Significant 2018 Decisions Affecting Private Company M&A

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DENVER CAPITAL MATRIX Funding Sources for Entrepreneurs and Small Business

DENVER CAPITAL MATRIX Funding sources for entrepreneurs and small business. Introduction The Denver Office of Economic Development is pleased to release this fifth annual edition of the Denver Capital Matrix. This publication is designed as a tool to assist business owners and entrepreneurs with discovering the myriad of capital sources in and around the Mile High City. As a strategic initiative of the Denver Office of Economic Development’s JumpStart strategic plan, the Denver Capital Matrix provides a comprehensive directory of financing Definitions sources, from traditional bank lending, to venture capital firms, private Venture Capital – Venture capital is capital provided by investors to small businesses and start-up firms that demonstrate possible high- equity firms, angel investors, mezzanine sources and more. growth opportunities. Venture capital investments have a potential for considerable loss or profit and are generally designated for new and Small businesses provide the greatest opportunity for job creation speculative enterprises that seek to generate a return through a potential today. Yet, a lack of needed financing often prevents businesses from initial public offering or sale of the company. implementing expansion plans and adding payroll. Through this updated resource, we’re striving to help connect businesses to start-up Angel Investor – An angel investor is a high net worth individual active in and expansion capital so that they can thrive in Denver. venture financing, typically participating at an early stage of growth. Private Equity – Private equity is an individual or consortium of investors and funds that make investments directly into private companies or initiate buyouts of public companies. Private equity is ownership in private companies that is not listed or traded on public exchanges. -

The 2018 Preqin Private Capital Fund Terms Advisor – Sample Pages

THE 2018 PREQIN PRIVATE CAPITAL FUND TERMS ADVISOR – SAMPLE PAGES 1. EXECUTIVE SUMMARY Fig. 1.1: Annual Global Private Capital Fundraising, 2000 - 2018 YTD (As at June 2018) 2,500 2,307 2,340 2,044 1,945 2,000 1,855 1,632 1,642 1,659 nvestors remain satisfied with private The opaque nature of private capital 1,570 1,500 1,424 capital, with fundraising in 2017 surpassing investments makes it consistently difficult 1,333 I 1,183 1,118 the $800bn mark for the first time on record for a consensus or benchmark to be reached 1,000 921 (Fig. 1.1). More capital was also distributed across the industry. Unique features change 811 768 848 667 688 712 669 700 across fewer funds, resulting in the average the profile of a given fund, and greatly 605 583 547 587 575 500 387 451 fund size growing to $507mn in 2017 affect how fees are set out and levied. 2017 365 327 322 274 239 172 222 compared to $411mn in 2016. This suggests once again saw greater movement towards 135 106 that competition in the market remains transparency throughout the industry, as 0 fierce and that managers will need to ensure voiced by many investors interviewed by 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 they are continually providing satisfaction Preqin during the course of the year. It is to and striving for an alignment of interests clear at this point that the momentum is 2018 YTD Year of Final Close with their LPs. -

Fresh Money 2013-Q4 Copyright

Fresh Money 2013-Q4 http://jaycaplan.com/ Date VC/PE Website Headline Location Techrockies Reports that Boulder Ventures Is To Raise $100M 12/26/13 Boulder Ventures http://www.boulderventures.com/ Sixth Fund Boulder, CO Boston-based private equity firm Mansa Capital Management Raises $50M to invest in healthcare information technology (HCIT) and services companies that help to contain healthcare 12/21/13 Mansa Capital Management http://www.mansacapital.com/ costs and improve clinical outcomes Boston PE Firn Welsh, Carson, Anderson & Stowe Raising $3B 12th PE Fund for growth-oriented companies in the healthcare and 12/13/13 Welsh, Carson, Anderson & Stowe http://www.welshcarson.com/ information/business services industries New York 12/21/13 Economic Development Corp. http://www.nycedc.com/press-release/deputy-mayor-steel-and-nycedc-announce-two-new-initiatives-dramatically-grow-citysWSJ: New York City to Start $50M Venture Fund for Biotech New York Growth PE Firm Great Point Partners closes $215M health care 12/21/13 Great Point Partners http://www.gppfunds.com/ investment Fund II Greenwich, CT 12/13/13 Investor AB http://www.investorgrowthcapital.com/ Investor Growth Capital Ends Venture Investing New York Biomark Capital Forms $200M VC fund by Splitting Off from 12/3/13 Biomark Capital http://biomarkcapital.com/ Burrill Capital Greenwich, CT 12/3/13 5AM Venture Management http://5amventures.com/ 5AM Ventures Raises $250M Fourth Life Science Venture Fund Menlo Park CA, Boston MA Gilde Healthcare closes €145 million ($200 million) Utrecht, The Netherlands, 11/26/13 Gilde Healthcare http://www.gildehealthcare.com/ transatlantic growth capital fund Cambridge, MA Edmond de Rothschild Investment Partners Closes 4th €192M 11/4/13 Edmond de Rothschild Investment Partnershttp://www.edmond-de-rothschild.fr/En/edrip/Pages/default.aspxEuropean Life Science Fund Paris, France Palo Alto, CA, Boston, MA, Venture Debt Leader Hercules Technology Growth Capital Westminster, CO, McLean, VA, 11/4/13 Hercules Technology Growth Capital, http://www.htgc.com/Inc. -

