Oregon Capital Scan a Line Is Drawn FINAL

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Raising Capital from the Community Alternative Capital Development Through Crowdfunding

Raising Capital from the Community Alternative Capital Development through Crowdfunding November 2013 Green For All - Business Accelerator Program greenforall.org/resources Acknowledgments © Green For All 2013 Written by Jessica Leigh Green for All would like to thank the following individuals and organizations for their contributions to this guide: Jenny Kassan, Cutting Edge Capital; Brahm Ahmadi, People’s Community Market; Justin Renfro, Kiva Zip; Joanna De Leon, Triple Green Custom Print Developers; Ben Bateman, Indi- egogo; Lisa Curtis, Kuli Kuli; Erin Barnes, ioby; Helen Ho, Biking Public Project, Recycle-a-Bicycle Other parties that helped in the preparation of this report: Jeremy Hays and Khary Dvorak-Ewell RAISING CAPITAL FROM THE COMMUNITY Green For All Business Accelerator Program Introduction Community Capital Today’s economy brings new capital development challenges for the small businesses that drive green innova- tion and strengthen our neighborhoods. Obtaining traditional financing from banks has become increasingly prohibitive. Venture capital funds and angel investors seek businesses that provide fast growth and high re- turns. Cultivating a sustainable small business that prioritizes people and the environment generally does not lend itself to these conditions. A recent survey by the National Small Business Association (NSBA) found that nearly half of small-business respondents said they needed funds and were unable to find any willing sources, be it loans, credit cards or investors.1 Additionally, the novelty of small green businesses makes them more risky and less appealing for traditional sources of capital. Environmentally focused entrepreneurs often have little choice but to compromise their mission or the direction of their company in an attempt to secure financing. -

Direct Primary Care: a Legal and Regulatory Review of an Emerging Practice Model

DIRECT PRIMARY CARE: A LEGAL AND REGULATORY REVIEW OF AN EMERGING PRACTICE MODEL Abstract Direct Primary Care (“DPC”) practices are a type of retainer practice where physicians directly charge patients a periodic fee and avoid any third party fee for service payments. These physicians have been small and overlooked group for many years, but the recent growth of the model demands attention. Previously tacit insurance commissioners have taken notice. Laws enacted by six state legislatures and the Affordable Care Act provides a background from which a legal framework can be developed. This article will articulate “business of insurance” concerns encountered by DPC physicians including recommended contractual provisions to minimize this risk, compare state laws written chiefly to address this concern, consider the DPC provisions of the Affordable Care Act, and briefly consider tax and scope of practice policy implications of the DPC model. A Definition & Introduction A retainer practice model involves a contract between the physician and patient whereby ongoing primary care services are provided in exchange for a periodic fee.1 For the practice to qualify as a direct primary care practice (a subset of the retainer category) the practice must 1) charge a periodic fee, 2) not bill any third parties on a fee for service basis, and 3) any per visit charge must be less than the monthly equivalent of the periodic fee.2 Billing third parties on a 1 Eskew, P. Direct Primary Care Membership Medicine, W V Med J, 2014 Mar-Apr;110 (2):8-11. 2 Interpretations of the Wash. Rev. Code § 48.150.010 (2007), Louisiana Senate Bill No. -

