Rolling Stock Perspective

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

This Document Is Important and Requires Your Immediate Attention

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in doubt as to any aspect of this circular or as to the action to be taken, you should consult a licensed securities dealer or registered institution in securities, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in the Company, you should at once hand this circular and the accompanying form of proxy to the purchaser or the transferee or to the bank, licensed securities dealer, registered institution in securities or other agent through whom the sale or transfer was effected for transmission to the purchaser or the transferee. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. This circular is for information purposes only and is being provided to you solely for the purpose of considering the resolutions to be voted upon at the SGM to be held on Tuesday, 24 November 2015. This circular does not constitute an offer to issue or sell or an invitation of an offer to acquire, purchase or subscribe for securities in Hong Kong, the United States or any other jurisdiction, nor is it intended to invite any such offer or invitation. Securities may not be offered or sold in the United States absent registration or an exemption from registration under the U.S. -

GRAHAM FARISH PRODUCTS by ITEM NUMBER COLOUR(S) & ITEM № RUNNING №(S)

GRAHAM FARISH PRODUCTS BY ITEM NUMBER COLOUR(S) & ITEM № RUNNING №(s). FULL DESCRIPTION LIVERIES Junior Starter Set consisting of Item A) General Purpose 0-6-0T Tank locomotive, Running Number 268 in Southern Green Livery, Item B) 12 Ton Planked Vent Van, Running Number 5 in 370-025 268, 5, 5014 Green, Brown & Red 'Worthington' Brown Livery, Item C) 7 Plank Wagon End Door Wagon, Running Number 5014 in 'CARLTON MAIN COLLIERY CO. LTD' Red Livery, Item D) 20 Ton LMS Brake Van, in SR Brown Livery, Item E) 8 Pieces 379-452 track, Item F) Bachmann A/C Mains Transformer & Controller Junior Starter Set consisting of Item A) General Purpose 0-6-0T Tank locomotive, Running Number 7309 in LMS Crimson Livery, Item B) 12 Ton Planked Vent Van, Running Number 5 in 370-025A 7309, 5, 5014 Crimson, Brown, Grey & Red 'Worthington' Brown Livery, Item C) 7 Plank Wagon End Door Wagon, Running Number 5014 in 'CARLTON MAIN COLLIERY CO. LTD' Red Livery, Item D) 20 Ton LMS Brake Van in SR Grey Livery, Item E) 8 Pieces 379-452 track, Item F) Bachmann A/C Mains Transformer & Controller Junior Starter Set consisting of Item A) J94 Class 0-6-0 Saddle Tank Locomotive, Running Number 68040 in BR Black Livery with Late Crest, Item B) 12 Ton Planked Vent Van, Running Number 68040, 505969, 346 & 370-050 Black, Brown, Grey & Orange 505969 in LMS Grey Livery, Item C) 7 Plank Wagon End Door Wagon, Running Number 346 in 'J. R. WOOD CO. LTD' Orange Livery, Item D) 20 Ton LMS Brake Van, Running Number NE151752 NE151752 in BR Brown Livery, Item E) 8 Pieces 379-452 track, Item -

Records of Wolverton Carriage and Wagon Works

Records of Wolverton Carriage and Wagon Works A cataloguing project made possible by the Friends of the National Railway Museum Trustees of the National Museum of Science & Industry Contents 1. Description of Entire Archive: WOLV (f onds level description ) Administrative/Biographical History Archival history Scope & content System of arrangement Related units of description at the NRM Related units of descr iption held elsewhere Useful Publications relating to this archive 2. Description of Management Records: WOLV/1 (sub fonds level description) Includes links to content 3. Description of Correspondence Records: WOLV/2 (sub fonds level description) Includes links to content 4. Description of Design Records: WOLV/3 (sub fonds level description) (listed on separate PDF list) Includes links to content 5. Description of Production Records: WOLV/4 (sub fonds level description) Includes links to content 6. Description of Workshop Records: WOLV/5 (sub fonds level description) Includes links to content 2 1. Description of entire archive (fonds level description) Title Records of Wolverton Carriage and Wagon Works Fonds reference c ode GB 0756 WOLV Dates 1831-1993 Extent & Medium of the unit of the 87 drawing rolls, fourteen large archive boxes, two large bundles, one wooden box containing glass slides, 309 unit of description standard archive boxes Name of creators Wolverton Carriage and Wagon Works Administrative/Biographical Origin, progress, development History Wolverton Carriage and Wagon Works is located on the northern boundary of Milton Keynes. It was established in 1838 for the construction and repair of locomotives for the London and Birmingham Railway. In 1846 The London and Birmingham Railway joined with the Grand Junction Railway to become the London North Western Railway (LNWR). -

Serial Asset Type Active Designation Or Undertaking?

