Top 50 Sponsors

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Enhancing the In-Store Experience

Enhancing the in-store experience for female customers of Tommy Hilfiger Achieving more together Foreword The ‘Anton Dreesmann Leerstoel voor Retailmarketing’ Foundation - supported by a group of leading retailers in the Netherlands - has chosen Rabobank as its partner to host and co-organise its annual congress. The partnership started in 2011 and we have prolonged this successful collaboration until at least 2020. We appreciate the opportunity to share our knowledge and views on retail with key players and other stakeholders in the sector. The January 2017 congress, ‘Retailing Beyond Borders – Working on Transition’ took place in the Duisenberg Auditorium in Utrecht. During this congress the ‘Rabobank Anton Dreesmann Thesis Award´ was granted to Samira Darkaoui for her thesis entitled ‘Enhancing the in-store experience for female customers of Tommy Hilfiger´. Part of this award is the publication of the thesis as a book. The result of which is now in front of you. Capturing and embedding knowledge is important, both for Rabobank as a knowledge-driven financial organisation and for retailers. We therefore support the initiatives of the Foundation to combine scholarly knowledge with retail practice. The ´Rabobank Anton Dreesmann Thesis Award´ is one of these initiatives. The thesis of Samira Darkaoui, who graduated from the Delft University of Technology, discusses an actual and interesting case at Tommy Hilfiger, the well-known fashion player. The problem for Tommy Hilfiger is the lack of connection that women have with the brand. In order to address this issue, a systematic approach is followed. A wide number of topics is taken into account including brand identity, store interior and (female) consumer behaviour in order to understand the complete shopping experience. -

Overview of Corporate Financial Reporting CHAPTER 1

cc01OverviewOfCorporateFinancialReporting.indd01OverviewOfCorporateFinancialReporting.indd PagePage 1-11-1 19/01/1819/01/18 2:232:23 PMPM f-0157f-0157 //208/WB02258/9781119407003/ch01/text_s208/WB02258/9781119407003/ch01/text_s CHAPTER 1 kevin brine/Shutterstock Overview of Corporate Financial Reporting Dollar Store Business Is No than $420 million from issuing shares, and it had more than $2.9 billion in sales that year. Small Change Company management is continually looking for ways to increase sales and reduce costs. It recently increased the max- When Salim Rossy opened a general store in Montreal imum price of items from $3 to $4, widening the number of in 1910, he fi nanced it with his earnings from peddling suppliers it can use and boosting the types of products it can items like brooms and dishcloths in the countryside around carry. “Customers are responding positively to the off ering,” Montreal. By the time his grandson Larry took charge in said Neil Rossy, who took over from his father Larry as Chief 1973, S. Rossy Inc. had grown into a chain of 20 fi ve-and- Executive Offi cer in 2016. dime stores, with most items priced at either 5 or 10 cents. In Shareholders and others, such as banks and suppliers, use 1992, the company opened its fi rst Dollarama store, selling all a company’s fi nancial statements to see how the company has items for $1. Today, the business, now called Dollarama Inc., performed and what its future prospects might be. Sharehold- is Canada’s largest dollar store chain. It operates more than ers use them to make informed decisions about things such 1,000 stores in every province and now sells goods between as whether to sell their shares, hold onto them, or buy more. -

Gildan Activewear Nominates Four New Directors to Board

Gildan Activewear Nominates Four New Directors to Board Montreal, Thursday, March 29, 2018 - Gildan Activewear Inc. (GIL: TSX and NYSE) today announced that its Board of Directors has nominated Maryse Bertrand, Marc Caira, Charles M. Herington and Craig Leavitt as Director nominees to be voted on by the Company’s shareholders at its upcoming Annual Meeting of Shareholders to be held on May 3, 2018 in Montreal, Quebec. “The competitive dynamics in the apparel industry continue to evolve and these proposed director candidates are highly accomplished individuals who will bring a wealth of experience to the Board as the Company continues to grow” said Gildan’s Chairman Bill Anderson. Maryse Bertrand has had a career in law and business spanning over 35 years. Ms. Bertrand is currently an advisor in corporate governance and risk management and is a member of the Boards of Directors of National Bank of Canada, Canada’s sixth largest retail and commercial bank, and Metro Inc., a leader in the grocery and pharmaceutical distribution sectors in Canada. From 2016 to 2017, she was Strategic Advisor and Counsel to Borden Ladner Gervais LLP, and, prior to that she was Vice-President, Real Estate Services, Legal Services and General Counsel at CBC/Radio-Canada, Canada’s public broadcaster. Prior to 2009, Ms. Bertrand was a partner at Davies Ward Phillips and Vineberg LLP, where she specialized in M&A and corporate finance, and served on the firm’s National Management Committee. She was named as Advocatus emeritus (Ad. E.) in 2007 by the Quebec Bar in recognition of her exceptional contribution to the legal profession. -