Appendix D - Securities Held by Funds October 18, 2017 Annual Report of Activities Pursuant to Act 44 of 2010 October 18, 2017

Report of Activities Pursuant to Act 44 of 2010 Appendix D - Securities Held by Funds October 18, 2017 Annual Report of Activities Pursuant to Act 44 of 2010 October 18, 2017 Appendix D: Securities Held by Funds The Four Funds hold thousands of publicly and privately traded securities. Act 44 directs the Four Funds to publish “a list of all publicly traded securities held by the public fund.” For consistency in presenting the data, a list of all holdings of the Four Funds is obtained from Pennsylvania Treasury Department. The list includes privately held securities. Some privately held securities lacked certain data fields to facilitate removal from the list. To avoid incomplete removal of privately held securities or erroneous removal of publicly traded securities from the list, the Four Funds have chosen to report all publicly and privately traded securities. The list below presents the securities held by the Four Funds as of June 30, 2017. 1345 AVENUE OF THE A 1 A3 144A AAREAL BANK AG ABRY MEZZANINE PARTNERS LP 1721 N FRONT STREET HOLDINGS AARON'S INC ABRY PARTNERS V LP 1-800-FLOWERS.COM INC AASET 2017-1 TRUST 1A C 144A ABRY PARTNERS VI L P 198 INVERNESS DRIVE WEST ABACUS PROPERTY GROUP ABRY PARTNERS VII L P 1MDB GLOBAL INVESTMENTS L ABAXIS INC ABRY PARTNERS VIII LP REGS ABB CONCISE 6/16 TL ABRY SENIOR EQUITY II LP 1ST SOURCE CORP ABB LTD ABS CAPITAL PARTNERS II LP 200 INVERNESS DRIVE WEST ABBOTT LABORATORIES ABS CAPITAL PARTNERS IV LP 21ST CENTURY FOX AMERICA INC ABBOTT LABORATORIES ABS CAPITAL PARTNERS V LP 21ST CENTURY ONCOLOGY 4/15 -

The State of Growth Equity for Minority Business: a River of Capital Flowing Past Our Communities

The State of Growth Equity for Minority Business | 1 The State of Growth Equity for Minority Business: A river of capital flowing past our communities Marlene Orozco and Eutiquio “Tiq” Chapa The State of Growth Equity for Minority Business | 2 The NAIC (www.naicpe.com) was formed in 1971 as About this White Paper the American Association of MESBICs (AAMESBIC), Inc., under President Richard M. Nixon’s Black Capital- ism program, which sought to ease access to capital The National Association of Investment for diverse business. During the 1980s, AAMESBIC Companies, Inc. (NAIC) commissioned this report lobbied successfully for legislation that would allow alongside the report by Lawrence C. Manson, Jr., diverse firms to repurchase the preferred stock from “Access to Capital: Accelerating Growth of Diverse- the U.S. Small Business Administration (SBA) while and Women-Owned Businesses,” as part of a grant raising funds that were not SBA regulated. AAMESBIC from the Minority Business Development Agency firms began approaching pension funds and other (MBDA), an agency within the United States Depart- institutional investors to raise larger pools of capital. ment of Commerce. The grant seeks to facilitate the aggregation and deployment of $1 billion in growth In the next decade, the organization changed its name equity capital to ethnically Diverse- and Women- to the National Association of Investment Companies, Owned Business Enterprises (DWBEs). Inc. as most members had turned from reliance on the SBA to become independent, institutional private equi- ty firms. Today, the NAIC has a membership of more In this report, Marlene Orozco, Chief Executive Officer than 80 diverse private equity and hedge fund firms of Stratified Insights, LLC, a premier research managing more than $165 billion in assets. -

