OG Dpmq a Ent 1 -2,125,878

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Working Together to Build Bridges to the Future

DEC. 612, 2019 5 Working together to build bridges to the future SENATOR JOHN HEINZ HISTORY CENTER GETTY IMAGES SPONSORED BY: 2 PITTSBURGH BUSINESS TIMES THE PITTSBURGH REGION AND OUR NEXT 75 Th e next chapter in our region’s history eventy-fi ve years. Th at’s an entire improving quality of place. lifetime. We will only succeed in reaching S When you get to 75 years – so this goal if we join together and involve we’re told – you’re wiser. Your world- as many people as possible. At the Our view broadens. You understand how Next 75 Summit in June and the Allegh- things succeed and how things fail. eny Conference’s 75th Annual Meeting Over the past 75 years of regional earlier this week, packed rooms, buzz- transformation, two generations of lead- ing with the energy and enthusiasm of Jeff Broadhurst and Toni Murphy are ers have shaped the story of our region, everyone present, proved a point: we co-chairs of the Allegheny Conference and a third is taking the reins. have the ability to propel this place for- on Community Development’s Our Next Much of 2019 was devoted to listening ward to achieve its fullest potential. 75 initiative. to emerging leaders – that third genera- Such a future off ers: tion – as well as to the voices of experi- • A Strong Economy that leverages ence. From Butler to Washington … from our human and natural resources with a will give them pause – and give them Greensburg to Pittsburgh … we invit- focus on tech and innovation, a well-cal- cause – to draw inspiration from us, ed leaders from across our region to the ibrated business ecosystem and eff ective much as we do from the leaders who table to gather directly from them more marketing. -

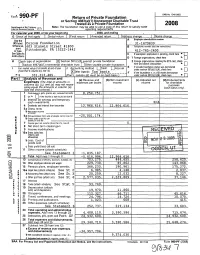

Return of Private Foundation

OMB No 1545.0052 Forril 990-PF Return of Private Foundation • or Section 4947(a)(1) Nonexempt Charitable Trust Treated as a Private Foundation 2008 Department of the Treasury Note : The foundation may be able to use a copy of this return to satisfy state Intern a l Reve nue Service (77) reporting requirements or tax , 2008, and endin g For calendar year 2008, year beginning G Check all that a pp ly Initial return Final return Amended return Address change Name chan ge Employer identification number Use the A IRS label . Colcom Foundation 31-1479839 Otherwise , 603 Stanwix Street #1800 B Telephone number (see the instructions) print Pittsburgh, PA 15222-1442 or type . 412-765-2400 See Specific C If exemption application is pending, check here 01 Instructions. l1b. D 1 Foreign organizations , check here H H Check type of organization X Section 501(c)(3 exempt private foundation 2 Foreign organizations meeting the 85% test, check q Section 4947 (a)( 1 ) nonexem pt chartable trust Other taxable p rivate foundation here and attach computation assets at of year Accounting Cash Accrual E If private foundation status was terminated I Fair market value of all end J method under section 507(b)(1)(A) , check here (from Part fl, column (c), line 16) Other (specify) Tax basis_ _ _ _ _ _ F If the foundation is in a 60- month termination $ 331, 313, 485. (Part 1, column (d) must be on cash basis under section 507(b)(1)(B, check here I- F Revenue Part I Analysis of an d (a) Revenue and (b) Net investment (c) Adjusted net (d) Disbursements Expenses (The total of amounts in expenses per books income income for charitable columns (b), (c), and (d) may not neces- purposes sarily equal the amounts in column (a) (cash basis only) (see the Instructions 1 Contributions , gifts, grants, etc , received (alt sch) 8 , 254 , 751. -

2013 River Towns Report

When the Pennsylvania Environmental Council (PEC) first launched the River Town Program in 2010, its goal was to help communities to recognize the river as an asset around which potential community and economic development could background occur, and thus be recognized as a resource worthy of protection. For PEC, this program has evolved into a model for PEC originally launched the River Town Program along the Allegheny River just north of Pittsburgh as a pilot to apply implementing collaborative solutions to environmental protection and restoration, by recognizing the inextricable links the strategies used successfully in previous asset-based community development initiatives in river towns. Models between the environment, the economy and quality of life. included the trail town initiatives along the Great Allegheny Passage and the C&O Canal Towpath, traditional Main Street Programs and others. This report describes the River Town process and highlights the successes of many of the communities who have participated in the program. The successes described are the work of many partners and the credit for all achievements “River Towns,” the communities bordering rivers throughout Pennsylvania, were founded as manufacturing centers belongs to the communities themselves. close to river and rail transportation. With the decline of manufacturing, these communities suffered both job loss and population decline as generations that once prospered working in industries next to the river were forced to leave to find jobs elsewhere. The River Town model seeks to improve the vitality, stability, sustainability and prosperity of communities, businesses and neighborhoods. This is the foundation upon which related economic development, including recreational tourism and environmental initiatives, such as stormwater management, trail development and clean energy projects are built. -

