Broker Upgrades and Downgrades & Key Uk

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Full Portfolio Holdings

Hartford Multifactor International Fund Full Portfolio Holdings* as of August 31, 2021 % of Security Coupon Maturity Shares/Par Market Value Net Assets Merck KGaA 0.000 152 36,115 0.982 Kuehne + Nagel International AG 0.000 96 35,085 0.954 Novo Nordisk A/S 0.000 333 33,337 0.906 Koninklijke Ahold Delhaize N.V. 0.000 938 31,646 0.860 Investor AB 0.000 1,268 30,329 0.824 Roche Holding AG 0.000 74 29,715 0.808 WM Morrison Supermarkets plc 0.000 6,781 26,972 0.733 Wesfarmers Ltd. 0.000 577 25,201 0.685 Bouygues S.A. 0.000 595 24,915 0.677 Swisscom AG 0.000 42 24,651 0.670 Loblaw Cos., Ltd. 0.000 347 24,448 0.665 Mineral Resources Ltd. 0.000 596 23,709 0.644 Royal Bank of Canada 0.000 228 23,421 0.637 Bridgestone Corp. 0.000 500 23,017 0.626 BlueScope Steel Ltd. 0.000 1,255 22,944 0.624 Yangzijiang Shipbuilding Holdings Ltd. 0.000 18,600 22,650 0.616 BCE, Inc. 0.000 427 22,270 0.605 Fortescue Metals Group Ltd. 0.000 1,440 21,953 0.597 NN Group N.V. 0.000 411 21,320 0.579 Electricite de France S.A. 0.000 1,560 21,157 0.575 Royal Mail plc 0.000 3,051 20,780 0.565 Sonic Healthcare Ltd. 0.000 643 20,357 0.553 Rio Tinto plc 0.000 271 20,050 0.545 Coloplast A/S 0.000 113 19,578 0.532 Admiral Group plc 0.000 394 19,576 0.532 Swiss Life Holding AG 0.000 37 19,285 0.524 Dexus 0.000 2,432 18,926 0.514 Kesko Oyj 0.000 457 18,910 0.514 Woolworths Group Ltd. -

2.7 Informa Recommended Offer for UBM.Pdf

THIS ANNOUNCEMENT IS AN ADVERTISEMENT AND NOT A PROSPECTUS OR PROSPECTUS EQUIVALENT DOCUMENT AND INVESTORS SHOULD NOT MAKE ANY INVESTMENT DECISION IN RELATION TO THE NEW INFORMA SHARES EXCEPT ON THE BASIS OF INFORMATION IN THE PROSPECTUS AND THE SCHEME DOCUMENT WHICH ARE PROPOSED TO BE PUBLISHED IN DUE COURSE NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF THAT JURISDICTION THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR IMMEDIATE RELEASE 30 January 2018 CREATION OF A LEADING B2B INFORMATION SERVICES GROUP THROUGH A RECOMMENDED OFFER FOR UBM PLC BY INFORMA PLC The boards of Informa PLC ("Informa") and UBM plc ("UBM") are pleased to confirm the creation of a leading B2B Information Services Group (the "Enlarged Group") through a recommended offer (the "Offer") for UBM by Informa. The Offer, which is being recommended to shareholders by the boards of Informa and UBM, comprises a mix of shares and cash consideration from Informa for the entire issued and to be issued share capital of UBM. The boards of both companies believe there is a compelling commercial and strategic rationale for creating the Enlarged Group, to offer major benefits to Customers and Colleagues, while having the potential to create significant value for Shareholders, supported by accelerated growth opportunities, significant operating synergies and attractive earnings accretion. Stephen A. Carter, Chief Executive of Informa said: "It is clear that the B2B Market is moving to Operating Scale and Industry Specialisation. Our recommended offer for UBM promises to create a leading B2B Information Services Group with the international reach and market capabilities to take full advantage of these trends." He added: "The Enlarged Group has the potential to deliver strong growth and significant value for shareholders. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

