Annual Financial Statements and Management Report of DZ BANK AG

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fitch Revises Outlooks on German Cooperative Banks and DZ BANK to Stable; Affirms at 'AA-'

01 JUL 2021 Fitch Revises Outlooks on German Cooperative Banks and DZ BANK to Stable; Affirms at 'AA-' Fitch Ratings - Frankfurt am Main - 01 Jul 2021: Fitch Ratings has revised Genossenschaftliche FinanzGruppe (GFG) and the members of its mutual support scheme, including GFG's central institution DZ BANK AG Deutsche Zentral-Genossenschaftsbank (DZ BANK) and 814 local cooperative banks, to Stable Outlook from Negative Outlook. Their Long-Term Issuer Default Ratings (IDRs) have been affirmed at 'AA-'. The revisions of the Outlooks reflect our view that the risk of significant deterioration of the operating environment, leading to a durable weakening of GFG's asset quality and profitability, has subsided since our last rating action in August 2020. GFG is not a legal entity but a cooperative banking network whose cohesion is ensured by a mutual support scheme managed by the National Association of German Cooperative Banks (BVR). GFG's IDRs apply to each member bank, in accordance with Annex 4 of Fitch's criteria for rating banking structures backed by mutual support schemes. The ratings are underpinned by the high effectiveness of the scheme given its long and successful record of ensuring GFG's cohesion, monitoring members' risks and enforcing corrective measures when needed. The scheme has effectively protected its members' viability and averted losses for their creditors since its inception. Fitch has also downgraded Deutsche Apotheker- und Aerztebank eG's (apoBank) Long-Term Deposit Rating because we no longer expect the bank's buffer of senior non-preferred and more junior debt to remain sustainably above 10% of risk weighted assets (RWAs) as the bank is not required to maintain resolution debt buffers. -

+01 Text Edeka

Kapitel 2 / Mechanismen und Folgen / Wo ist das Problem? Edeka Die Edeka-Gruppe (Eigenschreibweise: EDEKA) ist 1923 begann im Unternehmen die Zentralverrech- seit 2005 durch die Übernahme der Spar-Handels- nung. 1931 erreichten die Umsätze der inzwischen gesellschaft der größte Verbund im deutschen 430 Genossenschaften die Summe von 267 Millionen Einzelhandel. Eigentümer der Edeka-Gruppe sind Reichsmark. Die Stimmenverluste der Wirtschafts- Genossenschaften, in denen sich selbständige partei im Jahr 1932 lösten einen Druck der Edeka- Einzelhändler*innen zusammengeschlossen haben. Genossen auf die Verbandsführung aus, sich mehr Regionalgesellschaften sind für das Großhandelsge- den Positionen der Nationalsozialisten zuzuwen- schäft verantwortlich und beliefern die selbständi- den, doch die NSDAP honorierte das nicht. Ab 1933 gen Händler*innen wie die Filialbetriebe, die über stand Edeka mit seinen Genossenschaften unter die Regionalgesellschaften oder die Edeka-Zentrale Druck. Die Edeka-Gruppe forderte ihre Mitglieder AG & Co KG zur Gruppe gehören oder mit ihr ko- auf, den NS-„Kampfbünden für den gewerblichen operieren. Mittelstand“ beizutreten. Am 18. April erklärte sie freiwillig ihre Gleichschaltung mit der Folge, dass Geschichte ein Erster und ein Zweiter Präsident, jeweils mit Anfangszeit NSDAP-Parteibuch, dem Generaldirektor auf die Finger sahen. Borrmann wurde 1933 Parteimitglied. Die Edeka-Gruppe entstand 1898, als sich 21 Ab 1936 wurde das Handeln des Unternehmens Einkaufsvereine aus dem Deutschen Reich im dirigistisch reglementiert. Halleschen Torbezirk in Berlin zur Einkaufsgenos- Das Geschäftsgebiet von Edeka wurde auf das Saar- senschaft der Kolonialwarenhändler im Halleschen land und nach dem so genannten „Anschluss“ auch Torbezirk zu Berlin – kurz E. d. K. – zusammen- auf Österreich ausgedehnt. 1937 schied Borrmann schlossen. als Generaldirektor aus und Paul König übernahm Dreizehn solcher Genossenschaften vereinigten (bis 1966) dessen Funktion. -