Název 1 99Funken 2 Abundance Investment 3 Angelsden

# Název 1 99funken 2 Abundance Investment 3 Angelsden 4 Apontoque 5 Appsplit 6 Barnraiser 7 Bidra.no 8 Bloom venture catalyst 9 Bnktothefuture 10 Booomerang.dk 11 Boosted 12 Buzzbnk 13 Catapooolt 14 Charidy 15 Circleup 16 Citizinvestor 17 CoAssets 18 Companisto 19 Crowdcube 20 CrowdCulture 21 Crowdfunder 22 Crowdfunder.co.uk 23 Crowdsupply 24 Cruzu 25 DemoHour 26 DigVentures 27 Donorschoose 28 Econeers 29 Eppela 30 Equitise 31 Everfund 32 Experiment 33 Exporo 34 Flzing v 35 Fondeadora 36 Fundit 37 Fundrazr 38 Gemeinschaftscrowd 39 Goteo 40 GreenVesting.com 41 Greenxmoney 42 Hit Hit 43 Housers 44 Idea.me 45 Indiegogo 46 Innovestment 47 Invesdor.com 48 JD crowdfunding 49 Jewcer 50 Karolina Fund 51 Katalyzator 52 Ketto 53 Kickstarter 54 KissKissBankBank 55 Kreativcisobe 56 Labolsasocial 57 Lanzanos 58 Lignum Capital 59 Marmelada 60 Massivemov 61 Mesenaatti.me 62 Monaco funding 63 Musicraiser 64 MyMicroInvest 65 Nakopni me 66 Namlebee 67 Octopousse 68 Oneplanetcrowd International B.V. 69 Penězdroj 70 Phundee 71 PledgeCents 72 Pledgeme 73 Pledgemusic 74 Pozible 75 PPL 76 Projeggt 77 Rockethub 78 Seed&Spark 79 Seedmatch 80 Seedrs 81 Snowballeffect 82 Spacehive 83 Spiele offensive 84 Start51 85 Startlab 86 Startme 87 Startnext 88 Startovac 89 Startsomegood 90 Syndicate Room 91 TheHotStart 92 Thundafund 93 Tubestart 94 Ulule 95 Venturate 96 Verkami 97 Vision bakery 98 Wemakeit 99 Wishberry 100 Zoomal Legenda: *Sociální média Vysvětlení zkratek pro sociální média F - Facebook T - Twitter Lin - LinkedIn G+ - Google plus YouT - YouTube Insta - Instagram -

Access to Capital Directory

State of Nevada Department of Business and Industry Access to Capital Resource Directory Page | 1 GRANTS Government grants are funded by your tax dollars and, therefore, require very stringent compliance and reporting measures to ensure the money is well spent. Grants from the Federal government are authorized and appropriated through bills passed by Congress and signed by the President. The grant authority varies widely among agencies. Some business grants are available through state and local programs, nonprofit organizations and other groups. These grants are not necessarily free money, and usually require the recipient to match funds or combine the grant with other forms of financing such as a loan. The amount of the grant money available varies with each business and each grantor. Below are some resources to grant searches and specific grant opportunities: Program/Sponsor Product Details Contact Information There is a loan/grant search tool (Access Business.usa.gov Financing Wizard). Mostly loans here but Support Center some grant possibilities. SBA has authority to make grants to non- For Clark County Only – profit and educational organizations in Phone: 702-388-6611 many of its counseling and training Email: Roy Brady at SBA-Government programs, but does not have authority to [email protected] Grant Resources make grants to small businesses. Click on the 'Program/Sponsor" link for articles on Outside of Clark County – government grant facts and research Phone: 775-827-4923 Email: [email protected] grants for small businesses. Grant program assistance is provided in many ways, including direct or guaranteed loans, grants, technical assistance, Nevada USDA service centers by USDA Rural research and educational materials. -

HANDBOOK on HEALTHCARE REFORM DECEMBER 2017 Thomasjeffersoninst.Org Thomas Jefferson Institute for Public Policy

