Access to Capital Directory

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

East Africa Crowdfunding Landscape Study

REPORT | OCTOBER 2016 East Africa Crowdfunding Landscape Study REDUCING POVERTY THROUGH FINANCIAL SECTOR DEVELOPMENT Seven Things We Learned 1 2 3 4 East African East Africa’s Crowdfunding There’s appetite to crowdfunding platforms report risks and the do business and to markets are on promising regulatory learn more from the move. progress. environment. across East Africa. Crowdfunding platforms Since 2012 M-Changa In Kenya, for example, Over 65 participants at- (donation, rewards, debt has raised $900,000 Section 12A of the Capi- tended the Indaba & and equity) raised $37.2 through 46,000 tal Markets Act provides a Marketplace from all cor- million in 2015 in Kenya, donations to 6,129 safe space for innovations ners of the East African Rwanda, Tanzania and fundraisers. Pesa Zetu to grow before being sub- market. Uganda. By the end of Q1 and LelaFund are also ject to the full regulatory 2016, this figure reached opening access to their regime. $17.8 million – a 170% deals on the platform. year-on-year increase. 5 6 7 East Africa’s MSMEs ex- There are both commercial Global crowdfunding press a demand for alterna- and development oppor- markets are growing tive finance, but they’re not tunities for crowdfunding fast but also evolving. always investment-ready or platforms in East Africa. Finance raised by crowdfunding able to locate financiers. Crowdfunding platforms have the platforms worldwide increased from 45% of Kenyan start-ups sampled re- potential to mobilise and allocate $2.7 billion in 2012 to an estimated quire between $10,000 and $50,000 capital more cheaply and quickly $34 billion in 2015. -

Raising Capital from the Community Alternative Capital Development Through Crowdfunding

Raising Capital from the Community Alternative Capital Development through Crowdfunding November 2013 Green For All - Business Accelerator Program greenforall.org/resources Acknowledgments © Green For All 2013 Written by Jessica Leigh Green for All would like to thank the following individuals and organizations for their contributions to this guide: Jenny Kassan, Cutting Edge Capital; Brahm Ahmadi, People’s Community Market; Justin Renfro, Kiva Zip; Joanna De Leon, Triple Green Custom Print Developers; Ben Bateman, Indi- egogo; Lisa Curtis, Kuli Kuli; Erin Barnes, ioby; Helen Ho, Biking Public Project, Recycle-a-Bicycle Other parties that helped in the preparation of this report: Jeremy Hays and Khary Dvorak-Ewell RAISING CAPITAL FROM THE COMMUNITY Green For All Business Accelerator Program Introduction Community Capital Today’s economy brings new capital development challenges for the small businesses that drive green innova- tion and strengthen our neighborhoods. Obtaining traditional financing from banks has become increasingly prohibitive. Venture capital funds and angel investors seek businesses that provide fast growth and high re- turns. Cultivating a sustainable small business that prioritizes people and the environment generally does not lend itself to these conditions. A recent survey by the National Small Business Association (NSBA) found that nearly half of small-business respondents said they needed funds and were unable to find any willing sources, be it loans, credit cards or investors.1 Additionally, the novelty of small green businesses makes them more risky and less appealing for traditional sources of capital. Environmentally focused entrepreneurs often have little choice but to compromise their mission or the direction of their company in an attempt to secure financing. -

Kiva Innovating in the Field of Education by Microlending to Students Around the World

Kiva Innovating in the Field of Education by Microlending To Students Around the World Join the Global Movement for Women’s Empowerment and Education by Directing a $25 Loan for Free at Kiva.org/women More Kiva Education Stories, September 2012: Back to School: 6th grade teacher Kristen Goggin brings Kiva into the classroom Back to School: Campolindo Cougars have Kiva spirit! Kiva goes back to school with education loans around the world New Field Partner: Colfuturo makes graduate school possible for Colombia's future leaders New Field Partner: CampoAlto brings vocational training to Colombia's marginalized students New Field Partner: Building a new generation of leaders with African Leadership Academy Media Contact: Jason Riggs, [email protected] August 15, 2012 -- While those in the developed world live in the age of the information revolution, millions of the world’s poor are still unable to receive even a basic education. It’s estimated that a billion people entered this century unable to read a book or sign their own name. Access to education sits at the crux of poverty and economic development. With a more educated population we nourish a more robust and dynamic workforce, stronger civic engagement and home-grown innovations solving regional problems. Without access to education, progress comes to a stand still. Not surprisingly the countries with the most out- of-school children are also are some of the world’s poorest. Outside the United States, student loans are rare. For too many young people, no matter how bright and gifted they may be, access to higher education can be near impossible without the necessary financial resources. -