Unternehmensbericht 2013 Unternehmensbericht 2013 EDEKA-Verbund Der EDEKA-Verbund – „Unternehmer-Unternehmen“ Und Treibende Kraft Im Deutschen Lebensmittelhandel

Unternehmensbericht 2013 EDEKA-Verbund EDEKA-Verbund ∙ Unternehmensbericht 2013 Unternehmensbericht ∙ EDEKA-Verbund Der EDEKA-Verbund – „Unternehmer-Unternehmen“ und treibende Kraft im deutschen Lebensmittelhandel Seit Jahrzehnten prägt der EDEKA-Verbund maßgeblich die Entwicklungen in der deutschen Lebensmittelwirtschaft. Mit ausgefeilten Strategien, dem ihm traditionell innewohnenden Unternehmergeist sowie einem ausgeprägten Innovationswillen. Ein eingespieltes Team aus mehr als 4.000 selbstständigen Kaufleuten, sieben regiona- len Großhandelsbetrieben und der Hamburger EDEKA-Zentrale repräsentiert dabei die unverkennbare Struktur aus drei leistungsstarken und flexibel agierenden Ver- bundstufen. Angetrieben von dem genossenschaftlichen Auftrag zur kontinuierlichen Schaffung und Förderung mittelständischer Betriebe im Lebensmitteleinzelhandel. Als der qualifizierte Nahversorger Deutschlands steht EDEKA für generationenüber- greifenden, nachhaltigen und ökonomisch verantwortungsvollen Handel. Umsatzentwicklung EDEKA-Verbund Nettoumsätze in Mrd. € 2009* 2010* 2011* 2012 2013 % Selbstständiger Einzelhandel 17,0 18,4 20,0 21,3 22,6 5,8 Regie-Einzelhandel 9,1 8,6 8,4 8,3 8,0 -3,7 Netto Marken-Discount 9,9 10,4 10,7 11,3 11,8 4,5 Backwaren-Einzelhandel 0,6 0,6 0,7 0,7 0,7 -1,2 Lebensmitteleinzelhandel 36,6 38,1 39,8 41,6 43,0 3,4 C+C / Großverbrauchergeschäft 1,7 1,7 1,9 1,9 1,9 0,2 Drittumsätze 1,4 1,5 1,5 1,3 1,3 -1,7 EDEKA-Verbund gesamt 39,7 41,2 43,2 44,8 46,2 3,1 * bereinigt um Umsätze von NETTO Stavenhagen und Kooperationspartnern -

