2010 ANNUAL Reportpage 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Enhancing the In-Store Experience

Enhancing the in-store experience for female customers of Tommy Hilfiger Achieving more together Foreword The ‘Anton Dreesmann Leerstoel voor Retailmarketing’ Foundation - supported by a group of leading retailers in the Netherlands - has chosen Rabobank as its partner to host and co-organise its annual congress. The partnership started in 2011 and we have prolonged this successful collaboration until at least 2020. We appreciate the opportunity to share our knowledge and views on retail with key players and other stakeholders in the sector. The January 2017 congress, ‘Retailing Beyond Borders – Working on Transition’ took place in the Duisenberg Auditorium in Utrecht. During this congress the ‘Rabobank Anton Dreesmann Thesis Award´ was granted to Samira Darkaoui for her thesis entitled ‘Enhancing the in-store experience for female customers of Tommy Hilfiger´. Part of this award is the publication of the thesis as a book. The result of which is now in front of you. Capturing and embedding knowledge is important, both for Rabobank as a knowledge-driven financial organisation and for retailers. We therefore support the initiatives of the Foundation to combine scholarly knowledge with retail practice. The ´Rabobank Anton Dreesmann Thesis Award´ is one of these initiatives. The thesis of Samira Darkaoui, who graduated from the Delft University of Technology, discusses an actual and interesting case at Tommy Hilfiger, the well-known fashion player. The problem for Tommy Hilfiger is the lack of connection that women have with the brand. In order to address this issue, a systematic approach is followed. A wide number of topics is taken into account including brand identity, store interior and (female) consumer behaviour in order to understand the complete shopping experience. -

Panties of Legend

Kris Newton [email protected] The Power to Change the World is in your Panties YOU are a regular, panty-wearing slob like the rest of us. You have exactly three layers – the same number as everybody else, and nearly half as many as a burrito. You've got a few distinguishing Features that make you stand out, one or two Fetishes that occasionally make you spout comical nosebleeds, and a Big Dream in your heart. You live a normal, boring life, but this roleplaying game isn't about that. That would be stupid. It's about the way your life changes when you don the Panties of Legend. THE PANTIES OF LEGEND are mysterious underwear of unknown origin. Only a handful of the panties are known to exist (and if the phrase "handful of the panties" excites you, you're playing the right game). When you sublimate sexual urges, your panties charge up like an overwrought metaphor for burgeoning sexuality, granting you superhuman Powers. Nothing can stop you when your panties are magical... except for your Rivals. YOUR RIVALS wear the other Panties of Legend. Despite their rarity, Panties of Legend probably belong to all your best friends and worst enemies at work or school. Go figure. When a Rival is near, you feel a tingle in your panties. Don't be confused; that's your body's natural way of telling you to defeat your Rivals and increase your magical powers. The only way to safely gain Panty Power is to make other Panties of Legend explode. PANTIES OF LEGEND GAIN POWER WHEN YOU'RE TURNED ON, BUT EXPLODE WHEN THEY'RE OVERCHARGED. -

American Apparel Fights for Survival with New Plan

latimes.com/news BUSINESS American Apparel Fights For Survival With New Plan American Apparel plans to cut $30 may be cautious to wade into the legal The Gores Group, BCBG Max Azria and million in expenses, trim work- mess. The company says it will fight the Laundry by Shelli Segal. force, shrink store size and launch lawsuits, but doing so could prove to be a Schneider’s been steadily reshaping a new fall clothing line. distraction. the executive team at American Apparel. Paula Schneider, who joined the com- The new additions to the company’s lead- BY DEBRA BORCHARDT pany as ceo in January, said, “We are ership team include Christine Olcu as committed to turning this company general manager of global retail and Brad The troubled American Apparel Inc. around. Today’s announcements are nec- Gebhard as president of wholesale. Olcu said it might not have enough money to essary steps to help American Apparel is tasked with improving store productivi- survive for the next year and could have adapt to headwinds in the retail industry, ty and Gebhard, who has been working in to raise additional capital to stay alive. preserve jobs for the overwhelming ma- the capacity as a consultant will oversee The company known for the sometimes jority of our outrageous behavior by founder Dov 10,000 employ- Charney said it has embarked on a turn- “Even if American Apparel increases revenue ees, and return and cuts costs, there can be no guarantee around plan that includes cutting costs the business to and new executive appointments. -

