Download of Constituents Varies Widely from One Index to the Next Excess Return Data at a Monthly Frequency

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Raising Capital from the Community Alternative Capital Development Through Crowdfunding

Raising Capital from the Community Alternative Capital Development through Crowdfunding November 2013 Green For All - Business Accelerator Program greenforall.org/resources Acknowledgments © Green For All 2013 Written by Jessica Leigh Green for All would like to thank the following individuals and organizations for their contributions to this guide: Jenny Kassan, Cutting Edge Capital; Brahm Ahmadi, People’s Community Market; Justin Renfro, Kiva Zip; Joanna De Leon, Triple Green Custom Print Developers; Ben Bateman, Indi- egogo; Lisa Curtis, Kuli Kuli; Erin Barnes, ioby; Helen Ho, Biking Public Project, Recycle-a-Bicycle Other parties that helped in the preparation of this report: Jeremy Hays and Khary Dvorak-Ewell RAISING CAPITAL FROM THE COMMUNITY Green For All Business Accelerator Program Introduction Community Capital Today’s economy brings new capital development challenges for the small businesses that drive green innova- tion and strengthen our neighborhoods. Obtaining traditional financing from banks has become increasingly prohibitive. Venture capital funds and angel investors seek businesses that provide fast growth and high re- turns. Cultivating a sustainable small business that prioritizes people and the environment generally does not lend itself to these conditions. A recent survey by the National Small Business Association (NSBA) found that nearly half of small-business respondents said they needed funds and were unable to find any willing sources, be it loans, credit cards or investors.1 Additionally, the novelty of small green businesses makes them more risky and less appealing for traditional sources of capital. Environmentally focused entrepreneurs often have little choice but to compromise their mission or the direction of their company in an attempt to secure financing. -

Název 1 99Funken 2 Abundance Investment 3 Angelsden

# Název 1 99funken 2 Abundance Investment 3 Angelsden 4 Apontoque 5 Appsplit 6 Barnraiser 7 Bidra.no 8 Bloom venture catalyst 9 Bnktothefuture 10 Booomerang.dk 11 Boosted 12 Buzzbnk 13 Catapooolt 14 Charidy 15 Circleup 16 Citizinvestor 17 CoAssets 18 Companisto 19 Crowdcube 20 CrowdCulture 21 Crowdfunder 22 Crowdfunder.co.uk 23 Crowdsupply 24 Cruzu 25 DemoHour 26 DigVentures 27 Donorschoose 28 Econeers 29 Eppela 30 Equitise 31 Everfund 32 Experiment 33 Exporo 34 Flzing v 35 Fondeadora 36 Fundit 37 Fundrazr 38 Gemeinschaftscrowd 39 Goteo 40 GreenVesting.com 41 Greenxmoney 42 Hit Hit 43 Housers 44 Idea.me 45 Indiegogo 46 Innovestment 47 Invesdor.com 48 JD crowdfunding 49 Jewcer 50 Karolina Fund 51 Katalyzator 52 Ketto 53 Kickstarter 54 KissKissBankBank 55 Kreativcisobe 56 Labolsasocial 57 Lanzanos 58 Lignum Capital 59 Marmelada 60 Massivemov 61 Mesenaatti.me 62 Monaco funding 63 Musicraiser 64 MyMicroInvest 65 Nakopni me 66 Namlebee 67 Octopousse 68 Oneplanetcrowd International B.V. 69 Penězdroj 70 Phundee 71 PledgeCents 72 Pledgeme 73 Pledgemusic 74 Pozible 75 PPL 76 Projeggt 77 Rockethub 78 Seed&Spark 79 Seedmatch 80 Seedrs 81 Snowballeffect 82 Spacehive 83 Spiele offensive 84 Start51 85 Startlab 86 Startme 87 Startnext 88 Startovac 89 Startsomegood 90 Syndicate Room 91 TheHotStart 92 Thundafund 93 Tubestart 94 Ulule 95 Venturate 96 Verkami 97 Vision bakery 98 Wemakeit 99 Wishberry 100 Zoomal Legenda: *Sociální média Vysvětlení zkratek pro sociální média F - Facebook T - Twitter Lin - LinkedIn G+ - Google plus YouT - YouTube Insta - Instagram -