EMS Counterparty Spreadsheet Master

1 ECHO MONITORING SOLUTIONS COUNTERPARTY RATINGS REPORT Updated as of October 24, 2012 S&P Moody's Fitch DBRS Counterparty LT Local Sr. Unsecured Sr. Unsecured Sr. Unsecured ABN AMRO Bank N.V. A+ A2 A+ Agfirst Farm Credit Bank AA- AIG Financial Products Corp A- WR Aig-fp Matched Funding A- Baa1 Allied Irish Banks PLC BB Ba3 BBB BBBL AMBAC Assurance Corporation NR WR NR American International Group Inc. (AIG) A- Baa1 BBB American National Bank and Trust Co. of Chicago (see JP Morgan Chase Bank) Assured Guaranty Ltd. (U.S.) A- Assured Guaranty Municipal Corp. AA- Aa3 *- NR Australia and New Zealand Banking Group Limited AA- Aa2 AA- AA Banco Bilbao Vizcaya Argentaria, S.A. BBB- Baa3 *- BBB+ A Banco de Chile A+ NR NR Banco Santander SA (Spain) BBB (P)Baa2 *- BBB+ A Banco Santander Chile A Aa3 *- A+ Bank of America Corporation A- Baa2 A A Bank of America, NA AA3AAH Bank of New York Mellon Trust Co NA/The AA- AA Bank of North Dakota/The AA- A1 Bank of Scotland PLC (London) A A2 A AAL Bank of the West/San Francisco CA A Bank Millennium SA BBpi Bank of Montreal A+ Aa2 AA- AA Bank of New York Mellon/The (U.S.) AA- Aa1 AA- AA Bank of Nova Scotia (Canada) AA- Aa1 AA- AA Bank of Tokyo-Mitsubish UFJ Ltd A+ Aa3 A- A Bank One( See JP Morgan Chase Bank) Bankers Trust Company (see Deutsche Bank AG) Banknorth, NA (See TD Bank NA) Barclays Bank PLC A+ A2 A AA BASF SE A+ A1 A+ Bayerische Hypo- und Vereinsbank AG (See UniCredit Bank AG) Bayerische Landesbank (parent) NR Baa1 A+ Bear Stearns Capital Markets Inc (See JP Morgan Chase Bank) NR NR NR Bear Stearns Companies, Inc. -

Frank Westhoff Former Member of the Board of Managing Directors of DZ BANK AG

Curriculum Vitae Frank Westhoff Former Member of the Board of Managing Directors of DZ BANK AG Personal data Place of residence Eppstein Dates of birth 12.06.1961 in Wolfsburg Nationality German Independence (+) Member of the Supervisory Board of Commerzbank Initial appointment 05/2021 Curr. term of office General Annual Meeting 2021 – 2023 Committees Risk Committee (Chairman) Audit Committee Compensation Control Committee Competences and experiences Extensive knowledge of the European banking market, especially in corporate and real estate-oriented customer business. Far-reaching experience in the finance and risk management of large banks as a long-standing head of risk of one of the largest German banks. Comprehensive supervisory board practice as supervisory board/chairman of various companies in the financial sector between 2004 and 2019. Long-term career in banking with experience in customer service, risk and bank management as well as accompanying strategy and consolidation programs. Career highlights 2002– 2017 DZ BANK AG 2006 – 2017 Member of the Board of Managing Directors, Chief Risk Officer, Credit Department, risk controlling, compliance and various regions and customers, Frankfurt/Main 2002 – 2006 Department Head for Business Analysis, Chief Credit Officer, Frankfurt/Main 1990 – 2002 Deutsche Bank AG 2002 Director for the southern region, Munich 1996 – 2001 Head of Strategy/Structure/Processes in the credit department, Senior Credit Officer, Director, Frankfurt/Main 1995 – 1996 Head of Corporate Clients Austria, Vienna 1991 -

List of PRA-Regulated Banks

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 2nd December 2019 (Amendments to the List of Banks since 31st October 2019 can be found below) Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The ADIB (UK) Ltd EFG Private Bank Limited Ahli United Bank (UK) PLC Europe Arab Bank plc AIB Group (UK) Plc Al Rayan Bank PLC FBN Bank (UK) Ltd Aldermore Bank Plc FCE Bank Plc Alliance Trust Savings Limited FCMB Bank (UK) Limited Allica Bank Ltd Alpha Bank London Limited Gatehouse Bank Plc Arbuthnot Latham & Co Limited Ghana International Bank Plc Atom Bank PLC Goldman Sachs International Bank Axis Bank UK Limited Guaranty Trust Bank (UK) Limited Gulf International Bank (UK) Limited Bank and Clients PLC Bank Leumi (UK) plc Habib Bank Zurich Plc Bank Mandiri (Europe) Limited Hampden & Co Plc Bank Of Baroda (UK) Limited Hampshire Trust Bank Plc Bank of Beirut (UK) Ltd Handelsbanken PLC Bank of Ceylon (UK) Ltd Havin Bank Ltd Bank of China (UK) Ltd HBL Bank UK Limited Bank of Ireland (UK) Plc HSBC Bank Plc Bank of London and The Middle East plc HSBC Private Bank (UK) Limited Bank of New York Mellon (International) Limited, The HSBC Trust Company (UK) Ltd Bank of Scotland plc HSBC UK Bank Plc Bank of the Philippine Islands (Europe) PLC Bank Saderat Plc ICBC (London) plc Bank Sepah International Plc ICBC Standard Bank Plc Barclays Bank Plc ICICI Bank UK Plc Barclays Bank UK PLC Investec Bank PLC BFC Bank Limited Itau BBA International PLC Bira Bank Limited BMCE Bank International plc J.P. -