Hbi Letterhead

news release FOR IMMEDIATE RELEASE News Media: Kirk Saville, (336) 519-6192 Analysts and Investors: T.C. Robillard, (336) 519-2115 HANESBRANDS AND BELLE INTERNATIONAL ENTER LICENSING AGREEMENT TO INTRODUCE CHAMPION FOOTWEAR AND ACCESSORIES IN CHINA Partnership combines the power of the Champion brand with Belle’s extensive retail network, e-commerce expertise and supply chain capabilities WINSTON-SALEM, N.C. – (Feb. 26, 2021) – HanesBrands and Belle International today announced a licensing agreement that will introduce a line of Champion footwear and accessories to consumers in China next year. Under the agreement, Belle will distribute the new collection designed specifically for consumers in China through its countrywide retail network and e-commerce platform. The Champion product range will tap into the brand’s aesthetic and be available by June 2021. “We’re thrilled to expand our long-term distribution relationship with Belle to include a license for footwear and accessories in China, said Jon Ram, group president of global activewear for HanesBrands. “Belle has demonstrated vast capabilities across brick-and- mortar retail, e-commerce, consumer insights and supply chain – and we’re confident the partnership will further accelerate the global growth of the Champion brand.” Fashion Clothing, a Belle International company based in Shanghai, has been a strategic partner for the Champion brand since June 2019. The company operates hundreds of Champion-branded brick-and-mortar and official online stores on leading e-commerce platforms, including Alibaba Group’s TMALL, JD.com and VIP.com. “We see outstanding potential for Champion in the large, growing market in China, and Belle International’s long history of serving consumers in the country, extensive nationwide store network and cross-category supply chain capabilities make us complementary partners,” said Fang Sheng, executive director and president of the footwear and new ventures business group for Belle International. -

Competition Among Domestic Apparel Manufacturers Mary Simpson Walden University

Walden University ScholarWorks Walden Dissertations and Doctoral Studies Walden Dissertations and Doctoral Studies Collection 2017 Competition Among Domestic Apparel Manufacturers Mary Simpson Walden University Follow this and additional works at: https://scholarworks.waldenu.edu/dissertations Part of the Business Administration, Management, and Operations Commons, and the Management Sciences and Quantitative Methods Commons This Dissertation is brought to you for free and open access by the Walden Dissertations and Doctoral Studies Collection at ScholarWorks. It has been accepted for inclusion in Walden Dissertations and Doctoral Studies by an authorized administrator of ScholarWorks. For more information, please contact [email protected]. Walden University College of Management and Technology This is to certify that the doctoral study by Mary Simpson has been found to be complete and satisfactory in all respects, and that any and all revisions required by the review committee have been made. Review Committee Dr. Timothy Malone, Committee Chairperson, Doctor of Business Administration Faculty Dr. Jon Corey, Committee Member, Doctor of Business Administration Faculty Dr. Richard Johnson II, University Reviewer, Doctor of Business Administration Faculty Chief Academic Officer Eric Riedel, Ph.D. Walden University 2017 Abstract Competition Among Domestic Apparel Manufacturers by Mary P. Simpson MBA, Liberty University, 2006 BS, Liberty University, 1986 Doctoral Study Submitted in Partial Fulfillment of the Requirements for the Degree of Doctor of Business Administration Walden University August 2017 Abstract Apparel manufacturing characterizes a sustainable means of creating employment and encouraging economic growth; however, 86% of U.S. apparel manufacturing companies and 74.7% in North Carolina have closed since the late 1990s. Less than 3% of apparel bought in the United States is domestic. -

