0C Page 2 of 2 (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered -

Brazil Mobile Observatory 2012 Brazil Mobile Observatory 2012 Contents

Brazil Mobile Observatory 2012 Brazil Mobile Observatory 2012 Contents Introduction 1 Executive Summary 3 1 Characteristics of the Brazilian mobile market 9 1.1 The telecom industry and mobile services in Brazil 9 1.2 A growing market 11 1.3 A highly competitive market for mobile 20 2 The economic contribution of the Brazilian mobile industry 23 2.1 The economic contribution of mobile telephony to the economy 23 2.2 The economic impact of mobile broadband and mobile data 34 2.3 The social impact of mobile telephony 36 3 Market outlook: mobile at the centre of the future Brazilian society 45 3.1 Affordable smartphones will make mobile broadband a daily user experience 47 3.2 Mobile will be at centre of the World Cup and Olympic Games delivery 49 3.3 New business opportunities will be driven by mobile technology 50 3.4 Operators have committed to significant network investment to meet the increasing demand 57 4 Regulation of the Brazilian mobile sector 59 4.1 Taxation on mobile consumers and operators is one of the highest worldwide 59 4.2 The telecommunications sector is strictly regulated 61 5 A roadmap for growth and social and digital inclusion 71 5.1 Three key areas for growth and regional leadership 71 5.2 Existing barriers to growth can be removed by supportive policies 72 5.3 A collaborative approach between government and operators 74 can maximise the benefits from growth Appendix A Mobile operators in Brazil 75 Appendix B About This Study 78 Acronyms and Abbreviations 79 Important Notice from Deloitte 95 1 Brazil Mobile Observatory 2012 Introduction Introduction The GSMA Mobile Observatory series first started with an analysis of the European market in 2008 and continued with reports on Asia and Africa.