IMI Plc Annual Report 2012 ENGINEERING ADVANTAGE

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Full Portfolio Holdings

Hartford Multifactor International Fund Full Portfolio Holdings* as of August 31, 2021 % of Security Coupon Maturity Shares/Par Market Value Net Assets Merck KGaA 0.000 152 36,115 0.982 Kuehne + Nagel International AG 0.000 96 35,085 0.954 Novo Nordisk A/S 0.000 333 33,337 0.906 Koninklijke Ahold Delhaize N.V. 0.000 938 31,646 0.860 Investor AB 0.000 1,268 30,329 0.824 Roche Holding AG 0.000 74 29,715 0.808 WM Morrison Supermarkets plc 0.000 6,781 26,972 0.733 Wesfarmers Ltd. 0.000 577 25,201 0.685 Bouygues S.A. 0.000 595 24,915 0.677 Swisscom AG 0.000 42 24,651 0.670 Loblaw Cos., Ltd. 0.000 347 24,448 0.665 Mineral Resources Ltd. 0.000 596 23,709 0.644 Royal Bank of Canada 0.000 228 23,421 0.637 Bridgestone Corp. 0.000 500 23,017 0.626 BlueScope Steel Ltd. 0.000 1,255 22,944 0.624 Yangzijiang Shipbuilding Holdings Ltd. 0.000 18,600 22,650 0.616 BCE, Inc. 0.000 427 22,270 0.605 Fortescue Metals Group Ltd. 0.000 1,440 21,953 0.597 NN Group N.V. 0.000 411 21,320 0.579 Electricite de France S.A. 0.000 1,560 21,157 0.575 Royal Mail plc 0.000 3,051 20,780 0.565 Sonic Healthcare Ltd. 0.000 643 20,357 0.553 Rio Tinto plc 0.000 271 20,050 0.545 Coloplast A/S 0.000 113 19,578 0.532 Admiral Group plc 0.000 394 19,576 0.532 Swiss Life Holding AG 0.000 37 19,285 0.524 Dexus 0.000 2,432 18,926 0.514 Kesko Oyj 0.000 457 18,910 0.514 Woolworths Group Ltd. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

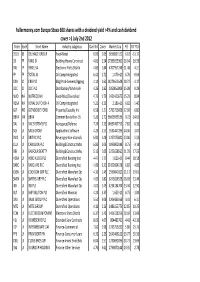

Fullermoney.Com Europe Stoxx 600 Shares with a Dividend Yield >4

Fullermoney.com Europe Stoxx 600 shares with a dividend yield >4% and cash dividend cover >1 July 2nd 2012 Ticker Exch Short Name industry subgroup Dvd Yld Cover Market Cap P/E TR YTD DELB BB DELHAIZE GROUP Food-Retail 6.09 2.65 3696837120 6.10 -31.17 DG FP VINCI SA Building-Heavy Construct 4.81 1.54 27399055360 10.64 10.33 RXL FP REXEL SA Electronic Parts Distrib 4.83 1.84 4707957248 11.48 4.21 FP FP TOTAL SA Oil Comp-Integrated 6.42 2.72 1.07E+11 6.76 -9.63 CRH ID CRH PLC Bldg Prod-Cement/Aggreg 4.14 1.62 14079643648 18.72 -1.17 DCC ID DCC PLC Distribution/Wholesale 4.26 1.82 1950855808 15.08 0.29 NUO NA NUTRECO NV Food-Misc/Diversified 4.73 1.79 2431420672 15.29 8.04 RDSA NA ROYAL DUTCH SH-A Oil Comp-Integrated 5.21 3.23 2.18E+11 6.82 -5.40 GJF NO GJENSIDIGE FORSI Property/Casualty Ins 6.58 1.21 5795755008 12.60 6.80 BBVA SM BBVA Commer Banks Non-US 5.26 1.71 36606939136 9.72 -14.65 BA/ LN BAE SYSTEMS PLC Aerospace/Defense 7.24 2.13 14692467712 7.82 6.36 SGE LN SAGE GROUP Applications Software 4.23 2.57 5531447296 14.36 -1.07 BVIC LN BRITVIC PLC Beverages-Non-alcoholic 6.03 1.48 1257075840 13.06 5.33 CLLN LN CARILLION PLC Building&Construct-Misc 6.80 2.09 1890802048 8.75 -3.14 BBY LN BALFOUR BEATTY Building&Construct-Misc 5.15 2.05 3222658560 11.29 17.55 HSBA LN HSBC HLDGS PLC Diversified Banking Inst 4.47 1.77 1.62E+11 9.44 18.58 BARC LN BARCLAYS PLC Diversified Banking Inst 4.09 3.10 32422064128 6.82 -4.85 CKSN LN COOKSON GRP PLC Diversified Manufact Op 4.10 1.49 2590840320 11.17 19.61 SMIN LN SMITHS GRP PLC Diversified Manufact -