Directory Download Our App for the Most Up-To-Date Directory Info

DIRECTORY DOWNLOAD OUR APP FOR THE MOST UP-TO-DATE DIRECTORY INFO. E = East Broadway N = North Garden C = Central Parkway S = South Avenue W = West Market m = Men’s w = Women’s c = Children’s NICKELODEON UNIVERSE = Theme Park The first number in the address indicates the floor level. ACCESSORIES Almost Famous Body Piercing E350 854-8000 Chapel of Love E318 854-4656 Claire’s E179 854-5504 Claire’s N394 851-0050 Claire’s E292 858-9903 GwiYoMi HAIR Level 3, North 544-0799 Icing E247 854-8851 Soho Fashions Level 1, West 854-5411 Sox Appeal W391 858-9141 APPAREL A|X Armani Exchange m w S141 854-9400 abercrombie c W209 854-2671 Abercrombie & Fitch m w N200 851-0911 aerie w E200 854-4178 Aéropostale m w N267 854-9446 A’GACI w E246 854-1649 Alpaca Connection m w c E367 883-0828 Altar’d State w N105 763-489-0037 American Eagle Outfitters m w S120 851-9011 American Eagle Outfitters m w N248 854-4788 Ann Taylor w S218 854-9220 Anthropologie w C128 953-9900 Athleta w S145 854-9387 babyGap c S210 854-1011 Banana Republic m w W100 854-1818 Boot Barn m w c N386 854-1063 BOSS HUGO BOSS m S176 854-4403 Buckle m w c E203 854-4388 Burberry m w S178 854-7000 Calvin Klein Performance w S130 854-1318 Carhartt m w c N144 612-318-6422 Carter’s baby c S254 854-4522 Champs Sports m w c W358 858-9215 Champs Sports m w c E202 854-4980 Chapel Hats m w c N170 854-6707 Charlotte Russe w E141 854-6862 Chico’s w S160 851-0882 Christopher & Banks | c.j. -

European Union

OFFICE OF TEXTILES AND APPAREL (OTEXA) Market Reports Textiles, Apparel, Footwear and Travel Goods European Union The following information is provided only as a guide and should be confirmed with the proper authorities before embarking on any export activities. Import Tariffs The EU is a customs union that provides for free trade among its 28 member states--Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Croatia, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, The Netherlands, Poland, Portugal, Romania, Slovak Republic, Slovenia, Spain, Sweden, and The United Kingdom. The EU levies a common tariff on imported products entered from non-EU countries. By virtue of the Belgium-Luxembourg Economic Union (BLEU), Belgium and Luxembourg are considered a single territory for the purposes of customs and excise. The United Kingdom (UK) withdrew from the EU effective February 1, 2020. During the transition period, which ends on December 31, 2020, EU law continues to be applicable to and in the UK. Any reference to Member States shall be understood as including the UK where EU law remains applicable to and in the UK until the end of the transition period according to the Withdrawal Agreement (OJ C 384 1, 12.11.2019, p. 1). EU members apply the common external tariff (CET) to goods imported from non-EU countries. Import duties are calculated on an ad valorem basis, i.e., expressed as a percentage of the c.i.f. (cost, insurance and freight) value of the imported goods. EU: Tariffs (percent ad valorem) on Textiles, Apparel, Footwear and Travel Goods HS Chapter/Subheading Tariff Rate Range (%) Yarn -silk 5003-5006 0 - 5 -wool 5105-5110 2 - 5 -cotton 5204-5207 4 - 5 -other vegetable fiber 5306-5308 0 - 5 -man-made fiber 5401-5406/5501-5511 3.8 - 5 ....................... -

Annual Report

Annual Report Form 10-K for the Fiscal Year Ended December 31, 2016 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2016 or TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number: 001-32891 Hanesbrands Inc. (Exact name of registrant as specified in its charter) Maryland 20-3552316 (State of incorporation) (I.R.S. employer identification no.) 1000 East Hanes Mill Road Winston-Salem, North Carolina 27105 (Address of principal executive office) (Zip code) (336) 519-8080 (Registrant’s telephone number including area code) Securities registered pursuant to Section 12(b) of the Act: Common Stock, par value $0.01 per share Name of each exchange on which registered: New York Stock Exchange Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes No Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

