Financial Reporting by Investment Managers

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Brewin Dolphin Select Managers Fund

MI Brewin Dolphin Select Managers Fund Annual Report 28 February 2019 MI Brewin Dolphin Select Managers Fund Contents Page Directory* . 1 Statement of the Authorised Corporate Director’s Responsibilities . 2 Certification of the Annual Report by the Authorised Corporate Director . 2 Statement of the Depositary’s Responsibilities . 3 Independent Auditor’s Report to the Shareholders . 4 MI Select Managers Bond Fund Investment Objective and Policy* . 6 Investment Adviser's Report* . 6 Portfolio Statement* . 8 Comparative Table* . 24 Statement of Total Return . 26 Statement of Change in Net Assets Attributable to Shareholders . 26 Balance Sheet . 27 Notes to the Financial Statements . 28 Distribution Table . 40 MI Select Managers North American Equity Fund Investment Objective and Policy* . 41 Investment Adviser's Report* . 41 Portfolio Statement* . 43 Comparative Tables* . 49 Statement of Total Return . 51 Statement of Change in Net Assets Attributable to Shareholders . 51 Balance Sheet . 52 Notes to the Financial Statements . 53 Distribution Tables . 60 MI Select Managers UK Equity Fund Investment Objective and Policy* . 61 Investment Adviser's Report* . 61 Portfolio Statement* . 63 Comparative Tables* . 72 Statement of Total Return . 74 Statement of Change in Net Assets Attributable to Shareholders . 74 Balance Sheet . 75 Notes to the Financial Statements . 76 Distribution Tables . 83 MI Select Managers UK Equity Income Fund Investment Objective and Policy* . 84 Investment Adviser's Report* . 84 Portfolio Statement* . 86 Comparative Tables* . 92 Statement of Total Return . 94 Statement of Change in Net Assets Attributable to Shareholders . 94 Balance Sheet . 95 Notes to the Financial Statements . 96 Distribution Tables . 103 General Information* . 104 *These collectively comprise the Authorised Corporate Director’s Report. -

Annual Reports and Accounts 2011

AnnuA l RepoR ts A nd Accounts 2011 • Elgin • Inverness Aberdeen • Aberdeen Dorchester Hereford Marlborough Stoke-on-Trent Blenheim House Hamilton House 35 Bridge Street Woodstock Court Highpoint Fountainhall Road 6 Nantillo Street Hereford Blenheim Road Festival Park Aberdeen, AB15 4DT Poundbury, Dorchester HR4 9DG Marlborough Stoke-on-Trent Dundee • T 01224 267900 Dorset, DT1 3WN T 01432 364 300 Wiltshire, SN8 4AN ST1 5BG T 01305 215770 T 01672 519600 T 01782 210250 Belfast Inverness Waterfront Plaza Dublin Lyle House Newcastle Swansea 8 Laganbank Road Tilman Brewin Dolphin Fairways Business Park Time Central Axis 6 • Edinburgh Belfast 3 Richview Office Park Inverness 30-34 Gallowgate Axis Court Glasgow • BT1 3LY Clonskeagh IV2 6AA Newcastle upon Tyne Mallard Way T 028 9044 6000 Dublin 14 T 01463 225 888 NE1 4SR Swansea Vale T +353 (0) 1 260 0080 T 0191 279 7300 Swansea SA7 0AJ Birmingham W www.tam.ie Jersey T 01792 763960 9 Colmore Row Kingsgate House Norwich Birmingham Dumfries 55 The Esplanade Jacquard House Taunton B3 2BJ 43 Buccleuch Street St Helier Old Bank of England Court Ashford Court Dumfries • T 0121 710 3500 Dumfries, DG1 2AB Jersey, JE2 3QB Queen Street Blackbrook Business Park • Newcastle T 01387 252361 T 01534 703 000 Norwich, NR2 4SX Blackbrook Park Avenue Bradford T 01603 767776 Taunton • Penrith Auburn House Dundee Leeds Somerset Belfast • 8 Upper Piccadilly 31-32 City Quay 34 Lisbon Street Nottingham TA1 2PX • Teesside Bradford Camperdown Street Leeds Waterfront House T 01823 445750 BD1 3NU Dundee, DD1 3JA LS1 4LX Waterfront Plaza T 01274 728 866 T 01382 317200 T 0113 245 9341 Nottingham, NG2 3DQ Teesside T 0115 852 5580 Progress House • York Brighton Edinburgh Leicester Fudan Way • Leeds Invicta House PO Box No. -