Access to Capital Directory

State of Nevada Department of Business and Industry Access to Capital Resource Directory Page | 1 GRANTS Government grants are funded by your tax dollars and, therefore, require very stringent compliance and reporting measures to ensure the money is well spent. Grants from the Federal government are authorized and appropriated through bills passed by Congress and signed by the President. The grant authority varies widely among agencies. Some business grants are available through state and local programs, nonprofit organizations and other groups. These grants are not necessarily free money, and usually require the recipient to match funds or combine the grant with other forms of financing such as a loan. The amount of the grant money available varies with each business and each grantor. Below are some resources to grant searches and specific grant opportunities: Program/Sponsor Product Details Contact Information There is a loan/grant search tool (Access Business.usa.gov Financing Wizard). Mostly loans here but Support Center some grant possibilities. SBA has authority to make grants to non- For Clark County Only – profit and educational organizations in Phone: 702-388-6611 many of its counseling and training Email: Roy Brady at SBA-Government programs, but does not have authority to [email protected] Grant Resources make grants to small businesses. Click on the 'Program/Sponsor" link for articles on Outside of Clark County – government grant facts and research Phone: 775-827-4923 Email: [email protected] grants for small businesses. Grant program assistance is provided in many ways, including direct or guaranteed loans, grants, technical assistance, Nevada USDA service centers by USDA Rural research and educational materials. -

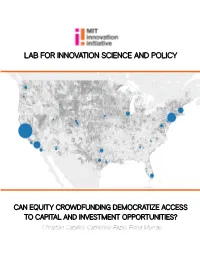

Lab for Innovation Science and Policy

LAB FOR INNOVATION SCIENCE AND POLICY CAN EQUITY CROWDFUNDING DEMOCRATIZE ACCESS TO CAPITAL AND INVESTMENT OPPORTUNITIES? Christian Catalini, Catherine Fazio, Fiona Murray Can Equity Crowdfunding Democratize Access to Capital and Investment Opportunities? Christian Catalini Catherine Fazio Fiona Murray MIT Innovation Initiative Lab for Innovation Science and Policy Report © 2016 Massachusetts Institute of Technology May 2016 Cover: The map plots equity crowdfunding investment activity across the United States on the leading U.S. Title II platform. The grayscale represents income per capita (a proxy for wealth), and the blue circles reflect the size of online investment by accredited investors in the focal region. (Catalini and Luo, 2016). 1 Introduction “Oculus Rift virtual reality headset raised $2.4 million on Kickstarter [in 2012], no strings attached. Those donors weren’t looking for a payout; they wanted to support something they believed in, and maybe get a pair of virtual reality goggles to play with. But when Facebook bought Oculus a year and a half later for $2 billion in cash and stock, backers wondered: what if I’d asked for equity instead of a poster?”1 At that time, however, equity was not an option. Although securities laws had been changed (through Title III of the 2012 Jumpstart our Business Startups (JOBS) Act) to permit equity crowdfunding of startups from all investors (regardless of income or net worth), concerns remained over protecting unsophisticated investors from fraud and subjecting nascent startups and online platforms to disclosure and review requirements. The U.S. SEC (Securities and Exchange Commission) struggled to craft implementing regulations “stringent enough to protect investors but flexible enough to allow for meaningful fund-raising,”2 Title III stalled and did not take effect. -

