Guide to Investing in Algeria

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Trade and Improving the Coitions of Access for Its Products to the Community Market

No L 141/98 Official Journal of the European Communities 28 . 5 . 76 INTERIM AGREEMENT between the European Economic Community and the Kingdom of Morocco THE COUNCIL OF THE EUROPEAN COMMUNITIES, of the one part, and HIS MAJESTY THE KING OF MOROCCO, of the other part, PREAMBLE WHEREAS a Cooperation Agreement between the European Economic Community and the Kingdom of Morocco was signed this day in Rabat; WHEREAS pending the entry into force of that Agreement, certain provisions of the Agreement relating to trade in goods should be implemented as speedily as possible by means of an Interim Agreement, HAVE DECIDED to conclude this Agreement, and to this end have designated as their Plenipotentiaries : THE COUNCIL OF THE EUROPEAN COMMUNITIES : Gaston THORN, President-in-Office of the Council of the European Communities, President and Minister for Foreign Affairs of the Government of the Grand Duchy of Luxembourg ; Claude CHEYSSON, Member of the Commission of the European Communities ; THE KINGDOM OF MOROCCO, Dr Ahmed LARAKI, Minister of State responsible for Foreign Affairs. TITLE I a view to increasing the rate of growth of Morocco's trade and improving the coitions of access for its products to the Community market. TRADE COOPERATION A. Industrial products Article 1 Article 2 The object of this Agreement is to promote trade between the Contracting Parties, taking account of 1 . Subject to the special provisions of Articles 4, their respective levels of development and of the 5 and 7, products originating in Morocco which are need to ensure a better balance in their trade, with not listed in Annex II to the Treaty establishing the 28 . -

Cortés After the Conquest of Mexico

CORTÉS AFTER THE CONQUEST OF MEXICO: CONSTRUCTING LEGACY IN NEW SPAIN By RANDALL RAY LOUDAMY Bachelor of Arts Midwestern State University Wichita Falls, Texas 2003 Master of Arts Midwestern State University Wichita Falls, Texas 2007 Submitted to the Faculty of the Graduate College of the Oklahoma State University in partial fulfillment of the requirements for the Degree of DOCTOR OF PHILOSOPHY December, 2013 CORTÉS AFTER THE CONQUEST OF MEXICO: CONSTRUCTING LEGACY IN NEW SPAIN Dissertation Approved: Dr. David D’Andrea Dissertation Adviser Dr. Michael Smith Dr. Joseph Byrnes Dr. James Cooper Dr. Cristina Cruz González ii Name: Randall Ray Loudamy Date of Degree: DECEMBER, 2013 Title of Study: CORTÉS AFTER THE CONQUEST OF MEXICO: CONSTRUCTING LEGACY IN NEW SPAIN Major Field: History Abstract: This dissertation examines an important yet woefully understudied aspect of Hernán Cortés after the conquest of Mexico. The Marquisate of the Valley of Oaxaca was carefully constructed during his lifetime to be his lasting legacy in New Spain. The goal of this dissertation is to reexamine published primary sources in light of this new argument and integrate unknown archival material to trace the development of a lasting legacy by Cortés and his direct heirs in Spanish colonial Mexico. Part one looks at Cortés’s life after the conquest of Mexico, giving particular attention to the themes of fame and honor and how these ideas guided his actions. The importance of land and property in and after the conquest is also highlighted. Part two is an examination of the marquisate, discussing the key features of the various landholdings and also their importance to the legacy Cortés sought to construct. -