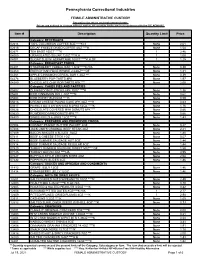

FEMALE ADMINISTRATIVE CUSTODY See Policy for Return and Replacement Terms

Pennsylvania Correctional Industries FEMALE ADMINISTRATIVE CUSTODY See policy for return and replacement terms. Prices are subject to change without notice. All quantity limits are in accordance with the DC ADM-815. Item # Description Quantity Limit Price Category: BEVERAGES 02614 100% COLUMBIAN COFFEE 5OZ ****K,H None 2.61 02616 DECAF FREEZE DRIED COFFEE 4OZ ****K None 1.54 02671 TEA BAGS 100CT ****K 1 2.46 04000 GRANULATED SUGAR 12OZ ****K,H 1 1.00 04001 SUGAR SUB W/ ASPARTAME 100CT ****K,H,GF 1 1.25 Category: BREAKFAST FOODS 04201 STRAWBERRY CEREAL BAR 1.3OZ ****K,H/A None 0.39 04260 ENERGY BAR,FDGE BRWNE 2.64OZ****GF None 1.31 04261 APPLE CINNAMON CEREAL BAR 1.3OZ *** None 0.39 04276 BLUEBERRY POP-TARTS 8PK None 1.97 04280 CHOCOLATE CHIP POP-TARTS 8PK *** None 2.00 Category: CAKES PIES AND PASTRIES 05602 DUNKIN DONUT STICKS 6PK 10OZ ****K None 1.36 05604 ICED CINNAMON ROLL 4OZ ****K None 0.62 05608 ICED HONEY BUN 6OZ ****K None 0.59 05616 CREAM CHEESE POUND CAKE 2PK 4OZ ****K None 0.63 05617 PEANUT BUTTER WAFERS 6-2PKS 12OZ ****K None 1.76 05628 CHOCOLATE COVERED MINI DONUTS 6PK *** None 0.66 05630 POWDERED MINI DONUTS 6PK *** None 0.66 06800 SWISS ROLLS 6-2PKS 12OZ ****K None 1.43 Category: PREPARED AND PRESERVED FOODS 07004 CREAMY PEANUT BUTTER PACKET 2OZ None 0.27 07406 JACK LINK'S ORIGINAL BEEF STEAK 2OZ None 2.21 07409 BACON SINGLES 6 SLICES .78OZ None 1.80 07411 BEEF & CHEESE STICK 1OZ None 0.57 07413 BEEF SUMMER SAUSAGE HOT 5OZ None 1.44 07414 BEEF SUMMER SAUSAGE REGULAR 5OZ None 1.44 07420 TURKEY SUMMER SAUSAGE SWEET 5OZ****GF -

Request for Comments Concerning Trade Regulation Rule on Care Labeling of Textile Wearing Apparel and Certain