Annual Report and Accounts 2013 Annual Report and Accounts 2013

Annual Report and Accounts 2013 Annual Report and Accounts 2013 Brewin Dolphin Holdings PLC, 12 Smithfield Street, London EC1A 9BD T 020 7246 1000 F 020 3201 3001 W brewin.co.uk E [email protected] Brewin Dolphin provides a range of investment management, financial advice and execution only services in the UK and Eire. “Our priorities are clear. They are to reinforce our high standard of service to clients and ensure an improved return to shareholders. Discretionary Investment Management is currently the core of our business model and our mission is to provide a compelling and consistent offering, relevant to all our clients. Over the past decade we have evolved from a stockbroker into a private client investment manager. Our evolution must continue as we strive to become the leading provider of personal Discretionary Wealth Management in the UK.” David Nicol, Chief Executive Investment proposition • Strong client relationships with a long-term track record of personalised service • Growth market with good long-term prospects • New management team with clear goals and a strategy to achieve them • Our strategy will generate value for all stakeholders We are already creating value in 2013 • Total income grew by 9% to £283.7m • Adjusted profit before tax grew by 22% to £52.3m • Adjusted profit margin increased from 16.5% to 18.5% • Discretionary funds under management (FUM) grew by 17% to £21.3bn • Adjusted earnings per share (EPS) grew by 19.2% to 14.9p (2012: 12.5p) • Full year dividend increased by 20% to 8.6p • Total Shareholder Return was 63% Contents Business review Section 1 Business review Financial Highlights 02 Business Highlights 03 Chairman’s Statement 04 Overview of the Business and Strategy 06 Strategic Report 08 A. -

Description Iresscode Exchange Current Margin New Margin 3I

Description IRESSCode Exchange Current Margin New Margin 3I INFRASTRUCTURE PLC 3IN LSE 20 20 888 HOLDINGS PLC 888 LSE 20 20 ASSOCIATED BRITISH ABF LSE 10 10 ADMIRAL GROUP PLC ADM LSE 10 10 AGGREKO PLC AGK LSE 20 20 ASHTEAD GROUP PLC AHT LSE 10 10 ANTOFAGASTA PLC ANTO LSE 15 10 ASOS PLC ASC LSE 20 20 ASHMORE GROUP PLC ASHM LSE 20 20 ABERFORTH SMALLER COM ASL LSE 20 20 AVEVA GROUP PLC AVV LSE 20 20 AVIVA PLC AV LSE 10 10 ASTRAZENECA PLC AZN LSE 10 10 BABCOCK INTERNATIONAL BAB LSE 20 20 BARR PLC BAG LSE 25 20 BARCLAYS PLC BARC LSE 10 10 BRITISH AMERICAN TOBA BATS LSE 10 10 BAE SYSTEMS PLC BA LSE 10 10 BALFOUR BEATTY PLC BBY LSE 20 20 BARRATT DEVELOPMENTS BDEV LSE 10 10 BARING EMERGING EUROP BEE LSE 50 100 BEAZLEY PLC BEZ LSE 20 20 BH GLOBAL LIMITED BHGG LSE 30 100 BOWLEVEN PLC BLVN LSE 60 50 BANKERS INVESTMENT BNKR LSE 20 20 BUNZL PLC BNZL LSE 10 10 BODYCOTE PLC BOY LSE 20 20 BP PLC BP LSE 10 10 BURBERRY GROUP PLC BRBY LSE 10 10 BLACKROCK WORLD MININ BRWM LSE 20 65 BT GROUP PLC BT-A LSE 10 10 BRITVIC PLC BVIC LSE 20 20 BOVIS HOMES GROUP PLC BVS LSE 20 20 BROWN GROUP PLC BWNG LSE 25 20 BELLWAY PLC BWY LSE 20 20 BIG YELLOW GROUP PLC BYG LSE 20 20 CENTRAL ASIA METALS PLC CAML LSE 40 30 CLOSE BROTHERS GROUP CBG LSE 20 20 CARNIVAL PLC CCL LSE 10 10 CENTAMIN PLC CEY LSE 20 20 CHARIOT OIL & GAS LTD CHAR LSE 100 100 CHEMRING GROUP PLC CHG LSE 25 20 CONYGAR INVESTMENT CIC LSE 50 40 CALEDONIA INVESTMENTS CLDN LSE 25 20 CARILLION PLC CLLN LSE 100 100 COMMUNISIS PLC CMS LSE 50 100 CENTRICA PLC CNA LSE 10 10 CAIRN ENERGY PLC CNE LSE 30 30 COBHAM PLC -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Jupiter Green Investment Trust PLC Report & Accounts for the Year Ended 31 March 2012