THOMAS JEFFERSON INSTITUTE FOR PUBLIC POLICY HANDBOOK ON HEALTHCARE REFORM DECEMBER 2017 thomasjeffersoninst.org Thomas Jefferson Institute for Public Policy The Thomas Jefferson Institute for Public Policy is a non- partisan research and education organization devoted to improving the lives of the people in Virginia. The Institute was organized in 1996, and was the only state and local government focused public policy foundation in Virginia based on a philosophy of limited government, free enterprise and individual responsibility. It is a “solutions tank” seeking better ways to accomplish the policies and programs currently being undertaken by state and local government – always based on the Institute’s underlying philosophy. The first study was published in February 1997. The work of the Thomas Jefferson Institute for Public Policy is geared toward educating our political, business and community leadership about the issues facing our society here in Virginia. The Institute offers creative solutions to these problems in a non-partisan manner. The Thomas Jefferson Institute is a fully approved foundation by the Internal Revenue Service. It is designated a 501 ( c ) 3 organization and contributions are tax-deductible under the law. Individuals, corporations, associations and foundations are invited to contribute to the Thomas Jefferson Institute and participate in our programs. For more information on the programs and publications of the Thomas Jefferson Institute, please contact: Thomas Jefferson Institute for Public Policy 9035 Golden Sunset Lane Springfield, Virginia 22153 703-440-9447 email: [email protected] website: www.thomasjeffersoninst.org This paper, “Handbook on Healthcare Reform” is published by the Thomas Jefferson Institute for Public Policy. -

News Arts Eats

NORTHERN SANTA BARBARA COUNTY’S NEWS AND ENTERTAINMENT WEEKLY > JANUARY 23 - JANUARY 30, 2020 > VOL. 20 NO. 47 > WWW.SANTAMARIASUN.COM AT THE MOVIES 1 Bad Boys: It’s definitely a sequel [31] Whole For the Sun’s annual Health and body Wellness issue, take a walk [10], find a new kind of health care [12], and redirect your energy [15] care BY SUN STAFF Solvang deals with more Sketching Polaroids Doughnuts and wine NEWS political unease [5] ARTS in Lompoc [29] EATS at Riverbench [35] Follow Our Footsteps! JANUARY 23 - JANUARY 30, 2020 VOL. 20 NO. 47 o you have your New Year’s resolutions out and ready? Join classes now to perform in Well, I’ve already forgotten mine, but if yours have anything to do with your health, this is the issue for Sleeping Beauty Dyou. In the Sun’s annual Health and Wellness Issue, you can find out more about the program in Santa Barbara County Classes for ages 2 through adult! where some doctors prescribe walking as a remedy [10], an 2 alternative business model to traditional health care [12], and CARE FOR ALL: The goal of the direct using energy to heal what ails you [15]. primary care health care model is to provide direct physician-to-patient Come try a class for free! Also this week, read about what Solvang is doing with its access at an affordable rate. Board of Architectural Review [5], an artist who preserves Polaroids in charcoal [29], a new book detailing the history of Solvang [30], and what it takes to pair doughnuts with wine [35]. -

EBPA Callender 2019

©Copyright 2019, The Phia Group, LLC Self-Funding, A Deep Dive Into Innovative Solutions ©Copyright 2019, The Phia Group, LLC Today’s Speaker Tim Callender, Esq. Vice President, Sales & Marketing . LEARN • PLAN • SAVE • PROTECT ©Copyright 2019, The Phia Group, LLC Self-Funding – Why It Matters Healthcare Costs – Out of Control • Lack of transparency • Convoluted and confusing system • The wrong incentives • Payer, provider, and plan sponsor tolerance • We’ve made this mess together – we can fix it through self-funding LEARN • PLAN • SAVE • PROTECT ©Copyright 2019, The Phia Group, LLC Self-Funding – Why It Matters Healthcare Costs – Out of Control – Lack of Transparency • $57 for a FRED (Fog Reduction Elimination Device: a 2 inch sQuare gauze strip used to wipe moisture from lenses in the operating room) • $200 for a bag of IV solution • $985 pair of scissors • $1,028 for a 1 oz container of contrast solution • $11 for a mucous recovery system (a box of tissues) • $350 for an IV kit LEARN • PLAN • SAVE • PROTECT ©Copyright 2019, The Phia Group, LLC Self-Funding – Why It Matters Healthcare Costs – Out of Control – Worst Offenders • Air Ambulance • Implantable Devices • Devices typically marked up between 500% and 1,000% of cost • Some providers get gouged on the procurement side as well • Dialysis • Dialysis facilities routinely charge 1,000% to 2,000% of Medicare allowable rates LEARN • PLAN • SAVE • PROTECT ©Copyright 2019, The Phia Group, LLC Self-Funding – Why It Matters Healthcare Costs – Out of Control • Payer and Plan Sponsor Tolerance -

