Market Literature

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Financial Statements and Management Report of DZ BANK AG

2017 Annual Financial Statements and Management Report of DZ BANK AG DZ BANK AG 1 2017 Annual Financial Statements and Management Report Contents Contents 02 Management report of DZ BANK AG 06 DZ BANK AG fundamentals 16 Business report 30 Events after the balance sheet date 32 Human resources report and sustainability 38 Outlook 44 Combined opportunity and risk report 152 Annual financial statements of DZ BANK AG 154 Balance sheet as at December 31, 2017 156 Income statement for the period January 1 to December 31, 2017 158 Notes 212 Responsibility statement 213 Independent auditors’ report (translation) 2 DZ BANK AG 2017 Annual Financial Statements and Management Report Management report of DZ BANK AG Contents Management report of DZ BANK AG 06 DZ BANK AG fundamentals 30 Events after the balance sheet date 06 Business model 32 Human resources report 07 Strategic focus as a network-oriented and sustainability central institution and financial services group 32 Human resources report 07 Cooperative Banks / Verbund 32 HR work in the year of the migration 08 Corporate Banking 32 Professional development 08 Retail Banking 32 Training and development of young talent 09 Capital Markets 33 Health management 09 Transaction Banking 33 Work-life balance 33 TeamUp trainee program 10 Management of DZ BANK 33 ‘Verbund First’ career development program 10 Management units 33 Corporate Campus for Management & Strategy 10 Governance 34 DZ BANK Group’s employer branding campaign 13 Key performance indicators 34 Employer awards 13 Management process 34 -

EMS Counterparty Spreadsheet Master

1 ECHO MONITORING SOLUTIONS COUNTERPARTY RATINGS REPORT Updated as of October 24, 2012 S&P Moody's Fitch DBRS Counterparty LT Local Sr. Unsecured Sr. Unsecured Sr. Unsecured ABN AMRO Bank N.V. A+ A2 A+ Agfirst Farm Credit Bank AA- AIG Financial Products Corp A- WR Aig-fp Matched Funding A- Baa1 Allied Irish Banks PLC BB Ba3 BBB BBBL AMBAC Assurance Corporation NR WR NR American International Group Inc. (AIG) A- Baa1 BBB American National Bank and Trust Co. of Chicago (see JP Morgan Chase Bank) Assured Guaranty Ltd. (U.S.) A- Assured Guaranty Municipal Corp. AA- Aa3 *- NR Australia and New Zealand Banking Group Limited AA- Aa2 AA- AA Banco Bilbao Vizcaya Argentaria, S.A. BBB- Baa3 *- BBB+ A Banco de Chile A+ NR NR Banco Santander SA (Spain) BBB (P)Baa2 *- BBB+ A Banco Santander Chile A Aa3 *- A+ Bank of America Corporation A- Baa2 A A Bank of America, NA AA3AAH Bank of New York Mellon Trust Co NA/The AA- AA Bank of North Dakota/The AA- A1 Bank of Scotland PLC (London) A A2 A AAL Bank of the West/San Francisco CA A Bank Millennium SA BBpi Bank of Montreal A+ Aa2 AA- AA Bank of New York Mellon/The (U.S.) AA- Aa1 AA- AA Bank of Nova Scotia (Canada) AA- Aa1 AA- AA Bank of Tokyo-Mitsubish UFJ Ltd A+ Aa3 A- A Bank One( See JP Morgan Chase Bank) Bankers Trust Company (see Deutsche Bank AG) Banknorth, NA (See TD Bank NA) Barclays Bank PLC A+ A2 A AA BASF SE A+ A1 A+ Bayerische Hypo- und Vereinsbank AG (See UniCredit Bank AG) Bayerische Landesbank (parent) NR Baa1 A+ Bear Stearns Capital Markets Inc (See JP Morgan Chase Bank) NR NR NR Bear Stearns Companies, Inc. -