Serial Asset Type Active Description of Record or Artefact Registered Disposal to / Date of Designation, Designation or Number Current Designation Class Designation Undertaking? Responsible Meeting or Undertaking Organisation 1 Record YES Brunel Drawings: structural drawings 1995/01 Network Rail 22/09/1995 Designation produced for Great Western Rly Co or its Infrastructure Ltd associated Companies between 1833 and 1859 [operational property] 2 Disposed NO The Gooch Centrepiece 1995/02 National Railway 22/09/1995 Disposal Museum 3 Replaced NO Classes of Record: Memorandum and Articles 1995/03 N/A 24/11/1995 Designation of Association; Annual Reports; Minutes and working papers of main board; principal subsidiaries and any sub-committees whether standing or ad hoc; Organisation charts; Staff newsletters/papers and magazines; Files relating to preparation of principal legislation where company was in lead in introducing legislation 4 Disposed NO Railtrack Group PLC Archive 1995/03 National Railway 24/11/1995 Disposal Museum 5 YES Class 08 Locomotive no. 08616 (formerly D 1996/01 London & 22/03/1996 Designation 3783) (last locomotive to be rebuilt at Birmingham Swindon Works) Railway Ltd 6 Record YES Brunel Drawings: structural drawings 1996/02 BRB (Residuary) 22/03/1996 Designation produced for Great Western Rly Co or its Ltd associated Companies between 1833 and 1859 [Non-operational property] 7 Record YES Brunel Drawings: structural drawings 1996/02 Network Rail 22/03/1996 Designation produced for Great Western Rly Co or its Infrastructure -

COF-IPS-03 Digital Displacement for Non-Passenger Rail

Digital Displacement for Non-Passenger Rail (COF-IPS-03) Final Report Gordon Voller, Engineering Manager, Artemis Intelligent Power Ltd Win Rampen, Founder Director, Artemis Intelligent Power Ltd Stephen Laird, Research Manager, Artemis Intelligent Power Ltd Andy Martlew, T & RS Development Engineer, Direct Rail Services Paul Allen, Professor of Railway Engineering, University of Huddersfield Messaoud Mehafdi, Senior Lecturer in Accountancy, University of Huddersfield 18 June 2020 1 Executive Summary This project studies the feasibility of using Digital Displacement hydraulics in non- passenger rail vehicle applications in order to reduce emissions from diesel powered vehicles and provide more efficient transfer of power from future alternative fuel and electric powered vehicles. Artemis Intelligent Power is the global leader in Digital Displacement hydraulics – a fundamental innovation which offers a radical increase in efficiency and control for a wide range of applications. It can be delivered as a ‘straight swap’ for conventional hydraulic pumps or can be integrated to bring system-wide benefits including improved control and reduced fuel consumption. Artemis is working closely with majority owner Danfoss Power Solutions to further develop the core technology and bring a number of ground-breaking, sector-specific applications to the rail, off-highway and industrial markets. The project was completed in two phases, an initial research phase looking at each application area in non-passenger rail, followed by a more in-depth study of -

Business Highlights

Business Highlights January to June Hutchison Global Communications Limited (“HGC”) GAMECO breaks ground for its Qingyuan Landing launches its Retail Cloud solution to enterprises of Gear Overhaul Base Longwan Shop in South China. all sizes. The Cheung Kong Group completes its reorganisation A S Watson Group’s Health & Beauty Benelux has and creates CK Hutchison Holdings Limited and reached an agreement to acquire all 50 stores of Cheung Kong Property Holdings Limited. the Dirx health and beauty retail network with an additional five locations being rolled out in the CKI and Power Assets Holdings Limited (“Power Netherlands. Assets”) introduce a strategic investor, Qatar Investment Authority, to HK Electric Investments CK Life Sciences Int’l (Holdings) Inc (“CK Life (“HKEI”) through the sale of interests in HKEI. Sciences”) completes the acquisition of three of McWilliam’s vineyards in Australia. Barcelona Europe South Terminal acquires 20% shareholding interest in Depot tmZ Husky Energy commences oil production at the Services S.L.. Sunrise Energy Project in northern Alberta and starts steaming at the second of its two processing Husky Energy commences production at the South plants in the second half of the year. White Rose project in the Jeanne d’Arc Basin offshore Newfoundland and Labrador. 3 UK reaches agreement with Telefónica SA to acquire O2 UK to provide UK customers with better 3 Hong Kong harnesses the combined strengths service and innovation. of 4G LTE and Wi-Fi to launch Voice Over Wi-Fi service. CK Hutchison and CKI complete the acquisition of Eversholt Rail Group, a rolling stock company in the UK, for an enterprise value of approximately £2.5 billion. -