Manulife Fidelity True North Fund

CANADIAN LARGE CAP EQUITY Code 7143 Volatility meter Low High Manulife Fidelity True North Fund Fund (6) Benchmark (9) Based on 3 year standard deviation How the underlying fund is invested UNDERLYING FUND -> Fidelity True North Fund - O Objective The Fund aims to achieve long term capital growth by investing primarily in Canadian Composition equity securities. Canadian Equity 78.50% United States Equity 9.08% Managed by FIAM LLC Cash & Equivalents 8.47% Fund managers Maxime Lemieux Foreign Equity 2.88% Other 1.07% Inception date February 2001 Manulife inception date January 2009 Total assets $5,079.1 million Underlying fund operating expense (2015) in IMF Equity Industry Financials 17.69% Energy 16.87% Consumer Staples 10.82% Consumer Discretionary 9.79% Industrials 9.30% Information Technology 8.17% Materials 6.24% Other 21.12% Overall past performance This graph shows how a $10,000 investment in this fund would have changed in value over time, Geographic split based on gross returns. Gross rates of return are shown before investment management Canada 78.56% fees have been deducted. The shaded returns represent the underlying fund returns prior to the United States 9.04% Manulife Fund’s inception date. United Kingdom 0.77% Israel 0.55% Japan 0.51% Manulife Fidelity True North Fund - ($18,950) Ireland 0.51% S&P/TSX Composite Cap TR - ($14,386) Bermuda 0.45% Fidelity True North Fund Series O Other 9.61% Top holdings within the underlying fund (As at June 30, 2016) 15,000 Toronto-Dominion Bank 7.41% Loblaw Companies -

Stock-Table-Canada-Newsletter.Pdf

The table below displays stock information as of February 1, 2021. Stock information for March will be available by March 5, 2021. EDWARD JONES STOCKS § Ticker Symbol Ticker Current Opinion Price Recent Forward Est. on Based P/E Forward Est. L-T EPS Growth Estimate PEGY DividendsAnnual Dividend Yield L-T Dividend Growth Estimate DividendsCash Since Invested $10,000 10 Years Ago CategoryInvestment Important Disclosures (High – Low) EPS AS OF 02/01/21 Range Price 52-week S&P / TSX Composite 17692.45 18058.61 - 11172.73 1215.59 14.6 6 1.6 538.38 3.04 12,902 COMMUNICATION SERVICES (8%) Alphabet - US GOOGL BUY 1893.07 1932.08 - 1008.87 61.74 30.7 15 2.0 0.00 0.0 NA 61,902 G AT&T - US T BUY 28.65 38.82 - 26.08 3.33 8.6 3 0.8 2.08 7.3 0 1984 17,934 G/I 12 BCE - Canada BCE.T BUY 54.51 65.28 - 46.03 3.43 15.9 4 1.6 3.33 6.1 4 1881 25,056 G/I Omnicom Group - US OMC BUY 62.86 80.25 - 44.50 5.96 10.5 7 1.0 2.60 4.1 5 1986 18,340 G Rogers Communications - Canada RCI.B.T HOLD 58.05 66.87 - 46.81 3.74 15.5 4 2.1 2.00 3.4 0 2003 23,801 G/I Shaw Communications - Canada SJR.B.T BUY 22.17 26.64 - 17.77 1.47 15.1 4 1.6 1.19 5.4 0 1982 16,259 G/I TELUS - Canada T.T BUY 26.54 27.74 - 18.55 1.30 20.4 5 2.1 1.24 4.7 5 1993 32,613 G/I Verizon Communications - US VZ BUY 54.28 61.95 - 48.84 4.93 11.0 4 1.3 2.51 4.6 2 1984 23,620 G/I CONSUMER DISCRETIONARY (8%) Amazon - US AMZN BUY 3342.88 3552.25 - 1626.03 45.00 74.3 30 2.5 0.00 0.0 NA 194,229 G Canadian Tire - Canada CTC.A.T HOLD 171.48 181.57 - 67.15 12.00 14.3 8 1.3 4.70 2.7 10 1996 33,245 G/I Dollarama - Canada -

