Annual Report and Accounts 2017 …INCREDIBLE THINGS HAPPEN

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2.7 Informa Recommended Offer for UBM.Pdf

THIS ANNOUNCEMENT IS AN ADVERTISEMENT AND NOT A PROSPECTUS OR PROSPECTUS EQUIVALENT DOCUMENT AND INVESTORS SHOULD NOT MAKE ANY INVESTMENT DECISION IN RELATION TO THE NEW INFORMA SHARES EXCEPT ON THE BASIS OF INFORMATION IN THE PROSPECTUS AND THE SCHEME DOCUMENT WHICH ARE PROPOSED TO BE PUBLISHED IN DUE COURSE NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF THAT JURISDICTION THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR IMMEDIATE RELEASE 30 January 2018 CREATION OF A LEADING B2B INFORMATION SERVICES GROUP THROUGH A RECOMMENDED OFFER FOR UBM PLC BY INFORMA PLC The boards of Informa PLC ("Informa") and UBM plc ("UBM") are pleased to confirm the creation of a leading B2B Information Services Group (the "Enlarged Group") through a recommended offer (the "Offer") for UBM by Informa. The Offer, which is being recommended to shareholders by the boards of Informa and UBM, comprises a mix of shares and cash consideration from Informa for the entire issued and to be issued share capital of UBM. The boards of both companies believe there is a compelling commercial and strategic rationale for creating the Enlarged Group, to offer major benefits to Customers and Colleagues, while having the potential to create significant value for Shareholders, supported by accelerated growth opportunities, significant operating synergies and attractive earnings accretion. Stephen A. Carter, Chief Executive of Informa said: "It is clear that the B2B Market is moving to Operating Scale and Industry Specialisation. Our recommended offer for UBM promises to create a leading B2B Information Services Group with the international reach and market capabilities to take full advantage of these trends." He added: "The Enlarged Group has the potential to deliver strong growth and significant value for shareholders. -

Informa 2018 Full Year Results Statement

Informa LEI: 5493006VM2LKUPSEDU20 Press Release 7 March 2019 Informa PLC Results for 12 Months to 31 December 2018 2018: Combination & Creation 2019: Performance & Growth KEY FINANCIAL AND OPERATING HIGHLIGHTS1 • Strong Revenue Growth: +3.7% underlying and +34.9% reported to £2,369.5m, including six months of UBM (2017: £1,756.8m) • Higher Adjusted Operating Profit: +2.3% underlying and +34.4% reported to £732.1m (2017: £544.9m) • Improved Statutory Operating Profit: £363.2m (2017: £344.7m) • Increased Adjusted Diluted Earnings per Share: +7.0% to 49.2p (2017: 46.0p); Statutory EPS of 19.7p (2017: 37.6p), with prior year including non-cash credit from US tax reforms • Attractive Free Cash Flow: £503.2m and £600m+ including a full year of UBM (2017: £400.9m) • Robust Balance Sheet, in line with plan: Net debt/EBITDA1 at 2.9x (2017: 2.5x) • Enhanced Dividend: up 7.1% to 21.90p (2017: 20.45p) London: Informa (LSE: INF.L), the International Exhibitions, Events, Information Services and Scholarly Research Group, today published its financial results for the 12 months to 31 December 2018, reporting a further period of operational progress and improving financial performance. Stephen A. Carter, Group Chief Executive, said: “In 2018, the Informa Group delivered a fifth consecutive year of improving growth, increasing adjusted profits, adjusted earnings per share, cashflow and dividends.” He added: “In 2019, our focus is on continuing Performance and Growth as we consolidate our market positions and further reduce complexity. This will enable -

Introduction Welcome to the UBM Annual Report for 2016. This Interactive Pdf Allows You to Easily Access the Information That You Require

Annual Report and Accounts 2016 Introduction Welcome to the UBM Annual Report for 2016. This interactive pdf allows you to easily access the information that you require. Use the page icons within the text or the document controls located at the top of each page to navigate through the report. How to use this document Search by keyword Print a single page or whole section Return to the contents page Return to previous view Forward Backward Annual Report and Accounts 2016 Strategic Report 02 Chairman’s Statement 06 Our Business Explained 08 Business Model 10 Why own UBM? 11 Market Context 13 2016 Highlights 14 Chief Executive’s Review 20 Our People 24 Strategic Priorities and KPIs 26 Strategic Review UBM Annual ReportStrategic and Accounts 2016 Report 36 Sustainability Report Strategic Report page 04-44 40 Risk Management Our Business Model 42 Principal Risks UBM B2B Events: exceptional experiences 46 Operating and Financial Review for our customers EXPERT OUR ISE E ENC LL E EV Governance Report XC E Intimately understand E OMER TY N Create fully featured, ST PES T G CU E our customers’ needs to IN Buyers X highly valued experiences T P E E create propositions that K R for our customers R I 58 Board of Directors E bring the right buyers, A to meet, interact and N L M C s Activate and e sellers, leaders and r E trade – harnessing the D a e d N n promote global e learners together r power of face-to-face A r 60 Corporate Governance Statement a s S e trade and and digital E L L B2B commerce A S 62 Leadership R Sellers S E IP L H AT S 62 Nominations -