2019-01 20 Point Plan Issue14.Pdf

Fleet Management Good Practice Guide – 20 Point Plan Issue 14 – January 2019 AMENDMENT RECORD Issue Dated Notes Section 2: MP code removed from Technical incident reasons 14 December 2018 table “701D” 14 December 2018 Inclusion of new Section 10: Managing Ageing Rolling Stock 14 December 2018 Sections new cover inserted 14 December 2018 General document sections restructure 14 December 2018 Gary Cooper’s foreword updated Fleet Management Good Practice Guide: Issue 14 - January 2019 ii Foreword Our customers’ needs have been consistent ever since the birth of the railway, whether they are passengers, or businesses that send freight by rail, and the message is simply: run my train on time. Meeting this need is a priority for all of us in rail, and the desire for on-time service delivery shows in the correlation between punctuality and customer satisfaction and, in turn, the correlation between customer satisfaction and rail businesses’ revenues. It is important therefore, for the industry and the country as well as customers that we run punctual trains. We have been failing to do this for too long. After improving performance every month from 2002 – 2011, we now repeatedly miss the punctuality levels that TOCs and NR Routes agree they will deliver. The reliability of the vehicles we operate is part of that under-delivery and we have to do better. In 2013, the fleet planned a national passenger fleet performance challenge of delivering 11 500 MTIN by March 2019, a 20% improvement in reliability over this five- year control period. The reality is that we are likely to deliver only 9 000 MTIN by then. -

The Treachery of Strategic Decisions

The treachery of strategic decisions. An Actor-Network Theory perspective on the strategic decisions that produce new trains in the UK. Thesis submitted in accordance with the requirements of the University of Liverpool for the degree of Doctor in Philosophy by Michael John King. May 2021 Abstract The production of new passenger trains can be characterised as a strategic decision, followed by a manufacturing stage. Typically, competing proposals are developed and refined, often over several years, until one emerges as the winner. The winning proposition will be manufactured and delivered into service some years later to carry passengers for 30 years or more. However, there is a problem: evidence shows UK passenger trains getting heavier over time. Heavy trains increase fuel consumption and emissions, increase track damage and maintenance costs, and these impacts could last for the train’s life and beyond. To address global challenges, like climate change, strategic decisions that produce outcomes like this need to be understood and improved. To understand this phenomenon, I apply Actor-Network Theory (ANT) to Strategic Decision-Making. Using ANT, sometimes described as the sociology of translation, I theorise that different propositions of trains are articulated until one, typically, is selected as the winner to be translated and become a realised train. In this translation process I focus upon the development and articulation of propositions up to the point where a winner is selected. I propose that this occurs within a valuable ‘place’ that I describe as a ‘decision-laboratory’ – a site of active development where various actors can interact, experiment, model, measure, and speculate about the desired new trains. -

Chiltern Railways Passenger Board Annual Report 2013

CHILTERN RAILWAYS PASSENGER BOARD ANNUAL REPORT 2013-2014 Ian Rivett – Chairman Nick Walker – Vice Chairman Chairman’s Introduction: This is the twelfth Annual Report of the Chiltern Railways Passenger Board and summarises the key issues affecting Chiltern Railways in the past year and the valuable contributions made by the Board in discussions at each of the meetings and in correspondence. The Board plays an important role in providing the opportunity for Chiltern Railways senior management to present their plans and to be held accountable for any performance issues. The Board also acts as an information source, to enable Chiltern Railways senior managers to understand the issues and concerns that directly affect the passengers who use the services. Background: The Chiltern Railways Passenger Board was established in April 2002. Facilitating the Board is a requirement of the Chiltern Franchise agreement (schedule 13 – clause 11.7) which requires that: The Board meets at least once each year and seeks to ensure that Chiltern Railways conducts its business in the best interest of passengers. The Board comprises of representatives from Passenger User Groups and Local Authorities along the Chiltern Railways line of route. The Board monitors the operational performance of Chiltern Railways and reviews infrastructure upgrades, passenger’s facilities, timetable changes, fares proposals and passenger satisfaction surveys and supports integrated transport schemes proposals. Chairman’s Comment: Another challenging year for Chiltern Railways, particularly with the closure of the Bicester Town to Oxford line for major upgrade works. The procurement of a long term rail replacement bus service between Bicester Town and Oxford with new double deck buses (see header picture), specially modified to carry bicycles and emblazoned with the strapline “Next Stop, London Marylebone”. -