Fiscal Quarter-End Holdings (Pdf)

Quarterly Schedules of Portfolio Holdings International & Global Funds July 31, 2020 Retirement Institutional Administrative Investor Class Class Class Class Harbor Diversified International All Cap Fund HNIDX HAIDX HRIDX HIIDX Harbor Emerging Markets Equity Fund HNEMX HAEMX HREMX HIEEX Harbor Focused International Fund HNFRX HNFSX HNFDX HNFIX Harbor Global Leaders Fund HNGIX HGGAX HRGAX HGGIX Harbor International Fund HNINX HAINX HRINX HIINX Harbor International Growth Fund HNGFX HAIGX HRIGX HIIGX Harbor International Small Cap Fund HNISX HAISX HRISX HIISX Harbor Overseas Fund HAORX HAOSX HAOAX HAONX Table of Contents Portfolios of Investments HARBOR DIVERSIFIED INTERNATIONAL ALL CAP FUND. ..... 1 HARBOR EMERGING MARKETS EQUITY FUND . .......... 8 HARBOR FOCUSED INTERNATIONAL FUND. ................................. 11 HARBOR GLOBAL LEADERS FUND. ................. 13 HARBOR INTERNATIONAL FUND . 15 HARBOR INTERNATIONAL GROWTH FUND . ........................ 21 HARBOR INTERNATIONAL SMALL CAP FUND. ................. 24 HARBOR OVERSEAS FUND . ............................................ 26 Notes to Portfolios of Investments ..................................... 31 Harbor Diversified International All Cap Fund PORTFOLIO OF INVESTMENTS—July 31, 2020 (Unaudited) Value, Cost, and Principal Amounts in Thousands COMMON STOCKS—96.4% COMMON STOCKS—Continued Shares Value Shares Value AEROSPACE & DEFENSE—0.7% BANKS—Continued 28,553 Airbus SE (France)* .............................. $ 2,090 236,142 Svenska Handelsbanken AB (Sweden) ............... $ -

Description Holding Book Cost Market Price Market Value £000'S £000'S

DORSET COUNTY PENSION FUND VALUATION OF PORTFOLIO AT CLOSE OF BUSINESS 31 March 2017 Book Market Description Holding Market Value Cost Price £000's £000's UK EQUITIES MINING ACACIA MINING 33,000 147.93 4.502 148.57 ANGLO AMERICAN ORD USD0.54 270,390 2,804.18 12.27 3,317.69 ANTOFAGASTA ORD GBP0.05 74,500 151.50 8.355 622.45 BHP BILLITON ORD USD0.50 436,926 2,401.54 12.395 5,415.70 CENTAMIN EGYPT LTD 226,000 349.07 1.732 391.43 FRESNILLO 35,500 88.20 15.52 550.96 GLENCORE XSTRATA 2,412,543 5,662.91 3.141 7,577.80 HOCHSCHILD MINING ORD GBP0.25 49,000 108.90 2.765 135.49 KAZ MINERALS 53,600 89.80 4.551 243.93 PETRA DIAMONDS 106,900 169.67 1.329 142.07 POLYMETAL INT'L 53,800 514.30 9.945 535.04 RANDGOLD RESOURCES ORD USD0.05 19,250 485.32 69.7 1,341.73 RIO TINTO ORD GBP0.10 (REG) 250,150 2,876.49 32.185 8,051.08 VEDANTA RESOURCES ORD USD0.10 18,500 75.07 8.11 150.04 Total MINING 15,924.89 28,524.69 OIL & GAS PRODUCERS AFREN PLC 218,000 215.93 0 0.00 BP ORD USD0.25 3,948,100 13,177.95 4.5885 18,115.86 CAIRN ENERGY ORD GBP0.06153846153 119,207 236.32 2.048 244.14 NOSTRUM OIL & GAS 17,700 84.36 4.796 84.89 ROYAL DUTCH 'B' ORD EUR0.07 1,642,961 20,190.09 21.945 36,054.78 TULLOW OIL ORD GBP 0.10 188,500 789.92 1.99026 375.16 Total OIL & GAS PRODUCERS 34,694.58 54,658.45 CHEMICALS CRODA INTL ORD GBP0.10 26,995 211.15 35.77 965.61 ELEMENTIS 99,000 130.23 2.899 287.00 JOHNSON MATTHEY ORD GBP1.00 40,357 446.31 30.82 1,243.80 SYNTHOMER 57,665 118.87 4.751 273.97 VICTREX ORD GBP0.01 17,000 111.61 19.02 323.34 Total CHEMICALS 1,018.16 3,087.91 CONSTRUCTION -