The Shape of Women: Corsets, Crinolines & Bustles

The Shape of Women: Corsets, Crinolines & Bustles – c. 1790-1900 1790-1809 – Neoclassicism In the late 18th century, the latest fashions were influenced by the Rococo and Neo-classical tastes of the French royal courts. Elaborate striped silk gowns gave way to plain white ones made from printed cotton, calico or muslin. The dresses were typically high-waisted (empire line) narrow tubular shifts, unboned and unfitted, but their minimalist style and tight silhouette would have made them extremely unforgiving! Underneath these dresses, the wearer would have worn a cotton shift, under-slip and half-stays (similar to a corset) stiffened with strips of whalebone to support the bust, but it would have been impossible for them to have worn the multiple layers of foundation garments that they had done previously. (Left) Fashion plate showing the neoclassical style of dresses popular in the late 18th century (Right) a similar style ball- gown in the museum’s collections, reputedly worn at the Duchess of Richmond’s ball (1815) There was public outcry about these “naked fashions,” but by modern standards, the quantity of underclothes worn was far from alarming. What was so shocking to the Regency sense of prudery was the novelty of a dress made of such transparent material as to allow a “liberal revelation of the human shape” compared to what had gone before, when the aim had been to conceal the figure. Women adopted split-leg drawers, which had previously been the preserve of men, and subsequently pantalettes (pantaloons), where the lower section of the leg was intended to be seen, which was deemed even more shocking! On a practical note, wearing a short sleeved thin muslin shift dress in the cold British climate would have been far from ideal, which gave way to a growing trend for wearing stoles, capes and pelisses to provide additional warmth. -

102Nd Annual Meeting to Feature Spanx CEO; EXPO Chamber Chair

Abington • Avon • Bridgewater Brockton • Canton • East Bridgewater • Easton • Halifax • Hanover • Hanson • Holbrook • Norwell • Randolph • Rockland • Sharon • Stoughton • West Bridgewater •Whitman November 2015 Leading Businesses reportSusan Joss Re-Elected Leading Communities 102nd Annual Meeting to Feature Spanx CEO; EXPO Chamber Chair The Chamber is pleased to Premier Sponsor: Contributing Sponsor: announce that CHAMBER MISSION Susan Joss, To best serve the unique Exec. Director interests and needs of of Brockton member businesses and to Neighborhood champion the broader Health Center economic vitality of the was re-elected Chair of the Metro Metro South region. South Chamber. November 18, 2015 Prior to Nike, Jan served as the V.P./General Sue Joss was elected as Chair Conference Center at Massasoit Manager of Women’s at Reebok and held execu- in November 2014 and has 770 Crescent Street, Brockton tive roles in the luxury goods sector at Prada beau- served as the Executive Director ty, Calvin Klein Cosmetics and CHANEL. Jan also of the Brockton Neighborhood Schedule: served as the Beauty and Fitness Editorial Director Health Center, a non-profit, mul- Business-to-Business EXPO: 10:30am-12:00pm for YM Magazine and was a freelance beauty and ticultural, community health cen- Annual Meeting Luncheon: 12:00pm-1:45pm fitness writer for various publications including ter, since January of 1994. She also Business-to-Business EXPO: 1:45pm-3:00pm Elle, Self and Seventeen. serves as the Vice-Chair of the Banner Environmental Jan grew up in Brockton, Massachusetts, attend- Massachusetts League of Ribbon Cutting, page 6 Keynote Speaker: ed Brockton High School, and is a graduate of Community Health Centers and Jan Singer - CEO of Spanx, Inc.; Brockton Ithaca College. -