Allegheny's Riverfronts

ALLEGHENY’S RIVERFRONTS A Progress Report on Municipal Riverfront Development in Allegheny County DECEMBER 2010 Allegheny County Allegheny’s Riverfronts Dear Friends: In Allegheny County, we are known for our rivers. In fact, our rivers have repeatedly been in the national spotlight – during the Forrest L. Wood Cup and Pittsburgh G-20 Summit in 2009, and during World Environment Day in 2010. We are fortunate to have more than 185 miles of riverfront property along the Allegheny, Monongahela, Ohio and Youghiogheny Rivers. Our riverfronts provide opportunities for recreation, conservation and economic development. Providing access to our waterways has always been a key priority and we have been very successful in connecting communities through our trail and greenway system. Through partnerships with businesses, foundations and trail groups, we are on target to complete the Great Allegheny Passage along the Monongahela River before the end of 2011. This trail has been improving the economy and quality of life in towns throughout the Laurel Highlands and Southwestern Pennsylvania, and now its benefits will spread north through the Mon Valley and into the City of Pittsburgh. Our riverfronts provide opportunities for greening our region through the use of new trees, rain gardens and riverside vegetation that aid in flood control, improved water quality and a more natural experience. Allegheny County riverfronts have also always been great places to live. More people will be able to experience riverfront living with the development of communities such as Edgewater at Oakmont, which promises to be one of the best new neighborhoods in the region. I am so proud of all that we have accomplished along our riverfronts and excited about all that is yet to come. -

Philanthropic Investment Is Transforming Downtown Pittsburgh Into a Popular Tourist Destination, a Bustling Entertainment Hub�—�And the City’S New “In” Neighborhood

THE HEINZ ENDOWMENTS NONPROFIT ORG issue 2 2014 US POSTAGE Howard Heinz Endowment Vira I. Heinz Endowment PAID 625 Liberty Avenue PITTSBURGH PA 30th Floor PERMIT NO 57 Pittsburgh, PA 15222-3115 412.281.5777 www.heinz.org Philanthropic investment is transforming Downtown Pittsburgh into a popular tourist destination, a bustling entertainment hub—and the city’s new “in” neighborhood. The Magazine of The Heinz Endowments Preteen promise. page 4 This magazine was printed on Opus Dull, which has among the highest post-consumer waste content of any premium coated paper. Opus is third-party certifi ed according to the chain-of-custody standards of FSC.® The electricity used to make it comes from Green e-certifi ed renewable energy. GIRLS ON FIRE ARTISTS’ COLLECTIONS 33 CLEARING SAFE KEEPING Veteran Leaders CONGESTION With support from The Heinz The City of Pittsburgh and Carnegie Offi cials representing 40 municipalities and Endowments, the nonprofi t Mellon University are expanding a network 11 school districts in southwestern Pennsylvania’s Leadership Pittsburgh provided a of high-tech traffi c signals that adapt to vehicle Mon Valley have unveiled a plan for a regional training series for post-9/11 travel in real time, reducing congestion and air land bank that is expected to open next year. The veterans that usually is reserved pollution. In 2012, 18 signals were installed in the Endowments awarded a $45,000 grant to the Steel for business executives and other city’s East Liberty neighborhood, resulting in a professionals. The Community 42 percent drop in vehicle wait time, a 24 percent Valley, Turtle Creek Valley and Twin Rivers councils Leadership Course for Veterans reduction in travel time and a 21 percent drop in of governments to support their work in developing accepted vets who had shown vehicle emissions. -