We Are All Self-Funded Now February 4-6

The New Reality: We are All Self-Funded Now February 4-6 Program sponsored by: Caesars Palace ● Las Vegas, NV ● #HCAAExecForum ● hcaa.org TABLE OF CONTENTS Welcome .......................................................................................... 3 Thank You to Our Partners ......................................................... 4 Thank You to Our Sponsors ........................................................ 5 WIFI Instructions ............................................................................ 5 HCAA Mission, Vision and Values Statement ...................... 6 Antitrust Policy/Ethics Policy/Anti-Harassment Policy .... 7 Schedule-At-A-Glance .................................................................. 8 Speakers .................................................................................. 9 - 13 Schedule of Events .............................................................. 14 - 17 HCAA Management Staff / Past Presidents ........................ 17 2018-2019 Officers and Board of Directors ........................ 18 HCAA Committees & Task Forces ......................................... 19 Member Companies ............................................................ 20 - 21 CSFS® Information .............................................................. 22 - 24 Sponsor/Partner Materials ................................................ 25 - 53 Maps of Caesars Palace .................................................... 54 - 55 2 TABLE OF CONTENTS WELCOME TO EXECUTIVE FORUM 2019 Welcome to the 2019 HCAA -

Defining the Place of Direct Primary Care in a Value-Based Care System

REVIEW ARTICLE Defining the Place of Direct Primary Care in a Value-Based Care System Lindsey E. Carlasare, MBA ABSTRACT INTRODUCTION Introduction: Direct primary care, one of several retainer-based practice models, is a niche Health care in the United States has trans- practice type that offers an alternative to the traditional fee-for-service and insurance-based formed in recent years as influences through- practices most prevalent in US health care. In Wisconsin, the prevalence of direct primary care out the system necessitate changes in the practices is higher than in most other states. The market for direct primary care practice may be ways patient care is delivered and paid for. growing along with the industry shift to value-based care and an increase in physicians’ desire Physicians increasingly find themselves fac- to reduce the increasing administrative work and regulations that detract from patient care and ing burdensome administrative work,1 pres- increase burnout. Many physicians are seeking ways to reduce these burdens so they have sure to increase the quantity of patients,2 and more time with patients. Some are transitioning their practice to a retainer-based model, such increased levels of burnout.3 Recent research as direct primary care, in which they collect a retainer from patients in exchange for more time, shows 82% of Wisconsin physicians report freer communication, and less paperwork. some level of professional burnout and over half feel their work environment is chaotic or Objective: The objective of this review is to provide information about the direct primary care practice model, possible drivers to this model of care, and its advantages and drawbacks for hectic.4 Insurers are navigating higher costs physicians and patients. -