CED 2014 Innovators Report Hires

INNOVATORS REPORT 2013 Trends in North Carolina Entrepreneurship 2013 IPO WATCH 226 NATIONAL 9 STATEWIDE 1. Aerie Pharmaceuticals 26 2. ChannelAdvisor SOUTHEAST 3. Chimerix 4. Heat Biologics 5. LipoScience 6. Ply Gem Holdings 7. Quintiles 8. Regado Biosciences 9. Stock Building Supply REPORT SOURCES: CED, National Venture Capital Association (NVCA), North Carolina Biotechnology Center, Ernst & Young, PricewaterhouseCoopers, SBIR.gov The Innovators Report is made possible by generous gifts to the CED Annual Fund. Thank you to our many supporters! For more information on how to contribute, please visit www.cednc.org/donate. MAJOR MERGERS & NC EVENTS ACQUISITIONS* DSM Pharmaceuticals Patheon $2.6 billion Santarus Salix Pharmaceuticals $2.6 billion COMPANY PRA International Kolberg, Kravis & Roberts $1.3 billion MILESTONES Solstas Lab Partners Quest Diagnostics $570 million Medicago Mitsubishi Tanabe Pharma $357 million Recognized as Advanced Liquid Logic Illumina $96 million 50 million Named Cracks a “Disrupter” sponsored 2013 Top 50 for the wireless Exam Design Pearson VUE app installs Fierce in Digital industry by Top 15 Health Entrepreneur Magazine Geomagic 3D Systems GrassRoots Biotechnology Monsanto Novella Clinical Quintiles Secure Enterprise Computing Agio Technology Axial Republic Appia Scioderm Exchange Wireless Tekelec Oracle ACQUIRED ACQUIRED BY *Partial listing DEALS & PARTNERSHIPS Signs up Yahoo! Sports, Bloomberg, CBS and Gannett $70 million deal with Toyama Chemical Company and a $58 million BARDA contact CHATHAM THERAPEUTICS -

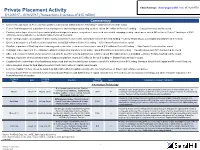

Private Placement Activity Chris Hastings | [email protected] | 917-621-3750 6/12/2017 – 6/16/2017 (Transactions in Excess of $15 Million) Commentary

Private Placement Activity Chris Hastings | [email protected] | 917-621-3750 6/12/2017 – 6/16/2017 (Transactions in excess of $15 million) Commentary . Element AI, a provider of AI as a Service platform, raised $102 million in Series A funding — Data Collective led the round. Fusion Risk Management, a provider of risk management and contingency planning services, raised $41 million in Series C funding — Catalyst Investors led the round. Conviva, a developer of an intelligent control platform designed to power every internet-connected screen with engaging viewing experiences, raised $40 million in Series F funding at a $260 million pre-money valuation — Australia Future Fund led the round. Drone Racing League, an organizer of drone racing competitions and events, raised $25 million in Series B funding — Liberty Media Group, Lux Capital and Sky UK led the round. Entelo, a developer of a SaaS recruitment platform, raised $20 million in Series C1 funding — US Venture Partners led the round. ShipBob, a provider of SaaS logistics technology and services for e-commerce businesses, raised $18 million in Series B funding — Bain Capital Ventures led the round. HelloSign, a developer of a free eSignature platform designed to sign documents online, raised $16 million in Series E funding — Foundry Group and Zach Coelius led the round. AEye, a developer of robotic vision systems created to be used for sensing autonomous vehicles, raised $16 million in Series A funding — Kleiner Perkins Caufield led the round. Highspot, a provider of a cloud-based sales engagement platform, raised $15 million in Series B funding — Shasta Ventures led the round. -