Annual Report08

08_AR_build.qxd:Layout 1 3/23/09 1:04 PM Page 1 ANNUAL REPORT08 ALLEGHENY CONFERENCE ON COMMUNITY DEVELOPMENT AND ITS AFFILIATES GREATER PITTSBURGH CHAMBER OF COMMERCE PENNSYLVANIA ECONOMY LEAGUE OF SOUTHWESTERN PENNSYLVANIA PITTSBURGH REGIONAL ALLIANCE About the Conference ounded in 1944, the Allegheny Con - Three affiliated organizations, each staffed The PITTSBURGH REGIONAL ALLIANCE Fference on Community Development by the Conference, provide research and (PRA), a 10-county regional economic is one of the nation’s leading economic analysis, advocacy and marketing to realize development partnership, markets south - and community development organiza - the vision of the Conference leadership. western Pennsylvania to companies tions. Combining strong private sector across the region and around the world The PENNSYLVANIA ECONOMY LEAGUE OF leadership with commitment from public to attract capital investment and stim - SOUTHWESTERN PENNSYLVANIA provides sector partners, we work to stimulate eco - ulate job creation. public policy research and analysis on the nomic growth and improve the Pittsburgh most critical issues for our region’s com - region’s quality of life. Our strategic focus petitiveness. is on creating a more competitive busi - ness climate and marketing the Pitts - The GREATER PITTSBURGH CHAMBER OF burgh region for investment and job COMMERCE, working with private and creation. The Conference relies upon the public sector partners, serves as our re - Regional Investors Council – leaders of gion’s chief advocate at all levels of gov - more than 300 companies and organiza - ernment to secure public sector investment tions – to provide time, talent and re - and legislative and regulatory improve - sources to advance our agenda. ments to our business climate. -

MID-YEAR REPORT College Update December 2019

MID-YEAR REPORT December 2019 College Update HIGHLIGHTS INSIDE Enrollment, Retention & Engagement With the second half of the 2019–2020 Initiatives Remain Top Priorities academic year fast approaching, I’d like to Investing in Educational Excellence: take this opportunity to share the latest New Faculty & Administrative Hires news regarding CCAC’s major initiatives New Partnerships & Programs Expand Educational Opportunities and other accomplishments, including the Capital Improvement Projects: Enhancing recent launch of our fundraising campaign, CCAC Programs, Services & Image Pioneering Pittsburgh’s New Workforce, Office of Sponsored Programs & Sponsored in addition to student engagement and Research: Recent Grant Awards community outreach activities as well CCAC Educational Foundation: Recent Grants & Gifts as information on recent awards and CCAC Highlights: Awards & Other Distinctions recognitions presented to members Autumn Events Showcase the College of our college community. CCAC’s Community Outreach Extends Dr. Quintin B. Bullock Far & Wide CCAC President On November 18, I was pleased to join County Executive Rich Fitzgerald, Executive Vice President of Corporate Affairs for Highmark Health and Chair of the Highmark Foundation Daniel Onorato, Chair and President of the PNC Foundation Sally McCrady, Allegheny General Hospital Chief Nursing Officer Marge DiCuccio and CCAC Board Chair Frederick Thieman to publicly launch Pioneering Pittsburgh’s New Workforce—a $65 million fundraising campaign designed to support CCAC’s collaborative workforce initiative that was first announced in September 2017. Chief of Staff to Representative Jake Wheatley Keyva Clark, CCAC President Held in the Milton Hall Rotunda on Allegheny Campus, the launch Quintin Bullock, County Executive Rich Fitzgerald, CCAC Board Chair Frederick included the announcement of a $5 million lead gift from Highmark Thieman, Chair and President of the PNC Foundation Sally McCrady, Allegheny Health to fund a 10-year investment in workforce development. -

Regional Investors Council

2021 REGIONAL INVESTORS COUNCIL #1 Cochran Inc. Children’s Hospital of Pittsburgh Foundation Fairmont Pittsburgh II-VI Incorporated Children’s Museum of Pittsburgh Familylinks AAA East Central CIBC Bank USA Farmers National Bank Accenture Citizens Bank of PA / NY / NJ / DE Federal Home Loan Bank of Pittsburgh Adagio Health, Inc. Civil & Environmental Consultants, Inc. Federal Reserve Bank of Cleveland, Advanced Robotics for Manufacturing (ARM) Claude Worthington Benedum Foundation Pittsburgh Branch AHRCO Coghill Investment Strategies, LLC Federated Hermes Inc. Alcoa Corporation Cohen & Co First Commonwealth Bank Allegheny College Colcom Foundation First National Bank of Pennsylvania Allegheny County Airport Authority Colliers International FirstEnergy Corporation Allegheny Health Network Columbia Gas FirstEnergy Foundation Alschuler Communications Comcast Ford Business Machines, Inc. American Eagle Outfitters, Inc. Commonwealth Charter Academy Fragasso Financial Advisors AmeriHealth Caritas Community College of Allegheny County Frost Brown Tood LLC Aquatech International Corporation Community College of Beaver County GAI Consultants, Inc. Arch Street Management, LLC Compunetix, Inc. Gateway Financial Group, Inc. Argo AI Concurrent Technologies Corporation Gateway Health Plan ATI Constructors Association of Giant Eagle, Inc. Aurora Innovation Western Pennsylvania Goodwill of Southwestern Pennsylvania Aviation Facilities Company Management, LLC (AFCO) Covestro LLC Google Pittsburgh Babst, Calland, Clements and Zomnir, P.C. Cowden Associates, Inc. Grant Street Associates, Inc. Bank of America Merrill Lynch Cozen O’Connor Greater Pittsburgh Arts Council BCG Crown Castle Greater Pittsburgh Community Food Bank BDO USA, LLP Deloitte LLP Green Building Alliance Beaver Valley Slag, Inc. Denny Civic Solutions H.J. Heinz Company Foundation BHE GT&S Dentons Cohen & Grigsby, P.C. HarbisonWalker International BKD, LLP Desmone Architects HDR, Inc. -