Frank Westhoff Former Member of the Board of Managing Directors of DZ BANK AG

Curriculum Vitae Frank Westhoff Former Member of the Board of Managing Directors of DZ BANK AG Personal data Place of residence Eppstein Dates of birth 12.06.1961 in Wolfsburg Nationality German Independence (+) Member of the Supervisory Board of Commerzbank Initial appointment 05/2021 Curr. term of office General Annual Meeting 2021 – 2023 Committees Risk Committee (Chairman) Audit Committee Compensation Control Committee Competences and experiences Extensive knowledge of the European banking market, especially in corporate and real estate-oriented customer business. Far-reaching experience in the finance and risk management of large banks as a long-standing head of risk of one of the largest German banks. Comprehensive supervisory board practice as supervisory board/chairman of various companies in the financial sector between 2004 and 2019. Long-term career in banking with experience in customer service, risk and bank management as well as accompanying strategy and consolidation programs. Career highlights 2002– 2017 DZ BANK AG 2006 – 2017 Member of the Board of Managing Directors, Chief Risk Officer, Credit Department, risk controlling, compliance and various regions and customers, Frankfurt/Main 2002 – 2006 Department Head for Business Analysis, Chief Credit Officer, Frankfurt/Main 1990 – 2002 Deutsche Bank AG 2002 Director for the southern region, Munich 1996 – 2001 Head of Strategy/Structure/Processes in the credit department, Senior Credit Officer, Director, Frankfurt/Main 1995 – 1996 Head of Corporate Clients Austria, Vienna 1991 -

List of PRA-Regulated Banks

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 2nd December 2019 (Amendments to the List of Banks since 31st October 2019 can be found below) Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The ADIB (UK) Ltd EFG Private Bank Limited Ahli United Bank (UK) PLC Europe Arab Bank plc AIB Group (UK) Plc Al Rayan Bank PLC FBN Bank (UK) Ltd Aldermore Bank Plc FCE Bank Plc Alliance Trust Savings Limited FCMB Bank (UK) Limited Allica Bank Ltd Alpha Bank London Limited Gatehouse Bank Plc Arbuthnot Latham & Co Limited Ghana International Bank Plc Atom Bank PLC Goldman Sachs International Bank Axis Bank UK Limited Guaranty Trust Bank (UK) Limited Gulf International Bank (UK) Limited Bank and Clients PLC Bank Leumi (UK) plc Habib Bank Zurich Plc Bank Mandiri (Europe) Limited Hampden & Co Plc Bank Of Baroda (UK) Limited Hampshire Trust Bank Plc Bank of Beirut (UK) Ltd Handelsbanken PLC Bank of Ceylon (UK) Ltd Havin Bank Ltd Bank of China (UK) Ltd HBL Bank UK Limited Bank of Ireland (UK) Plc HSBC Bank Plc Bank of London and The Middle East plc HSBC Private Bank (UK) Limited Bank of New York Mellon (International) Limited, The HSBC Trust Company (UK) Ltd Bank of Scotland plc HSBC UK Bank Plc Bank of the Philippine Islands (Europe) PLC Bank Saderat Plc ICBC (London) plc Bank Sepah International Plc ICBC Standard Bank Plc Barclays Bank Plc ICICI Bank UK Plc Barclays Bank UK PLC Investec Bank PLC BFC Bank Limited Itau BBA International PLC Bira Bank Limited BMCE Bank International plc J.P. -