Jupiter Green Investment Trust PLC Report & Accounts for the year ended 31 March 2012 JUPITER GREEN INVESTMENT TRUST PLC Annual Report and Accounts 2012 ■ Contents Investment Objective, Investment Policy, Investment Approach and Benchmark Index 2 Dividend Policy, Planned Life of the Company and Discount Control 4 Company Information 5 Directors 6 Financial Highlights 7 Chairman’s Statement 8 Manager’s Review 9 Portfolio Investments 10 Company Profiles for Top Twenty Investments 12 Sector and Geographical Analysis of Investments 13 Report of the Directors 14 Directors’ Remuneration Report 21 Directors’ Responsibilities for the Financial Statements 23 Independent Auditors’ Report 24 Statement of Comprehensive Income 25 Statement of Financial Position 26 Statement of Changes in Equity 27 Cash Flow Statement 28 Notes to the Accounts 29 Notice of Annual General Meeting 40 Important Risk Warnings 43 Investor Information 44 Form of Proxy Form of Direction 1 JUPITER GREEN INVESTMENT TRUST PLC Annual Report and Accounts 2012 ■ Investment Objective, Investment Policy, Investment Approach and Benchmark Index Investment Objective The Company’s investment objective is to generate long-term capital growth through a diverse portfolio of companies providing environmental solutions. Investment Policy The Company invests globally in companies which have a significant focus on environmental solutions. Specifically, the Company looks to invest across three key areas: infrastructure, resource efficiency and demographics. The Company’s portfolio has a bias towards small and medium capitalisation companies. It invests primarily in securities which are quoted, listed or traded on a recognised exchange. However, up to 5 per cent. of the Company’s Total Assets (at the time of such investment) may be invested in unlisted securities. -

Finn-Ancial Times Finncap Financials & Insurance Quarterly Sector Note

finn-ancial Times finnCap Financials & Insurance quarterly sector note Q3 2020 | Issue 9 Highlights this quarter: Elevated uncertainty and volatility have been hallmarks of the last 18 months, with Brexit, the UK General Election and more recently COVID-19 all contributing to the challenges that face investors wishing to carve out solid and stable returns amid these ‘unprecedented’ times. With this is mind, and simulating finnCap’s proven Slide Rule methodology, we found the highest quality and lowest value stocks across the financials space, assessing how the make-up of these lists changed over the period January 2019 to July 2020, tracking indexed share price performance over the period as well as movements in P/E and EV/EBIT valuations. The top quartile list of Quality companies outperformed both the Value list and the FTSE All Share by rising +2.5% over the period versus -5.4% for the All Share and -14.3% for Value stocks. Furthermore, the Quality list had protection on the downside in the market crash between February and March 2020, and accelerated faster amid the market rally between late March and July 2020. From high to low (January to March), Quality moved -36.3% against the Value list at -45.5%, while a move off the lows to July was +37.4% for Quality and +34.0% for Value. There was some crossover between the Quality and Value lists, with 7 companies of the top quartile (16 companies in total) appearing in both the Quality and Value lists. This meant that a) investors could capture what we call ‘Quality at Value’ (i.e. -

Brewin Dolphin Holdings PLC Annual Report and Accounts 2015 Accounts and Report Annual

Brewin Dolphin Holdings PLC Holdings Dolphin Brewin Annual Report and Accounts 2015 Brewin Dolphin Holdings PLC Annual Report and Accounts 2015 Contents Overview 34 Corporate Responsibility 82 Directors’ Responsibilities 96 Consolidated Cash 02 Highlights 40 Resources and Relationships 83 Independent Auditor’s Report Flow Statement 04 Chairman’s Statement 97 Company Cash Flow Statement Governance Financial Statements 98 Notes to the Financial Strategic Report 44 Chairman’s Introduction 90 Consolidated Income Statement Statements 08 Business Overview to Governance 91 Consolidated Statement of 10 Business Model 46 Directors and their Biographies Comprehensive Income Additional Information 12 Market Environment 48 Corporate Governance Report 92 Consolidated Balance Sheet 148 Five Year Record Continuing 14 Our Strategy 53 Board Risk Committee Report 93 Consolidated Statement of Operations (unaudited) 16 Chief Executive’s Statement 56 Audit Committee Report Changes in Equity 149 Appendix – Calculation of KPIs 20 Measuring Our Performance 62 Nomination Committee Report 94 Company Balance Sheet 150 Glossary 23 Results 64 Directors’ Remuneration Report 95 Company Statement of Changes 151 Shareholder Information 30 Principal Risks and Uncertainties 80 Other Statutory Information in Equity 152 Branch Address List Brewin Dolphin Holdings PLC Annual Report and Accounts 2015 Overview Brewin Dolphin provides a range of investment management and financial advice services in the Strategic Report United Kingdom, Channel Islands and the Republic of Ireland. -