Uebersicht Der Unterverwahrer.Xlsx

Übersicht der Unterverwahrer der DZ PRIVATBANK S.A. Stand: 28.06.2021 Markt Lagerstelle Unterverwahrer Beziehungsstatus ÄGYPTEN HSBC BANK EGYPT SAE ARGENTINIEN CLEARSTREAM BANKING S.A. LUXEMBOURG AUSTRALIEN BNP PARIBAS SECURITIES SERVICES S.A. AUSTRALIA BRANCH BANGLADESH STANDARD CHARTERED BANK DHAKA BRANCH BELGIEN EUROCLEAR BANK SA/NV BENIN STANDARD CHARTERED BANK COTE D'IVOIRE SA BRASILIEN BANCO BNP PARIBAS BRASIL S.A. BRASILIEN CITIBANK EUROPE PLC LUXEMBOURG BRANCH Citibank Sao Paulo BULGARIEN CLEARSTREAM BANKING S.A. LUXEMBOURG Eurobank EFG Bulgaria AD Sofia BURKINA-FASO STANDARD CHARTERED BANK COTE D'IVOIRE SA CHILE CITIBANK EUROPE PLC LUXEMBOURG BRANCH Banco de Chile DÄNEMARK NORDEA DANMARK, filial af Nordea Bank Abp Finland DEUTSCHLAND DZ BANK AG DEUTSCHE ZENTRAL-GENOSSENSCHAFTSBANK Deutsche WertpapierService Bank AG Muttergesellschaft DEUTSCHLAND DZ BANK AG DEUTSCHE ZENTRAL-GENOSSENSCHAFTSBANK diverse, abhängig vom Markt Muttergesellschaft DEUTSCHLAND DZ PRIVATBANK S.A. NIEDERLASSUNG STUTTGART DZ BANK AG DEUTSCHE ZENTRAL-GENOSSENSCHAFTSBANK Niederlassung der DZ PRIVATBANK S.A. ELFENBEINKUESTE STANDARD CHARTERED BANK COTE D'IVOIRE SA ESTLAND CLEARSTREAM BANKING S.A. LUXEMBOURG AS SEB Pank, Tallinn FINNLAND NORDEA BANK ABP FRANKREICH EUROCLEAR BANK SA/NV GHANA STANDARD CHARTERED BANK GHANA PLC GRIECHENLAND CITIBANK EUROPE PLC LUXEMBOURG BRANCH Citibank Europe Plc Athen Branch GROSSBRITANNIEN CITIBANK NA LONDON BRANCH GUINEA BISSAU STANDARD CHARTERED BANK COTE D'IVOIRE SA HONGKONG STANDARD CHARTERED BANK (HK) LTD. INDIEN STANDARD CHARTERED BANK MUMBAI BRANCH INDONESIEN PT BANK HSBC INDONESIA IRLAND REPUBLIK CITIBANK NA LONDON BRANCH IRLAND REPUBLIK EUROCLEAR BANK SA/NV W/ IRLAND ISLAND ISLANDSBANKI HF. ISRAEL BANK HAPOALIM B.M. ITALIEN BNP PARIBAS SECURITIES SERVICES MILANO BRANCH ITALIEN CITIBANK EUROPE PLC JAPAN MUFG BANK LTD JORDANIEN STANDARD CHARTERED BANK AMMAN BRANCH KANADA CITIBANK CANADA KENIA STANDARD CHARTERED BANK KENYA LTD KOLUMBIEN CITIBANK EUROPE PLC LUXEMBOURG BRANCH Cititrust Colombia S.A. -