Uebersicht Der Unterverwahrer.Xlsx

Übersicht der Unterverwahrer der DZ PRIVATBANK S.A. Stand: 28.06.2021 Markt Lagerstelle Unterverwahrer Beziehungsstatus ÄGYPTEN HSBC BANK EGYPT SAE ARGENTINIEN CLEARSTREAM BANKING S.A. LUXEMBOURG AUSTRALIEN BNP PARIBAS SECURITIES SERVICES S.A. AUSTRALIA BRANCH BANGLADESH STANDARD CHARTERED BANK DHAKA BRANCH BELGIEN EUROCLEAR BANK SA/NV BENIN STANDARD CHARTERED BANK COTE D'IVOIRE SA BRASILIEN BANCO BNP PARIBAS BRASIL S.A. BRASILIEN CITIBANK EUROPE PLC LUXEMBOURG BRANCH Citibank Sao Paulo BULGARIEN CLEARSTREAM BANKING S.A. LUXEMBOURG Eurobank EFG Bulgaria AD Sofia BURKINA-FASO STANDARD CHARTERED BANK COTE D'IVOIRE SA CHILE CITIBANK EUROPE PLC LUXEMBOURG BRANCH Banco de Chile DÄNEMARK NORDEA DANMARK, filial af Nordea Bank Abp Finland DEUTSCHLAND DZ BANK AG DEUTSCHE ZENTRAL-GENOSSENSCHAFTSBANK Deutsche WertpapierService Bank AG Muttergesellschaft DEUTSCHLAND DZ BANK AG DEUTSCHE ZENTRAL-GENOSSENSCHAFTSBANK diverse, abhängig vom Markt Muttergesellschaft DEUTSCHLAND DZ PRIVATBANK S.A. NIEDERLASSUNG STUTTGART DZ BANK AG DEUTSCHE ZENTRAL-GENOSSENSCHAFTSBANK Niederlassung der DZ PRIVATBANK S.A. ELFENBEINKUESTE STANDARD CHARTERED BANK COTE D'IVOIRE SA ESTLAND CLEARSTREAM BANKING S.A. LUXEMBOURG AS SEB Pank, Tallinn FINNLAND NORDEA BANK ABP FRANKREICH EUROCLEAR BANK SA/NV GHANA STANDARD CHARTERED BANK GHANA PLC GRIECHENLAND CITIBANK EUROPE PLC LUXEMBOURG BRANCH Citibank Europe Plc Athen Branch GROSSBRITANNIEN CITIBANK NA LONDON BRANCH GUINEA BISSAU STANDARD CHARTERED BANK COTE D'IVOIRE SA HONGKONG STANDARD CHARTERED BANK (HK) LTD. INDIEN STANDARD CHARTERED BANK MUMBAI BRANCH INDONESIEN PT BANK HSBC INDONESIA IRLAND REPUBLIK CITIBANK NA LONDON BRANCH IRLAND REPUBLIK EUROCLEAR BANK SA/NV W/ IRLAND ISLAND ISLANDSBANKI HF. ISRAEL BANK HAPOALIM B.M. ITALIEN BNP PARIBAS SECURITIES SERVICES MILANO BRANCH ITALIEN CITIBANK EUROPE PLC JAPAN MUFG BANK LTD JORDANIEN STANDARD CHARTERED BANK AMMAN BRANCH KANADA CITIBANK CANADA KENIA STANDARD CHARTERED BANK KENYA LTD KOLUMBIEN CITIBANK EUROPE PLC LUXEMBOURG BRANCH Cititrust Colombia S.A. -

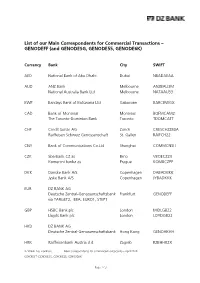

List of Our Main Correspondents for Commercial Transactions – GENODEFF (And GENODESG, GENODE55, GENODE6K)

List of our Main Correspondents for Commercial Transactions – GENODEFF (and GENODESG, GENODE55, GENODE6K) Currency Bank City SWIFT AED National Bank of Abu Dhabi Dubai NBADAEAA AUD ANZ Bank Melbourne ANZBAU3M National Australia Bank Ltd Melbourne NATAAU33 BWP Barclays Bank of Botswana Ltd Gaborone BARCBWGX CAD Bank of Montreal Montreal BOFMCAM2 The Toronto-Dominion Bank Toronto TDOMCATT CHF Credit Suisse AG Zurich CRESCHZZ80A Raiffeisen Schweiz Genossenschaft St. Gallen RAIFCH22 CNY Bank of Communications Co.Ltd Shanghai COMMCNSH CZK Sberbank CZ as Brno VBOECZ2X Komercni banka as Prague KOMBCZPP DKK Danske Bank A/S Copenhagen DABADKKK Jyske Bank A/S Copenhagen JYBADKKK EUR DZ BANK AG Deutsche Zentral-Genossenschaftsbank Frankfurt GENODEFF via TARGET2, EBA: EURO1, STEP1 GBP HSBC Bank plc London MIDLGB22 Lloyds Bank plc London LOYDGB22 HKD DZ BANK AG Deutsche Zentral-Genossenschaftsbank Hong Kong GENOHKHH HRK Raiffeisenbank Austria d.d. Zagreb RZBHHR2X DZ BANK AG, Frankfurt Main Correspondents for Commercial Transactions – April 2018 GENODEFF (GENODESG, GENODE55, GENODE6K) Page 1 / 3 HUF Magyar. Takarékbank zrt Budapest TAKBHUHB Sberbank Magyarorszag ZRT Budapest MAVOHUHB IDR HSBC Ltd Jakarta HSBCIDJA ILS Bank Hapoalim BM Tel-Aviv POALILIT INR ICICI Bank Ltd Mumbai ICICINBB Bank of India Mumbai BKIDINBB ISK Landsbankinn hf Reykjavik NBIIISRE JOD Arab Bank plc Amman ARABJOAX JPY Sumitomo Mitsui Banking Corp. Tokyo SMBCJPJT The Bank of Tokyo-Mitsubishi UFJ Tokyo BOTKJPJT KRW Korea Exchange Bank Seoul KOEXKRSE KWD National Bank of Kuwait SAK -