2020 Regional Investors Council

2020 REGIONAL INVESTORS COUNCIL #1 Cochran Inc. Carnegie Mellon University Eckert Seamans Cherin & Mellott, LLC AAA East Central Carnegie Museums of Pittsburgh Elliott Group Accenture Catalyst Connection Ellwood Group, Inc. Accion Labs CBRE Enterprise Bank Adagio Health, Inc. CDI Printing Services, Inc. EQT Corporation AE7 Pittsburgh CGI EQT Foundation AHRCO Chatham University Ernst & Young LLP Alcoa Corporation Chevron Evoqua Water Technologies, LLC Align Leadership Children’s Hospital of Pittsburgh Foundation Expedient Allegheny College Children’s Museum of Pittsburgh Fairmont Pittsburgh Allegheny County Airport Authority Citizens Bank of PA / NY / NJ / DE Familylinks Allegheny Health Network City of Hermitage Federal Home Loan Bank of Pittsburgh Alschuler Communications Civil & Environmental Consultants, Inc. Federal Reserve Bank of Cleveland, AMCOM Office Systems Claude Worthington Benedum Foundation Pittsburgh Branch American Eagle Outfitters, Inc. CNX Resources Corporation Federated Investors, Inc. AmeriHealth Caritas Coghill Investment Strategies, LLC FedEx Ground Aquatech International Corporation Cohen & Co First Commonwealth Bank Arlanxeo Cohen & Grigsby, P.C. First National Bank of Pennsylvania Arch Street Management, LLC Colcom Foundation FirstEnergy Corporation Arconic Foundation Colliers International FirstEnergy Foundation Arconic Inc. Columbia Gas Ford Business Machines Inc. ARM Institute Comcast Fragasso Financial Advisors ATI Commonwealth Charter Academy GAI Consultants, Inc. Aurora Innovation Community College of Allegheny County Gateway Financial Group, Inc. Babst, Calland, Clements and Zomnir, P.C. Community College of Beaver County Gateway Health Plan Bank of America Merrill Lynch Compunetix, Inc. Giant Eagle, Inc. Bayer Concurrent Technologies Corporation Goodwill of Southwestern Pennsylvania BDO USA, LLP Constructors Association of Google Pittsburgh Beaver County Chamber of Commerce Western Pennsylvania Grant Street Associates, Inc. Beaver Valley Slag, Inc. -

2021 Regional Investors Council

2021 REGIONAL INVESTORS COUNCIL #1 Cochran Inc. Children’s Hospital of Pittsburgh Foundation Expedient II-VI Incorporated Children’s Museum of Pittsburgh Fairmont Pittsburgh AAA East Central CIBC Bank USA Familylinks Accenture Citizens Bank of PA / NY / NJ / DE Farmers National Bank Adagio Health, Inc. Civil & Environmental Consultants, Inc. Federal Home Loan Bank of Pittsburgh Advanced Robotics for Manufacturing (ARM) Claude Worthington Benedum Foundation Federal Reserve Bank of Cleveland, AHRCO Coghill Investment Strategies, LLC Pittsburgh Branch Alcoa Corporation Cohen & Co Federated Hermes Inc. Allegheny College Colcom Foundation First Commonwealth Bank Allegheny County Airport Authority Colliers International First National Bank of Pennsylvania Allegheny Health Network Columbia Gas FirstEnergy Corporation Alschuler Communications Comcast FirstEnergy Foundation American Eagle Outfitters, Inc. Commonwealth Charter Academy Ford Business Machines, Inc. AmeriHealth Caritas Community College of Allegheny County Fragasso Financial Advisors Aquatech International Corporation Community College of Beaver County Frost Brown Tood LLC Arch Street Management, LLC Compunetix, Inc. GAI Consultants, Inc. Argo AI Concurrent Technologies Corporation Gateway Financial Group, Inc. ATI Constructors Association of Gateway Health Plan Aurora Innovation Western Pennsylvania Giant Eagle, Inc. Aviation Facilities Company Management, LLC (AFCO) Covestro LLC Goodwill of Southwestern Pennsylvania Babst, Calland, Clements and Zomnir, P.C. Cowden Associates, Inc. Google Pittsburgh Bank of America Merrill Lynch Cozen O’Connor Grant Street Associates, Inc. BCG Crown Castle Greater Pittsburgh Arts Council BDO USA, LLP Deloitte LLP Greater Pittsburgh Community Food Bank Beaver Valley Slag, Inc. Denny Civic Solutions Green Building Alliance BHE GT&S Dentons Cohen & Grigsby, P.C. H.J. Heinz Company Foundation BKD, LLP Desmone Architects HarbisonWalker International BNY Mellon DICK’S Sporting Goods HDR, Inc. -