State of Rhode Island Investment Commission Meeting

STATE OF RHODE ISLAND INVESTMENT COMMISSION MEETING DATA AT MARCH 31, 2008 KENNETH E. GOODREAU DEPUTY GENERAL TREASURER FOR FINANCE MEMBERS OF THE STATE INVESTMENT COMMISSION Hon. Frank T. Caprio, Cltah' Mr. J, Michael Costello Ms. Rosemary Booth Gallogly Mr. Robert R. Gaudreau, J,·. Mr. Robert Giudici Dr. Robe,·t J, McKenna Ms. Marcia Reback Mr. And,·ew K. Reilly Mr. John R. Treat !' F RHODE ISLAND STATE INVESTMENT COMMISSION MEETING NOTICE The next meeting of the Rhode Island State Investment Commission has been scheduled for Wednesday, April 23, 2008 at 9:00 a.m. in Room 135 of the State House. AGENDA I. Membership Roll Call 2. Approval of Minutes • State Investment Commission Meeting held on 3/26/08 * 3. General Consultant Capital Markets Review - Deputy Treasurer 4. Alternative Investments Consultant - PCG • TPG Partners IV * • Constellation Ventures III * 5. Legal Counsel Report 6. Deputy Treasurer for Finance Report 7. Treasurer's Report 8. New Business * Commission members may be asked to vote on th:'.~ item. POSTED ON APRIL 17, 2008 State of Rhode Island and Providence Plantations STATE INVESTMENT COMMISSION Regular Meeting March 26, 20008 A State Investment Commission (SIC) meeting was held in Room 135, State House, Providence, Rhode Island on Wednesday, March 26, 2008 The Treasurer called the meeting to order at 9:05 a.m. Membership Roll Call. Present were: Mr. Michael Costello, Ms. Rosemary Booth Gallogly, Mr. Robert Gaudreau, Mr. Robert Giudici, Ms. Marcia Reback, Mr. Andrew Reilly, Mr. John Treat, and General Treasurer Frank T. Caprio. Dr. Robert McKenna arrived at 9: 10 am. -

Private Eq Uity Valuation

PRIVATE EQUITY VALUATION EQUITY PRIVATE Independent advice for the institutional investor The Ohio Bureau of Workers’ Compensation FINAL REPORT December 28, 2005 (This page left blank intentionally) CONTENTS 1 Executive Summary 2 Exhibit One - Summary of Investments 3 Exhibits Two through Eleven - Portfolio Characteristics 4 Meeting Notes 5 Fund Information G:\BWC\WP\Private Equity\PE Valuation Report\PE Valuation Report- Danialle.doc (This page left blank intentionally) EXECUTIVE SUMMARY The Ohio Bureau of Workers’ Compensation (the Bureau) has asked Ennis Knupp + Associates to review the valuations of the 68 private equity partnerships managed by 54 private equity managers. This report provides you with our findings and conclusions. There are four sections in the remainder of this report. Section Two (Exhibit One) lists all investments in the private equity portfolio. Section Three provides different characteristics of the portfolio, as shown below. Section Four provides notes on our conference calls with the managers. Section Five provides portfolio holdings of the partnerships and rationales for the valuations. Contents Description Exhibit One An alphabetical listing of the Bureau’s Private Equity partnerships showing the Market Value of the Bureau’s holdings on March 31, 2005. Exhibit Two A listing of the Bureau’s Private Equity partnerships ranked from largest to smallest according to March 31, 2005 Market Value. Exhibit Three A listing of the Bureau’s Private Equity partnerships ranked from largest to smallest according to the Bureau’s percentage ownership of the partnership. Exhibit Four A listing of the Bureau’s Private Equity partnerships grouped by the state domicile of the general partnership office. -