Mediterranean Action Plan

UNITED NATIONS ENVIRONMENT PROGRAMME MEDITERRANEAN ACTION PLAN MED POL WORLD HEALTH ORGANIZATION MUNICIPAL WASTEWATER TREATMENT PLANTS IN MEDITERRANEAN COASTAL CITIES LES STATIONS D’EPURATON DES EAUX USEES MUNICIPALES DANS LES VILLES COTIERES DE LA MEDITERRANEE MAP Technical Reports Series No. 128 UNEP/MAP Athens, 2000 Note: The designations employed and the presentation of the material in this document do not imply the expression of any opinion whatsoever on the part of UNEP/MAP concerning the legal status of any State, Territory, city or area, or of its authorities, or concerning the delimitation of their frontiers or boundaries. Responsibility for the preparation of this document was entrusted to WHO (Dr. G. Kamizoulis). Data provided by National MED POL Coordinators have also been included in this report. Note: Les apppellations employées dans ce document et la présentation des données qui y figurent n'impliquent de la part du PNUE/PAM aucune prise de position quant au statut juridique des pays, territoires, villes ou zones, ou de leurs authorités, ni quant au tracé de leurs frontières ou limites. La responsibilité de l’élaboration de ce document a été confée à l’OMS (Dr. G. Kamizoulis). Des données communiquées par les Coordonnateurs naionaux pur le MED POL on également incluses dans le rapport. © 2001 United Nations Environment Programme / Mediterranean Action Plan (UNEP/MAP) P.O. Box 18019, Athens, Greece © 2001 Programme des Nations Unies pour l'environnement / Plan d’action pur la Méditerranée (PNUE/PAM) B.P. 18019, Athènes, Grèce ISBN 92 807 1963 7 This publication may be reproduced in whole or in part and in any form for educational or non-profit purposes without special permission from the copyright holder, provided acknowledgement of the source is made. -

Evapotranspirations.Pdf

100 200 300 400 500 600 700 800 900 1000 1100 1200 1300 1400 1500 1600 44 Bi z ert e 48 48 E E 47 46 Kelibia N 32 Chet aibi Tabarka 40 Tu ni s - C. 43 46 37 A Collo 36 41 T un is -M. R 35 Annaba El Kala R 46 30 Skikda Beja 40 B. El-Amri E 42 38 Ain El Ksar 41 Ain Draham T 35 33 33 49 I Dellys-Afir 44 Jijel 31 Medjez el bab Nabeul 500 38 AghribCap Sigli 37 39 500 D 45 Bejaïa Guenitra Ben Mehidi E A lger 43 40Tizi Ouzou 42 El Milia Azzaba Jendouba M 43 T henia 40 52 El Harrach 44 Oued Marsa 29 Teboursouk R Ain El Hammam E 5054 Cherchell 40 Ighil 29 Gue l ma 36 M Cap Té nès Ha mi z 28 Bouker dane46 31 38 Hamma Bouziane 22 37 29 Constantine 26 Té nès Blida Bouira 24 Ain Dalia Souk Ahras Le Kef 40 M' Chedellah 28 21 Sil iana 46 39 Mil iana 41 Guenzet 51 57 Br ahim 40 40 El Attafs 34 Me dea 32 Ha mmam G ro uz 25 Monastir 50 28 53 54 Setif Sedrata 50 Cap I vi Ard El Beida Chlef Ghrib Sour El Ghoz lane El Eulma Beni Slimane 52 46 46 B.B.Arreridj 43 Ma t kar Kairouan 400 Merdjet El Amel Berr ouaghia 400 34 35 52 28 51 Mostaga nem 35 29 Boghar Bir Chouhada O um El Bouaghi 5251 Theniet El Had 52 47 47 40 El Nouadeur T hala Tetouan Malaliyene Arzew Relizane Ammi Mo u ss a Sidi Aissa 41 E l Ancor 30 Bou Thaleb 37 Oran 39 33 Kh emisti Chefchaouen 49 Sidi M'hamed 35 Fergoug 46 48 41 33 Tissemsilt Tebessa Ali Tlat 50 47 44 Cheurfas38 37 36 Dahmouni 39 43 Mascara Sidi Bouzid 55 Al-Hoceima Nador Be ni Saf Sar no 38 41 Sidi Ben Adda 34 Ti aret Sfax 34 44 Gh r iss Bakhadda 33 300 38 44 45Ghazaouet Bou Hanifia 300 Zaio Ber k ane 40 Sidi Bel Abbas Dar Dr iouch -