UK P&L 161107 MAR.Xlsx

Messels December 2016 Rec Last UK FTSE 100 Stocks Open price Close/last %chg Index Relative 30-Nov 30-Dec BP/ LN Equity BP PLC 459.45 509.6 10.9% 5.29% 5.6% 30-Nov 30-Dec RRS LN Equity Randgold Resources Ltd 5700 6415 12.5% 5.29% 7.3% 30-Nov 30-Dec RIO LN Equity Rio Tinto PLC 2990 3158.5 5.6% 5.29% 0.3% 30-Nov 30-Dec BA/ LN Equity BAE Systems PLC 600.5 591.5 -1.5% 5.29% -6.8% 30-Nov 30-Dec CRH LN Equity CRH PLC 2660 2830 6.4% 5.29% 1.1% 30-Nov 30-Dec CRDA LN Equity Croda International PLC 3262 3196 -2.0% 5.29% -7.3% 30-Nov 30-Dec AHT LN Equity Ashtead Group PLC 1567 1580 0.8% 5.29% -4.5% 30-Nov 30-Dec BNZL LN Equity Bunzl PLC 2060 2109 2.4% 5.29% -2.9% 30-Nov 30-Dec EXPN LN Equity Experian PLC 1510 1574 4.2% 5.29% -1.1% 30-Nov 30-Dec WOS LN Equity Wolseley PLC 4645 4962 6.8% 5.29% 1.5% 30-Nov 30-Dec GSK LN Equity GlaxoSmithKline PLC 1495.5 1562 4.4% 5.29% -0.8% 30-Nov 30-Dec BRBY LN Equity Burberry Group PLC 1429 1497 4.8% 5.29% -0.5% 30-Nov 30-Dec RB/ LN Equity Reckitt Benckiser Group PLC 6763 6886 1.8% 5.29% -3.5% 30-Nov 30-Dec MRW LN Equity Wm Morrison Supermarkets PLC 217.5 230.7 6.1% 5.29% 0.8% 13-Dec 30-Dec ITV LN Equity ITV PLC 192.1 206.4 7.4% 2.50% 4.9% 20-Dec 30-Dec REL LN Equity RELX PLC 1417 1449 2.3% 1.40% 0.9% 30-Nov 30-Dec MCRO LN Equity Micro Focus International PLC 2111 2179 3.2% 5.29% -2.1% 30-Nov 30-Dec BARC LN Equity Barclays PLC 215.95 223.45 3.5% 5.29% -1.8% 06-Dec 30-Dec DLG LN Equity Direct Line Insurance Group PLC 354.8 369.4 4.1% 5.35% -1.2% 30-Nov 30-Dec PRU LN Equity Prudential PLC 1548.5 1627.5 5.1% 5.29% -0.2% -