Market Analysis, Economics and Success Drivers of Equity Crowdfunding

Dipartimento di Impresa e Cattedra di Advanced Corporate Management Finance MARKET ANALYSIS, ECONOMICS AND SUCCESS DRIVERS OF EQUITY CROWDFUNDING RELATORE: CANDIDATO: Prof. Cristiano Cannarsa Salvatore Luciano Furnari CORRELATORE: Matr. 691441 Prof. Raffaele Oriani Anno Accademico 2016/2017 1 Contents Introduction ............................................................................................................. 4 Chapter 1 – Equity crowdfunding ............................................................................. 6 1.1 Definition and origins ..................................................................................... 6 1.2 Classification .................................................................................................. 8 1.2.1 Equity crowdfunding and other crowdfunding models .............................. 8 1.2.2 Definition of the target and type of campaign: All-Or-Nothing vs Keep-It- All .................................................................................................................. 16 1.3. Equity crowdfunding benefits ...................................................................... 23 1.3.1 Advantages for investors ........................................................................ 24 1.3.2 Advantages for issuers............................................................................ 26 1.4 Equity crowdfunding risks ............................................................................ 30 1.4.1 Risk for investors .................................................................................. -

PROVIDING RESOURCES for SMALL BUSINESSES SBDC at UW

PROVIDING RESOURCES FOR SMALL BUSINESSES Guide to Business Investment and Financing A Financial Resource Compilation for Wisconsin Businesses SBDC at UW-Stevens Point Address: 032 Old Main Building 2100 Main St., Stevens Point, WI 54481 Phone: 715-346-4609 Web: www.uwsp.edu/SBDC Email: [email protected] The SBDC at UW-Stevens Point, part of a network of 12 SBDC locations throughout Wisconsin Assisting Startup and Existing Businesses One of 12 in Wisconsin, the Small Business Development Center (SBDC) at UW-Stevens Point offers no cost, confidential advising and resources as well as fee based workshops/conferences to both startup and existing businesses throughout nine counties - Adams, Langlade, Lincoln, Marathon, Oneida, Portage, Vilas, Waupaca and Wood. We can help you: Start | Manage | Finance | Grow | Market This Business Investment and Financing Guide is published and distributed on the basis that the publisher is not responsible for the results of any actions taken by users of information contained in this guide nor for any error in or omission from this guide. The publisher expressly disclaim all and any liability and responsibility to any person, whether a reader of this guide or not, in respect of claims, losses or damage or any other matter, either direct or consequential arising out of or in relation to the use and reliance, whether wholly or partially, upon any information contained or products referred to in this guide. SBDC UW-Stevens Point, Guide to Business Investment and Financing Version 1.1: revised December 28, 2017 This list was compiled from various sources including those listed below. -

In the United States District Court for the Southern District of New York

Case 1:15-cv-06192-DLC Document 22 Filed 11/27/15 Page 1 of 24 IN THE UNITED STATES DISTRICT COURT FOR THE SOUTHERN DISTRICT OF NEW YORK GUST, INC., : : Plaintiffs : : v. : CIVIL ACTION NO.: 1:15-cv-06192 : ALPHACAP VENTURES, LLC, : RICHARD JUAREZ : : Defendants : GUST’S FIRST AMENDED COMPLAINT Plaintiff Gust, Inc. f/k/a AngelSoft LLC (“Gust”), by and through its attorneys, White and Williams LLP, hereby states the following for its Complaint for inter alia Declaratory Judgment against AlphaCap Ventures, LLC (“AlphaCap”) and Richard Juarez (AlphaCap and Richard Juarez collectively “Defendants”): NOTICE OF RELATED CASE Please note that the following case, currently before the Honorable Robert W. Schroeder, III of the United States District Court for the Eastern District of Texas, is related to this filing: AlphaCap Ventures, LLC v. Gust, Inc. f/k/a Angelsoft LLC , 15-cv-00056-RWS (“the Eastern District of Texas case”). The instant case and the Eastern District of Texas involve the same patents and share some, but not all, parties and causes of action. While the Eastern District of Texas case includes AlphaCap’s claims of patent infringement and Gust’s declaratory judgment claims of invalidity and non-infringement, the Eastern District of Texas case does not include Gust’s claims of Abuse of Process, Patent Misuse, and Violation of Section 2 of the Sherman Act, included 16306061v.1 Case 1:15-cv-06192-DLC Document 22 Filed 11/27/15 Page 2 of 24 herein. The Eastern District of Texas case does not include Mr. Richard Juarez as an individual party. -