Annual Financial Statements and Management Report of DZ BANK AG Key Figures

2016 Annual Financial Statements and Management Report of DZ BANK AG Key figures DZ BANK AG Dec. 31, Dec. 31, € million 2016 2015 2016 2015 FINANCIAL PERFORMANCE LIQUIDITY ADEQUACY Operating profit before allowances Economic liquidity adequacy for losses on loans and advances 827 769 (€ billion)2 3.8 4.0 Allowances for losses on loans and Liquidity coverage ratio – LCR advances -313 123 (percent) 139.9 106.6 Operating profit 514 892 Net income for the year 323 399 CAPITAL ADEQUACY Cost/income ratio (percent) 64.7 63.1 Economic capital adequacy (percent)3 4 163.5 173.5 Dec. 31, Jan. 1, Common equity Tier 1 capital ratio 2016 2016 (percent)5 18.1 19.0 NET ASSETS Common equity Tier 1 capital ratio applying CRR in full (percent)6 18.1 19.0 Assets Tier 1 capital ratio (percent)5 19.1 20.2 Loans and advances to banks 118,095 101,022 Total capital ratio (percent)5 24.4 26.6 Loans and advances to customers 33,744 31,710 Leverage ratio (percent)5 4.0 4.6 Bonds and other fixed-income Leverage ratio applying CRR in full securities 45,591 48,253 (percent)6 4.0 4.6 Shares and other variable-yield securities 68 56 AVERAGE NUMBER OF EMPLOYEES Trading assets 38,187 45,929 DURING THE YEAR 5,673 5,590 Other assets 17,630 17,681 LONG-TERM RATING Equity and liabilities Standard & Poor’s AA- AA- Deposits from banks 120,150 119,986 Moody’s Investors Service Aa3 Aa3 Deposits from customers 27,938 22,720 Fitch Ratings AA- AA- Debt certificates issued including bonds 48,173 45,782 Trading liabilities 31,966 31,889 Other liabilities 14,832 14,131 Equity 10,256 10,143 Total assets/total equity and liabilities 253,315 244,651 Volume of business1 284,037 274,059 1 Total equity and liabilities including contingent liabilities and other obligations. -

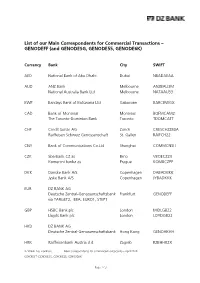

List of Our Main Correspondents for Commercial Transactions – GENODEFF (And GENODESG, GENODE55, GENODE6K)

List of our Main Correspondents for Commercial Transactions – GENODEFF (and GENODESG, GENODE55, GENODE6K) Currency Bank City SWIFT AED National Bank of Abu Dhabi Dubai NBADAEAA AUD ANZ Bank Melbourne ANZBAU3M National Australia Bank Ltd Melbourne NATAAU33 BWP Barclays Bank of Botswana Ltd Gaborone BARCBWGX CAD Bank of Montreal Montreal BOFMCAM2 The Toronto-Dominion Bank Toronto TDOMCATT CHF Credit Suisse AG Zurich CRESCHZZ80A Raiffeisen Schweiz Genossenschaft St. Gallen RAIFCH22 CNY Bank of Communications Co.Ltd Shanghai COMMCNSH CZK Sberbank CZ as Brno VBOECZ2X Komercni banka as Prague KOMBCZPP DKK Danske Bank A/S Copenhagen DABADKKK Jyske Bank A/S Copenhagen JYBADKKK EUR DZ BANK AG Deutsche Zentral-Genossenschaftsbank Frankfurt GENODEFF via TARGET2, EBA: EURO1, STEP1 GBP HSBC Bank plc London MIDLGB22 Lloyds Bank plc London LOYDGB22 HKD DZ BANK AG Deutsche Zentral-Genossenschaftsbank Hong Kong GENOHKHH HRK Raiffeisenbank Austria d.d. Zagreb RZBHHR2X DZ BANK AG, Frankfurt Main Correspondents for Commercial Transactions – April 2018 GENODEFF (GENODESG, GENODE55, GENODE6K) Page 1 / 3 HUF Magyar. Takarékbank zrt Budapest TAKBHUHB Sberbank Magyarorszag ZRT Budapest MAVOHUHB IDR HSBC Ltd Jakarta HSBCIDJA ILS Bank Hapoalim BM Tel-Aviv POALILIT INR ICICI Bank Ltd Mumbai ICICINBB Bank of India Mumbai BKIDINBB ISK Landsbankinn hf Reykjavik NBIIISRE JOD Arab Bank plc Amman ARABJOAX JPY Sumitomo Mitsui Banking Corp. Tokyo SMBCJPJT The Bank of Tokyo-Mitsubishi UFJ Tokyo BOTKJPJT KRW Korea Exchange Bank Seoul KOEXKRSE KWD National Bank of Kuwait SAK -