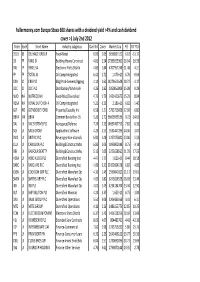

Fullermoney.Com Europe Stoxx 600 Shares with a Dividend Yield >4

Fullermoney.com Europe Stoxx 600 shares with a dividend yield >4% and cash dividend cover >1 July 2nd 2012 Ticker Exch Short Name industry subgroup Dvd Yld Cover Market Cap P/E TR YTD DELB BB DELHAIZE GROUP Food-Retail 6.09 2.65 3696837120 6.10 -31.17 DG FP VINCI SA Building-Heavy Construct 4.81 1.54 27399055360 10.64 10.33 RXL FP REXEL SA Electronic Parts Distrib 4.83 1.84 4707957248 11.48 4.21 FP FP TOTAL SA Oil Comp-Integrated 6.42 2.72 1.07E+11 6.76 -9.63 CRH ID CRH PLC Bldg Prod-Cement/Aggreg 4.14 1.62 14079643648 18.72 -1.17 DCC ID DCC PLC Distribution/Wholesale 4.26 1.82 1950855808 15.08 0.29 NUO NA NUTRECO NV Food-Misc/Diversified 4.73 1.79 2431420672 15.29 8.04 RDSA NA ROYAL DUTCH SH-A Oil Comp-Integrated 5.21 3.23 2.18E+11 6.82 -5.40 GJF NO GJENSIDIGE FORSI Property/Casualty Ins 6.58 1.21 5795755008 12.60 6.80 BBVA SM BBVA Commer Banks Non-US 5.26 1.71 36606939136 9.72 -14.65 BA/ LN BAE SYSTEMS PLC Aerospace/Defense 7.24 2.13 14692467712 7.82 6.36 SGE LN SAGE GROUP Applications Software 4.23 2.57 5531447296 14.36 -1.07 BVIC LN BRITVIC PLC Beverages-Non-alcoholic 6.03 1.48 1257075840 13.06 5.33 CLLN LN CARILLION PLC Building&Construct-Misc 6.80 2.09 1890802048 8.75 -3.14 BBY LN BALFOUR BEATTY Building&Construct-Misc 5.15 2.05 3222658560 11.29 17.55 HSBA LN HSBC HLDGS PLC Diversified Banking Inst 4.47 1.77 1.62E+11 9.44 18.58 BARC LN BARCLAYS PLC Diversified Banking Inst 4.09 3.10 32422064128 6.82 -4.85 CKSN LN COOKSON GRP PLC Diversified Manufact Op 4.10 1.49 2590840320 11.17 19.61 SMIN LN SMITHS GRP PLC Diversified Manufact -

Finn-Ancial Times Finncap Financials & Insurance Quarterly Sector Note

finn-ancial Times finnCap Financials & Insurance quarterly sector note Q3 2020 | Issue 9 Highlights this quarter: Elevated uncertainty and volatility have been hallmarks of the last 18 months, with Brexit, the UK General Election and more recently COVID-19 all contributing to the challenges that face investors wishing to carve out solid and stable returns amid these ‘unprecedented’ times. With this is mind, and simulating finnCap’s proven Slide Rule methodology, we found the highest quality and lowest value stocks across the financials space, assessing how the make-up of these lists changed over the period January 2019 to July 2020, tracking indexed share price performance over the period as well as movements in P/E and EV/EBIT valuations. The top quartile list of Quality companies outperformed both the Value list and the FTSE All Share by rising +2.5% over the period versus -5.4% for the All Share and -14.3% for Value stocks. Furthermore, the Quality list had protection on the downside in the market crash between February and March 2020, and accelerated faster amid the market rally between late March and July 2020. From high to low (January to March), Quality moved -36.3% against the Value list at -45.5%, while a move off the lows to July was +37.4% for Quality and +34.0% for Value. There was some crossover between the Quality and Value lists, with 7 companies of the top quartile (16 companies in total) appearing in both the Quality and Value lists. This meant that a) investors could capture what we call ‘Quality at Value’ (i.e. -