SEC Adopts Final Crowdfunding Rules Under the JOBS Act

Corporate Alert November 2015 SEC Adopts Final Crowdfunding Rules under the JOBS Act On October 30, 2015, the U.S. Securities and Exchange Commission (SEC) adopted final rules under Title III of the JOBS Act to enable U.S. companies to offer and sell securities through crowdfunding (Regulation Crowdfunding). This alert provides an overview of the SEC crowdfunding rules slated to become effective in early May 2016, with certain related forms, such as Form Funding Portal (which will be used to register as a funding portal), becoming effective at the end of January 2016. Generally, Regulation Crowdfunding implements a JOBS Act exemption for certain activities related to crowdfunding from the registration requirements of the U.S. Securities Act of 1933 (Securities Act), subject to investment limitations on investors, as well as disclosure requirements for issuers and intermediaries engaged in crowdfunding transactions. The JOBS Act also exempts certain crowdfunding intermediaries (funding portals) from broker-dealer registration under the U.S. Securities Exchange Act of 1934 (Exchange Act). “Crowdfunding” is a term for internet-based fundraising characterized by decentralized groups of donors/investors individually committing relatively modest amounts of capital to small businesses, social projects, artistic performances, etc. Popular sites such as Kickstarter and IndieGoGo already provide a crowdfunding platform for the solicitation of donations, while sites like Fundrise, CircleUp and AngelList facilitate securities offerings using existing securities registration exemptions such as Regulation A and Regulation D. However, under current federal securities laws and regulations, participation in crowdfunding offerings under Regulation D generally cannot be extended to non-accredited investors, and the use of Regulation A involves an onerous disclosure and review process at both the state and federal levels. -

Briefing – Investing in Robotics and Automation: Supporting Ideas Through Crowdfunding Platforms

MENU Briefing – Investing in robotics and automation: Supporting ideas through crowdfunding platforms JUNE 27, 2018 BY DAVID EDWARDS In this article, Robotics and Automation News takes a look at crowdfunding platforms If you’ve got some money to invest, you may have considered, or even participated in, a crowdfunding campaign. You wouldn’t be alone, of course, since literally billions of dollars have been raised in the past few years through such platforms. The giants of the crowdfunding market are names you may be familiar with – Kickstarter and Indiegogo come to mind immediately. Between them, these two platforms raised $3 billion by 2015, according to Investopedia. Indiegogo, which was established in 2007, had raised $1 billion, while Kickstarter, founded in 2009, had raised $2 billion. That was a couple of years ago, so they may have reached another billion between them by now. Also, many similar crowdfunding platforms have been started in the past few years, a few of them by the big two mentioned above. For example, Indiegogo launched a platform called Microventures, which has capital commitments of approximately $12 million, according to data collated by Crowdfund Capital Advisors and published on VentureBeat.com. (See pie chart below.) Along with Kickstarter and Indiegogo, Investopedia includes another crowdfunding platform called CircleUp in its “top 3”. CircleUp has raised approximately $305 million for more than 200 entrepreneurs since its launch in 2011. CircleUp tends to specialise in helping what are described as “emerging brands” that are looking to raise capital to grow their business and take it to the next stage. -

Crowdfunding and Online Auction Ipos

Brigham Young University Law School BYU Law Digital Commons Faculty Scholarship 12-31-2015 Pricing Disintermediation: Crowdfunding and Online Auction IPOs A. Christine Hurt BYU Law School, [email protected] Follow this and additional works at: https://digitalcommons.law.byu.edu/faculty_scholarship Part of the Business Organizations Law Commons, Entrepreneurial and Small Business Operations Commons, and the Finance and Financial Management Commons Recommended Citation A. Christine Hurt, Pricing Disintermediation: Crowdfunding and Online Auction IPOs, 2015 Iʟʟ. L. Rᴇᴠ. 217. This Article is brought to you for free and open access by BYU Law Digital Commons. It has been accepted for inclusion in Faculty Scholarship by an authorized administrator of BYU Law Digital Commons. For more information, please contact [email protected]. PRICING DISINTERMEDIATION: CROWDFUNDING AND ONLINE AUCTION IPOS ChristineHurt* Recently, the concept of crowdfunding has reignited a desire among both entrepreneurs and investors to harness technology to as- sist smaller issuers in the funding of their business ventures. Like the online auction IPO of the previous decade, equity crowdfunding promises both to disintermediate capital raising and democratize re- tail investing. In addition, crowdfunding could make capital raising more accessible to small issuers than any type of IPO or private offer- ing. Until the passage of the Jumpstart Our Business Startups Act ("JOBS Act") in 2012, however, crowdfunding sites operated in a netherworld of uncertain regulation. In this crowdfunding Wild West, various types of entrepreneurs raised monies in various ways, some in obvious violation of the FederalSecurities Acts. The passage of Title III of the JOBS Act, the Capital Raising Online While Deterring Fraud and Unethical Non-Disclosure Act ("CROWDFUND" Act) seemed to bless the attempts of crowdfund- ing pioneers in the area of capital raising. -