Trends in Global Higher Education: Tracking an Academic Revolution a Report Prepared for the UNESCO 2009 World Conference on Higher Education Philip G

Trends in Global Higher Education: Tracking an Academic Revolution A Report Prepared for the UNESCO 2009 World Conference on Higher Education Philip G. Altbach Liz Reisberg Laura E. Rumbley Published with support from SIDA/SAREC trend_final-rep_noApp.qxd 18/06/2009 12:21 Page 1 Trends in Global Higher Education: Tracking an Academic Revolution A Report Prepared for the UNESCO 2009 World Conference on Higher Education Philip G. Altbach Liz Reisberg Laura E. Rumbley trend_final-rep_noApp.qxd 18/06/2009 12:21 Page 2 The editors and authors are responsible for the choice and presentation of the facts contained in this document and for the opinions expressed therein, which are not necessarily those of UNESCO and do not commit the Organization. The designations employed and the presentation of the material throughout this document do not imply the expression of any opinion whatsoever on the part of UNESCO concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. Published in 2009 by the United Nations Educational, Scientific and Cultural Organization 7, place de Fontenoy, 75352 Paris 07 SP Set and printed in the workshops of UNESCO Graphic design - www.barbara-brink.com Cover photos © UNESCO/A. Abbe © UNESCO/M. Loncarevic © UNESCO/V. M. C. Victoria ED.2009/Conf.402/inf.5 © UNESCO 2009 Printed in France trend_final-rep_noApp.qxd 18/06/2009 12:21 Page i Table of Contents Table of Contents Executive Summary iii Preface xxiii Abbreviations xxvi 1. Introduction 1 2. Globalization and Internationalization 23 3. -

Název 1 99Funken 2 Abundance Investment 3 Angelsden

# Název 1 99funken 2 Abundance Investment 3 Angelsden 4 Apontoque 5 Appsplit 6 Barnraiser 7 Bidra.no 8 Bloom venture catalyst 9 Bnktothefuture 10 Booomerang.dk 11 Boosted 12 Buzzbnk 13 Catapooolt 14 Charidy 15 Circleup 16 Citizinvestor 17 CoAssets 18 Companisto 19 Crowdcube 20 CrowdCulture 21 Crowdfunder 22 Crowdfunder.co.uk 23 Crowdsupply 24 Cruzu 25 DemoHour 26 DigVentures 27 Donorschoose 28 Econeers 29 Eppela 30 Equitise 31 Everfund 32 Experiment 33 Exporo 34 Flzing v 35 Fondeadora 36 Fundit 37 Fundrazr 38 Gemeinschaftscrowd 39 Goteo 40 GreenVesting.com 41 Greenxmoney 42 Hit Hit 43 Housers 44 Idea.me 45 Indiegogo 46 Innovestment 47 Invesdor.com 48 JD crowdfunding 49 Jewcer 50 Karolina Fund 51 Katalyzator 52 Ketto 53 Kickstarter 54 KissKissBankBank 55 Kreativcisobe 56 Labolsasocial 57 Lanzanos 58 Lignum Capital 59 Marmelada 60 Massivemov 61 Mesenaatti.me 62 Monaco funding 63 Musicraiser 64 MyMicroInvest 65 Nakopni me 66 Namlebee 67 Octopousse 68 Oneplanetcrowd International B.V. 69 Penězdroj 70 Phundee 71 PledgeCents 72 Pledgeme 73 Pledgemusic 74 Pozible 75 PPL 76 Projeggt 77 Rockethub 78 Seed&Spark 79 Seedmatch 80 Seedrs 81 Snowballeffect 82 Spacehive 83 Spiele offensive 84 Start51 85 Startlab 86 Startme 87 Startnext 88 Startovac 89 Startsomegood 90 Syndicate Room 91 TheHotStart 92 Thundafund 93 Tubestart 94 Ulule 95 Venturate 96 Verkami 97 Vision bakery 98 Wemakeit 99 Wishberry 100 Zoomal Legenda: *Sociální média Vysvětlení zkratek pro sociální média F - Facebook T - Twitter Lin - LinkedIn G+ - Google plus YouT - YouTube Insta - Instagram -