DZ Bank Germany

DZ Bank Germany Active This profile is actively maintained Send feedback on this profile Created before Nov 2016 Last update: Feb 9 2021 About DZ Bank DZ Bank is the thirth largest bank in Germany by assets, and acts as the central banking institution for more than 900 cooperative banks. It is part of the Volksbanken Raiffeisenbanken co-operative network, one of Germany's largest private sector financial institutions. In this network DZ Bank functions as a central institution. The DZ Bank Group includes DVB Bank, a transportation finance bank; Bausparkasse Schwäbisch Hall, a building society; DG HYP, a provider of real estate finance; DZ PRIVATBANK Gruppe; R+V Versicherung, an insurance company; TeamBank, a provider of consumer finance; Union Investment Group, an asset management company; VR LEASING; and other institutions. In January 2013 DZ Bank signed up to the Equator Principles, and is profiled as part of BankTrack's Tracking the Equator Principles campaign. Website http://www.dzbank.com/ Headquarters Platz der Republik 60265 Frankfurt am Main Hessen Germany CEO/chair Uwe Fröhlich and Cornelius Riese co-CEOs Supervisor Federal Financial Supervisory Authority (BaFin) Annual report Annual report 2019 Ownership At the end of 2019, 94.7 percent of shares were held by local cooperative banks. Complaints DZ Bank's Guiding Principles for Complaints can be found here. and grievances Sustainability Voluntary standards DZ Bank has committed itself to the following voluntary standards: Carbon Disclosure Project Equator Principles German Sustainability Code Global Reporting Initiative Principles for Responsible Banking (PRB) United Nations Global Compact Investment policies DZ Bank's webpage on corporate social responsibility can be accessed here. -

FINANCIALS a Research Publication by DZ BANK AG

1/17 FINANCIALS A Research Publication by DZ BANK AG Bail-in regulations making banks' BONDS liability structure more important Special 13 Jul 2015 » With the introduction of rigorous resolution regimes designed to allow the or- derly resolution and recovery of distressed banks it has become ever more im- portant to understand a bank’s liability structure, since a resolution can lead to TABLE OF CONTENTS a bail-in of equity and bond holders. The amount of equity and loss-absorbing liabilities a bank holds, and how these are distributed between the different INVESTIGATING A BANK’S LIABILITY ranks of the bail-in hierarchy, provide an indication of the loss an investor may STRUCTURE 2 be faced with on an individual instrument. OVERVIEW: CAPITAL INSTRUMENTS AND » In this publication we will start by presenting the liability structure - i.e. the equi- LOSS-ABSORBING LIABILITIES 3 ty instruments and loss-absorbing liabilities - of the banks we cover as at the HOW LARGE A BAIL-IN CAN BE EXPECTED? year-end 2014. We then simulate a loss to determine what impact this has on SIMULATION OF A LOSS 5 the bank’s capital ratios. It also provides an indication of the extent to which shareholders and creditors would be bailed in in the event that the institution is SENSITIVITY OF INDIVIDUAL BANKS - OVERVIEW 9 subject to resolution and recovery and the CET1 ratio has to be brought back up to a predefined level. CONCLUSION 11 » The results of the simulation are that even with a loss of 5% of total assets, IMPRINT 13 and even more so at a loss of 8% of assets, a large haircut is imposed on sen- ior creditors at many banks. -