Broker Upgrades and Downgrades & Key Uk

Shard Capital Stockbrokers T +44 (0) 207 186 9950 rd 23 Floor, F +44 (0) 207 186 9979 20Fenchurch St, E [email protected] London, EC3M 3BY W shardcapitalstockbrokers.com BROKER UPGRADES AND DOWNGRADES & KEY UK CORPORATE SNAPSHOTS 17 January 2018 UK Broker Upgrades / Downgrades Please contact us for more information Code Company Broker Recomm. From Recomm. To Price From Price To Upgrades BLND British Land Co Plc Peel Hunt Add Add 675 700 BMY Bloomsbury Publishing Plc Peel Hunt Add Add 200 210 BYG Big Yellow Group Plc Berenberg Hold Buy 820 920 Euromoney Institutional Investor ERM Peel Hunt Buy Buy 1330 1420 Plc ETO Entertainment One Ltd Peel Hunt Hold Hold 260 300 GOCO Gocompare.com Group Plc Peel Hunt Buy Buy 125 140 RMV Rightmove Plc Peel Hunt Hold Hold 4000 4400 SAFE Safestore Holdings Plc Berenberg Buy Buy 465 550 Jefferies SPI Spire Healthcare Group Hold Buy 259 290 International UBM UBM Plc Peel Hunt Buy Buy 760 810 Zero Preference Growth Trust ZPG Peel Hunt Buy Buy 400 410 Plc/The Downgrades FERG Ferguson Plc RBC Capital Markets Outperform Sector Perform 5200 6000 HMSO Hammerson Plc Peel Hunt Hold 550 525 WMH William Hill Plc Peel Hunt Hold Reduce 290 290 https://www.shardcapitalstockbrokers.com/trading-platform/ https://www.shardcapitalstockbrokers.com/trading-platform/ https://www.shardcapitalstockbrokers.com/trading-platform/ https://www.shardcapitalstockbrokers.com/trading-platform/ https://www.shardcapitalstockbrokers.com/trading-platform/ BROKER UPGRADES AND DOWNGRADES & KEY UK CORPORATE SNAPSHOTS Code Company Broker Recomm. -

Creating a Leading B2B Information Services Group

Creating a Leading B2B Information Services Group Recommended Offer by Informa PLC for UBM plc 30 January 2018 Disclaimer THIS PRESENTATION AND ITS CONTENTS ARE NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF THAT JURISDICTION This presentation has been prepared by Informa PLC (the "Company") solely for your information and for use at one or more meetings in connection with the offer by the Company for UBM plc ("UBM") howsoever implemented (the "Offer"). For the purposes of this notice, "presentation" means this document and any oral presentation, any question and answer session and any written or oral material discussed or distributed in connection with it. This presentation is not a prospectus and does not constitute or form part of, and should not be construed as, any offer, invitation, solicitation or recommendation to purchase, sell or subscribe for any securities of the Company or UBM in any jurisdiction and neither the issue of the information nor anything contained herein shall form the basis of or be relied upon in connection with, or act as an inducement to enter into, any investment activity. This presentation does not purport to contain all of the information that may be required to evaluate any investment in the Company or UBM or any of their securities. Any investment decision should be made solely on the basis of formal offer-related documentation to be released in relation to the Offer. Any person considering an investment in the Company or UBM is advised to obtain independent advice as to the legal, tax, accounting, financial, credit and other related advice prior to making an investment. -

Annual Report

2014 Annual Report 1 Independent Television News Limited 200 Gray’s Inn Road London WC1X 8XZ Telephone Registered number 548648 ITN.co.uk CONTENTS OVERVIEW Highlights 04 Our business 06 Chief Executive’s Review 18 Chairman’s Statement 23 GOVERNANCE Board of Directors 26 Executive team 28 Strategic report 32 Directors’ report 38 Statement of Directors’ responsibilities 40 Independent auditor’s report 41 ACCOUNTS Accounts 43 3 Independent Television News Limited AT A GLANCE 5,757 4,958 3,735 Group operating profit £m* 2014: £5.76m 2,319 + 298% on 2009 * Excluding exceptionals 942 £0m -2,893 09 10 11 12 13 14 Group revenue £m ITN Productions Revenue £m 2014: £112.0m 2014: £16.7m + 16% on 2010 + 44% year on year 111,959 108,739 16,739 105,829 11,627 98,207 10,800 96,249 7,675 7,059 £80m £0m 10 11 12 13 14 10 11 12 13 14 4 Annual Report and Accounts 2014 AT A GLANCE Major awards won 2014: 46 2013: 43 46 Broadcast television commissions Commercials 2014: 36 2014: 37 + 100% on 2013 + 37% on 2013 36 37 5 Independent Television News Limited ITV NEWS 6 Annual Report and Accounts 2014 OUR BUSINESS 7 Independent Television News Limited ITV NEWS ITV News secures the big exclusives, providing balanced reporting and comprehensive analysis from a top team of expert journalists to a daily audience of up to eight million viewers across the UK. Produced by ITN since its inception in 1955, ITV News airs national news programmes at 1.30pm, 6.30pm and 10pm, informing public opinion and generating debate through news exclusives, investigative journalism and bold, accessible reporting on the latest news agenda. -

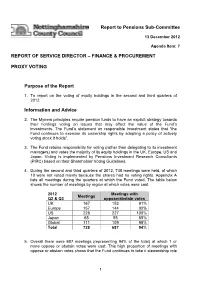

Report to Pensions Sub-Committee REPORT of SERVICE DIRECTOR – FINANCE & PROCUREMENT PROXY VOTING Purpose of the Report