Annual Report 2014

CHEUNG KONG INFRASTRUCTURE HOLDINGS LIMITED CHEUNG KONG CHEUNG KONG INFRASTRUCTURE HOLDINGS LIMITED (Incorporated in Bermuda with limited liability) (Stock Code: 1038) ANNUAL REPORT 2014 ANNUAL CHEUNG KONG INFRASTRUCTURE HOLDINGS LIMITED 12th Floor, Cheung Kong Center, 2 Queen’s Road Central, Hong Kong Tel: (852) 2122 3133 Fax: (852) 2501 4550 www.cki.com.hk Annual Report 2014 CKI is the largest publicly listed infrastructure company in Hong Kong with diversified investments in Energy Infrastructure, Transportation Infrastructure, Water Infrastructure, Waste Management and Infrastructure Related Business. Operating in Hong Kong, Mainland China, the United Kingdom, the Netherlands, Australia, New Zealand and Canada, it is a leading player in the global infrastructure arena. 01E_CKI039_Cover_AW.indd 2 15年3月26日 下午3:25 CONTENTS 008 082 Ten-year Financial Summary Consolidated Statement of 010 Financial Position Chairman’s Letter 083 016 Consolidated Statement of Group Managing Director’s Report Changes in Equity 021 084 Long Term Development Strategy Consolidated Statement of Cash Flows 022 Awards 085 Notes to the Consolidated 026 Financial Statements Business Review 028 Investment in Power Assets 145 030 Infrastructure Investment in United Kingdom Principal Subsidiaries 036 Infrastructure Investment in Australia 040 Infrastructure Investment in New Zealand 146 042 Infrastructure Investment in Netherlands Principal Associates 044 Infrastructure Investment in Canada 046 Infrastructure Investment in Mainland China 148 047 Investment in Infrastructure -

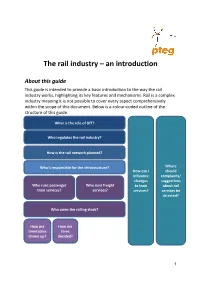

The Rail Industry – an Introduction

The rail industry – an introduction About this guide This guide is intended to provide a basic introduction to the way the rail industry works, highlighting its key features and mechanisms. Rail is a complex industry meaning it is not possible to cover every aspect comprehensively within the scope of this document. Below is a colour-coded outline of the structure of this guide. What is the role of DfT? Who regulates the rail industry? How is the rail network planned? Who’s responsible for the infrastructure? Where How can I should influence complaints/ changes suggestions Who runs passenger Who runs freight to train about rail train services? services? services? services be directed? Who owns the rolling stock? How are How are timetables fares drawn up? decided? 1 What is the role of DfT? The role of the Department for Transport (DfT) in the running of the railways is to provide strategic direction and to procure rail services and projects that only it can specify. Responsibility for day-to-day delivery of railway services rests with the industry. Visit http://www.dft.gov.uk/rail/ for more information. Who regulates the rail industry? The Office of Rail Regulation (ORR) is the independent economic and safety regulator for the railways. On the economic side it: Regulates Network Rail’s stewardship of the national rail network. Licences operators of railway assets. Approves track, station, light maintenance depot access. Investigates potential breaches of the Competition Act 1998 (alongside the Office of Fair Trading). On the safety side it seeks to secure the safe operation of the railway system and protect staff and the public from health and safety risks arising from the railways. -

View Annual Report

FirstGroupplc Principal and registered office London office FirstGroup plc FirstGroup plc 395 King Street 50 Eastbourne Terrace Aberdeen AB24 5RP Paddington Keeping people Tel. +44 (0)1224 650100 London W2 6LG Fax. +44 (0)1224 650140 Tel. +44 (0)20 7291 0505 Ann Registered in Scotland Fax. +44 (0)20 7436 3337 ualReport and Accounts 2012 number SC157176 www.firstgroup.com moving and Printed in the UK by Royle Print, a Carbon Neutral printing company, on material made from 100% post consumer waste; the printer and paper communities manufacturing mill are both accredited with ISO 14001 environmental management systems standard and both are Forestry Stewardship Council certified. When you have finished with this report, please dispose of it in your recycled waste stream. prospering www.firstgroup.com Annual Report and Accounts 2012 Overview About us Shareholder profile At 23 May 2012 Number of shareholders % Shares held % Performance By category FirstGroup plc is the leading transport Individuals 37,892 95.0 46,748,910 9.7 operator in the UK and North America. Banks and Nominees 1,695 4.3 427,940,406 88.8 Insurance and assurance 1 – 300 – With revenues of over £6.5 billion per Other companies 114 0.3 1,889,454 0.4 Other institutions 150 0.4 5,488,100 1.1 annum and approximately 124,000 39,852 100.0 482,067,170 100.0 employees we transport more than By size of holding 1-1,000 30,642 76.9 8,011,808 1.7 Governance 2.5 billion passengers every year. 1,001-5,000 7,138 17.9 15,759,366 3.3 5,001-10,000 1,072 2.7 7,428,005 1.5 In our increasingly congested world 10,001-100,000 699 1.7 19,184,334 4.0 we help to keep people moving and Over 100,000 301 0.8 431,683,657 89.5 39,852 100.0 482,067,170 100.0 communities prospering.