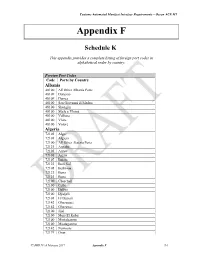

Appendix F – Schedule K

Customs Automated Manifest Interface Requirements – Ocean ACE M1 Appendix F Schedule K This appendix provides a complete listing of foreign port codes in alphabetical order by country. Foreign Port Codes Code Ports by Country Albania 48100 All Other Albania Ports 48109 Durazzo 48109 Durres 48100 San Giovanni di Medua 48100 Shengjin 48100 Skele e Vlores 48100 Vallona 48100 Vlore 48100 Volore Algeria 72101 Alger 72101 Algiers 72100 All Other Algeria Ports 72123 Annaba 72105 Arzew 72105 Arziw 72107 Bejaia 72123 Beni Saf 72105 Bethioua 72123 Bona 72123 Bone 72100 Cherchell 72100 Collo 72100 Dellys 72100 Djidjelli 72101 El Djazair 72142 Ghazaouet 72142 Ghazawet 72100 Jijel 72100 Mers El Kebir 72100 Mestghanem 72100 Mostaganem 72142 Nemours 72179 Oran CAMIR V1.4 February 2017 Appendix F F-1 Customs Automated Manifest Interface Requirements – Ocean ACE M1 72189 Skikda 72100 Tenes 72179 Wahran American Samoa 95101 Pago Pago Harbor Angola 76299 All Other Angola Ports 76299 Ambriz 76299 Benguela 76231 Cabinda 76299 Cuio 76274 Lobito 76288 Lombo 76288 Lombo Terminal 76278 Luanda 76282 Malongo Oil Terminal 76279 Namibe 76299 Novo Redondo 76283 Palanca Terminal 76288 Port Lombo 76299 Porto Alexandre 76299 Porto Amboim 76281 Soyo Oil Terminal 76281 Soyo-Quinfuquena term. 76284 Takula 76284 Takula Terminal 76299 Tombua Anguilla 24821 Anguilla 24823 Sombrero Island Antigua 24831 Parham Harbour, Antigua 24831 St. John's, Antigua Argentina 35700 Acevedo 35700 All Other Argentina Ports 35710 Bagual 35701 Bahia Blanca 35705 Buenos Aires 35703 Caleta Cordova 35703 Caleta Olivares 35703 Caleta Olivia 35711 Campana 35702 Comodoro Rivadavia 35700 Concepcion del Uruguay 35700 Diamante 35700 Ibicuy CAMIR V1.4 February 2017 Appendix F F-2 Customs Automated Manifest Interface Requirements – Ocean ACE M1 35737 La Plata 35740 Madryn 35739 Mar del Plata 35741 Necochea 35779 Pto. -

Ottoman Algeria in Western Diplomatic History with Particular Emphasis on Relations with the United States of America, 1776-1816

REPUBLIQUE ALGERIENNE DEMOCRATIQUE ET POPULAIRE MINISTERE DE L’ENSEIGNEMENT SUPERIEUR ET DE LA RECHERCHE SCIENTIFIQUE UNIVERSITE MENTOURI, CONSTANTINE _____________ Ottoman Algeria in Western Diplomatic History with Particular Emphasis on Relations with the United States of America, 1776-1816 By Fatima Maameri Dissertation submitted to the Faculty of Letters and Languages Department of Languages, University Mentouri, Constantine in fulfillment of the requirements for the degree of doctorat d’Etat Board of Examiners: Supervisor: Dr Brahim Harouni, University of Constantine President: Pr Salah Filali, University of Constantine Member: Pr Omar Assous, University of Guelma Member: Dr Ladi Toulgui, University of Guelma December 2008 DEDICATION To the Memory of my Parents ii ACKNOWLEDGEMENTS First of all, I would like to thank my supervisor Dr Brahim Harouni for his insightful and invaluable remarks as well as his patience which proved to be very decisive for this work. Without his wise advice, unwavering support, and encouragement throughout the two last decades of my research life this humble work would have never been completed. However, this statement is not a way to elude responsibility for the final product. I alone am responsible for any errors or shortcomings that the reader may find. Financial support made the completion of this project easier in many ways. I would like to express my gratitude for Larbi Ben M’Hidi University, OEB with special thanks for Pr Ahmed Bouras and Dr El-Eulmi Laraoui. Dr El-Mekki El-Eulmi proved to be an encyclopedia that was worth referring to whenever others failed. Mr. Aakabi Belkacem is laudable for his logistical help and kindness. -