Marketplace Sponsorship Opportunities Information Pack 2017

MarketPlace Sponsorship Opportunities Information Pack 2017 www.airmic.com/marketplace £ Sponsorship 950 plus VAT Annual Conference Website * 1 complimentary delegate pass for Monday www.airmic.com/marketplace only (worth £695)* A designated web page on the MarketPlace Advanced notification of the exhibition floor plan section of the website which will include your logo, contact details and opportunity to upload 20% discount off delegate places any PDF service information documents Advanced notification to book on-site meeting rooms Airmic Dinner Logo on conference banner Advanced notification to buy tickets for the Annual Dinner, 12th December 2017 Logo in conference brochure Access to pre-dinner hospitality tables Opportunity to receive venue branding opportunities Additional Opportunities * This discount is only valid for someone who have never attended an Airmic Conference Airmic can post updates/events for you on before Linked in/Twitter ERM Forum Opportunity to submit articles on technical subjects in Airmic News (subject to editor’s discretion) Opportunity to purchase a table stand at the ERM Forum Opportunity to promote MP content online via @ Airmic Twitter or the Airmic Linked In Group About Airmic Membership Airmic has a membership of about 1200 from about 480 companies. It represents the Insurance buyers for about 70% of the FTSE 100, as well as a very substantial representation in the mid-250 and other smaller companies. Membership continues to grow, and retention remains at 90%. Airmic members’ controls about £5 billion of annual insurance premium spend. A further £2 billion of premium spend is allocated to captive insurance companies within member organisations. Additionally, members are responsible for the payment of insurance claims from their business finances to the value of at least £2 billion per year. -

IMI Plc Annual Report and Accounts 2017 IMI Plc Annual Report & Accounts 2017

IMI plc Annual Report and Accounts 2017 IMI plc Annual Report & Accounts 2017 Engineering GREAT the IMI Way IMI plc Annual Report and Accounts 2017 Our purpose is to deliver Contents great solutions that tackle the Introduction 02-09 most demanding engineering 02 Chairman’s statement 04 Group overview challenges. We help some of 05 IMI eco-system the world’s biggest industrial companies operate their Strategic 10-49 Review† processes safely, cleanly, Our Chief Executive reviews 2017 and outlines our strategy and the progress efficiently and cost effectively. we are making. 12 Chief Executive’s review We operate through three 16 Our strategic model divisions – IMI Critical 18 Strategic growth priorities 28 Operational review Engineering, IMI Precision 34 Corporate responsibility 44 Measurements and targets Engineering and IMI Hydronic 46 How we manage risk Engineering – and employ Corporate approximately 11,000 people Governance 50-85 in over 50 countries around We introduce our Board, and explain our governance structure the world. and how it operates. 52 The Board 54 Letter from the Chairman 55 Corporate Governance Report 60 Audit Committee Report 64 Nominations Committee Report 66 Directors’ Remuneration Report Financial 86-170 Statements Our financial statements for the year presented in a user-friendly format. 88 Finance Director’s introduction 90 Primary statements 98 Section 1 - Basis of preparation 99 Section 2 - Results for the year 110 Section 3 - Operating assets and liabilities 116 Section 4 - Capital structure and financing costs 140 Section 5 - Other notes 146 Directors’ Report † The Strategic Report on pages 10 to 49, 91, 92 to 93, 95 and 97 has been approved by the 168 Five year summary Board of Directors and signed on their behalf by Mark Selway, Chief Executive, on 1 March 2018. -