Informa 2018 Full Year Results Statement

Informa LEI: 5493006VM2LKUPSEDU20 Press Release 7 March 2019 Informa PLC Results for 12 Months to 31 December 2018 2018: Combination & Creation 2019: Performance & Growth KEY FINANCIAL AND OPERATING HIGHLIGHTS1 • Strong Revenue Growth: +3.7% underlying and +34.9% reported to £2,369.5m, including six months of UBM (2017: £1,756.8m) • Higher Adjusted Operating Profit: +2.3% underlying and +34.4% reported to £732.1m (2017: £544.9m) • Improved Statutory Operating Profit: £363.2m (2017: £344.7m) • Increased Adjusted Diluted Earnings per Share: +7.0% to 49.2p (2017: 46.0p); Statutory EPS of 19.7p (2017: 37.6p), with prior year including non-cash credit from US tax reforms • Attractive Free Cash Flow: £503.2m and £600m+ including a full year of UBM (2017: £400.9m) • Robust Balance Sheet, in line with plan: Net debt/EBITDA1 at 2.9x (2017: 2.5x) • Enhanced Dividend: up 7.1% to 21.90p (2017: 20.45p) London: Informa (LSE: INF.L), the International Exhibitions, Events, Information Services and Scholarly Research Group, today published its financial results for the 12 months to 31 December 2018, reporting a further period of operational progress and improving financial performance. Stephen A. Carter, Group Chief Executive, said: “In 2018, the Informa Group delivered a fifth consecutive year of improving growth, increasing adjusted profits, adjusted earnings per share, cashflow and dividends.” He added: “In 2019, our focus is on continuing Performance and Growth as we consolidate our market positions and further reduce complexity. This will enable -

Fiscal Quarter-End Holdings (Pdf)

Quarterly Schedules of Portfolio Holdings International & Global Funds July 31, 2020 Retirement Institutional Administrative Investor Class Class Class Class Harbor Diversified International All Cap Fund HNIDX HAIDX HRIDX HIIDX Harbor Emerging Markets Equity Fund HNEMX HAEMX HREMX HIEEX Harbor Focused International Fund HNFRX HNFSX HNFDX HNFIX Harbor Global Leaders Fund HNGIX HGGAX HRGAX HGGIX Harbor International Fund HNINX HAINX HRINX HIINX Harbor International Growth Fund HNGFX HAIGX HRIGX HIIGX Harbor International Small Cap Fund HNISX HAISX HRISX HIISX Harbor Overseas Fund HAORX HAOSX HAOAX HAONX Table of Contents Portfolios of Investments HARBOR DIVERSIFIED INTERNATIONAL ALL CAP FUND. ..... 1 HARBOR EMERGING MARKETS EQUITY FUND . .......... 8 HARBOR FOCUSED INTERNATIONAL FUND. ................................. 11 HARBOR GLOBAL LEADERS FUND. ................. 13 HARBOR INTERNATIONAL FUND . 15 HARBOR INTERNATIONAL GROWTH FUND . ........................ 21 HARBOR INTERNATIONAL SMALL CAP FUND. ................. 24 HARBOR OVERSEAS FUND . ............................................ 26 Notes to Portfolios of Investments ..................................... 31 Harbor Diversified International All Cap Fund PORTFOLIO OF INVESTMENTS—July 31, 2020 (Unaudited) Value, Cost, and Principal Amounts in Thousands COMMON STOCKS—96.4% COMMON STOCKS—Continued Shares Value Shares Value AEROSPACE & DEFENSE—0.7% BANKS—Continued 28,553 Airbus SE (France)* .............................. $ 2,090 236,142 Svenska Handelsbanken AB (Sweden) ............... $ -