Tll''''''" ~ EDITORIAL ~

Journal of Coastal Research iii-xiii Royal Palm Beach, Florida Summer 1998 .tll''''''" ~ EDITORIAL ~ Coastal and Port Engineering: Synergistic Disciplines from the Overarching Purview of Integrated Coastal Management The principle objectives of maritime engineering fall broad not included in these lists, especially those of importance only ly into two classifications: (1) transportation, and (2) recla to local economies. In contrast to the large numbers of small mation and conservancy. The first category includes works er ports that go unreported, Table 1 lists several hundred that are directed at providing facilities for the safe and eco ports of international and national significance. Although the nomical transfer of cargo and passengers between land ve list is far from complete, it serves to emphasize the point that hicles and ships; fishing ports for the landing and distribution there are numerous major port and harbor facilities around of the harvest of the sea; harbors of refuge for ships and small the world's coastline. The numbers of facilities, their size, and craft; and marinas for the mooring or laying up of small pri frequency of occurrence along coastal stretches bear consid vate craft. Reclamation and conservancy works, on the other eration from several points of view. It is thus perhaps worth hand, focus on protection of the land area from encroachment while to briefly summarize the important place of ports and by the sea, to the recovery and conversion of land use areas harbors in global and local economies. The figures in Table 2 occupied by the sea, and to the maintenance of river estuaries emphasize, by way of one example, the importance of port, as efficient means for the discharge of inland runoff. -

Preliminary Observations of Geotechnical Failures During the 21 May 2003 M 6.8 Boumerdes, Earthquake, Algeria

Missouri University of Science and Technology Scholars' Mine International Conference on Case Histories in (2004) - Fifth International Conference on Case Geotechnical Engineering Histories in Geotechnical Engineering 13 Apr 2004 - 17 Apr 2004 Preliminary Observations of Geotechnical Failures During the 21 May 2003 M 6.8 Boumerdes, Earthquake, Algeria Said Salah-Mars URS Corporation, Oakland, California Clark Fenton URS Corporation, Oakland, California Fouad Bendimerad RMS, Newark, California Abdeldjelil Belarbi Missouri University of Science and Technology, [email protected] Yumei Wang DOGAMI, Portland, Oregon Follow this and additional works at: https://scholarsmine.mst.edu/icchge Part of the Geotechnical Engineering Commons Recommended Citation Salah-Mars, Said; Fenton, Clark; Bendimerad, Fouad; Belarbi, Abdeldjelil; and Wang, Yumei, "Preliminary Observations of Geotechnical Failures During the 21 May 2003 M 6.8 Boumerdes, Earthquake, Algeria" (2004). International Conference on Case Histories in Geotechnical Engineering. 10. https://scholarsmine.mst.edu/icchge/5icchge/session00g/10 This work is licensed under a Creative Commons Attribution-Noncommercial-No Derivative Works 4.0 License. This Article - Conference proceedings is brought to you for free and open access by Scholars' Mine. It has been accepted for inclusion in International Conference on Case Histories in Geotechnical Engineering by an authorized administrator of Scholars' Mine. This work is protected by U. S. Copyright Law. Unauthorized use including reproduction for redistribution requires the permission of the copyright holder. For more information, please contact [email protected]. PRELIMINARY OBSERVATIONS OF GEOTECHNICAL FAILURES DURING THE 21 MAY 2003 M 6.8 BOUMERDES, EARTHQUAKE, ALGERIA* Said Salah-Mars Clark Fenton Fouad Bendimerad Abdeldjelil Belarbi Yumei Wang URS Corporation URS Corporation RMS Dept. -