Chair's Introduction

Governance statement I have also met with a number of our major customers. I see it as an important part of the Chair’s role to have a strong relationship with key customers that complements the depth and breadth of the Group’s management relationships, through a programme of regular senior-level meetings. I intend to develop this role further, and am committed to supporting the continued improving momentum of dialogue with our primary customers. We have been pleased to welcome customers to participate in a number of contract reviews at the Board during the year. I have also enjoyed meeting many of Babcock’s shareholders to hear, directly from them, their views, concerns and Ruth Cairnie priorities. The Board and I are clear about Chair the importance of corporate governance and its role in the long-term success of the Group. Purpose and culture Chair’s introduction At the Board we recognise the essential role that a clear purpose and a strong corporate culture play in assuring the I am pleased to present my first Group’s long-term success. During the year the Board has worked to clarify Chair’s report on the work of the Babcock’s purpose, which we describe on Babcock Board. Since joining the page 10, and we expect to do more on Board in April last year, I have focused this over the coming year. This purpose is underpinned by the corporate culture, much time engaging with Babcock’s based on strong values that I found in stakeholders in order to get a real evidence across my induction visits. -

Prayer Diary May 2010

Monday 24th York Hospital John and Charles Wesley, evangelists, Please pray for the Chaplains, the Revd Stuart Petty, the Revd Andrew Foster Methodist, Father Pat Diocese of York Prayer Diary May 2010 hymn writers, 1791 O Keeffe Roman Catholic, Father Stephen Maughan Roman Catholic Locum, the Revd Ann Vaughan and 1788 Ordinary Methodist, Gillian Eweis C of E. All patients, staff and visitors at York Hospital, Bootham Park time resumes DEL Saturday 1st Bishopthorpe Palace week 8 Hospital and all other units around the city covered by the Team. We give thanks especially for the Philip and James team of chaplaincy volunteers who play such an important part of our work here. Apostles Archbishop of York: The Rt Revd Dr John Sentamu, Chief of Staff: The Revd Malcolm Macnaughton, Chaplain & Diocese of Cueibet (Sudan), Bishop Reuben Makoi Researcher: The Revd Dr Daphne Green, Executive Officer & Researcher: Margaret Pattinson, Director of Communications: Kerron Cross. Tuesday 25th Workplace Chaplain—Chris Cullwick The Venerable Bede, Please pray for the Archbishop in his ministry in church and nation, and in particular for all he does in the monk, scholar, Diocese of Cuernavaca (Mexico), Bishop Ramiro Vera Diocese and Province of York. Please pray for the appointment of a Director for the Archbishop’s Youth Trust, historian, 735 , and for its work in encouraging young leaders and change makers . Aldhelm, bishop,709 Diocese of Chester (York, England), Bishop Peter Forster . Wednesday 26th St Peter’s School Sunday 2nd Augustine, archbishop, York Deanery The Revd Jonathan Daly 5th Sunday of 605 John Calvin, Easter Rural Dean: The Revd Martin Baldock. -

Equities As at 30 June 2014

NOTTINGHAMSHIRE COUNTY COUNCIL PENSION FUND Equity holdings as at 30 June 2014 UK Equities Holding 3I GROUP ORD GBP0.738636 710,208 ABERDEEN ASSET MANAGEMENT ORD 10P 220,000 AGGREKO PLC COM STK GBP0.04832911 57,108 ALENT PLC COMM GBP0.10 90,000 ANGLO AMERICAN PLC ORD US$0.54945 (POST CON) 410,920 ANITE ORD 11.25P 250,000 ARM HOLDINGS ORD 0.05P 480,000 ASSOCIATED BRITISH FOODS ORD 5 15/22P 150,000 ASTRAZENECA GROUP US$0.25 375,000 AVIVA PLC ORD 25P 834,600 BABCOCK INTERNATIONAL GROUP ORD 60P 270,000 BAE SYSTEMS PLC 2.5P 1,327,300 BALFOUR BEATTY PLC ORD 50P 830,000 BARCLAYS PLC ORD 25P 4,450,000 BARRATT DEVELOPMENTS PLC ORD 10P 500,000 BBA AVIATION 252,000 BBGI SICAV SA/FUND 300,000 BELLWAY ORD 12.5P 120,000 BERENDSEN PLC ORD GBP0.30 16,055 BERKELEY GRP HLDG ( 1 NEW ORD & 4 B SHARES) 60,000 BG GROUP PLC ORD 10P 1,100,000 BHP BILLITON US$ 0.50 (UK REGD) 665,963 BODYCOTE PLC ORD 17 3/11P 120,000 BP PLC ORD US$0.25 5,750,000 BRIT (WI) ORD GBP0.01 300,000 BRITISH AMERICAN TOBACCO ORD 25P 500,000 BRITISH LAND CO ORD 25P 360,000 BRITISH SKY BROADCASTING ORD 50P 240,000 BROWN (N) GROUP PLC ORD 11.05263157P 75,000 BT GROUP ORD 5P 2,200,000 BTG ORD 10P 189,386 BUNZL 100,000 CABLE & WIRELESS COMMUNICATION COM STK 1,524,000 CAPITA PLC GBP0.02066666 200,000 CARILLION ORD 50P 450,000 CARNIVAL PLC ORD US$1.66 62,934 CARPETRIGHT ORD 1P 60,000 CENTRICA ORD 6 14/81P 1,800,000 CHESNARA PLC ORD5P 32,580 CITY LONDON IVESTMENTS 82,000 CLIPPER (WI) ORD 0.05P 300,000 COBHAM ORD 2.5P 700,000 COLT GROUP SA COM STK EUR5 413,284 COMPASS GROUP ORD 10P 600,000 CONNECT -