Minneapolis Intelligent Operations Platform Mission Control Focus Manage Event Horizon Normal Planned Events

Minneapolis Intelligent Operations Platform Mission Control Focus Manage Event Horizon Normal Planned Events Predicted Events Better coordinate city operations to gain efficiencies Deal more effectively with special events Improve handling of Day-to-Day emergencies Operations Unplanned Events 11 “Working” Functional Concept • Pattern mining and Correlations • Capacity analysis • Clustering analysis • Resource optimization • Streaming, Sequence Analysis • Planning & Impact analysis • Simulation analysis • Institutional Knowledge capturing • Effectiveness metrics modeling • Learning & classification • Statistical analysis and reporting • Trend analysis 12 Customer Perspectives Residents / visitors Elected Officials Department leaders and employees Business view – Enterprise versus specific need(s) Geographic focus – City-wide versus specific geography (ward, precinct, etc.) Data visualized – map versus time Emphasizes value in having a product with generic, and thus, wide-spread application 13 Turning data into decisions Philosophy: Data → Information → Knowledge Largely focused on Rear-view Macro-geography with some exceptions One dimensional (based on data from one department) Current City data-driven efforts Police Code4 Results Minneapolis Intelligent Operations Platform (IOP) 14 Current approach Measure / monitor Adjust Apply best intervention guess as necessary intervention Measure / monitor 15 What we get today Tot al Number of Fires 2.500 2,194 2.068 1,859 1\IINNEAPOLIS POLICE DEPARTMENT . 2.000 1,17~ 1.808 Vmlent Cnnu• Hot Spots m 2012 1.489 1,500 1,401 1,37) 1,348 1.347 1.2SO 1.200 age- adj usted death rate 1,000 per 1000 pooplo • S68 ._ 0 '-r- L 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 201J 201J 2014 T>rget thru Ql r.raet Sourc~. -

Understanding and Promoting Micro-Finance Activities in Kiva.Org

Understanding and Promoting Micro-Finance Activities in Kiva.org Jaegul Choo Changhyun Lee Daniel Lee Georgia Institute of Georgia Institute of Georgia Tech Research Technology Technology Institute [email protected] [email protected] [email protected] Hongyuan Zha Haesun Park Georgia Institute of Georgia Institute of Technology Technology [email protected] [email protected] ABSTRACT Non-profit Micro-finance organizations provide loaning op- portunities to eradicate poverty by financially equipping im- poverished, yet skilled entrepreneurs who are in desperate need of an institution that lends to those who have little. Kiva.org, a widely-used crowd-funded micro-financial ser- vice, provides researchers with an extensive amount of pub- licly available data containing a rich set of heterogeneous information regarding micro-financial transactions. Our ob- jective in this paper is to identify the key factors that en- courage people to make micro-financing donations, and ulti- mately, to keep them actively involved. In our contribution to further promote a healthy micro-finance ecosystem, we detail our personalized loan recommendation system which we formulate as a supervised learning problem where we try Figure 1: An overview of how Kiva works. 1. A borrower to predict how likely a given lender will fund a new loan. requests a loan to a (field) partner, and a loan is disbursed. We construct the features for each data item by utilizing 2. The partner uploads a loan request to Kiva, and lenders the available connectivity relationships in order to integrate fund the loan. 3. The borrower makes repayments through all the available Kiva data sources. -

Dare to Venture: Data Science Perspective on Crowdfunding Ruhaab Markas Southern Methodist University, [email protected]