Report to Pensions Sub-Committee 13 December 2012 Agenda Item: 7 REPORT OF SERVICE DIRECTOR – FINANCE & PROCUREMENT PROXY VOTING Purpose of the Report 1. To report on the voting of equity holdings in the second and third quarters of 2012. Information and Advice 2. The Myners principles require pension funds to have an explicit strategy towards their holdings voting on issues that may affect the value of the Fund’s investments. The Fund’s statement on responsible investment states that “the Fund continues to exercise its ownership rights by adopting a policy of actively voting stock it holds”. 3. The Fund retains responsibility for voting (rather than delegating to its investment managers) and votes the majority of its equity holdings in the UK, Europe, US and Japan. Voting is implemented by Pensions Investment Research Consultants (PIRC) based on their Shareholder Voting Guidelines. 4. During the second and third quarters of 2012, 738 meetings were held, of which 10 were not voted mainly because the shares had no voting rights. Appendix A lists all meetings during the quarters at which the Fund voted. The table below shows the number of meetings by region at which votes were cast. 201 2 Meetings with Meetings Q2 & Q3 oppose/abstain votes UK 167 152 91% Europe 157 144 92% US 228 227 100% Japan 65 55 85% Global 111 109 98% Total 728 687 94% 5. Overall there were 687 meetings (representing 94% of the total) at which 1 or more oppose or abstain votes were cast. This high proportion of meetings with oppose or abstain votes shows that the Fund continues to take it stewardship role 1 seriously through considered exercise of its voting rights. -

Broker Upgrades and Downgrades & Key Uk

Shard Capital Stockbrokers T +44 (0) 207 186 9950 rd 23 Floor, F +44 (0) 207 186 9979 20Fenchurch St, E [email protected] London, EC3M 3BY W shardcapitalstockbrokers.com BROKER UPGRADES AND DOWNGRADES & KEY UK CORPORATE SNAPSHOTS 21 July 2017 UK Broker Upgrades / Downgrades Please contact us for more information Code Company Broker Recomm. From Recomm. To Price From Price To Upgrades OTB On the Beach Group Plc Peel Hunt Buy Buy 450 500 Downgrades OSB OneSavings Bank Plc Peel Hunt Add Add 505 425 Initiate/Neutral/Unchanged AGK Aggreko Plc Credit Suisse Underperform Underperform AVV Aveva Group Plc Credit Suisse Outperform Outperform BRBY Burberry Group Plc Credit Suisse Neutral Neutral DC. Dixons Carphone Plc Credit Suisse Outperform Outperform DRX Drax Group Plc Credit Suisse Outperform Outperform ELM Elementis Plc Credit Suisse Outperform Outperform EMG Man Group Plc Credit Suisse Outperform Outperform ENQ EnQuest Plc Barclays Capital Underweight Underweight 35 35 ETO Entertainment One Ltd Credit Suisse Neutral Neutral GLEN Glencore Plc Credit Suisse Outperform Outperform GSK GlaxoSmithKline Plc Credit Suisse Neutral Neutral https://www.shardcapitalstockbrokers.com/trading-platform/ https://www.shardcapitalstockbrokers.com/trading-platform/ https://www.shardcapitalstockbrokers.com/trading-platform/ https://www.shardcapitalstockbrokers.com/trading-platform/ https://www.shardcapitalstockbrokers.com/trading-platform/ BROKER UPGRADES AND DOWNGRADES & KEY UK CORPORATE SNAPSHOTS Code Company Broker Recomm. From Recomm. To Price From Price -

Prospectus May 2020

IMPORTANT NOTICE IMPORTANT: You must read the following disclaimer before continuing. This electronic transmission applies to the attached document, which has been prepared in connectionwith the proposed rights issue (the "Rights Issue") of new ordinary shares in Hyve Group plc (the "Company") and the proposed admission of the shares to the Official List of the Financial Conduct Authority ("FCA") and to trading on the Main Market of the London Stock Exchange ("Admission"). You areadvised to read this disclaimer carefully before reading, accessing or making any other use of the attached document. In accessing the attached document, you agree to and represent and warrant that you will be bound by the following terms and conditions, including any modifications to them each time you receive any information from the Company, Numis Securities Limited ("Numis"), Barclays Bank PLC ("Barclays") or HSBC Bank plc ("HSBC") as a result of such access. You acknowledge that the delivery of this electronic transmission and the attached document is confidential and intended for you only and you agree you will not forward, reproduce or publish this electronic transmission or the attached document to any other person. The attached document is not a prospectus for the purposes of the Prospectus Rules issued by the FCA. Accordingly, the attached document has not been pre-approved by or filed with the FCA. The information in the attached document, which is in draft form and is incomplete, is subject to updating, completion, revision, further verification and amendment. Neither the Company, Numis, HSBC, Barclays or their affiliates or their respective representatives are under any obligation to keep current the information contained in the attached document. -