How the Poll Was Conducted

Overall 2014 2013 Bank % Interest rates Equity 1 2 Commerzbank 16.1 2 1 Deutsche Bank 15.8 Interest rate swaps Repurchase agreements OTC single-stock options – Germany Equity index options 3 3 UniCredit 12.9 4 5 DZ Bank 7.1 2014 2013 Bank % 2014 2013 Bank % 2014 2013 Bank % 2014 2013 Bank % 5 – JP Morgan 6.8 1 1 Deutsche Bank 20.7 1 1 Deutsche Bank 23.9 1 1 UniCredit 22.1 1 n/a Commerzbank 21.3 6 8 Barclays 6.3 2 3 Commerzbank 18.0 2 3 Commerzbank 21.2 2= 3 Commerzbank 18.2 2 UniCredit 18.3 7 4 Landesbank Baden-Württemberg 6.1 3 – Barclays 11.3 3 2 UniCredit 17.1 2= 2 Deutsche Bank 18.2 3 Deutsche Bank 17.2 8 6 BNP Paribas 6.0 4 2 UniCredit 11.2 4 – Barclays 12.6 4 – BNP Paribas 9.6 4 JP Morgan 10.4 9 7 HSBC 5.2 5 4 DZ Bank 10.1 5 5 Landesbank Baden-Württemberg 9.4 5 – Credit Suisse 7.7 5 Credit Suisse 9.3 10 – Credit Suisse 5.1 Interest rate options Cross-currency swaps OTC single-stock options – international Exchange-traded funds 2014 2013 Bank % 2014 2013 Bank % 2014 2013 Bank % 2014 2013 Bank % Overall 1 1 Deutsche Bank 19.2 1 1 Commerzbank 20.7 1 3 Commerzbank 19.0 1 1 UniCredit 22.1 2 3 Commerzbank 17.8 2 2 Deutsche Bank 19.3 2 2 Deutsche Bank 18.4 2 3 Commerzbank 21.4 Interest rates 3 2 UniCredit 12.1 3 3 UniCredit 13.2 3 1 UniCredit 18.1 3 2 Deutsche Bank 20.0 4 4 DZ Bank 12.0 4 – Citi 10.4 4 – JP Morgan 10.7 4 4 Societe Generale 9.2 2014 2013 Bank % 5 – Barclays 9.2 5 5 DZ Bank 10.2 5 4 UBS 7.5 5 – Morgan Stanley 7.3 1 1 Deutsche Bank 20.7 2 3 Commerzbank 19.4 Forward rate agreements 3 2 UniCredit 13.2 Other 4 – Barclays 10.7 -

Interfaces & Partners

Interfaces & Partners Data Bloomberg B-Pipe ITG Logic Bloomberg Data License Markit Group Limited Bloomberg Desktop API Proquote Bloomberg Server API Quick Charles River Data Service – Reference Telemet Orion Charles River Data Service – Real-Time The Yield Book Inc. Charles River Data Service – Benchmarks Thomson Reuters DataScope Select AP Pre-Trade Analytics Barclays The Yield Book Inc. ITG Thomson Reuters Jefferies/Quantitative Execution Strategies (QES) UBS SJ Levinson & Sons Accounting Systems Advent APX Princeton ePAM Advent Axys Princeton Financial Systems/PAM, ePAM Advent Geneva Princeton PAM Citi Accounting Princeton PFI DST GPS SS&C Camra DST InfoQuest SS&C Pacer Eagle Investment Systems/Eagle STAR Thomson Reuters PORTIA IDS GIM 2 Wall Street Office Metavante Equity Algo Trading Abel/Noser (US) Credit Suisse (Global) Aqua Securities, L.P (US) Daiwa Capital Securities Markets Co. Ltd (APAC) Auerbach Grayson (Global) Dash Financial (US) Barclay’s Capital (Global) Deutsche Bank (Global) BestEx Pty Ltd DnB NOR Bank ASA (EU,UK) BMO Capital Markets Corp Drexel Hamilton LLC BMO Nesbitt Burns DZ BANK AG (EU) BNP Paribas (Global) Exane (US,EU,UK) BTIG, LLC (US) Execution Ltd (UK) Canaccord Capital (Global) Fidelity Capital Markets (US) CIBC World Markets (US, CAN) FOX River Execution (US) CIMB Securities (Singapore) Pte Ltd (Global) Goldman Sachs (Global) Citigroup (Global) Guggenheim Securities LLC (US) Clearpool, Group (US) HSBC (Global) CLSA Limited (Global) Instinet (Global) Commonwealth Securities, Ltd (Global) ISI Group (US) ConvergEx Execution Solutions (US) ITG Inc. (Global) Cowen & Company, LLC. (US) Jefferies & Company (US) 1 Interfaces & Partners Equity Algo Trading (cont’d) JP Morgan (Global) Quantitative Brokers, LLC (US) Knight Securities (US) Raymond James (US) Leerink Swann & Co. -