A Selection of LP Attendees Confirmed to Date Include

12TH ANNUAL SEPTEMBER 23-25, 2019 . THE FAIRMONT HOTEL, SAN FRAN A Selection of LP Attendees Confirmed to Date Include: • 747 Capital • Korea Venture Investment Corporation • Aberdeen Standard Investments • KStone Partners LLC • AlpInvest Partners • Lion Investment Partners • Andina Family Office • Menlo Companies • Arizona PSPRS • Morgan Creek Capital Management • Athena Capital Advisors • Morgan Stanley • Aurora Management • Morgan Stanley (AIP) • BHR Equity Invetment Fund Management Co • Northleaf Capital Partners • Brooke Private Equity Associates • Ocean Avenue Capital • Calibruim AG • Cambridge Associates • Pantheon Ventures • Campton Private Equity Advisors • Portfolio Advisors • CM Capital Advisors • Private Advisors, LLC • CPE • Privos Capital (MFO) • Crow Holdings Capital Partners • Promus Access • Darwin Ventures • QIC Global Private Capital • Delegate Advisors, LLC • RCP Advisors • Edgewood Ventures LLC • Redmount Capital Partners • Empire Holdings Nationwide • Regulator Group • Fort Washington Investment Advisors • Sapphire Partners • GEN II Fund Services LLC • Sapphire Ventures • Guardian Life Insurance • Schusterman Family Office • Guggenheim Partners • Stepstone Group • Hancock Capital Management • The Abernathy Group • Hauser Private Equity • Thrivent • HGGC • Tradewind Capital Group • Honda Innovations • ICONIQ Capital • Twin Bridge Capital Partners • InterPrivate • Unigestion • Invesco Private Capital • Vista Ridge Capital • Wafra Inc • Jasper Ridge Partners • WBR LLC • Jordan Park • Wells Fargo • JRC • Wilshire Associates -

DENVER CAPITAL MATRIX Funding Sources for Entrepreneurs and Small Business

DENVER CAPITAL MATRIX Funding sources for entrepreneurs and small business Sixth Edition Introduction Denver Economic Development & Opportunity (DEDO) Definitions is pleased to release this sixth edition of the Denver Venture Capital – Venture capital is capital provided by investors to Capital Matrix. small businesses and start-up firms that demonstrate possible high- growth opportunities. Venture capital investments have a potential for This publication is designed as a tool to assist business considerable loss or profit and are generally designated for new and owners and entrepreneurs with discovering the myriad speculative enterprises that seek to generate a return through a of capital sources in and around the Mile High City. potential initial public offering or sale of the company. The Denver Capital Matrix provides a comprehensive Angel Investor – An angel investor is a high net worth individual active in directory of financing sources, from traditional bank venture financing, typically participating at an early stage of growth. lending, to venture capital firms, private equity firms, angel Private Equity – Private equity is an individual or consortium of investors investors, mezzanine sources and more. and funds that make investments directly into private companies or Small businesses provide the greatest opportunity for job initiate buyouts of public companies. Private equity is ownership in private companies that is not listed or traded on public exchanges. This is creation today. Yet, a lack of needed financing often prevents considered an illiquid and long-term investment. businesses from implementing expansion plans and adding payroll. Through this updated resource, DEDO strives to help Mezzanine Financing – Mezzanine financing is a hybrid of debt and connect businesses to equity financing that is typically used to finance the expansion of start- up and expansion capital so that they can thrive in existing companies. -

Beirne Wealth Consulting Services, LLC

Beirne Wealth Consulting Services, LLC Response to: Request for Proposal For City of Burlington Employees’ Retirement System RFP for Investment Advisory Services Submitted on October 8, 2020 John-Oliver Beirne, CRPC,MBA Partner and President Beirne Wealth Consulting Services, LLC 3 Enterprise Drive, Suite 410 Shelton, CT 06484 (203) 701-8606 [email protected] Table of Contents • Post Table of Contents: Transmittal Letter • Tab I: Request for Proposal • Tab II: Form ADV Part I & II • Tab III: Insurance • Tab IV: Client List • Tab V: Risk Guidelines • Tab VI: IPS • Tab VII: Sample Report Hooker & Holcombe Attn: Arthur J. Meizner 1300 Hall Boulevard, Suite 1C Bloomfield, CT 06002 Beirne Wealth Consulting Services, LLC (BWC) would like to formally submit its qualifications to be the Investment Consultant for the City of Burlington. If we are selected you will benefit from working with an organization that focuses on the institutional consulting field. Beirne Wealth Consulting Services, LLC has advised clients for over fifty years. BWC was formed as an independent, SEC-registered investment adviser that is owned and controlled entirely by its senior professionals. We act purely as an independent consultant. The firm does not sell any investment products, receive commissions, take finder’s fees, or accept any other form of third party remuneration from its institutional clients. Over the years BWC has provided assistance to numerous clients in the design, implementation, and monitoring of their investment portfolios. We use a well-defined process in consulting work that is based on a global set of standards and draws on extensive research resources. At the present, BWC advises several institutional retirement plans.