Description Holding Book Cost Market Price Market Value £000'S £000'S

DORSET COUNTY PENSION FUND VALUATION OF PORTFOLIO AT CLOSE OF BUSINESS 31 March 2017 Book Market Description Holding Market Value Cost Price £000's £000's UK EQUITIES MINING ACACIA MINING 33,000 147.93 4.502 148.57 ANGLO AMERICAN ORD USD0.54 270,390 2,804.18 12.27 3,317.69 ANTOFAGASTA ORD GBP0.05 74,500 151.50 8.355 622.45 BHP BILLITON ORD USD0.50 436,926 2,401.54 12.395 5,415.70 CENTAMIN EGYPT LTD 226,000 349.07 1.732 391.43 FRESNILLO 35,500 88.20 15.52 550.96 GLENCORE XSTRATA 2,412,543 5,662.91 3.141 7,577.80 HOCHSCHILD MINING ORD GBP0.25 49,000 108.90 2.765 135.49 KAZ MINERALS 53,600 89.80 4.551 243.93 PETRA DIAMONDS 106,900 169.67 1.329 142.07 POLYMETAL INT'L 53,800 514.30 9.945 535.04 RANDGOLD RESOURCES ORD USD0.05 19,250 485.32 69.7 1,341.73 RIO TINTO ORD GBP0.10 (REG) 250,150 2,876.49 32.185 8,051.08 VEDANTA RESOURCES ORD USD0.10 18,500 75.07 8.11 150.04 Total MINING 15,924.89 28,524.69 OIL & GAS PRODUCERS AFREN PLC 218,000 215.93 0 0.00 BP ORD USD0.25 3,948,100 13,177.95 4.5885 18,115.86 CAIRN ENERGY ORD GBP0.06153846153 119,207 236.32 2.048 244.14 NOSTRUM OIL & GAS 17,700 84.36 4.796 84.89 ROYAL DUTCH 'B' ORD EUR0.07 1,642,961 20,190.09 21.945 36,054.78 TULLOW OIL ORD GBP 0.10 188,500 789.92 1.99026 375.16 Total OIL & GAS PRODUCERS 34,694.58 54,658.45 CHEMICALS CRODA INTL ORD GBP0.10 26,995 211.15 35.77 965.61 ELEMENTIS 99,000 130.23 2.899 287.00 JOHNSON MATTHEY ORD GBP1.00 40,357 446.31 30.82 1,243.80 SYNTHOMER 57,665 118.87 4.751 273.97 VICTREX ORD GBP0.01 17,000 111.61 19.02 323.34 Total CHEMICALS 1,018.16 3,087.91 CONSTRUCTION -

Schroder UK Mid Cap Fund

Schroder UK Mid Ca p Fund plc Half Year Report and Accounts For the six months ended 31 March 2020 Key messages – Portfolio of “high conviction” stocks aiming to provide a total return in excess of the FTSE 250 (ex-Investment Companies) Index and an attractive level of yield. – Dividend has tripled since 2007 as portfolio investments have captured the cash generative nature of investee companies, in a market where income has become an increasingly important part of our investors’ anticipated returns. – Provides exposure to dynamic mid cap companies that have the potential to grow to be included in the FTSE 100 index, which are at an interesting point in their life cycle, and/or which could ultimately prove to be attractive takeover targets. – Proven research driven investment approach based on the Manager’s investment process allied with a strong selling discipline. – Managed by Andy Brough and Jean Roche with a combined 50 years’ investment experience 1, the fund has a consistent, robust and repeatable investment proces s. 1Andy Brough became Lead Manager on 1 April 2016 . Investment objective Schroder UK Mid Cap Fund plc’s (the “Company”) investment objective is to invest in mid cap equities with the aim of providing a total return in excess of the FTSE 250 (ex -Investment Companies) Index. Investment policy The strategy is to invest principally in the investment universe associated with the benchmark index, but with an element of leeway in investment remit to allow for a conviction-driven approach and an emphasis on specific companies and targeted themes. The Company may also invest in other collective investment vehicles where desirable, for example to provide exposure to specialist areas within the universe. -

Marketplace Sponsorship Opportunities Information Pack 2017

MarketPlace Sponsorship Opportunities Information Pack 2017 www.airmic.com/marketplace £ Sponsorship 950 plus VAT Annual Conference Website * 1 complimentary delegate pass for Monday www.airmic.com/marketplace only (worth £695)* A designated web page on the MarketPlace Advanced notification of the exhibition floor plan section of the website which will include your logo, contact details and opportunity to upload 20% discount off delegate places any PDF service information documents Advanced notification to book on-site meeting rooms Airmic Dinner Logo on conference banner Advanced notification to buy tickets for the Annual Dinner, 12th December 2017 Logo in conference brochure Access to pre-dinner hospitality tables Opportunity to receive venue branding opportunities Additional Opportunities * This discount is only valid for someone who have never attended an Airmic Conference Airmic can post updates/events for you on before Linked in/Twitter ERM Forum Opportunity to submit articles on technical subjects in Airmic News (subject to editor’s discretion) Opportunity to purchase a table stand at the ERM Forum Opportunity to promote MP content online via @ Airmic Twitter or the Airmic Linked In Group About Airmic Membership Airmic has a membership of about 1200 from about 480 companies. It represents the Insurance buyers for about 70% of the FTSE 100, as well as a very substantial representation in the mid-250 and other smaller companies. Membership continues to grow, and retention remains at 90%. Airmic members’ controls about £5 billion of annual insurance premium spend. A further £2 billion of premium spend is allocated to captive insurance companies within member organisations. Additionally, members are responsible for the payment of insurance claims from their business finances to the value of at least £2 billion per year. -