Advancing Gender Equality in Venture Capital

ADVANCING GENDER EQUALITY IN VENTURE CAPITAL WHAT THE EVIDENCE SAYS ABOUT THE CURRENT STATE OF THE INDUSTRY AND HOW TO PROMOTE MORE GENDER DIVERSITY, EQUALITY, AND INCLUSION Women and Public Policy Program Harvard Kennedy School October 2019 ADVANCING GENDER EQUALITY IN VENTURE CAPITAL WHAT THE EVIDENCE SAYS ABOUT THE CURRENT STATE OF THE INDUSTRY AND HOW TO PROMOTE MORE DIVERSITY, EQUALITY, AND INCLUSION This report was authored by Siri Chilazi, Research Fellow at the Women and Public Policy Program at Harvard Kennedy School. Please direct any correspondence to: Women and Public Policy Program Harvard Kennedy SchoolWomen and Public Policy Program 79 JFK Street Harvard Kennedy School Cambridge, MA 02138 October 2019 [email protected] TABLE OF CONTENTS THE CASE FOR CHANGE Foreword .................................................................................................................................................... 1 Why Should VCs Care About Gender Equality? .................................................................................. 2 An Ecosystem Approach to Advancing Gender Equality in Venture Capital .................................... 5 RESEARCH REPORT: ADVANCING GENDER EQUALITY IN VENTURE CAPITAL Venture Capitalists and Gender Equality .............................................................................................. 8 Industry-Wide Barriers to Gender Equality ............................................................................................ 9 What Works: Dismantling Industry-Wide -

Crowdfunding Cheat Sheet

Crowdfunding Cheat Sheet Crowdfunding is a new, transformative capital-raising process empowered by technology that turns the trust and goodwill of your network into funds to start or grow your business by allowing a large number of people to share small amounts of their social, creative, and financial capital Type of Donation Rewards Investment (JOBS Act) Intrastate/DPO Lending Crowdfunding contributions in exchange securities, unaccredited securities, online platforms for rewards or perks, and accredited** investors, unaccredited and How does it fundraising for personal that match pre-sales/pre-payment for subject to SEC rules - accredited** work? needs or causes borrowers with products before Reg CF, Reg D (506c), investors with individual lenders manufacturing Reg A+ state-specific rules individuals, individuals, startups & existing startups & existing businesses pre-startups, startups Who is it for? individuals, nonprofits pre-startups, startups, businesses with local with an investor strategy & existing existing businesses, nonprofits focus businesses ArtistShare ~ Barnraiser AgFunder** ~ AngelList** ~ Bankroll CaringCrowd ~ Causes Credibles ~ Crowd Supply CircleUp** ~ Crowdfunder** CauseVox ~ Classy Experiment ~ Fundable Crowdfund Mainstreet ~ EquityNet** CrowdRise ~ Deposit-a-Gift Hatchfund ~ iFundWomen Fundable** ~ Honeycomb Credit DonorsChoose ~ FirstGiving no platform needed Examples of Indiegogo ~ InKind Localstake ~ Manhattan Street Capital Kiva* Fundly ~ Fundrazr or state-specific Kickstarter ~ Patreon