SMU Data Science Review Volume 2 | Number 1 Article 19 2019 Dare to Venture: Data Science Perspective on Crowdfunding Ruhaab Markas Southern Methodist University, [email protected] Yisha Wang Southern Methodist University, [email protected] Follow this and additional works at: https://scholar.smu.edu/datasciencereview Part of the Entrepreneurial and Small Business Operations Commons Recommended Citation Markas, Ruhaab and Wang, Yisha (2019) "Dare to Venture: Data Science Perspective on Crowdfunding," SMU Data Science Review: Vol. 2 : No. 1 , Article 19. Available at: https://scholar.smu.edu/datasciencereview/vol2/iss1/19 This Article is brought to you for free and open access by SMU Scholar. It has been accepted for inclusion in SMU Data Science Review by an authorized administrator of SMU Scholar. For more information, please visit http://digitalrepository.smu.edu. Markas and Wang: Data Science Perspective on Crowdfunding Dare to Venture: Data Science Perspective on Crowdfunding Ruhaab Markas1, Yisha Wang1, John Tseng2 1Master of Science in Data Science, Southern Methodist University, Dallas, TX 75275 USA 2Independant Consultant Dallas, TX 75275 USA {Rmarkas, YishaW}@smu.edu, [email protected] Abstract. Crowdfunding is an emerging segment of the financial sectors. Entrepreneurs are now able to seek funds from the online community through the use of online crowdfunding platforms. Entrepreneurs seek to understand attributes that play into a successful crowdfunding project (commonly known as campaign). In this paper we seek so understand the field of crowdfunding and various factors that contribute to the success of a campaign. We aim to use traditional modeling techniques to predict successful campaigns for Kickstarter. -

Kiva User Funds, Llc Financial Statements As of May 31, 2012

KIVA USER FUNDS, LLC FINANCIAL STATEMENTS AS OF MAY 31, 2012 KIVA USER FUNDS, LLC CONTENTS May 31, 2012 Page INDEPENDENT AUDITOR’S REPORT 1 FINANCIAL STATEMENT Balance Sheet 2 Notes to Financial Statement 3 - 12 INDEPENDENT AUDITOR’S REPORT To the Board of Directors Kiva User Funds, LLC San Francisco, California We have audited the accompanying balance sheet of Kiva User Funds, LLC (“KUF”) as of May 31, 2012. This financial statement is the responsibility of KUF's management. Our responsibility is to express an opinion on this financial statement based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provide a reasonable basis for our opinion. In our opinion, the balance sheet referred to above presents fairly, in all material respects, the financial position of Kiva User Funds, LLC as of May 31, 2012, in conformity with accounting principles generally accepted in the United States of America. SingerLewak LLP San Jose, California October 26, 2012 KIVA USER FUNDS, LLC BALANCE SHEET AS OF May 31, 2012 ASSETS Cash $ 41,134,798 Accounts receivable from users 33,846 Loans receivable 35,483,885 Total assets$ 76,652,529 LIABILITIES Accounts payable to lenders$ 96,362 Due to Kiva Microfunds 700,120 Unsettled loan transactions 45,004,947 Funds held on behalf of users 27,450,915 Unredeemed Kiva Cards 3,400,185 Total liabilities$ 76,652,529 The accompanying notes are an integral part of this financial statement. -