People's Democratic Republic of Algeria

PEOPLE'S DEMOCRATIC REPUBLIC OF ALGERIA Ministry of Higher Education and Scientific Research University of Tlemcen Faculty of Letters and languages Department of English Dissertation Submitted to the Department of English as Partial Fulfillment for the Degree of Master in English Language (Literature and Civilization) Presented by: Supervised by: - Mr. Mouade RAMDANE - Dr. Noureddine MOUHADJER Academic Year: 2015/2016 Acknowledgments First of all, I would like to thank all the people who contributed in some way to the work described in this Thesis. Primarily, I thank my advisor, Dr. Noureddine MOUHADJER, as well as the co supervisor Dr. Abd-el-Kader BENSAFA. I should like, also, to thank the Members of the Jury, Dr. Nawel BENMOSTEFA, Dr.Bassou Abderrrahmen. I would like also to thank all Algerian historians, all enlightened intellectuals who leads, their daily struggles against obscurantism and illusion, and promote the knowledge and rationalism, to go towards lucidity. I am grateful for the rich scientific sources obtained by them that, allowed me to pursue my graduate school studies. I must express my very profound gratitude and support.I would like to acknowledge the Department of Foreign Languages, Section of English. My graduate experience benefitted greatly from the courses I took, and the high quality Seminars that the department organized there. I Abstract This research, investigates the process of the Algerian culture through time, and seeks to give an evaluative review of it. Then this study will go over and will try to dig deeper and deeper, for the underlying causes of our cultural problems, focusing on the historical process of this problem, since Algeria when it was subjected to the ottoman rule and the French colonization until the aftermath of the independence, through an inductive approach. -

Recueil Des Notices Et Memoires De La Societe Archeologique De La

I." M\: RECUEIL\ DES Notices et Mémoires DE LA SOCH'CTÉ ARCHÉOLOGIQUE DU DÉPARTEMENT DE CONSTANTINE 6' VOLUME DE LA CINQUIÈME SElil aUARANTE-NEUVIÈME VOLUME DE LA COLLECTION ANNÉE 1915 CONSTANTIiNlL Impriineiie V^« D. BR\H\M, 21, rue Carainan ALOER PARIS Renr ROGER LibraiPxE-Editeur JOURDAN, Liljrairie africaine et coloniale Place du Gouvernement 38, rue de F.ieurus 1916 UNIVERSITY OF FLORIDA LIBRARIES RECUEIL DES Notices et Mémoires DE LA SOCIÉTÉ ARCHÉOLOGIQUE DU DÉPARTEMENT DE CONSTANTINE 6*" VOLUME DE LA CINQUIÈME SÉRIE aUARANTE-NEUVIÈME VOLUME DE LA COLLECTION ANNÉE 1915 CONSTANTINE Imprimerie V^« D. BR4HAlM, 21, rue Garaman ALGER PARIS Reniï ROGER JOURDA.N, Libraire-Editeur Librairie africaine et coloniale Place du Gouvernement 3S, rue de Fleurus 1916 U«¥ersJt> of Flarida Lrbrariat Avis important Article 29 des statuts. — « La Soêiélé laisse aux histori- « auteurs la responsabilité des faits et déductions exposés « ques, archéologiques, scientifiques ou autres, « dans les mémoires imprimés dans son Recueil. » LISTE DES KIENIBRES DE LA SOCIÉTÉ MM. LuTAUD, Gouverneur Général de l'Algérie. Seignouret, 0. #, Préfet du Déparlement. N*** Général, commandant la Division dd Gons tantine. Constantine. MoRiNAUD, 0. #, II, Maire de Composition du Bureau pour 1915 Président : M. Maguelonne. Mercier. Vice-Préddent : ,M. Gustave Secrétaire- Bibliothécaire : M. Thépenier. Trésorier : M. Debruge. Bibliothécaire adjoint : M. Solignac. Commission des Manuscrits MM. Maguelonne, Président ; Mercier (Gustave), Debruge, f Membres Choisnet, Thépenier, IV MKMBEKS HOHOHAÏHKS conser- 1904 MM. Babelon, #, membre de l'Institut, vateur à la Bibliothèque nationale, rue de Vermeuil, 30. 1 inspecteur des Monuments 1904 Ballu, |j , ci, historiques de l'Algérie, rue Blanche, 80. professeur au 1894 Bréal (Michel), G i^, I ||, Collège de France, membre de l'Institut, 70, rue d'Assas, Paris. -