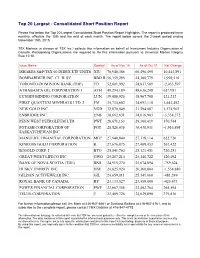

Top 20 Largest - Consolidated Short Position Report

Top 20 Largest - Consolidated Short Position Report Please find below the Top 20 Largest Consolidated Short Position Report Highlights. The report is produced twice monthly, effective the 15th and the end of each month. The report below covers the 2-week period ending November 15th, 2015. TSX Markets (a division of TSX Inc.) collects this information on behalf of Investment Industry Organization of Canada. Participating Organizations are required to file this information pursuant to Universal Market Integrity Rule 10.10. Issue Name Symbol As of Nov 15 As of Oct 31 Net Change ISHARES S&P/TSX 60 INDEX ETF UNITS XIU 70,940,386 60,496,495 10,443,891 BOMBARDIER INC. CL 'B' SV BBD.B 56,359,295 54,360,779 1,998,516 TORONTO-DOMINION BANK (THE) TD 52,801,992 54,837,589 -2,035,597 ATHABASCA OIL CORPORATION J ATH 49,294,189 48,636,208 657,981 LUNDIN MINING CORPORATION LUN 39,088,920 38,967,708 121,212 FIRST QUANTUM MINERALS LTD. J FM 35,734,602 34,091,110 1,643,492 NEW GOLD INC. NGD 32,870,049 31,294,087 1,575,962 ENBRIDGE INC. ENB 30,662,631 34,016,903 -3,354,272 PENN WEST PETROLEUM LTD. PWT 28,671,163 28,300,419 370,744 POTASH CORPORATION OF POT 28,520,036 30,436,931 -1,916,895 SASKATCHEWAN INC. MANULIFE FINANCIAL CORPORATION MFC 27,940,840 27,318,114 622,726 KINROSS GOLD CORPORATION K 27,676,875 27,409,453 267,422 B2GOLD CORP. -

Stoxx® Canada Total Market Mid Index

STOXX® CANADA TOTAL MARKET MID INDEX Components1 Company Supersector Country Weight (%) EMERA Utilities Canada 3.01 BAUSCH HEALTH Health Care Canada 2.71 WSP GLOBAL Construction & Materials Canada 2.59 Teck Resources Ltd. Cl B Basic Resources Canada 2.48 Canadian Tire Corp. Ltd. Cl A Retail Canada 2.36 ALGONQUIN POWER & UTILITIES Utilities Canada 2.34 CAE Industrial Goods & Services Canada 2.27 CCL INDS.'B' Industrial Goods & Services Canada 2.12 CANADIAN APARTMENT PROP REIT Real Estate Canada 2.11 Kinross Gold Corp. Basic Resources Canada 2.11 TFI INTERNATIONAL Industrial Goods & Services Canada 2.04 LIGHTSPEED POS Technology Canada 1.97 AIR CANADA Travel & Leisure Canada 1.95 Cameco Corp. Energy Canada 1.93 INTER PIPELINE Energy Canada 1.83 TOROMONT INDUSTRIES Industrial Goods & Services Canada 1.81 TOURMALINE OIL Energy Canada 1.81 GILDAN ACTIVEWEAR Consumer Products & Services Canada 1.77 Blackberry Ltd Technology Canada 1.72 RITCHIE BROS.AUCTIONEERS (NYS) Consumer Products & Services Canada 1.68 WEST FRASER TIMBER Basic Resources Canada 1.62 FIRSTSERVICE Real Estate Canada 1.62 NORTHLAND POWER Utilities Canada 1.56 PAN AMER.SILV. (NAS) Basic Resources Canada 1.55 LUNDIN MINING Basic Resources Canada 1.53 ALTAGAS Utilities Canada 1.51 KEYERA CORP Energy Canada 1.51 IA FINANCIAL CORP Insurance Canada 1.51 EMPIRE 'A' Personal Care, Drug & Grocery Stores Canada 1.49 DESCARTES SYSTEMS GROUP Technology Canada 1.44 RIOCAN REIT.TST. Real Estate Canada 1.44 ONEX Financial Services Canada 1.44 TMX GROUP Financial Services Canada 1.41 ARC RESOURCES LTD Energy Canada 1.29 Element Fleet Management Corp. -