IAC-17-#### Page 1 of 6 IAC-17-### Crowdfunding for Space Missions

68th International Astronautical Congress (IAC), Adelaide, Australia, 25-29 September 2017. Copyright ©2017 by the International Astronautical Federation (IAF). All rights reserved. IAC-17-### Crowdfunding For Space Missions Graham Johnsona a Inmarsat Global Ltd. [email protected] Abstract Crowdfunding (via websites such as kickstarter.com) has become an increasingly popular method for funding projects and start-up companies for a wide range of terrestrial products and services. A small, but not insignificant number of space projects have also used this method of fundraising, and there is potentially much greater scope for this type of funding. This paper presents an analysis of crowd-funding campaigns that have been used to fund space- related projects, and in particular, spaceflight missions. It assesses the relative success of these campaigns and proposes some insights as to what makes a successful space crowdfunding campaign. Keywords: Crowdfunding, Space, Mission Acronyms/Abbreviations have attempted to use crowdfunding as either their CAT Cubesat Ambipolar Thruster principle source of funding, or as a stepping stone to ISS International Space Station further progress their project. Kickstarter appears to be LEO Low Earth Orbit the most popular platform for space mission funding, although there have also been a small number of space projects on IndieGoGo, Rockethub and Gofundme. 1. Introduction In this paper a summary of space mission ‘Crowdfunding’ is a process by which the creator of crowdfunding campaigns is presented, an assessment is a product or service can appeal directly to the public for made of the typical level of funding which individuals cash funding. It is important to note that the contribute, and the potential for scale-up to future space contributors, or ‘funders’, are not actually investing in projects is discussed. -

Lab for Innovation Science and Policy

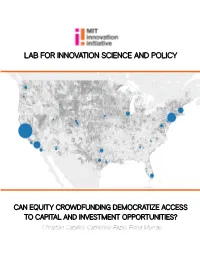

LAB FOR INNOVATION SCIENCE AND POLICY CAN EQUITY CROWDFUNDING DEMOCRATIZE ACCESS TO CAPITAL AND INVESTMENT OPPORTUNITIES? Christian Catalini, Catherine Fazio, Fiona Murray Can Equity Crowdfunding Democratize Access to Capital and Investment Opportunities? Christian Catalini Catherine Fazio Fiona Murray MIT Innovation Initiative Lab for Innovation Science and Policy Report © 2016 Massachusetts Institute of Technology May 2016 Cover: The map plots equity crowdfunding investment activity across the United States on the leading U.S. Title II platform. The grayscale represents income per capita (a proxy for wealth), and the blue circles reflect the size of online investment by accredited investors in the focal region. (Catalini and Luo, 2016). 1 Introduction “Oculus Rift virtual reality headset raised $2.4 million on Kickstarter [in 2012], no strings attached. Those donors weren’t looking for a payout; they wanted to support something they believed in, and maybe get a pair of virtual reality goggles to play with. But when Facebook bought Oculus a year and a half later for $2 billion in cash and stock, backers wondered: what if I’d asked for equity instead of a poster?”1 At that time, however, equity was not an option. Although securities laws had been changed (through Title III of the 2012 Jumpstart our Business Startups (JOBS) Act) to permit equity crowdfunding of startups from all investors (regardless of income or net worth), concerns remained over protecting unsophisticated investors from fraud and subjecting nascent startups and online platforms to disclosure and review requirements. The U.S. SEC (Securities and Exchange Commission) struggled to craft implementing regulations “stringent enough to protect investors but flexible enough to allow for meaningful fund-raising,”2 Title III stalled and did not take effect. -

Club Industry Consulting

The Financial Power of the Crowd Part I The Democratization and Socialization of Raising Capital Raising capital has never been an easy task for entrepreneurs, and for most entrepreneurs launching a business raising capital can be the “straw” that often breaks the camel’s back; the challenge most likely to derail their business vision. Until recently, raising equity for a business venture, be it start-up capital or growth capital, was comparable to a soldier navigating a minefield without a mine detector. At the height of the recession a confluence of variables (i.e., stricter lending practices by banks, movement of venture capital away from start-ups, private equity firms retrenching and refocusing on proven business models, shifts in consumer purchasing behavior, shrinking personal savings accounts, impact of the cloud and social media and a new generation of young entrepreneurs) came to bear what would forever change the landscape for how entrepreneurs sought capital to bring their business vision to reality. This innovative new world of financing called crowdfunding has opened doors for entrepreneurs who only a decade ago would have had no chance of raising the capital needed to start or grow their business. Crowdfunding is rooted in the convergence of social connectivity, investing democratization (i.e. anyone can invest), cloud-based technology and government regulation. In 2012 the passage of the JOBS Act (Jumpstart Our Business Start-Ups) added an exponentially more powerful environment for the introduction of additional approaches for crowdfunding, opening the doors for both accredited and non-accredited investors to invest in the dreams and business solutions of entrepreneurs.