Annual Report 2013

Morgan Advanced Materials plc Materials Advanced Morgan Morgan Advanced Materials plc Quadrant, 55-57 High Street MORGAN ADVANCED MATERIALS PLC Windsor, Berkshire SL4 1LP ANNUAL REPORT 2013 Tel: +44 (0)1753 837000 Fax: +44 (0)1753 850872 www.morganadvancedmaterials.com Annual Report 2013 INNOVATION ONE AMBITION MORGAN INTEGRITY COLLABORATION APPLICATIONS ENGINEERING MATERIALS SCIENCE For more information about Morgan Advanced Materials, ONE please visit our website. MORGAN www.morganadvancedmaterials.com Find out more about Morgan Advanced Materials Morgan Advanced Materials graduate recruitment on Facebook. is committed to building www.facebook.com/morganceramics A sustainable competitive advantage in attractive markets with truly differentiated products and services underpinned by world-leading technology. The Group produces a wide range of specialist, high-specification materials that have extraordinary attributes and properties. Engineered into products, they deliver enhanced performance, often under extreme conditions. The Group’s dynamic, highly skilled people are continuously engaged in finding solutions for complex and technologically demanding applications, which are used all over the world. This Report has been printed in the UK. Our printers are environmental management In short, the group supplies innovative, differentiated system ISO 14001-accredited and Forest Stewardship Council (FSC) chain of custody-certified. All inks used are vegetable-based. This paper is environmentally friendly ECF (elemental chlorine-free) and wood-free with a high content of selected products made from highly technical advanced pre-consumer recycled material. The mill is fully FSC-certified. The paper is also materials which enable its customers’ products and completely bio-degradable and recyclable. If you have finished reading this Report and no longer wish to retain it, please pass it on to processes to perform more efficiently, more reliably other interested readers, return it to Morgan Advanced Materials or dispose of it in your recycled paper waste. -

IBELIEVE in God the Father Almighty

Westminster Abbey EVENSONG MARKING THE FIFTIETH ANNIVERSARY OF THE ANGLICAN CENTRE IN ROME Tuesday 14th June 2016 5.00 pm THE ANGLICAN CENTRE IN ROME The Anglican Centre in Rome was established by the Anglican Communion in 1966 in response to the ecumenical opportunities opened up by the Second Vatican Council. It is the base for the Representative of the Archbishop of Canterbury to the Holy See. The Centre was dedicated on 22nd March 1966 by Archbishop Michael Ramsey, and officially opened on 5th October 1966 by Cardinal Willebrands who said, ‘The Centre will contribute to research, by studies, by conversation, to the dialogue which will be developed in the immediate future. It will contribute by personal contact, by thought, by prayer.’ That is a good definition of what the Centre has done for the last fifty years, and continues to do, contributing to the development of a much closer relationship between the Roman Catholic Church and the Anglican Communion after four centuries of separation. Throughout this period the Centre has occupied an apartment in the Palazzo Doria Pamphilj, in the centre of historic Rome, leased to the Centre by the Doria Pamphilj family at a very modest rent. In 1992 the Centre, which had been funded directly by the Anglican Communion, was incorporated as a UK charity, established to operate and raise funds for the Centre on behalf of the Anglican Communion. The Centre has a library of Anglican theology (about 14,000 volumes) to make information about Anglicanism available to the academic community in Rome. The Centre runs courses to enable Anglicans to become more familiar with the Roman Catholic Church, and symposia to discuss issues of mutual interest.