IMI Plc Annual Report and Accounts 2017 IMI Plc Annual Report & Accounts 2017

IMI plc Annual Report and Accounts 2017 IMI plc Annual Report & Accounts 2017 Engineering GREAT the IMI Way IMI plc Annual Report and Accounts 2017 Our purpose is to deliver Contents great solutions that tackle the Introduction 02-09 most demanding engineering 02 Chairman’s statement 04 Group overview challenges. We help some of 05 IMI eco-system the world’s biggest industrial companies operate their Strategic 10-49 Review† processes safely, cleanly, Our Chief Executive reviews 2017 and outlines our strategy and the progress efficiently and cost effectively. we are making. 12 Chief Executive’s review We operate through three 16 Our strategic model divisions – IMI Critical 18 Strategic growth priorities 28 Operational review Engineering, IMI Precision 34 Corporate responsibility 44 Measurements and targets Engineering and IMI Hydronic 46 How we manage risk Engineering – and employ Corporate approximately 11,000 people Governance 50-85 in over 50 countries around We introduce our Board, and explain our governance structure the world. and how it operates. 52 The Board 54 Letter from the Chairman 55 Corporate Governance Report 60 Audit Committee Report 64 Nominations Committee Report 66 Directors’ Remuneration Report Financial 86-170 Statements Our financial statements for the year presented in a user-friendly format. 88 Finance Director’s introduction 90 Primary statements 98 Section 1 - Basis of preparation 99 Section 2 - Results for the year 110 Section 3 - Operating assets and liabilities 116 Section 4 - Capital structure and financing costs 140 Section 5 - Other notes 146 Directors’ Report † The Strategic Report on pages 10 to 49, 91, 92 to 93, 95 and 97 has been approved by the 168 Five year summary Board of Directors and signed on their behalf by Mark Selway, Chief Executive, on 1 March 2018. -

Women in Finance Charter List of 273 Signatories

Women in Finance Charter List of 273 signatories 68 new Charter signatories announced on 11 July 2018 Links to gender diversity targets to be published here in September Admiral Group AE3 Media Armstrong Wolfe Australia and New Zealand Banking Group Limited Barrington Hibbert Associates BNP Paribas Personal Finance BondMason Bovill Ltd Bower Recruitment Brooks Macdonald plc Canada Life Coventry Building Society Daiwa Capital Markets Europe Ltd EIS Association Ellis Davies Financial Planning Ltd Engage Financial Services Ltd Equifax Ltd Evolution Financial Planning Fintech Strategic Advisors Ltd Fintellect Recruitment First Wealth LLP Flood Re Ltd Foresight Franklin Templeton Investments GAM Global Processing Services Goji Investments Grant Thornton Hinckley and Rugby Building Society HUBX ICAEW Intermediate Capital Group Investec Asset Management Limited 11 July 2018 11 July 2018 J. P. Morgan Kames Capital plc Lazard & Co Limited Lazard Asset Management Limited LifeSearch Magenta Financial Planning Marsh Ltd Medianett Ltd Mortgages for Businesses Ltd MT Finance Ltd Mustard Seed Impact Ltd National Association of Commercial Finance Brokers Nomura International PIMCO Prytania Solutions Limited Pukka Insure Ltd Rathbone Brothers plc Scottish Equity Partners SDB Bookkeeping Services Semper Capital Management Shepherd Compello Ltd St. James’s Place plc Stonehaven International Sussex Independent Financial Advisers Ltd Tesco Underwriting The British United Provident Association (BUPA) The Meyer Partnership The Mortgage & Insurance Bureau TP