Annual Report 2017

ANNUAL REPORT 2017 WHERE IS DOWNTOWN PITTSBURGH HEADING? How can the Pittsburgh Downtown Partnership be prepared to Through these conversations we heard what you love, why you meet the rapidly changing landscape of our city? In 2017, the PDP love it, and what you want to see changed. With your support, undertook a stakeholder engagement process to better understand the PDP already has many efforts underway to support the the challenges and obstacles facing Downtown and to chart a continued growth and development of Downtown. In this report, course to address these issues, head on. we will share our success around events we produce, economic development assistance we provide, advocacy around transit We hosted focus groups that included representatives from the and mobility issues that we moved forward, and the clean and PDP staff and board, business owners, property owners, residents, safe services we know are a vital aspect to keeping Downtown employees, and partner organizations. We spoke with civic leaders vibrant. We will also share more about what we heard from our from the offices of the Mayor and the County Executive and stakeholders and what plans we have in place to ensure that department heads from City Planning, Mobility and Infrastructure, Downtown Pittsburgh continues to head in the right direction. and Public Works. Through numerous conversations and surveys we created an interactive process where stakeholders were asked to concentrate on thematic areas relating to quality of life, economic development, transportation, and marketing focused around three guiding questions which are important indicators of a downtown’s vitality: IS DOWNTOWN PITTSBURGH WELCOMING? IS DOWNTOWN PITTSBURGH ENGAGING? IS DOWNTOWN PITTSBURGH GROWING? 1 WHAT WE DID We also began working with a large group of stakeholders to discuss the It is vital that the environment of Downtown Pittsburgh consistently feels ways in which students and young people experience Downtown Pittsburgh, safe, clean, and inviting. -

Conservative Transparency

• Return of Private Foundation OMB No 1545-0052 Form 990-PF or Section 4947(aXl) Nonexempt Charitable Trust Treated as a Private Foundation 2007 Department of the Treasury Note : The foundation may be able to use a copy of this return to satisfy state Internal Revenue Service reporting requirements For 2007, and e^ G-Check all that a pp ly- Initial return Finz ended return ;hange I I Name Chang Employer identification number Use the Colcom Foundation IRS la^el. 603 Stanwix Street #1800 31-1479839 Otherwise, B Telephone number (see the instructions) print Pittsburgh, PA 15222-1442 or type. 412-765-2400 See Specific C If exemption application is pending, check here Instructions. D 1 Foreign organizations, check here - q H Check type of organization. U Section 501(c)(3 exempt private foundation 2 Foreign organizations meeting the 85% test, check q Section 4947(a)( 1 ) nonexem pt charitable trust Other taxable private foundation here and attach computation E private foundation status was terminated q Cash Accrual If Fair market value of all assets at end of year J Accounting method: under section 507(b)(1)(A), check here (from Part 11, column (c), line 16) X] Other (specify) Tax basis F If the foundation is in a 60-month termination ^ $ 504 937 663. (Part 1, column (d) must be on cash basis iinrler a cr+i-n cn7fh\/1\ /R\ A-1, here F1 a.4 I An a I7 • of Reve nue an d (a) Revenue and (b) Net investment (c) Adjusted net (d) Disbursements Expenses (The total of amounts in expenses per books income I income for charitable columns (b), (c), and (d) may not neces- purposes sartly equal the amounts in column (a) (cash basis only) (see the instructions) .) 1 Contributions.