Finanzbericht EDEKA ZENTRALE Konzern

2020 2020 EDEKA ZENTRALE KONZERN BERICHT FINANZ EDEKA ZENTRALE Konzern FINANZBERICHT 2020 DER KONZERN IM ÜBERBLICK IN EUR MIO. 31.12.2020 31.12.2019 VERÄNDERUNG Vermögenslage Bilanzsumme 8.634,9 7.879,6 755,3 Anlagevermögen 4.605,3 4.180,0 425,2 Vorräte 1.018,6 1.005,6 13,0 Flüssige Mittel 221,5 243,0 -21,5 Übriges Umlaufvermögen, Rechnungsabgrenzungsposten und aktive latente Steuern 2.789,5 2.450,9 338,6 Eigenkapital 2.077,0 2.093,1 -16,1 Eigenkapitalquote (in %) 24,05 26,56 - Rückstellungen 863,8 657,9 205,9 Verbindlichkeiten gegenüber Kreditinstituten 495,3 413,0 82,4 Übrige Verbindlichkeiten inklusive Rechnungsabgrenzungsposten 5.198,8 4.715,7 483,1 IN EUR MIO. 2020 2019 VERÄNDERUNG Finanzlage Cashflow aus der laufenden Geschäftstätigkeit 437,2 -8,0 445,1 Cashflow aus der Investitionstätigkeit -259,3 -331,3 72,0 - davon Auszahlungen in das immaterielle und Sachanlagevermögen -238,4 -255,2 16,7 Cashflow aus der Finanzierungstätigkeit 111,1 -132,0 243,1 Finanzmittelfonds 206,5 -82,5 289,0 IN EUR MIO. 2020 2019 VERÄNDERUNG Ertragslage Umsatzerlöse 38.754,3 35.580,8 3.173,5 - davon Umsatzerlöse aus Handelsgeschäft 37.923,2 34.783,6 3.139,7 Materialaufwand und Bestandsveränderungen -34.369,1 -31.502,1 -2.867,0 Rohertrag 4.385,2 4.078,7 306,5 Rohertrags-Marge (in %) 11,32 11,46 - Personalaufwand -2.022,3 -1.914,8 -107,5 Personalaufwandsquote (in %) 5,22 5,38 - Mitarbeiter im Jahresdurchschnitt (Anzahl) 80.623 74.953 5.670 Betriebsergebnis 382,0 315,7 66,2 Finanzergebnis 65,2 153,5 -88,3 Steuern -146,1 -107,5 -38,5 Konzern-Jahresüberschuss 301,1 361,7 -60,6 TITEL INHALT ZUSAMMEN - ZUSAMMEN GEFASSTER 1 LAGEBERICHT 43 KONZERNANHANG GEFASSTER 3 Geschäftsmodell 44 Allgemeine Grundsätze des EDEKA ZENTRALE Stiftung & Co. -