How Objects That Carry Contradictory Institutional Logics Trigger Identity

Journal of Business Research 105 (2019) 443–453 Contents lists available at ScienceDirect Journal of Business Research journal homepage: www.elsevier.com/locate/jbusres “To Spanx or not to Spanx”: How objects that carry contradictory ☆ T institutional logics trigger identity conflict for consumers ⁎ Maria Carolina Zanettea, , Daiane Scarabotob a ESLSCA Business School, 1 Rue Bougainville, 75007 Paris, France b Pontificia Universidad Catolica de Chile, Av. Vicuña Mackenna 4860, Macul, Santiago, Chile ARTICLE INFO ABSTRACT Keywords: Despite claims supporting its relevance, the role of objects as carriers of institutional logics has been overlooked Institutional carriers in marketing research. This study examines how the extended materiality of consumption objects—that is, the Extended materiality material substances, designer intentions, and marketing efforts objectified in them—may trigger identity conflict Identity conflict for consumers, particularly when such objects are carriers of contradictory institutional logics. We collected and Shapewear analyzed qualitative data on body-shaping undergarments (i.e., shapewear), which carry the contradictory logics Institutional logics of constricted femininity and flexible feminism. We explain how the extended materiality of shapewear creates intimate tension for consumers by interfering with how consumers relate to their own bodies and to other people, thereby prompting identity conflict. 1. Introduction beliefs through their physical properties (Jones, Meyer, Jancsary, & Höllerer, 2017). These conceptualizations have sparked interest among Institutional logics are socially constructed, supra-organizational institutional theorists in developing understandings of the agentic role patterns through which social reality acquires meaning by producing of materials in maintaining institutional orders or enabling institutional and reproducing material and symbolic practices (Friedland & Alford, change (Monteiro & Nicolini, 2014). -

2010 ANNUAL Reportpage 1

2010N AN UAL REPORT 0526_cov.indd 2 4/7/11 10:30 AM COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN* Among The Warnaco Group, Inc., the Russell 2000 index, the S&P Midcap 400 index, the Dow Jones US Clothing & Accessories index $250 and the S&P Apparel, Accessories & Luxury Goods index COMPARISONCOMParisON OF OF 5YEAR 5-YEar CCUMULATIVEUMULatiVE TO TOTALtaL RE TRETURN*Urn* e Warnaco Group, Inc. compared to select indices $250 $200 250 250 $200 $150 200 200 $150 150 150 $100 $100 100 100 $50 $50 50 50 $0 0 0 $0 3/06 6/06 9/06 3/07 6/07 9/07 3/08 6/08 9/08 3/09 6/09 9/09 3/10 6/10 9/10 12/05 12/06 12/07 12/08 12/09 12/10 12/05 3/06 6/06 9/06 12/06 3/07 6/07 9/07 12/07 3/08 6/08 9/08 12/083/096/09 9/09 12/09 3/10 6/10 9/10 12/10 e Warnaco Group, Inc. Russell 2000 S&P MidCap 400 Dow Jones U.S. Clothing & Accessories The Warnaco Group, Inc. Russell 2000 S&P Apparel, Accessories & Luxury Goods *$100 invested on 12/31/05 in stock or index, including reinvestment of dividends. Fiscal year ending December 31. S&P Midcap 400 Dow Jones US Clothing & Accessories Copyright © 2011 S&P, a division of e McGraw-Hill Companies Inc. All rights reserved. Copyright © 2011 Dow Jones & Co. All rights reserved. S&P Apparel, Accessories & Luxury Goods *$100 invested on 12/31/05 in stock or index, including reinvestment of dividends. -

Women in Leadership at S&P/Tsx Companies

WOMEN IN LEADERSHIP AT S&P/TSX COMPANIES Women in Leadership at WOMEN’S S&P/TSX Companies ECONOMIC Welcome to the first Progress Report of Women on Boards and Executive PARTICIPATION Teams for the companies in the S&P/TSX Composite Index, the headline AND LEADERSHIP index for the Canadian equity market. This report is a collaboration between Catalyst, a global nonprofit working with many of the world’s leading ARE ESSENTIAL TO companies to help build workplaces that work for women, and the 30% Club DRIVING BUSINESS Canada, the global campaign that encourages greater representation of PERFORMANCE women on boards and executive teams. AND ACHIEVING Women’s economic participation and leadership are essential to driving GENDER BALANCE business performance, and achieving gender balance on corporate boards ON CORPORATE and among executive ranks has become an economic imperative. As in all business ventures, a numeric goal provides real impetus for change, and our BOARDS collective goal is for 30% of board seats and C-Suites to be held by women by 2022. This report offers a snapshot of progress for Canada’s largest public companies from 2015 to 2019, using the S&P/TSX Composite Index, widely viewed as a barometer of the Canadian economy. All data was supplied by MarketIntelWorks, a data research and analytics firm with a focus on gender diversity, and is based on a review of 234 S&P/TSX Composite Index companies as of December 31, 2019. The report also provides a comparative perspective on progress for companies listed on the S&P/TSX Composite Index versus all disclosing companies on the TSX itself, signalling the amount of work that still needs to be done.