Boumerdes Report-Semi2 Better.Indd

The Boumerdes, Algeria, Earthquake of May 21, 2003 EERI Learning from Earthquakes Reconnaissance Report October 2003 This report was sponsored by the Earthquake Engineering Research Institute with support from the National Science Foundation Earthquake Engineering Research Institute 2003-04 © 2003 Earthquake Engineering Research Institute, Oakland, California 94612-1934. All rights reserved. No part of this report may be reproduced in any form or by any means without the prior writt en permission of the Earthquake Engineering Research Institute, 499 14th St., Suite 320, Oakland, CA 94612-1934. The Earthquake Engineering Research Institute’s participation in this reconnaissance eff ort and publication of this report was supported by the National Science Foundation under grant CMS-0131895. This report is published by the Earthquake Engineering Research Institute, a nonprofi t corporation. The objective of the Earthquake Engineering Research Institute is to reduce earthquake risk by advancing the science and practice of earthquake engineering; by improving understanding of the impact of earthquakes on the physical, social, economic, political and cultural environment; and by advocating comprehensive and realistic measures for reducing the harmful eff ects of earthquakes. Any opinions, fi ndings, conclusions and recommendations expressed herein are those of the authors and do not necessarily refl ect the views of the National Science Foundation, EERI or the authors’ organizations. Unless otherwise noted, all fi gures shown in this publication were provided by contributors. Copies of this report may be ordered from: Earthquake Engineering Research Institute 499 14th St., Suite 320 Oakland, CA 94612-1934 Telephone: 510-451-0905 Fax: 510-451-5411 e-mail: [email protected] website: www.eeri.org Printed in the United States of America ISBN # EERI Publication Number 2003-04 Technical Editor and Primary Author: Fouad Bendimerad Editors: Sarah K. -

DELLYS « Non Au 19 Mars »

INFO 766 DELLYS « Non au 19 Mars » DELLYS Ville côtière sur le littoral Nord algérien ; est un chef-lieu de commune situé à 100 km à l’Est d’ALGER. Climat méditerranéen avec été chaud. HISTOIRE Le 31 décembre 1857, à quelques mètres des remparts au dessus de la porte des Jardins, des travaux militaires mettaient à jour un très beau sarcophage qui a été transporté au Musée d’Alger. L’éminent BERBRUGGER en a fait la description suivante : « ...le sarcophage est en marbre blanc avec le couvercle adapté par scellements en fer fixés au plomb ; il mesure 2,15 mètres de longueur, 0,60 de largeur et 0,60 de profondeur. A l’intérieur un cercueil en plomb contenant un squelette. Ce tombeau était sculpté sur sa face antérieure. Le bas relief est divisé en sept intervalles par huit colonnes d’ordre ionique. Dans les entrecolonnements vingt figures rendent des scènes de la vie du défunt… » DELLYS ou TEDELLIS (avec OULAD-KED-DACH et BEN-NEHOUD, ses annexes), a d'abord été fondée par une colonie carthaginoise, les Romains y formèrent plus tard un établissement appelé Rusuccuru, qui devint une puissante cité sous l'empereur CLAUDE (l'an 50 après Jésus-Christ). Les anciens remparts, visibles surtout à l'Ouest, les citernes romaines de SIDI-SOUSSAN, des mosaïques, un magnifique sarcophage déposé aujourd'hui au musée d'Alger, des médailles et des amphores trouvées dans les fondations de l'hôpital et de la mosquée, tels sont les vestiges de Rusuccuru, dans lequel on retrouve le Rousoukkour (le cap des poissons) des Carthaginois.