FTSE Factsheet

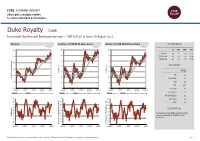

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Duke Royalty DUKE Investment Banking and Brokerage Services — GBP 0.4125 at close 10 August 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 10-Aug-2021 10-Aug-2021 10-Aug-2021 0.45 140 140 1D WTD MTD YTD Absolute -2.4 -1.2 -1.8 35.2 130 130 0.4 Rel.Sector -2.4 -0.5 -3.6 25.9 Rel.Market -2.8 -1.7 -3.7 20.9 120 120 0.35 VALUATION 110 110 0.3 Trailing 100 100 Relative Price Relative Price Relative 0.25 PE -ve Absolute Price (local (local currency) AbsolutePrice 90 90 EV/EBITDA -ve 0.2 80 80 PB 2.0 PCF 28.1 0.15 70 70 Div Yield 4.6 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Price/Sales -ve Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.2 90 90 90 Div Payout -ve 80 80 80 ROE -ve 70 70 70 Share Index) Share Share Sector) Share - 60 - 60 60 DESCRIPTION 50 50 50 40 40 The Company is a globally focused investment 40 RSI RSI (Absolute) 30 30 company specialising in diversified royalty investment. -

Stoxx® Europe Total Market Financial Services Index

STOXX® EUROPE TOTAL MARKET FINANCIAL SERVICES INDEX Components1 Company Supersector Country Weight (%) LONDON STOCK EXCHANGE Financial Services GB 10.21 DEUTSCHE BOERSE Financial Services DE 9.72 INVESTOR B Financial Services SE 8.23 PARTNERS GRP HLDG Financial Services CH 5.46 3I GROUP PLC. Financial Services GB 4.58 STANDARD LIFE ABERDEEN Financial Services GB 3.39 EXOR NV Financial Services IT 2.91 INVESTOR A Financial Services SE 2.82 GRP BRUXELLES LAMBERT Financial Services BE 2.74 M&G Financial Services GB 2.63 HARGREAVES LANSDOWN Financial Services GB 2.32 INTERMEDIATE CAPITAL GRP Financial Services GB 2.01 KINNEVIK B Financial Services SE 1.93 SCHRODERS Financial Services GB 1.68 AMUNDI Financial Services FR 1.54 EURONEXT Financial Services FR 1.41 INDUSTRIVARDEN A Financial Services SE 1.37 INDUSTRIVARDEN C Financial Services SE 1.32 INVESTEC Financial Services GB 1.24 WENDEL Financial Services FR 1.20 QUILTER Financial Services GB 1.17 ACKERMANS & VAN HAAREN Financial Services BE 1.14 SOFINA Financial Services BE 1.09 IG GRP HLDG Financial Services GB 1.08 MAN GRP Financial Services GB 1.04 PARGESA Financial Services CH 1.01 TP ICAP Financial Services GB 0.98 EURAZEO Financial Services FR 0.98 ASHMORE GRP Financial Services GB 0.97 BOLSAS Y MERCADOS ESPANOLES Financial Services ES 0.93 GRENKE N Financial Services DE 0.92 AZIMUT HLDG Financial Services IT 0.84 ONESAVINGS BANK Financial Services GB 0.80 JUPITER FUND MANAGEMENT Financial Services GB 0.79 JOHN LAING GROUP Financial Services GB 0.78 LATOUR INVESTMENT B Financial -

Chrysalis Investments Limited

THIS PROSPECTUS IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to what action you should take you are recommended to seek your own financial advice immediately from your stockbroker, bank, solicitor, accountant or other independent financial adviser who is authorised under the Financial Services and Markets Act 2000 (the “FSMA”) if you are in the United Kingdom, or from another appropriately authorised independent financial adviser if you are in a territory outside the United Kingdom. This Prospectus comprises a prospectus relating to Chrysalis Investments Limited (the “Company”) in connection with the issue of Shares, prepared in accordance with the Prospectus Regulation Rules of the Financial Conduct Authority made pursuant to section 73A of the FSMA. This Prospectus has been approved by the Financial Conduct Authority for the purposes of the UK version of Regulation (EU) 2017/1129 (the “EU Prospectus Regulation”) which forms part of UK law by virtue of the European Union (Withdrawal) Act 2018 (the “UK Prospectus Regulation”). The Financial Conduct Authority only approves this Prospectus, as the competent authority under the Prospectus Regulation Rules, as meeting the standards of completeness, comprehensibility and consistency imposed by the UK Prospectus Regulation. Such approval should not be considered as an endorsement of the Company that is the subject of this Prospectus or of the quality of the Shares. This Prospectus has been drawn up and published in accordance with the UK Prospectus Regulation. Investors should make their own assessment as to the suitability of investing in the Shares. The Shares are only suitable for investors: (i) who understand and are willing to assume the potential risks of capital loss and that there may be limited liquidity in the underlying investments of the Company; (ii) for whom an investment in the Shares is part of a diversified investment programme; and (iii) who fully understand and are willing to assume the risks involved in such an investment.