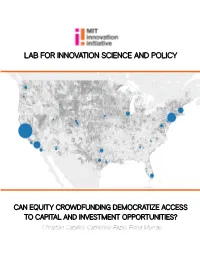

Lab for Innovation Science and Policy

LAB FOR INNOVATION SCIENCE AND POLICY CAN EQUITY CROWDFUNDING DEMOCRATIZE ACCESS TO CAPITAL AND INVESTMENT OPPORTUNITIES? Christian Catalini, Catherine Fazio, Fiona Murray Can Equity Crowdfunding Democratize Access to Capital and Investment Opportunities? Christian Catalini Catherine Fazio Fiona Murray MIT Innovation Initiative Lab for Innovation Science and Policy Report © 2016 Massachusetts Institute of Technology May 2016 Cover: The map plots equity crowdfunding investment activity across the United States on the leading U.S. Title II platform. The grayscale represents income per capita (a proxy for wealth), and the blue circles reflect the size of online investment by accredited investors in the focal region. (Catalini and Luo, 2016). 1 Introduction “Oculus Rift virtual reality headset raised $2.4 million on Kickstarter [in 2012], no strings attached. Those donors weren’t looking for a payout; they wanted to support something they believed in, and maybe get a pair of virtual reality goggles to play with. But when Facebook bought Oculus a year and a half later for $2 billion in cash and stock, backers wondered: what if I’d asked for equity instead of a poster?”1 At that time, however, equity was not an option. Although securities laws had been changed (through Title III of the 2012 Jumpstart our Business Startups (JOBS) Act) to permit equity crowdfunding of startups from all investors (regardless of income or net worth), concerns remained over protecting unsophisticated investors from fraud and subjecting nascent startups and online platforms to disclosure and review requirements. The U.S. SEC (Securities and Exchange Commission) struggled to craft implementing regulations “stringent enough to protect investors but flexible enough to allow for meaningful fund-raising,”2 Title III stalled and did not take effect. -

Managing Principal of Mitigate Partners

Carl C. Schuessler, Jr., DHP, DIA, GBDS Managing Principal of Mitigate Partners, LLC Carl Schuessler is the Founder and Managing Principal of Mitigate Partners, a Risk Management, Cost Containment and Employee Benefits Consulting firm, which is a partnership of 28 employee benefit consulting and brokerage firms that allows local management within a collaborative environment with more than 150 years of combined experience. We are an intentionally small “concierge” consulting firm offering a unique approach to benefits management for a select group of clients. We have chosen collaboration over competition and maintain healthy relationships with a cadre’ of like-minded consultants and resources throughout the United States. Being open to and encouraging the ideas of others allows us to remain on the cutting edge of thinking in our area of expertise, rather than developing the myopic view of the world that so often occurs in single source benefit brokerage shops. With more than 30 years of experience in benefits consulting and financial services, Carl pioneered the fiduciary approach to benefits advisory services. His interest in treating the employer’s money like his own, led Carl through years of research culminating in the development of his proprietary t FairCo$t Health Plan, an innovative plan design seamlessly integrated with a High- Performance Healthcare Solutions platform that provides best-in-class benefits at substantially lower costs while improving clinical and financial outcomes for health plans and their members. A founding Health Rosetta Charter Certified Advisor, Carl is a highly accomplished speaker and author who is engaged in the pursuit of EMPLOYER-Built Healthcare to replace the archaic Insurer-Built Healthcare system that has ceased to meet the needs of employers and their employees. -

Market Analysis, Economics and Success Drivers of Equity Crowdfunding

Dipartimento di Impresa e Cattedra di Advanced Corporate Management Finance MARKET ANALYSIS, ECONOMICS AND SUCCESS DRIVERS OF EQUITY CROWDFUNDING RELATORE: CANDIDATO: Prof. Cristiano Cannarsa Salvatore Luciano Furnari CORRELATORE: Matr. 691441 Prof. Raffaele Oriani Anno Accademico 2016/2017 1 Contents Introduction ............................................................................................................. 4 Chapter 1 – Equity crowdfunding ............................................................................. 6 1.1 Definition and origins ..................................................................................... 6 1.2 Classification .................................................................................................. 8 1.2.1 Equity crowdfunding and other crowdfunding models .............................. 8 1.2.2 Definition of the target and type of campaign: All-Or-Nothing vs Keep-It- All .................................................................................................................. 16 1.3. Equity crowdfunding benefits ...................................................................... 23 1.3.1 Advantages for investors ........................................................................ 24 1.3.2 Advantages for issuers............................................................................ 26 1.4 Equity crowdfunding risks ............................................................................ 30 1.4.1 Risk for investors ..................................................................................