View Annual Report

2008 ANNUAL REPORT DZ BANK GROUP FINANCIAL SERVICES PROVIDER IN THE COOPERATIVE FINANCIAL SERVICES NETWORK 1,200 COOPER DZ BANK BANK BUSINESS SEGMENT RETAIL BUSINESS SEGMENT BUSINESS LINES BUSINESS LINES » Corporate Banking » Asset Management » Investment Banking » Retail & Private Banking » Process Management BRANDS AND MARKET POSITIONS IN GERMANY BRANDS AND MARKET POSITIONS IN GERMANY NO. 51 NO. 3 (RETAIL FUNDS) NO. 2 (EQUIPMENT LEASING)2 NO. 3 (SUBSIDIARIES OF NO. 2 (SUBSIDIARIES OF GERMAN BANKS IN IRELAND)1 GERMAN BANKS IN SWITZERLAND)1 NO. 3 (VOLUME OF NO. 1 (CREDIT PROCESSING) SPECIALIST CONSUMER FINANCE) NO. 1 (PROVIDER OF FOREIGN EXCHANGE AND INTERNATIONAL PAYMENT SERVICES) PRODUCT BRANDS PRODUCT BRANDS NO. 1 (GERMAN MARKET FOR CERTIFICATES) NO. 3 (VOLUME OF SPECIALIST CONSUMER FINANCE) « RATIVE BANKS GROUP DZ BANK Group REAL ESTATE FINANCE BUSINESS SEGMENT INSURANCE BUSINESS SEGMENT BUSINESS LINE BUSINESS LINE » Real Estate Finance » Insurance BRANDS AND MARKET POSITIONS IN GERMANY BRANDS AND MARKET POSITIONS IN GERMANY NO. 1 (HOME SAVINGS)2 NO. 2 (LIFE INSURANCE)2 1 Total assets 2 New business KEY FIGURES DZ BANK GROUP € million 2008 2007 FINANCIAL PERFORMANCE Operating profit/loss1 -929 1,277 Impairment losses on loans and advances -545 -209 Profit/loss before tax -1,472 1,068 Net profit/loss -1,055 897 Cost/income ratio (percent) > 100.0 66.9 FINANCIAL POSITION Assets Loans and advances to banks 70,036 67,531 Loans and advances to customers 117,021 106,307 Financial assets held for trading 114,443 130,025 Investments 66,322 -

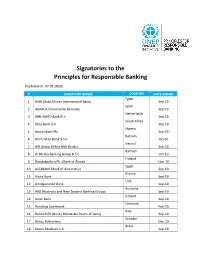

Signatories to the Principles for Responsible Banking

Signatories to the Principles for Responsible Banking (Updated on: 07.09.2020) # SIGNATORY BANKS COUNTRY DATE SIGNED Egypt 1 AAIB (Arab African International Bank) Sep-19 Spain 2 ABANCA Corporación Bancaria Sep-19 Netherlands 3 ABN AMRO Bank N.V. Sep-19 South Africa 4 Absa Bank Ltd. Sep-19 Nigeria 5 Access Bank Plc Sep-19 Bahrain 6 Ahli United Bank B.S.C Jan-20 Ireland 7 AIB Group (Allied Irish Banks) Sep-19 Bahrain 8 Al Baraka Banking Group B.S.C. Oct-19 Finland 9 Ålandsbanken Plc. (Bank of Åland) Nov-19 Egypt 10 ALEXBANK (Bank of Alexandria) Sep-19 Greece 11 Alpha Bank Sep-19 USA 12 Amalgamated Bank Sep-19 Australia 13 ANZ (Australia and New Zealand Banking Group) Sep-19 Iceland 14 Arion Bank Sep-19 Denmark 15 Aurskorg Sparebank Feb-20 Italy 16 Banca MPS (Banca Monte dei Paschi di Siena) Sep-19 Ecuador 17 Banco Bolivariano Dec-19 Brazil 18 Banco Bradesco S.A. Sep-19 Brazil 19 Banco da Amazônia Jan-20 Argentina 20 Banco de Galicia y Buenos Aires SA Sep-19 Ecuador 21 Banco de la Produccion S.A Produbanco Sep-19 Ecuador 22 Banco de Machala S.A. Sep-19 Mexico 23 Banco del Bajio, S.A. Aug-20 Ecuador 24 Banco Diners Club del Ecuador S.A. Nov-19 Nicaragua 25 Banco Grupo Promerica Nicaragua Sep-19 Ecuador 26 Banco Guayaquil Sep-19 El Salvador 27 Banco Hipotecario de El Salvador S.A. Sep-19 Ecuador 28 Banco Pichincha Sep-19 Dominican Republic 29 Banco Popular Dominicano Sep-19 Costa Rica 30 Banco Promerica Costa Rica Sep-19 Paraguay 31 Banco Regional Jul-20 Spain 32 Banco Sabadell Sep-19 Ecuador 33 Banco Solidario Nov-19 Colombia 34 Bancolombia