DZ Bank Germany

DZ Bank Germany Active This profile is actively maintained Send feedback on this profile Created before Nov 2016 Last update: Feb 9 2021 About DZ Bank DZ Bank is the thirth largest bank in Germany by assets, and acts as the central banking institution for more than 900 cooperative banks. It is part of the Volksbanken Raiffeisenbanken co-operative network, one of Germany's largest private sector financial institutions. In this network DZ Bank functions as a central institution. The DZ Bank Group includes DVB Bank, a transportation finance bank; Bausparkasse Schwäbisch Hall, a building society; DG HYP, a provider of real estate finance; DZ PRIVATBANK Gruppe; R+V Versicherung, an insurance company; TeamBank, a provider of consumer finance; Union Investment Group, an asset management company; VR LEASING; and other institutions. In January 2013 DZ Bank signed up to the Equator Principles, and is profiled as part of BankTrack's Tracking the Equator Principles campaign. Website http://www.dzbank.com/ Headquarters Platz der Republik 60265 Frankfurt am Main Hessen Germany CEO/chair Uwe Fröhlich and Cornelius Riese co-CEOs Supervisor Federal Financial Supervisory Authority (BaFin) Annual report Annual report 2019 Ownership At the end of 2019, 94.7 percent of shares were held by local cooperative banks. Complaints DZ Bank's Guiding Principles for Complaints can be found here. and grievances Sustainability Voluntary standards DZ Bank has committed itself to the following voluntary standards: Carbon Disclosure Project Equator Principles German Sustainability Code Global Reporting Initiative Principles for Responsible Banking (PRB) United Nations Global Compact Investment policies DZ Bank's webpage on corporate social responsibility can be accessed here. -

Market Literature

FEDERATED PRIME CASH OBLIGATIONS FUND Portfolio as of October 31, 2019 Current Net Assets -- $ 29,942,031,661 Weighted Average Maturity: 39 Days Weighted Average Life: 85 Days Credit Rating: AAAm STANDARD & POOR'S Aaa-mf MOODY'S AAAmmf FITCH Federated offers daily portfolio holdings information for this fund. To request more information or sign up for this service, please contact us at 1-800-245-4270. (2) Effective (3) Final Principal Amount (1) Security Description CUSIP Base Value/Cost Maturity Maturity Category of Investment ASSET-BACKED SECURITIES - 0.3% $ 65,000,000 (4) HPEFS Equipment Trust 2019-1, Class A1, 2.150% 40438DAA7 $ 65,000,000 10/9/2020 10/9/2020 Other Asset Backed Securities $ 36,699,442 Santander Drive Auto Receivables Trust 2019-3, Class A1, 2.208% 80286HAA7 $ 36,699,442 8/17/2020 8/17/2020 Other Asset Backed Securities TOTAL ASSET-BACKED SECURITIES $ 101,699,442 CERTIFICATE OF DEPOSIT - 12.1% $ 50,000,000 Bank of Montreal, 2.690% 06370RVU0 $ 50,000,000 3/9/2020 3/9/2020 Certificate of Deposit $ 140,000,000 Bank of Montreal, 2.700% 06370RWH8 $ 140,000,000 3/19/2020 3/19/2020 Certificate of Deposit $ 50,000,000 Bank of New York Mellon, N.A., 2.400% 06405VCS6 $ 49,997,293 12/11/2019 12/11/2019 Certificate of Deposit $ 70,000,000 DZ Bank AG Deutsche Zentral-Genossenschaftsbank, 2.070% $ 69,533,979 2/26/2020 2/26/2020 Certificate of Deposit $ 125,000,000 DZ Bank AG Deutsche Zentral-Genossenschaftsbank, 2.070% $ 124,153,546 2/28/2020 2/28/2020 Certificate of Deposit $ 198,000,000 DZ Bank AG Deutsche Zentral-Genossenschaftsbank,