NOTICE NO. CA/2018/401/Lo UBM Plc - Takeover

NOTICE NO. CA/2018/401/Lo UBM Plc - Takeover ISSUE DATE: 05 June 2018 EFFECTIVE DATE: 15 June 2018 CONTRACTS: Single Stock Futures UBN COMPANY: UBM Plc CORPORATE ACTION: Takeover REFERENCE: CA/2018/035/Lo ISIN: OLD: JE00BD9WR069 NEW: GB00BMJ6DW54 DETAILS: **Update to Notice CA/2018/035/Lo UBM Plc (“UBM”) has announced that they have entered into a definitive takeover agreement with Informa Plc (“Informa”). Informa will acquire UBM for a combination of 163 GBX in cash and 1.083 Informa shares for each UBM share held (“the Offer”). Additionally, UBM shareholders will receive a special dividend of 14.9454 GBX per share. ADJUSTMENTS: Provided that the Offer becomes effective, the following adjustments will be made: . The contracts shall be adjusted using the ratio method and subsequently re-designated as contracts based on Informa Plc Shares. The contracts will be referred to by ICE Futures Europe as UBM Plc ex-event contracts. The adjustment ratio shall be calculated using the theoretical value of UBM Plc shares and the closing price of Informa Plc on the London Stock Exchange on 14 June 2018 as follows: ( 163 + 14.9454 + (1.083 ∗ 퐼푛푓표푟푚푎 푃푙푐)) 푇ℎ푒표푟푒푡푐푎푙 푉푎푙푢푒 = 1 1 (푇ℎ푒표푟푒푡푐푎푙 푉푎푙푢푒 − 163 − 14.9454) ∗ ( ) 푅푎푡표 = 1.083 푇ℎ푒표푟푒푡푐푎푙 푉푎푙푢푒 NOTICE NO. CA/2018/401/Lo Page 2 of 2 Futures: . Lot Size: The lot size will be divided by the ratio. The adjusted lot size will be specified in the final notice. Variation Margin: Daily Settlement Prices on 14 June 2018 shall be multiplied by the ratio to generate reference prices for the purpose of variation margin calculations at the close of business on 15 June 2018. -

Independent Television News Limited Registered Number 548648 2013 ANNUAL REPORT

2013 ANNUAL REPORT Independent Television News Limited Registered Number 548648 2013 ANNUAL REPORT CONTENTS The Headlines Page 3 Our Business Page 6 Our People Page 16 Chief Executive’s Review Page 22 Chairman’s Statement Page 26 Strategic Report Page 28 Directors’ Report Page 32 Statement of Directors’ Responsibilities Page 34 Independent Auditor’s Report Page 35 Accounts Page 37 2 THE HEADLINES 3 THE HEADLINES 2009 2010 2011 2012 2013 2012 2013 £5.0m £3.7m £3.7m £5.0m £2.3m 3.4% 4.7% £0.9m £2.9m £7.9m swing in operating profit* Operating profit margin* rises ITN’s annual operating profit* rises to £5m in ITN’s operating profit margin* increased from 2013, a £7.9m upwards swing since 2009. 3.4% to 4.7%. * Operating profit on ordinary activities before exceptional * Operating profit margin before exceptional items items ITN sweeps the board ITN Productions growth continues ITN won 43 significant industry awards across ITN Productions continued to grow, producing its divisions in 2013, including prestigious hon- 134 broadcast hours, including seven new series ours from the Royal Television Society and the and 23 advertising campaigns. Foreign Press Association. 4 THE HEADLINES ITV News gets a new look Channel 5 News revamps 6.30pm programme ITV News launched a new look studio and branding as part of ITV’s brand refresh. Channel 5 News launched NewsTalk Live, the UK’s only daily primetime current affairs debate show. Channel 4 News wins an Emmy ITN Source secures Qatar deal Channel 4 News took home the coveted ITN Source won a multi-million pound licensing International Emmy Award as well as being contract with the Qatar Foundation.