57552 Federal Register / Vol. 60, No. 221 / Thursday, November 16, 1995 / Proposed Rules Paragraph 6005 Class E Airspace Areas Subsequent to publication in the Commission, Room H±159, Sixth and Extending Upward From 700 Feet or More Federal Register it was discovered that Pennsylvania Ave., NW., Washington, Above the Surface of the Earth the geographical coordinates and airport DC 20580. Comments about this * * * * * name were in error. conditional exemption to the Care AGL ND E5 Hettinger, ND [New] Labeling Rule should be identified as Hettinger Municipal Airport, ND Conclusion ° ′ ′′ ° ′ ′′ ``Conditional exemption for symbols, 16 (Lat. 46 00 56 N, long. 102 39 20 W). In consideration of the erroneous CFR Part 423ÐComment.'' That airspace extending upward from 700 information, action to revise the Class E FOR FURTHER INFORMATION CONTACT: feet above the surface within a 6.4-mile airspace serving Rice Lake Municipal Constance M. Vecellio, Attorney, radius of the Hettinger Municipal Airport Airport, Rice Lake, WI, has been and within 1.9 miles each side of the 136 Federal Trade Commission, withdrawn. bearing from the Hettinger Municipal Airport Washington, DC 20580, (202) 326±2966. from the 6.4-mile radius to 8.9 miles List of Subjects in 14 CFR Part 71 southeast of the airport, and that airspace SUPPLEMENTARY INFORMATION: Airspace, Incorporation by reference, extending upward from 1,200 feet above the I. Introduction surface bounded by a line beginning at Lat. Navigation (air). 462000N/Long. 1025800W, to Lat. 462000N/ Withdrawal of Proposed Rule On June 15, 1994, the Commission Long. 1024400W, to Lat. 454500N/Long. published a Federal Register notice 1020900W, to Lat. -

Preference Erosion:After Hong Kong

Appendix to Chapter 2 (A2) While a large number of preference schemes are offered by developed and developing country trade partners, the main preference-giving countries for developing and least developed countries are the QUAD+: the EU, USA, Japan, Canada and Australia. The EU and USA are discussed in Chapter 2, and we begin here with some information on the others (see relevant chapters in Hoekman et al., 2009 for more detail). Japan offers GSP preferential tariff treatment to 141 developing countries, with LDCs being eligible for duty and quota free treatment on specified products. Canada imports most of its goods from the North American Free Trade Association (NAFTA) at significant margins of preference relative to MFN rates. Developing countries accounted for just under 20 per cent of its total imports in 2003, mostly under MFN, although about a quarter were subject to the General Preferential Tariff (GPT), which is generally less than half the MFN tariff. About three-quarters of preferential imports to Australia enter under devel- oping country preferences, although since 2003 a more generous LDC preference scheme has been in place. The remainder of this appendix provides details and tables to supple- ment the discussion in Chapter 2. Japan Japan’s GSP started in 1971. The current arrangements offer preferential tariff treatment to 141 developing countries, with LDCs being eligible for special preferential treatment (duty and quota free treatment on specified products). GSP treatment is granted to selected agricultural and fishery products (337 items) and industrial products (3,216 items). There is some duty free treatment under GSP for agricultural products (without ceilings), and presumption of duty free treatment for industrial products, with exceptions for sensitive items and ceilings on a significant proportion – about one-third – of indus- trial products subject to GSP treatment. -

Hanes Australasia

APCO MEMBER CASE STUDY: HANES AUSTRALASIA Could a single plastic hanger really be a customers hangers with their online orders, but problem? When Hanes Australasia, owner of we decided to invest in a solution.’ market-leading brands Bonds, Berlei, Bras The catalyst for change, she says, was two- N Things, Champion and Sheridan recently fold. First, the company considered it the invested in additional resource to manually right thing to do in reducing its environmental remove plastic hangers on its Bonds garments footprint and by increasing its own internal ordered online, the answer soon became clear. recycling rates. And, second, some customers Within six months, over half a million plastic were getting in touch and asking Hanes not to hangers, or 15 tonnes of plastic, had been send hangers out with their Bonds orders. retrieved instead of ending up in their online customers’ bins and likely headed for landfill. In 2019, at least a million hangers are expected ‘Customers are increasingly to be fed back into the company’s ‘closed loop considering sustainability when hanger recycling program’. This particular waste challenge emerged as they are making brand choices and customers embraced online. In stores, hangers younger consumers, in particular, are are routinely removed at the point of sale, and far more aware of the environmental re-used up to seven times in the company’s closed loop program, before being recycled. By effects of their purchasing decisions.’ retaining the hangers, Hanes could keep track of them across their lifecycle and avoid them being ‘Customers are increasingly considering lost to landfill or leaking into the environment sustainability when they are making brand as waste.